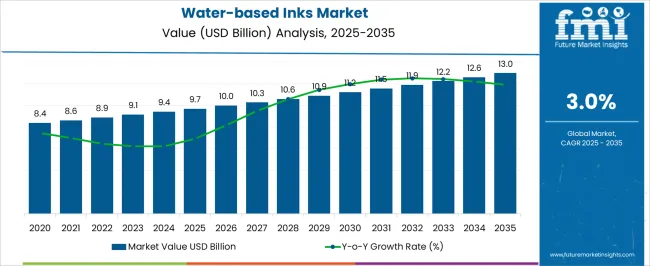

The Water-based Inks Market is estimated to be valued at USD 9.7 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

| Metric | Value |

|---|---|

| Water-based Inks Market Estimated Value in (2025 E) | USD 9.7 billion |

| Water-based Inks Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The water based inks market is expanding steadily due to increasing demand for environmentally sustainable printing solutions and the tightening of regulations around volatile organic compound emissions. Industries are shifting toward eco friendly alternatives that ensure worker safety and reduce environmental impact while maintaining high print quality.

Advancements in resin technologies and pigment dispersion have improved adhesion, durability, and color vibrancy of water based inks, making them suitable for a broad range of substrates. Growing adoption in packaging, labeling, and publishing is being reinforced by consumer preference for sustainable products and corporate commitments to circular economy practices.

The market outlook remains favorable as investments continue in developing high performance water based formulations that align with both performance requirements and environmental standards.

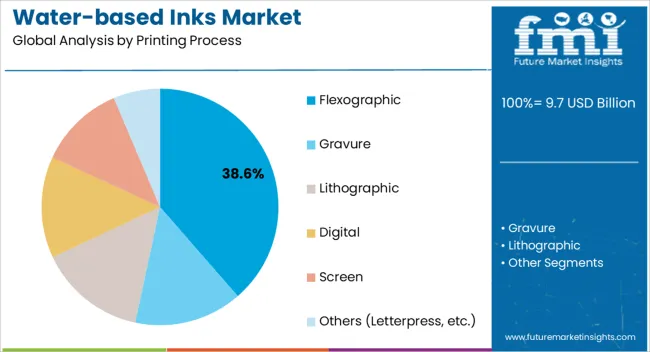

The flexographic printing process segment is expected to hold 38.60% of total revenue by 2025 within the printing process category, positioning it as the most significant contributor. This growth is being driven by its adaptability to various substrates including paper, film, and corrugated materials, as well as its compatibility with high speed printing operations.

Flexography is widely favored in the packaging and labeling industry due to its efficiency, cost effectiveness, and ability to support large scale production runs. Its compatibility with water based inks enhances sustainability while ensuring consistent print quality.

These attributes have strengthened the dominance of flexography as the leading printing process segment.

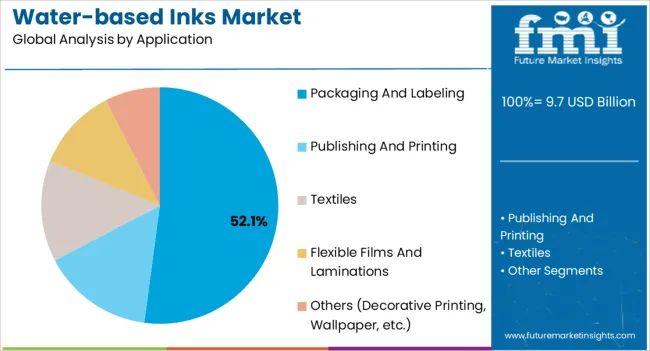

The packaging and labeling application segment is projected to account for 52.10% of total market revenue by 2025, making it the leading application area. Growth is being propelled by increasing demand for sustainable packaging, rising e commerce activities, and heightened consumer awareness around eco friendly products.

Packaging manufacturers are adopting water based inks to meet regulatory requirements, improve recyclability, and align with brand sustainability goals. The ability of these inks to deliver high print resolution and vibrant colors on diverse substrates has reinforced their use in flexible packaging, folding cartons, and labels.

This combination of performance and sustainability benefits has cemented packaging and labeling as the dominant application segment.

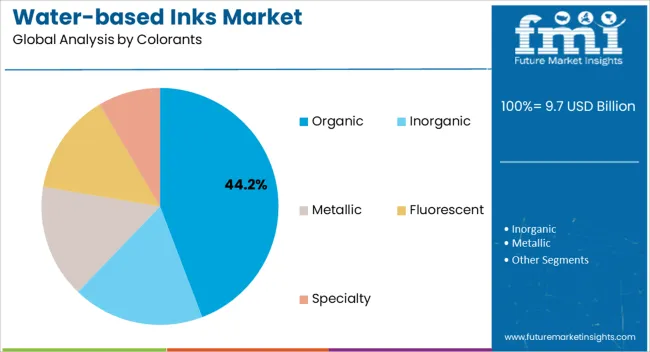

The organic colorants segment is expected to contribute 44.20% of total revenue by 2025 within the colorants category, positioning it as the leading subsegment. This is attributed to rising demand for biodegradable and non toxic colorants that align with consumer and regulatory expectations for safer products.

Organic colorants offer superior color brilliance and stability, making them suitable for premium packaging and high quality print applications. Their adoption has been further supported by innovations in natural dye extraction and synthetic organic pigment development.

With industries moving toward greener supply chains, the preference for organic colorants continues to strengthen, consolidating their leadership in the colorants segment.

The historical sales of water-based inks have demonstrated a positive growth trajectory of 2.0%. Driven by factors such as environmental regulations, sustainability initiatives, and consumer demand for eco-friendly products. As the market continues to evolve, the future demand for water-based inks is expected to further increase.

The Future Sales Outlook for the Market is Optimistic, Driven by Several Factors

Environmental regulations are expected to become even more stringent in the future, favoring the use of water-based inks. Governments and regulatory bodies are likely to promote the adoption of sustainable inks to reduce the environmental impact of printing processes.

The water-based inks market is witnessing growth in emerging markets and applications. Industries such as textiles, industrial printing, and digital printing are adopting water-based inks due to their eco-friendly nature and improved performance.

Based on these factors the market is likely to record a CAGR of 3.1% in the analysis period of 2025 to 2035.

The United States has stringent environmental regulations that have influenced the adoption of water-based inks. Regulations by agencies such as the Environmental Protection Agency (EPA) and state-specific agencies focus on reducing VOC emissions and promoting the use of environmentally friendly alternatives.

Consumer awareness of environmental issues and their preference for sustainable products have played a significant role in the adoption of water-based inks. Consumers in the United States are increasingly seeking products that align with their values and have a lower environmental impact.

Europe is one of the influential markets for water-based inks, capturing a market share of 17.9% in 2025. The region has witnessed a shift towards sustainable packaging materials, driven by consumer preferences and regulatory requirements. European countries actively promote collaboration between industry players, research institutions, and governmental bodies to drive sustainability initiatives in the printing industry. These collaborations foster innovation, knowledge sharing, and the development of environmentally friendly solutions like water-based inks. Such initiatives have created a supportive ecosystem for the growth of the water-based inks market in Europe.

India has a significant share in the water-based inks market and has been experiencing steady growth. Factors driving this growth include increasing environmental awareness, the expansion of the packaging industry, regulatory support, technological advancements, and the demand for sustainable printing solutions. The government's focus on reducing VOC emissions and promoting eco-friendly practices has further fueled the adoption of water-based inks in India. The market is expected to continue expanding as more businesses and consumers prioritize environmentally friendly printing solutions.

The United Kingdom is witnessing a growth of 2.1% between 2025 to 2035. The market has experienced steady growth, driven by factors such as environmental regulations, sustainability initiatives, and the increasing demand for eco-friendly printing solutions.

Consumer awareness and demand for sustainable products have played a significant role in the adoption of water-based inks in the United Kingdom. Consumers are increasingly seeking environmentally friendly options, and businesses are responding by adopting water-based inks to meet this demand.

Flexography is a popular printing process used for various applications such as packaging, labels, and corrugated materials. The use of water-based inks in flexographic printing has gained traction due to their eco-friendliness, low VOC emissions, and compliance with regulatory standards.

The ability of water-based inks to adhere well to a wide range of substrates makes them suitable for flexographic printing on materials like paper, cardboard, and flexible packaging. As the demand for sustainable and environmentally friendly printing solutions continues to rise, the flexographic segment is expected to contribute significantly to the growth of the water-based inks market.

The food and beverage sector holds a prominent share of 43.2% in the global market. Water-based inks are widely used for printing on food packaging materials, including cartons, labels, flexible packaging, and beverage cans.

The stringent safety and regulatory requirements for food contact materials make water-based inks a preferred choice. They offer low levels of migration, ensuring that the ink does not transfer to the food or beverage product, thereby maintaining its safety and quality.

Additionally, water-based inks are non-toxic, odorless, and environmentally friendly, aligning with the industry's increasing focus on sustainability. As consumer demand for safe and sustainable food packaging grows, the food and beverages segment is expected to continue driving the demand for water-based inks.

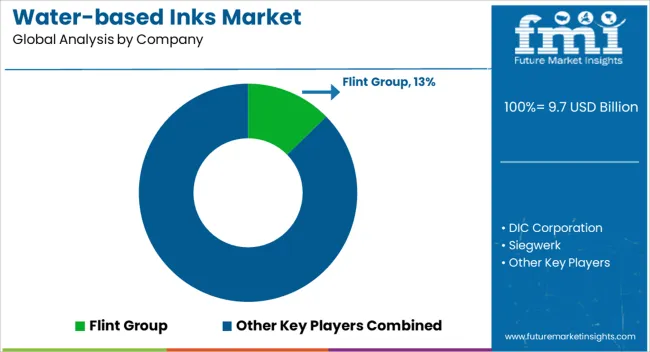

The competitive landscape in the water-based inks market is characterized by the presence of several key players, both global and regional, vying for market share. These companies compete based on factors such as product offerings, technological advancements, pricing strategies, distribution networks, and customer relationships.

Key market players operating in the water-based inks market include DIC Corporation; Flint Group; Hubergroup; Sakata Inx Corporation; Siegwerk Druckfarben AG & Co. KGaA; T&K TOKA Co. Ltd.; Toyo Ink SC Holdings Co., Ltd.; Fujifilm Holdings Corporation; American Inks & Technology; and Wikoff Color Corporation.

Recent Developments:

The global water-based inks market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the water-based inks market is projected to reach USD 13.0 billion by 2035.

The water-based inks market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in water-based inks market are flexographic, gravure, lithographic, digital, screen and others (letterpress, etc.).

In terms of application, packaging and labeling segment to command 52.1% share in the water-based inks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hand Sinks Market - Hygiene & Compliance in Foodservice 2025 to 2035

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Underbar Sinks Market - Space-Saving & Functional Bar Solutions 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Drinks Market Size and Share Forecast Outlook 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Decorative Inks Market Analysis by Application and Region Through 2035

Understanding Market Share Trends in Conductive Inks

Breakfast Drinks Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water-Borne Inks and Paints Market Growth - Trends & Forecast 2025 to 2035

Janitorial Sinks Market Growth - Trends & Forecast 2025 to 2035

Aloe Vera Drinks Market Outlook – Growth, Size & Demand 2025-2035

Eco-Friendly Inks Market Size and Share Forecast Outlook 2025 to 2035

Compartment Sinks Market - Hygiene & Efficient Kitchen Workflow 2025 to 2035

Understanding Eco-Friendly Inks Market Share Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA