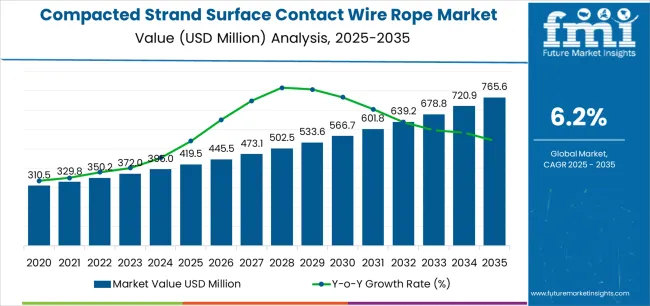

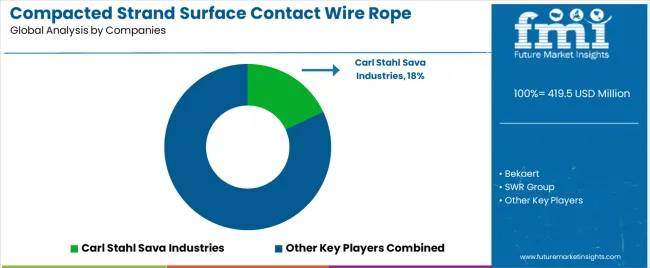

The global compacted strand surface contact wire rope market is valued at USD 419.5 million in 2025 and is projected to reach USD 765.6 million by 2035, registering a CAGR of 6.2%. Rolling CAGR analysis across the decade reflects consistent structural demand growth supported by infrastructure renewal, mining operations, and maritime transport applications. These ropes are designed to deliver high tensile strength, reduced elongation, and superior fatigue resistance, making them suitable for lifting, hoisting, and load-bearing environments where reliability and dimensional stability are critical.

Manufacturers continue to refine compaction techniques that enhance contact surface density, improving both wear resistance and load distribution efficiency. Advancements in wire coating and lubrication processes are extending service life, particularly in offshore and construction segments exposed to abrasive conditions. Automation in rope production and non-destructive testing technologies are improving product consistency and quality control.

Regional demand patterns indicate dominant consumption in Asia Pacific, led by China, India, and Japan, where industrial expansion and port development sustain long-term volume growth. Europe and North America maintain steady replacement demand through established mining and energy sectors. Material sourcing, metallurgical precision, and tensile certification protocols remain defining parameters shaping market performance through 2035.

Between 2025 and 2030, the Compacted Strand Surface Contact Wire Rope Market is projected to increase from USD 419.5 million to USD 566.7 million, representing a 35.1% rise and accounting for 46.3% of the total market growth expected over the decade. This expansion will be driven by growing demand from the construction, mining, and marine industries, where high strength, durability, and reduced diameter loss are critical. Advancements in wire compaction techniques and surface treatment technologies are improving load-bearing capacity and fatigue resistance. Manufacturers are increasingly focusing on precision manufacturing and specialized coatings to enhance performance and lifespan in heavy-duty applications.

From 2030 to 2035, the market is forecast to grow from USD 566.7 million to USD 765.6 million, marking a 35.1% increase and contributing 53.7% of the decade’s total expansion. This phase will see wider adoption of high-tensile, corrosion-resistant wire ropes in offshore engineering, elevators, and infrastructure projects. Rising investment in renewable energy installations, particularly wind turbines, will stimulate demand for advanced wire rope systems with superior fatigue performance. Ongoing R&D in metallurgical composition and compacted strand design will further optimize performance efficiency, enabling the market to achieve sustained growth and technological advancement across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 419.5 million |

| Market Forecast Value (2035) | USD 765.6 million |

| Forecast CAGR (2025–2035) | 6.2% |

The compacted strand surface contact wire rope market is expanding as industries demand stronger, more fatigue-resistant lifting and hoisting solutions capable of withstanding heavy mechanical stress. These ropes, produced through strand compaction processes that reduce inter-wire gaps and increase contact area, deliver higher breaking strength, smoother operation, and longer service life compared to conventional designs. Construction, mining, port handling, and offshore sectors increasingly specify compacted strand variants for cranes, elevators, and winches where consistent load performance and reduced vibration are critical.

Manufacturers emphasize precise strand geometry and surface finishing to achieve uniform stress distribution and minimize abrasion between layers, improving operational efficiency and safety in demanding environments. Advancements in metallurgy and wire drawing technology support the production of finer, high-tensile steel grades suitable for compacted structures. Growing investment in infrastructure projects and large-scale material transport systems sustains consistent demand for durable lifting materials. Maintenance cost reduction and extended replacement intervals further strengthen the business case for adoption. However, the higher production cost and complex manufacturing requirements limit widespread use among small-scale operators. As engineering standards evolve toward greater reliability and mechanical optimization, compacted strand surface contact wire ropes continue to gain acceptance across global heavy-industry sectors.

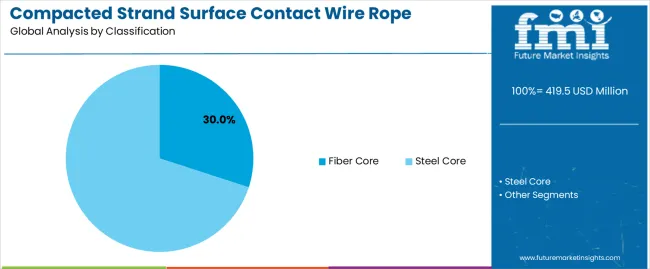

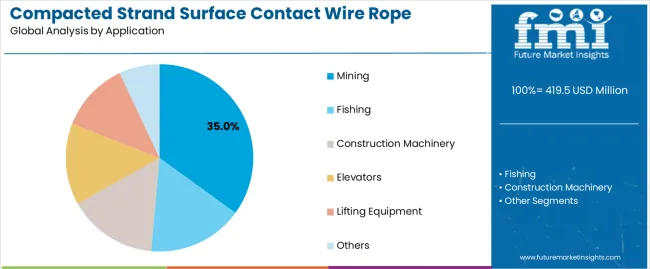

The compacted strand surface contact wire rope market is segmented by classification, application, and region. By classification, the market is divided into fiber core and steel core wire ropes. Based on application, it is categorized into mining, fishing, construction machinery, elevators, lifting equipment, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define the structural composition and industrial utilization patterns of compacted strand wire ropes across global markets.

The fiber core segment accounts for approximately 30.0% of the global compacted strand surface contact wire rope market in 2025, representing the leading classification category. Its dominance reflects its continued preference in applications that require flexibility, corrosion resistance, and reduced weight. Fiber core wire ropes are commonly utilized in lifting operations and construction equipment where bending fatigue performance is essential for operational safety and service life.

The segment’s market position is supported by its suitability for moderate-load applications, where ease of handling and lubrication absorption improve operational reliability. Fiber cores, typically made from natural or synthetic materials, also enhance rope flexibility compared to steel alternatives, making them ideal for equipment with smaller drum diameters. Despite the higher strength characteristics of steel core ropes, fiber core variants maintain strong adoption in industries prioritizing adaptability and mechanical resilience under dynamic loading conditions. Manufacturers continue to refine core materials to improve moisture resistance and dimensional stability. The segment remains prominent due to balanced performance characteristics that align with cost-effective and safety-focused lifting and rigging operations across construction, marine, and general industrial applications.

The mining segment represents about 35.0% of the total compacted strand surface contact wire rope market in 2025, making it the largest application category. This segment’s leading position is attributed to the extensive use of wire ropes in hoisting, haulage, and conveying systems within mining operations. Compacted strand wire ropes are favored for their high breaking strength, abrasion resistance, and improved surface contact, ensuring consistent performance under heavy loads and demanding environmental conditions.

The mining industry relies on these ropes for shaft hoisting, dragline operation, and material transport, where structural integrity and fatigue resistance are essential. The compacted surface reduces strand deformation and enhances wear life, enabling longer maintenance intervals and improved operational safety. Demand is particularly strong in regions with significant mining activity, including East Asia, Latin America, and Africa. Steel producers and rope manufacturers continue developing advanced compaction techniques to improve load distribution and reduce internal friction. The segment’s growth is supported by global investment in mineral extraction and the replacement of conventional wire ropes with high-durability alternatives. Mining remains the central application for compacted strand wire ropes due to its reliance on dependable lifting and hauling solutions under intensive mechanical stress conditions.

The compacted strand surface contact wire rope market is growing as industries seek durable and high-performance lifting and hoisting solutions. These ropes feature increased surface contact between strands, improving fatigue and wear resistance while extending service life. Expanding applications in construction, mining, elevators, and port operations support market growth. Cost sensitivity, material supply fluctuations, and compatibility issues with existing equipment limit wider adoption. The market trend is moving toward lightweight, high-strength materials and specialised rope profiles designed for efficiency and safety in demanding operating conditions across industrial and infrastructure sectors.

Demand is driven by the need for wire ropes capable of withstanding heavy loads, continuous operation, and harsh environments. Compacted strand designs reduce internal friction and provide smoother contact with drums and sheaves, resulting in longer operational life and reduced maintenance. Expanding mining, construction, and offshore activities are increasing usage of these ropes in cranes, hoists, and lifting systems. The global shift toward automated and high-capacity machinery further enhances demand for reliable wire rope solutions that deliver consistent performance and minimize downtime in critical applications.

High production costs and complex manufacturing processes limit the adoption of compacted strand surface contact wire ropes. Specialized compaction equipment, stringent quality control, and advanced metallurgy raise the overall product cost, reducing accessibility for small or medium-scale operations. Retrofitting existing equipment can also be costly due to the need for compatible drums or anchoring systems. In developing regions, limited technical expertise and price sensitivity slow the shift from conventional wire ropes to higher-performance alternatives, even when operational benefits are clearly established.

The market is progressing toward the use of advanced materials, innovative surface treatments, and optimized rope geometries. Manufacturers are focusing on lighter yet stronger wire ropes that maintain load-bearing capacity while reducing weight and wear. Adoption of high-strength steel, improved coatings, and synthetic core technologies enhances corrosion resistance and flexibility. Custom rope profiles designed for specific mechanical conditions are gaining popularity in sectors such as construction, marine transport, and heavy equipment. Expanding infrastructure investment and modernization in emerging economies continue to drive the evolution of compacted strand technologies.

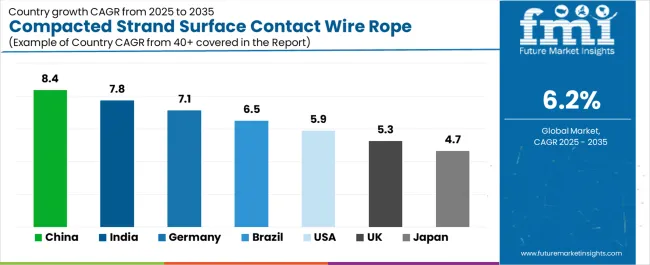

| Country | CAGR (%) |

|---|---|

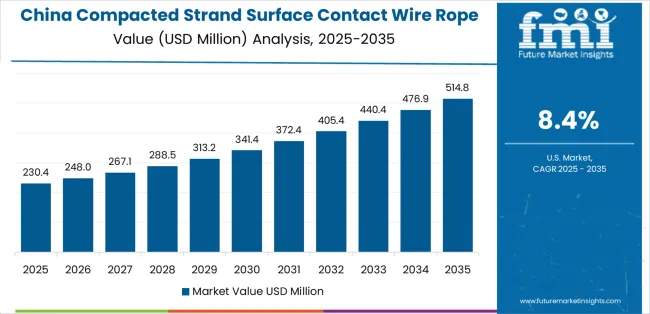

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The compacted strand surface contact wire rope market is experiencing robust global expansion, led by China at an 8.4% CAGR through 2035, driven by rapid industrialization, construction growth, and advances in heavy-duty material manufacturing. India follows at 7.8%, supported by infrastructure development, mining projects, and increasing demand in transportation and energy sectors. Germany, growing at 7.1%, benefits from precision engineering and innovation in high-tensile steel wire applications. Brazil records 6.5%, reflecting growing industrial operations and port modernization. The USA, with a 5.9% CAGR, remains strong in aerospace and marine sectors, while the UK (5.3%) and Japan (4.7%) show consistent progress through focus on safety standards, product innovation, and efficiency in load-bearing and lifting applications.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from compacted strand surface contact wire ropes in China is projected to grow at a CAGR of 8.4% through 2035, supported by large-scale infrastructure construction, industrial modernization, and transportation system upgrades. The expansion of ports, mining operations, and high-rise construction is driving sustained demand for high-tensile wire ropes. Domestic manufacturers are investing in advanced compaction technologies and surface treatment methods to enhance durability and fatigue resistance. Government infrastructure programs and export-oriented manufacturing are reinforcing steady utilization across industrial sectors.

Revenue from compacted strand surface contact wire ropes in India is increasing at a CAGR of 7.8%, supported by rapid industrialization and modernization across construction, power, and logistics sectors. Demand from cranes, elevators, and material handling equipment continues to grow with expanding infrastructure projects. Domestic rope manufacturers are focusing on surface compaction and anti-corrosion technologies to meet heavy-load performance standards. Government investment in transportation and port capacity development supports consistent market growth.

Revenue from compacted strand surface contact wire ropes in Germany is advancing at a CAGR of 7.1%, supported by the country’s engineering precision and advanced material technology. Industrial equipment, offshore applications, and cranes in logistics and energy sectors are primary users of high-performance wire ropes. Manufacturers continue to improve compaction uniformity and surface finish to extend operational life. Germany’s regulatory focus on safety and performance standards maintains consistent replacement cycles.

Revenue from compacted strand surface contact wire ropes in Brazil is projected to rise at a CAGR of 6.5%, supported by growing industrial capacity, construction expansion, and mining sector investment. The country’s heavy industry and infrastructure projects continue to rely on high-strength wire ropes for lifting, transport, and port operations. Import partnerships with global rope manufacturers provide access to specialized products meeting technical standards.

Revenue from compacted strand surface contact wire ropes in the United States is increasing at a CAGR of 5.9%, supported by safety regulations, heavy industry modernization, and investment in material handling systems. Demand from construction, energy, and transportation sectors remains steady due to equipment replacement requirements. Manufacturers are focusing on improved compaction precision and surface protection coatings. Replacement of aging industrial infrastructure continues to generate sustained procurement activity.

Revenue from compacted strand surface contact wire ropes in the United Kingdom is growing at a CAGR of 5.3%, supported by modernization in construction, maritime, and industrial maintenance sectors. The focus on reliable lifting and hoisting systems drives replacement demand for durable compacted ropes. Manufacturers are introducing advanced wire compaction methods and corrosion-resistant coatings suited for maritime applications. Ongoing infrastructure maintenance ensures consistent product consumption.

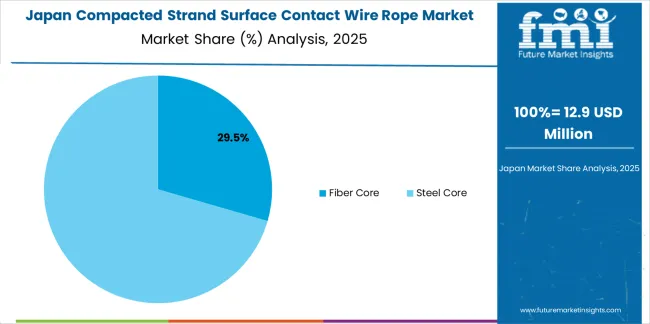

Revenue from compacted strand surface contact wire ropes in Japan is projected to grow at a CAGR of 4.7%, supported by high engineering precision, strong safety standards, and consistent equipment maintenance cycles. Domestic producers emphasize compacted wire geometry, tensile uniformity, and anti-fatigue design. Demand from shipbuilding, cranes, and industrial lifting systems remains steady due to reliability requirements. Continuous improvement in coating materials and wire alignment technology sustains long-term competitiveness.

The global compacted strand surface contact wire rope market is moderately fragmented, with competition shaped by established steel wire manufacturers and specialized lifting and rigging system producers. Carl Stahl Sava Industries maintains a recognized position through precision-engineered compacted strand designs tailored for high-load and structural applications. Bekaert and SWR Group occupy significant shares within the premium segment, leveraging advanced metallurgical processes and surface compaction technologies to enhance tensile strength and fatigue resistance. Industrial Wire Rope Supply and Usha Martin compete through wide product portfolios and global distribution networks serving mining, construction, and offshore operations.

Kiswire and Teufelberger emphasize high-performance steel grades and customized compaction profiles for specialized lifting and mechanical transmission uses. PFEIFER and DSR Wire provide tailored solutions for heavy-duty and crane applications, focusing on dimensional accuracy and surface uniformity. Gustav Wolf and YoungWire maintain stable positions in industrial supply chains, supporting OEM and maintenance markets. Brugg and Fasten Steel Rope demonstrate regional competitiveness in Europe and Asia, respectively, emphasizing production capacity and consistent quality standards. Chinese manufacturers such as Guizhou Steel Rope, Shenwang Group Wire Rope, Zhongying Wire Rope, Taili Steel Rope, Langshan Wire Rope, Safety Wire Rope, JULI Sling, and YUNYU Metal Products strengthen market volume through cost-efficient production and export-focused strategies. Competitive advantage across the sector depends on metallurgical precision, strand compaction consistency, corrosion resistance, and certification compliance, while long-term differentiation relies on advanced surface treatment technology and automated manufacturing control.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 419.5 million |

| Type (Classification) | Fiber Core, Steel Core |

| Application | Mining, Fishing, Construction Machinery, Elevators, Lifting Equipment, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Carl Stahl Sava Industries, Bekaert, SWR Group, Industrial Wire Rope Supply, Usha Martin, Kiswire, Teufelberger, PFEIFER, DSR Wire, Gustav Wolf, YoungWire, Brugg, Fasten Steel Rope, Guizhou Steel Rope, Shenwang Group, Zhongying Wire Rope, Taili Steel Rope, Langshan Wire Rope, JULI Sling, YUNYU Metal Products |

| Additional Attributes | Dollar sales by classification and application; regional adoption trajectories (notably East Asia and South Asia); analysis of metallurgical quality, compaction uniformity, and surface treatments; production and equipment complexity constraints; retrofit compatibility and certification requirements; lifecycle cost, maintenance intervals, and opportunities in high-tensile alloys and corrosion-resistant coatings. |

The global compacted strand surface contact wire rope market is estimated to be valued at USD 419.5 million in 2025.

The market size for the compacted strand surface contact wire rope market is projected to reach USD 765.6 million by 2035.

The compacted strand surface contact wire rope market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in compacted strand surface contact wire rope market are fiber core and steel core.

In terms of application, mining segment to command 35.0% share in the compacted strand surface contact wire rope market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Strand Displacement Amplification Market - Growth & Outlook 2025 to 2035

Chopped Strand Mat Stitch Bonding Machine Market Size and Share Forecast Outlook 2025 to 2035

Prestressed Concrete Wire and Strand Market Growth – Trends & Forecast 2024-2034

Ropes Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Ropeless Elevator Market Growth – Trends & Forecast 2024-2034

Rope Rescue Harness Market

Propene-1,3-Sulfonic Acid Lactone Market Size and Share Forecast Outlook 2025 to 2035

Property Management Software Market Growth - Trends & Forecast 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA