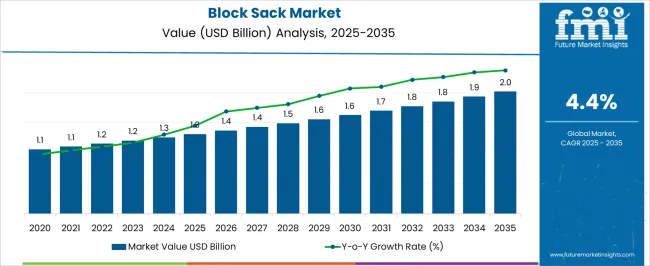

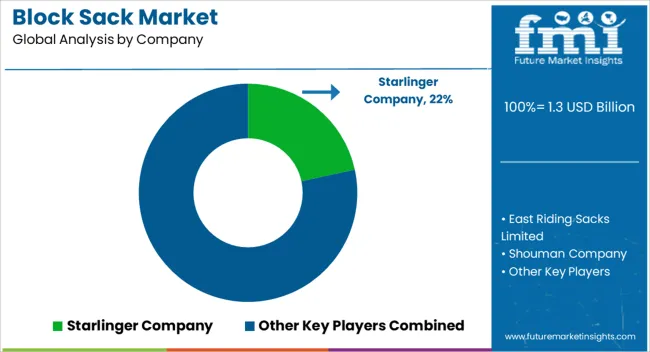

The Block Sack Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Block Sack Market Estimated Value in (2025 E) | USD 1.3 billion |

| Block Sack Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The block sack market is witnessing robust growth. Increasing demand for efficient packaging solutions, rising e-commerce activities, and the need for safe and durable material handling are driving market expansion. Current dynamics are influenced by evolving supply chain requirements, regulatory emphasis on sustainable and recyclable materials, and technological advancements in sack manufacturing processes.

The future outlook is shaped by growth in transportation, logistics, and industrial storage applications, as well as the adoption of automation in handling and packaging operations. Market participants are focusing on product innovation, cost optimization, and distribution network expansion to enhance accessibility and operational efficiency. Growth rationale is based on the versatility, strength, and protective qualities of block sacks.

Improved material performance, coupled with compatibility with mechanized loading and unloading systems, is supporting increased adoption Strategic investments in manufacturing capacity and expansion into emerging markets are expected to sustain long-term market growth and reinforce the importance of block sacks across industrial and commercial supply chains.

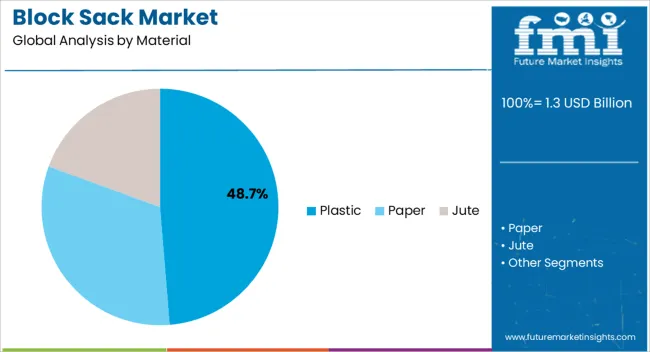

The plastic material segment, accounting for 48.70% of the material category, has emerged as the leading segment due to its durability, lightweight nature, and cost-effectiveness. Adoption has been driven by resistance to moisture and chemicals, which ensures the safe transport and storage of bulk goods. Consistent manufacturing standards and process innovations have enhanced quality and performance.

Market preference is supported by compatibility with automated filling and sealing systems, reducing operational downtime. Sustainability initiatives, including recycling and the development of eco-friendly plastics, are further reinforcing its position.

Strategic collaborations between manufacturers and logistics providers have enhanced product reach and reliability Ongoing R&D into high-performance plastic formulations is expected to maintain the segment’s market leadership and expand applicability across diverse industrial end uses.

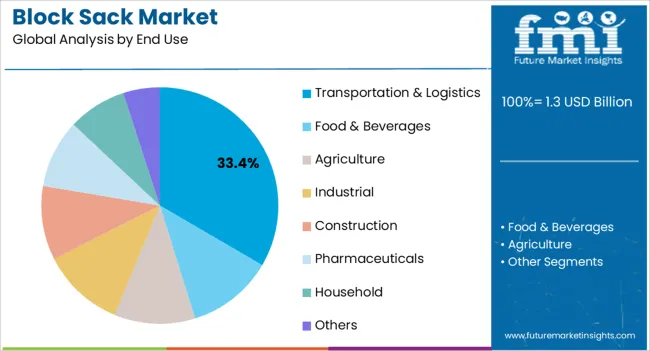

The transportation and logistics end-use segment, representing 33.40% of the category, has maintained a leading position due to the increasing need for secure and efficient handling of bulk materials. Adoption has been driven by high-volume shipping requirements, durability demands, and operational efficiency in warehouses and distribution centers.

The segment benefits from the compatibility of block sacks with mechanized loading and unloading systems, which reduces labor costs and improves turnaround time. Regulatory compliance in material handling and packaging safety further supports adoption.

Growth is reinforced by expansion in e-commerce, industrial distribution networks, and cross-border transportation Continuous improvements in sack design and handling processes are expected to sustain the segment’s market share and contribute to broader adoption in global logistics operations.

Block Sacks Redefining Packaging with Durability and Innovation: The durability and adaptability of block sack products, which provide an extra benefit for employing block sacks in many industries, are key elements supporting the increase of the market share for these bags. Given the valve provision, which facilitates a quicker filling and sealing of the product, the demand for block sacks is also increasing.

Block Sacks Ride the Wave of Sustainable Packaging Demand: Significant market drivers for the block sack include rising environmental concerns and an awareness of the necessity for sustainable operations. Consumers are increasingly looking for environmentally friendly substitutes for conventional packaging of corrugated boxes. The market is significantly influenced by government legislation and programs that attempt to reduce plastic waste and promote sustainable packaging options. Firms need to follow these regulations.

Customization and Recyclability Propel Block Sack Market Forward: Lower start-up capital and raw material needs are what is driving the block sack market. Transporting safe and tear-resistant materials is the main factor driving the block sack market. This factor is projected to boost sales of block sacks throughout the projection period. The market share increase of block sacks is primarily driven by customization and recyclability.

Block Sacks are the Smart Choice for Businesses Seeking Economical Packaging: Block sacks are economical and practical packing options, particularly for large or heavy objects. Businesses aiming to simplify their packaging procedures and lower overall expenses are likely to find this appealing. Nowadays, customers favor simple package options to handle, open, and discard. Block sacks are a common option since they are convenient to handle and store.

eCommerce Frenzy Fuels Block Sack Market Surge: Multiple sectors are using eye-catching block sack branding and advertising, which is helping to increase sales of block sacks. The primary block sack market demand, which comes in a range of shapes, sizes, and colors, is anticipated to be in the retail industry. The booming e-commerce sector is a key driver for the block sack market. As online shopping continues to gain popularity, the demand for durable and secure packaging solutions like block sacks has surged.

Block Sack Sales Poised for Growth in Booming Construction and Pharma Industries: The block sack market also mirrors the construction industry's growth. Given their incredible strength, material carrying capacity, and resistant qualities, block sacks are used by the construction industry for storing cement. As a result, it is projected that block sack sales in the building sectors are going to rise. The pharmaceutical business, on the other hand, has a significant demand for paper block sacks for the storage of pharmaceuticals and medications.

The global block sack market size surged by USD 1.3 billion from 2025 to 2025. During this period, the increasing demand for efficient storage solutions in households and commercial spaces drove the demand for rubble sacks. The rising popularity of minimalistic and clutter-free lifestyles encouraged consumers to invest in storage solutions like the block sack.

Fast forward to 2025, the global block sack market is likely to grow 1.5X by 2035, showcasing a 4.6% CAGR. The global block sack market is expected to grow over the forecast period as a result of rising awareness of the demand for protection against food spoiling and loss brought on by environmental conditions. Block sack markets are likely to grow as a result of the rapid expansion in seed and fertilizer storage.

Given its adaptability and branding potential, the growth of block sack market share continues. Numerous agricultural endeavors and the installation of agro agencies around the Asia Pacific are expected to offer profitable prospects for the expanding debris containment sack industry.

There is an increasing desire for commodities developed from recycled block sack materials or those that are easily recyclable as people become more environmentally concerned. Reacting to these block sack market trends and consumer demand, manufacturers have come up with eco-friendly solutions.

| Trends |

|

|---|---|

| Opportunities |

|

| Challenges |

|

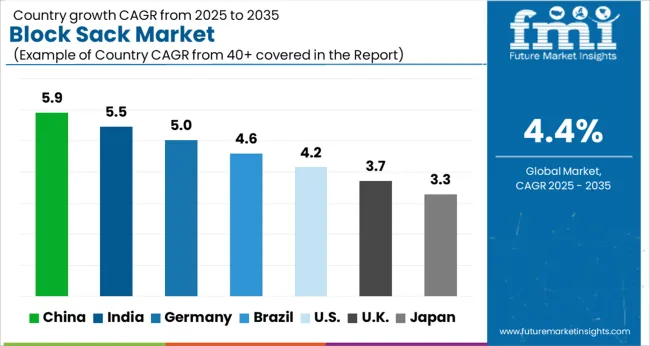

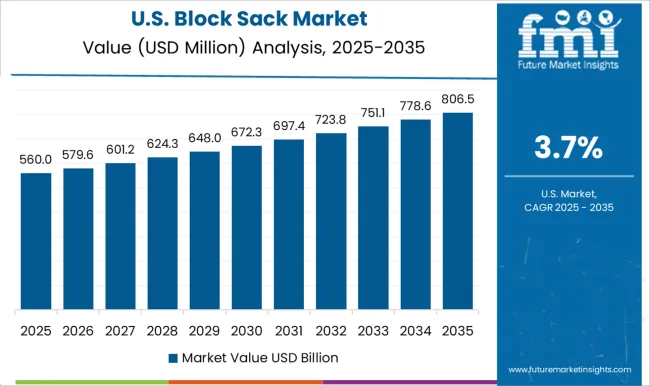

| Countries | Block Sack Market Forecast CAGR from 2025 to 2035 |

|---|---|

| India | 6.0% |

| China | 5.5% |

| United Kingdom | 3.9% |

| France | 3.1% |

| Canada | 3.6% |

| United States | 2.7% |

Within the ever-evolving block sack industry, each country brings its unique flair and significance to the global landscape. India, a developing market, has seen a continuous increase in the usage of block sacks, demonstrating its expanding importance.

On the other hand, China is a key player in the world supply chain due to its strong industrial skills. Eco-friendly block sack solutions have drawn a lot of interest from France, a country recognized for emphasizing sustainability.

Leading the way in incorporating cutting-edge technology into the block sack market is the United Kingdom, a center of innovation. Canada's forward-thinking activities in the block sack sector show its responsible attitude toward environmental management. Last but not least, the United States continues to influence the global block sack market with its large customer base owing to its diversified industrial sectors.

Customers in India are more concerned about sustainability issues than any other customers globally. They assert that their readiness to pay for green is the maximum. Second, compared to other countries, consumers in this country are more concerned about waste containment and disposal solutions.

Similar to the global findings, consumers believe that food-related items should prioritize sustainable packaging above everything else. This underscores the demand for eco-friendly packaging solutions in the food industry, which is a significant segment of the block sack market.

According to the Indian Institute of Packaging (IIP), the prevalence of packaging in India has increased by 200 % over the past ten years. As a result, adopting smarter and environmentally friendly packaging alternatives has taken center stage. In terms of various sustainability challenges, Generation X is the generation that exhibits the maximum levels of concern, followed by Gen Zers, Millennials, and Baby Boomers. Businesses in the block sack market demand to keep pace with this growth while aligning with sustainability goals.

Notably, India has become the first Asian country to create a plastics pact, starting a revolutionary new endeavor to unite top corporations at the national level to make promises to create a circular system for plastics. This commitment is likely to significantly impact the market by driving demand for ecological packaging alternatives like sustainable block sacks.

China is the world's paramount manufacturer and user of packaging, and the country's heightened concern for the environment has prompted a move toward environmentally friendly packaging options. China's packaging market is expanding as a result of the country's rapid urbanization, booming economy, and rising standard of living.

More secure, practical, distinctive, and environmentally friendly packaging has become more popular among consumers. In order to promote the use of sustainable packaging materials, the government has also developed policies. In China, there were 1.3 million metric tons of sustainable packaging sold in 2024. This policy-driven approach provides a favorable environment for manufacturers and consumers to adopt sustainable packaging solutions, such as block sacks.

The fast economic growth and rise in the standard of living in China have increased the demand for packaged foods. Chinese residents from rural regions are moving to cities like Shanghai and Beijing as a result of urban China's economic expansion.

This has increased food consumption and made China's business one of the world's leading food and beverage industries, which is projected to fuel the demand for packaging solutions there. This, in turn, directly impacts the demand for packaging solutions like block sacks.

One of the prime consumers and manufacturers of agricultural goods worldwide is China. It also contains many regular processing facilities handling fruits and vegetables, increasing demand of valve sack nationwide. As a result, there is a consistent demand for reliable packaging options, including block sacks, to support the distribution of these goods.

The implementation of fees on single-use carrier bags in the United Kingdom has profoundly impacted the block sack market. Following the installation of fees on single-use carrier bags, the United Kingdom has seen a dramatic 98% decrease in the consumption of plastic bags. On July 31, 2025, the British Department for Environment, Food & Rural Affairs (Defra) announced the updated statistics. Tesco, Sainsbury's, Asda, Waitrose, Morrisons, the Co-operative Group, and Marks & Spencer are just a few of the United Kingdom's supermarket companies that implemented a USD0.06 fee on all single-use plastic bags in 2020.

This fee was raised to USD 0.12 later in 2024. According to Defra's research, the average individual in the country now only buys two single-use plastic bags from these merchants each year, down from 140 before the imposition of fees in 2020.

This emphasis on sustainability has ripple effects on various industries, including the demand for eco-conscious construction materials like block sacks. The United Kingdom has a significant competitive advantage in the construction industry. This country is a global leader in engineering, design, and architecture, and British businesses are setting the standard for environmentally friendly building practices.

This emphasis on sustainability has ripple effects on various industries, including the demand for eco-conscious construction materials like block sacks. New opportunities are opening up for the country as a result of changes in the global economy. The government is doing everything it can to support company growth and give them the drive they need to compete in the global construction waste bag market.

In France, the packaging market is anticipated to expand significantly throughout the forecast period. The rise of the e-commerce industry, together with increased customer demand for practical and environmentally friendly packaging solutions, are the main drivers of this development. With the convenience of online shopping becoming increasingly popular, businesses are shipping products to consumers more frequently than ever before. As a result, there is a growing demand for efficient and reliable packaging solutions, including block sacks.

A critical development influencing the block sack market is the recent regulatory action taken by the government. The government adopted a regulation prohibiting single-use packaging in dining establishments in France. Prominent fast-food companies are not allowed to sell meals in disposable containers or single-use utensils like knives or forks beginning on January 1, 2025. Reusable plates, cups, and cutlery are going to be available in place of single-use goods at restaurants that can feed more than 20 guests at once. France's trash, including plastic, is to be reduced as a result of the action. Paper wrappers are going to be used in place of boxes for eat-in burgers and sandwiches in restaurants and cafés under the new regulation.

The United States dominates the sustainable packaging market, and it is anticipated that this dominance is likely to persist during the projection period. The growing customer awareness of sustainable packaging and the rising demand for eco-friendly products are two factors that have contributed to the growth of hessian sacks and the sustainable packaging sector in the United States.

The United States government's benevolent rules also significantly contribute to the expansion of the sustainable packaging sector. Additionally, the number of food and beverage businesses is prime in the United States, and as the emphasis on sustainable practices grows, so does the demand for sustainable packaging options. With their reusability and eco-friendly attributes, block sacks stand as a compelling choice in this context.

The United States' remarkable position as a global leader in the food and beverage industry is another critical factor. The country has one of the leading and highly diverse food and beverage industries in the world. It encompasses a wide range of products and cuisines and is home to many well-known global food and beverage companies. Hence, there is a substantial market for sustainable packaging solutions like block sacks. As the emphasis on sustainable practices within this industry continues to grow, so too does the demand for eco-conscious packaging options.

Eco-friendly packaging is becoming more popular among consumers and producers, which is affecting the block sack market in Canada. The Canada Plastics Pact, an initiative by more than 40 Canada-based businesses, aims to recycle or compost 50% of Canada's plastic packaging by 2025. A brand's efforts to utilize more environmentally friendly packaging are being supported by fiber-based flexible packaging, which is also gaining popularity in the nation. As a result, many brands are actively seeking out environmentally friendly alternatives, including block sacks, to align with these sustainability objectives.

It is necessary to become LEED-certified in order to construct environmentally friendly structures in Canada. Various cities have varied requirements in terms of building codes, building materials, and building site waste management. Many levels of LEED Certification assist the building sector in improving the capacity of structures to perform and sustain environmental impacts that favorably influence the inhabitants' health and comfort. 4,336 construction projects in Canada had filed for LEED certification as of November 2025. Offices and offices with mixed uses are the sorts of facilities with the maximum certifications.

Only 271 multifamily residential LEED-certified projects were active in the entire country at the time. As a result, businesses are seeking packaging solutions that align with their efforts to construct environmentally responsible buildings and block sacks are seen as a favorable choice in this regard.

As far as the material is concerned, the paper milk segment dominates the global block sack market in 2025, accounting for a 34.7% share. Similarly, the building and construction segment takes the lead when considering the end use, commanding a 42.1% market share in 2025.

| Segment | Market Share in 2025 |

|---|---|

| Paper Material | 34.7% |

| Building and Construction End Use | 42.1% |

Given the increased focus on environmental sustainability and eco-friendliness in recent years, the Paper Material category has dominated the Block Sack market. Comparing paper bags to alternatives made of plastic or other synthetic materials, paper bags are said to be more ecologically friendly. These paper block sacks fit this trend as consumers and organizations look for more eco-friendly packaging options to lessen their carbon footprint.

Paper bags are a favored option for different applications due to their adaptability. They are often used to package multiple things. These include industrial goods, building supplies, groceries, food items, and so forth. Given its ability to meet the demands of many businesses and consumers, this segment's diversity has aided in its domination.

Given its massive consumption of bulk commodities, including cement, sand, gravel, and different aggregates, the building and construction end use segment enjoys a prominent position in the block sack market. Block sacks were created to store and carry these large and heavy items effectively.

They are essential for many types of building projects, from small residential structures to huge infrastructure initiatives. This is due to their longevity and ability to support heavy loads. Additionally, the construction industry is distinguished by its consistent demand. This demand is frequently fueled by urbanization, the growth of the infrastructure, and continuing maintenance projects. Block sack suppliers have a stable market because of this ongoing demand for bulk materials, which makes this market appealing to them.

In the block sack market, competition thrives through diverse strategies. Some place an emphasis on a product's originality by providing distinctive features and designs. For cost savings and competitive pricing, others use scale. Investments are made in user-friendly interfaces and attentive service since the focus is on the customer. Sustainable performance is fueled by block sack innovation.

Partnerships with merchants and e-commerce platforms help to grow the distribution channels. Collaborations with waste management organizations help to spread awareness of green technologies. With environmentally sensitive consumers, branding promotes environmental responsibility. Customized approaches that promise constant innovation are the key to success.

Recent Developments

The global block sack market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the block sack market is projected to reach USD 2.0 billion by 2035.

The block sack market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in block sack market are plastic, paper and jute.

In terms of end use, transportation & logistics segment to command 33.4% share in the block sack market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blockchain Interoperability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Energy Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Block Pallets Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Technology Market Analysis & Forecast 2025 to 2035, By Solution, Use Case, Enterprise Size, Industry, and Region

Market Share Breakdown of Block Pallets Industry

Blockchain in Banking Market

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Block Margarine Market

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Antiblock Additive Market Size and Share Forecast Outlook 2025 to 2035

Paver Blocks Market Size and Share Forecast Outlook 2025 to 2035

Water Blocking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA