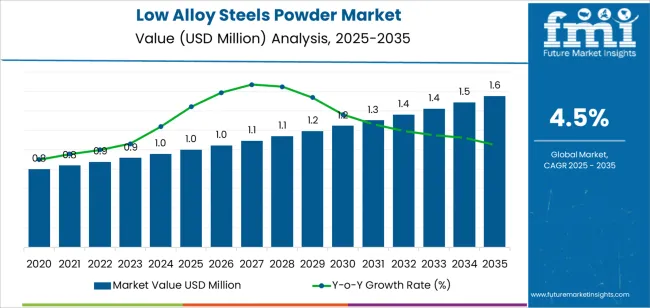

The global low alloy steels powder market is forecast to reach USD 1.6 million by 2035, reflecting an absolute increase of USD 0.6 million over the forecast period. The market is valued at USD 1.0 million in 2025 and is expected to grow at a CAGR of 4.5%. This growth is driven by the increasing demand for low alloy steel powders in industries such as automotive, aerospace, and manufacturing, where lightweight, high-performance materials are needed for applications that require superior strength, wear resistance, and corrosion resistance. Advancements in powder metallurgy and additive manufacturing are contributing to market expansion by enabling more efficient and precise production processes.

Low alloy steels are widely used in powder form for applications that demand a balance between cost-effectiveness and performance. These materials offer enhanced properties compared to carbon steels, making them suitable for a variety of industrial uses, including the production of gears, structural components, and tooling. The adoption of low alloy steel powders in additive manufacturing processes, particularly 3D printing, has gained traction due to the growing need for custom, on-demand manufacturing solutions. As industries increasingly focus on reducing material waste and improving manufacturing flexibility, low alloy steel powders provide an ideal solution that meets both technical and economic requirements.

The market growth is also supported by the increasing emphasis on energy efficiency and sustainability in industrial production. Low alloy steel powders enable more efficient manufacturing processes with less material waste compared to traditional methods. Furthermore, the automotive and aerospace industries are driving demand for these powders, as lightweight yet durable components are required for fuel-efficient vehicles and advanced aerospace systems. The growing trend of electric vehicles (EVs) and the need for high-performance materials in EV motors and batteries are expected to further boost demand for low alloy steel powders in the coming years.

Between 2025 and 2030, the low alloy steels powder market is projected to grow from USD 1.0 million to approximately USD 1.3 million, adding USD 0.3 million, which accounts for roughly 50% of the total forecast growth for the decade. This period will be characterized by increasing adoption of low alloy steel powders in automotive, aerospace, and additive manufacturing applications, as well as technological advancements that improve powder production methods.

From 2030 to 2035, the market is expected to expand from approximately USD 1.3 million to USD 1.6 million, adding USD 0.3 million, which constitutes about 50% of the overall growth. This phase will be marked by further growth in the automotive and aerospace sectors, as well as increasing integration of low alloy steel powders in 3D printing and additive manufacturing applications, driving demand for efficient, high-performance materials in complex manufacturing processes.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.0 billion |

| Market Forecast Value (2035) | USD 1.6 billion |

| Forecast CAGR (2025-2035) | 4.5% |

The low alloy steels powder market is growing due to the increasing demand for high-performance materials in various industries such as automotive, aerospace, and manufacturing. Low alloy steels are valued for their strength, durability, and resistance to wear and corrosion, making them ideal for high-stress applications. The shift towards additive manufacturing, particularly 3D printing, is also contributing to the demand for low alloy steel powders, as these materials offer superior quality and efficiency in additive processes.

As industries continue to push for lightweight yet durable materials, low alloy steels provide an attractive solution. In the automotive and aerospace sectors, for example, reducing weight while maintaining strength is essential for improving fuel efficiency and performance. The versatility of low alloy steels, coupled with advancements in powder metallurgy techniques, has led to their widespread adoption in precision manufacturing applications.

The growing focus on sustainability and cost-effectiveness is driving the use of low alloy steels in various sectors. These materials help reduce waste and energy consumption during production. Challenges such as the high cost of raw materials and the complexity of manufacturing processes may limit growth in regions with budget constraints.

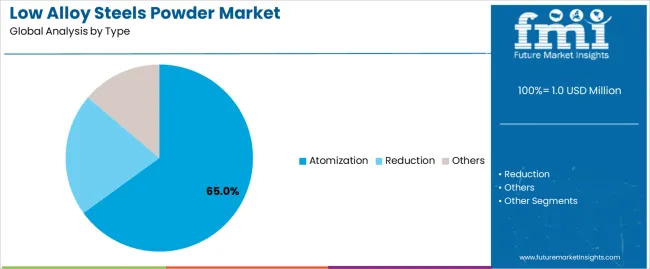

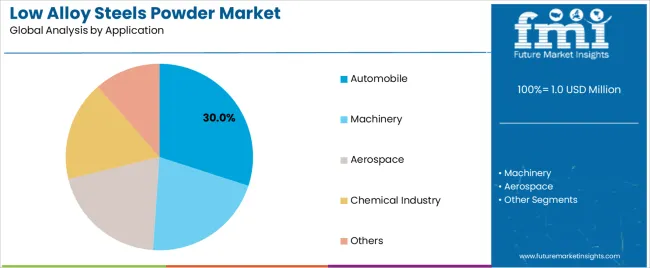

The market is segmented by type, application, and region. By type, the market is divided into atomization, reduction, and other types. Based on application, the market is categorized into automobile, machinery, aerospace, chemical industry, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

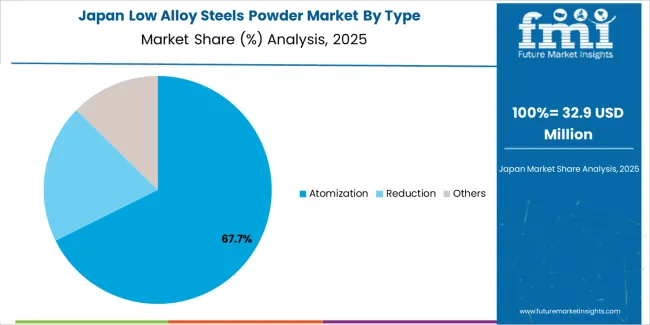

The atomization segment dominates the low alloy steels powder market, capturing 65.0% of the market share. This process involves converting molten metal into fine particles, a method that ensures the production of high-quality powders with consistent characteristics. Atomized powders are highly favored in manufacturing due to their superior particle size distribution, uniformity, and high density. These powders offer excellent mechanical properties, such as enhanced strength and wear resistance, making them ideal for applications requiring precision and durability.

The reduction and other segments account for the remaining share. The reduction process involves the use of specific chemical agents to extract metals from ores, offering powders with tailored compositions for applications requiring reduced impurities. Although the atomization process currently holds the largest share, the growing demand for customized alloy powders in niche applications could increase the adoption of reduction and other powder production methods, driving competition and innovation within the market.

The automobile segment is the largest contributor, accounting for approximately 30.0% of the low alloy steels powder market share. The automotive industry's demand for lightweight yet durable materials has driven the adoption of low alloy steels powders in manufacturing. These powders are ideal for producing components such as engine parts, transmission gears, and chassis, where strength, wear resistance, and weight reduction are critical. The automotive sector's emphasis on high-performance, cost-effective materials boosts the demand for advanced powder metallurgy techniques.

The machinery, aerospace, and chemical industry segments also represent significant shares in the market. The machinery segment benefits from these powders due to their ability to withstand heavy-duty use in parts that require high strength and resistance to extreme conditions. The aerospace sector utilizes these powders for producing parts that need to perform under high pressures and temperatures. The chemical industry uses these powders for components requiring corrosion resistance and long-term durability. While the automobile sector leads with a 30.0% share, these other sectors contribute to the overall growth of the low alloy steels powder market through specialized applications.

The market is expanding due to the increasing demand for efficient and reliable low alloy steel powders in automotive, aerospace, and industrial equipment sectors. These powders offer features like high strength, wear resistance, and compatibility with powder‑metallurgy and additive‑manufacturing processes. Key drivers include growth in electric vehicle components and equipment modernization, while restraints stem from high raw‑material costs and processing‑complexity in powder production.

Why Are Low Alloy Steel Powders Gaining Popularity?

Low alloy steel powders are gaining popularity due to their enhanced mechanical properties and versatility in manufacturing processes, particularly in near net shape manufacturing. These powders allow for the production of components with superior strength, wear resistance, and durability, making them ideal for high demand applications like gears, bearings, and structural parts. The ability to produce parts with minimal material waste is another key advantage, making low alloy steel powders an attractive option for industries focused on cost reduction.

The rise of powder metallurgy, which uses powders to create components by compacting and sintering, has significantly increased the demand for these materials. Furthermore, the advancement of 3D printing technologies has expanded the scope for low alloy steel powders, allowing for the creation of complex, customized parts with greater precision and efficiency.

How Are Powder Technologies Driving Growth in the Low Alloy Steel Powder Sector?

Powder technologies are playing a crucial role in the growth of the low alloy steel powder sector by enabling precise control over particle size, alloy composition, and material properties. The process of atomization, where molten metal is rapidly cooled to form powder particles, has evolved, leading to powders with more uniform size distributions and superior quality. Heat treatment and post processing techniques, such as sintering and annealing, are being optimized to further enhance the material’s mechanical properties, making them suitable for demanding applications.

Additionally, innovations like additive manufacturing (3D printing) and binder jetting are driving new applications for low alloy steel powders, enabling the production of complex parts with intricate geometries that would be difficult or impossible to achieve with traditional manufacturing methods. The integration of digital manufacturing and industrial automation is also contributing to the sector’s growth, enabling faster and more efficient production cycles. These advancements are expanding the range of industries and applications where low alloy steel powders can be used, including automotive, aerospace, and medical device manufacturing.

What Are the Key Challenges Impacting the Adoption of Low Alloy Steel Powders?

Despite the promising potential of low alloy steel powders, several challenges are hindering their broader adoption. One of the most significant barriers is the high cost associated with powder production, particularly the energy intensive atomization process and the specialized post processing required to achieve the desired mechanical properties, such as strength and wear resistance. These costs make low alloy steel powders more expensive than traditional manufacturing materials, which can deter adoption, especially in cost sensitive industries.

Material consistency and quality control also present challenges, particularly for high performance applications that demand uniform properties across large production runs. Variations in particle size or composition can lead to defects or performance issues. Another restraint is the compatibility of low alloy steel powders with legacy manufacturing processes. Adapting existing systems to handle powder materials requires capital investment, new equipment, and skilled operators, which may not be feasible for some manufacturers.

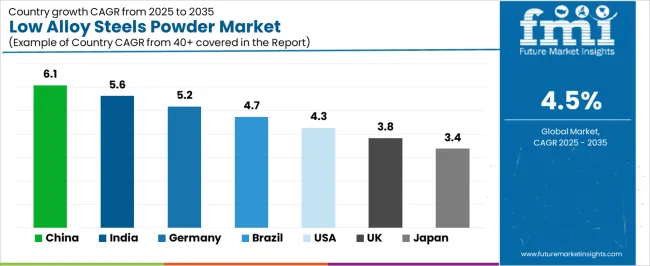

| Country | CAGR (%) |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| Brazil | 4.7% |

| USA | 4.3% |

| UK | 3.8% |

| Japan | 3.4% |

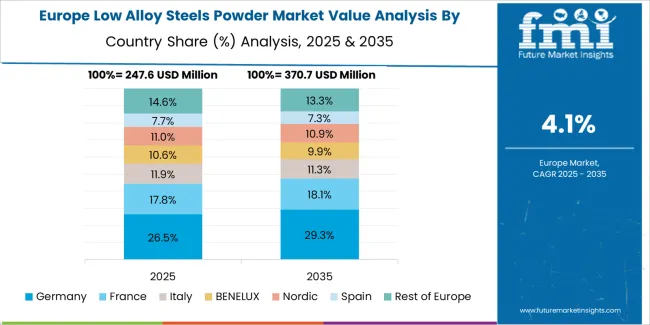

The global low alloy steels powder market is growing steadily, with China leading at a 6.1% CAGR, driven by rapid industrialization, advanced manufacturing needs, and growing demand for high-performance materials in sectors like automotive and construction. India follows closely at 5.6%, fueled by expanding industrial bases and increasing energy demands. Germany grows at a 5.2% CAGR, supported by its advanced manufacturing and aerospace sectors. Brazil’s market grows at 4.7%, driven by infrastructure development and the need for durable materials. The USA sees a 4.3% CAGR, influenced by automotive and aerospace industries, while the UK and Japan grow at 3.8% and 3.4%, respectively, due to manufacturing innovation and additive technologies.

China is leading the low alloy steels powder market with a 6.1% CAGR, driven by its vast industrialization and increasing demand for advanced materials across various sectors. The country’s manufacturing sector, particularly in automotive, heavy machinery, and construction, requires high-performance materials to maintain efficiency and ensure durability. As China continues to grow as the world’s largest producer of steel, low alloy steels powders are becoming essential for producing robust and lightweight components needed in industrial processes. These alloys are crucial for parts requiring high strength and resistance to wear, such as gears, bearings, and engine components.

In addition to the growing industrial base, China’s efforts to modernize its power grid and the rising adoption of renewable energy sources like wind and solar power are further contributing to the demand for low alloy steels powders. These materials are critical in managing the stresses in renewable energy infrastructure, where reliable power generation and distribution are needed. As China continues to expand its investments in smart manufacturing, automation, and additive manufacturing technologies, the demand for high-quality low alloy steels powder will continue to rise. This ensures that China will maintain its dominant position in the global low alloy steels powder market.

India is experiencing steady growth in the low alloy steels powder market, with a 5.6% CAGR, primarily due to its rapidly expanding industrial sector and rising energy demands. India’s manufacturing industries, including automotive, aerospace, and construction, require high-strength, lightweight materials for precision parts. The country’s demand for durable components that can withstand high stress and wear has driven the adoption of low alloy steels powders. These materials are crucial for producing machine parts and components that require enhanced mechanical properties, particularly in high-performance industries such as automotive and machinery.

The Indian government’s push toward infrastructure development and increased electrification across the country is also contributing to market growth. As India continues to invest in renewable energy, including solar and wind power, there is a growing need for materials that can withstand fluctuating power demands in the energy sector. This creates opportunities for low alloy steels powders in sectors that require high-strength materials for renewable energy infrastructure. The increasing integration of advanced manufacturing technologies such as 3D printing also boosts the demand for these powders in additive manufacturing processes. As India’s industrial base continues to expand, the market for low alloy steels powders is set for sustained growth.

Germany is seeing steady growth in the low alloy steels powder market, with a 5.2% CAGR, driven by its strong industrial and automotive sectors. Germany’s manufacturing industry is renowned for producing high-quality, precision-engineered components, and low alloy steels are essential for ensuring the durability and strength of these parts. The automotive sector in particular requires advanced materials to meet stringent safety and performance standards, making low alloy steels powders a key material in the production of critical components like engine parts, gears, and suspension systems. Germany’s commitment to industrial automation and technological innovation supports the continuous demand for these high-performance materials.

Germany’s emphasis on renewable energy sources like solar and wind power also drives the demand for low alloy steels powders. As the country works toward integrating these renewable energy sources into its grid, the need for materials that offer superior resistance to wear and corrosion is increasing. Low alloy steels are particularly important in applications where durability is essential, such as in power generation systems and industrial machinery. As Germany continues to lead in industrial innovation and renewable energy, the demand for low alloy steels powder is expected to continue growing, especially as industries evolve towards more sustainable practices.

Brazil is witnessing moderate growth in the low alloy steels powder market, with a 4.7% CAGR, driven by its expanding industrial base and the growing demand for materials in sectors like automotive, mining, and construction. Brazil’s manufacturing industry relies heavily on durable materials that offer superior mechanical properties. Low alloy steels powders play a crucial role in the production of high-performance components for industries that require materials capable of withstanding extreme conditions. The country’s rising industrial activities and infrastructure development projects further contribute to the demand for these advanced materials, which are used in critical equipment and machinery.

The adoption of renewable energy in Brazil, particularly in hydropower, solar, and wind power, is also driving the demand for low alloy steels powders. These materials are essential for renewable energy infrastructure, where high-strength materials are required to ensure efficiency and durability. As Brazil continues to invest in expanding its energy sector and modernizing its infrastructure, the market for low alloy steels powders will continue to grow. Additionally, Brazil’s focus on enhancing its manufacturing capabilities and adopting advanced technologies in sectors such as 3D printing will further boost the demand for these high-performance materials in the years ahead.

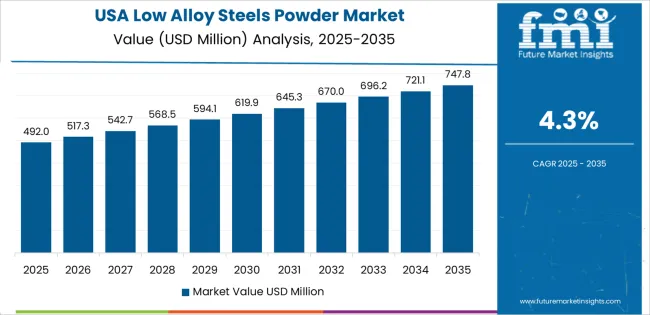

The USA is experiencing steady growth in the low alloy steels powder market, with a 4.3% CAGR, driven by the increasing demand for high-performance materials in industries like automotive, aerospace, and heavy machinery. As industries in the USA continue to focus on automation and efficiency, the need for durable, lightweight materials are growing. Low alloy steels powders are essential for the production of precision components that require high mechanical properties, such as gears, bearings, and engine parts. The automotive industry’s growing focus on fuel efficiency and lightweight vehicles further increases the need for these advanced materials in the USA.

In addition to the automotive sector, the integration of renewable energy into the national grid, including wind and solar power, is increasing the demand for low alloy steels powders. These materials are critical for power generation systems, where resistance to corrosion and wear is essential. The USA’s commitment to clean energy and green technologies is pushing industries to adopt more sustainable solutions, which in turn drives the adoption of low alloy steels powders. With continuous advancements in manufacturing technologies and a growing emphasis on high-performance materials, the market for low alloy steels powder in the USA is expected to continue its steady growth.

The UK is experiencing moderate growth in the low alloy steels powder market, with a 3.8% CAGR, driven by the demand for high-performance materials in industries such as automotive, aerospace, and engineering. As the UK focuses on energy efficiency and reducing its carbon footprint, the need for lightweight, durable materials that can withstand high stress is increasing. Low alloy steels powders are crucial in the production of automotive and aerospace components that require exceptional mechanical properties. The UK’s automotive industry is transitioning toward more fuel-efficient and lightweight vehicles, which is increasing the demand for these advanced materials.

The UK’s strong focus on sustainability and renewable energy is also driving the market for low alloy steels powders. The need for high-strength materials in renewable energy infrastructure, such as wind and solar power systems, is growing. Low alloy steels are essential for ensuring the durability and efficiency of power generation systems. As the UK continues to invest in infrastructure and renewable energy projects, the demand for low alloy steels powders is expected to rise. The growing adoption of advanced manufacturing techniques, such as 3D printing, will further contribute to the market growth in the UK.

Japan is seeing steady growth in the low alloy steels powder market, with a 3.4% CAGR, driven by its strong industrial base, technological advancements, and focus on energy efficiency. Japan’s automotive, electronics, and manufacturing sectors require high-performance materials to meet stringent safety and performance standards. Low alloy steels powders are used extensively in these industries to produce components that can withstand wear, stress, and extreme operating conditions. Japan’s commitment to precision engineering and advanced manufacturing techniques ensures that the demand for these materials remains strong, particularly in sectors requiring high-strength components.

Japan’s focus on sustainability and renewable energy adoption is also driving the market for low alloy steels powders. The country’s integration of renewable energy sources, particularly solar and wind power, is increasing the need for durable materials that can manage fluctuating energy supply and demand. Low alloy steels are essential for manufacturing components used in power generation systems and industrial machinery. As Japan continues to invest in renewable energy projects and industrial automation, the demand for high-performance, durable materials like low alloy steels powders will continue to grow steadily, supporting market expansion.

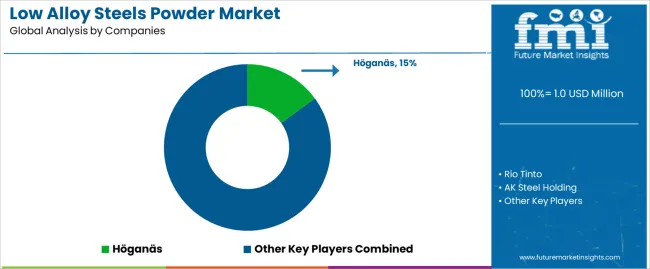

The low alloy steels powder market is driven by several key players, each offering advanced solutions for powder metallurgy applications across industries such as automotive, aerospace, and manufacturing. Höganäs is the market leader, holding a 15% share, known for its extensive expertise in producing high-quality metal powders for a wide range of industrial uses. The company’s focus on innovation, product consistency, and customer-centric solutions has solidified its position as the leader in the sector.

In addition to Höganäs, major players like Rio Tinto, AK Steel Holding, and KOBELCO also play significant roles in the market. Rio Tinto is a global leader in mining and metallurgy, offering a range of metal powders, while AK Steel focuses on producing high-performance steels with low alloy content for demanding applications. KOBELCO, known for its advanced powder metallurgy technologies, provides solutions for a variety of industrial sectors. These companies are recognized for their ability to supply high-quality powders that meet the increasing demand for durable and lightweight materials used in manufacturing processes.

Other players such as Metal Powder Products, Sandvik, and Pellets focus on innovation and product diversification to cater to a wide array of industries. Regional players like Daido Steel, AMETEK, and Pometon Powder are expanding their footprint, offering specialized solutions to meet specific customer needs. Companies like NANOSTEEL, Laiwu Iron & Steel Group, and Jiande Yitong contribute to the market with competitive pricing and a focus on delivering high-quality, cost-effective low alloy steel powders. The competitive landscape is shaped by product innovation, material quality, and the ability to cater to the evolving demands of industries requiring advanced material solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Atomization, Reduction, Others |

| Application | Automobile, Machinery, Aerospace, Chemical Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Höganäs, Rio Tinto, AK Steel Holding, KOBELCO, Metal Powder Products, Sandvik, Pellets, Daido Steel, AMETEK, Carpenter Technology, Pometon Powder, NANOSTEEL, Laiwu Iron & Steel Group, Jiande Yitong, Wuhan Iron & Steel Group, Ma Steel, Haining Feida |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in low alloy steels powder technologies, integration with manufacturing processes. |

The global low alloy steels powder market is estimated to be valued at USD 1.0 million in 2025.

The market size for the low alloy steels powder market is projected to reach USD 1.6 million by 2035.

The low alloy steels powder market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in low alloy steels powder market are atomization, reduction and others.

In terms of application, automobile segment to command 30.0% share in the low alloy steels powder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA