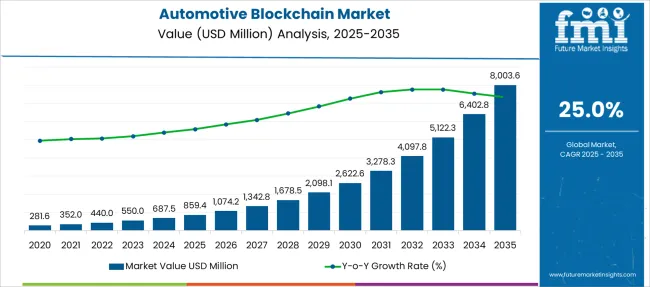

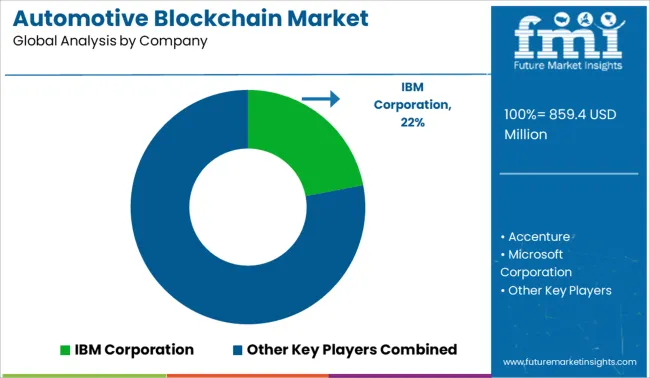

The Automotive Blockchain Market is estimated to be valued at USD 859.4 million in 2025 and is projected to reach USD 8003.6 million by 2035, registering a compound annual growth rate (CAGR) of 25.0% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Blockchain Market Estimated Value in (2025 E) | USD 859.4 million |

| Automotive Blockchain Market Forecast Value in (2035 F) | USD 8003.6 million |

| Forecast CAGR (2025 to 2035) | 25.0% |

The Automotive Blockchain Market is being driven by growing demand for secure, transparent, and efficient data exchange across the automotive ecosystem. Vehicle manufacturers, suppliers, and mobility service providers have been embracing blockchain to safeguard sensitive data related to per‑vehicle maintenance, parts provenance, and regulatory compliance. Investments in connected vehicle technologies and autonomous fleets have further enhanced adoption of decentralized ledger solutions.

Interoperability standards and consortium initiatives have enabled seamless integration among stakeholders, supporting data sharing without compromising trust. Additionally, rising concerns about counterfeit parts and cybersecurity threats have underscored the need for immutable transaction records.

Over the forecast period, growing acceptance of blockchain for smart contracts, vehicle identity management, and pay‑per‑use insurance models is expected to shape future market expansion. As the sector transitions towards vehicle electrification and shared mobility, automotive blockchain solutions are poised to play a central role, reinforcing innovation and operational resilience across global supply networks..

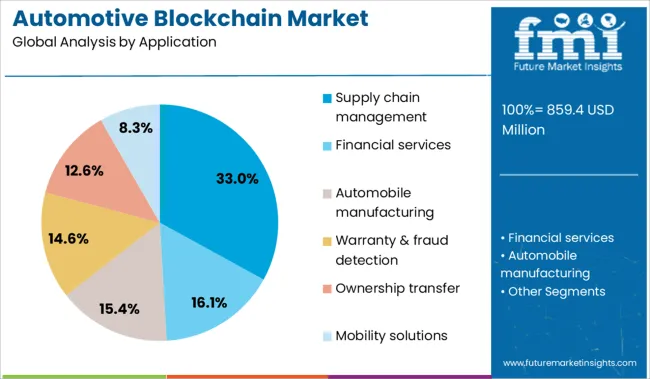

The market is segmented by Application, Provider, and Mobility Type and region. By Application, the market is divided into Supply chain management, Financial services, Automobile manufacturing, Warranty & fraud detection, Ownership transfer, and Mobility solutions.

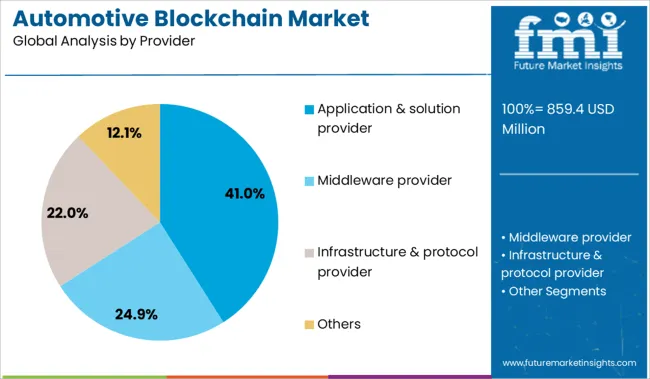

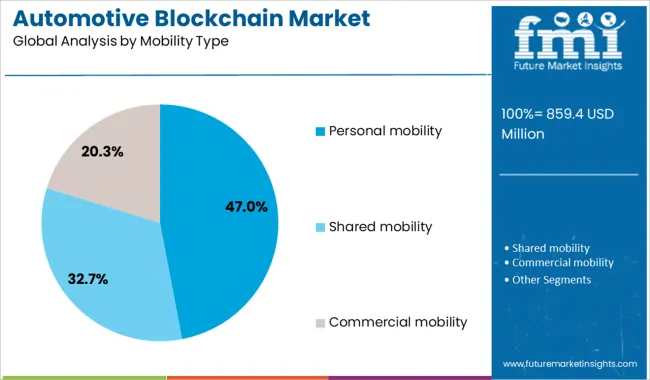

In terms of Provider, the market is classified into Application & solution provider, Middleware provider, Infrastructure & protocol provider, and Others. Based on Mobility Type, the market is segmented into Personal mobility, Shared mobility, and Commercial mobility. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The supply chain management application segment is positioned to command 33% of the Automotive Blockchain Market in 2025. This dominant position has been influenced by increasing demand for transparency in parts traceability and anti‑counterfeit measures across the automotive value chain. Real‑time tracking of component provenance and automated payment via smart contracts have been leveraged to reduce administrative overhead and dispute resolution.

Blockchain‑enabled transparency has also been called upon to meet regulatory requirements regarding safety and emissions standards. Supply chain operations have been made more resilient by shared immutable ledgers among multiple-tier suppliers and OEMs.

Additionally, operational efficiency has been enhanced by secure cross‑enterprise data exchange, which has minimized delays and improved inventory accuracy. These factors have collectively supported the segment’s leadership in 2025 revenue share..

The application & solution provider segment is forecast to achieve a share of 41% in the Automotive Blockchain Market in 2025. This leading position has been attributed to the increasing number of collaborations between automakers and technology vendors as enterprises seek turnkey blockchain platforms.

Providers of modular blockchain frameworks, integration services, and support have gained traction by simplifying deployment and accelerating time to market. Service bundles that include smart contract templates, cybersecurity compliance, and platform-as-a-service offerings have been tailored for automotive use cases, making them attractive to OEMs and suppliers.

The focus on developer‑friendly toolkits and scalable infrastructure has further enhanced solution adoption. As demand for consulting and managed services continues to rise, integration capabilities have been identified as a key differentiator, reinforcing the dominant share achieved by this provider segment..

The personal mobility type segment is expected to hold 47% of the Automotive Blockchain Market revenue share in 2025, making it the leading sector. This prominence has been linked to growing consumer adoption of connected vehicle applications such as shared rides, vehicle data monetization, micro‑insurance, and digital identity management.

Blockchain has been leveraged to enable secure peer‑to‑peer transactions, fractional vehicle ownership schemes, and seamless usage-based billing models. Data accuracy and user privacy controls have been improved in personal mobility through distributed governance, while secure data exchange between drivers, insurers, and service platforms has been enabled.

Mobility providers have been incentivized to integrate blockchain infrastructures to support digital wallets and incentivization programs. The convergence of these factors has propelled the segment ahead, as personal vehicle use cases continue to outpace commercial mobility adoption in revenue contribution..

Blockchain is transforming automotive supply chains by enhancing traceability, security, and recall management. Simultaneously, its role in shared mobility and EV ecosystems enables seamless transactions, identity verification, and peer-to-peer energy trading.

The need for enhanced traceability across the automotive supply chain is driving the adoption of blockchain technology. OEMs and Tier 1 suppliers are increasingly integrating blockchain to prevent counterfeit parts, streamline documentation, and secure supplier credentials. Escalating recalls and warranty claims have further compelled automakers to track component origins with greater accuracy. Additionally, rising cyber threats and the shift toward connected vehicles amplify the demand for tamper-proof systems. Blockchain’s decentralized architecture addresses these concerns by offering immutable ledgers and smart contract capabilities. Automakers and logistics firms are collaborating to standardize blockchain use cases, particularly in parts provenance, warranty lifecycle, and logistics optimization, making transparency and data integrity key market growth drivers.

As shared mobility models and EV adoption gain ground, blockchain is emerging as a pivotal tool for enabling seamless transactions, energy trading, and vehicle identity management. Car-sharing platforms are leveraging blockchain for secure user authentication, real-time vehicle access, and usage-based payment processing. In parallel, EV stakeholders are exploring peer-to-peer charging payments and battery ownership traceability via blockchain. Fleet operators are also embracing blockchain for dynamic leasing, insurance, and predictive maintenance. The shift toward multi-stakeholder ecosystems, ranging from OEMs to charging infrastructure providers, is creating a need for interoperable, transparent platforms. These developments are reshaping revenue streams and operational models, positioning blockchain as central to future-ready mobility networks.

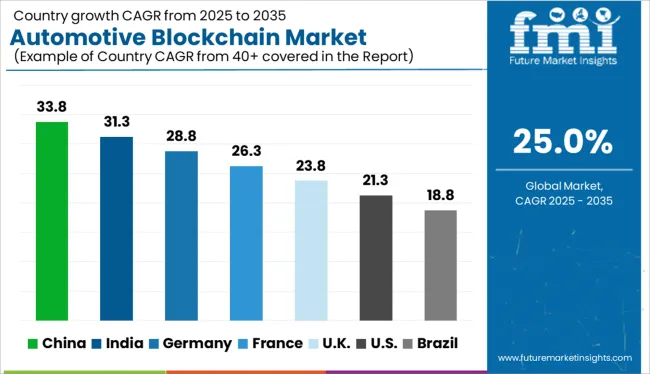

| Country | CAGR |

|---|---|

| India | 31.3% |

| Germany | 28.8% |

| France | 26.3% |

| UK | 23.8% |

| USA | 21.3% |

| Brazil | 18.8% |

The global automotive blockchain market is projected to grow at a CAGR of 25.0% from 2025 to 2035, as automakers and mobility platforms increasingly adopt decentralized ledgers for supply chain traceability, secure data sharing, smart contracts, and vehicle identity management. This surge is propelled by the push for digital transparency, cyber resilience, and EV ecosystem integration. BRICS economies are emerging as blockchain innovation hubs, with China growing at 33.8% and India at 31.3%. China’s aggressive deployment in EV traceability and battery lifecycle management, coupled with India’s push for secure logistics and vehicle financing platforms, position both markets well above the global average. Among OECD members, Germany leads with a 28.8% CAGR, driven by blockchain-enabled mobility-as-a-service (MaaS) models and OEM innovation. The UK (23.8%) and US (21.3%) are investing steadily in blockchain infrastructure for autonomous vehicle data and decentralized insurance models. ASEAN countries are increasingly adopting blockchain to streamline cross-border automotive trade and ensure component provenance in local manufacturing chains.

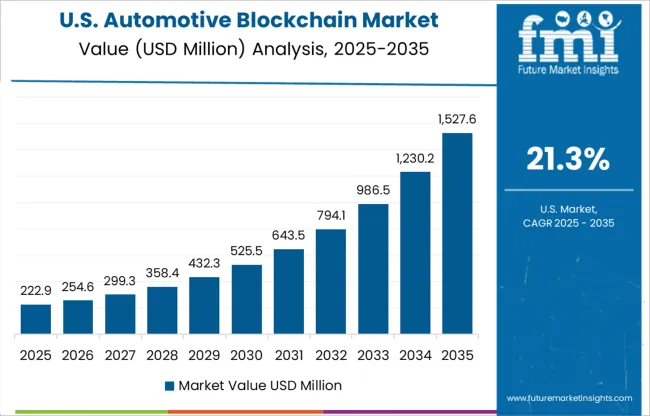

The CAGR of the USA automotive blockchain market rose from around 11.4% during 2020–2024 to 16.8% for the 2025–2035 period, driven by OEM focus on data authentication and mobility service platforms. Use cases expanded in insurance automation, connected vehicle data security, and decentralized maintenance records. The growth was bolstered by cross-sector collaborations between automakers and blockchain tech providers for telematics integration. Regulatory bodies issued draft compliance standards for distributed ledger usage in vehicle registration and title tracking by 2027, fostering adoption. Furthermore, North America’s fleet leasing ecosystem began integrating smart contracts into EV fleet operations and carbon offset credits.

The CAGR in the United Kingdom climbed from approximately 9.5% during 2020–2024 to 14.7% in the 2025–2035 period, reflecting heightened focus on automotive compliance, vehicle leasing, and decentralized V2X ecosystems. Market growth was driven by post-Brexit digital infrastructure policies and DVLA's move toward pilot blockchain systems for driver licensing. Shared mobility players accelerated blockchain implementation for real-time payment authentication and ride verification. The UK's autonomous vehicle trials also explored blockchain for traffic coordination and data traceability. Increased adoption among EV charging networks and lease companies triggered scalable DLT-based authentication for user accounts, enabling revenue-grade metering.

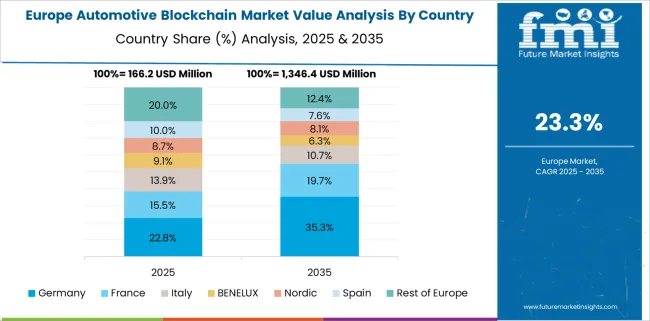

Germany’s CAGR advanced from about 10.9% in 2020–2024 to 15.9% for 2025–2035, supported by structured rollout across automotive clusters in Bavaria, Baden-Württemberg, and Lower Saxony. Automakers adopted blockchain for traceability of green steel and battery sourcing to meet EU carbon compliance. Mobility-as-a-Service (MaaS) platforms started embedding blockchain to authenticate subscriptions, optimize fare models, and manage microtransactions in real-time. German OEMs deepened blockchain usage in internal processes such as procurement, parts genealogy, and warranty lifecycle management. EU initiatives accelerated the digital twin rollout using blockchain for vehicle lifecycle audits by 2028.

China’s CAGR expanded from 12.6% in 2020–2024 to 18.3% during 2025–2035, propelled by state-driven vehicle digitization programs, a vast EV ecosystem, and traceability regulations for export-grade components. The Chinese Ministry of Industry and Information Technology (MIIT) encouraged blockchain trials for intelligent transportation systems in pilot smart cities. Large domestic automakers integrated DLT to manage component validation, smart insurance, and remote diagnostics. Regional governments incentivized supply chain blockchain for semiconductors and high-grade batteries. Additionally, consumer-facing platforms began adopting blockchain to manage second-hand vehicle authenticity and EV residual value assessment.

India’s CAGR rose from 11.7% in 2020–2024 to 17.5% during 2025–2035, underpinned by growing investments in digital vehicle ownership records, rising EV adoption, and smart mobility incentives. The Ministry of Road Transport and Highways initiated pilot projects on blockchain-based RC and insurance portability. Automotive fintech startups gained traction, offering decentralized leasing and micro-loan tracking for commercial vehicle buyers. Blockchain-enabled component traceability also gained importance amid tightening AIS-140 compliance and electric three-wheeler boom. Cross-platform interoperability emerged as a focus for state-level transport authorities integrating toll, FASTag, and fuel management systems.

In the automotive blockchain market, leading technology providers are driving transformation through secure data exchange, smart contract deployment, and vehicle lifecycle tracking. IBM Corporation, Microsoft Corporation, and Accenture have emerged as key enablers, offering blockchain-as-a-service (BaaS) platforms tailored to OEMs, insurers, and mobility service providers. These firms are integrating distributed ledger technologies into areas such as supply chain authentication, over-the-air updates, and automotive finance, while collaborating with regulators to shape data compliance frameworks. Microsoft’s Azure Blockchain and IBM’s Hyperledger Fabric have been pivotal in powering traceability and ownership validation projects for global automakers. Automotive-focused players like Tech Mahindra and ShiftMobility are advancing decentralized maintenance record systems and connected vehicle data solutions. CarVertical has gained traction with blockchain-backed used vehicle history reporting across Europe and Asia. Helbiz, a shared micromobility company, is leveraging blockchain for ride authentication and user identity, aligning with urban digital mobility trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 859.4 Million |

| Application | Supply chain management, Financial services, Automobile manufacturing, Warranty & fraud detection, Ownership transfer, and Mobility solutions |

| Provider | Application & solution provider, Middleware provider, Infrastructure & protocol provider, and Others |

| Mobility Type | Personal mobility, Shared mobility, and Commercial mobility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM Corporation, Accenture, Microsoft Corporation, Tech Mahindra, Helbiz, ShiftMobility, and CarVertical |

| Additional Attributes | Dollar sales, share, growth by application (fleet, insurance, supply chain), OEM adoption rates, regulatory alignment, deployment models (cloud vs on-premise), and ecosystem partnerships. |

The global automotive blockchain market is estimated to be valued at USD 859.4 million in 2025.

The market size for the automotive blockchain market is projected to reach USD 8,003.6 million by 2035.

The automotive blockchain market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in automotive blockchain market are supply chain management, financial services, automobile manufacturing, warranty & fraud detection, ownership transfer and mobility solutions.

In terms of provider, application & solution provider segment to command 41.0% share in the automotive blockchain market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA