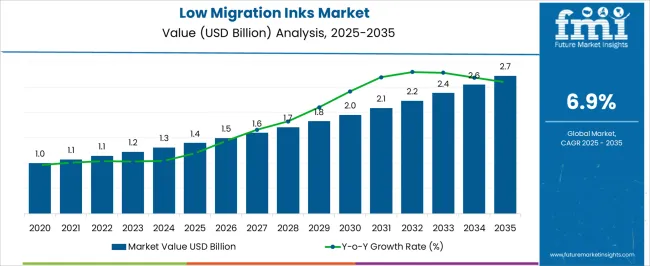

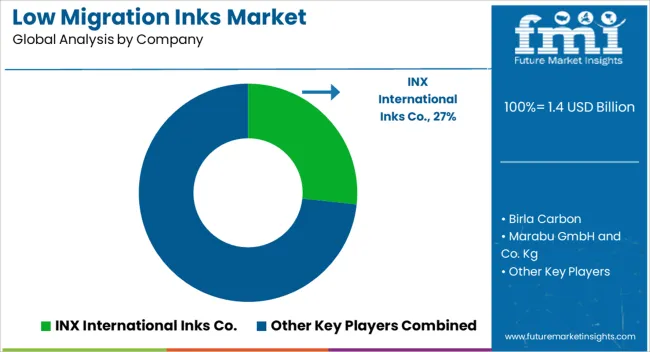

The Low Migration Inks Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Low Migration Inks Market Estimated Value in (2025 E) | USD 1.4 billion |

| Low Migration Inks Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The low migration inks market is expanding steadily due to stricter regulatory standards on food and pharmaceutical packaging, rising consumer concerns over product safety, and brand commitments to sustainable printing practices. Growing emphasis on compliance with European and North American food safety directives has accelerated adoption of inks that prevent chemical transfer from packaging to consumables.

Advancements in ink formulation, including reduced solvent content, enhanced curing properties, and improved adhesion on diverse substrates, are supporting wider industry integration. Packaging converters and brand owners are investing in low migration inks to meet both regulatory and consumer expectations while maintaining high print quality.

The outlook remains favorable as the demand for safe, compliant, and visually appealing packaging continues to rise, particularly in food, beverage, and healthcare applications.

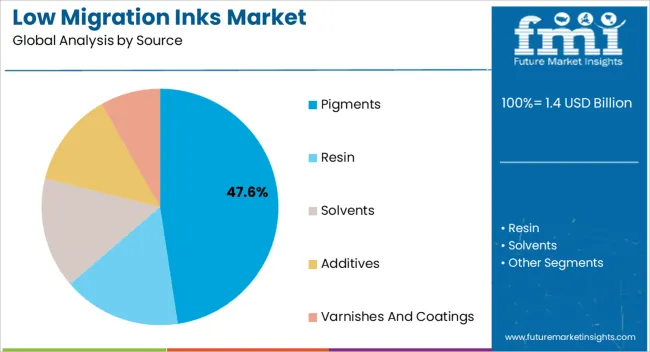

The pigments segment is projected to hold 47.60% of the total market revenue by 2025 within the source category, establishing it as the leading contributor. This dominance is driven by the ability of pigments to provide higher stability, stronger color strength, and enhanced resistance to light and chemicals compared to dyes.

Pigments are preferred for packaging that requires long shelf life and consistent print performance under varying storage conditions.

The increasing demand for vivid, durable, and non migratory color solutions in sensitive packaging has strengthened the position of pigment based inks, ensuring their continued leadership in this segment.

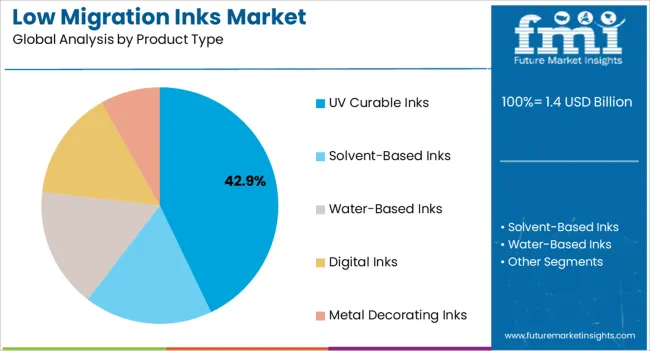

The UV curable inks segment is anticipated to account for 42.90% of market revenue by 2025 within the product type category, positioning it as the dominant segment. Growth has been supported by their fast curing speed, low volatile organic compound emissions, and suitability for diverse substrates such as plastics, glass, and metal.

Their application is highly valued in food and pharmaceutical packaging where precise print quality and low migration compliance are essential. Additionally, UV curable inks enable energy efficiency and high productivity in printing operations, factors that have reinforced their adoption.

This blend of performance, safety, and sustainability advantages has allowed the UV curable inks segment to secure its leading market position.

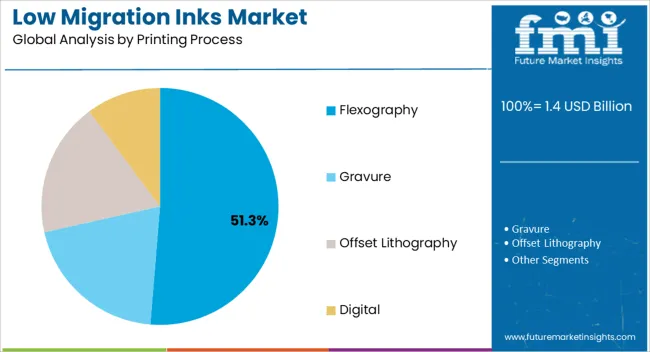

The flexography segment is expected to capture 51.30% of total revenue by 2025 within the printing process category, making it the largest contributor. Its prominence is attributed to cost effectiveness, high speed production capabilities, and adaptability across a wide range of packaging materials including flexible films, paper, and corrugated substrates.

Flexography has become the preferred printing process for food and beverage packaging due to its ability to deliver consistent print quality while meeting regulatory compliance requirements for low migration. Continuous technological improvements in flexographic presses and inks have further enhanced efficiency and print resolution.

These factors have cemented flexography as the leading printing process segment in the low migration inks market.

From 2020 to 2025, the global low migration inks industry witnessed a decent CAGR of 4.4%. This growth was attributed to rising awareness of the chemicals in primary packaging percolating into contents.

Demand for safe, uncontaminated, and hygienic products across various industries led to widespread adoption of low migration inks. Implementation of stringent regulations pertaining to the use of harmful chemicals by governments further propelled growth.

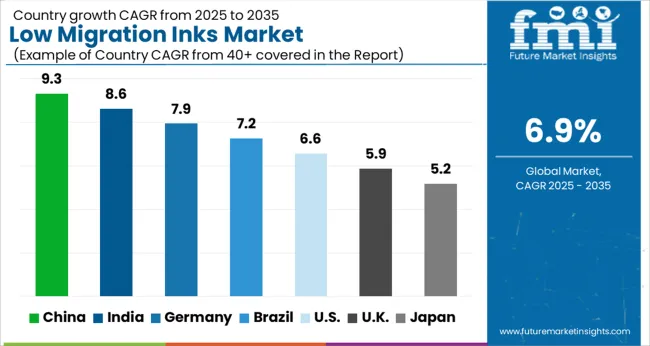

The global market is expected to rise at a CAGR of 6.9% from 2025 to 2035. By the end of 2035, the market size is anticipated to reach USD 2.8 billion.

The global market is expected to continue its positive growth trajectory from 2025 to 2035. It is likely to be driven by increasing concerns over uncontaminated and safe products, especially for food consumables.

Growth of the food, beverages, and food service sectors has paved the way for an increased demand for low migration inks. Their inability to permeate into the product, which is in contact with the packaging is likely to propel demand.

The market is also expected to witness significant growth in Asia Pacific due to the presence of developing economies such as China and India. However, growth of existing players might be hindered by emergence of new manufacturers in this region.

Challenges for Low Migration Inks Manufacturers/Companies:

Upcoming Opportunities in the Low Migration Inks Industry:

Latest Low Migration Inks Market Trends:

United States-based Food Retailers to Look for Low Migration UV Inks

| Country | The United States |

|---|---|

| Estimated Market Size (2035E) | USD 2.7 million |

| CAGR (2025 to 2035) | 5.4% |

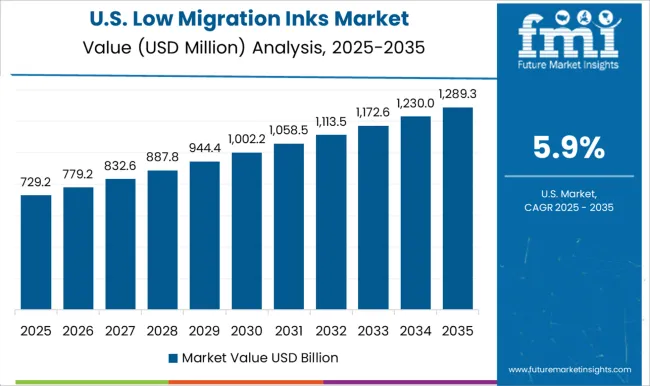

The United States low migration inks industry size is anticipated to surpass a valuation of USD 2.7 million by 2035. It is likely to flourish at a CAGR of 5.4% from 2025 to 2035.

As low migration inks are increasingly being used to print on pharmaceutical packaging, their demand is expected to witness steady growth in the country. The United States is home to one of the largest pharmaceutical markets in the world. It also houses numerous food retailers, further fueling low migration ink sales in the country.

Government-led Awareness Programs in China to Push Sales of Low Migration Inks and Coatings

| Country | China |

|---|---|

| Estimated Market Size (2035E) | USD 294.5 million |

| CAGR (2025 to 2035) | 7.5% |

China low migration inks market is estimated to exceed a valuation of USD 294.5 million by the end of 2035. It is set to expand 2.2 times its current market size in the forecast period.

The country is considered to be one of the top food manufacturers in the world. Demand for low migration inks in China is projected to skyrocket with rising awareness among millennials about food safety. Government agencies are also creating awareness programs to mitigate migration of toxic substances from primary packaging into foodstuff.

Flexographic Ink Companies to Experience High Demand and Sales through 2035

Based on printing process, the flexography segment is expected to witness a CAGR of 6.5% during the forecast period. Flexography printing offers high-quality print results, especially for packaging materials such as labels, bags, and cartons.

Low migration inks used in flexography printing have low levels of harmful chemicals that can migrate into food or other products. They are hence considered to be safe for use in food packaging and other sensitive applications.

Flexography printing also uses water-based inks that are more environmentally friendly than traditional solvent-based inks. This feature would make it a popular choice among consumers who are increasingly concerned about the environmental impact of products they buy.

Use of UV Curable Inks to Skyrocket with Surging Need for Long-lasting Prints

The UV curable inks segment by product type is anticipated to offer lucrative growth opportunities to low migration ink companies. It is set to expand 1.9 times from 2025 to 2035.

UV curable ink dries almost instantly when exposed to UV light. This feature makes it ideal for high-speed printing processes.

UV curable ink is also highly resistant to fading, smudging, and water damage. These properties would make it suitable for printing on outdoor signage, vehicle wraps, and other applications that require long-lasting prints.

UV curable ink is free from volatile organic compounds (VOCs) and does not emit harmful odors or fumes. It is also energy-efficient since it requires less drying time compared to other inks.

UV curable ink can hence be used on a wide range of substrates, including plastic, metal, glass, and paper. It can be utilized on non-porous materials, which makes it appropriate for printing on packaging and labels.

Strict Safety Norms to Augment Demand for Low Migration Food Packaging Inks

Based on end use, the food segment is expected to lead the global low migration inks industry in the assessment period. The segment is likely to expand at a CAGR of 7.1% from 2025 to 2035, finds Future Market Insights (FMI).

Growth of international trade in the food industry has led to increased need for packaging materials that comply with regulations in multiple countries. Low migration inks can be a preferred option as they meet the strictest food safety standards worldwide.

Long transportation times and varying climatic conditions in the food supply chain are set to result in rising demand for new packaging. Low migration inks are designed to maintain their integrity and stability under a variety of conditions, which would propel sales.

Modern consumers are becoming more aware of food safety. They are increasingly demanding products that are safe and free from harmful chemicals. This has led to a growing demand for low migration inks, which are considered safer for use in food packaging.

The low migration inks market is highly competitive, with several players striving to gain a larger market share of low migration inks market. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Product Innovation

Low migration ink manufacturers are investing heavily in their research & development facilities. They aim to offer ink solutions with a much lower ability to seep into packaged contents.

Strategic Partnerships and Collaborations

Key players are set to form strategic partnerships to collaborate with other competitive companies. They are focusing on enhancing their strengths and cater to a larger share of industries. Such collaborations would also allow them to gain access to or develop new technologies that might further bolster their sales.

Expansion into Emerging Markets

The global market is exhibiting speedy growth in emerging economies such as India and China. Renowned players are increasing their presence in such markets by opening local operational facilities and expanding their distribution networks.

Key Developments in the Low migration Inks Market:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.4 billion |

| Projected Market Valuation (2035) | USD 2.7 billion |

| Value-based CAGR (2025 to 2035) | 6.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD billion) and Volume (tons) |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Central Asia; Balkan and Baltics Countries; Russia and Belarus; East Asia; South Asia and Pacific; and the Middle East and Africa. |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Australia & New Zealand, Gulf Cooperation Council Countries, Türkiye, and South Africa |

| Key Segments Covered | Source, Product Type, Printing Process, End Use, and Region |

| Key Companies Profiled | INX International Inks Co.; Birla Carbon; Marabu GmbH and Co. Kg; Sun Chemicals; Huber Group; Kao Collins Inc.; Siegwerk AG & Co. KGaA; Hapa AG; Epple Druckfarben AG; Nazdar Ink Technologies; Durst Group AG |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global low migration inks market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the low migration inks market is projected to reach USD 2.7 billion by 2035.

The low migration inks market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in low migration inks market are pigments, resin, solvents, additives and varnishes and coatings.

In terms of product type, uv curable inks segment to command 42.9% share in the low migration inks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Low Migration Ink Providers

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA