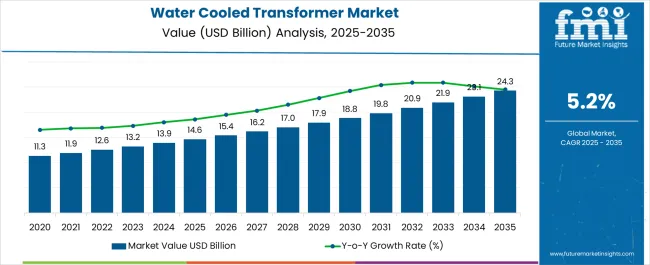

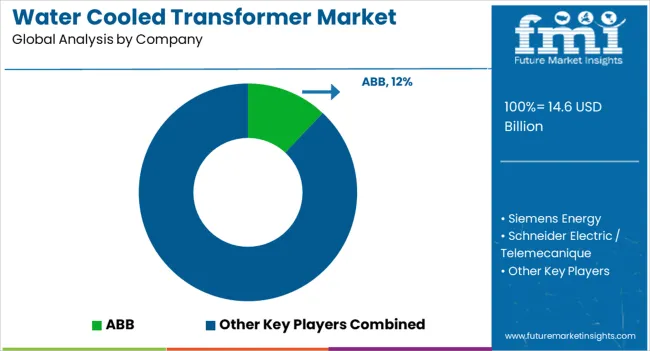

The water cooled transformer market is valued at USD 14.6 billion in 2025 and is projected to reach USD 24.3 billion by 2035, advancing at a CAGR of 5.2% during the forecast period. Growth is being influenced by rising electricity demand, expansion of power-intensive industries, and the requirement for efficient cooling in high-capacity transformers. Adoption is strong in utility-scale projects, industrial plants, and renewable energy integration where compact design and superior thermal management are essential.

Manufacturers are focusing on advanced insulation materials, enhanced heat dissipation technologies, and eco-friendly cooling mediums to meet evolving regulatory standards. Asia Pacific continues to drive demand with large-scale infrastructure expansion, while Europe and North America sustain steady adoption through modernization of aging grid infrastructure and industrial facilities.

| Metric | Value |

|---|---|

| Water Cooled Transformer Market Estimated Value in (2025 E) | USD 14.6 billion |

| Water Cooled Transformer Market Forecast Value in (2035 F) | USD 24.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Water Cooled Transformer market is experiencing steady expansion as industries increasingly require high-capacity, reliable power distribution solutions that can operate efficiently under demanding conditions. The technology’s ability to maintain optimal performance in high-temperature environments has made it a preferred choice for heavy industrial operations, marine applications, and renewable energy installations.

Adoption is being supported by growing emphasis on energy efficiency, space optimization, and operational safety, particularly in facilities where water cooling enables higher load handling and extended equipment lifespan. The integration of advanced monitoring systems and automation capabilities is also enhancing operational reliability and predictive maintenance for water cooled transformers.

Investments in power infrastructure modernization, coupled with rising electricity demand across manufacturing, mining, and offshore platforms, are expected to sustain long-term growth As regulatory standards increasingly focus on efficiency and environmental performance, water cooled transformers are positioned to play a key role in high-performance power systems, ensuring stable and sustainable energy delivery in both existing and emerging applications.

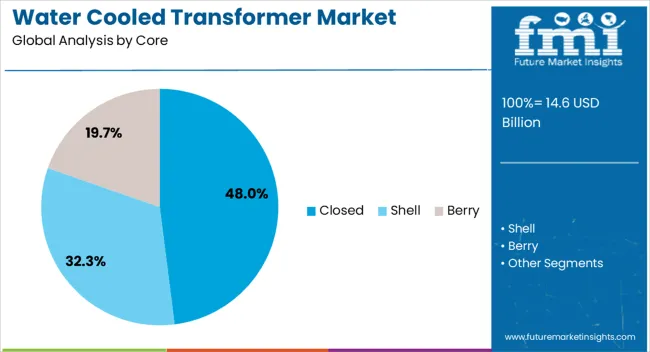

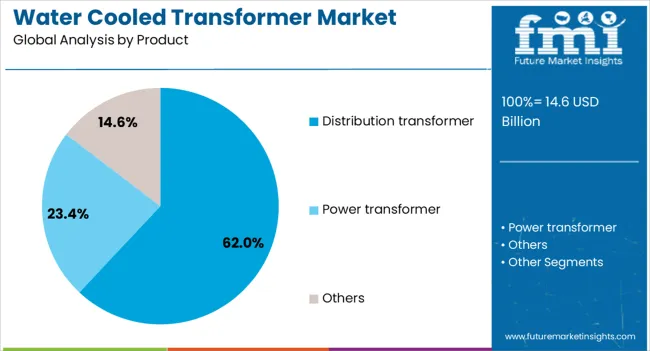

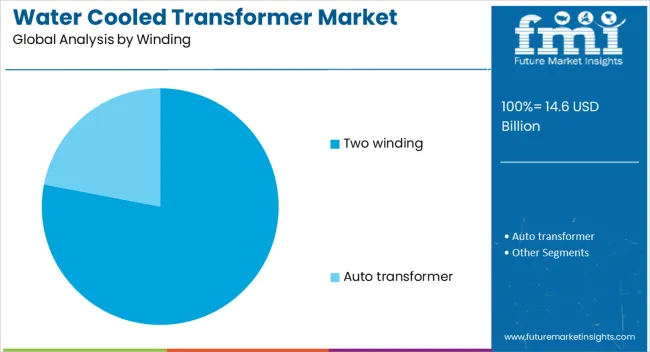

The water cooled transformer market is segmented by core, product, winding, voltage, insulation, rating, application, and geographic regions. By core, water cooled transformer market is divided into Closed, Shell, and Berry. In terms of product, water cooled transformer market is classified into Distribution transformer, Power transformer, and Others. Based on winding, water cooled transformer market is segmented into Two winding and Auto transformer. By voltage, water cooled transformer market is segmented into Medium voltage and High voltage. By insulation, water cooled transformer market is segmented into Oil, Solid, Gas, and Others. By rating, water cooled transformer market is segmented into ≤ 10 MVA. By application, water cooled transformer market is segmented into Industrial, Commercial, and Utility. Regionally, the water cooled transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The closed core product segment is projected to hold 48% of the Water Cooled Transformer market revenue share in 2025, making it the leading core configuration. Its growth has been supported by superior magnetic flux containment, which minimizes energy losses and enhances operational efficiency. Closed core designs offer high mechanical strength and stability, ensuring consistent performance in high-load applications.

The segment’s adoption has been reinforced by its suitability for large-scale industrial operations where continuous and stable power supply is critical. Its compatibility with water cooling technology allows for effective thermal management, enabling higher capacity operation without risk of overheating.

Additionally, the closed core configuration facilitates a longer operational lifespan and reduced maintenance requirements, making it a cost-effective solution over the equipment’s lifecycle As industries continue to prioritize energy efficiency and durability in power distribution systems, the closed core product type has maintained its position as the most preferred choice in the market.

The distribution transformer segment is expected to account for 62% of the Water Cooled Transformer market revenue share in 2025, establishing it as the dominant product type. This leadership is attributed to its essential role in delivering electricity from transmission systems to end users with minimal energy loss.

The adoption of water cooling in distribution transformers has significantly improved operational reliability, particularly in high-demand environments where efficient thermal regulation is critical. The segment’s growth has been further driven by infrastructure development in urban, industrial, and renewable energy projects, where stable and efficient power distribution is a priority.

The ability to handle variable load conditions without compromising performance has made water cooled distribution transformers a preferred choice for utility companies and industrial operators Furthermore, advancements in smart monitoring systems and fault detection have enhanced operational safety and reduced downtime, reinforcing the segment’s strong position in the overall market landscape.

The two winding winding segment is projected to command 78% of the Water Cooled Transformer market revenue share in 2025, positioning it as the leading winding configuration. This dominance is supported by its simple and robust design, which provides reliable electrical isolation between primary and secondary circuits.

The configuration’s compatibility with water cooling systems enables effective heat dissipation, ensuring efficient performance even under high load and continuous operation. Its ease of manufacturing and cost efficiency have contributed to its widespread adoption in both utility and industrial applications.

The two winding configuration is also valued for its operational safety and low maintenance requirements, factors that align with the increasing demand for dependable and long-life power equipment As sectors continue to invest in modernizing power distribution networks with high-performance, energy-efficient solutions, the two winding winding segment remains a preferred choice, reinforcing its leading position within the market.

The water cooled transformer market is advancing due to the rising need for efficient thermal management in high-capacity power systems. These transformers are increasingly installed in steel plants, chemical facilities, and mining operations where energy demand is continuous and equipment reliability is critical. Their compact design and superior cooling efficiency make them suitable for data centers and renewable power integration, where space and thermal performance are major concerns. Manufacturers are emphasizing advanced insulation materials, eco-friendly cooling systems, and improved heat dissipation designs to support heavy-duty performance. As industries pursue stable power supply and high-load efficiency, water cooled transformers are becoming an indispensable choice for handling elevated operational stresses while meeting modern energy performance standards.

Expansion of renewable energy projects and modernization of aging power grids are creating significant opportunities for water cooled transformers. Utilities are investing in grid stability solutions where compact, high-efficiency transformers are required for wind, solar, and hydroelectric power applications. Adoption is further supported by regulatory frameworks that emphasize energy efficiency and emissions reduction. Manufacturers are responding by integrating smart monitoring systems, IoT-enabled diagnostics, and predictive maintenance technologies into transformer designs. This digital layer enables optimized performance, early fault detection, and lifecycle cost savings. With renewable installations growing rapidly in Asia Pacific, Europe, and North America, water cooled transformers are being adopted to ensure reliable power conversion, efficient cooling, and improved grid resilience in fluctuating energy supply environments.

The water cooled transformer market is advancing due to the rising need for efficient thermal management in high-capacity power systems. These transformers are increasingly installed in steel plants, chemical facilities, and mining operations where energy demand is continuous and equipment reliability is critical. Their compact design and superior cooling efficiency make them suitable for data centers and renewable power integration, where space and thermal performance are major concerns. Manufacturers are emphasizing advanced insulation materials, eco-friendly cooling systems, and improved heat dissipation designs to support heavy-duty performance. As industries pursue stable power supply and high-load efficiency, water cooled transformers are becoming an indispensable choice for handling elevated operational stresses while meeting modern energy performance standards.

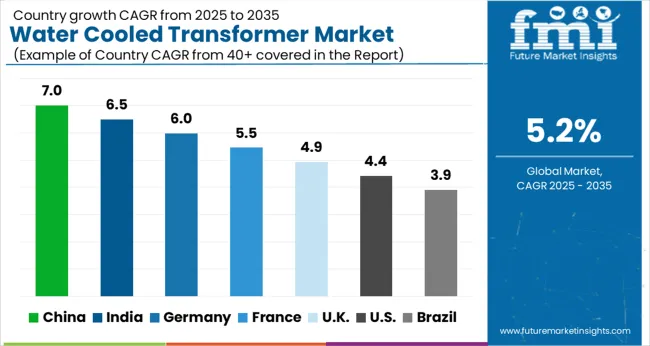

China’s water cooled transformer market is projected to grow at a CAGR of 7.0%, the fastest among all profiled nations. Expansion is being driven by rapid industrialization, rising electricity consumption, and large-scale renewable integration. High-capacity transformers are being deployed in power-intensive industries, steel plants, and hydroelectric stations where advanced cooling solutions are essential. Government-backed investments in smart grid infrastructure are supporting demand for compact and efficient transformer systems. Domestic manufacturers are focusing on energy-efficient designs, eco-friendly insulation, and enhanced monitoring features. Export strength also remains notable, with Chinese suppliers targeting Asian and African markets. Adoption has been reinforced by the need for reliable and space-efficient solutions in mega infrastructure projects.

High-capacity installations in power-intensive industries

Smart grid projects accelerate transformer deployment

Export-oriented manufacturing boosts global presence

India’s water cooled transformer market is forecasted to advance at a CAGR of 6.5%, supported by growing electricity demand and modernization of transmission infrastructure. Expansion of smart city projects and industrial corridors has elevated the need for compact transformers capable of handling heavy loads. State utilities are procuring water cooled systems for thermal power plants, renewable integration, and metro rail projects. Demand has also been stimulated by private sector investments in steel, cement, and petrochemical industries. Local manufacturers are improving designs with eco-friendly cooling mediums and advanced insulation materials to meet efficiency targets. Challenges remain in rural adoption, but metropolitan projects and government-backed electrification initiatives continue to stimulate long-term growth.

Metro and smart city projects drive adoption

Utilities invest in renewable and thermal grid upgrades

Local manufacturers improve eco-friendly designs

Germany’s water cooled transformer market is expected to grow at a CAGR of 6.0%, influenced by EU energy efficiency regulations and strong industrial modernization efforts. Adoption has been prominent in renewable power projects, industrial hubs, and advanced manufacturing facilities where efficient cooling is a priority. German suppliers emphasize precision engineering, smart monitoring integration, and modular transformer designs to cater to diverse applications. Municipal utilities have adopted water cooled systems for grid stabilization and urban infrastructure upgrades. Export activity remains strong, with German-built systems supplied to other European Union countries due to their reliability and compliance with strict standards. Increasing demand for energy storage and renewable integration continues to support steady growth.

EU energy directives boost demand for efficient systems

Modular and smart-enabled transformers gain traction

Exports to EU neighbors sustain international sales

France is projected to expand at a CAGR of 5.5%, reflecting moderate but steady adoption across industrial and utility applications. Demand has been concentrated in chemical facilities, urban infrastructure projects, and renewable energy integration. French utilities are modernizing outdated transmission systems with compact, water cooled transformers that offer superior cooling performance. Government policies promoting clean energy and grid stability are reinforcing procurement. Manufacturers are focused on developing lightweight, durable units with improved safety features to serve both domestic and regional demand. Export opportunities are evident in Mediterranean and African countries where French suppliers maintain trade relationships. Adoption of digital monitoring solutions has been observed in major infrastructure projects, signaling a gradual shift toward smarter energy systems.

Modernization of aging grid infrastructure supports growth

Adoption in chemical and renewable projects rises

Regional exports target Mediterranean and African markets

The United Kingdom’s water cooled transformer market is forecasted to grow at a CAGR of 4.9%, driven by infrastructure replacement cycles and demand from high-capacity projects. Adoption has been notable in renewable integration, data centers, and metropolitan grid upgrades. Municipal utilities and private operators are gradually phasing out older systems in favor of compact water cooled designs that improve energy efficiency. Domestic manufacturers are focusing on compliance with emission and energy-saving regulations while developing systems with advanced monitoring features. Demand has also been supported by investments in offshore wind and urban electrification projects. Growth remains steady but slower compared to leading European markets, constrained by higher capital costs and longer procurement timelines.

Offshore wind projects stimulate transformer demand

Data centers require compact and efficient cooling systems

Replacement cycles support moderate market expansion

The United States is projected to grow at a CAGR of 4.4%, matching the global baseline. Market growth is driven by replacement of aging transmission infrastructure and demand from heavy industries. Utilities are investing in water cooled transformers for large-capacity load handling in urban centers and power-intensive manufacturing hubs. Adoption of digital monitoring technologies is expanding, as predictive maintenance and real-time performance tracking become standard in utility projects. Renewable integration in states such as California and Texas is generating new opportunities, particularly for compact systems in solar and wind applications. Domestic manufacturers are innovating in eco-friendly cooling mediums and smart grid-compatible designs. However, slower procurement processes and reliance on legacy systems moderate overall growth.

Replacement of aging assets fuels baseline growth

Renewable integration in solar and wind states supports adoption

Digital monitoring systems enhance operational efficiency

The water cooled transformer market is supported by a specialized network of global and regional suppliers focusing on high-capacity transformers designed for efficient thermal management in power-intensive applications. Siemens Energy and ABB Ltd. lead the market, offering advanced water cooled transformer solutions for utilities, data centers, and renewable energy projects. Their portfolios emphasize compact design, digital monitoring, and superior cooling performance tailored for both industrial and grid-scale applications. General Electric (GE) also plays a major role, supplying water cooled transformers integrated with predictive diagnostics and eco-friendly cooling mediums for heavy industries and infrastructure modernization.

Asian manufacturers such as TBEA, Hyundai Electric & Energy Systems, and Toshiba Energy Systems & Solutions Corporation contribute significantly, producing large-capacity water cooled transformers for high-demand sectors including steel, petrochemicals, and mining. Indian suppliers like Bharat Heavy Electricals Limited (BHEL) provide cost-efficient solutions to domestic utilities and industrial plants. European firms including Schneider Electric, Siemens Transformatoren, and Maschinenfabrik Reinhausen focus on modular water cooled transformers for industrial clusters and renewable integration across EU markets.

Specialized material and technology players such as Hammond Power Solutions, Wilson Power Solutions, and JST Transformateurs emphasize customized water cooled designs for niche applications like marine power systems, metro rail networks, and offshore platforms. Companies including Crompton Greaves Power and Hyosung Heavy Industries supply region-specific solutions with a focus on durability and extended service life. As the demand for compact, high-efficiency transformers grows, suppliers are investing in eco-friendly insulation systems, IoT-enabled monitoring, and additive manufacturing for precision components, ensuring continued adoption across energy, industrial, and infrastructure sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.6 Billion |

| Core | Closed, Shell, and Berry |

| Product | Distribution transformer, Power transformer, and Others |

| Winding | Two winding and Auto transformer |

| Voltage | Medium voltage and High voltage |

| Insulation | Oil, Solid, Gas, and Others |

| Rating | ≤ 10 MVA |

| Application | Industrial, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens Energy, Schneider Electric / Telemecanique, General Electric / GE Grid Solutions, Hitachi Energy, and Other regional / local manufacturers (various) |

| Additional Attributes | Dollar sales by type including distribution transformers, power transformers, and furnace transformers, application across utilities, industrial, and commercial sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising electricity demand, need for efficient and reliable power distribution, and adoption of advanced cooling technologies. |

The global water cooled transformer market is estimated to be valued at USD 14.6 billion in 2025.

The market size for the water cooled transformer market is projected to reach USD 24.3 billion by 2035.

The water cooled transformer market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in water cooled transformer market are closed, shell and berry.

In terms of product, distribution transformer segment to command 62.0% share in the water cooled transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA