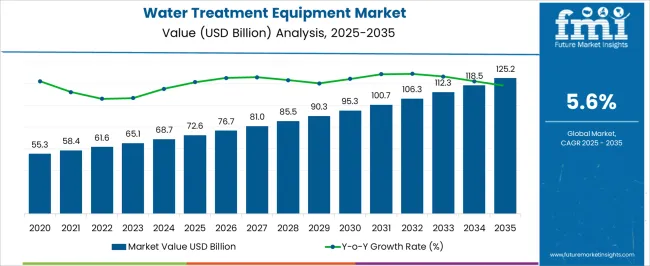

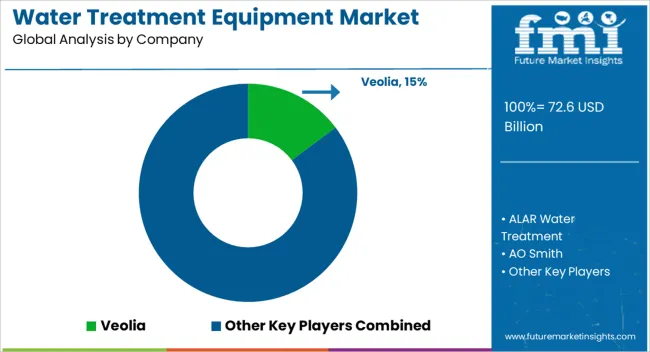

The Water Treatment Equipment Market is estimated to be valued at USD 72.6 billion in 2025 and is projected to reach USD 125.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. The chart highlights consistent growth, reflecting the rising emphasis on clean water access, industrial wastewater management, and municipal treatment infrastructure. Early years in the forecast show gradual improvement, with market value moving from USD 72.6 billion in 2025 to USD 90.3 billion in 2028. By 2030, the market will surpass USD 100 billion, maintaining strong momentum through the mid-2030s.

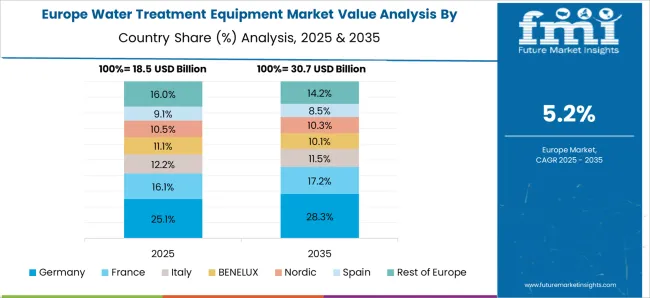

The YoY growth rate line indicates relative stability, with moderate peaks around 2029–2032 before tapering slightly toward 2035. This reflects both the steady adoption of advanced treatment technologies and replacement cycles in mature markets. Stringent water quality regulations reinforce demand, the rise of industrial recycling initiatives, and heightened investment in smart monitoring and filtration systems. The market outlook also benefits from regional demand surges in Asia-Pacific, North America, and Europe, where water scarcity and aging infrastructure drive large-scale deployments.

| Metric | Value |

|---|---|

| Water Treatment Equipment Market Estimated Value in (2025 E) | USD 72.6 billion |

| Water Treatment Equipment Market Forecast Value in (2035 F) | USD 125.2 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

Rising urbanization and industrialization have contributed to elevated water contamination levels, driving the need for advanced treatment systems across municipal, industrial, and residential sectors. Governments and environmental bodies are enforcing stricter wastewater discharge and potable water quality regulations, which are encouraging infrastructure investments and upgrades.

Additionally, the shift toward decentralized water treatment, combined with growing demand for energy-efficient and smart filtration technologies, has been accelerating market adoption. Industry players are investing in automation, IoT-enabled monitoring, and membrane technologies to enhance performance, reliability, and sustainability.

Aging infrastructure in developed regions and the lack of access to clean water in emerging economies are also acting as catalysts for long-term growth.

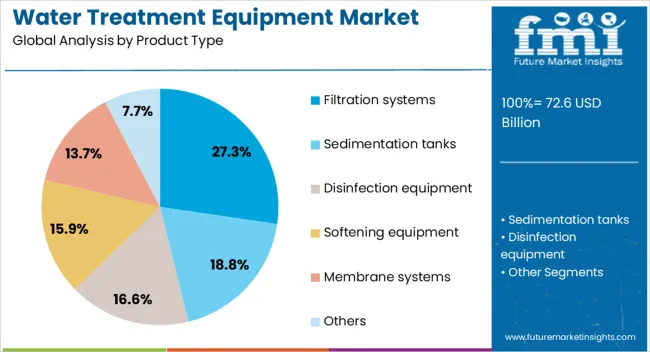

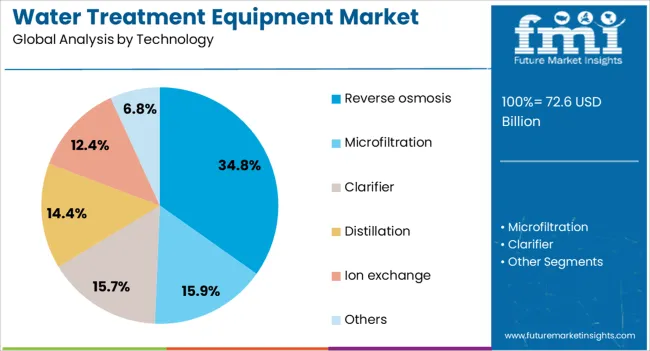

The water treatment equipment market is segmented by product type, technology, end-use, distribution channel, and geographic regions. By product type, the water treatment equipment market is divided into Filtration systems, Sedimentation tanks, Disinfection equipment, softening equipment, Membrane systems, and Others. In terms of technology, the water treatment equipment market is classified into Reverse Osmosis, Microfiltration, Clarifier, Distillation, Ion Exchange, and Others.

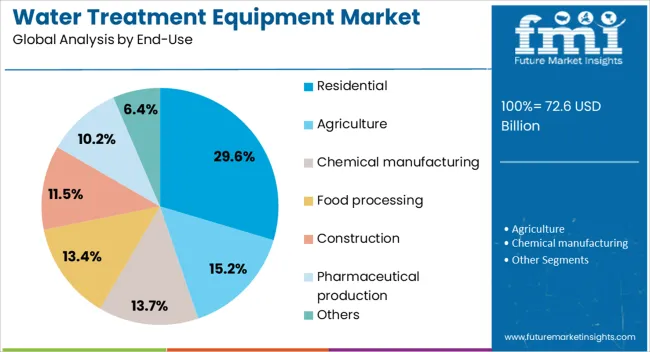

Based on end-use, the water treatment equipment market is segmented into Residential, Agriculture, Chemical manufacturing, Food processing, Construction, Pharmaceutical production, and Others. By distribution channel, the water treatment equipment market is segmented into Direct and Indirect. Regionally, the water treatment equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The filtration systems segment is projected to account for 27.3% of the market revenue share in 2025, positioning it as the leading product type. This dominance is being driven by the system’s ability to effectively remove physical impurities, sediments, and suspended solids from water, ensuring a foundational level of treatment across both municipal and residential applications. The popularity of filtration systems has been supported by their operational simplicity, cost-efficiency, and minimal maintenance requirements.

In recent years, manufacturers have enhanced system designs to support modular configurations and compatibility with smart sensors, which has improved both efficiency and monitoring capabilities. Demand has also been influenced by the rise in point-of-entry and point-of-use systems, particularly in areas with unreliable water supply.

The segment’s adaptability to both centralized and decentralized installations, along with compliance with evolving water safety standards, has ensured its continued relevance.

The reverse osmosis technology segment is anticipated to hold 34.8% of the Water Treatment Equipment market revenue share in 2025, making it the largest technology segment. Its leadership is attributed to its high efficiency in removing dissolved salts, heavy metals, and chemical contaminants, which is critical for both drinking water and industrial-grade water applications. The process has gained widespread adoption due to increasing demand for desalination, wastewater recycling, and ultrapure water production.

The technology’s low chemical usage and reduced environmental footprint have made it a preferred choice under stringent environmental compliance frameworks. Recent improvements in membrane durability, energy recovery systems, and modular system integration have enhanced reverse osmosis efficiency and reduced operating costs.

These enhancements have enabled scalable deployment across industries such as food and beverage, pharmaceuticals, and power generation The growing emphasis on sustainable water management and zero-liquid discharge initiatives has also reinforced the segment’s role as a cornerstone technology in advanced water treatment solutions.

The residential segment is expected to represent 29.6% of the Water Treatment Equipment market revenue share in 2025, establishing it as the leading end-use category. This growth is being fueled by increasing consumer awareness of water quality issues, rising health consciousness, and expanding access to affordable home treatment systems. Residential users have shown a preference for compact, energy-efficient systems that provide safe drinking water at the point of use.

This segment has also benefited from innovations in product design, including smart purification technologies that monitor water quality in real time and notify users of required maintenance. The segment’s expansion is further supported by the prevalence of hard water and microbial contamination in many urban and peri-urban regions.

Increased adoption of RO systems, UV sterilizers, and multi-stage filtration units has addressed the demand for safer water in households. Ongoing public health campaigns and regulatory support for domestic water quality improvements are also sustaining the growth of this segment across both developed and emerging markets.

The Nonwoven Baby Diaper Market is expanding steadily as parents seek products that offer superior comfort, absorbency, and skin protection for infants. Nonwoven materials contribute softness, breathability, and efficient fluid management, which are critical for preventing diaper rash and enhancing baby care. Increasing birth rates in emerging regions and rising disposable incomes support greater adoption of premium diapers. Manufacturers focus on innovations in materials and design, including eco-friendly options and improved fit, to meet diverse consumer preferences and regulatory standards related to safety and hygiene.

Parents increasingly prioritize baby diapers that provide exceptional comfort and prevent skin irritation, driving demand for advanced nonwoven materials. These materials offer softness and breathability while efficiently locking in moisture, reducing the risk of diaper rash. Baby diapers now commonly feature multi-layered nonwoven fabrics designed for quick absorption and dryness. Manufacturers are incorporating hypoallergenic, dermatologically tested fabrics to ensure safety for sensitive infant skin. The market benefits from rising awareness about infant hygiene and health, particularly in urban and semi-urban areas. Product differentiation also comes through ergonomic designs that improve fit and flexibility for active babies. This growing focus on comfort and skin health supports premium diaper sales, encouraging manufacturers to continually enhance nonwoven fabric technologies.

Environmental concerns push manufacturers to develop eco-friendly nonwoven materials that are biodegradable or sourced from renewable fibers. Disposable diapers traditionally contribute to landfill waste, prompting demand for greener alternatives without sacrificing performance. Companies invest in sustainable sourcing, recycling, and production methods to create diapers that appeal to environmentally conscious consumers. Efforts include using plant-based fibers, reducing chemical treatments, and optimizing nonwoven fabric blends for lower environmental impact. Some brands offer compostable diaper lines targeting niche markets willing to pay a premium. Regulatory frameworks in various countries encourage or mandate increased use of sustainable materials in baby care products. This shift encourages innovation and broadens consumer options, helping brands build long-term trust and loyalty while addressing ecological concerns.

Emerging economies with increasing birth rates, improving healthcare infrastructure, and growing middle-class populations present significant growth opportunities for nonwoven baby diapers. Rising disposable income and urbanization lead to greater adoption of disposable diapers over traditional cloth alternatives. In these regions, awareness campaigns and distribution expansion into rural and semi-urban areas help boost market penetration. Local manufacturers are investing in production capacity and tailoring product offerings to regional preferences, including cost-effective and premium diaper ranges. Additionally, government health initiatives promoting infant hygiene indirectly support market growth. Expansion of organized retail and e-commerce platforms further enhances accessibility and convenience for consumers. This demographic and economic transition in emerging markets positions them as key growth drivers for global diaper manufacturers seeking volume and value gains.

The nonwoven baby diaper market is highly competitive, with both global giants and regional players investing heavily in product innovation and marketing. Companies differentiate through patented nonwoven fabric technologies, superior absorption systems, and ergonomic designs that enhance baby comfort. Branding and packaging also play crucial roles in influencing consumer loyalty and premium positioning. Strategic partnerships with healthcare professionals and pediatricians support brand credibility and educational outreach. Private-label products continue to gain traction, especially in cost-sensitive markets, creating pricing pressures. In response, manufacturers focus on value-added features like wetness indicators, breathable waistbands, and hypoallergenic linings to justify premium prices. Marketing emphasizes trust, safety, and innovation to capture discerning parents. This competitive environment drives continuous R&D, product diversification, and channel expansion, shaping the market’s dynamic growth.

The global nonwoven baby diaper market is projected to grow at a CAGR of 4.5% through 2035, supported by ongoing demand in infant care, healthcare facilities, and retail sectors. Among BRICS nations, China leads with 6.1% growth, driven by large-scale production and expanding domestic consumption. India follows at 5.6%, where rising birth rates and increased product availability have influenced market expansion.

In the OECD region, Germany reports 5.2% growth, backed by high product quality standards and established supply chains. France, growing at 4.7%, has maintained steady demand through hospitals and retail pharmacies. The United Kingdom, at 4.3%, reflects consistent usage within both private and public caregiving environments. Market dynamics have been shaped by product safety regulations, absorbency benchmarks, and labeling requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Growth in the nonwoven baby diaper market in China has been recorded at a CAGR of 6.1%, driven by expanding healthcare access and rising newborn populations. Domestic manufacturers have increased production capacity by introducing ultra-absorbent core materials combined with soft nonwoven layers for enhanced comfort. Distribution channels have broadened to include tier-two and tier-three cities, where disposable diapers are increasingly adopted over traditional alternatives. Retailers have diversified product portfolios with varying sizes and absorbency levels to meet regional preferences. The demand for hypoallergenic and breathable diaper variants has increased, especially in urban centers. Contract producers have ramped up specialty nonwoven fabrics to support major brands. Packaging innovations aimed at easy handling and disposal have also been implemented.

India has witnessed steady growth in the nonwoven baby diaper market at a CAGR of 5.6%, primarily supported by rising awareness of infant hygiene and increased disposable income. Local manufacturers have adopted breathable nonwoven fabric technologies to improve diaper comfort in hot climates. The rural and semi-urban sectors have shown increased acceptance of disposable diapers, driving demand for cost-efficient and mid-range products. Retail chains and online platforms have expanded accessibility, especially during festival seasons and promotions. Product development has focused on leak-proof designs combined with soft elastic waistbands. Educational campaigns on diaper usage and disposal methods have also contributed to market expansion. Packaging tailored for easy portability has been introduced to meet consumer convenience requirements.

A CAGR of 5.2% has been observed in Germany’s nonwoven baby diaper market, driven by a preference for high-performance products meeting strict regulatory standards. Diapers featuring superabsorbent polymers combined with biodegradable nonwoven layers have been adopted to reduce environmental impact. Manufacturers have focused on dermatologically tested fabrics to minimize skin irritation and allergies. Retailers have increased the availability of premium and organic diaper lines to cater to eco-conscious consumers. Distribution networks have enhanced supply chain efficiencies to maintain consistent product availability. Innovations in wetness indicators and adjustable fasteners have been integrated to improve user convenience. Specialized packaging designed for recycling and minimal waste has been promoted across stores.

Growth of 4.7% CAGR has been recorded in France’s nonwoven baby diaper market as demand rises for gentle, breathable diapers with effective leak protection. Production facilities have adopted multilayer nonwoven structures that improve softness and moisture distribution. Retailers have responded to consumer preferences by stocking fragrance-free and dermatologically safe diaper options. Pediatricians and healthcare providers have supported adoption by recommending products that reduce rash incidences. Promotional activities have focused on highlighting hypoallergenic materials and natural fiber blends. Packaging innovations include compact designs for space-saving storage and enhanced portability. Seasonal demand spikes have been managed through improved inventory strategies across regional warehouses.

The United Kingdom has registered a CAGR of 4.3% in the nonwoven baby diaper market, fueled by consumer demand for gentle, high-absorbency products suited for sensitive skin. Manufacturers have integrated elasticized side panels and breathable nonwoven back sheets to improve fit and ventilation. Retailers have expanded product ranges to include hypoallergenic and dermatologically approved diapers targeting newborns and toddlers. Distribution channels have improved accessibility through pharmacy chains and e-commerce platforms. Brands have invested in packaging designs that support resealing and disposal convenience. Medical professionals have advocated for products that reduce diaper dermatitis risk, further increasing adoption. Consumer education on diaper disposal and environmental impact has also been intensified.

Mid-sized companies such as Drylock Technologies NV and First Quality Enterprises Inc. competed by offering cost-effective solutions and regional customization, while niche brands like Cotton Babies and The Honest Co. targeted organic and natural product segments. The competitive environment was marked by product innovation through incremental technology advancements and strategic partnerships, with a focus on expanding distribution channels in emerging markets. The market is expected to face disruption from software-driven smart diaper solutions and sensor-enabled wearables that monitor infant health and hygiene in real-time. Startups integrating IoT and AI technologies are anticipated to challenge traditional manufacturers by offering personalized care products and data-driven insights. This digital transformation will compel legacy players to innovate beyond product features and embrace technology-led value propositions to stay competitive in an increasingly connected and health-conscious consumer landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 72.6 Billion |

| Product Type | Filtration systems, Sedimentation tanks, Disinfection equipment, Softening equipment, Membrane systems, and Others |

| Technology | Reverse osmosis, Microfiltration, Clarifier, Distillation, Ion exchange, and Others |

| End-Use | Residential, Agriculture, Chemical manufacturing, Food processing, Construction, Pharmaceutical production, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Veolia, ALAR Water Treatment, AO Smith, ChemREADY, Culligan, Evoqua Water Technologies, Ecowater, Kurita Europe GmbH, LennTech B.V, Pall Corporation, Parkson Corporation, Pentair, SAMCO, Smith & Loveless, and Suez |

| Additional Attributes | Dollar sales by type including filtration systems, disinfection systems, and desalination units, application across municipal, industrial, and residential sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising water scarcity, stringent environmental regulations, and increasing demand for clean and safe water solutions. |

The global water treatment equipment market is estimated to be valued at USD 72.6 billion in 2025.

The market size for the water treatment equipment market is projected to reach USD 125.2 billion by 2035.

The water treatment equipment market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in water treatment equipment market are filtration systems, sedimentation tanks, disinfection equipment, softening equipment, membrane systems and others.

In terms of technology, reverse osmosis segment to command 34.8% share in the water treatment equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

South America Residential Water Treatment Equipment Market Trends – Growth & Forecast 2022 to 2032

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Coatings Market Size and Share Forecast Outlook 2025 to 2035

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods and Capsules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA