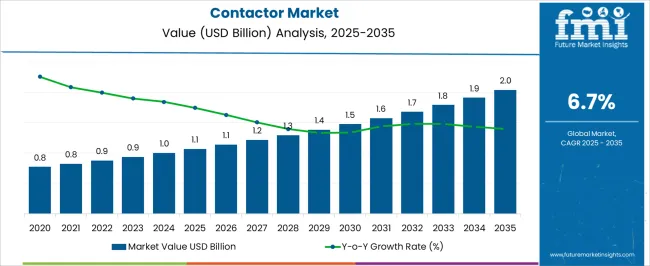

The contactor market, valued at USD 1.1 billion in 2025, is projected to reach USD 2.0 billion by 2035, with a CAGR of 6.7%. Between 2021 and 2025, the market is expected to grow from USD 0.8 billion to USD 1.1 billion, with annual increments of USD 0.8 billion, USD 0.9 billion, and USD 1.0 billion. This early phase marks a period of modest growth, driven by increasing demand for contactors in industrial and commercial applications. The adoption of contactors in electrical systems for power control and protection is key to this phase, with growth fueled by steady industrial expansion and upgrades to energy-efficient systems. As the market progresses into 2026-2030, it accelerates, expanding from USD 1.1 billion to USD 1.5 billion, passing through USD 1.2 billion, 1.3 billion, and 1.4 billion.

This inflection point marks stronger growth, driven by rising automation and increasing demand for smart grids, renewable energy solutions, and electric vehicles (EVs). The shift towards these advanced technologies requires more sophisticated and reliable electrical components, including contactors. From 2031 to 2035, the market is expected to continue expanding, reaching USD 2.0 billion, with intermediate values progressing through USD 1.6 billion, USD 1.7 billion, USD 1.8 billion, and USD 1.9 billion. This final phase highlights robust growth, driven by increased adoption of clean energy solutions, more automation in industries, and advancements in electrical systems that require higher-performing contactors. The market’s expansion reflects the growing demand for sustainable, efficient energy systems across various sectors.

| Metric | Value |

|---|---|

| Contactor Market Estimated Value in (2025 E) | USD 1.1 billion |

| Contactor Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The electrical equipment market is the largest contributor, accounting for approximately 35-40% of the market. Contactors are widely used in electrical circuits to control the flow of electricity, making them essential components in power distribution systems, motor control centers, and circuit protection. The industrial automation market contributes around 25-30%, as contactors are crucial for automating machinery and controlling electrical power to various industrial equipment, ensuring smooth operations in factories and plants.

The construction market holds about 15-18%, with contactors used in building electrical systems, from residential homes to large-scale commercial complexes, for switching applications and ensuring safe electrical connections. The automotive market adds approximately 10-12%, as contactors are used in electric vehicles (EVs) and other automotive applications for controlling various electrical components, such as motors, HVAC systems, and lighting. The energy and utilities market contributes around 5-8%, where contactors play a critical role in the switching of electrical grids, renewable energy systems, and other power generation and distribution networks.

The contactor market is witnessing robust growth, supported by increasing electrification trends across industries and the rising adoption of energy-efficient systems. Demand has been amplified by advancements in automation, renewable energy integration, and electric mobility, creating sustained opportunities for high-performance contactors. The current market scenario reflects heightened investment in electrical infrastructure modernization, with both industrial and transportation sectors driving adoption.

Regulatory frameworks promoting energy efficiency and electrical safety have further reinforced market expansion, as contactors are essential for reliable switching and protection in medium- and high-voltage applications. The future outlook remains optimistic, with the rapid penetration of electric vehicles, renewable power projects, and smart grid technologies poised to create substantial demand.

Ongoing technological innovations, including the development of compact, durable, and arc-resistant contactor designs, are expected to enhance operational efficiency and lifespan. As industries transition towards cleaner and more automated systems, the contactor market is set to remain a pivotal segment in the global electrical components landscape.

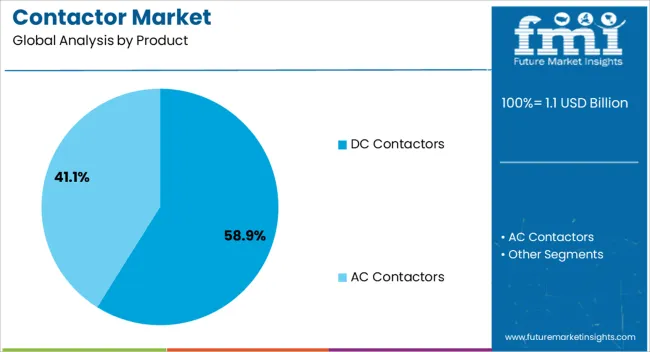

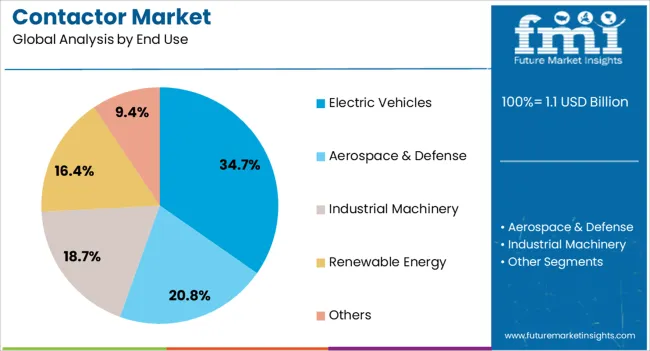

The contactor market is segmented by product, end use, and geographic regions. By product, contactor market is divided into DC Contactors and AC Contactors. In terms of end use, contactor market is classified into Electric Vehicles, Aerospace & Defense, Industrial Machinery, Renewable Energy, and Others. Regionally, the contactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The DC contactors segment dominates the product category, representing approximately 58.9% of the market share. This segment’s growth is attributed to its critical role in electric vehicle applications, where direct current switching is essential for battery management systems and propulsion units.

The segment benefits from increased adoption in battery-powered systems, particularly in electric vehicles and solar installations, where DC switching is critical. Continuous advancements in contact materials, arc suppression technologies, and miniaturization have further strengthened the appeal of DC contactors.

Additionally, manufacturers are focusing on improving thermal efficiency and reducing maintenance requirements, which aligns with end-user preferences for long-lasting and energy-efficient solutions. With the ongoing shift towards electrification and storage-based power systems, DC contactors are expected to maintain their dominant market position in the foreseeable future.

The electric vehicles segment leads the end-use category, accounting for around 34.7% of the market share. Its dominance is attributed to the accelerating global shift towards sustainable transportation and the substantial investments in EV production capacity. Contactors play a critical role in electric vehicles by enabling safe and efficient power distribution, battery isolation, and protection during charging and operation.

The segment’s growth is reinforced by stringent emission regulations and government incentives that encourage EV adoption, thereby driving demand for specialized contactor solutions. Advancements in high-voltage contactor technology have improved reliability and safety standards, making them integral components in EV powertrains.

Additionally, the proliferation of fast-charging infrastructure and the development of larger battery packs have increased the technical requirements for contactors, spurring innovation in this category. With the EV market projected to expand rapidly over the next decade, the electric vehicles segment is expected to remain the leading end-use application for contactors.

Contactors are essential for controlling the switching of electrical circuits, and their demand is driven by the expanding automation and electrification of various sectors, including energy, construction, and manufacturing. The market is also supported by advancements in smart grids, renewable energy systems, and electric vehicles (EVs). Challenges include the high cost of raw materials, energy-efficient production processes, and the need for regular technological upgrades to meet evolving safety standards. Opportunities exist in the growing adoption of smart contactors integrated with IoT and wireless communication features. Trends point to a shift towards energy-efficient, high-performance, and compact contactors that can handle high-voltage applications in increasingly sophisticated electrical systems.

The demand for contactors is driven by the increasing trend of automation and electrification in industrial applications. Industries are increasingly adopting electric systems for their efficiency, cost-effectiveness, and ability to improve operational reliability. In manufacturing plants, automated control systems rely on contactors to manage high-voltage electrical circuits, ensuring the safe operation of machinery and equipment. Additionally, the shift towards renewable energy sources, such as solar and wind power, is creating demand for contactors that can control electrical systems in these installations. The growing use of electric vehicles (EVs) is also contributing to the expansion of the contactor market, as specialized contactors are required to manage high-current electrical circuits in EV charging stations and battery systems.

The contactor market faces challenges related to the high cost of raw materials such as copper, aluminum, and other alloys used in manufacturing electrical components. Additionally, the complexity of designing contactors that meet increasingly stringent safety and performance standards, particularly in high-voltage applications, requires significant investment in research and development. Manufacturers must also contend with the cost and energy consumption associated with the production processes, which can affect the overall pricing of contactors. Regulatory compliance, particularly regarding electrical safety standards and environmental regulations, adds to the operational complexity. As electrical systems evolve, contactor manufacturers must continuously upgrade their products to maintain performance in more advanced and diverse applications.

Smart contactors allow for remote monitoring, diagnostics, and control of electrical systems, which is particularly valuable in industrial and commercial applications that require high levels of automation and efficiency. The rise of electric vehicles (EVs) also presents significant opportunities, as specialized contactors are essential for controlling the charging and discharging of electric vehicle batteries. As the adoption of EVs continues to grow, the demand for contactors that can handle the high current and voltage levels involved in EV charging infrastructure is expected to increase. Manufacturers who can offer technologically advanced, energy-efficient, and reliable contactors are well-positioned to capture these emerging market opportunities.

The contactor market is witnessing trends toward the development of energy-efficient, high-performance, and compact contactor solutions. As industries and consumers alike prioritize energy efficiency, manufacturers are designing contactors that reduce energy consumption and minimize waste during operation. The trend toward compact and modular contactors is driven by the increasing need for space-saving electrical components in modern electrical systems. There is a growing emphasis on the development of contactors that can handle high-voltage and high-current applications, particularly in sectors such as renewable energy, transportation, and electric vehicles. These innovations are helping to meet the demand for more efficient and versatile electrical systems, further boosting the contactor market.

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

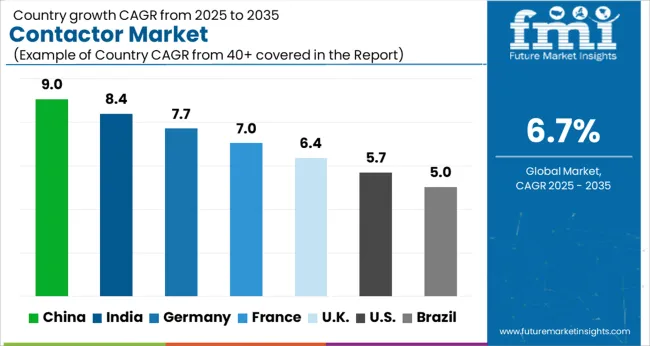

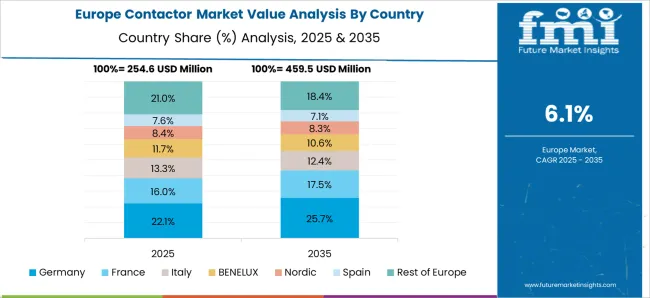

The global contactor market is projected to grow at a CAGR of 6.7% from 2025 to 2035. China leads the market with a CAGR of 9.0%, followed by India at 8.4% and Germany at 7.7%. The UK and USA are expected to grow at 6.4% and 5.7%, respectively. The market is primarily driven by the increasing industrialization, infrastructure development, and adoption of energy-efficient and automation solutions across key sectors such as manufacturing, energy, and construction. The demand for reliable and efficient electrical components like contactors is expected to grow as the world moves towards more modern and sustainable energy systems. The analysis includes over 40+ countries, with the leading markets detailed below.

The contactor market in China is expected to grow at a CAGR of 9.0% from 2025 to 2035, driven by the country’s extensive industrialization and focus on infrastructure development. With China being one of the largest manufacturing hubs globally, the demand for electrical components like contactors is surging in sectors such as automotive, construction, and energy. The adoption of automation in manufacturing processes is increasing the demand for efficient electrical systems, with contactors playing a critical role in managing electrical circuits and ensuring safety. China’s expansion in renewable energy projects, such as solar and wind farms, is contributing to market growth by integrating more sophisticated electrical systems that rely on contactors for safe operations. Additionally, the growing demand for electric vehicles (EVs) and energy-efficient solutions in both residential and industrial sectors further enhances the need for advanced electrical components.

The contactor market in India is expected to grow at a CAGR of 8.4% from 2025 to 2035, driven by the country’s rapid industrialization and infrastructure expansion. As India continues to invest in the modernization of its electrical grid and the growth of urban areas, the demand for efficient and reliable electrical components such as contactors is increasing. The automotive sector’s shift toward electrification and energy-efficient solutions is also contributing to the growing demand for contactors. The rise of automation in industrial sectors such as manufacturing and mining is another factor driving the market. India’s focus on renewable energy projects, including solar power generation and smart grid development, is further boosting the need for advanced electrical solutions. With the expanding middle class and increased residential and commercial infrastructure, demand for energy-efficient electrical systems is expected to rise.

The contactor market in Germany is projected to grow at a CAGR of 7.7% from 2025 to 2035, supported by the country’s robust manufacturing and industrial sectors. Germany’s push toward Industry 4.0 and automation in manufacturing is driving the demand for advanced electrical components, with contactors playing a vital role in controlling electrical circuits and ensuring safety. Additionally, Germany’s automotive sector is increasingly adopting electric vehicle (EV) technologies, requiring efficient and safe electrical solutions, which is boosting the demand for contactors. The country’s commitment to renewable energy integration, particularly in wind and solar power, is another key factor contributing to market growth. Germany’s extensive infrastructure development, including smart grid technologies and energy-efficient buildings, further enhances the demand for reliable electrical systems.

The contactor market in the UK is expected to grow at a CAGR of 6.4% from 2025 to 2035. The market’s growth is supported by increasing investments in renewable energy, energy-efficient solutions, and infrastructure development. The UK’s push toward achieving net-zero emissions by 2050 is creating a surge in demand for electrical components that can support sustainable energy systems, such as solar and wind power. The rise in residential and commercial infrastructure development in the country is driving the need for efficient electrical systems that use contactors to manage circuits safely. The increasing adoption of electric vehicles (EVs) and advancements in the automotive sector are also contributing to the demand for contactors, as EVs require reliable and efficient electrical components. The UK is also witnessing a growing trend of industrial automation and smart grid development, which further boosts the need for advanced electrical components.

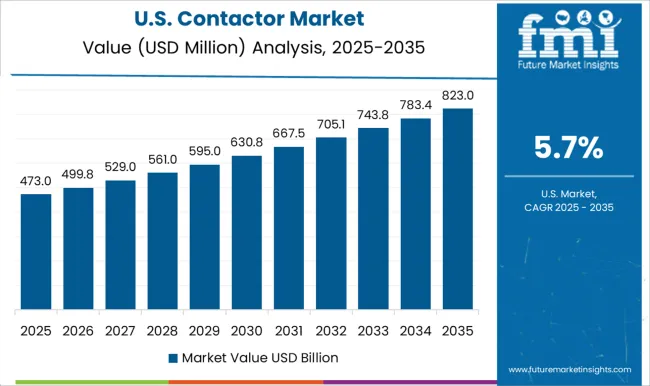

The USA contactor market is expected to grow at a CAGR of 5.7% from 2025 to 2035. The growth is fueled by ongoing investments in infrastructure, smart grid technologies, and energy-efficient solutions across residential, commercial, and industrial sectors. The USA market is also benefiting from the rapid electrification of the automotive sector, including the adoption of electric vehicles (EVs), which requires advanced electrical systems that rely on contactors for safety and efficiency. Furthermore, the USA government’s initiatives to promote energy efficiency, reduce carbon emissions, and modernize the electrical grid are also contributing to the market’s growth. In addition, the demand for automation in industries such as manufacturing, mining, and transportation is pushing the need for reliable electrical components like contactors.

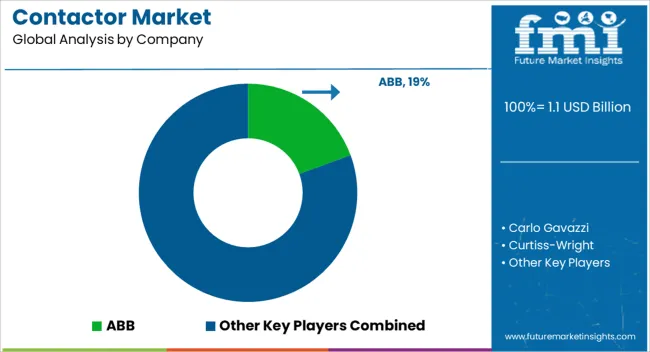

In the contactor market, competition revolves around providing reliable, efficient, and cost-effective solutions for controlling electrical circuits in a variety of industries, including industrial automation, power distribution, and HVAC systems. ABB is a market leader, offering a broad range of contactors with advanced features like energy efficiency, durability, and compact designs. The company's focus is on providing automation and control solutions that meet the growing demands of industrial sectors, particularly in power generation and distribution. Carlo Gavazzi competes by offering high-quality contactors for industrial automation, focusing on low power consumption, ease of integration, and long operational lifespans. The company emphasizes customization and user-friendly designs for enhanced performance in diverse applications. Curtiss-Wright focuses on providing reliable and high-performance contactors for demanding industries such as aerospace and defense. Their contactors are engineered for mission-critical applications, ensuring high reliability and safety under extreme conditions. Eaton competes with a diverse portfolio of electrical components, including contactors designed for energy management and power distribution. Eaton's contactors are known for their robust construction, energy efficiency, and ability to handle heavy-duty applications in industrial and commercial sectors.

Fuji Electric offers a comprehensive range of contactors, with a focus on energy efficiency and long-lasting performance, particularly in industrial automation and HVAC systems. Geya specializes in low-voltage electrical control and protection products, including compact contactors that cater to both industrial and residential applications. Kunshan GuoLi Electronic Technology, with a focus on cost-effective and reliable solutions, provides contactors that are widely used in power distribution and automation sectors. KA Schmersal competes by offering specialized contactors for industrial safety applications, emphasizing high safety standards and easy integration into automated systems. Lovato Electric is known for its innovative contractor solutions, designed for use in automation systems, electrical panels, and machinery, prioritizing ease of use and cost efficiency. LS Electric and Mitsubishi Electric provide a range of contactors designed for industrial automation and power distribution, with a focus on product reliability, efficiency, and cutting-edge technology. Rockwell Automation, a key player in industrial control, competes by offering intelligent contactors integrated with advanced automation and monitoring systems, allowing for real-time diagnostics and energy optimization in complex industrial environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product | DC Contactors and AC Contactors |

| End Use | Electric Vehicles, Aerospace & Defense, Industrial Machinery, Renewable Energy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Carlo Gavazzi, Curtiss-Wright, Eaton, Fuji Electric, Geya, Kunshan GuoLi Electronic Technology, KA Schmersal, Lovato Electric, LS Electric, Mitsubishi Electric, and Rockwell Automation |

| Additional Attributes | Dollar sales by product type (electrical, motor, safety), application (industrial, residential, commercial), and voltage (low voltage, medium voltage). Demand dynamics are driven by the growing need for energy-efficient and reliable electrical systems, industrial automation trends, and the demand for smart and connected control systems. Regional growth is strong in North America, Europe, and Asia-Pacific, supported by increasing industrial automation, manufacturing activities, and investments in energy-efficient infrastructure. |

The global contactor market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the contactor market is projected to reach USD 2.0 billion by 2035.

The contactor market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in contactor market are dc contactors and ac contactors.

In terms of end use, electric vehicles segment to command 34.7% share in the contactor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contactor-based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Train Contactor Market - Growth & Demand 2025 to 2035

Vacuum Contactors Market Growth - Trends & Forecast 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Electric Vehicle Contactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Contactor Market Size and Share Forecast Outlook 2025 to 2035

General Purpose DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA