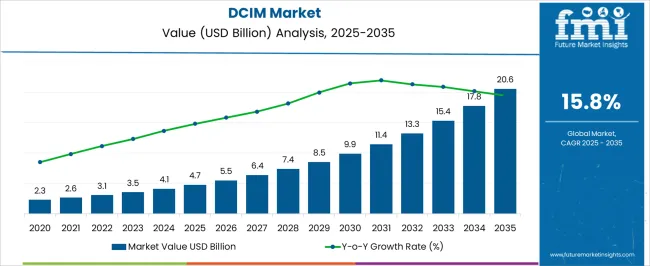

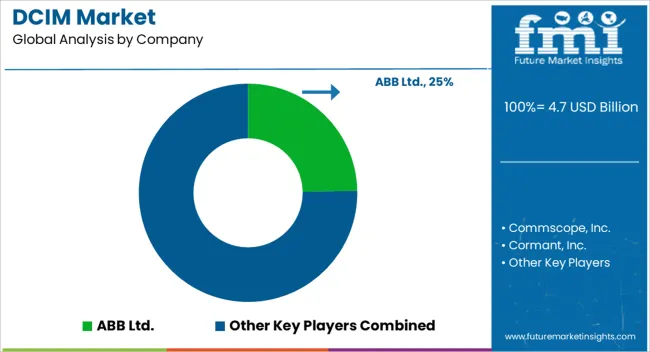

The DCIM Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 20.6 billion by 2035, registering a compound annual growth rate (CAGR) of 15.8% over the forecast period.

| Metric | Value |

|---|---|

| DCIM Market Estimated Value in (2025 E) | USD 4.7 billion |

| DCIM Market Forecast Value in (2035 F) | USD 20.6 billion |

| Forecast CAGR (2025 to 2035) | 15.8% |

The DCIM market is expanding rapidly due to the increasing complexity of data center operations, rising demand for energy efficiency, and the need for real time monitoring of IT infrastructure. Organizations are focusing on optimizing asset utilization, reducing downtime, and improving compliance with environmental and regulatory standards.

Growth is further driven by the surge in digital transformation initiatives, cloud adoption, and expansion of colocation facilities. Integration of AI, IoT, and predictive analytics into DCIM platforms has enhanced performance monitoring and capacity planning capabilities, making them indispensable for modern data centers.

As enterprises place greater emphasis on automation, sustainability, and cost efficiency, the market outlook remains strong with ample opportunities for innovation and adoption across industries.

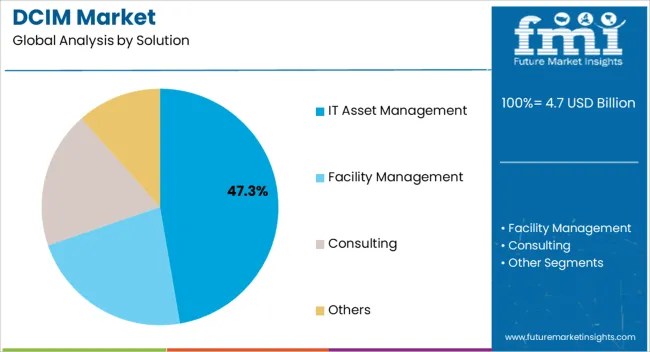

The IT asset management solution is expected to represent 47.30% of total revenue by 2025 within the solution category, making it the most dominant segment. Its growth is attributed to the rising demand for better visibility and control over physical and virtual assets in data centers.

Organizations are increasingly relying on asset management tools to track hardware, optimize lifecycle management, and reduce operational costs. Enhanced regulatory compliance, improved forecasting, and reduced risks of asset misplacement have also contributed to the segment’s leadership.

By delivering accurate asset intelligence and integration with monitoring platforms, IT asset management has established itself as the preferred solution in the DCIM landscape.

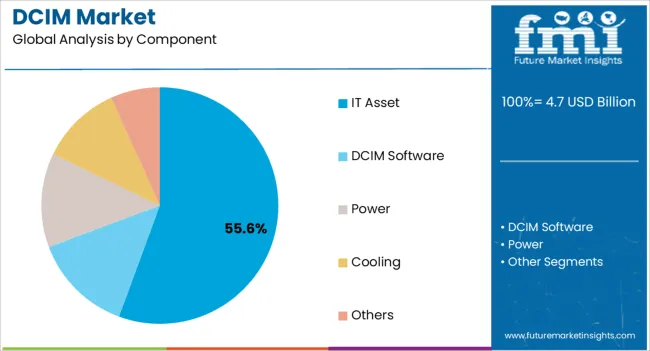

The IT asset component is projected to account for 55.60% of total revenue by 2025, positioning it as the leading segment within the component category. This dominance is being reinforced by the critical role IT assets play in ensuring data center performance, scalability, and reliability.

Enterprises are investing in solutions that provide continuous monitoring and optimization of IT assets to support workloads across cloud and hybrid environments. Increased demand for automation, predictive maintenance, and efficient lifecycle management has strengthened the need for comprehensive IT asset coverage.

This focus has driven the segment’s prominence, underlining its role in operational continuity and cost control.

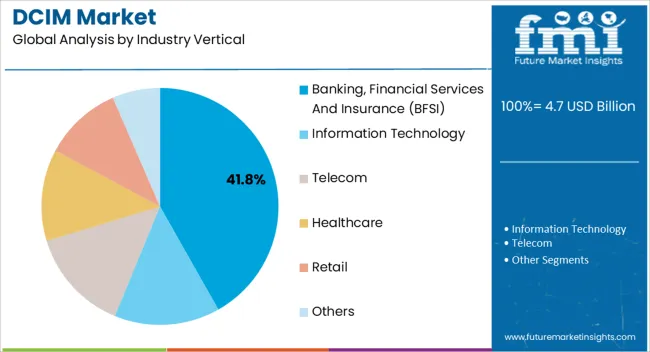

The banking financial services and insurance vertical is forecasted to capture 41.80% of total revenue by 2025, making it the leading industry vertical. This growth is attributed to the high volume of data generated in BFSI operations and the stringent need for uptime, compliance, and secure data management.

DCIM solutions have been instrumental in enabling banks and financial institutions to achieve operational efficiency, maintain regulatory standards, and manage energy usage effectively. The sector’s focus on digital banking, fintech expansion, and secure cloud adoption has further propelled the need for advanced infrastructure management tools.

As BFSI organizations continue to modernize their IT environments, DCIM adoption is set to remain dominant within this vertical.

The global data center infrastructure management market expanded at a captivating CAGR of 13.7% from 2020 to 2025. In 2020, the global market size stood at USD 1,851.8 million. In the following years, the market gained significant traction, accounting for USD 3,100.2 million.

In recent years, digitalization and internet reach have astronomically increased. Businesses are rapidly dispersing computer resources across many settings. Such as cloud servers, edge data centers, and physical systems.

According to the 2020 Voice of the Enterprise: Datacenter Transformation, Budgets, and Outlook study, 57% of respondents said they use cloud service providers. Nearly 54% said they own and run their data centers. Around 41% said they rent space from colocation data center operators.

The adoption of the hybrid strategy for demand for DCIM agility and 24x7 connection has resulted in a surge in the utilization of Software as a Service (SaaS) solutions. Because more equipment is squeezed into the data center area, IT management is critical. These factors point to the demanding necessity, hence strong sales of DCIM are predicted.

As the market develops, data center operators' need for end-to-end visibility across infrastructure increases. However, the data center industry is going through a significant shift due to the introduction of supplementary and new technologies. Data centers, IT, and facility operators are gradually implementing tools like DCIM. To gain comprehensive visibility into key data centers infrastructure information, such as operations, configuration, and resource consumption.

By solutions, the facility management segment is anticipated to garner swift growth in the coming years. The segment captured a market share of 40.3% in 2025. Facility management is integral in ensuring that data centers run efficiently. They can help in the identification of areas to save energy and cut costs. The increasing energy costs impel data center operators to increase energy efficiency. As data centers become more complex, facility management’s demand is bound to augment.

The IT asset management segment is anticipated to witness substantial growth. The increasing adoption of cloud computing is boosting the need to manage mushroom IT assets. Due to the growing numbers of IT assets in different locations, IT asset management becomes more critical. To ensure proper compliance, security, and utilization of resources, demand for IT asset management in the market is likely to escalate. Racks, Hyperview, Sunbird Software, and Nlyte Software, are a few of the DCIM market companies with notable IT asset management features.

The Banking, Financial Services, and Insurance (BFSI) industry vertical captured 21.2% of the global market share in 2025. For the BFSI vertical, data centers enable business continuity by concentrating on concerns such as manageability, scalability, efficiency, and energy efficiency. These concerns may not be addressed until data centers are properly monitored. The growing demand for digital banking services impels the NFSI industry to manage large amounts of data and IT infrastructure. The increasing data traffic in the BFSI sector is likely to bolster the segment’s expansion.

Cloud services are being adopted by the Information Technology (IT) sector. Cloud services assist reduce operating expenses and provide high business continuity. The use of cloud services in the IT sector necessitates data centers that can store and analyze data in real-time. Sales of DCIM in this area provide significant computational power and minimize time to market. Data centers also provide services in the form of overlays or Virtual Local Area Networks (VLANs), such as virtual machine disc libraries, file or object storage, firewalls, load balancers, IP addresses, or network connections.

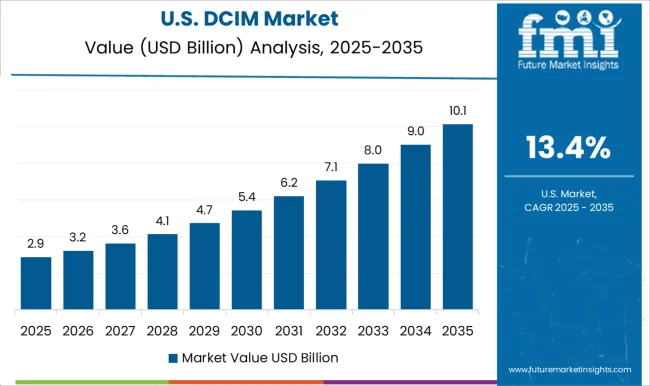

The North America DCIM market exhibited a CAGR of 28.4% in 2025. The data center market in the Western region of the United States is established and developed. The area has excellent connectivity and is adjacent to IT centers, making it a smart investment for data center operators.

California comprises nearly 90% of digital businesses, including cloud service providers and other IT and technology firms. The demand for additional data center infrastructures is being driven by the increasing use of mobile broadband, cloud computing, and big data analytics. Additionally, the growing popularity of cloud computing among organizations in North America is escalating. The falling server prices are anticipated to uptick demand for DCIM throughout the forecast period.

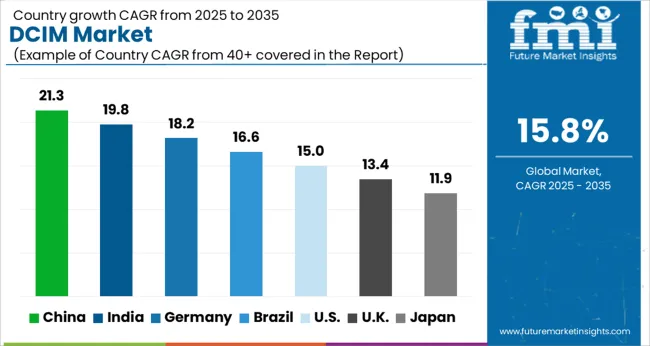

Asia Pacific is a swiftly developing region in the DCIM market, with significant data center development investments. Huge investments in verticals such as BFSI, retail, healthcare, manufacturing, telecommunications, and IT are being made in key nations such as India, China, and Japan. Resulting in the development and economic expansion in Asia Pacific countries.

China garnered a 15.4% market share in 2025. The demand for DCIM in this region continues to rise with the increase in internet-enabled gadgets grows. This surge in development has spurred data center building in the area, which is likely to drive sales of DCIM solutions and service adoption.

India captured a 14.6% market share in 2025. As part of a green effort, governments around the area are proposing new energy efficiency rules. These include carbon emission taxes, efficient power consumption, and other measures. The demand for DCIM software to manage data centers is necessitated by such regulatory constraints.

Owing to certain sizable competitors, such as IBM, Siemens, and Schneider Electric, which are present in the DCIM market, there is fierce competition. They have gained a competitive advantage over other players due to their capacity to constantly develop their services. They've been able to gain a firmer footing in the market through strategic alliances, research and development, and mergers and acquisitions.

The key players are concentrating on releasing products and services that, depending on numerous factors, align with shifting business dynamics. The key players may work together by forming strategic alliances to enter new markets.

Recent Developments in the DCIM Market:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & The Middle East and Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, Benelux, South Africa, Northern Africa GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand. |

| Key Segments Covered | The solution, Component, Industry Vertical, and Region. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global DCIM market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the DCIM market is projected to reach USD 20.6 billion by 2035.

The DCIM market is expected to grow at a 15.8% CAGR between 2025 and 2035.

The key product types in DCIM market are it asset management, facility management, consulting and others.

In terms of component, it asset segment to command 55.6% share in the DCIM market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA