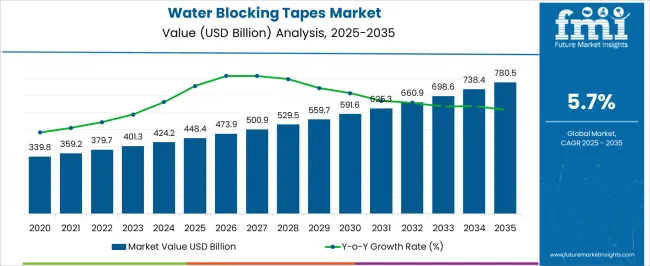

The Water Blocking Tapes Market is estimated to be valued at USD 448.4 billion in 2025 and is projected to reach USD 780.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. The water blocking tapes market is projected to grow from USD 448.4 billion in 2025 to USD 591.6 billion by 2030, generating an incremental gain of USD 143.2 billion over the first five years. This represents 43.9% of the total incremental growth over the 10-year forecast period. This early-phase growth is driven by increasing demand for waterproofing solutions in construction, cables, and packaging applications.

The market will benefit from expanding urbanization, advancements in material technology, and the need for more durable products in industrial applications such as telecommunications and automotive sectors. The second half (2030–2035) will contribute USD 188.9 billion, representing 56.1% of the total growth, reflecting stronger momentum due to innovations in water-resistant tape technologies and increased adoption across new industrial applications. Annual increments rise from USD 0.9 billion in early years to USD 4.2 billion by 2035, signaling accelerated growth driven by the growing emphasis on infrastructure development, sustainability, and improved manufacturing processes. Manufacturers focusing on eco-friendly, high-performance products will capture the largest share of this USD 332.1 billion opportunity.

| Metric | Value |

|---|---|

| Water Blocking Tapes Market Estimated Value in (2025 E) | USD 448.4 billion |

| Water Blocking Tapes Market Forecast Value in (2035 F) | USD 780.5 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The water blocking tapes market is experiencing robust growth driven by increasing demand for moisture-resistant materials in cable manufacturing, infrastructure modernization, and telecommunications expansion. These tapes play a critical role in preventing water ingress, ensuring long-term cable integrity, and reducing maintenance costs across high-performance electrical and communication networks.

Innovations in polymer chemistry and tape construction have improved compatibility with a wider range of cable designs, including high voltage and fiber optic cables. Growing investments in renewable energy projects and smart grid infrastructure are also contributing to rising adoption.

As global industries continue to prioritize durability, environmental resilience, and operational reliability, the water blocking tapes market is expected to maintain positive momentum across diverse utility and industrial segments.

The water blocking tapes market is segmented by conductivity, adhesive side, end-use industry, and geographic regions. By conductivity, the water blocking tapes market is divided into Semi-Conductive and Non-Conductive. In terms of the adhesive side, the water blocking tapes market is classified into single-sided and double-sided. Based on end-use industry, the water blocking tapes market is segmented into Telecommunication, Power Transmission, Oil and Gas, Automotive, Construction, and Others. Regionally, the water blocking tapes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

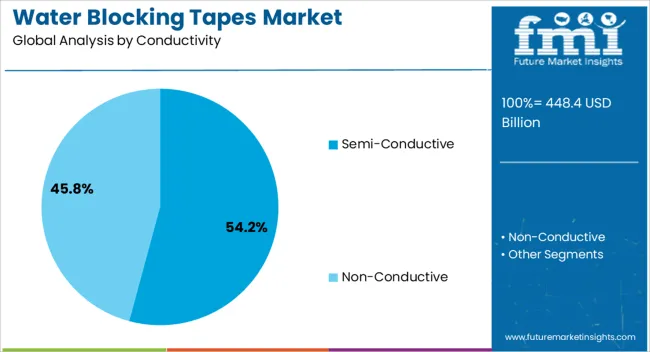

The semi-conductive segment is projected to account for 54.20% of total revenue by 2025 within the conductivity category, establishing its leadership in the market. This dominance is driven by the segment’s ability to provide controlled electrical shielding while maintaining high moisture resistance in complex cable assemblies.

Semi-conductive tapes are widely used in power transmission and distribution networks where electrical insulation and water blocking are both critical. The demand has been strengthened by the rise in underground and underwater cabling projects, which require enhanced protection against water penetration and dielectric stress.

As the need for reliable and high-performance electrical infrastructure grows, the semi-conductive type continues to be preferred across the energy and telecommunication sectors.

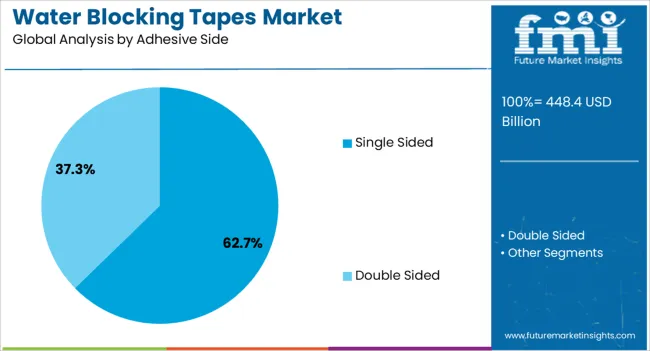

The single sided segment is expected to hold 62.70% of the overall market revenue by 2025 under the adhesive side category, making it the most prominent configuration. This format is favored for its ease of application, strong adhesion to cable components, and efficient water blocking capability in both joint and splicing processes.

The configuration allows manufacturers to streamline tape installation while maintaining consistent coverage and performance standards. Single-sided tapes are also compatible with high-speed manufacturing lines, reducing production time and labor costs.

Their versatility across both medium and high voltage cable systems has contributed to widespread adoption, securing their lead in the adhesive side segment.

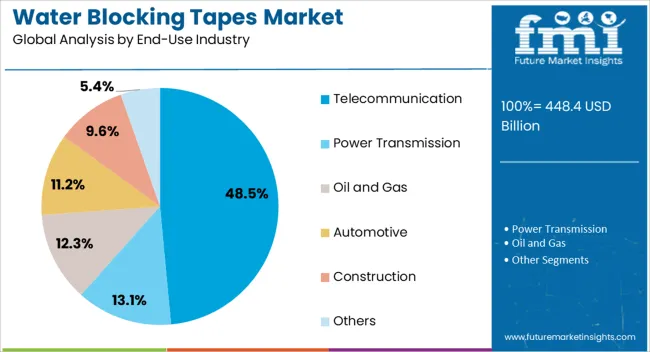

The telecommunication industry is projected to contribute 48.50% of total market revenue by 2025, emerging as the leading end-use segment. This growth is attributed to the rapid expansion of fiber optic networks, 5G infrastructure, and high-speed data transmission systems requiring robust cable protection solutions.

Water blocking tapes are critical in ensuring the longevity and reliability of telecommunication cables deployed in both buried and aerial environments. With increasing investments in rural connectivity and data center expansions, the demand for advanced moisture-resistant materials has intensified.

The ability of these tapes to enhance operational life and reduce service disruptions has made them an integral component in modern telecommunication systems, securing their position as the top-end use application.

The water blocking tapes market is driven by increasing demand for reliable cable protection in construction and energy sectors. Opportunities in expanding infrastructure and trends toward eco-friendly solutions are shaping the market. However, high raw material costs and product availability remain challenges. By 2025, overcoming these obstacles through affordable sourcing and improved production will be key for continued growth and adoption of water blocking solutions.

The water blocking tapes market is growing due to the increasing demand for reliable water protection in cables and wires. Water blocking tapes are essential in preventing water penetration in electrical cables, ensuring their durability and functionality, especially in harsh environments. The growing need for efficient, long-lasting infrastructure in industries like telecommunications, power, and construction is driving market growth. By 2025, the demand for these tapes will continue to rise as industries prioritize reliability and safety in their cable systems.

Opportunities in the water blocking tapes market are increasing with the growth of the construction and energy sectors. As infrastructure projects expand, especially in areas with high moisture or exposure to water, the need for cables protected with water blocking tapes is increasing. Similarly, the energy sector, including renewable energy projects, requires durable and water-resistant cable systems. By 2025, these opportunities will drive further demand for high-quality water blocking solutions, supporting the growth of the market.

Emerging trends in the water blocking tapes market include the rise of eco-friendly and biodegradable water blocking solutions. As industries increasingly focus on reducing environmental impact, there is a growing demand for water blocking tapes made from sustainable materials that provide the same level of protection. By 2025, eco-conscious manufacturers will continue to drive innovation in biodegradable water blocking tapes, addressing both environmental and performance requirements.

Despite growth, challenges such as high raw material costs and limited product availability persist in the water blocking tapes market. The production of high-quality, water-resistant tapes requires specialized materials that can be expensive, particularly for advanced formulations. Additionally, supply chain issues can affect the timely availability of these products. By 2025, addressing these challenges through cost-effective sourcing and efficient production methods will be crucial for market expansion.

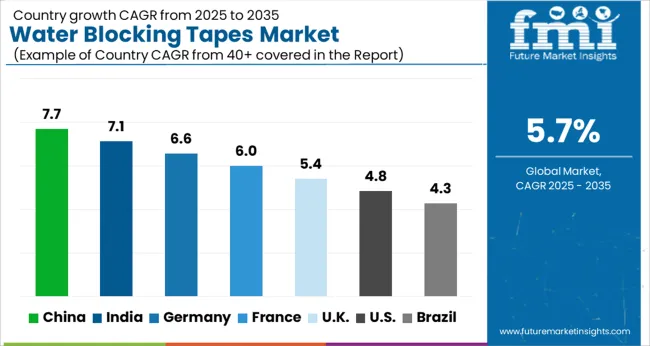

The global water blocking tapes market is projected to grow at a 5.7% CAGR from 2025 to 2035. China leads with a growth rate of 7.7%, followed by India at 7.1%, and France at 6%. The United Kingdom records a growth rate of 5.4%, while the United States shows the slowest growth at 4.8%. These varying growth rates are driven by factors such as increasing demand for water-resistant and durable cable protection, growing infrastructure development, and rising awareness about the importance of reliable water blocking materials in telecom and energy sectors. Emerging markets like China and India are seeing higher growth due to rapid industrialization, expanding telecommunication networks, and rising investments in infrastructure, while more mature markets like the USA and the UK experience steady growth driven by regulatory standards, technological advancements, and the need for more robust water-resistant materials. This report includes insights on 40+ countries; the top markets are shown here for reference.

The water blocking tapes market in China is growing rapidly, with a projected CAGR of 7.7%. China’s expanding industrial base, increasing demand for efficient telecom and energy infrastructure, and focus on water-resistant and durable materials are driving the demand for water blocking tapes. The rapid growth of telecommunication networks and the construction of large-scale infrastructure projects, particularly in urban and rural areas, are major contributors to market growth. Additionally, China’s emphasis on improving manufacturing technologies and adhering to safety and performance standards further boosts the demand for water blocking tapes.

The water blocking tapes market in India is projected to grow at a CAGR of 7.1%. India’s growing telecommunication and power sectors, combined with rapid infrastructure development, are driving the demand for water blocking tapes. The increasing focus on improving cable performance, reducing maintenance costs, and ensuring reliability in telecommunications and power grids further accelerates the market growth. Additionally, India’s government initiatives to expand infrastructure and provide better connectivity in rural areas contribute to the rising adoption of water blocking tapes across the country.

The water blocking tapes market in France is projected to grow at a CAGR of 6%. France’s increasing demand for high-quality, durable cable materials in sectors like telecommunications, energy, and automotive is driving steady market growth. The country’s focus on improving infrastructure and telecommunication networks, along with the rising need for advanced protection materials, further accelerates the demand for water blocking tapes. Additionally, France’s regulatory framework promoting safety standards and performance reliability continues to support the widespread adoption of water blocking tapes in various industries.

The water blocking tapes market in the United Kingdom is projected to grow at a CAGR of 5.4%. The UK’s demand for reliable and high-performance cable protection materials in the telecommunication, energy, and automotive sectors is driving steady market growth. The country’s focus on sustainability, energy efficiency, and regulatory compliance, coupled with increasing investments in infrastructure projects, contributes to the demand for advanced water blocking materials. Additionally, the UK market benefits from ongoing improvements in manufacturing technologies and rising consumer awareness about the importance of durable, eco-friendly materials.

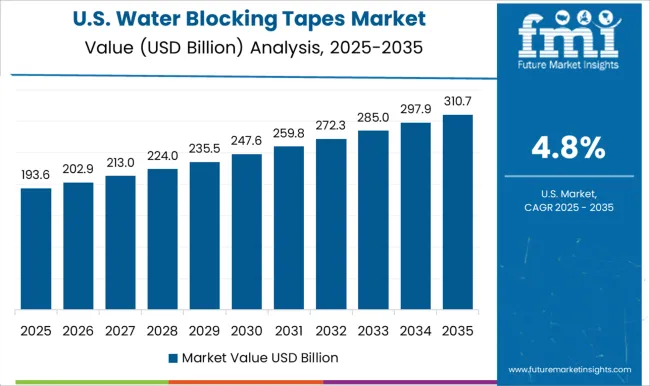

The water blocking tapes market in the United States is expected to grow at a CAGR of 4.8%. The USA market remains steady, driven by the growing demand for high-performance cable materials, particularly in telecommunications, energy, and infrastructure sectors. The increasing focus on durability, efficiency, and reducing maintenance costs in cable systems contributes to steady market growth. Additionally, the USA government’s commitment to improving energy efficiency, expanding broadband connectivity, and upgrading infrastructure further accelerates the demand for water blocking tapes.

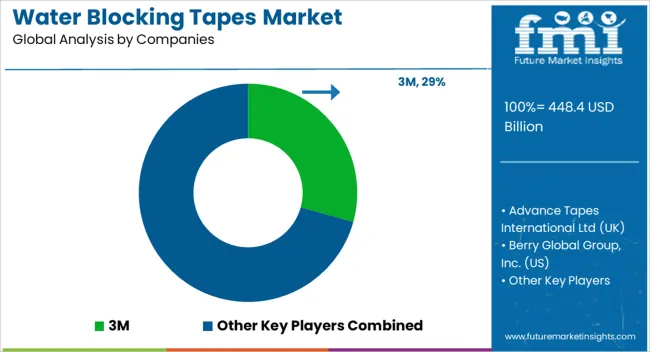

The water blocking tapes market is dominated by 3M, which leads with its high-quality, durable water blocking tape solutions widely used in the telecommunications, electrical, and construction sectors for preventing water ingress in cables and wiring systems. 3M’s dominance is supported by its advanced technology, strong brand recognition, and extensive product offerings that meet diverse industry needs. Key players such as Berry Global Group, Inc., Intertape Polymer Group, and Scapa Group Ltd. maintain significant market shares by providing high-performance water blocking tapes that enhance cable protection, improve insulation, and extend the lifespan of cables in harsh environmental conditions.

These companies focus on offering innovative solutions with enhanced adhesion properties and resistance to moisture and corrosion. Emerging players like Advance Tapes International Ltd., Nichiban Co., Ltd., and Fori Group are expanding their market presence by offering specialized water blocking tapes designed for niche applications such as high-temperature environments, industrial cable networks, and offshore installations. Their strategies include improving tape composition, enhancing water resistance capabilities, and focusing on cost-effective, eco-friendly solutions. Market growth is driven by increasing demand for reliable cable protection in critical infrastructure projects, rising use of advanced materials in cable manufacturing, and the growing trend toward energy-efficient solutions. Innovations in tape technology, multi-layer designs, and sustainable materials are expected to continue shaping competitive dynamics and fuel further growth in the global water blocking tapes market.

| Item | Value |

|---|---|

| Quantitative Units | USD 448.4 Billion |

| Conductivity | Semi-Conductive and Non-Conductive |

| Adhesive Side | Single Sided and Double Sided |

| End-Use Industry | Telecommunication, Power Transmission, Oil and Gas, Automotive, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Advance Tapes International Ltd (UK), Berry Global Group, Inc. (US), Star Materials, Intertape Polymer Group (Canada), Nichiban Co., Ltd. (Japan), Fori Group, Scapa Group Ltd (UK), Navank Consultants, Nantong Siber Communication, Unitape, and Chhaperia Cable Material Pvt. Ltd |

| Additional Attributes | Dollar sales by tape type and application, demand dynamics across telecommunications, power transmission, and construction sectors, regional trends in water blocking tape adoption, innovation in moisture-resistant and eco-friendly materials, impact of regulatory standards on safety and performance, and emerging use cases in cable insulation and sustainable packaging solutions. |

The global water blocking tapes market is estimated to be valued at USD 448.4 billion in 2025.

The market size for the water blocking tapes market is projected to reach USD 780.5 billion by 2035.

The water blocking tapes market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in water blocking tapes market are semi-conductive and non-conductive.

In terms of adhesive side, single sided segment to command 62.7% share in the water blocking tapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA