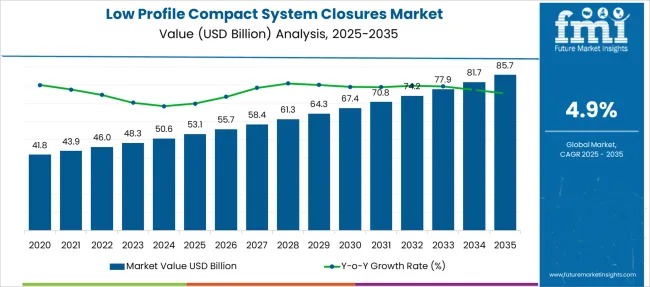

The Low Profile Compact System Closures Market is estimated to be valued at USD 53.1 billion in 2025 and is projected to reach USD 85.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Low Profile Compact System Closures Market Estimated Value in (2025 E) | USD 53.1 billion |

| Low Profile Compact System Closures Market Forecast Value in (2035 F) | USD 85.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The low profile compact system closures market is gaining momentum due to growing demand for lightweight, space saving, and user friendly packaging solutions across various industries. Manufacturers are focusing on designing closures that enhance product accessibility, minimize leakage, and support recyclability without compromising functionality.

With increased consumption of ready to drink beverages and single serve food products, there is a strong shift toward closures that deliver convenience while aligning with environmental sustainability goals. Ongoing innovations in material science and molding technologies are enabling the production of high precision closures that ensure a secure seal and extend shelf life.

In addition, regulatory efforts promoting the reduction of plastic waste and the adoption of eco efficient packaging are further influencing market trends. As consumer expectations evolve and operational efficiency becomes a priority for brands, the outlook for low profile compact system closures remains strong across both mass market and premium packaging segments.

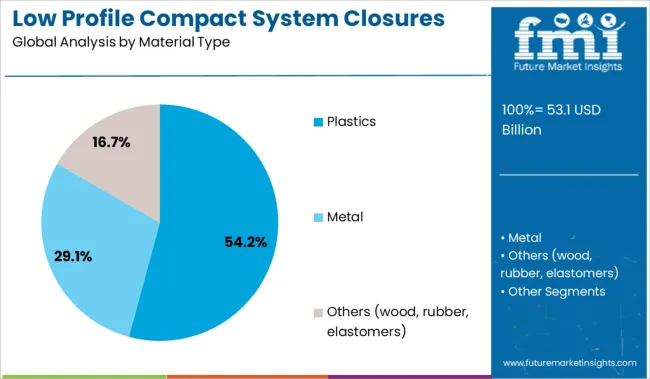

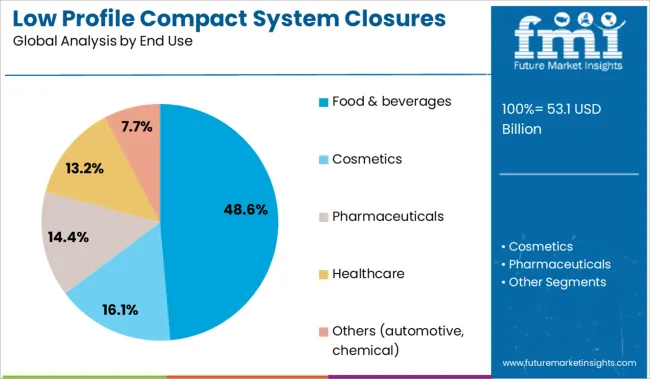

The market is segmented by Material Type and End Use and region. By Material Type, the market is divided into Plastics, Metal, and Others (wood, rubber, elastomers). In terms of End Use, the market is classified into Food & beverages, Cosmetics, Pharmaceuticals, Healthcare, and Others (automotive, chemical). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastics segment is projected to contribute 54.20% of total market revenue by 2025 within the material type category, making it the leading choice for manufacturers. This dominance is supported by the versatility, cost efficiency, and lightweight characteristics of plastics, which allow for the production of durable and flexible closures suitable for high volume applications.

Technological advancements in polymer blends have enabled enhanced barrier properties and greater compatibility with various product formulations. Additionally, plastics offer superior moldability, making them ideal for precision engineered low profile closures that meet brand and consumer performance expectations.

The recyclability of newer plastic formulations and the integration of post consumer resin content are also enhancing the material’s acceptance in sustainable packaging programs. As a result, plastics continue to be the preferred material across a wide spectrum of closure applications.

The food and beverages segment is expected to account for 48.60% of the total market revenue by 2025 within the end use category, emerging as the dominant application area. This growth is driven by the increasing consumption of bottled drinks, dairy products, and packaged food that require secure, tamper evident, and easy to open closures.

Manufacturers in this segment are focusing on closures that ensure product freshness, prevent contamination, and support brand identity through design customization. The trend toward on the go consumption and smaller packaging formats is also supporting the demand for compact and functional closures.

As regulatory standards for food safety and packaging integrity tighten globally, the adoption of advanced closure systems in the food and beverage industry continues to rise, establishing it as the largest end use category in the market.

Closures are produced using a variety of materials. The primary purpose of the material selection was to enhance the beauty of the product while keeping its functionality intact. In the cosmetics, pharmaceutical, food and beverage, and healthcare industries, low profile compact system closures have emerged as an extremely appealing type of closures.

The shelf life of the product is subsequently extended as a result.

Since this style of packaging maintains the integrity of the product and facilitates product protection, low profile compact system closures are becoming more popular across a variety of end-use sectors. These closures secure the container efficiently, keeping the product in place by preventing the loss of weight resulting from moisture evaporation.

As low-profile compact system closures offer an airtight seal that avoids packaged food spoiling, the food and beverage sector is the primary end-use industry for these goods. Due to the growing trend of on-the-go consumption and the necessity for packaging that is simple to open and close, the food and beverage sector is predicted to generate huge demand for low profile compact system closure sales.

For items like creams and lotions, which require an airtight seal, the cosmetics sector adopts low profile compact system closures to shield the goods from outside contamination. Numerous pharmaceutical products including ophthalmic solutions, inhalers, injectable, and others, employ these closures. Low-profile compact system closures provide these goods with outstanding airtightness and leak-proof sealing.

Another significant end-user of these closures has been the healthcare sector as a result of the rising need for packaging that is safe for children and older citizens. These closures are frequently found on the packaging of dietary supplements, prescription medications, and over-the-counter medicines.

The low profile compact system closures are one of the newest and best closure technologies currently on the market. Multiple uses of low profile compact system closures are creating demand for it across the manufacturing industries. Since this methodology preserves the qualities of the product throughout use and on the shelves, several manufacturing industries find it ideal for compositions that are solvent-based and water-based.

These factors are likely to create enormous opportunities for the market players.

The forecast period is likely to bring about growth opportunities for market players in the global low profile compact system closure sales market due to the increased demand for portable and lightweight packaging solutions from the food & beverage and healthcare industries.

In the food and beverage business, aseptic packaging is becoming even more popular, which is yet another important factor generating lucrative market potential.

Manufacturers are putting their resources into standardized mass manufacturing of goods. Sustainable packaging is another area of emphasis. Companies are concentrating on obtaining recyclable materials for the production of caps. Then it is being investigated how recycled aluminum, steel, and plastic, which may be processed further and utilized as raw materials, can be utilized. For instance, to boost product sustainability, Closure Systems International and Coca-Cola introduced a beverage closure in October 2024 that included 30% PCR.

By offering highly specialized solutions like low profile compact system closures with BPA-free material, appealing colors, and printing suitable surfaces, manufacturers in the sector are trying to get a competitive edge and stand out in the market. Suppliers of raw materials concentrate on providing products with superior packaging qualities so that closure makers may create specialized designs.

Packaging today demands convenience not only in the functionality of the packaging, but also the storage, transport and disposal. With the rising disposable incomes, personal use products have seen a tremendous rise in demand. This has in turn triggered the supply of the products, and innovations to reduce the total cost of their production and packaging.

By that token, low profile compact system closures have fittingly found their way in the packaging production systems. Low profile compact system closures reduce the overall weight of the packaged product. Weight reduction is achieved due to the less use of raw material in the production of the low profile compact system closures.

In terms of sustainability, less energy is utilized during production, which is a major driver for the growth of low profile compact system closures market. Moreover, Transport of total number of units per truck also increase, which is expected to boost the global low profile compact system closures market growth.

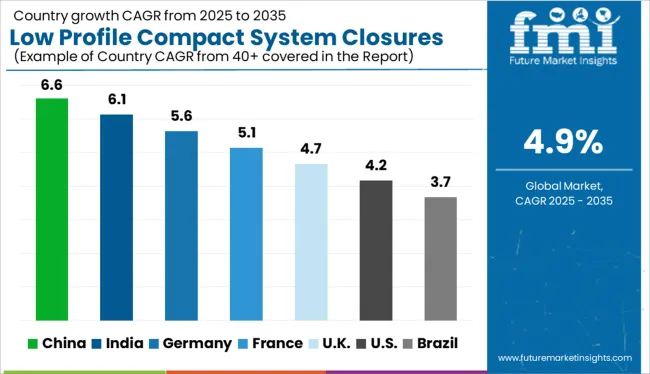

In terms of geography, the low profile compact system closures has been divided in to five key regions; North America, Latin America, Europe, Asia-Pacific and Middle East & Africa. The low profile compact system closures is expected to exhibit an above average CAGR during the forecast period. Asia Pacific is expected to be the fastest growing region for low profile compact system closures market during the forecast period.

Due to the rising per capita income and the increase in industrialization, Asia Pacific region will also fare the largest in terms of consumption, as well as production in global low profile compact system closures market. Latin America and Europe will closely follow behind the growth pattern of the Asia Pacific region during the forecast period in low profile compact system closures.

North America and Europe will comparatively witness a slower growth in terms of the low profile compact system closures market during the forecast period.

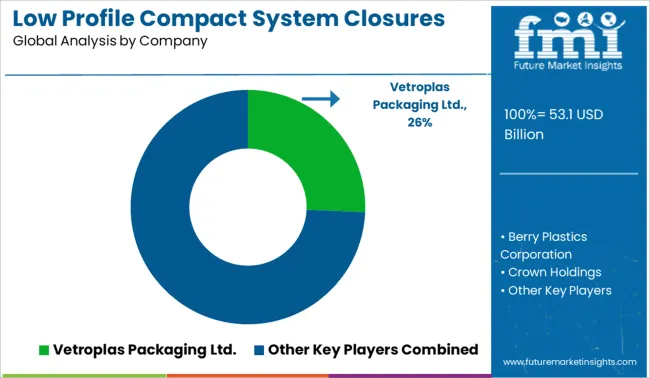

Some of the key players in the low profile compact system closures are Vetroplas Packaging Ltd., Berry Plastics Corporation, Crown Holdings, Portola Packaging Inc., Silgan Plasic Closures Solutions, Global Closure Systems, Paradigm Packaging Inc., OBerk Company LLC, Reynolds Group Holdings and PolyChem Alloy Inc among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections done using a suitable set of assumptions and methodologies.

The research report provides analysis and information according to categories such as market segments, geographies, type, machine size and end use.

The global low profile compact system closures market is estimated to be valued at USD 53.1 billion in 2025.

The market size for the low profile compact system closures market is projected to reach USD 85.7 billion by 2035.

The low profile compact system closures market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in low profile compact system closures market are plastics, metal and others (wood, rubber, elastomers).

In terms of end use, food & beverages segment to command 48.6% share in the low profile compact system closures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Flow Monitoring System Market

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Compacted Strand Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Compact Rotary Actuator Market Size and Share Forecast Outlook 2025 to 2035

Compact Pneumatic Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Compact Resin Type Silencer Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA