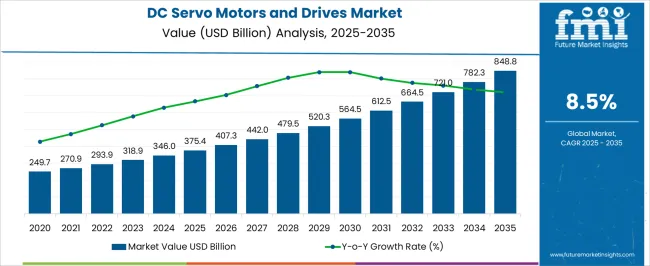

The DC servo motors and drives market is estimated to be valued at USD 375.4 billion in 2025 and is projected to reach USD 848.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. A contribution of volume versus price growth analysis indicates that the primary driver of market expansion in the early years is volume growth, with price growth contributing incrementally as the market matures.

Between 2025 and 2030, the market grows from USD 375.4 billion to USD 564.5 billion, contributing USD 189.1 billion in growth, with a CAGR of 9.0%. The volume contribution during this phase is significant as the demand for DC servo motors and drives increases across industries like automotive, manufacturing, and robotics. The growing need for high efficiency, precision, and automation in production lines drives the volume of sales. From 2030 to 2035, the market continues to grow from USD 564.5 billion to USD 848.8 billion, adding USD 284.3 billion in growth, with a slightly lower CAGR of 8.0%.

While volume growth continues to dominate, price growth becomes a more noticeable contributor in this later phase as manufacturers introduce advanced, high-performance products with premium features, including IoT connectivity, higher efficiency, and better control. Overall, volume growth plays a dominant role in early-stage expansion, while price growth contributes significantly as the market matures and product offerings become more sophisticated.

| Metric | Value |

|---|---|

| DC Servo Motors and Drives Market Estimated Value in (2025 E) | USD 375.4 billion |

| DC Servo Motors and Drives Market Forecast Value in (2035 F) | USD 848.8 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The DC servo motors and drives market is experiencing a strong growth trajectory, influenced by increasing demand for precise motion control in industrial and commercial environments. This growth is being supported by a broader shift toward automation and digitization across sectors such as robotics, electronics manufacturing, and automotive.

Industry news reports and company investor briefings have highlighted the growing deployment of DC servo systems in advanced machinery and automated processes, as businesses prioritize efficiency, accuracy, and scalability. The market is also being driven by advancements in feedback control systems, encoder technologies, and compact motor designs that enable improved performance in space-constrained environments.

Furthermore, the rise in electric and autonomous vehicle production has intensified the need for high-efficiency motion control solutions, where DC servo systems offer a strong value proposition. Future market potential is expected to be fueled by increased investment in smart factories and industrial IoT integration, where real-time responsiveness and programmable motion systems are critical to operational success.

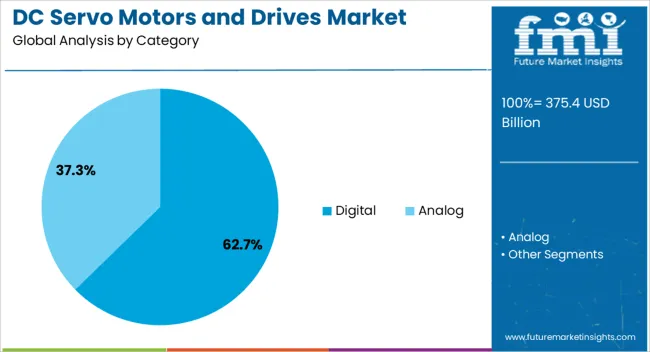

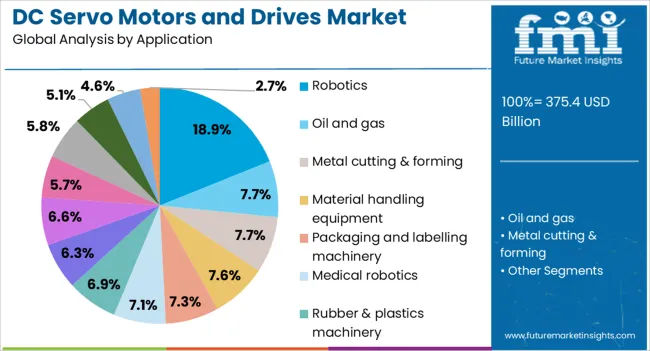

The DC servo motors and drives market is segmented by category, application, and geographic regions. By category, the DC servo motors and drives market is divided into Digital and Analog. In terms of application, the DC servo motors and drives market is classified into Robotics, Oil and gas, Metal cutting & forming, Material handling equipment, Packaging and labelling machinery, Medical robotics, Rubber & plastics machinery, Warehousing, Automation, Extreme environment applications, Semiconductor machinery, AGV, Electronics, and Others. Regionally, the DC servo motors and drives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The digital category is projected to account for 62.7% of the DC Servo Motors and Drives Market revenue share in 2025, making it the most dominant category. This leadership is being driven by the ability of digital servo systems to deliver enhanced precision, real-time feedback, and seamless integration with industrial automation protocols. Digital control allows for fine-tuned adjustments, improved energy efficiency, and reduced system noise, which have become essential for modern production environments.

Adoption has been reinforced by the growing requirement for predictive maintenance and condition monitoring, both of which are enabled through digital interfaces. Technical documentation from motor and drive manufacturers indicates a shift toward digital systems due to their superior diagnostics, configurability, and compatibility with PLC and CNC platforms.

As industries continue to invest in scalable and intelligent automation infrastructure, digital DC servo systems are being favored for their long-term adaptability and lower operational risks.

The robotics application segment is expected to hold 18.9% of the DC Servo Motors and Drives Market revenue share in 2025, positioning it as a key growth contributor. This segment’s prominence is being fueled by rapid advancements in industrial automation and the expanding role of robotics in precision-driven tasks across manufacturing, logistics, and medical industries.

Servo motors and drives are being increasingly embedded into robotic arms and autonomous platforms where precise control of speed, torque, and position is critical. Industry announcements and R&D initiatives have demonstrated a strong focus on collaborative robotics and mobile robots, both of which require compact, efficient, and responsive motion control systems.

The shift toward mass customization and flexible manufacturing systems has also amplified the need for servo-driven robotic solutions. With robotics becoming integral to modern production and service ecosystems, the sustained demand for intelligent motor and drive integration has ensured the robotics application segment remains a key driver of market growth.

The DC servo motors and drives market is expanding rapidly due to the growing demand for high-precision motion control solutions across various industries. These systems offer exceptional accuracy, speed, and torque control, making them ideal for applications such as robotics, automation, and manufacturing. As industries increasingly automate processes to improve productivity, the need for reliable, efficient motion control solutions is rising. Technological advancements in motor and drive designs, along with their integration with advanced control systems, are further driving market growth. The shift towards electric and automated systems in sectors like automotive and aerospace is also contributing to the growth of this market.

The primary driver behind the growth of the DC servo motors and drives market is the increasing adoption of automation across industries. Automation technologies require precise, high-performance motion control systems, and DC servo motors are ideal for applications that demand accurate positioning and speed control. In industries such as robotics, automotive manufacturing, and CNC machining, DC servo motors enable high-precision movements that are crucial for product quality and operational efficiency. Additionally, the growing demand for robotics and automated systems, driven by the need to reduce labor costs and improve production processes, is pushing the market forward. As industries continue to embrace smart manufacturing and advanced automation, the need for DC servo motors and drives will continue to rise, providing further opportunities for growth.

Despite their benefits, the adoption of DC servo motors and drives is often limited by their high costs. These systems, particularly high-performance models, can require significant initial investment, making them less accessible to smaller businesses or startups. The complexity of maintenance is another challenge, as DC servo motors require regular servicing and expertise to ensure they continue to operate at optimal efficiency. This need for specialized maintenance can lead to additional operational costs. Furthermore, integrating these advanced systems into existing manufacturing processes can be complex, as it requires compatibility with other control systems and machinery. Overcoming these cost and maintenance challenges is crucial for expanding the use of DC servo motors in a broader range of industries.

The DC servo motors and drives market presents numerous growth opportunities, particularly through advancements in motor technology and the expansion of applications across new industries. Innovations in digital controllers and improved feedback systems are enhancing the performance and efficiency of DC servo motors, making them even more suitable for high-precision applications. As industries such as packaging, material handling, and aerospace continue to adopt automation, the demand for DC servo motors and drives is expected to increase. The growing use of electric vehicles (EVs) presents new opportunities for DC servo motors in applications such as powertrain systems and steering. The ongoing integration of these motors with advanced control systems, including AI and IoT, opens new doors for smart manufacturing solutions and predictive maintenance, further expanding their market potential.

One of the key trends shaping the DC servo motors and drives market is the increasing integration with smart control systems and the Internet of Things (IoT). As industries embrace Industry 4.0, DC servo motors are being connected to IoT platforms, enabling real-time monitoring, data collection, and predictive maintenance. This integration allows manufacturers to optimize motor performance, reduce downtime, and enhance operational efficiency. Additionally, the use of advanced control algorithms and AI to fine-tune the operation of DC servo motors is enhancing their accuracy and reliability in demanding applications. The trend toward more intelligent and interconnected manufacturing systems is expected to accelerate the adoption of DC servo motors and drives, creating new growth opportunities and improving overall system performance across various industries.

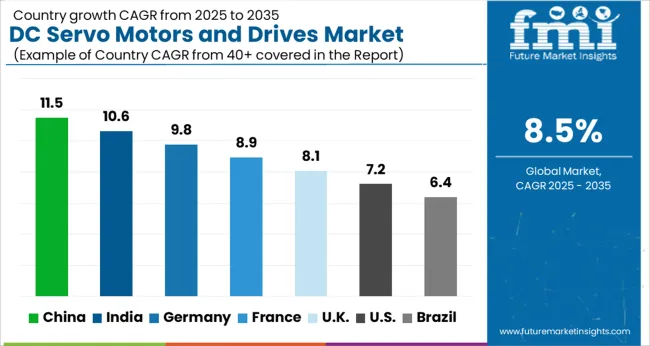

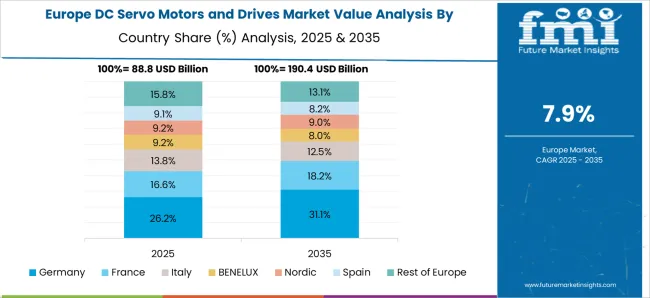

The global DC servo motors and drives market is expected to grow at a CAGR of 8.5% through 2035, driven by increasing automation in industries such as manufacturing, automotive, and robotics. China leads the market with a growth rate of 11.5%, followed by India at 10.6%. France records a growth rate of 8.9%, while the UK shows 8.1% and the USA follows at 7.2%. The market is primarily fueled by the increasing need for high-efficiency, precision control systems in automated machinery. China and India are leading the growth due to rapid industrialization and expanding manufacturing sectors. In developed economies like the USA, UK, and France, automation technologies in industrial processes continue to drive steady growth. The analysis spans over 40+ countries, with the leading markets shown below.

The DC servo motors and drives market in China is expected to grow at a CAGR of 11.5%, supported by the country’s strong focus on automation in manufacturing and industrial sectors. As China’s manufacturing industry continues to expand and modernize, the need for high-precision control systems like DC servo motors and drives is rising. The country’s rapid industrialization, particularly in robotics and automation for industries such as automotive, electronics, and textiles, is driving the adoption of these systems. China’s push toward smart manufacturing and Industry 4.0 further fuels the demand for advanced motor and drive technologies. With a large number of manufacturers producing and adopting servo motor solutions, China is at the forefront of the global market expansion.

The DC servo motors and drives market in India is projected to grow at a CAGR of 10.6%, driven by the country’s rapidly expanding manufacturing sector and industrial automation initiatives. As India focuses on modernizing its industrial infrastructure, there is a growing demand for high-performance motors and drives in sectors such as automotive, robotics, and packaging. The need for automation to improve productivity and reduce labor costs is propelling the adoption of DC servo motors in manufacturing processes. The Indian government’s initiatives to improve industrial competitiveness and the rise of smart manufacturing are contributing to the growth of the DC servo motor and drive market. As industries continue to upgrade machinery, the market for advanced motor solutions in India will see significant growth.

Demand fot DC servo motors and drives in France is expected to grow at a CAGR of 8.9% , fueled by the increasing demand for automation in industries such as automotive, aerospace, and food processing. The country’s focus on improving production efficiency and precision in manufacturing processes is driving the adoption of DC servo motors. Additionally, France’s strong industrial sector, including its robotics and automation industries, continues to innovate and integrate advanced motor technologies. The rising need for higher efficiency, lower energy consumption, and more reliable systems in industrial machinery also drives market growth. The shift toward Industry 4.0 in France is expected to further support the demand for advanced servo motor solutions.

The UK DC servo motors and drives market is anticipated to grow at an 8.1% CAGR, driven by the increasing use of automation in various industrial sectors. The demand for high-performance, energy-efficient servo motors is growing in industries such as automotive, manufacturing, and robotics. As industries look to reduce costs and improve production efficiency, the need for advanced motor solutions like DC servo motors is rising. The UK’s focus on adopting smart manufacturing technologies and its advanced automotive sector also contribute to the growth of the market. With a strong emphasis on automation and innovation, the UK is well-positioned to continue driving market demand.

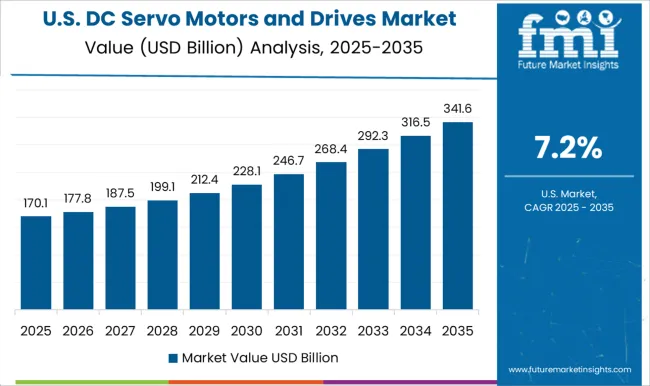

The USA DC servo motors and drives market is expected to grow at a 7.2% CAGR, supported by the continued adoption of automation technologies in manufacturing. The demand for precision control and high-efficiency motors is rising in industries such as automotive, aerospace, and industrial machinery. As the USA manufacturing sector focuses on improving productivity and reducing costs, the use of advanced motor technologies like DC servo motors is increasing. The rise of robotics and smart factories is driving the need for more efficient, reliable motor solutions. Additionally, USA manufacturers are focusing on innovations that improve energy efficiency and motor performance, further contributing to the market’s growth.

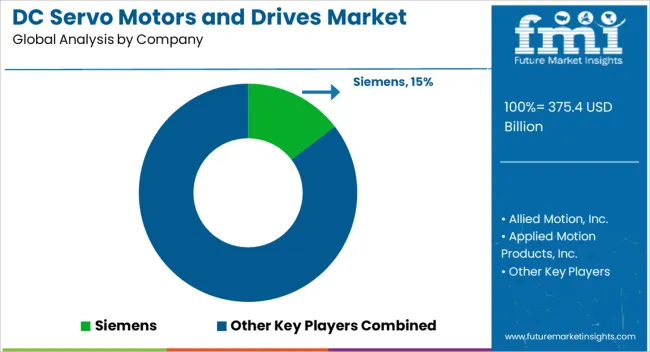

The DC servo motors and drives market is characterized by key players providing high-performance motion control solutions for various industrial applications, including robotics, automation, and manufacturing processes. Siemens is a market leader, offering advanced servo motors and drives known for their precision, reliability, and integration with industrial automation systems. Allied Motion, Inc. specializes in providing high-quality DC servo motors and drives, focusing on energy-efficient solutions that deliver smooth and precise motion control in a wide range of applications. Applied Motion Products, Inc. provides high-performance servo motors and drives that cater to both standard and custom applications, emphasizing ease of use, scalability, and flexible control. AXOR IND. S.a.s offers advanced motion control systems, with a focus on providing high torque and smooth performance for industrial processes and machinery. Bosch Rexroth Corporation is a major player, known for its innovative and reliable DC servo motors and drives used in automation systems, robotics, and conveyor applications. Fuji Electric Co., Ltd. provides advanced servo motor and drive solutions that enhance precision and energy efficiency in various industrial applications. Ingenia Cat S.L.U. specializes in high-torque DC servo motors designed for robotics, aerospace, and medical device applications, providing reliable performance in demanding environments.

JVL A/S offers integrated servo motors and drives known for their compact size and high efficiency, catering to industries like packaging, medical devices, and automation. Kinco Electric (Shenzhen) Ltd. is recognized for providing cost-effective, high-quality DC servo motors and drives for a variety of industrial applications, offering products known for their precision and energy efficiency. Kollmorgen offers high-performance servo systems with advanced motion control technology, focusing on providing reliable solutions for industrial machinery and automation systems. Leadshine specializes in servo drives and motors that are suitable for a wide range of motion control applications, known for their affordability and precision. NIDEC CORPORATION provides advanced DC servo motors and drives that deliver high performance and energy efficiency in industrial automation and robotics. Panasonic Corporation offers a broad range of motion control products, including DC servo motors and drives, designed to optimize performance and energy consumption in various manufacturing processes. Shenzhen Jiayu Mechatronic Co., Ltd. offers affordable, high-quality DC servo motor solutions designed for industrial automation, robotics, and control systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 375.4 Billion |

| Category | Digital and Analog |

| Application | Robotics, Oil and gas, Metal cutting & forming, Material handling equipment, Packaging and labelling machinery, Medical robotics, Rubber & plastics machinery, Warehousing, Automation, Extreme environment applications, Semiconductor machinery, AGV, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, Allied Motion, Inc., Applied Motion Products, Inc., AXOR IND. S.a.s, Bosch Rexroth Corporation, Fuji Electric Co., Ltd., Ingenia Cat S.L.U., JVL A/S, Kinco Electric (Shenzhen) Ltd., Kollmorgen, Leadshine, NIDEC CORPORATION, Panasonic Corporation, and Shenzhen Jiayu Mechatronic Co., Ltd. |

| Additional Attributes | Dollar sales by product type (servo motors, servo drives, integrated servo systems) and end-use segments (industrial automation, robotics, packaging, material handling, automotive). Demand dynamics are driven by the growing need for precision motion control in automated systems, increased adoption of robotics, and the shift towards energy-efficient manufacturing processes. Regional trends show strong growth in North America, Europe, and Asia-Pacific, where industrial automation and robotics are gaining traction in manufacturing, automotive, and logistics. Innovation trends focus on enhancing motor efficiency, reducing size and weight, and integrating IoT capabilities into motion control systems. Environmental considerations include improving energy efficiency in servo systems and promoting eco-friendly materials and processes. |

The global DC servo motors and drives market is estimated to be valued at USD 375.4 billion in 2025.

The market size for the DC servo motors and drives market is projected to reach USD 848.8 billion by 2035.

The DC servo motors and drives market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in DC servo motors and drives market are digital and analog.

In terms of application, robotics segment to command 18.9% share in the DC servo motors and drives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DCIM Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

DC Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

DC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Motor Control Devices Market Size and Share Forecast Outlook 2025 to 2035

DC Powered Servers Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

DC Drive Market Size, Share, Trends & Forecast 2024-2034

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

DC and PKI Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA