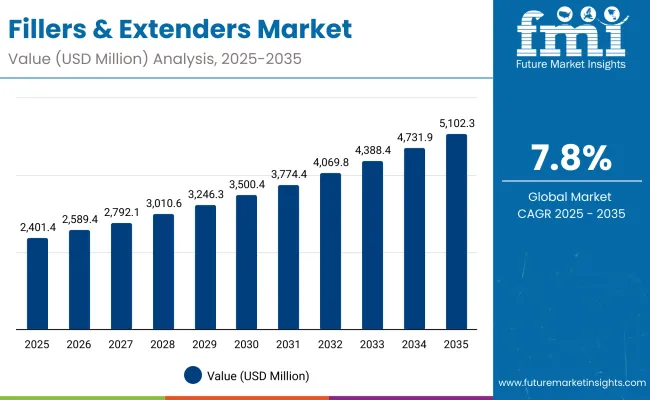

The global Fillers & Extenders Market has been valued at USD 2,401.40 Million in 2025 and is projected to reach USD 5,102.30 Million by 2035, marking an incremental gain of USD 2,700.90 Million across the decadeThe expansion equates to a 7.80% CAGR, more than doubling the market value within the forecast horizon.

Fillers & Extenders Market Key Takeaways

| Metric | Value |

|---|---|

| Fillers & Extenders Market Estimated Value in (2025E) | USD 2,401.40 Million |

| Fillers & Extenders Market Forecast Value in (2035F) | USD 5,102.30 Million |

| Forecast CAGR (2025 to 2035) | 7.80% |

The trajectory reflects consistent demand acceleration across personal care, skincare, and color cosmetics, where texture modification, soft-focus performance, and stability optimization continue to be prioritized in B2B formulation strategies.

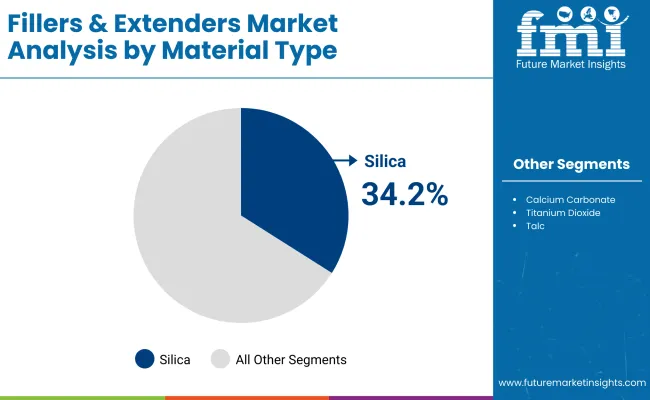

During the first five years, from 2025 to 2030, the market is set to rise from USD 2,401.40 Million to USD 3,500.40 Million, accounting for USD 1,099.00 Million of additional value, or 41% of decade growth. This phase is expected to witness steady adoption in face powders & foundations as leading brands seek blurring and mattifying benefits that support premium sensorial positioning. Silica is anticipated to dominate the material mix with 34.20% share in 2025, reflecting its role in opacity control and stability enhancement within pressed and loose powder systems.

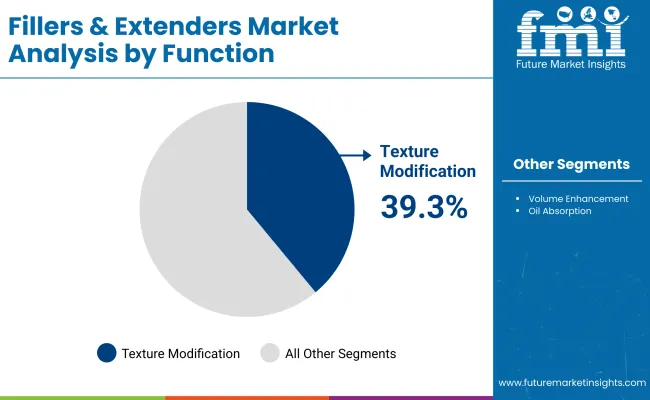

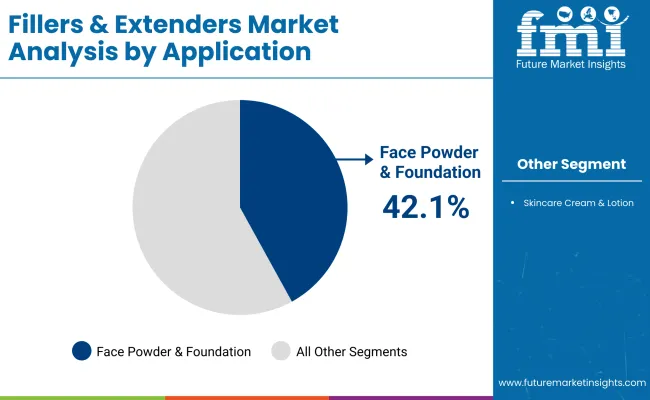

From 2030 to 2035, the market is projected to expand from USD 3,500.40 Million to USD 5,102.30 Million, delivering USD 1,601.90 Million of growth, or 59% of total decade gains. This acceleration is likely to be driven by rising hybrid skincare-makeup launches and stronger penetration of optical-enhancement claims in mass markets. Face powders & foundations are expected to hold a leading 42.10% application share, while texture modification will remain the key function at 39.30% share in 2025, sustaining demand momentum for engineered filler solutions across global formulations.

From 2020 to 2024, the Fillers & Extenders Market advanced steadily as demand for optical blurring, mattifying, and rheology-modifying solutions in personal care accelerated. Suppliers with strong formulation support and validated purity profiles captured competitive advantage, particularly in color cosmetics and premium skincare formulations. By 2025, demand will expand to USD 2,401.40 Million, and the market is expected to more than double by 2035, reaching USD 5,102.30 Million with sustained 7.80% CAGR.

The competitive landscape is anticipated to remain fragmented, with BASF leading at 8.40% share, while niche ingredient specialists continue to scale presence through texture innovation and clean-label compliance.Value creation is expected to shift toward engineered particle morphology and multifunctional filler systems that align with hybrid makeup-skincare trends and pharmaceutical-grade topicals.Regions such as China and India are forecast to post double-digit CAGRs, reshaping global demand flows. The advantage is projected to migrate from raw material supply alone to holistic ecosystem support, documentation rigor, and responsiveness to evolving regulatory thresholds.

Growth in the Fillers & Extenders Market is being driven by rising demand for advanced formulation ingredients that enhance texture, opacity, and stability in personal care and cosmetic products. Increased consumer preference for hybrid makeup-skincare solutions has accelerated the use of engineered fillers that deliver both functional and sensorial benefits. Optical performance attributes such as blurring, mattifying, and soft-focus effects are being prioritized as brands seek differentiation in complexion and color cosmetics.

Expansion is also being fueled by strong momentum in emerging markets, where rising disposable incomes and rapid urbanization are increasing uptake of premium personal-care products. In regions such as China and India, double-digit growth rates are projected, supported by innovation in dermocosmetic lines and pharmaceutical topicals. Regulatory tightening around safety and heavy-metal control is encouraging the adoption of high-purity fillers with validated traceability, favoring suppliers with advanced quality systemas. As sustainable and multifunctional ingredient solutions gain traction, the Fillers & Extenders Market is expected to remain on a strong upward trajectory through 2035.

The Fillers & Extenders Market has been segmented by material type, function, and application, offering insights into how demand is distributed across the industry. These categories reflect the evolving role of fillers in enhancing texture, stability, and sensory performance across cosmetic and personal care formulations. By material type, differences in particle morphology and chemical properties shape adoption in powders, creams, and hybrid systems. By function, texture modification, oil control, and optical effects guide selection in both skincare and color cosmetics. Applications further reveal demand clustering in face powders, foundations, and emulsions, where visual finish and formulation consistency are critical. Understanding these segments highlights how functional benefits and consumer-driven claims are shaping procurement decisions, creating opportunities for suppliers to position specialized ingredients across value-added formulations.

| Material Type | Market Value Share, 2025 |

|---|---|

| Silica | 34.2% |

| Others | 65.8% |

Silica is projected to account for 34.20% share (USD 821.28 Million) in 2025, while other materials collectively represent 65.80% share (USD 1,580.12 Million) in the Fillers & Extenders Market. Silica is being adopted for its opacity control, rheology balance, and soft-focus effects that align with premium skincare and complexion products. Growth is expected to be supported by rising demand for lightweight textures and oil-control properties in both mass and prestige formulations. Alternatives are projected to remain vital due to cost-performance optimization and broad compatibility. Innovation in particle engineering is likely to sustain competition across material classes, ensuring silica retains its strategic role while other materials support diverse formulation needs.

| Function | Market Value Share, 2025 |

|---|---|

| Texture modification | 39.3% |

| Others | 60.7% |

Texture modification is anticipated to capture 39.30% share (USD 943.75 Million) in 2025, while other functions hold 60.70% share (USD 1,457.65 Million) in the Fillers & Extenders Market. Demand is being shaped by preference for smooth, spreadable formulations that enhance coverage, payoff, and sensorial elegance across cosmetics and skincare. Hybrid products that merge skincare efficacy with cosmetic performance are expected to reinforce the dominance of this segment. Long-wear and transfer-resistant claims are projected to further drive adoption, positioning texture-focused fillers at the center of formulation innovation. While other functions collectively maintain a larger share, texture modification is likely to remain the primary driver of adoption across the decade.

| Application | Market Value Share, 2025 |

|---|---|

| Face powders & foundations | 42.1% |

| Others | 57.9% |

Face powders & foundations are forecasted to command 42.10% share (USD 1,010.99 Million) in 2025, while other applications represent 57.90% share (USD 1,390.41 Million) in the Fillers & Extenders Market. This leadership reflects sustained demand for complexion-enhancing products that provide mattifying, blurring, and oil-absorbing benefits. Consumer preference for hybrid formulations that combine color coverage with skincare attributes is expected to strengthen this trend. Increasing demand for long-wear, natural finish, and transfer-resistant performance is projected to deepen reliance on engineered fillers tailored for optical and tactile effects. Although other applications such as skincare creams, lotions, and color cosmetics are expanding, face powders & foundations are anticipated to remain the anchor of filler consumption globally.

Complex formulation needs, regulatory scrutiny, and evolving consumer expectations are reshaping the Fillers & Extenders Market, where functional innovation and compliance assurance are weighed against margin pressures, driving both opportunities and constraints in ingredient adoption across global personal care and cosmetic applications.

Shift Toward Multifunctional Ingredient Platforms

A significant driver is being observed in the transition from single-function fillers to multifunctional ingredient platforms that combine optical enhancement, oil absorption, and texture modulation within a single material class.This evolution is projected to reduce formulation complexity and streamline supply chains for brand owners seeking efficiency in high-volume SKUs. Functional layering is expected to be minimized, enabling cleaner label claims and faster development cycles. Integration of multifunctional fillers into hybrid skincare-makeup products is anticipated to accelerate, as demand shifts toward versatile solutions that enhance both performance and sustainability credentials. Suppliers with validated multifunctional profiles are likely to secure preferred-vendor status, reflecting heightened procurement prioritization of cost-efficiency and reduced inventory redundancy.

Regulatory-Driven Transparency in Ingredient Profiling

A defining trend is being shaped by intensified regulatory oversight requiring greater transparency in filler characterization, including crystalline silica thresholds, heavy-metal testing, and traceability of raw materials. Formulators are expected to demand granular data sheets supported by third-party validations to protect against compliance risks. Consumer-facing communication strategies are anticipated to extend beyond basic safety assurance, emphasizing ethical sourcing, sustainability certifications, and region-specific regulatory alignment. As digital ingredient passports and blockchain-backed traceability tools become more widely adopted, suppliers demonstrating transparent disclosure practices are projected to gain competitive advantage. This shift toward regulatory-driven transparency is expected to redefine supplier selection criteria and elevate documentation from a compliance formality to a central element of brand equity.

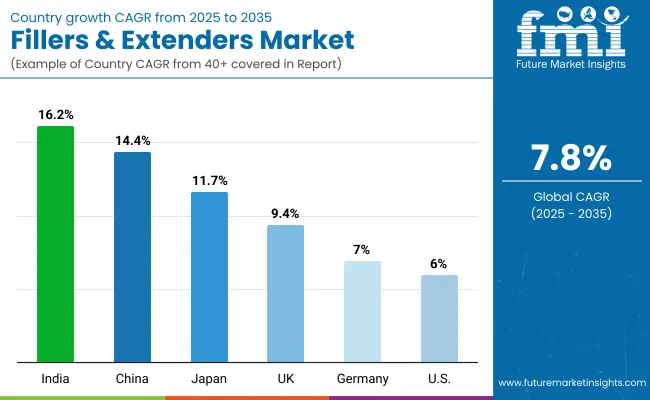

| Country | CAGR |

|---|---|

| China | 14.4% |

| USA | 6.0% |

| India | 16.2% |

| UK | 9.4% |

| Germany | 7.0% |

| Japan | 11.7% |

The Fillers & Extenders Market demonstrates varied growth momentum across major economies, shaped by differences in consumer behavior, industrial sophistication, and regulatory intensity. India is projected to record the fastest trajectory at 16.2% CAGR, supported by accelerated penetration of premium personal care and skincare products, alongside expansion of local manufacturing hubs catering to export-driven formulations. China follows closely with 14.4% CAGR, where strong domestic demand for hybrid skincare-makeup formats and government focus on quality compliance are expected to sustain rapid adoption. Local suppliers are anticipated to leverage cost-competitive manufacturing, while global players expand presence through innovation partnerships.

Japan, at 11.7% CAGR, is likely to benefit from its established beauty culture emphasizing texture and sensorial performance, driving reliance on advanced filler technologies.The UK and broader Europe, with 9.4% and 8.7% CAGRs respectively, are anticipated to maintain steady growth anchored by stringent regulatory frameworks and demand for clean-label ingredients. Germany, at 7.0%, reflects the influence of high-quality assurance standards that drive reliance on traceable and compliant filler systems. The USA is expected to expand at a more moderate 6.0% CAGR, reflecting market maturity and high baseline penetration, with incremental growth sustained by multifunctional ingredient innovation and evolving consumer claims around transparency and safety.

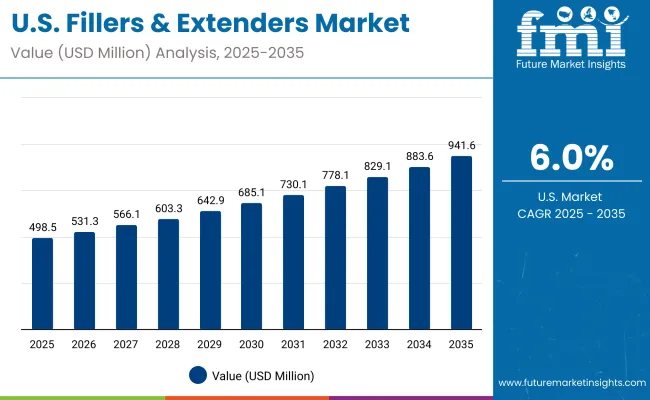

| Year | USA Fillers & Extenders Market (USD Million) |

|---|---|

| 2025 | 498.57 |

| 2026 | 531.30 |

| 2027 | 566.19 |

| 2028 | 603.36 |

| 2029 | 642.97 |

| 2030 | 685.18 |

| 2031 | 730.16 |

| 2032 | 778.10 |

| 2033 | 829.18 |

| 2034 | 883.61 |

| 2035 | 941.62 |

The Fillers & Extenders Market in the United States is projected to grow at a CAGR of 6.0% during 2025-2035, supported by steady expansion in cosmetics, skincare, and pharmaceutical topicals.Increasing alignment with multifunctional fillers designed to provide texture modification and blurring benefits is expected to strengthen adoption across face powders, foundations, and hybrid skincare-makeup products.

High regulatory scrutiny regarding heavy-metal content and crystalline silica thresholds is likely to reinforce supplier selection based on compliance and documentation rigor.Formulators are expected to prefer partners capable of delivering consistent particle morphology and validated safety profiles to support evolving product claims.

The Fillers & Extenders Market in the United Kingdom is projected to grow at a CAGR of 9.4% between 2025 and 2035, supported by rising emphasis on clean-label and regulatory-compliant formulations.Gradual adoption of multifunctional fillers is anticipated as cosmetic and skincare brands seek ingredients that deliver texture modification and stability alongside sustainability assurances.Formulation shifts are expected to prioritize traceable ingredients due to growing consumer scrutiny and evolving compliance standards.Hybrid formulations combining functional performance with natural positioning are projected to expand rapidly in both skincare and color cosmetics.Procurement teams are expected to reward suppliers demonstrating low-carbon footprints and advanced safety testing frameworks.

The Fillers & Extenders Market in India is expected to expand at the fastest CAGR of 16.2% from 2025 to 2035, reflecting strong consumer appetite for premium skincare and cosmetics.Increased urbanization and rising disposable incomes are projected to support large-scale adoption.Face powders and foundations are anticipated to anchor demand, reflecting cultural preferences for complexion-focused products.Local manufacturers are expected to strengthen competitiveness by integrating advanced fillers into mass and premium lines, addressing both affordability and performance.Consumer expectations for sensorial benefits and natural finish are projected to boost reliance on engineered fillers with multifunctional properties.International suppliers are anticipated to collaborate with local partners to secure market access while aligning with evolving safety and documentation frameworks.

The Fillers & Extenders Market in China is forecasted to grow at a CAGR of 14.4% during 2025-2035, driven by rapid expansion of hybrid skincare-makeup formats and strong consumer preference for texture-enhancing ingredients.Urban millennial and Gen Z consumers are expected to prioritize products delivering blurring, mattifying, and long-wear benefits, fueling demand for silica and multifunctional fillers.Local suppliers are projected to scale production capacity, while multinational firms are anticipated to invest in R&D hubs and compliance frameworks to address China’s evolving regulatory environment.Premium brands are expected to integrate engineered fillers into formulations offering sensorial elegance, while mid-tier players are projected to focus on cost-performance optimization.

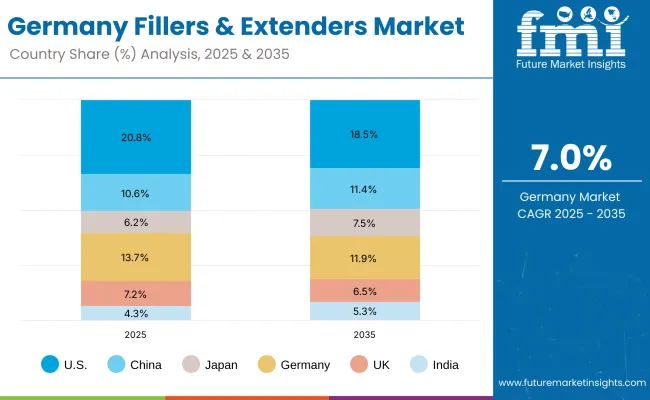

| Country | 2025 |

|---|---|

| USA | 20.8% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.7% |

| UK | 7.2% |

| India | 4.3% |

| Country | 2035 |

|---|---|

| USA | 18.5% |

| China | 11.4% |

| Japan | 7.5% |

| Germany | 11.9% |

| UK | 6.5% |

| India | 5.3% |

The Fillers & Extenders Market in Germany is projected to expand at a CAGR of 7.0% between 2025 and 2035, supported by stringent regulatory oversight and demand for high-purity fillers within cosmetic and pharmaceutical formulations.Procurement strategies are anticipated to focus on suppliers delivering robust documentation, validated purity profiles, and sustainability certifications to comply with EU standards.Growth is expected to be reinforced by dermocosmetic and prescription-linked skincare channels, where tolerability and safety are prioritized.Germany’s role as a hub for regulatory-driven innovation is anticipated to create opportunities for suppliers investing in eco-friendly filler solutions.Local consumer demand for clean, sustainable, and dermatologically tested formulations is expected to influence the adoption of advanced particle-engineered fillers.

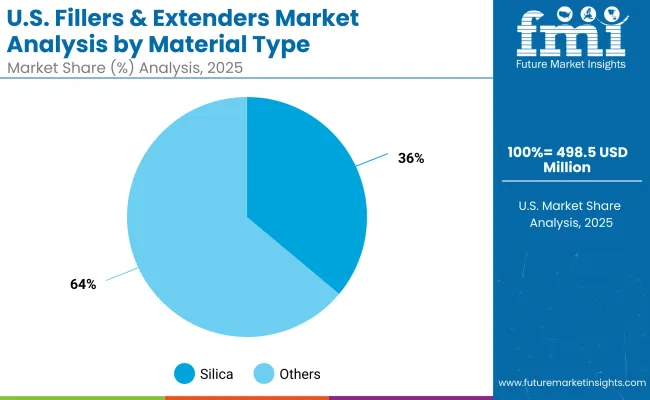

| USA By Material Type | Market Value Share, 2025 |

|---|---|

| Silica | 36.1% |

| Others | 63.9% |

The Fillers & Extenders Market in the USA is projected at USD 498.57 Million in 2025.Silica contributes 36.1%, while other materials hold 63.9%, reflecting a diverse material mix shaped by both performance-driven and cost-sensitive choices.The strong role of silica stems from its ability to deliver soft-focus, opacity control, and rheology balance, which are critical for face powders and foundations.Others collectively dominate due to broader availability and flexibility across emulsions, pressed powders, and hybrid systems.

Growth is expected to be influenced by compliance with stringent USA safety standards, driving preference for fillers with validated purity and traceable supply chains.Engineered silica is projected to gain higher value over the decade as multifunctional performance and regulatory alignment become decisive factors in procurement.

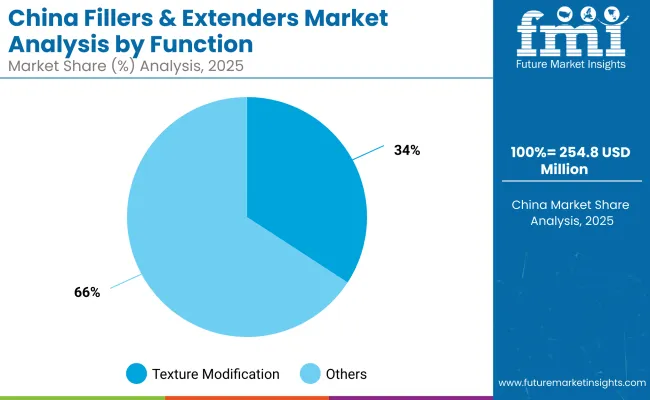

| China By Function | Market Value Share, 2025 |

|---|---|

| Texture modification | 34.2% |

| Others | 65.8% |

The Fillers & Extenders Market in China is projected at USD 254.83 Million in 2025.Texture modification contributes 34.2%, while other functions account for 65.8%, reflecting balanced reliance on performance-enhancing fillers across diverse product categories.Texture modification is being prioritized as local brands emphasize sensorial excellence, smooth payoff, and improved spreadability in complexion-focused and hybrid skincare-makeup formats.

Growth is anticipated to be reinforced by consumer expectations for natural finish, long-wear stability, and pore-blurring claims, making texture-driven fillers essential in premium and mass segments.Other functions remain dominant, as fillers continue to be integrated into a wider range of formulations including emulsions, creams, and lotions, supporting both performance and affordability.

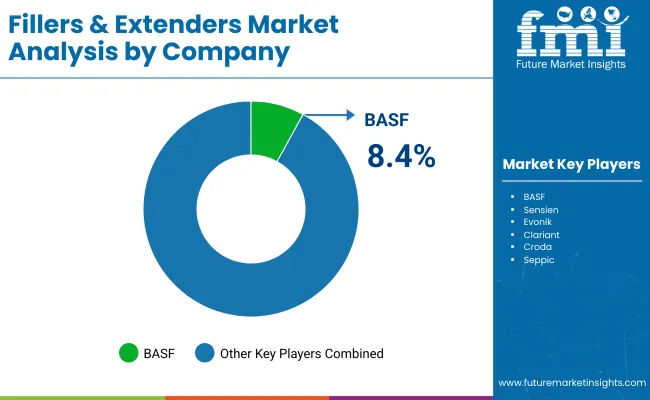

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.4% |

| Others | 91.6% |

The Fillers & Extenders Market is moderately fragmented, with global chemical majors, regional suppliers, and niche specialists competing across personal care, cosmetic, and pharmaceutical applications.BASF is identified as the leading player, holding 8.4% global market share in 2025, while the remaining 91.6% is distributed among a wide array of competitors.Strategies of leading players are increasingly oriented toward multifunctional filler platforms, compliance assurance, and sustainability certifications to address rising consumer and regulatory demands.

BASF’s scale, product diversification, and global supply chain presence enable it to maintain dominance, especially in high-volume categories such as face powders and foundations.Mid-sized companies including Clariant, Evonik, and Merck KGaA are focusing on specialty grades, emphasizing clean-label claims and advanced particle engineering to strengthen positioning in premium skincare and dermocosmetic segments.

Specialist ingredient companies such as Croda, Sensient, Kobo Products, and Seppic are advancing by tailoring formulations to niche consumer demands, particularly in hybrid makeup-skincare and sustainable ingredient solutions.The competitive advantage is shifting toward suppliers capable of providing regulatory-compliant, high-purity fillers with validated traceability, supported by digital product passports and lifecycle transparency frameworks.

Competitive differentiation is expected to intensify as formulation houses prioritize suppliers delivering documentation rigor, sensorial libraries, and global service reliability, beyond simple material availability.

Key Developments in Fillers & Extenders Market

| Item | Value |

|---|---|

| Market Size (2025E) | USD 2,401.40 Million |

| Market Size (2035F) | USD 5,102.30 Million |

| Forecast CAGR (2025-2035) | 7.80% |

| Time Horizon | 2025 to 2035 |

| Material Type | Silica; Others |

| Function | Texture modification; Others |

| Application | Face powders & foundations; Others |

| End-use Industry | Cosmetics & skincare; Personal care toiletries; Pharmaceutical topicals |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Key Companies Profiled | BASF; Clariant; Evonik; Merck KGaA; Croda; Sensient; Givaudan; Ashland; Kobo Products; Seppic |

| Additional Attributes | 2025 shares: Silica 34.20% (USD 821.28 Million); Texture modification 39.30% (USD 943.75 Million); Face powders & foundations 42.10% (USD 1,010.99 Million). Country CAGRs (2025-2035): India 16.20%, China 14.40%, Japan 11.70%, UK 9.40%, Germany 7.00%, USA 6.00%. Competitive split: BASF 8.40% (Global Value Share 2025). |

The global Fillers & Extenders Market is estimated to be valued at USD 2,401.40 Million in 2025.

The market size for the Fillers & Extenders Market is projected to reach USD 5,102.30 Million by 2035.

The Fillers & Extenders Market is expected to grow at a CAGR of 7.80% between 2025 and 2035.

The key product types in the Fillers & Extenders Market are silica and other fillers, reflecting diverse applications in cosmetics, personal care, and pharmaceutical topicals.

In terms of application, the face powders & foundations segment is expected to command 42.10% share in the Fillers & Extenders Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

WiFi Extenders Market Size and Share Forecast Outlook 2025 to 2035

Sack Fillers Market Size and Share Forecast Outlook 2025 to 2035

Dermal Fillers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dermal Fillers and Botulinum Toxin Market Outlook - Size, Trends & Forecast 2025 to 2035

Piston Fillers Market Size and Share Forecast Outlook 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Competitive Overview of Dermal Fillers Market Share

Plastic Fillers Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Aseptic Fillers Market Growth - Trends & Forecast 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Volumetric Cup Fillers Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Volumetric Cup Fillers Companies

Leading Providers & Market Share in Body Augmentation Fillers

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA