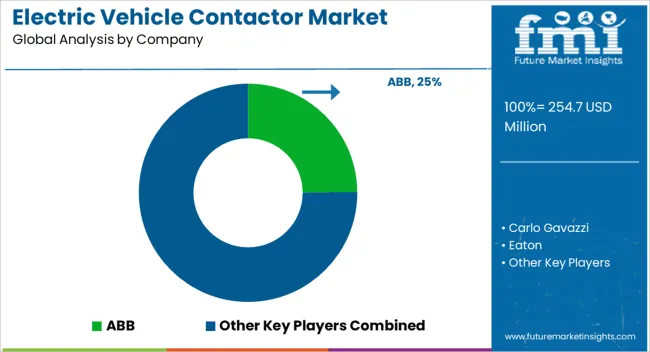

The global electric vehicle (EV) contactor market is projected to grow from USD 254.7 million in 2025 to USD 515.3 million by 2035, registering a CAGR of 7.3% over the forecast period. This growth is primarily driven by the rapid adoption of electric vehicles and hybrid electric vehicles worldwide, which has increased demand for reliable high-voltage switching and battery management components. EV contactors play a critical role in ensuring safety, efficient power transmission, and precise control of current flow in battery packs and charging systems.

From 2025 to 2030, moderate growth is expected as the market consolidates around key automotive OEMs and established component suppliers, with rising integration of EV contactors in passenger vehicles, buses, and commercial fleets. Innovation in solid-state contactors and lightweight, compact designs is anticipated to gradually influence purchasing decisions, particularly in Europe and North America, where EV adoption is accelerating.

Between 2030 and 2035, growth is expected to accelerate due to expanding EV production in Asia-Pacific, increased government incentives, and broader development of EV charging infrastructure. Enhanced focus on safety standards, high-performance battery systems, and integration with smart vehicle networks is likely to drive demand further. Companies investing in scalable manufacturing, technological innovation, and regional service networks are positioned to capture substantial market share during this period.

| Metric | Value |

|---|---|

| Electric Vehicle Contactor Market Estimated Value in (2025 E) | USD 254.7 million |

| Electric Vehicle Contactor Market Forecast Value in (2035 F) | USD 515.3 million |

| Forecast CAGR (2025 to 2035) | 7.3% |

The electric vehicle contactor market is shaped by five major parent markets, each influencing adoption rates and long-term growth. The automotive electrification market holds the largest share at 40%, as contactors are critical for high-voltage battery systems, hybrid platforms, and pure electric drivetrains. The energy storage systems market accounts for 22%, where contactors provide safe switching in stationary storage units that stabilize grid operations and renewable integration. The charging infrastructure segment contributes 18 percent, with contactors deployed in DC fast chargers, bidirectional charging stations, and commercial fleet charging points. The industrial automation and power electronics segment secures a 12% share, as contactors are used for switching in testing equipment, inverters, and energy management systems.

The aerospace and specialty mobility sector represents 8 percent, with contactors applied in electric buses, construction machinery, and emerging electric aviation prototypes. Collectively, automotive, energy storage, and charging infrastructure segments dominate with an 80% share, underscoring how transport electrification and grid modernization form the principal growth levers. The remaining 20% distributed across industrial automation and specialty mobility highlights the diversification of contactor applications beyond vehicles, demonstrating that the electric vehicle contactor market is not just vehicle-dependent but positioned across multiple technology-driven industries.

The electric vehicle contactor market is witnessing robust growth driven by the accelerating shift toward vehicle electrification and the growing adoption of high voltage electric powertrains. As electric vehicles become more advanced and energy dense, demand for reliable and durable contactors capable of managing large electrical loads has significantly increased.

Innovations in thermal management, arc suppression, and contact reliability are enhancing product lifespans and performance under high cycle conditions. Automotive OEMs are also emphasizing contactor integration into compact and lightweight platforms to support space constrained electric vehicle architectures.

Additionally, global regulatory mandates targeting carbon emission reduction are further accelerating electric vehicle production, reinforcing the need for efficient and safe contactor systems. With continuous advancements in battery technology and power electronics, the outlook for electric vehicle contactors remains positive, supported by the industry's drive toward increased efficiency, safety, and performance in next generation electric drivetrains.

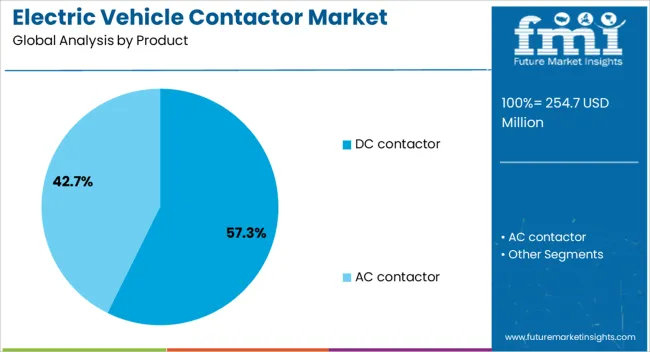

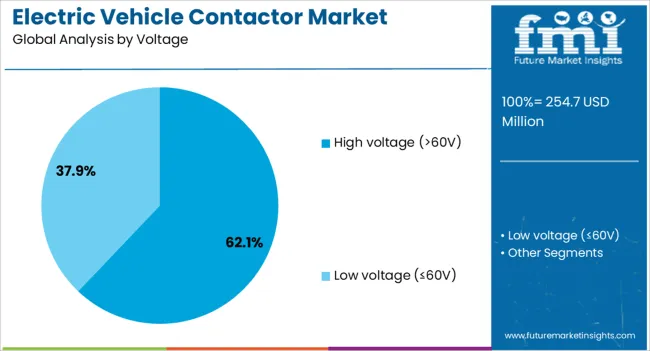

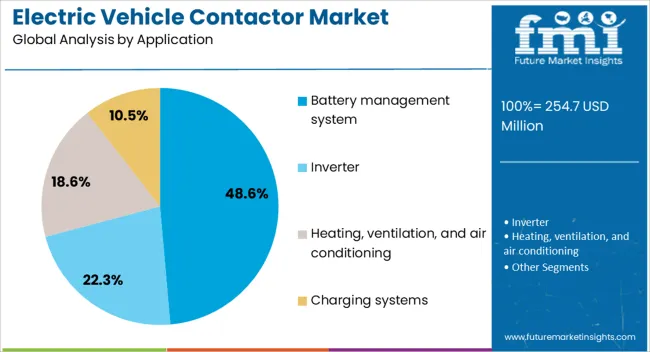

The electric vehicle contactor market is segmented by product, voltage, application, and geographic regions. By product, electric vehicle contactor market is divided into DC contactor and AC contactor. In terms of voltage, electric vehicle contactor market is classified into High voltage (>60V) and Low voltage (≤60V). Based on application, electric vehicle contactor market is segmented into Battery management system, Inverter, Heating, ventilation, and air conditioning, and Charging systems. Regionally, the electric vehicle contactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The DC contactor product segment is projected to account for 57.30% of the total market revenue by 2025, making it the dominant product type. This growth is attributed to its ability to handle high current switching operations essential for electric vehicle power distribution systems.

DC contactors are preferred for their reliability in breaking and making circuits under load, which is critical in maintaining safety and stability in electric vehicle operations. Their compact design, arc suppression capabilities, and thermal efficiency have contributed to their widespread adoption across electric vehicle platforms.

As powertrain voltages and current loads increase in modern EV models, the demand for high performance DC contactors continues to rise, reinforcing their leading position in the product segment.

The high voltage over 60V segment is expected to represent 62.10% of the total market revenue within the voltage category by 2025. This dominance is driven by the increasing deployment of high voltage architectures in electric vehicles to support improved energy efficiency and faster charging capabilities.

High voltage systems enable reduced current flow for the same power level, minimizing energy losses and optimizing system performance. Electric vehicle manufacturers are shifting to high voltage platforms to accommodate larger battery packs and more powerful drivetrains.

As a result, contactors designed for high voltage operation are becoming critical components for powertrain safety, fault isolation, and system protection, solidifying their prominence in the voltage category.

The battery management system application segment is projected to hold 48.60% of total market revenue by 2025, establishing it as the leading application area. This segment’s growth is driven by the central role of battery management systems in monitoring and protecting the battery pack in electric vehicles.

Contactors are integrated within these systems to enable controlled connection and disconnection of the battery from the vehicle's powertrain and auxiliary loads. They help prevent overcurrent conditions, short circuits, and unsafe voltage fluctuations, thereby ensuring safe and efficient battery operation.

As battery management systems evolve to handle more complex thermal and electrical controls, the integration of high reliability contactors becomes increasingly essential, reinforcing their dominance in this application category.

The electric vehicle contactor market is expanding with strong influence from high-voltage adoption, charging infrastructure, energy storage systems, and regulatory standards. Collectively, these dynamics underline its role as a central enabler of electric mobility and energy transition.

Expansion of electric vehicles with higher voltage battery packs has fueled the significance of contactors as core switching devices. These components ensure isolation, current management, and thermal safety under demanding conditions. Automakers are increasingly deploying contactors in both battery electric and plug-in hybrid models to maintain reliability. Growth is supported by regulatory pressure that mandates advanced safety measures in high-voltage circuits. This adoption pattern has enhanced demand across passenger vehicles, buses, and commercial fleets. With manufacturers focusing on improved current capacity and compact design, the role of contactors has been reinforced as indispensable. The trajectory indicates that high-voltage system integration is among the most dominant drivers shaping overall contactor demand worldwide.

Expansion of charging infrastructure has transformed contactor requirements by emphasizing fast and safe current switching. DC fast charging stations, home chargers, and commercial fleet depots all rely on high-performance contactors for safety compliance. The transition toward high-power charging networks has widened the scope for suppliers providing compact, reliable, and heat-resistant units. Demand is influenced by increasing installation of smart grid-compatible charging hubs across leading regions. Contactors play a pivotal role in bidirectional charging systems, ensuring safe energy transfer between vehicle and grid. Their presence within both public and private charging applications highlights their central position in infrastructure expansion. This growth cycle reflects how charging networks are creating an indispensable channel for long-term revenue growth.

Energy storage systems have become a crucial outlet for electric vehicle contactors, particularly for grid-level stabilization and renewable energy integration. Stationary battery systems require high-performance contactors to provide secure isolation, arc suppression, and enhanced fault protection. Demand is supported by rising deployment of microgrids and backup systems across industrial and commercial units. Contactors are enabling safer load balancing and longer system life by ensuring controlled switching in critical applications. Their adoption within renewable projects and utility-driven installations underlines the role of contactors beyond vehicle applications. Suppliers who integrate contactors into modular storage systems gain an advantage as grid operators pursue stability and cost efficiency, which has created opportunities for diversified revenue channels.

Safety regulations governing electric mobility and energy infrastructure have accelerated the requirement for advanced contactor designs. Standards imposed across Europe, North America, and Asia have emphasized fault tolerance, thermal resistance, and isolation capabilities. Contactors meeting stringent compliance requirements are increasingly favored by OEMs and infrastructure developers. Regulatory initiatives mandating electric vehicle safety certification and charging infrastructure reliability have acted as catalysts for contactor upgrades. Manufacturers are competing through testing certifications, material science, and innovative architectures that ensure reliability under high load. Compliance has not only safeguarded performance but also boosted consumer confidence, which is critical for mass adoption. Regulatory shifts are expected to continue shaping product portfolios and industry competition in the long term.

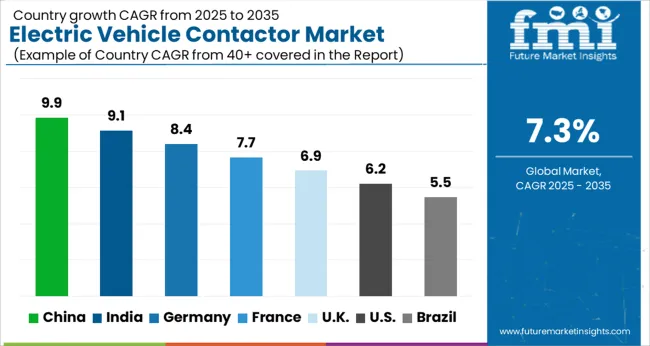

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

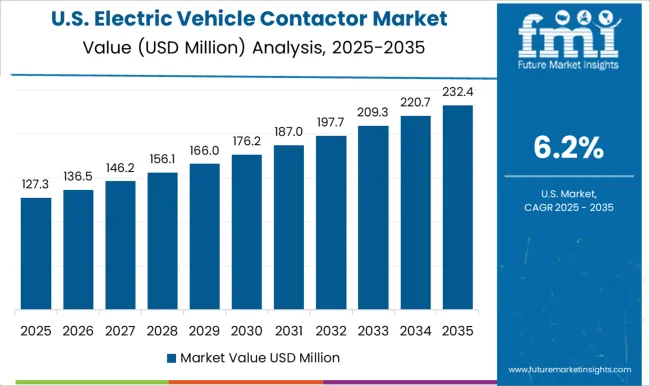

| USA | 6.2% |

| Brazil | 5.5% |

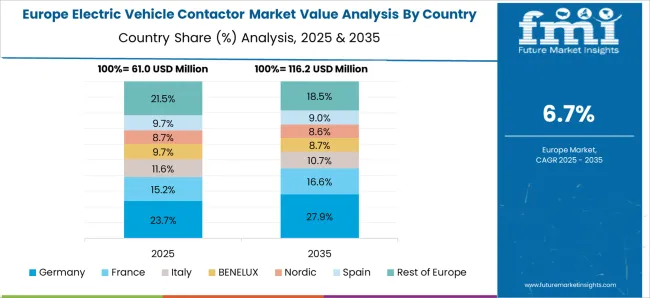

The global electric vehicle contactor market is projected to grow at a CAGR of 7.3% from 2025 to 2035. China leads the growth trajectory at 9.9%, followed by India at 9.1% and Germany at 8.4%, while France posts 7.7%, the UK records 6.9%, and the USA follows at 6.2%. The faster-growing Asian countries, particularly China and India, are benefiting from large-scale adoption of electric vehicles, extensive battery production bases, and government incentives. European nations such as Germany and France emphasize quality standards, safety compliance, and strong automotive manufacturing ecosystems. The UK and the USA show steady adoption through investments in fleet electrification and charging infrastructure expansion. The analysis spans over 40+ countries, with the leading markets detailed below.

The electric vehicle contactor market in China is projected to grow at a CAGR of 9.9% from 2025 to 2035, supported by scale in battery manufacturing, traction inverter integration, and localization of high-voltage components. Contactors are being specified across passenger cars, buses, and logistics fleets to secure isolation, arc suppression, and reliable current switching. Policies that prioritize domestic EV supply chains and charging corridors have created dependable volume for tiered suppliers. Testing to IEC and GB standards has been prioritized by OEMs to ensure fault tolerance in 800V architectures. In this view, China is expected to outpace peers as platform launches and cost engineering compress procurement cycles between 2025 and 2035.

The electric vehicle contactor market in India is projected to grow at a CAGR of 9.1% from 2025 to 2035, driven by localized EV platforms for two-wheelers, three-wheelers, and compact cars. Contactors are being adopted to manage pack isolation and thermal risks in cost-sensitive designs. State programs that promote public charging and fleet electrification have encouraged standardized specifications that simplify vendor qualification. Domestic assemblers are partnering with coil, seal, and enclosure suppliers to strengthen reliability in hot and dusty conditions. In an opinionated view, India is poised for persistent growth as contactor designs migrate from 400V to 800V on premium models through 2035.

The electric vehicle contactor market in Germany is projected to grow at a CAGR of 8.4% from 2025 to 2035, supported by engineering depth in power electronics and stringent type-approval norms. German OEMs specify contactors with tight tolerance on coil power, temperature rise, and endurance cycles to protect high-energy packs. Platform consolidation across brands is encouraging modular contactor families that reduce SKU complexity while preserving safety margins. Investment in premium EVs and performance hybrids keeps demand elevated for compact, low-loss devices that survive repeated fast-charge events. In a firm view, Germany is expected to sustain high specification thresholds through 2035, which favors suppliers with mature test benches and materials expertise.

The electric vehicle contactor market in the UK is projected to grow at a CAGR of 6.9% from 2025 to 2035, underpinned by fleet electrification, grid-service pilots, and charging investments. Contactors are being integrated into vans, buses, and last-mile vehicles to secure safe isolation during maintenance and rapid charging. Certification and traceability expectations remain high, which benefits suppliers offering documented failure analysis and end-of-line testing. Refurbishment programs for second-life batteries create recurring needs for reliable switching in stationary storage. It is judged that steady growth will continue as public charging density improves and municipal fleets scale through 2035.

The electric vehicle contactor market in the USA is projected to grow at a CAGR of 6.2% from 2025 to 2035, shaped by pickup trucks, SUVs, and commercial fleets that demand high current capacity. Contactors are being engineered for harsh thermal cycles, vibration profiles, and repeated DC fast-charge events. Federal and state incentives for manufacturing and charging corridors support domestic sourcing of coils, contacts, and magnetic assemblies. Safety certification to UL and SAE standards remains central to procurement. In an assertive view, momentum will persist through 2035 as fleet conversions, depot charging, and V2G pilots broaden use cases for durable, low-loss contactors.

The electric vehicle contactor market is shaped by global automotive component manufacturers, specialized EV solution providers, and regional electrical equipment producers. Leading players such as Siemens, ABB, TE Connectivity, and Schneider Electric hold strong positions by offering diversified portfolios of high-voltage contactors, relays, and switching devices for electric vehicles, hybrid vehicles, and charging infrastructure. Competitive differentiation is largely driven by switching reliability, current-carrying capacity, compact design, thermal performance, and integration with battery management systems. Regional manufacturers, particularly in Asia-Pacific and Europe, compete by offering cost-effective, lightweight, and customized contactor solutions to meet local automotive standards and OEM requirements.

Strategic partnerships with EV manufacturers, battery suppliers, and charging infrastructure providers enhance market reach and technology adoption. Innovation in solid-state contactors, high-voltage insulation materials, and smart monitoring systems further strengthens competitive positioning. Companies prioritizing regulatory compliance, safety certifications, and robust after-sales support are well-positioned to capture significant market share. Overall, firms combining technological expertise, scalable manufacturing, and strong distribution networks are expected to benefit from the growing adoption of electric vehicles and expansion of EV infrastructure globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 254.7 Million |

| Product | DC contactor and AC contactor |

| Voltage | High voltage (>60V) and Low voltage (≤60V) |

| Application | Battery management system, Inverter, Heating, ventilation, and air conditioning, and Charging systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Carlo Gavazzi, Eaton, Fuji Electric FA Components & Systems Co., Ltd., GEYA Electrical Equipment Supply, K.A. Schmersal GmbH & Co. KG, L&T, LOVATO Electric S.p.A., LS ELECTRIC, Mitsubishi Electric Corporation, Panasonic Corporation, Rockwell Automation, Schaltbau, Schneider Electric, Sensata Technologies, Inc., Siemens, TE Connectivity, and Toshiba International Corporation |

| Additional Attributes | Dollar sales by voltage range, share by application (EVs, charging, storage), regulatory compliance impact, supplier landscape shifts, pricing trends, and OEM partnership opportunities. |

The global electric vehicle contactor market is estimated to be valued at USD 254.7 million in 2025.

The market size for the electric vehicle contactor market is projected to reach USD 515.3 million by 2035.

The electric vehicle contactor market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in electric vehicle contactor market are dc contactor and ac contactor.

In terms of voltage, high voltage (>60v) segment to command 62.1% share in the electric vehicle contactor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Vehicle DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA