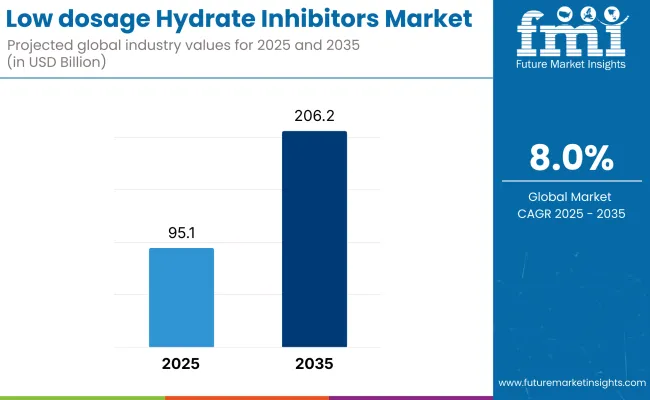

The worldwide low dosage hydrate inhibitors (LDHIs) market is set to grow aggressively, with a valuation expected to be USD 95.15 billion in 2025 and reaching about USD 206.27 billion by 2035 at a CAGR of about 8.0%.

The growth is fueled by increased demand for cost-effective, high-performance solutions for oil and gas operations.A major growth driver is the growing complexity of deepwater and ultra-deepwater exploration and production.

As oil companies venture further into remote and high-risk areas, the demand for advanced flow assurance technologies has heightened. LDHIs play a critical role in ensuring uninterrupted hydrocarbon flow and avoiding blockages by hydrate formation.

In addition, LDHIs are often more expensive per unit than traditional inhibitors. While they may be used at lower doses, the initial investment and technological knowledge required for best practice can be an issue for smaller operators or less developed industries.In spite of these challenges, there are plenty of opportunities.

Growth in subsea oil and gas infrastructure in areas such as the Gulf of Mexico, West Africa, and Southeast Asia is likely to drive substantial adoption. LDHIs are also picking up pace in Arctic operations, where hydrate formation risk is very high owing to sub-zero temperatures.

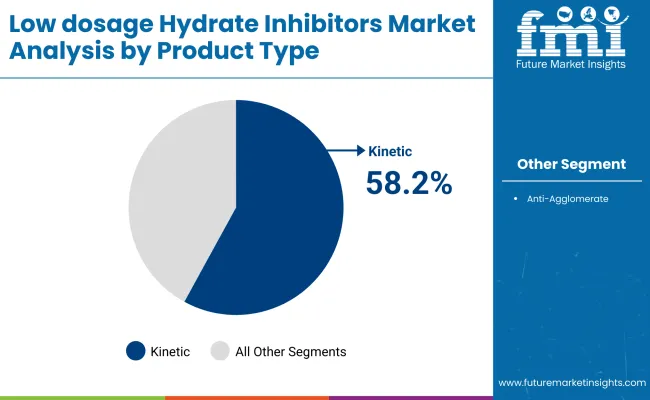

Continuous innovation is improving LDHI performance over wider operating ranges. Developments in kinetic hydrate inhibitors (KHIs) and anti-agglomerates (AAs) are allowing more customized and high-performance products, with their application extended to harsh production conditions. Hybrid products are also on the horizon, integrating the best of several LDHI types.

Simulation software and digital monitoring tools are increasingly being employed to simulate hydrate risks and maximize LDHI dosing techniques. This integration aids in proactive flow assurance planning and minimizes the risk of production downtime resulting from hydrate blockages.

LDHIs are revolutionizing flow assurance strategies within the world's oil and gas industry. With increased operational challenges, environmental considerations, and offshore operations, these inhibitors present an attractive blend of efficiency, performance, and sustainability.

Market Metrics - Low Dosage Hydrate Inhibitors Market

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 95.15 billion |

| Industry Value (2035F) | USD 206.27 billion |

| CAGR (2025 to 2035) | 8.0% |

The low dosage hydrate inhibitors (LDHIs) industry is growing strongly and is led by the growing need for effective flow assurance solutions in the oil and gas sector. LDHIs are gaining traction over conventional thermodynamic inhibitors owing to their lower dosing requirement and lower environmental footprint.

Oil & Gas Operators value solutions that are economical and provide uninterruptible production. They require LDHIs that are robust under changing conditions of operation and meet safety specifications. The option to tailor formulations to individual field conditions is another key consideration in their buying process.

Distributors focus on the reliability and cost of the supply chain. They demand regular availability of products to supply the needs of different customers and usually cooperate with manufacturers for timely delivery and maintenance.

Regulatory bodies enforce environmental compliance and operation safety regulations. They affect growth by promulgating standards that urge the use of LDHIs of lower environmental influence and improved safety profiles.

The industry has a push from stakeholders towards coming up with and integrating solutions that live up to performance standards, are regulatory-compliant, and catch up with the changing demands of the oil and gas sector.

Between 2020 and 2024, the industry showed consistent growth, fueled by the rising demand from the oil and gas sector for efficient flow assurance solutions. LDHIs such as kinetic hydrate inhibitors (KHIs) and anti-agglomerates (AAs) found favor due to their performance at lower dosages to prevent gas hydrate formation compared to conventional thermodynamic inhibitors.

Their efficiency translated into cost savings and less environmental footprints, and thus, LDHIs became a favored option in offshore and deepwater drilling operations. From 2025 to 2035, the industry will evolve with formulations being created as green and digitalized. Biodegradable and low-toxicity LDHIs are the future in the industry's pursuit of environmental sustainability.

Moreover, the use of real-time monitoring systems and artificial intelligence will have the potential to increase the accuracy of LDHI applications, maximizing the use of chemicals and efficiency. Emerging economies are expected to drive growth, driven by higher offshore exploration activities and investments in energy infrastructure.

Comparative Market Shift Analysis: LDHIs Market

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Offshore and deepwater oil & gas drilling operations | Increased application in environmentally sensitive areas and challenging drilling environments |

| Implementation of KHIs and AAs for effective hydrate prevention | Formulation of biodegradable LDHIs and integration with digital monitoring systems |

| Demand for cost-effective and efficient flow assurance solutions | Emphasis on environmental sustainability and operational efficiency |

| High adoption in North America and Asia-Pacific | High growth in emerging economies with rising offshore activities |

| Primarily KHIs and AAs | Launch of hybrid and eco-friendly LDHI formulation |

| First steps towards environmentally friendly practices | High focus on sustainable production and less environmental footprint |

The industry is subject to certain risks, such as changes in raw material prices, especially in the case of materials such as polymers and surfactants applied in inhibitor products. Price variations of these raw materials can be an important cause of production expenses, which may prove difficult to ensure cost-efficient pricing policies and, consequently, affect profit margins.

Stringent environmental and safety regulations are a significant threat to the industry. Adherence to different regional standards necessitates ongoing monitoring and adjustment. Non-compliance can lead to legal sanctions and harm to brand reputation, impacting industry position and customer confidence.

Supply chain disruptions, including transport delays or geopolitics, can impair the timely delivery of raw materials as well as final products. The disruptions can result in production stoppages and failed customer demand, negatively impacting sales and long-term business relationships.

The industry faces several challenges, such as rising competition and advancements in technology. The business has to spend money on research and development to innovate and upgrade product offerings constantly.

Dependence on industries such as oil and gas means that downturns in such industries will have a direct effect on demand for LDHIs. This risk can be mitigated through the diversification of the customer base across industries.

In short, the LDHI industry is exposed to risks of raw material price fluctuation, regulatory issues, supply chain disruptions, technological advancements, and economic recessions in sector-specific economies. Preemptive action in addressing these areas is essential to making this volatile sector grow and compete.

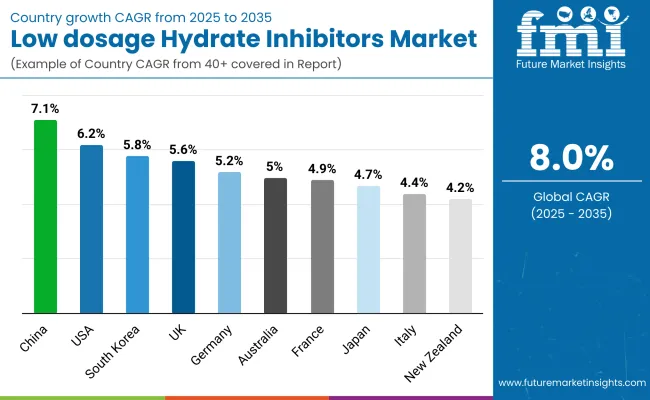

| Countries | CAGR (%) |

|---|---|

| USA | 6.2% |

| UK | 5.6% |

| France | 4.9% |

| Germany | 5.2% |

| Italy | 4.4% |

| South Korea | 5.8% |

| Japan | 4.7% |

| China | 7.1% |

| Australia | 5.0% |

| New Zealand | 4.2% |

The USA low-dosage hydrate inhibitor market is expected to witness a CAGR of 6.2% from 2025 to 2035, driven by persistent offshore oil and gas production and increasing investment in ultra-deepwater and deepwater fields. The Gulf of Mexico continues to be a strategic hub for hydrocarbon production, where low dosage hydrate inhibitors are central to flow assurance and the minimization of operational disruption.

Key players such as Halliburton, Schlumberger, and Baker Hughes are leading the development of complex chemical formulations to enhance hydrate inhibition efficiency and reduce environmental impact. The USA is witnessing a growing interest in the integration of low dosage hydrate inhibitors within full-production chemical management systems, with regulatory conditions compelling the use of low-toxicity and high-performance chemical solutions.

United Kingdom's low dosage hydrate inhibitors market is expected to grow at a CAGR of 5.6% over the forecast period, driven by renewed optimism in North Sea oilfield development and strategic efforts to secure energy. The renewed offshore investments have generated increased demand for flow assurance technologies that have both operational reliability and environmental responsibility.

Key players in the UK, like Aker Solutions and ChampionX, are investing in field applications and research of next-generation hydrate inhibitors. Their application at low dosage is because they are cost-effective and have a lower chemical footprint that aligns with broader sustainability goals across the UK offshore oil and gas industry.

France is forecasted to grow at a 4.9% CAGR from 2025 to 2035. Although hydrocarbon production is limited domestically, France has a presence in global energy markets owing to its multinational sector. Multinational involvement in offshore exploitation, particularly by Total Energies, sustains steady demand for hydrate management technology.

French engineering firms are supporting the optimization of subsea flow systems by employing low-dose hydrate inhibitors for high-risk wells. Technical cooperation and joint ventures with international oilfield service businesses are driving the innovation of ecologically friendly products, thereby augmenting France's position in world offshore operations when hydrate control is critical.

Germany's low-dosage hydrate inhibitor market is expected to register a CAGR of 5.2% over the forecast period. Although there is negligible domestic oil and gas extraction, the country is an ideal location for chemical innovation and engineering capabilities that enable the application of hydrate inhibition technologies globally.

German chemical firms like BASF and Clariant are investing in low-toxicity and biodegradable formulation development targeted at European and Middle Eastern offshore operators. Germany's export industry and sustainability commitment are driving the technology push for high-performance dosage hydrate inhibitors for global deployment offshore.

Italy is expected to grow at a compound annual growth rate of 4.4% during the period 2025 to 2035. The country's proficiency in offshore hydrocarbon production, particularly in the case of Eni and its related service providers, sustains the ongoing demand for hydrate inhibition in the North African and Mediterranean basins.

Flow assurance issues with maturing offshore fields are being addressed using low dosage hydrate inhibitors, offering economic and environmental advantages. Cooperation between Italian engineering firms and international chemical manufacturers is allowing the development of tailored solutions for complex subsea systems, keeping Italy relevant to local offshore production plans.

South Korea is likely to grow at a CAGR of 5.8% through the forecast period. The country's leadership in offshore infrastructure development and floating production systems are the factors behind the sustained demand for chemical-based flow assurance technologies, including advanced hydrate inhibitors.

Local oil and gas operators are more and more incorporating low dosage hydrate inhibitors in design projects for new liquefied natural gas and new offshore projects. Collaboration with foreign service providers is improving the supply and performance of hydrate inhibition systems, and environmental compliance is strengthening the country's strategic place in regional offshore exploration.

The low dosage hydrate inhibition market in Japan is projected to record a 4.7% CAGR from 2025 to 2035. Strategic investment into offshore methane hydrate exploration and production testing is driving the deployment of advanced hydrate inhibition technology. Government energy companies such as JOGMEC and INPEX are investigating future uses for low dosage inhibitors in future commercial production.

Japanese chemical firms are reported to provide high-performance, environmentally friendly products specially formulated for subsea operations. Foreign partnerships are facilitating knowledge sharing and technology growth, enabling Japan to be a key player in the innovation and application of low dosage hydrate inhibitors in the Asia-Pacific region.

China is expected to expand at the highest rate, with a projected CAGR of 7.1% from 2025 to 2035. Accelerating offshore drilling activity, particularly in the South China Sea, is a central driver of demand for effective hydrate control.

National oil corporations such as CNOOC and Sinopec are placing the highest priority on the inclusion of low dosage hydrate inhibitors in deepwater and ultra-deepwater development schemes. The domestic chemical manufacturing industry allows for scalable production of economic formulations while increasing emphasis on technological independence and environmental regulations, which is accelerating innovation and industry penetration.

Australia's low dosage hydrate inhibitors market will be growing at a CAGR of 5.0% in the forecast period. Western Australian offshore gas developments and long subsea tiebacks require robust flow assurance systems in which hydrate management is critical. The complexity of remote gas field operations has pushed the adoption of effective and environmentally friendly inhibition practices.

Key industry giants such as Woodside Energy and Santos are employing global alliances to implement innovative chemical technologies. The use of low dosage hydrate inhibitors is on the rise, together with exploration activities and infrastructure investment, asserting Australia's commitment to sustainable energy production.

New Zealand's low dosage hydrate inhibitors market is expected to expand at a CAGR of 4.2% from 2025 through 2035. While the size of local hydrocarbon operations is limited, steady activity in the Taranaki Basin and an environmental stewardship-led regulatory environment facilitate consistent demand for hydrate inhibition solutions.

Low-dosage hydrate inhibitor implementation is being promoted by regional collaboration with international chemical suppliers and engineering specialists. The need to optimize the operation of aging offshore assets while meeting stringent environmental policies is expected to continue supporting demand for low-volume, high-efficiency hydrate control solutions across New Zealand's offshore sector.

By product type, kinetic hydrate inhibitors (KHI) will lead with a revenue share of 58.2%, while anti-agglomerate (AA) Inhibitors will contribute the remaining 41.8%. The "kinetic hydrate inhibitors" here refer to those types that are most importantly set apart as being economical and biocompatible and have the ability not to interfere with flow properties while simply delaying hydrate formation.

These inhibitors, especially for deepwater offshore oil and gas exploration, enjoy extreme conditions favoring hydrate formation; therefore, in such situations, KHIs are mostly used. Companies such as Shell, BP, and Chevron, which are mostly applied offshore, include KHIs in their flow assurance strategies to prevent pipeline blockages without hindering production efficiency.

The push toward the environment-friendly KHI formulation would thus incentivize adoption in areas with stringent environmental regulations, such as the North Sea and the Gulf of Mexico. On the other hand, anti-aggregate inhibitors account for a staggering 41.8%.

Emulsification systems, particularly water-in-oil types, are also a system in which AAs do great. AAs do not inhibit the formation of hydrates but keep the hydrate small and in a dispersed form so they do not plug together into large hydrates. Their use is recommended for ultra-deepwater drilling fields for high-pressure and low-temperature pipelines.

The design of AA formulations is tailored to the crude composition and operating conditions concerned, as offered by companies such as Clariant, Halliburton, and Innospec. AA inhibitors are currently also being tested in hybrid LDHI formulations that provide extra protection when conventional measures may fail.

This growing emphasis on low-dosing, high-performance inhibitors that are operationally and environmentally efficient is expected to keep demand quite strong for KHI and AA segments in the global energy industries.

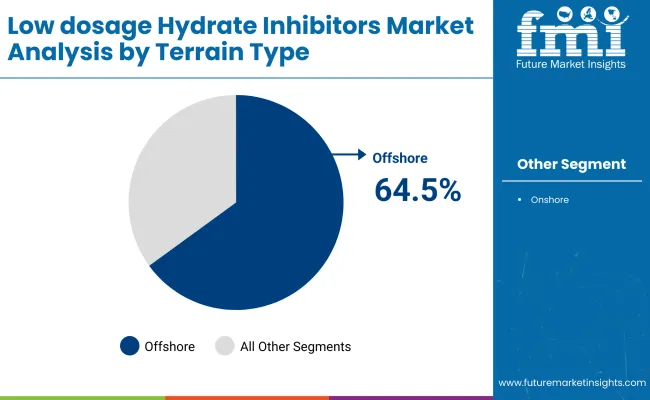

The offshore segment is expected to lead the industry in 2025 at around 64.5%, while the share for the onshore segment is likely to be 35.5% of the overall industry. Moreover, submarine environments have dominated the share in hydrate due to their formation in deep water and ultra-deepwater conditions, as well as low temperatures and high pressures conducive to gas hydrate formation.

LDHIs, particularly Kinetic Hydrate Inhibitors (KHI) and Anti-Agglomerate (AA) Inhibitors, are becoming a cost-effective and efficient way of flow assurance maintenance in such extreme conditions without the extensive logistics and environmental drawbacks associated with conventional thermodynamic inhibitors such as methanol or glycol.

For instance, TotalEnergies, Equinor, and ExxonMobil are fast overall adopting LDHI so that production is not interrupted in their offshore assets, especially in the North Sea, Brazilian Pre-Salt, and Gulf of Mexico regions. Moreover, ongoing installations of subsea flowlines, FPSOs, and long-distance tiebacks into offshore industries would add to the need for LDHIs to maintain operability.

However, on the other hand, the onshore segment is still fairly high, accounting for 35.5%, and this is being pushed mainly by the hydrate challenges in cold climate gas production areas such as Canada, Russia, and parts of the USA

Onshore operators use LDHIs to prevent intermittent hydrate issues in gathering systems, storage tanks, and extensive pipeline networks associated with quick pressure drops and cold ambient conditions.

Companies like BASF, Nalco Champion (Ecolab), and Schlumberger furnish these specialized LDHI solutions for both brownfield and greenfield onshore facilities, providing optimization of operational efficiency while minimizing environmental risks. The terrain segmentation fits with the trend of increasing versatility and growing application of LDHIs across diverse production environments in the global oil and gas industry.

The industry is constantly growing in competition, and leading players are improving chemical formulations, promoting better flow assurance technologies, and putting collaborative strategies with oil and gas producers and involved companies in place.

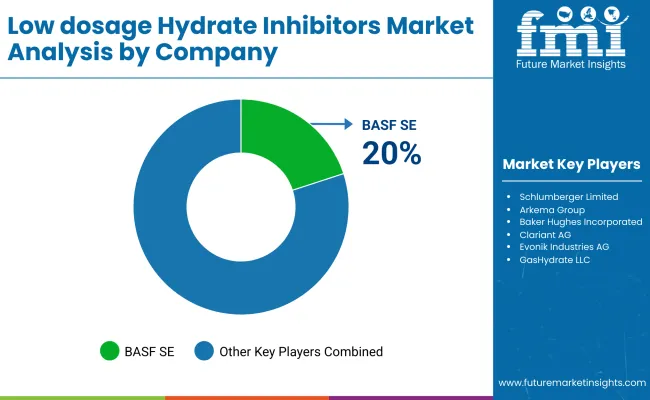

Such hegemonic firms as BASF SE, Schlumberger Limited, Arkema Group, Baker Hughes Incorporated, and Clariant AG also developed and commercialized their leading and proprietary hydrate prevention technologies after conducting numerous field tests and establishing strong partnerships with offshore drilling companies. All these firms stress low dosage efficiency in their environmentally friendly inhibitor solutions, which are also lower-cost alternatives for traditional thermodynamic inhibitors.

Ecolab Inc., Evonik Industries AG, and Force Chem Technologies LLC are a few examples of medium-sized companies that are focusing more on regional supply chain optimization rather than internationalization, specialized formulations for deepwater applications, and tailor-made solutions for varied reservoir conditions. This capability strengthens their competitive positioning: the ability to create unique chemical solutions that are designed specifically for subsea pipelines and cold-weather oilfield operations.

New companies such as Halliburton Co. and GasHydrate LLC are emerging with innovative next-generational lines of product development for kinetic hydrate inhibitors (KHIs) and anti-agglomerates (AAs) being developed to reduce the chances of pipeline blockage, ensure safer flow assurance, and minimize chemical use. Investments in R&D in inhibitor synergies with the existing system of production assure seamless integration with offshore and onshore practices.

Other factors that shape the competitive landscape are progress in molecular chemistry innovations, the growing demand for high-performance inhibitors in deep-sea exploration, and the low-toxicity hydrate-control methods instigated by environmental regulation. BASF SE and Schlumberger are the front runners in carrying out sustainable strategies in hydrate management with reduced operational costs and pipeline integrity optimized through advanced LDHIs.

Market Share Analysis by Company

| Company | Market Share (%) |

|---|---|

| BASF SE | 20-24% |

| Schlumberger Limited | 16-20% |

| Arkema Group | 12-16% |

| Baker Hughes Incorporated | 10-14% |

| Clariant AG | 8-12% |

| Others (combined) | 25-35% |

| Company Name | Key Offerings and Activities |

|---|---|

| BASF SE | Develop advanced KHIs and AAs for deepwater and ultra- deepwater flow assurance. |

| Schlumberger Limited | Provides comprehensive flow assurance solutions with high-efficiency hydrate inhibitors. |

| Arkema Group | Specializes in low-toxicity, biodegradable inhibitors for offshore applications. |

| Baker Hughes Incorporated | Offers next-generation LDHIs for enhanced gas flow and hydrate mitigation. |

| Clariant AG | Focuses on pipeline integrity and optimized hydrate control through custom chemical formulations. |

Key Company Insights

BASF SE (20-24%)

A global leader in chemical hydrate inhibitors, BASF emphasizes cost-effective, high-performance solutions for offshore energy projects.

Schlumberger Limited (16-20%)

Pioneering integrated flow assurance technologies, Schlumberger invests in sustainable, high-efficiency hydrate control solutions.

Arkema Group (12-16%)

Strengthens its presence through eco-friendly hydrate inhibitors, focusing on deepwater and arctic drilling applications.

Baker Hughes Incorporated (10-14%)

Expands its LDHI product line with enhanced compatibility for existing production infrastructure.

Clariant AG (8-12%)

Focuses on custom-formulated inhibitors tailored to regional reservoir conditions and pipeline needs.

Other Key Players

The low dosage hydrate inhibitor market is segmented into anti-agglomerate (AA) inhibitors and kinetic hydrate inhibitors (KHI).

The segmentation is into onshore and offshore terrains.

The report covers North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA)

The global market is estimated to be worth USD 95.15 billion in 2025.

Sales are projected to grow significantly, reaching USD 206.27 billion by 2035, driven by the demand for enhanced oil and gas extraction technologies in challenging environments.

China is expected to experience a CAGR of 7.1%, supported by its expanding energy industry and investments in oil and gas exploration.

Kinetic Hydrate Inhibitors (KHI) are leading the way in providing efficient solutions for preventing hydrate formation in offshore and deepwater oil and gas production.

Prominent companies include BASF SE, Schlumberger Limited, Arkema Group, Baker Hughes Incorporated, Clariant AG, Ecolab Inc., Evonik Industries AG, Force Chem Technologies LLC, Halliburton Co., and GasHydrate LLC.

Table 01: Global Market Value (000’US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 02: Global Market Value (000'US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 03: Global Market Value (000’US$) & Volume (Tons) Forecast by Region, 2018 to 2033

Table 04: North America Market Value (000’ US$) & Volume (Tons) Forecast by Country, 2018 to 2033

Table 05: North America Market Value (000’US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 06: North America Market Value (000’US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 07: Latin America Market Value (000'US$) & Volume (Tons) Forecast by Country, 2018 to 2033

Table 08: Latin America Market Value (000’US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 09: Latin America Market Value (000’ US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 10: Europe Market Value (000’US$) & Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (000’ US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 12: Europe Market Value (000’US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 13: South Asia Market Value (000’ US$) & Volume (Tons) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (000’ US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 15: South Asia Market Value (000’US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 16: East Asia Market Value (000’ US$) & Volume (Tons) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (000’ US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 18: East Asia Market Value (000’ US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 19: Oceania Market Value (000’ US$) & Volume (Tons) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (000’ US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 21: Oceania Market Value (000’ US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 22: Middle East & Africa Market Value (000’ US$) & Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Middle East & Africa Market Value (000’ US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 24: Middle East & Africa Market Value (000’ US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 25: USA Market Value (000’US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 26: USA Market Value (000’US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 27: Canada Market Value (000’US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 28: Canada Market Value (000’US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Table 29: Brazil Market Value (000’US$) & Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 30: Brazil Market Value (000’US$) & Volume (Tons) Forecast by Terrain Type, 2018 to 2033

Figure 01: Global GDP Growth Y-o-Y (%) Forecast Comparison by Region, 2016 to 2028

Figure 02: Global Oil & Gas Production Forecast Outlook

Figure 03: Demand Analysis of Natural Gas

Figure 04: Production of Natural Gas by Region (Bn Cubic Meters)

Figure 05: Global Energy Consumption by Fuel Type (2022)

Figure 06: Global Refined Product Demand by Region (2022)

Figure 07: Shale Gas Resources (Mn Cubic Meters)

Figure 08: World Energy Consumption by Energy Source (Quadrillion Btu)

Figure 09: 10 Prominent Countries of Chemical Sales (2022) by Value

Figure 10: Global Chemical Sales Share (2022) by Region

Figure 11: Global Market Value (000'US$) , 2022 to 2033

Figure 12: Global Market Absolute $ Opportunity Analysis, 2013 to 2028

Figure 15: Global Market Share and BPS Analysis By Type, 2023 & 2033

Figure 16: Global Market Y-o-Y Growth Projections by Type, 2022 to 2033

Figure 17: Global Market Attractiveness Analysis Projections by Type, 2022 to 2033

Figure 18: Global Market Absolute $ Opportunity by Anti-Agglomerate Inhibitors Segment, 2022 to 2033

Figure 19: Global Market Absolute $ Opportunity by Kinetic Hydrate Inhibitors Segment, 2022 to 2033

Figure 22: Global Market Share and BPS Analysis By Terrain Type, 2023 & 2033

Figure 23: Global Market Y-o-Y Growth Projections by Terrain Type, 2022 to 2033

Figure 24: Global Market Attractiveness Analysis Projections by Terrain Type, 2022 to 2033

Figure 25: Global Market Absolute $ Opportunity by Onshore Segment, 2022 to 2033

Figure 26: Global Market Absolute $ Opportunity by Offshore Segment, 2022 to 2033

Figure 29: Global Market Share and BPS Analysis By Region, 2023 & 2033

Figure 30: Global Market Y-o-Y Growth Projections by Region, 2022 to 2033

Figure 31: Global Market Attractiveness Analysis Projections by Region, 2022 to 2033

Figure 32: Global Market Absolute $ Opportunity by North America Segment, 2022 to 2033

Figure 33: Global Market Absolute $ Opportunity by Latin America Segment, 2022 to 2033

Figure 34: Global Market Absolute $ Opportunity by Europe Segment, 2022 to 2033

Figure 35: Global Market Absolute $ Opportunity by South Asia Segment, 2022 to 2033

Figure 35: Global Market Absolute $ Opportunity by East Asia Segment, 2022 to 2033

Figure 36: Global Market Absolute $ Opportunity by Oceania Segment, 2022 to 2033

Figure 37: Global Market Absolute $ Opportunity by Middle East & Africa Segment, 2022 to 2033

Figure 38: North America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 39: North America Market Y-o-Y Growth Projections by Country, 2022 to 2033

Figure 40: North America Market Attractiveness Analysis Projections by Country, 2022 to 2033

Figure 41: North America Market Absolute $ Opportunity by US Segment, 2022 to 2033

Figure 42: North America Market Absolute $ Opportunity by Canada Segment, 2022 to 2033

Figure 43: North America Market Share and BPS Analysis By Type, 2023 & 2033

Figure 44: North America Market Y-o-Y Growth Projections by Type, 2022 to 2033

Figure 45: North America Market Attractiveness Analysis Projections by Type, 2022 to 2033

Figure 46: North America Market Share and BPS Analysis By Terrain Type, 2023 & 2033

Figure 47: North America Market Y-o-Y Growth Projections by Terrain Type, 2022 to 2033

Figure 48: North America Market Attractiveness Analysis Projections by Terrain Type, 2022 to 2033

Figure 48: Latin America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 49: Latin America Market Y-o-Y Growth Projections by Country, 2022 to 2033

Figure 50: Latin America Market Attractiveness Analysis Projections by Country, 2022 to 2033

Figure 51: Latin America Market Absolute $ Opportunity by Brazil Segment, 2022 to 2033

Figure 52: Latin America Market Absolute $ Opportunity by Mexico Segment, 2022 to 2033

Figure 53: Latin America Market Absolute $ Opportunity by Rest of LA Segment, 2022 to 2033

Figure 54: Latin America Market Share and BPS Analysis By Type, 2023 & 2033

Figure 55: Latin America Market Y-o-Y Growth Projections by Type, 2022 to 2033

Figure 56: Latin America Market Attractiveness Analysis Projections by Type, 2022 to 2033

Figure 57: Latin America Market Share and BPS Analysis By Terrain Type, 2023 & 2033

Figure 58: Latin America Market Y-o-Y Growth Projections by Terrain Type, 2022 to 2033

Figure 59: Latin America Market Attractiveness Analysis Projections by Terrain Type, 2022 to 2033

Figure 60: Europe Market Share and BPS Analysis By Country, 2023 & 2033

Figure 61: Europe Market Y-o-Y Growth Projections by Country, 2022 to 2033

Figure 62: Europe Market Attractiveness Analysis Projections by Country, 2022 to 2033

Figure 63: Europe Market Absolute $ Opportunity by Germany Segment, 2022 to 2033

Figure 64: Europe Market Absolute $ Opportunity by Italy Segment, 2022 to 2033

Figure 65: Europe Market Absolute $ Opportunity by France Segment, 2022 to 2033

Figure 66: Europe Market Absolute $ Opportunity by United kingdom Segment, 2022 to 2033

Figure 67: Europe Market Absolute $ Opportunity by Spain Segment, 2022 to 2033

Figure 68: Europe Market Absolute $ Opportunity by BENELUX Segment, 2022 to 2033

Figure 69: Europe Market Absolute $ Opportunity by Russia Segment, 2022 to 2033

Figure 70: Europe Market Absolute $ Opportunity by Rest of Europe Segment, 2022 to 2033

Figure 71: Europe Market Share and BPS Analysis By Type, 2023 & 2033

Figure 72: Europe Market Y-o-Y Growth Projections by Type, 2022 to 2033

Figure 73: Europe Market Attractiveness Analysis Projections by Type, 2022 to 2033

Figure 74: Europe Market Share and BPS Analysis By Terrain Type, 2023 & 2033

Figure 75: Europe Market Y-o-Y Growth Projections by Terrain Type, 2022 to 2033

Figure 76: Europe Market Attractiveness Analysis Projections by Terrain Type, 2022 to 2033

Figure 77: South Asia Market Share and BPS Analysis By Country, 2023 & 2033

Figure 78: South Asia Market Y-o-Y Growth Projections by Country, 2022 to 2033

Figure 79: South Asia Market Attractiveness Analysis Projections by Country, 2022 to 2033

Figure 80: South Asia Market Absolute $ Opportunity by India Segment, 2022 to 2033

Figure 81: South Asia Market Absolute $ Opportunity by Thailand Segment, 2022 to 2033

Figure 82: South Asia Market Absolute $ Opportunity by Indonesia Segment, 2022 to 2033

Figure 83: South Asia Market Absolute $ Opportunity by Malaysia Segment, 2022 to 2033

Figure 84: South Asia Market Absolute $ Opportunity by Rest of SA Segment, 2022 to 2033

Figure 85: South Asia Market Share and BPS Analysis By Type, 2023 & 2033

Figure 86: South Asia Market Y-o-Y Growth Projections by Type, 2022 to 2033

Figure 87: South Asia Market Attractiveness Analysis Projections by Type, 2022 to 2033

Figure 88: South Asia Market Share and BPS Analysis By Terrain Type, 2023 & 2033

Figure 89: South Asia Market Y-o-Y Growth Projections by Terrain Type, 2022 to 2033

Figure 90: South Asia Market Attractiveness Analysis Projections by Terrain Type, 2022 to 2033

Figure 91: East Asia Market Share and BPS Analysis By Country, 2023 & 2033

Figure 92: East Asia Market Y-o-Y Growth Projections by Country, 2022 to 2033

Figure 93: East Asia Market Attractiveness Analysis Projections by Country, 2022 to 2033

Figure 94: East Asia Market Absolute $ Opportunity by China Segment, 2022 to 2033

Figure 95: East Asia Market Absolute $ Opportunity by Japan Segment, 2022 to 2033

Figure 96: East Asia Market Absolute $ Opportunity by South Korea Segment, 2022 to 2033

Figure 97: East Asia Market Share and BPS Analysis By Type, 2023 & 2033

Figure 98: East Asia Market Y-o-Y Growth Projections by Type, 2022 to 2033

Figure 99: East Asia Market Attractiveness Analysis Projections by Type, 2022 to 2033

Figure 100: East Asia Market Share and BPS Analysis By Terrain Type, 2023 & 2033

Figure 101: East Asia Market Y-o-Y Growth Projections by Terrain Type, 2022 to 2033

Figure 102: East Asia Market Attractiveness Analysis Projections by Terrain Type, 2022 to 2033

Figure 103: Oceania Market Share and BPS Analysis By Country, 2023 & 2033

Figure 104: Oceania Market Y-o-Y Growth Projections by Country, 2022 to 2033

Figure 105: Oceania Market Attractiveness Analysis Projections by Country, 2022 to 2033

Figure 106: Oceania Market Absolute $ Opportunity by Australia Segment, 2022 to 2033

Figure 107: Oceania Market Absolute $ Opportunity by New Zealand Segment, 2022 to 2033

Figure 108: Oceania Market Share and BPS Analysis By Type, 2023 & 2033

Figure 109: Oceania Market Y-o-Y Growth Projections by Type, 2022 to 2033

Figure 110: Oceania Market Attractiveness Analysis Projections by Type, 2022 to 2033

Figure 111: Oceania Market Share and BPS Analysis By Terrain Type, 2023 & 2033

Figure 112: Oceania Market Y-o-Y Growth Projections by Terrain Type, 2022 to 2033

Figure 113: Oceania Market Attractiveness Analysis Projections by Terrain Type, 2022 to 2033

Figure 114: Middle East & Africa Market Share and BPS Analysis By Country, 2023 & 2033

Figure 115: Middle East & Africa Market Y-o-Y Growth Projections by Country, 2022 to 2033

Figure 116: Middle East & Africa Market Attractiveness Analysis Projections by Country, 2022 to 2033

Figure 117: Middle East & Africa Market Absolute $ Opportunity by GCC Countries Segment, 2022 to 2033

Figure 118: Middle East & Africa Market Absolute $ Opportunity by Turkey Segment, 2022 to 2033

Figure 119: Middle East & Africa Market Absolute $ Opportunity by North Africa Segment, 2022 to 2033

Figure 120: Middle East & Africa Market Absolute $ Opportunity by South Africa Segment, 2022 to 2033

Figure 121: Middle East & Africa Market Absolute $ Opportunity by Rest of MEA Segment, 2022 to 2033

Figure 122: Middle East & Africa Market Share and BPS Analysis By Type, 2023 & 2033

Figure 123: Middle East & Africa Market Y-o-Y Growth Projections by Type, 2022 to 2033

Figure 124: Middle East & Africa Market Attractiveness Analysis Projections by Type, 2022 to 2033

Figure 125: Middle East & Africa Market Share and BPS Analysis By Terrain Type, 2023 & 2033

Figure 126: Middle East & Africa Market Y-o-Y Growth Projections by Terrain Type, 2022 to 2033

Figure 127: Middle East & Africa Market Attractiveness Analysis Projections by Terrain Type, 2022 to 2033

Figure 128: Emerging Markets Market Share by Country, 2018

Figure 129: Global Market Share by Region, 2018

Figure 130: Global & Emerging Countries Market Y-o-Y Growth Projections, 2022 to 2033

Figure 131: Global & Emerging Countries Market Share and BPS Analysis – 2023 & 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Hydrated Lime Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA