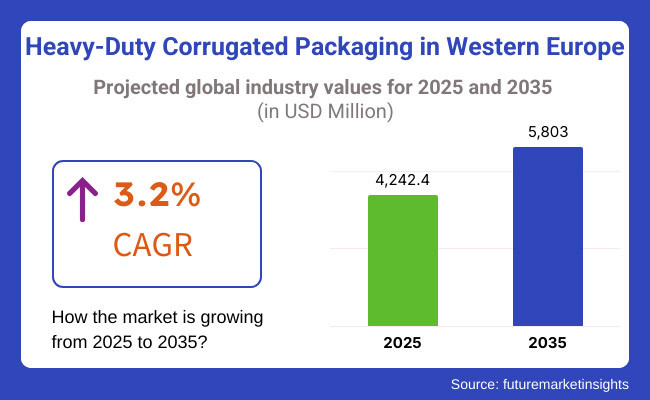

Sales of heavy-duty corrugated packaging in the Western Europe market are estimated to rise at a CAGR of 3.2% through 2035. The demand for heavy-duty corrugated packaging in Western Europe is anticipated to reach a valuation of USD 4,242.4 million in 2025 and grow by USD 5,803.0 million by 2035.

Due to its robustness and cost-effectiveness, heavy-duty corrugated packaging in Western Europe plays a significant role in various industries, including automotive, electronics, and food and beverages. This industry has been witnessing significant growth with the growing demand for sustainable packaging solutions. It offers superior protection for heavy and bulky items during transit.

The region’s robust manufacturing presence, with an emphasis on lowering environmental impact, has spurred creativity in the industry, including using recyclable and biodegradable materials. The industry has been significant not only in its contributions to logistics and distribution but also for its role in supporting Western Europe’s commitment to sustainability and circular economy principles.

During the period between 2020 and 2024, the heavy-duty corrugated packaging in Western Europe witnessed significant growth. Its growth has been driven by the expansion of the automotive sector in countries across the region like Germany, agricultural and food exports in Italy and rising collaborations with global retailers in France.

The UK post-Brexit climate encouraged businesses to look for dependable, local packaging solutions, driving market demand further. During this period, the market was also expanded by the surge of cross-border e-commerce in the Netherlands.

From 2025 to 2035, the industry is projected to witness a healthy growth, driven by the rising need for sustainable packaging solutions in various sectors. In addition, the growing importance of e-commerce, coupled with the necessity for efficient yet protective packaging, is expected to propel the further adoption of heavy-duty corrugated packaging across the region.

Strategic industry mergers and acquisitions, like Mondi's takeover of Schumacher Packaging's assets in 2024, are anticipated to upgrade the capabilities and industry share of companies, potentially resulting in more efficient and integrated packaging solutions. These trends manifest the industry's responsiveness and dedication to addressing changing market needs while prioritizing sustainability and operational efficiency.

The Western European heavy-duty corrugated packaging industry is being driven by factors such as the demand for sustainable packaging materials, rapid growth in e-commerce activities, and the need for cost-effective yet durable packaging solutions by industries that include automotive, food & beverage.

The key restraints include variations in raw material prices and environmental regulations. In recent years, many packaging printing companies have adopted new trends in packaging printing, such as a switch to recyclable and biodegradable materials, widespread adoption of digital printing technologies and innovative packaging designs that improve supply chain efficiency and reduce waste.

| Key Drivers | Key Restraints |

|---|---|

| Sustainability Focus: A Growing emphasis on environmental sustainability has led to a higher demand for eco-friendly and recyclable packaging. Companies are adopting corrugated packaging due to its renewable nature and its alignment with circular economy goals. | Raw Material Price Fluctuations: Prices for essential raw materials, such as paper and cardboard, fluctuate due to industry dynamics and supply chain disruptions, affecting packaging costs. |

| E-Commerce Growth: The expansion of e-commerce has increased the need for protective packaging that can withstand longer transit times and handling, making corrugated packaging a preferred option due to its durability. | Environmental Regulations: Strict environmental regulations regarding the production and disposal of packaging materials can impose additional compliance costs and operational challenges on manufacturers. |

| Cost-Effectiveness: Heavy-duty corrugated packaging is more affordable than alternative materials like plastic, offering an optimal balance between cost and performance, which makes it appealing to industries looking to reduce packaging expenditures. | Competition from Alternative Packaging: While corrugated packaging is popular, alternatives like plastic and metal packaging are emerging with claims of superior performance, posing a challenge to market dominance. |

| Industrial Demand: Key industries such as automotive, consumer electronics, and food & beverage continue to demand reliable, sturdy packaging solutions to protect heavy and bulky items during transportation, driving demand for heavy-duty corrugated options. | Supply Chain Disruptions: Logistics and transportation issues, especially in the aftermath of global events like the COVID-19 pandemic, may hinder the smooth flow of raw materials and finished products, affecting industrial growth. |

| Technological Advancements: Advances in packaging technology, such as digital printing and automated production lines, have improved the efficiency and customization options of corrugated packaging. This has further increased its adoption in various sectors. | Labor Shortages: The packaging industry is facing a shortage of skilled labor in key regions of Western Europe, which can affect production capacity and lead times. |

| Consumer Preference for Eco-friendly Products: Consumers are increasingly demanding products packaged in sustainable materials. As a result, companies are transitioning to corrugated packaging to meet consumer preferences and improve brand image. | Transportation Challenges: The increasing cost of transportation and logistics, especially with heavy-duty packaging, adds to overall packaging costs, limiting its competitiveness. |

| Government Support for Sustainable Practices: Governments in Western Europe are promoting the use of sustainable materials and pushing for greater recycling efforts, offering incentives to businesses that adopt green practices, thus boosting the industry for corrugated packaging. | Dependency on the Paper Industry: The heavy-duty corrugated packaging market is highly dependent on the paper and forestry industries. Any disruption in these sectors could have a significant impact on supply chains and production processes. |

| Growth in Regional Manufacturing: Western Europe’s robust manufacturing sector, including automobile and electronics production, continues to require durable and heavy-duty packaging for transportation, increasing demand for high-strength corrugated boxes. | Customization and Design Costs: High customization and design demands, although growing in popularity, increase the production time and cost of heavy-duty corrugated packaging, limiting widespread affordability for all businesses. |

| Shift Towards Digitalization: The integration of smart packaging technologies and digital printing in the corrugated packaging sector is enhancing brand visibility, tracking, and overall consumer experience, creating a growing preference for this type of packaging. | Waste Management Challenges: Although corrugated packaging is recyclable, the efficiency of waste collection, recycling, and processing systems remains a challenge, limiting the complete sustainability of the packaging. |

This table anticipates the key factors driving growth in the heavy-duty corrugated packaging market and the factors that might keep growth in check over the coming years. The industry is driven by technology developments and greater consumer and industrial demand for sustainable solutions. However, it is hindered by the fluctuating cost of its base materials, regulatory pressures, and competition from other packaging materials.

| Key Drivers | Impact |

|---|---|

| Sustainability Focus | High |

| E-Commerce Growth | High |

| Cost-Effectiveness | Medium |

| Industrial Demand | High |

| Technological Advancements | Medium |

| Consumer Preference for Eco-friendly Products | High |

| Government Support for Sustainable Practices | Medium |

| Growth in Regional Manufacturing | Medium |

| Shift Towards Digitalization | Low |

| Key Restraints | Impact |

|---|---|

| Raw Material Price Fluctuations | High |

| Environmental Regulations | High |

| Competition from Alternative Packaging | Medium |

| Supply Chain Disruptions | Medium |

| Labor Shortages | Medium |

| Transportation Challenges | Medium |

| Dependency on Paper Industry | Medium |

| Customization and Design Costs | Low |

| Waste Management Challenges | Low |

The industry for heavy-duty corrugated packaging is expected to continue growing among different types of products. Corrugated boxes are the most commonly used due to their adaptability and ability to offer maximum protection for heavy loads. Pallet boxes are also anticipated to experience a surge in demand based on their cost-effective storage and transportation.

Cover boxes, single and double, will see moderate growth because industries need extra protection for delicate products. Telescopic boxes are becoming popular due to their versatility in dealing with products of different sizes. Liquid bulk boxes will also increase, especially in the food and beverage and chemicals industries.

Octabins and high-performance totes will increasingly be employed for bulk transport, while vegetable totes will continue to enjoy demand in agriculture. At the same time, point-of-purchase (POP) displays are anticipated to continue in demand for retail purposes, as other specialty items such as edge protectors will keep playing special purposes.

The industry for heavy-duty corrugated packaging boards is likely to be driven by the requirement for increased protection levels. Single-wall boards will remain in use for markets that need lighter-duty packaging at a reduced cost. Double-wall boards are likely to experience steady growth as industries such as food and beverages and consumer electronics seek greater protection during transportation.

However, the demand for triple-wall boards is likely to witness a significant rise with their ability to support heavy-duty applications such as automotive parts, glassware and industrial products. Companies are anticipated to focus on optimising board designs to balance protection with cost-effectiveness.

Heavy-duty corrugated packaging demand will be influenced by the weight of the goods being transported. Packaging designed to carry up to 100 lbs is likely to remain prevalent in the consumer industry, especially in consumer electronics and homecare sectors. Meanwhile, industries like automotive and chemicals require protective packaging holding 100 lbs to 300 lbs.

This change is caused by the growing need for higher, bulkier items being shipped. Packaging for the transportation of more than 300 lbs. will experience greater utilization, especially in industrial and high-value materials such as car parts and delicate glassware, where maximum protection and stability while shipping are critically needed.

Sustainability is a key concern impacting the heavy-duty corrugated packaging industry. As a result, the industry is being pushed by the food and beverage sector as manufacturers prefer recyclable and eco-friendly packaging options. Demand in the sector will also be fuelled by chemicals and consumer electronics sectors, requiring packaging to adhere to strict safety and protection standards.

Beauty and personal care products will require more creative packaging solutions that keep products safe and serve as brand representation. Medical and textile industries will continue to require durable packaging for sensitive completion or raw services.

Whereas the automotive industry will necessitate heavy-duty corrugates for parts transportation, the homecare and glassware segments will require packaging solutions that ensure the highest level of protection.

The heavy-duty corrugated packaging industry in Germany will continue to develop through the forecast period. Its demand is driven by the strong manufacturing industry in sectors like automobiles and electronics. The country has been putting sustainability efforts into adopting eco-friendly packaging solutions.

The constant development of the e-commerce sector will also drive the demand for effective and economical packaging. Additionally, advances in packaging technology and mechanization will serve to enhance the efficiency of manufacturing and personalization.

As the country is focusing on circular economy values, the demand for recyclable corrugated packaging will increase, and it will become a major contributor to the European industry for the forecast period. The heavy-duty corrugated packaging sector will expand at a CAGR of 2.60% through 2035.

Italy’s heavy-duty corrugated packaging industry is likely to expand and place its dominance, especially in the food and beverage industry. It will boost the demand for sustainable and protective packaging. The demand for agricultural products will also surge due to its secure and long-lasting packaging.

As the country has been focusing on reducing the environmental footprint, attention will be directed toward recyclable and biodegradable packaging materials. The nation's sophisticated packaging technology will be producing innovations that both satisfy cost-efficiency and individualization needs.

The automobile industry and textile trade will also sustain their use of heavy-duty packages to shield the products from travel damage. The industry will grow at a CAGR of 3.00% in the country.

France will witness a steady growth in the heavy-duty corrugated packaging industry driven by its consumer electronics and food and beverage industries. The country’s growing demand for sustainability and green packaging will propel the industry's growth, especially in recyclable corrugated products.

The retail industry in France will also be responsible for the growing demand for point-of-purchase displays and other packaging items. In addition to this, the country’s dedication to circular economy principles and packaging design will allow businesses to address the consumers and regulatory demands.

The pharmaceutical industry will also likely witness a moderate demand for heavy-duty packaging solutions. The industry is likely to move at a CAGR of 3.70% through 2035.

Heavy-duty corrugated packaging in the United Kingdom is anticipated to grow with the expansion of the e-commerce sector and the surging demand for protective packaging solutions. Post-Brexit, the manufacturers in the United Kingdom started focusing on local manufacturing and boosting demand for sustainable packaging solutions.

The automotive, chemicals, and food industries will be principal drivers, especially as sectors attempt to force packaging solutions that meet strict environmental criteria. Pouch technology advances will enable cost-effectiveness and personalization, while the regulatory policies of the UK with regard to packaging waste will drive the shift towards recyclable materials.

The personal care and healthcare industries will drive demand for effective packaging solutions as well. The heavy-duty corrugated packaging industry is expected to grow at a steady CAGR of 4.10% in the upcoming decade.

Netherlands is poised for sustained continuous growth for heavy-duty corrugated packing businesses due to its location as the hub of European trade & logistics, end consumers. The country's agricultural and food industries will require heavy-duty packaging in order to ship goods securely.

The growth of e-commerce will also drive increasing demand for protection and sturdy packaging. As a leader in sustainability in Europe, the Netherlands will emphasise sustainable and recyclable corrugated packaging. The focus of the nation is only on digitalization, which is going to bring innovations in the packing technology as well and take customization and efficiency to the next level.

Reliable logistics infrastructure will guarantee a steady growth of the market. Netherlands' heavy-duty corrugated packaging industry is expected to grow at a CAGR of 4.50% by 2035.

The Western-European heavy-duty corrugated packaging industry is quite fragmented, with the large multinational firms and small regional players competing in the industry. Although various international companies also possess a significant market share.

The industry is fragmented due to several regions including low to moderate entry cost and availability of the resources. Moreover, the industry also requires technical expertise and knowledge, especially in packaging design and geographical area.

Stringent regulations regarding pollution and emissions, along with the growing usage of renewable energy alternatives, are expected to boost the industry growth of the global solar energy industry over the forecast period. Sunrun is the largest residential solar provider in the United States and held about ten percent of the domestic industry in 2023. This has led to the installation of over 6.7 gigawatts of capacity and has served more than one million customers.

Worldwide, Chinese companies make almost all solar panels. JA Solar, then Tongwei group, was the largest manufacturer. Tongwei Group has been on the Fortune Global 500 list, making it the first solar photovoltaic company to be listed on this prestigious list, which represents its significant industry impact.

First Solar Inc. manufactures photovoltaic modules and develops large-scale photovoltaic power plants and is headquartered in the United States. The company has forecasted revenue growth this year; fourth-quarter net income was USD 393 million, up thirteen % from a year earlier. Its strong domestic manufacturing presence positions First Solar, in particular, well, especially as solar tax credit policy remains uncertain.

These include CEA, JA Solar, and LONGi Green, although the precise number and percentage will depend on various factors within the solar industry about specific regions.

It's driven by e-commerce growth, sustainability, and the need for durable packaging in industries like food, automotive, and electronics.

Automotive, food & beverage, electronics, chemicals, and logistics.

It’s durable, cost-effective, recyclable, and offers excellent protection for heavy goods.

There's a push for recyclable and eco-friendly materials, reducing environmental impact.

Table 1: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Western Europe Industry Analysis and Outlook Volume (Units) Forecast by Country, 2019 to 2034

Table 3: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 4: Western Europe Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 5: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 6: Western Europe Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 7: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 8: Western Europe Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 9: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 10: Western Europe Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 12: UK Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 14: UK Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: UK Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 18: UK Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 20: UK Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 22: Germany Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 24: Germany Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 26: Germany Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 28: Germany Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Germany Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 32: Italy Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 33: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 34: Italy Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 35: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Italy Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 38: Italy Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 40: Italy Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 41: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 42: France Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 43: France Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 44: France Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 45: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: France Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: France Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 48: France Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 50: France Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 51: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 52: Spain Industry Analysis and Outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 53: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 54: Spain Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 55: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 56: Spain Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 57: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 58: Spain Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 59: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 60: Spain Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 61: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 62: Rest of Western Europe Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 63: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 64: Rest of Western Europe Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 65: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 66: Rest of Western Europe Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 67: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 68: Rest of Western Europe Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Western Europe Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 2: Western Europe Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 3: Western Europe Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 4: Western Europe Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 5: Western Europe Industry Analysis and Outlook Value (US$ Million) by Country, 2024 to 2034

Figure 6: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 7: Western Europe Industry Analysis and Outlook Volume (Units) Analysis by Country, 2019 to 2034

Figure 8: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 9: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 10: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 11: Western Europe Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 12: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 13: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 14: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 15: Western Europe Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 16: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 17: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 18: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 19: Western Europe Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 20: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 21: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 22: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 23: Western Europe Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 24: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 25: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 26: Western Europe Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 27: Western Europe Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 28: Western Europe Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 29: Western Europe Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 30: Western Europe Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: UK Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 32: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 34: UK Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 35: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 36: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 37: UK Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 38: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 39: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 41: UK Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 42: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 43: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 44: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: UK Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 49: UK Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 50: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 51: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 52: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 53: UK Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 54: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 55: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 56: UK Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 57: UK Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 58: UK Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 59: UK Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 60: UK Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 63: Germany Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 64: Germany Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 66: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 67: Germany Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 68: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 69: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 70: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 71: Germany Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 72: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 73: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 75: Germany Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 76: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 77: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 79: Germany Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 80: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 81: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 82: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 83: Germany Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 84: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 85: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 86: Germany Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 87: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 88: Germany Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 89: Germany Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 90: Germany Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 91: Italy Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 92: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 94: Italy Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 95: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 96: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 97: Italy Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 98: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 99: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 100: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 101: Italy Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 102: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 103: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 104: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 105: Italy Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 106: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 107: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 108: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 109: Italy Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 110: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 111: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 113: Italy Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 114: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 115: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 116: Italy Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 117: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 118: Italy Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 119: Italy Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 120: Italy Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 121: France Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 122: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 123: France Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 124: France Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 125: France Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 126: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 127: France Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 128: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 129: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 130: France Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 131: France Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 132: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 133: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 134: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: France Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: France Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 139: France Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 140: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 141: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 142: France Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 143: France Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 144: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 145: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 146: France Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 147: France Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 148: France Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 149: France Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 150: France Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 151: Spain Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 152: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 153: Spain Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 154: Spain Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 155: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 156: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 157: Spain Industry Analysis and Outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 158: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 159: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 160: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 161: Spain Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 162: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 163: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 164: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 165: Spain Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 166: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 167: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 168: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 169: Spain Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 170: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 171: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 172: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 173: Spain Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 174: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 175: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 176: Spain Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 177: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 178: Spain Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 179: Spain Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 180: Spain Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 181: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 182: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 183: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 184: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 185: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 186: Rest of Western Europe Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 187: Rest of Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 188: Rest of Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 189: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 190: Rest of Western Europe Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 191: Rest of Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 192: Rest of Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 193: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 194: Rest of Western Europe Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 195: Rest of Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 196: Rest of Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 197: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 198: Rest of Western Europe Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 199: Rest of Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 200: Rest of Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 201: Rest of Western Europe Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 202: Rest of Western Europe Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 203: Rest of Western Europe Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 204: Rest of Western Europe Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA