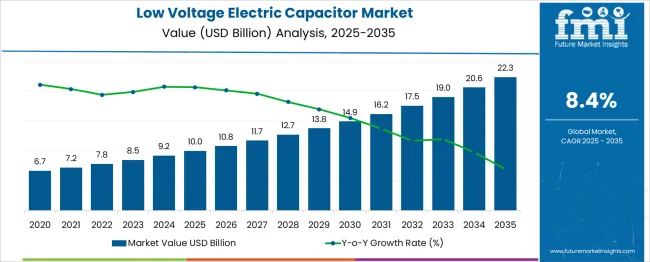

The Low Voltage Electric Capacitor Market is estimated to be valued at USD 10.0 billion in 2025 and is projected to reach USD 22.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Low Voltage Electric Capacitor Market Estimated Value in (2025 E) | USD 10.0 billion |

| Low Voltage Electric Capacitor Market Forecast Value in (2035 F) | USD 22.3 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The low voltage electric capacitor market is progressing steadily due to the accelerating adoption of electronics in daily life and the ongoing digital transformation across industries. These capacitors play a vital role in improving power factor, energy efficiency, and circuit stability, particularly in applications requiring low voltage control and precision.

Rising demand from consumer electronics, automotive systems, industrial automation, and telecommunications is creating sustained opportunities for manufacturers. As smart devices, IoT infrastructure, and portable electronics become more embedded in modern lifestyles, the importance of stable, compact, and high-performing capacitors continues to rise.

Additionally, energy efficiency regulations and miniaturization trends are driving advancements in capacitor design, favoring lightweight, durable, and thermally stable materials. Future growth will be propelled by emerging economies' infrastructure upgrades, the global expansion of electronic manufacturing, and continued investments in next-generation semiconductor devices.

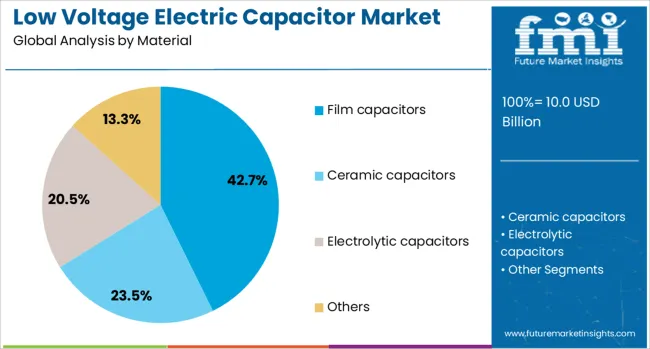

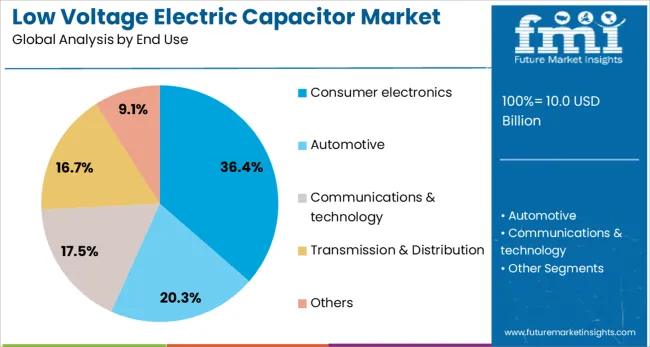

The low voltage electric capacitor market is segmented by material and end use and geographic regions. By material of the low voltage electric capacitor market is divided into Film capacitors, Ceramic capacitors, Electrolytic capacitors, and Others. In terms of end use of the low voltage electric capacitor market is classified into Consumer electronics, Automotive, Communications & technology, Transmission & Distribution, and Others. Regionally, the low voltage electric capacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Film capacitors dominate the material category with a 42.7% market share, largely due to their superior performance characteristics, including high insulation resistance, low self-inductance, and excellent thermal stability. These capacitors are increasingly preferred in low voltage applications across both consumer and industrial devices, where long operational life and reliability are critical.

The segment has benefited from widespread integration in power electronics, lighting systems, and inverter circuits. Ongoing advancements in dielectric films and encapsulation technologies have enhanced product durability, enabling better performance under variable voltage and temperature conditions.

As manufacturers seek components that support energy efficiency and consistent electrical output, film capacitors remain the material of choice. Their growing use in high-frequency and high-current environments is expected to solidify their role in future low voltage capacitor applications.

The consumer electronics segment holds a leading 36.4% share within the end use category, reflecting the pervasive integration of capacitors in devices such as smartphones, televisions, laptops, and wearables. Capacitors are essential for power conditioning, signal processing, and energy storage in these products, and their demand is directly tied to electronics production cycles and innovation trends.

The rise of compact, multifunctional devices has intensified the need for smaller yet more efficient capacitors that can perform reliably in constrained form factors. Growth in this segment is being driven by increased global consumption of electronics, expanding internet penetration, and the rollout of smart home technologies.

As user expectations for performance and battery life continue to grow, the segment will remain pivotal in dictating capacitor design and volume demand. Technological innovation and mass-scale consumer adoption are set to reinforce the dominance of this segment over the forecast period.

Increasing the use of power factor correction, grid integration, and industrial automation boosts demand for durable low-voltage capacitors. Expanding electrification, electric mobility adoption, and grid modernization present significant growth opportunities for customized capacitor solutions.

The market has been driven by growing reliance on power factor correction in commercial and industrial setups to maintain energy efficiency and reduce losses. Demand has been influenced by integration in renewable power grids and large-scale manufacturing units where stable reactive power is essential. Strong adoption across sectors such as automotive electronics, railways, and heavy machinery has strengthened its application scope. Industrial digitization has indirectly fueled capacitor utilization in automation and robotics-based operations, leading to an increased requirement for durable low voltage components. Vendors have been focusing on developing compact capacitors with extended lifecycles for better performance under varying load conditions, creating opportunities for higher adoption across energy-intensive domains and localized distribution networks.

Expanding electrification initiatives in developing economies have encouraged the deployment of energy-efficient components across distribution systems, creating favorable conditions for low voltage electric capacitors. Modernization of aging infrastructure in developed regions has been supported by significant investments in grid stability, making capacitors a critical component for voltage regulation. Rising penetration of electric mobility and the requirement for efficient charging infrastructure have promoted higher utilization of capacitors for energy balancing and harmonic mitigation. OEM collaborations with regional distributors have been increasing to enhance accessibility in fast-growing markets. These developments indicate significant prospects for suppliers who prioritize customized capacitor solutions for industry-specific requirements and regional electrical standards, ensuring stronger positioning in evolving demand clusters.

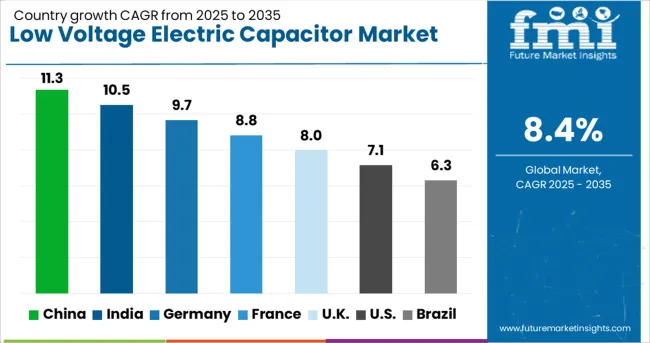

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

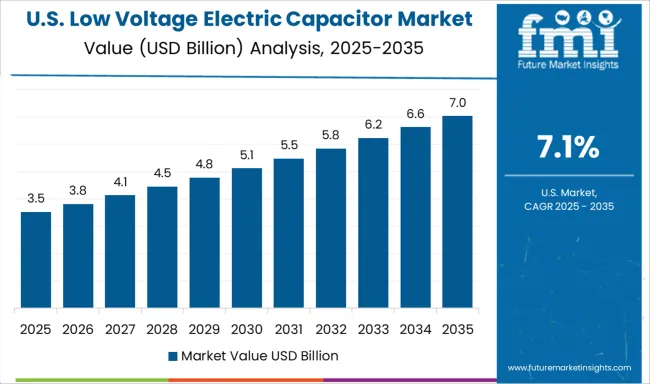

| USA | 7.1% |

| Brazil | 6.3% |

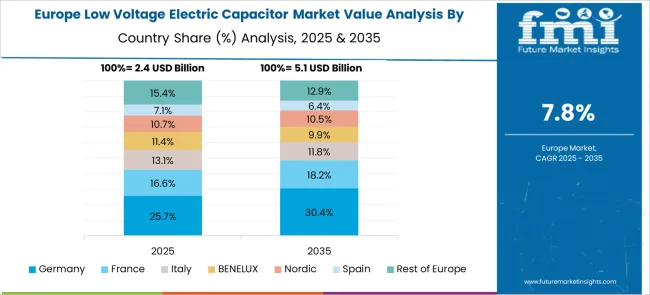

The low voltage electric capacitor sector, projected to grow at a global CAGR of 8.4% from 2025 to 2035, has shown strong performance in key economies. China, a member of the BRICS group, is leading with an 11.3% CAGR, driven by expansion in industrial automation and large-scale grid upgrades. India, another BRICS member, is exhibiting a 10.5% CAGR supported by increasing power distribution networks and electrification initiatives in semi-urban and rural regions. Germany, an OECD member, is maintaining a robust 9.7% CAGR as modernization of transmission systems and integration of electric mobility infrastructure drive component demand. The United Kingdom is posting an 8.0% CAGR, supported by grid resilience investments and regulatory emphasis on efficient energy systems. The United States is experiencing a steady 7.1% CAGR due to stable demand in established industrial bases and ongoing infrastructure enhancements. The report includes a comprehensive review of more than 40 countries, with the top five markets highlighted as reference.

The United Kingdom is projected to grow at an 8.0% CAGR, driven by energy transition programs and regulatory measures promoting efficient grid performance. Utilities are adopting low-voltage capacitors for reactive power control in renewable-integrated networks. Growth in electric mobility and EV charging infrastructure enhances the need for advanced capacitor systems that can handle fluctuating loads. Manufacturers are focusing on modular capacitor banks designed for urban distribution systems with limited installation space. Ongoing investments in grid resilience and power quality improvement provide steady demand, while emerging applications in commercial and industrial facilities create new opportunities for capacitor deployment.

The United States is anticipated to grow at a 7.1% CAGR, supported by demand for grid modernization and energy efficiency improvements across industrial facilities. Utilities deploy capacitor banks for reactive power compensation to meet regulatory targets on energy losses. The electrification of manufacturing, combined with renewable integration in state-level energy programs, supports capacitor usage in inverter-driven systems. Domestic suppliers emphasize the production of advanced dry-type capacitors for safety and reliability in critical applications. EV adoption and fast-charging station deployment create additional opportunities for capacitor integration in power conversion systems, further boosting industry growth.

Germany is expected to grow at a 9.7% CAGR, driven by modernization of transmission networks and integration of EV charging infrastructure. Compliance with stringent EU energy efficiency regulations fuels adoption of capacitors in smart grid applications. Automotive OEMs and industrial automation firms are investing in advanced capacitors for inverter systems, renewable integration, and robotics applications. Manufacturers emphasize high-performance polypropylene film capacitors for sustainable energy storage and grid stability. Expansion of wind and solar power capacity across the country further strengthens the role of capacitors in reactive power management. Germany’s leadership in precision engineering positions it as a key technology innovator in capacitor design.

China is projected to grow at an 11.3% CAGR, the highest among major economies, driven by industrial automation, renewable energy projects, and large-scale grid modernization programs. Government-backed investments in smart grids and distributed energy resources fuel demand for advanced capacitors that improve power factor and reduce energy losses. Domestic manufacturers are expanding production capacity for film capacitors to meet stringent quality requirements in EV charging infrastructure and renewable power installations. Export opportunities for cost-efficient capacitors also strengthen China’s leadership in the global market. Integration of capacitors into high-efficiency motor drives and inverter systems supports growth across manufacturing and transportation sectors.

India is forecast to grow at a 10.5% CAGR, supported by accelerated electrification and grid expansion in semi-urban and rural areas. Power distribution companies are adopting low-voltage capacitors for reactive power compensation, reducing transmission losses and improving energy efficiency. Rapid industrialization and the rollout of renewable energy parks enhance capacitor deployment across key sectors. Government programs such as the Revamped Distribution Sector Scheme (RDSS) promote modernization of electricity networks, creating strong demand for capacitor banks. Domestic manufacturers are focusing on producing cost-effective and durable capacitors to cater to both public utility projects and private industrial consumers.

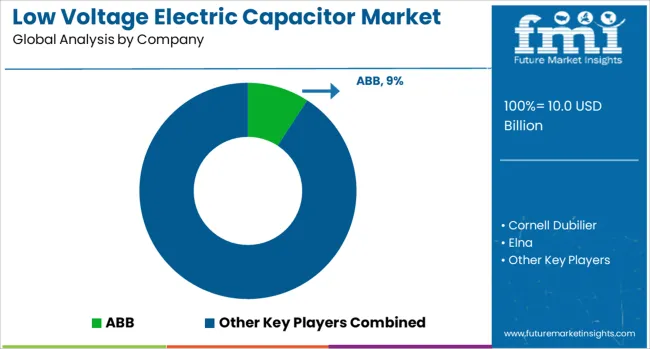

In the low voltage electric capacitor industry, major companies are concentrating on improving dielectric materials, enhancing lifecycle performance, and optimizing energy efficiency for power distribution and industrial systems. Companies such as ABB, Siemens, and Schneider Electric dominate through robust product portfolios integrated with smart grid applications and voltage stabilization technologies. These players emphasize partnerships with utilities and OEMs for large-scale deployments across renewable energy and automotive charging infrastructure.

Specialized capacitor manufacturers like Cornell Dubilier, Wima, and Xuansn Capacitor have focused on niche designs for power electronics and harmonic filtering. Japanese firms, including Murata Manufacturing, Kyocera AVX Components, Elna, and Taiyo Yuden, maintain strong positions in precision-based capacitors for industrial automation and consumer electronics. Global electronics leaders Panasonic, Samsung Electro-Mechanics, and TDK are expanding their influence through mass production capabilities and strategic sourcing initiatives to meet increasing global demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.0 Billion |

| Material | Film capacitors, Ceramic capacitors, Electrolytic capacitors, and Others |

| End Use | Consumer electronics, Automotive, Communications & technology, Transmission & Distribution, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Cornell Dubilier, Elna, Havells India, Kemet, Kyocera AVX Components, Murata Manufacturing, Panasonic, Samsung Electro-Mechanics, Schneider Electric, Siemens, Taiyo Yuden, TDK, Vishay Intertechnology, Wima, and Xuansn Capacitor |

| Additional Attributes | Dollar sales by capacitor type (film capacitors, electrolytic capacitors, ceramic capacitors) and application segment (power conditioning, motor start, renewable inverters); demand dynamics across industrial automation, HVAC systems, and electric vehicle charging; regional trends led by North America with Asia‑Pacific accelerating adoption in smart grid and renewable sectors; innovation in low-ESR polymers, self-healing dielectric layers, and miniaturized MLCC designs; and environmental impact of recycling initiatives, RoHS compliance, and regulations targeting hazardous materials disposal. |

The global low voltage electric capacitor market is estimated to be valued at USD 10.0 billion in 2025.

The market size for the low voltage electric capacitor market is projected to reach USD 22.3 billion by 2035.

The low voltage electric capacitor market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in low voltage electric capacitor market are film capacitors, ceramic capacitors, electrolytic capacitors and others.

In terms of end use, consumer electronics segment to command 36.4% share in the low voltage electric capacitor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Low Profile Compact System Closures Market Size and Share Forecast Outlook 2025 to 2035

Low Flow Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Low Code Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA