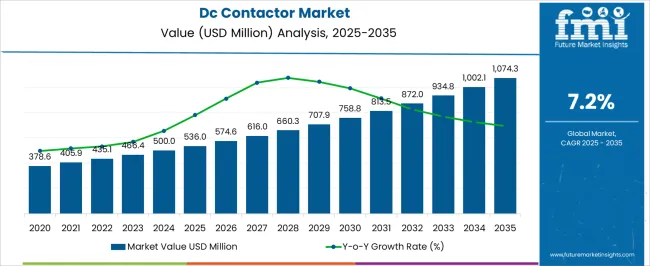

The DC contactor market, valued at USD 536.0 million in 2025 and projected to reach USD 1,074.3 million by 2035 at a CAGR of 7.2%, demonstrates a clear adoption path. From 2020 to 2024, the early adoption phase lifted the market from USD 378.6 million in 2020 to USD 500.0 million in 2024, showing consistent uptake across industrial and power applications. Between 2025 and 2030, the scaling phase emerges strongly as the market expands from USD 536.0 million in 2025 to USD 707.9 million by 2030, driven by demand acceleration and widening use cases across multiple segments.

From 2030 onward, the consolidation stage characterizes the market, where growth continues but at a more stabilized pace. The industry rises from USD 707.9 million in 2030 to USD 1,074.3 million in 2035, with expansion fueled by replacement demand and incremental additions rather than rapid new deployments. The lifecycle progression demonstrates a transition from foundation-building during early years to active acceleration in mid-phase and finally to structural maturity by 2035. This pattern ensures the DC contactor market remains on a stable growth path while balancing long-term adoption with consistent revenue opportunities within electrical systems.

| Metric | Value |

|---|---|

| Dc Contactor Market Estimated Value in (2025 E) | USD 536.0 million |

| Dc Contactor Market Forecast Value in (2035 F) | USD 1074.3 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The DC contactor market is part of the broader global electrical contactor market, estimated at around USD 8.5 billion in 2025. Within this parent industry, AC contactors dominate with nearly 80% share, while DC contactors represent around 6%, reflecting their specialized but essential role in DC-driven systems. Other segments such as miniature contactors account for 7%, definite purpose contactors for 4%, and vacuum contactors for 3%, together defining the overall market structure.

By 2035, the electrical contactor market is projected to exceed USD 13 billion, with AC contactors maintaining about 78% share due to their widespread use in residential, commercial, and industrial applications. DC contactors are expected to increase their contribution to 8%, supported by demand in electric mobility, renewable power systems, and industrial automation.

Within the DC segment, high-voltage applications account for roughly 45%, medium-voltage units for 35%, and low-voltage models for the remaining 20%. While smaller in scale compared to AC, the DC contactor segment demonstrates faster relative growth, highlighting its rising significance as part of the overall electrical equipment landscape.

The DC contactor market is experiencing strong growth driven by the rapid adoption of electric mobility, renewable energy integration, and advanced industrial automation. The rising deployment of battery-powered systems in transportation, grid storage, and industrial equipment has created a sustained need for reliable DC switching solutions.

Advances in arc suppression technology, compact designs, and enhanced current-handling capabilities have improved operational safety and performance in high-voltage environments. Regulatory focus on energy efficiency and safety standards is further encouraging manufacturers to innovate contactor designs for long service life and minimal maintenance.

With electric vehicles, solar power systems, and automated manufacturing requiring efficient DC switching, the market outlook remains favorable, offering opportunities for technological differentiation and strategic partnerships.

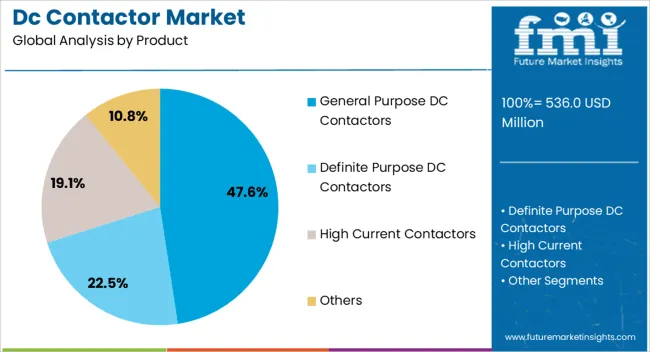

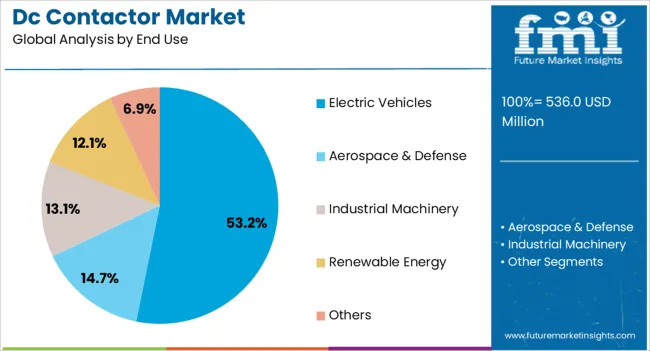

The DC contactor market is segmented by product, end use, and geographic regions. By product, the DC contactor market is divided into General Purpose DC Contactors, Definite Purpose DC Contactors, High Current Contactors, and Others. In terms of end use, the DC contactor market is classified into Electric Vehicles, Aerospace & Defense, Industrial Machinery, Renewable Energy, and Others. Regionally, the DC contactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The general purpose DC contactors segment is projected to account for 47.60% of total market revenue by 2025 within the product category, positioning it as the leading segment. This dominance is supported by the segment’s versatility across diverse applications, including industrial machinery, energy systems, and transportation equipment.

Its ability to handle varying voltage and current ratings, coupled with cost-effectiveness and ease of integration, has made it the preferred choice for a wide range of DC switching needs. Manufacturers have increasingly focused on improving durability, arc suppression, and thermal performance, enhancing reliability in demanding environments.

The adaptability and operational resilience of general purpose DC contactors continue to reinforce their leadership in the product segment.

The electric vehicles segment is expected to hold 53.20% of the total market revenue by 2025, establishing it as the dominant end use category. This growth is driven by the surging global shift toward electrified transportation and the corresponding demand for high-performance DC contactors in traction systems, battery management, and charging infrastructure.

The ability of DC contactors to ensure safe and efficient power distribution in high-voltage EV architectures has made them indispensable in modern electric vehicle design. Automakers and component suppliers are investing in advanced materials and contact technologies to enhance lifespan, reduce energy loss, and meet stringent automotive safety standards.

As EV adoption accelerates worldwide, the segment’s share is expected to remain strong, reflecting its central role in supporting sustainable transportation ecosystems.

The DC contactor market is expanding as industries adopt electrification technologies in automotive, renewable energy, and industrial automation applications. North America and Europe lead with demand from electric vehicles, battery storage systems, and rail transport, focusing on safety and durability. Asia-Pacific demonstrates rapid growth driven by large-scale EV manufacturing, solar projects, and infrastructure expansion. Manufacturers differentiate through arc suppression technologies, compact design, and high-voltage handling. Regional regulations, safety standards, and cost dynamics strongly influence adoption and competitive positioning in global markets.

Growth in electric vehicles, rail transport, and hybrid mobility solutions is a major driver of DC contactor demand. North America and Europe prioritize contactors designed for high-voltage EV batteries and rail electrification systems, emphasizing arc suppression and thermal stability. Asia-Pacific markets rapidly expand EV adoption and large bus fleets, requiring scalable, cost-efficient solutions. Differences in transportation electrification strategies influence design requirements, production volumes, and procurement practices. Leading suppliers deliver compact, high-reliability contactors for advanced applications, while regional manufacturers provide affordable models for mass-market vehicles. Transportation electrification contrasts strongly shape adoption, technological differentiation, and competitiveness in the global DC contactor market.

Deployment of renewable energy projects and battery energy storage systems is fueling demand for DC contactors. North America and Europe emphasize contactors supporting solar farms, wind systems, and grid-scale storage with high-voltage capabilities and long service life. Asia-Pacific markets prioritize cost-effective contactors for residential solar and microgrid projects to expand energy access. Differences in renewable integration strategies impact reliability, safety requirements, and project economics. Suppliers offering durable, renewable-ready contactors with arc-resistant designs secure greater adoption, while regional players target cost-sensitive storage solutions. Renewable integration contrasts shape adoption, safety compliance, and competitiveness in the global DC contactor market.

Strict safety standards and regulatory requirements for high-voltage systems strongly influence DC contactor adoption. North America and Europe mandate compliance with standards covering electrical isolation, fire safety, and thermal performance for EV and energy systems. Asia-Pacific markets vary, with advanced economies adopting international norms while developing regions follow domestic guidelines for cost-effectiveness. Differences in regulatory rigor affect approval processes, market access, and customer trust. Suppliers providing certified, globally compliant contactors gain strong adoption, while regional manufacturers compete through affordability. Regulatory and safety contrasts shape adoption, compliance strategies, and competitive positioning in global DC contactor markets.

Production costs and supply chain reliability are critical adoption factors for DC contactors. North America and Europe emphasize localized supply chains and premium designs to ensure resilience and performance in critical systems. Asia-Pacific markets focus on large-scale, cost-efficient production to meet high EV and renewable demand. Differences in cost structures and supply chain strategies affect pricing, delivery timelines, and market penetration. Leading suppliers invest in localized manufacturing and advanced materials to maintain competitiveness, while regional players deliver affordable, volume-driven solutions. Supply chain contrasts shape adoption, pricing dynamics, and growth opportunities across global DC contactor markets.

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global DC contactor market is projected to expand at a 7.2% CAGR through 2035, supported by applications in electric mobility, renewable integration, and industrial control systems. Among BRICS nations, China achieved 9.7% growth as production facilities were scaled up and exports of electrical components were increased, while India at 9.0% saw installations supported by infrastructure projects and automotive electrification. In the OECD region, Germany registered 8.3% growth where compliance frameworks ensured high-quality manufacturing and adoption across industrial automation. The United Kingdom, with 6.8% growth, sustained demand through consistent deployment in transport and energy networks. The USA, at 6.1%, remained a structured market where applications in defense and grid-related projects continued to provide incremental expansion. This report includes insights on 40+ countries; the top five markets are shown here for reference.

High adoption of renewable energy systems and electric mobility solutions has accelerated the DC contactor market in China, which is advancing at a 9.7% CAGR. The DC contactor market is being supported by demand for reliable switching devices in electric vehicles, battery storage units, and power distribution networks. Manufacturers are being focused on supplying durable, efficient, and cost competitive contactors for industrial and automotive applications. Distribution through authorized dealers, equipment suppliers, and online platforms is being strengthened. Investments in renewable power projects, charging infrastructure, and electric transportation are being identified as key contributors to market expansion. Continuous development in material durability, arc suppression, and compact designs is being undertaken. The DC contactor market in China is benefiting from the country leadership in clean energy and strong manufacturing capacity.

The rapid shift towards electric mobility and growing demand for industrial automation have pushed the DC contactor market in India to grow at 9.0% CAGR. The DC contactor market is being supported by its use in electric vehicles, solar installations, and backup power systems. Manufacturers are being encouraged to supply affordable and reliable solutions adapted to local infrastructure needs. Distribution networks are being expanded through partnerships with industrial distributors, authorized dealers, and renewable energy contractors. Technical workshops and awareness programs are being carried out to ensure correct installation and usage. Expansion of electric mobility, renewable energy adoption, and smart grid projects are being viewed as the main drivers of this market. Continuous product development for higher safety standards and better performance is being pursued.

Germany focus on advanced engineering and renewable energy integration is driving the DC contactor market at 8.3% CAGR. The DC contactor market is being supported by demand from electric vehicles, industrial equipment, and renewable power grids. Manufacturers are being encouraged to design high precision, durable, and performance optimized solutions that comply with stringent safety standards. Distribution channels are being maintained through industrial suppliers, authorized dealers, and technology integrators. Research on compact structures, advanced contact materials, and improved switching efficiency is being actively pursued. Growth in renewable energy adoption, electric transportation, and advanced automation systems is being recognized as major contributors. The DC contactor market in Germany is being strengthened by the country reputation for engineering quality and clean energy expansion.

Expanding renewable power and growing electric vehicle adoption are accelerating the DC contactor market in the United Kingdom, which is advancing at a 6.8% CAGR. The DC contactor market is being supported by its role in energy storage, EV charging, and industrial applications. Manufacturers are being encouraged to supply efficient, safe, and cost effective solutions that meet regulatory standards. Distribution through suppliers, equipment dealers, and renewable energy contractors is being strengthened. Public and private investments in renewable energy, charging networks, and industrial automation are being viewed as key factors driving demand. Continuous improvements in product designs for safety, arc suppression, and reliability are being pursued. The DC contactor market in the United Kingdom is expected to remain stable as adoption of EVs and clean energy accelerates.

Growing demand from electric vehicles, industrial automation, and energy storage systems has positioned the DC contactor market in the United States on a growth path at 6.1% CAGR. The DC contactor market is being supported by its widespread use in EV charging, renewable integration, and backup power systems. Manufacturers are being encouraged to deliver advanced, reliable, and high-capacity products to meet industry standards.

Distribution through authorized dealers, equipment suppliers, and industrial partners is being maintained. Research in heat-resistant materials, efficient switching mechanisms, and compact configurations is being pursued. Federal and state-level investments in renewable projects and electric mobility are being considered important contributors to growth. The DC contactor market in the United States is expected to expand further with rising energy transition initiatives.

The DC contactor market is competitive, with global and regional manufacturers offering solutions for industrial, transportation, renewable energy, and commercial applications. Key factors influencing competition include switching capacity, durability, compact design, safety certifications, and integration with control systems. Companies differentiate through high-performance components, advanced arc suppression technologies, and customizable solutions suitable for various voltage and current ratings.

Major players in the market include Schneider Electric, ABB, Siemens, Eaton, Fuji Electric, Mitsubishi Electric, LS Industrial Systems, Chint Group, Hager Group, and GE Industrial Solutions, all competing on reliability, product portfolio breadth, and global distribution networks. Regional and niche manufacturers focus on cost-effective solutions, specialized designs, and localized service support, particularly in emerging markets where DC contactor demand is growing due to renewable energy adoption and industrial automation.

Market competition is also driven by technological advancements such as smart contactors with IoT-enabled monitoring, remote control capabilities, and enhanced energy efficiency. Companies leverage strategic partnerships, R&D investments, and after-sales service programs to maintain and expand market share. Firms capable of combining high performance, safety compliance, and adaptability to customer-specific applications are gaining a competitive advantage in this evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 536.0 Million |

| Product | General Purpose DC Contactors, Definite Purpose DC Contactors, High Current Contactors, and Others |

| End Use | Electric Vehicles, Aerospace & Defense, Industrial Machinery, Renewable Energy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Carlo Gavazzi, Eaton, Fuji Electric, Geya, Lovato Electric, LS Electric, L&T, Mitsubishi Electric, Rockwell Automation, Schaltbau, Schmersal, Schneider Electric, Sensata Technologies, Siemens, TE Connectivity, and Toshiba |

| Additional Attributes |

The global dc contactor market is estimated to be valued at USD 536.0 million in 2025.

The market size for the dc contactor market is projected to reach USD 1,074.3 million by 2035.

The dc contactor market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in dc contactor market are general purpose dc contactors, definite purpose dc contactors, high current contactors and others.

In terms of end use, electric vehicles segment to command 53.2% share in the dc contactor market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA