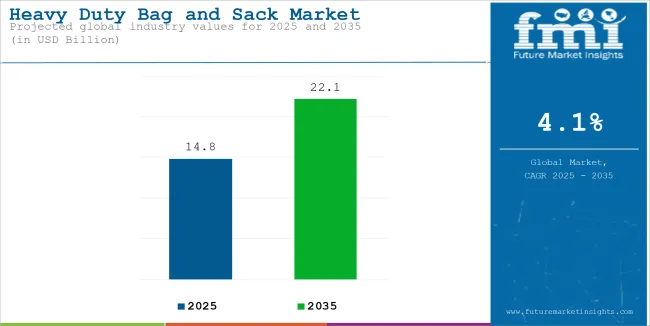

The heavy duty bag and sack market size is estimated to be worth USD 14.8 billion in 2025 and is anticipated to reach a value of USD 22.1 billion by 2035. Sales are projected to rise at a CAGR of 4.1% over the forecast period between 2025 and 2035. The revenue generated by heavy duty bag and sack in 2024 was USD 14.0 billion.

Heavy-duty bag and sack have a very high usage in the agriculture industry, capturing 32% plus of the heavy-duty bag and sack market by 2035. The heavy-duty bag has many applications as it is strong and can therefore bear heavy cargos as well as carry many crops, grains, and fertilizers. The contents are also protected from damage, moisture, and pests in these bags, ensuring safe storage and transportation.

Heavy Duty Bag and Sack Industry Forecast

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 14.0 billion |

| Estimated Size, 2025 | USD 14.8 billion |

| Projected Size, 2035 | USD 22.1 billion |

| Value-based CAGR (2025 to 2035) | 4.1% |

In the capacity segment, heavy-duty bag and sack with a capacity of 20 to 40 kg are expected to hold more than 54% of the market share over the forecast period. These are usually used because they are of the right size for most agricultural and industrial applications.

The weight is also easy to handle for the workers to avoid straining when moving goods. These bags are strong enough to carry heavy loads such as grains, fertilizers, and animal feed without breaking or spilling during handling. Furthermore, using bags in this weight range facilitates efficient storage and stacking, which saves space in warehouses and during transport.

The heavy duty bag and sack market will grow with profitable prospects in the forecast period, as it is expected to offer an incremental opportunity of USD 8.1 billion and will increase 1.6 times the existing value by 2035.

The below table presents the expected CAGR for the global market of heavy-duty bag and sack over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 3.0% (2024 to 2034) |

| H2 | 5.2% (2024 to 2034) |

| H1 | 4.0% (2025 to 2035) |

| H2 | 4.2% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.0%, followed by a slightly higher growth rate of 5.2% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.0% in the first half and remain relatively moderate at 4.2% in the second half. In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

Improvement in Protection by Manufacturers is Pushing Their Demand for Various End use Industries

Heavy-duty bag and sack manufacturers have improved considerably as far as the protection needed for products is concerned, which indeed meets the demand of businesses that undertake transportation. It now features unique protection properties for protection from UV rays, which is prevention for damage due to sunlight, and chemical resistance to protect the content from harmful chemicals.

They are less likely to tear easily and provide more protection to the contents in the bag during shipping and storage. Such features are crucial to businesses that deliver products safely and securely since they prevent leakage, spillage and breakage of the products packaged inside. Due to their ideal greater protection, these heavy-duty bags and sacks ensure their dependability as a shipment choice for any business in maintaining safe and efficient packaging.

Agricultural Products Fuel the Market of Heavy-Duty Bags and Sacks

Increased production of agricultural products raises the demand for heavy-duty bags and sacks to effectively pack and transport them. The demand for heavy-duty bags and sacks has increased to accommodate the increased production of grains, fertilizers and other agricultural products for safe transit over long distances. The demand for grains, cereals, and other related agricultural products also increases with rising population across various regions.

This translated to strong packaging that would support the increasingly larger volumes of harvests. Heavy-duty bags and sacks would provide the much-needed strength and durability for carrying agricultural products without any damage. It is made to withstand harsh conditions to ensure that the contents available are delivered with the necessary quality.

Competition from Alternative Packaging Solutions May Restrict the Growth of Market

Alternative packaging like biodegradable bags, reusable containers, and other eco-friendly choices cause big hurdles for the old heavy-duty bags market. Reusable containers have gained importance for durability against packaging waste; these containers are used repeatedly, decreasing dependence on single-use packaging with the aim of using sustainable packaging products.

Probably, the most crucial one is that it minimizes waste and carbon footprint. For instance, biodegradable bags are produced in such a way that after some time, they will experience natural changes, becoming more environmentally friendly than the ordinary plastic bag.

The global heavy duty bag and sack market recorded a CAGR of 3.3% during the historical period between 2020 and 2024. Market growth of heavy duty bag and sack was positive as it reached a value of USD 14.0 billion in 2024 from USD 12.3 billion in 2020.

Heavy-duty bags and sacks market has remained stable in recent years with gradual growth in consumer demand. It is because such bags have inherent benefits like minimal weight, effortless handling, great strength, and recyclable materials. Some heavy-duty bags have built-in safety handles or anti-skid surfaces so that they do not slip, and it gets easy to move and handle those. This especially is a prime concern in industries where people work under heavy burdens.

In the assessment period, global demand for heavy-duty bags and sacks is expected to grow strongly. The drivers for this are mainly sustainability regulations, customization of heavy-duty bags and sacks, innovation in weather-resistant bags, and growth of food and construction industries.

Tier 1 companies comprise market leaders with significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Mondi Group, Berry Global, Inc., LC Packaging International BV, Sonoco Products Company, ProAmpac LLC among others.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Muscat Polymers Pvt. Ltd., Al-Tawfiq Company, Inteplast Group, Global-Pak Inc., MegaSack Corporation, Cromwell Polyethylene Ltd., Segezha Group LLC, Alpha Poly Corporation, Seevent Plastics Ltd., Wooderson Packaging Ltd., and Nihon Matai Co., Ltd.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the future forecast for the heavy duty bag and sack market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 3.8% through 2035. In Europe, Spain is projected to witness a CAGR 3.3% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

| Germany | 3.9% |

| China | 5.4% |

| UK | 3.5% |

| Spain | 3.3% |

| India | 6.4% |

| Canada | 3.5% |

The demand for water-resistant heavy-duty bags and sacks in the construction industry is high in the United States. Rain and moisture penetrate construction materials when exposed to open construction sites. Therefore, robust and protective packaging solutions are essential. The water-resistant bags save materials such as cement, sand, and aggregates from moisture damage; therefore, the products remain good in quality and integrity within transportation and storage.

Ongoing infrastructure development and urbanization initiatives will fuel the growth of heavy-duty bags that can stand up to the harsh conditions of the job site. Among such bags, water-resistant heavy-duty bags and sacks are particularly useful since they keep water from seeping into the materials, thus protecting the strength and performance of construction products.

Rapid implementation of co-extrusion technology at an exponential level is hugely driving the demand for heavy-duty bags and sacks in China. This technology assists in the production of multi-layer films, increasing the strength, durability, and barrier properties of packaging materials toward significant applications in heavy-duty bags and sacks.

The increasing logistics industries in the country also require robust packaging solutions so that products can be delivered to their destinations without any damage and with a high level of efficiency. China is dominated by the fast adoption of co-extrusion technology, which drives the demand for heavy-duty bags and sacks. Co-extruded bags provide strength and protection from the external factors, so these bags are used to transport everything from agricultural products to industrial materials.

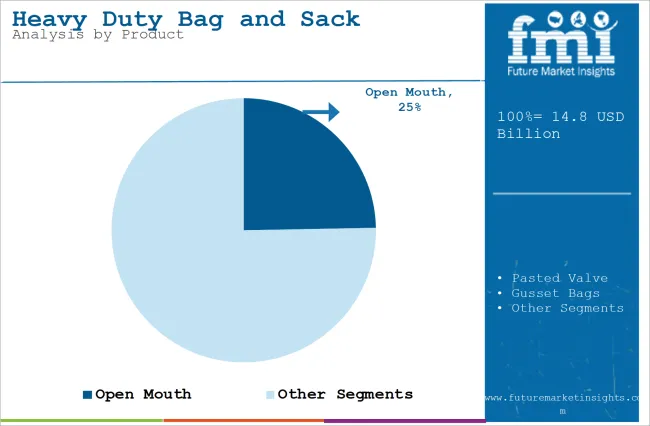

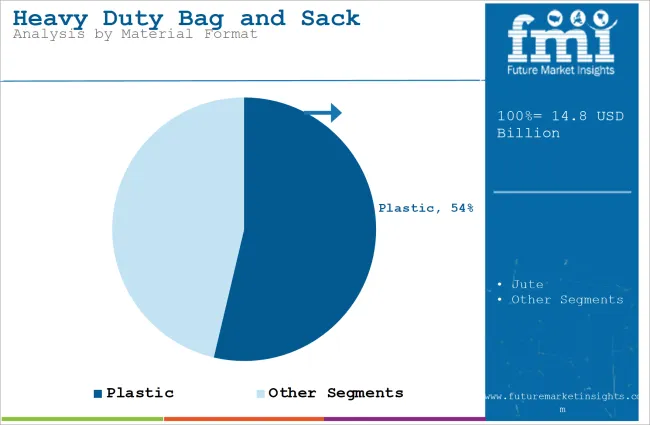

The section contains information about the leading segments in the industry. In terms of product, open mouth is estimated to account for a share of 24.7% by 2035. By material formats, plastic is projected to dominate by holding a share of 53.7% by the end 2035.

| Product | Market Share (2035) |

|---|---|

| Open Mouth | 24.7% |

Open-mouth bags can be applied at heavy-duty service since they allow easy filling up and use up. This product has an extra-large mouth opening on its top end which helps users quickly pour products into bags such as grain, seed fertilizers, and thus making it easy to handle for workers not creating a messy environment.

Once filled, the bags can be sealed or tied to keep the contents secure. Open-mouth bags are strong and durable so that they do not tear off easily when heavy loads are placed inside them. These factors cumulatively drive the demand for open moth heavy-duty bags and sacks.

| Material Format | Market Share (2035) |

|---|---|

| Plastic | 53.7% |

Plastic is primarily used for making bags and sacks because it is heavy-duty, strong, and light. Because of this, the bags bear much weight without tearing apart, ideal for carrying heavy things. Neither water nor many chemicals can penetrate it, meaning contents inside will remain safe and dry. Most importantly, plastic is comparatively cheap to manufacture compared with most other materials so it saves both manufacturers and the consumer money.

They are available in various sizes and forms, and can be molded to accommodate numerous end-use industries' requirements as well. Some plastic materials are also recyclable, thereby useful from the sustainable point of view. These factors altogether such as strength, affordability, and versatility make plastic the preferred material for heavy-duty bags and sacks in most industries

Key players of heavy duty bag and sack industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies for new product development.

Key Developments in Heavy Duty Bag and Sack Market:

In terms of material, the market of heavy duty bag and sack is divided into plastic, paper and jute. Plastic is further divided into HDPE, LDPE, LLDPE, PP, polystyrene and others.

In terms of product, the market of heavy duty bag and sack is segmented into open mouth, pasted valve, gusset bags, rubble sacks, woven sacks and trash sacks.

In terms of capacity, the market of heavy duty bag and sack is segmented into less than 20 kg, 20-40 kg and above 40 kg

End users in the market of heavy-duty bag and sack include food packaging, agriculture packaging, chemical & fertilizers packaging, building & construction related product packaging, automotive product packaging, and others.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

The heavy duty bag and sack industry is projected to witness CAGR of 4.1% between 2025 and 2035.

The global heavy duty bag and sack industry stood at USD 14.0 billion in 2024.

Global heavy duty bag and sack industry is anticipated to reach USD 22.1 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 6.4% in assessment period.

The key players operating in the heavy duty bag and sack industry are Mondi Group, Berry Global, Inc., LC Packaging International BV, Sonoco Products Company, ProAmpac LLC among others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 27: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 57: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Capacity, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Haul Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA