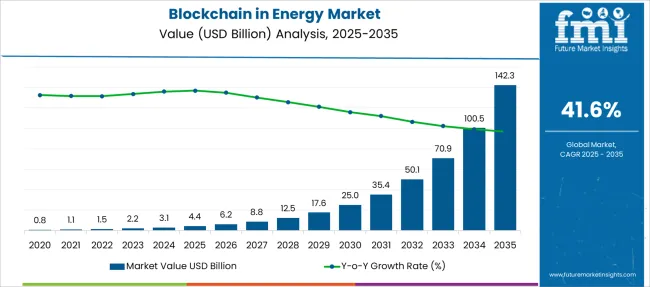

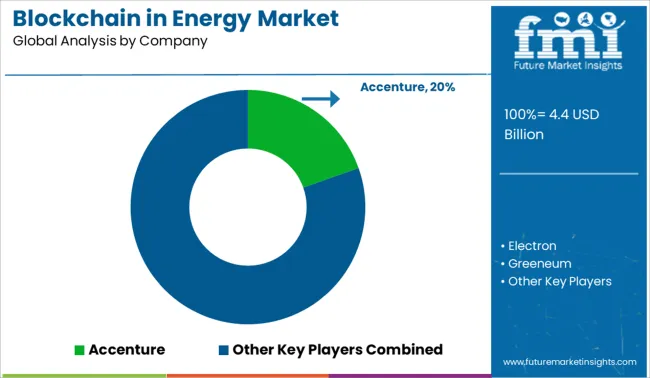

The Blockchain in Energy Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 142.3 billion by 2035, registering a compound annual growth rate (CAGR) of 41.6% over the forecast period.

| Metric | Value |

|---|---|

| Blockchain in Energy Market Estimated Value in (2025 E) | USD 4.4 billion |

| Blockchain in Energy Market Forecast Value in (2035 F) | USD 142.3 billion |

| Forecast CAGR (2025 to 2035) | 41.6% |

The blockchain in energy market is witnessing transformative growth as the energy sector pivots toward decentralization, enhanced transparency, and improved data integrity. Market momentum is being accelerated by the deployment of blockchain technologies in energy trading, grid management, peer-to-peer transactions, and renewable energy certificate tracking. Energy companies are adopting blockchain to streamline operations, reduce transaction costs, and establish secure, tamper-proof audit trails for compliance and regulatory reporting.

The integration of blockchain with smart meters, demand response systems, and distributed energy resources is enabling real-time validation of energy exchanges. Governments and utilities are also exploring blockchain for carbon credit verification and subsidy disbursement, signaling strong institutional support.

As energy systems become more complex with the rise of renewables and decentralized grids, blockchain is being positioned as a core digital infrastructure. Future opportunities are expected to emerge from tokenized energy trading platforms, cross-border settlements, and AI-integrated smart contracts driving automation and trust in energy ecosystems.

The market is segmented by category, application, and region. By Category, the market is divided into Public and Private. In terms of Application, the market is classified into Power, Grid Transactions, Peer to Peer Transactions, Energy Financing, Sustainability Attribution, Electric Vehicle Charging, Others, Oil & Gas, Supply Chain, Operations, Trading, and Security. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

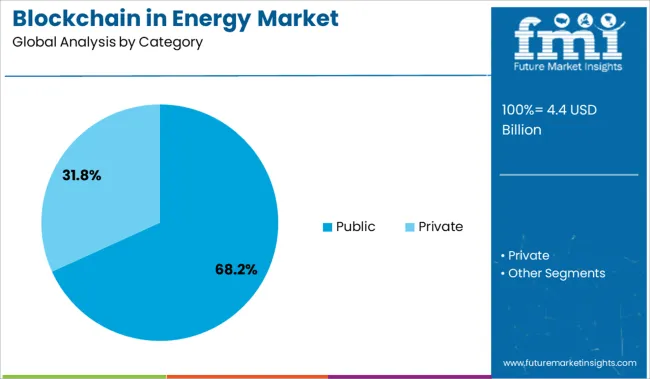

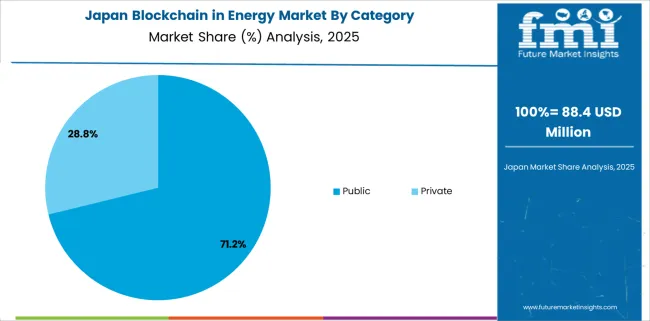

The public category is expected to account for 68.2% of total revenue in 2025, making it the dominant segment within the blockchain in energy market. This leadership is being driven by the openness, transparency, and decentralization benefits that public blockchains offer in multi-stakeholder energy environments.

Public blockchain networks allow all participants to access, verify, and audit transactions without reliance on centralized authorities, which is particularly valuable in peer-to-peer energy trading, green energy certificate issuance, and carbon offset tracking. Adoption has been further reinforced by the alignment of public blockchains with the principles of open energy markets and democratized access.

Energy communities, regulators, and tech startups have favored this category due to its lower entry barriers and flexibility in innovation. As scalability solutions improve and transaction speeds increase, public blockchains are expected to remain the backbone for energy applications requiring transparency, data permanence, and distributed control.

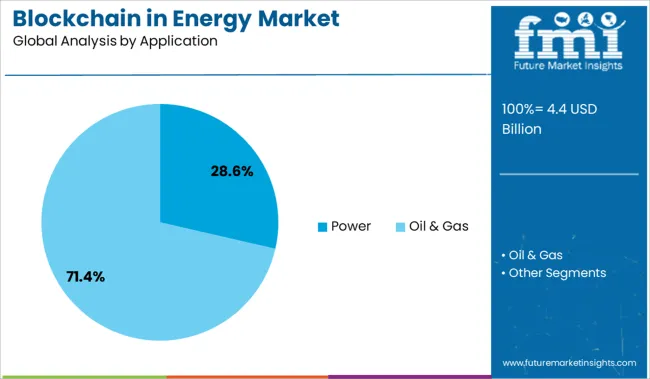

The power segment is anticipated to hold 28.6% of the application revenue share in 2025, establishing it as the leading use case within the blockchain in energy market. Its dominance is being shaped by the widespread integration of blockchain in electricity generation, distribution, and consumption systems.

Power utilities are leveraging blockchain to manage smart contracts for energy trading, automate grid transactions, and record renewable energy generation in real time. Blockchain’s ability to enable granular monitoring, facilitate load balancing, and support demand response has positioned it as a key enabler for next-generation power grids.

Additionally, its role in verifying and tracking energy origin and ownership has been critical for advancing green energy transparency and compliance. As smart grids evolve and decentralized energy assets grow, blockchain’s importance in the power segment is set to expand further, driving digital trust and operational efficiency across the electricity value chain.

The blockchain in energy space is undergoing structural realignment. Use cases like peer-to-peer energy trading, decentralized grid balancing, and tokenized incentives are moving from pilot to real-world implementation. Deployment intensity has increased across DER-rich nations, particularly where regulatory sandboxes allow market flexibility. Fragmented data and trust issues are being mitigated with cryptographic provenance.

Transparency and auditability have become non-negotiable across power value chains. Blockchain frameworks are increasingly used to verify green energy origins, prevent double-counting of carbon credits, and automate compliance with regional energy regulations. Smart contracts allow the creation of self-verifying ledgers for renewable energy certificates (RECs), creating a trust layer without needing centralized intermediaries. This becomes crucial in deregulated markets where grid-fed power blends multiple sources. Power purchase agreements (PPAs), especially virtual PPAs, are increasingly executed with blockchain backbones to minimize contract disputes and settlement delays. These platforms are also favored by ESG-oriented investors, where immutable records serve as verifiable credentials for decarbonization. Blockchain’s role in provenance, smart auditing, and dynamic asset tracking will remain core to its adoption curve.

The emergence of decentralized energy marketplaces, especially at the grid edge, offers a scalable use case for blockchain. Consumers equipped with solar panels or small wind turbines are being transformed into prosumers. By integrating blockchain into local energy grids, excess generation can be tokenized and traded securely within microgrids or community-based energy pools. This allows dynamic pricing, instant settlement, and transparent access to transaction histories. Importantly, the trustless nature of blockchain minimizes manipulation and governance disputes in such hyper-local exchanges. Energy utilities, instead of resisting disintermediation, are partnering with blockchain startups to launch sandbox pilots across Germany, the UK, and parts of South Korea. The opportunity lies in turning passive consumers into market participants.

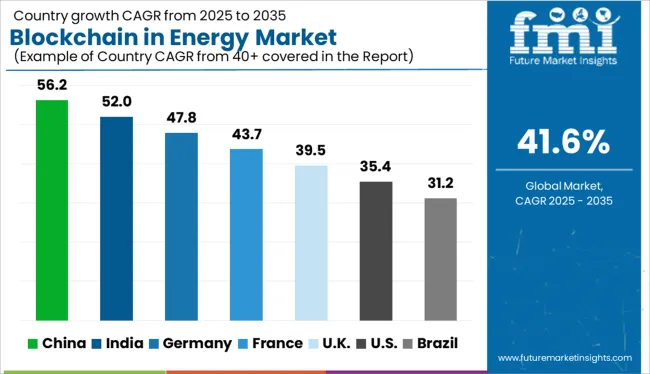

| Country | CAGR |

|---|---|

| India | 52.0% |

| Germany | 47.8% |

| France | 43.7% |

| UK | 39.5% |

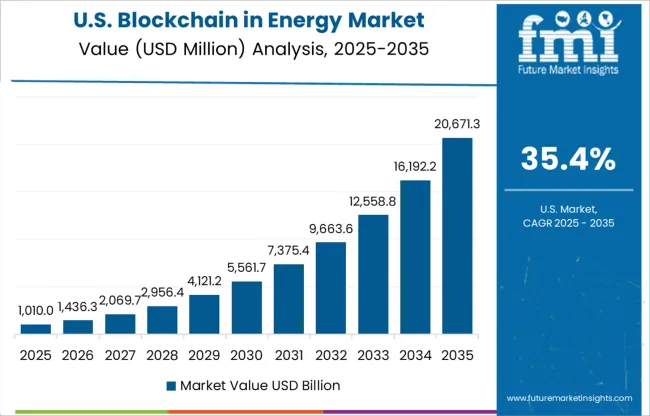

| USA | 35.4% |

| Brazil | 31.2% |

Global CAGR is set at 41.6%, though sharp disparities emerge when comparing BRICS and OECD economies. BRICS members China and India post standout figures at 56.2% and 52.0% respectively. In China, blockchain is being embedded in grid tokenization, peer-to-grid settlements, and carbon asset tracking backed by state utilities and provincial sandboxes. India’s acceleration is tied to peer-to-peer solar trading pilots, meter data tokenization, and blockchain-powered credit access for decentralized energy producers.Among OECD nations, Germany and France report solid expansion at 47.8% and 43.7%, underpinned by regulatory testbeds for blockchain in energy certificates, ancillary services, and virtual power plants. The United Kingdom lags at 39.5%, reflecting slower adoption cycles due to legacy asset lock-in and underdefined governance for tokenized energy flows. These five countries represent strategic benchmarks from a wider 40+ country analysis.

The blockchain in energy industry in the USA is expected to grow at a CAGR of 36.4% from 2025 to 2035. Growth is being held back by regulatory patchwork across states and a lack of unified digital infrastructure. However, opportunities are being unlocked through pilot deployments in microgrid settlements, renewable energy certificate (REC) validation, and time-of-use billing linked to blockchain smart contracts. Government-backed programs have remained limited, but private utilities are exploring consortium-based energy token platforms. Blockchain’s potential to enable peer-to-peer electricity trading and decentralized demand management has yet to be fully realized. Without clearer legislative guidance, innovation may remain scattered. Yet, investor attention has turned toward blockchain applications in EV charging optimization and carbon offset registries.

Sale of blockchain in the energy sector is projected to expand at a CAGR of 52.0%, supported by state-backed digital power reforms. Blockchain is being embedded in decentralized grid monitoring, time-synced energy metering, and subsidy disbursement audits. The Ministry of Power has prioritized transparency and traceability across transmission infrastructure. Platforms like Power Ledger have initiated peer-to-peer trading pilots, and these efforts have demonstrated replicable success in high-density housing societies and semi-urban clusters. The involvement of PSU energy firms and local tech startups is pushing interoperability standards. Strong interest has been observed in energy-as-a-service business models powered by blockchain, though gaps remain in developer training and grid readiness.

Demand blockchain in energy in China is set to register a CAGR of 56.2%, marking the fastest growth rate among major economies. The expansion is being fueled by direct state intervention, carbon market digitization, and integration of blockchain into industrial-grade microgrid orchestration. Technology giants and state-owned utilities are leading a consolidated push to develop proprietary blockchain protocols optimized for energy trading, emissions tracking, and real-time fault management. National goals tied to grid intelligence and emissions transparency have aligned well with blockchain deployment. Exports of blockchain-enabled energy modules and carbon tokens to neighboring Asian countries have begun. A strong link has been formed between the blockchain sector and China's broader Belt and Road energy corridor strategy.

Japan is expected to witness a CAGR of 38.1% in its blockchain in energy sector, where growth has been shaped by meticulous deployment models and collaborative industrial frameworks. Instead of mass adoption, the country has leaned toward curated sandbox testing, particularly in hydrogen supply chains, smart meter auditing, and virtual power plant coordination. Companies like Hitachi and Mitsubishi Electric have introduced blockchain nodes in predictive energy analytics, especially within smart city demonstration sites. However, hesitation from traditional utility players has kept momentum below potential. Japan's blockchain energy architecture prioritizes system stability and regulatory compliance, often at the cost of agility. Yet, its long-term outlook remains favorable due to rising ESG reporting mandates.

The blockchain in energy market in the UK is projected to grow at a CAGR of 39.5%, backed by progressive policy instruments and grid modernization projects. Innovation clusters in Scotland and southeast England have facilitated the development of decentralized energy exchanges. Ofgem’s sandbox regulatory initiatives have provided safe testing grounds for blockchain startups working on peer-to-peer electricity trading and REC tokenization. Offshore wind farms are leveraging blockchain for grid load transparency and payment traceability. While investment levels remain lower than in China or India, the UK offers a more stable regulatory pathway. Strategic alignment with pan-European digital energy standards is being prioritized to strengthen post-Brexit energy interconnectivity frameworks.

The blockchain in energy market features a layered and opportunity-driven competitive landscape. Accenture, IBM, and SAP dominate the enterprise blockchain market by offering energy asset digitization, automated contract execution, and decentralized data management for utilities. Oracle and Infosys are actively expanding blockchain middleware solutions to support smart metering, load reconciliation, and tokenized power settlements. Power Ledger and LO3 Energy drive market momentum in peer-to-peer energy trading, tapping regulatory gaps across OECD and BRICS economies. Greeneum and SunExchange are penetrating the decentralized solar finance market using blockchain to tokenize solar leases and carbon offsets. Kaleido and Electron are capturing grid flexibility and certificate trading segments by commercializing permissioned blockchain frameworks tailored for real-time load balancing and decentralized coordination.

In April 2024, Enact Systems integrated Oracle Blockchain into its award-winning solar software, enabling tokenized issuance of Renewable Energy Certificates and carbon credits tied to verified solar system performance and output.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Category | Public and Private |

| Application | Power, Grid Transactions, Peer to Peer Transactions, Energy Financing, Sustainability Attribution, Electric Vehicle Charging, Others, Oil & Gas, Supply Chain, Operations, Trading, and Security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Accenture, Electron, Greeneum, IBM, InfosysLimited, Kaleido, LO3Energy, Oracle, PowerLedger, SAP, and SunExchange |

| Additional Attributes | Dollar sales, share by public and private blockchain categories, adoption in decentralized grid transactions, energy tokenization models in peer-to-peer trading, blockchain-led traceability in EV charging, integration in oil & gas operations and trading platforms, surge in sustainability-linked digital registries and energy financing smart contracts |

The global blockchain in energy market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the blockchain in energy market is projected to reach USD 142.3 billion by 2035.

The blockchain in energy market is expected to grow at a 41.6% CAGR between 2025 and 2035.

The key product types in blockchain in energy market are public and private.

In terms of application, power segment to command 28.6% share in the blockchain in energy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blockchain Interoperability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Technology Market Analysis & Forecast 2025 to 2035, By Solution, Use Case, Enterprise Size, Industry, and Region

Blockchain in Banking Market

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Web 3.0 Blockchain Market Report – Growth, Demand & Forecast 2024-2034

Automotive Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Instruments for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Injectable Osteoarthritis Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA