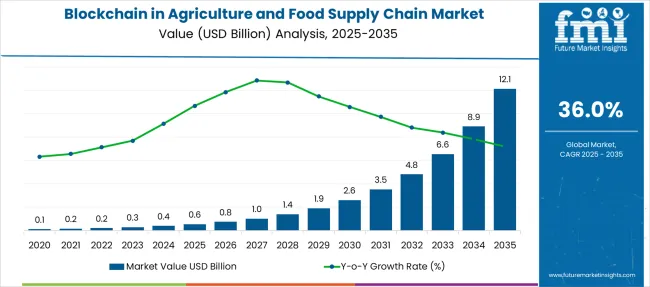

The Blockchain in Agriculture and Food Supply Chain Market is estimated to be valued at USD 0.6 billion in 2025 and is projected to reach USD 12.1 billion by 2035, registering a compound annual growth rate (CAGR) of 36.0% over the forecast period.

| Metric | Value |

|---|---|

| Blockchain in Agriculture and Food Supply Chain Market Estimated Value in (2025 E) | USD 0.6 billion |

| Blockchain in Agriculture and Food Supply Chain Market Forecast Value in (2035 F) | USD 12.1 billion |

| Forecast CAGR (2025 to 2035) | 36.0% |

The blockchain in agriculture and food supply chain market is witnessing accelerated transformation as stakeholders across the value chain seek tamper-proof, transparent, and efficient systems to manage production, processing, and distribution activities.

Rising concerns about food fraud, contamination events, and global supply chain disruptions have elevated the demand for immutable data systems that ensure authenticity, traceability, and compliance. Leading agribusinesses, cooperatives, and food retailers are increasingly deploying blockchain-enabled platforms to gain real-time visibility, automate audits, and integrate smart contracts for efficient transactional flow.

Government-backed initiatives and consortium-based projects are also supporting adoption, especially in emerging markets where inefficiencies and trust gaps are more pronounced. As the global focus shifts to carbon accounting and ethical sourcing, blockchain solutions are being positioned as foundational infrastructure for future-proofing food systems.

The convergence of blockchain with IoT and AI further expands its potential, unlocking predictive insights and real-time verification across production and logistics. This momentum is expected to foster robust segmental growth across various blockchain categories in the coming years.

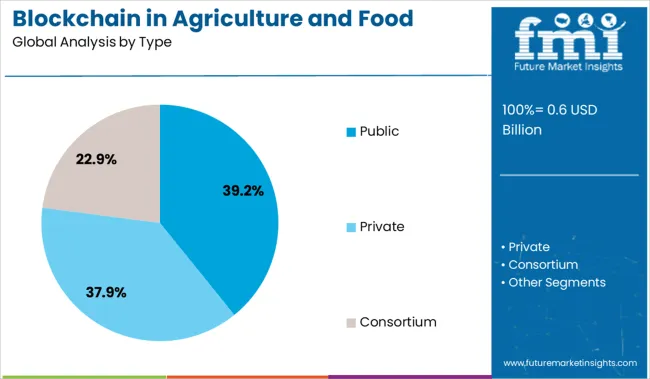

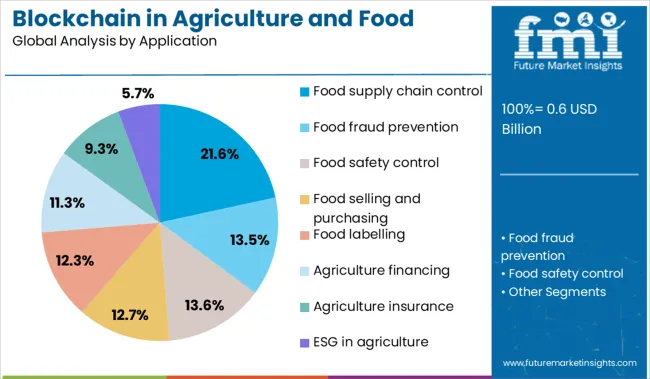

The market is segmented by Type, Application, Technology, and End-User and region. By Type, the market is divided into Public, Private, and Consortium. In terms of Application, the market is classified into Food supply chain control, Food fraud prevention, Food safety control, Food selling and purchasing, Food labelling, Agriculture financing, Agriculture insurance, and ESG in agriculture.

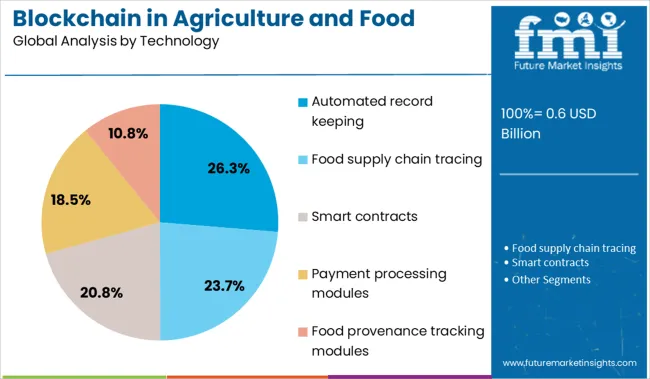

Based on Technology, the market is segmented into Automated record keeping, Food supply chain tracing, Smart contracts, Payment processing modules, and Food provenance tracking modules. By End-User, the market is divided into Raw food suppliers, Food manufacturers, Transportation and logistics providers, Food product distributors, and Government agencies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The public blockchain type is anticipated to hold 39.2% of total market revenue in 2025, making it the most dominant segment. Its widespread adoption is driven by the need for decentralized transparency in complex and distributed supply chains, particularly in agri-food ecosystems involving multiple stakeholders across borders.

Public blockchains enable open verification, ensuring that records of origin, handling, and processing are accessible and immutable to all parties. This openness builds trust across consumers, producers, regulators, and certifiers without relying on centralized authorities.

Open-source flexibility and lower infrastructure costs have also contributed to public blockchains being favored in pilot programs and large-scale implementations. Additionally, public networks facilitate the tokenization of assets and integration with mobile-based traceability tools, making them ideal for reaching smallholder farmers and end consumers in traceability-focused deployments.

Food supply chain control is projected to contribute 21.6% of the market revenue in 2025 under the application category, ranking it as a leading area of blockchain deployment. This dominance is attributed to the rising need for real-time monitoring and end-to-end traceability across perishable and high-risk food categories.

By automating checkpoints and creating a unified ledger of events from farm to fork, blockchain platforms have enabled stakeholders to detect inefficiencies, reduce wastage, and respond quickly to quality or safety issues. Compliance with safety certifications, sustainability audits, and regulatory requirements has further accelerated the use of blockchain for supply chain control.

Retailers and producers alike have integrated blockchain systems to ensure chain-of-custody verification, enhancing brand credibility and consumer trust in food products. As global trade becomes increasingly digitized and quality assurance becomes a competitive differentiator, food supply chain control applications are expected to retain their strategic relevance.

Automated record keeping is expected to command 26.3% of total market revenue in 2025 under the technology category, making it a key growth driver in blockchain implementations. The push for digitizing farm-to-shelf documentation has created strong demand for systems that reduce human intervention and secure audit trails across the food chain.

Automated data capture through IoT sensors and integration with blockchain nodes has enabled continuous, real-time logging of environmental conditions, processing steps, transportation data, and compliance verifications. These records are stored in immutable ledgers that can be referenced instantly by authorized parties, reducing delays, fraud, and administrative burdens.

Automated record keeping has been particularly valuable in managing certifications, recall readiness, and sustainability documentation. As the food industry navigates tightening global regulations and heightened consumer scrutiny, the demand for scalable, low-error digital record systems continues to reinforce the role of this technology in blockchain adoption.

Blockchain technology is being leveraged to enable secure record-keeping, smart contracts, and product tracing in agri-food networks. Supply chain actors from growers to retailers are being connected through immutable ledgers that support provenance, quality assurance, and reduced intermediaries.

Integration with IoT and data analytics is enhancing transparency, food safety, and operational efficiencies across global distribution systems. The market is projected to expand rapidly, with varied regional adoption driven by regulatory mandates and traceability demands.

Smart contract deployment and food provenance tracking have been prioritized to ensure uninterrupted visibility across supply chain nodes. Immutable ledger systems are being used to record harvest dates, certification levels, and transport logs in a tamper-proof environment. The use of blockchain has been supported by demand for accurate audit trails that reduce fraud and foodborne risks.

Integration with sensor-collected data and IoT-based monitoring has reinforced compliance with quality control requirements. Producers, processors, and retailers have been incentivized to adopt ledger systems through regulatory programs and consumer transparency pressure.

This has resulted in reduced manual paperwork, lowered reconciliation costs, and expedited food recall response times. By enabling trusted documentation of every stage from cultivation to shelf, blockchain has been positioned as a strategic asset for preserving product integrity and meeting stakeholder accountability standards.

Localized opportunities are being created via pilot initiatives that combine sensor-enabled traceability and programmable contracts. Smart contract frameworks have been deployed to automate payments to farmers upon shipment confirmation, while provenance modules have been used to authenticate organic or fair-trade certifications.

Decentralized platforms have been integrated with IoT devices to record temperature, humidity, and handling conditions in real time. Demand has been noted in regions where smallholder engagement is high and centralized record-keeping is weak. Furthermore, consortium-based blockchain networks are being formed by growers, processors, logistics firms, and regulators to create shared governance frameworks.

Expansion into carbon credit tracking, anti-counterfeit labelling, and finance-linked supply chain initiatives is being piloted. These deployments are being regarded as catalysts for broader adoption in fragmented ecosystems, enabling scalable, community-driven ledger solutions.

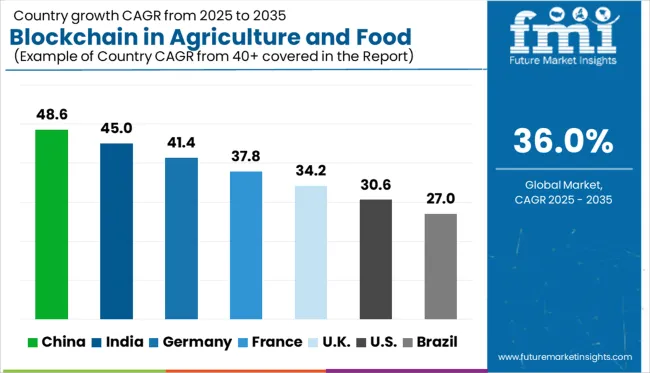

| Country | CAGR |

|---|---|

| China | 48.6% |

| India | 45.0% |

| Germany | 41.4% |

| France | 37.8% |

| UK | 34.2% |

| USA | 30.6% |

| Brazil | 27.0% |

The global blockchain in agriculture and food supply chain market is projected to grow at a CAGR of 36.0% from 2025 to 2035, supported by traceability mandates, farm-to-fork transparency models, and secure contract integration across agri-value chains. China leads with a 48.6% CAGR, driven by smart contract usage in grain logistics, QR-based produce traceability, and blockchain-enabled agri-financing platforms.

India follows at 45.0%, influenced by seed provenance tracking, input authentication, and farmer cooperatives digitizing procurement records. Germany grows at 41.4%, backed by pilot adoption in dairy chains, cold-chain IoT integration, and retailer verification layers. France posts 37.8%, driven by premium food authentication, supply origin certification, and agri-export documentation.

The United Kingdom records 34.2%, with growth shaped by blockchain use in organic labeling, grocery chain transparency, and fishery trace systems. These five countries reflect a diverse blend of traceability innovation, agri-fintech application, and digital compliance infrastructure from a wider 40+ nation dataset.

Demand for blockchain in the agriculture and food supply chain in China is projected to grow at a CAGR of 48.6%, fueled by nationwide traceability systems, logistics digitization, and agri-fintech integration. Blockchain platforms have been embedded within grain depots, livestock registries, and export inspection protocols.

Produce traceability via QR codes has been adopted in fresh produce markets and online grocery apps. Government-linked cooperatives and state-backed agri-tech firms have integrated smart contracts to automate payments, compliance, and inspection workflows. Blockchain nodes are being co-located with rural logistics hubs and food quality labs to decentralize verification. Local governments are encouraging technology fusion with IoT sensors and packaging authentication tools.

The blockchain in agriculture and food supply chain market in India is expected to grow at a CAGR of 45.0%, driven by adoption across seed supply, crop certification, and agricultural procurement systems. Blockchain has been adopted by farmer producer organizations (FPOs), agri-input distributors, and public procurement boards to record field data, storage timelines, and input origins.

Digitized mandi-level records and contract farming agreements are being executed through verifiable digital ledgers. Startups are introducing blockchain-integrated procurement apps with multilingual interfaces for regional adoption. Government trials in states with high agrarian activity have shown positive results in fertilizer distribution control and pesticide authenticity tracking.

Germany market, is projected to grow at a CAGR of 41.4%, shaped by demand for verifiable cold chain logistics, export-grade traceability, and digital batch verification. Blockchain applications are being piloted in dairy processing, meat export, and specialty vegetable distribution. Timestamped temperature logs and transport validation have been paired with blockchain ledgers for high-value perishables.

Retailers are using immutable product journey data to verify sourcing origin and freshness cycles. European compliance laws are influencing blockchain deployment as part of sustainability declarations and logistics proof-of-performance. Coordination with agri-logistics networks and food testing labs enhances traceability fidelity.

France is forecast to grow at a CAGR of 37.8%, supported by premium label verification, regional origin authentication, and small producer certification. Blockchain-based registries are being maintained for vineyard outputs, cheese designations, and GI-tagged produce. Digital certification of harvest date, processing location, and storage compliance is being deployed via NFC tags and smartphone-verifiable QR codes.

Collaborations between producer cooperatives and certification agencies have facilitated wider adoption. Trace logs are being used by exporters to meet foreign market documentation standards. The French segment emphasizes brand protection and identity preservation across food exports and boutique retail.

The United Kingdom blockchain in agriculture and food supply chain market is projected to expand at a CAGR of 34.2%, shaped by initiatives in organic certification, seafood transparency, and grocery chain digitization. Blockchain records are being used to trace fishing vessel location, harvest details, and cold storage handovers for fresh seafood imports.

Organic produce verification and batch identification have been embedded into supplier management software used by regional retailers. Retailers are incorporating blockchain proof points into consumer-facing QR systems. Startups are creating integrated traceability dashboards for fresh produce, poultry, and bakery segments. Government incentives and digital farming frameworks are supporting the wider adoption of digital farming.

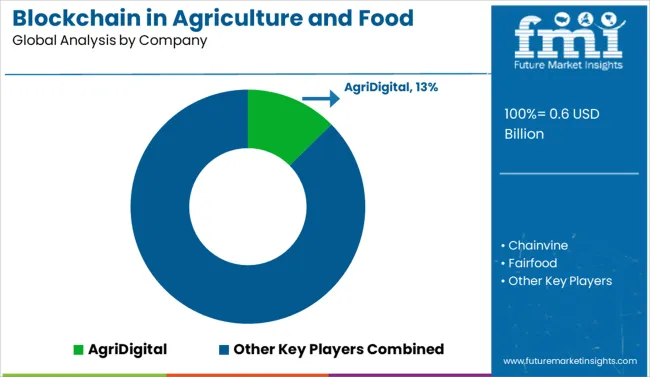

The blockchain in the agriculture and food supply chain industry is led by AgriDigital, holding a significant market share due to its comprehensive grain supply chain platform that integrates blockchain for transaction transparency and traceability. IBM and Microsoft have established strong enterprise-level blockchain frameworks, offering scalability and security across multi-stakeholder food ecosystems.

SAP SE and ScienceSoft USA Corporation enable blockchain integration within broader ERP and traceability systems. OriginTrail and TE-Food focus on decentralized data exchange, targeting perishable goods and livestock tracking. Ripe.io and Chainvine deliver blockchain-backed provenance solutions for farm-to-fork visibility, while Fairfood supports ethical sourcing and fair trade compliance.

Competitive intensity is shaped by API interoperability, auditability of supply chains, and data security in regulatory and consumer transparency mandates.

In 2025, Microsoft expanded its FarmBeats for Students program in partnership with Future Farmers of America, launching precision-agriculture hardware kits and curriculum to teach students AI- and blockchain-powered data insights for sustainable farming

| Item | Value |

|---|---|

| Quantitative Units | USD 0.6 Billion |

| Type | Public, Private, and Consortium |

| Application | Food supply chain control, Food fraud prevention, Food safety control, Food selling and purchasing, Food labelling, Agriculture financing, Agriculture insurance, and ESG in agriculture |

| Technology | Automated record keeping, Food supply chain tracing, Smart contracts, Payment processing modules, and Food provenance tracking modules |

| End-User | Raw food suppliers, Food manufacturers, Transportation and logistics providers, Food product distributors, and Government agencies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AgriDigital, Chainvine, Fairfood, IBM, Microsoft, OriginTrail, Ripe.io, SAPSE, ScienceSoftUSACorporation, and TE-FoodInternationalGmbH |

| Additional Attributes | Dollar sales in blockchain solutions for agriculture and food supply chains are segmented by application traceability, smart contracts, and quality assurance-with traceability platforms gaining dominant market share. Demand is rising for tamper-proof origin tracking and real-time compliance. EPC and CDMO tech integrators provide turnkey platforms. Adoption is strongest in North America and Europe, driven by food safety regulations and consumer transparency demands. |

The global blockchain in agriculture and food supply chain market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the blockchain in agriculture and food supply chain market is projected to reach USD 12.1 billion by 2035.

The blockchain in agriculture and food supply chain market is expected to grow at a 36.0% CAGR between 2025 and 2035.

The key product types in blockchain in agriculture and food supply chain market are public, private and consortium.

In terms of application, food supply chain control segment to command 21.6% share in the blockchain in agriculture and food supply chain market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blockchain Interoperability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Energy Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Technology Market Analysis & Forecast 2025 to 2035, By Solution, Use Case, Enterprise Size, Industry, and Region

Blockchain in Banking Market

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Web 3.0 Blockchain Market Report – Growth, Demand & Forecast 2024-2034

Automotive Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Instruments for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Injectable Osteoarthritis Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA