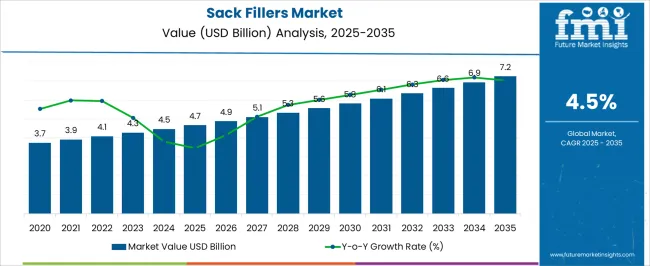

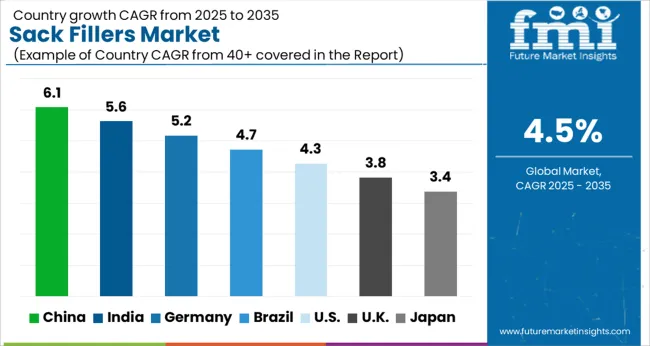

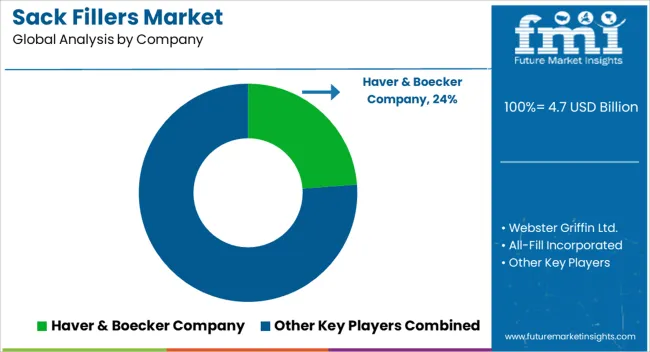

The Sack Fillers Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Sack Fillers Market Estimated Value in (2025 E) | USD 4.7 billion |

| Sack Fillers Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The sack fillers market is expanding steadily due to rising automation trends in packaging, increasing demand for efficiency in bulk material handling, and the emphasis on reducing operational downtime. Industries such as agriculture, construction materials, and chemicals are adopting advanced sack filling solutions to improve productivity and minimize labor dependency.

Enhanced precision, consistency, and speed in filling processes are being prioritized to meet the growing demand for packaged bulk goods across global supply chains. Technological advancements in machine design, integration with weighing systems, and ease of maintenance are further enhancing adoption.

Regulatory standards related to packaging accuracy and workplace safety are also driving the shift toward reliable and automated sack filling equipment. With industries focusing on high throughput, sustainability, and operational efficiency, the market outlook for sack fillers remains positive, supported by steady growth in both developed and emerging economies.

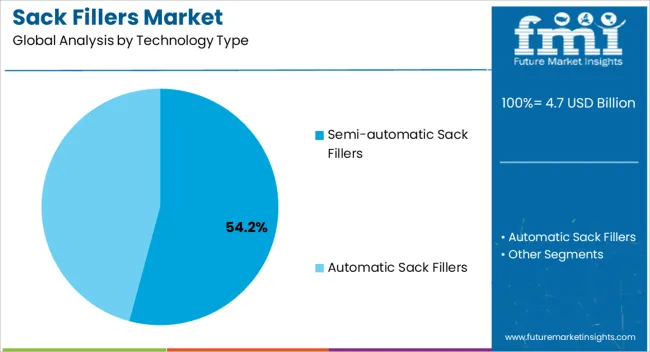

The semi automatic sack fillers segment is projected to hold 54.20% of total market revenue by 2025, positioning it as the leading technology type. Its dominance is attributed to its balance between automation efficiency and cost effectiveness, making it highly attractive for small and medium scale enterprises.

Semi automatic systems reduce manual workload while offering flexibility in handling different sack sizes and materials. Industries prefer these machines due to lower upfront investment compared to fully automated alternatives, combined with reliable performance in diverse applications.

The ability to maintain high filling accuracy while reducing operator fatigue has further reinforced its prominence in the technology type category.

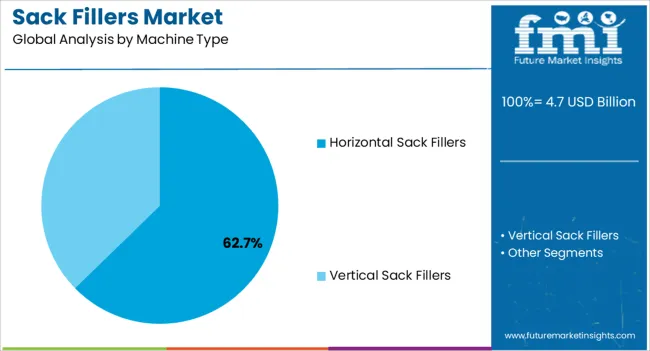

The horizontal sack fillers segment is expected to account for 62.70% of total market revenue by 2025 within the machine type category, making it the most prominent segment. This is driven by the operational efficiency, ergonomic design, and space saving advantages associated with horizontal configurations.

The ability to handle bulk filling tasks with reduced spillage and enhanced speed has made horizontal sack fillers a preferred choice for industries with high throughput demands. Their compatibility with automated conveyors and integrated weighing systems has further strengthened adoption.

These advantages collectively contribute to the sustained leadership of horizontal sack fillers in the machine type segment.

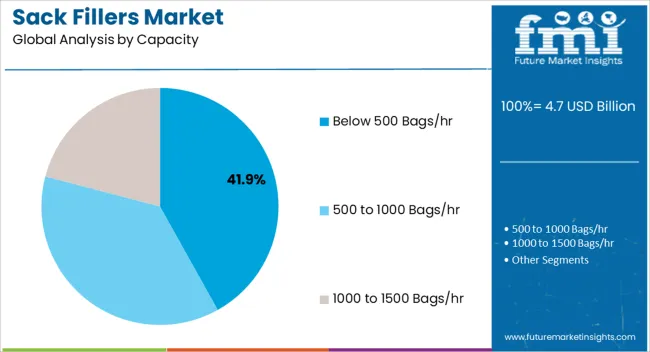

The below 500 bags per hour capacity segment is projected to hold 41.90% of total market revenue by 2025 under the capacity category, making it the leading segment. This capacity range is favored by industries with medium scale operations that prioritize flexibility and cost control.

It offers an optimal balance between throughput and energy efficiency, making it suitable for diverse applications in agriculture, construction, and chemical packaging. The ability to maintain consistency in smaller production runs while reducing wastage has supported its adoption.

As industries focus on improving efficiency without significant capital expenditure, this segment continues to dominate in the capacity category.

The global sack fillers market expanded at a modest CAGR of 4.1% from 2012 to 2025. In 2020, the global market size stood at USD 3,467.8 million. In the following years from 2020 to 2025, the market witnessed significant growth, accounting for USD 4,088.1 million in 2025.

The increasing industrialization is a prime factor augmenting the demand for sack fillers. The growth of the global economy has boosted the demand for several kinds of goods. The surge in demand for goods results in swelling more packaging, thereby boosting sack fillers demand.

The growing popularity of online shopping is playing a vital role in boosting market growth. The swiftly rising digitalization and improving income levels are enabling people to shop online more. This trend is increasing the demand for shipping and packaging products. As a result, the demand for sack fillers to fill boxes and bags is rising.

The increasing construction activities and urbanization also substantially amplify the market growth. Sack fillers are used to fill construction materials, such as sand, gravel, cement, and others. The increasing infrastructural development across developed and developing nations bolster market expansion. Furthermore, the swelling mining and earthmoving activities promote market development.

Automatic sack fillers are anticipated to be the dominating segment by technology type. The segment captured nearly 89.5% market share in 2025. High precision is required in the packaging of different kinds of products. From handling and filling industrial and chemical powders to agricultural products such as seeds, corn, wheat, and others, automated sack fillers play a vital role in improving operational efficiency.

Artificial Intelligence and automation are transforming operational methods across industries. Through the progressions in innovation, robotics, and sensors, automated sack fillers are witnessing significant evolution. New launches and technological development are expected to complement market expansion.

The food sack fillers segment by end-use accounted for a huge 38.5% market share in 2025. The increasing demand for pre-packaged foods is a key growth factor. The improving income levels, evolving lifestyles, and expanding middle-class population boost demand for packaged foods. The expansion of the food and beverage industry is anticipated to foster the segment’s expansion.

Agriculture sack fillers are expected to gain considerable growth during the forecast period. The swelling food demand due to the ever-increasing global population is impelling the agriculture industry to adopt modern production methods.

Agriculture sack fillers efficiently fill sacks or bags with grains, fertilizers, and seeds. They can fill sacks accurately and quickly, thereby reducing manual labor. This also helps to mitigate product damage risks during storage and transportation. The automated agriculture sack fillers market is likely to swell as agricultural producers sought cost-effective and efficient methods of production. The increase in smart farming techniques is likely to bolster fertilizer sack fillers demand.

The North America sack fillers market is expected to rise at a steady pace due to the already established market in the region. North America captured a staggering 19.8% market share in 2025. However, technological advancements and innovative sack-filling machines are expected to see moderate demand over the forecast period.

Europe captured a whopping 23.4% market share in 2025. Europe’s well-established industries have already adopted technologically advanced sack fillers. Also, there is a relatively lower requirement for these devices in the region. The establishment of new factories in some countries of Europe is expected to drive sales of sack fillers in the region.

India captured nearly 5.3% market share in 2025. The country has witnessed a substantial increase in its manufacturing sector in recent years. The nation is one of the leading emerging economies in Asia. It provides lucrative opportunities for multiple products and services.

Government initiatives are supporting the growth of the manufacturing sector with subsidies and attractive investment opportunities. This trend has spawned a growth spurt in food, chemical, construction, and other industries. These industries are the main end-use industries for super sack bag fillers.

Super sack bag filler machinery and equipment sales are fueled by the growth and expansion of these sectors. Apart from rapid urbanization, increasing technological proliferation is also influencing the Indian sack fillers market. Sack filler suppliers can focus on this market and grow their global market share significantly.

Japan captured a modest 11.2% sack fillers market share in 2025. Japan is recognized as one of the most technologically advanced nations in the world. Its technological supremacy is evident in its industries and lifestyle, and this has always favored multiple markets. Technological advantage makes Japan a very lucrative market for sack fillers.

Demand for automatic sack fillers is high in Japan as the working population of the nation is very low. Additionally, Japan’s mass population comprises geriatric people who don’t work. Japan holds a prominent share of the global marketplace. It is expected to showcase a good growth outlook over the forecast years.

The market in East Asia, South Asia, and the Pacific is expected to exhibit robust growth in the shipments of sack fillers. Demand for super sack bag fillers is also expected to be high and driven by emerging economies in these regions. Demand for super sack fillers from India and China is expected to be significantly more prominent than any other nation in these regions.

Sack filler companies are focusing on the research & development of new and innovative technologies that automate the process. They are focusing to work in the evolving technological industry. Sack filler manufacturers are also focusing on mergers and acquisitions to increase their overall global market presence in multiple geographies.

Recent Developments Observed by FMI:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Unit for Sales, USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; The Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Türkiye, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand |

| Key Segments Covered | Technology Type, Machine Type, Capacity, End Use, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global sack fillers market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the sack fillers market is projected to reach USD 7.2 billion by 2035.

The sack fillers market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in sack fillers market are semi-automatic sack fillers and automatic sack fillers.

In terms of machine type, horizontal sack fillers segment to command 62.7% share in the sack fillers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fillers & Extenders Market Size and Share Forecast Outlook 2025 to 2035

Coxsackievirus Infections Treatment Market – Growth & Drug Innovations 2025 to 2035

Block Sack Market Size and Share Forecast Outlook 2025 to 2035

White Sack Kraft Paper Market

Valve Sack Market

Dermal Fillers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dermal Fillers and Botulinum Toxin Market Outlook - Size, Trends & Forecast 2025 to 2035

Piston Fillers Market Size and Share Forecast Outlook 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Cement Sacks Market Growth – Demand & Forecast 2025 to 2035

Competitive Overview of Dermal Fillers Market Share

Coated Sack Kraft Paper Market

Rubble sacks Market

Farming Sack and Tote Market Size and Share Forecast Outlook 2025 to 2035

Plastic Fillers Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Aseptic Fillers Market Growth - Trends & Forecast 2025 to 2035

Natural Sack Kraft Papers Market

Hessian Sacks Market

PE Coated Sack Kraft Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA