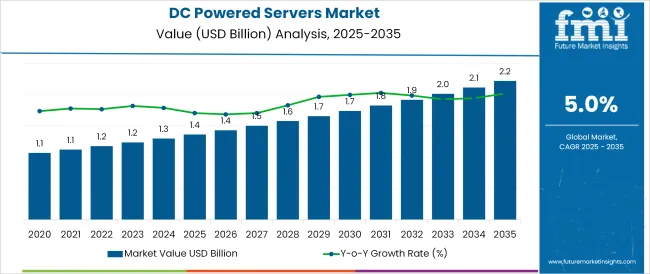

The DC Powered Servers Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 1.4 billion |

| Market Size in 2035 | USD 2.2 billion |

| CAGR (2025 to 2035) | 5.0% |

The DC powered servers market is gaining momentum as data center operators and enterprises increasingly prioritize energy efficiency, operational resilience, and sustainability in their IT infrastructure. This shift is being accelerated by rising power densities, demand for lower total cost of ownership, and growing regulatory scrutiny on data center energy consumption.

Industry journals, data center operator disclosures, and power equipment manufacturers’ annual reports emphasize that direct current (DC) powered servers enable reduced conversion losses, improved cooling efficiency, and simpler integration with renewable energy sources.

These benefits have led to greater adoption, particularly among hyperscale and colocation data centers seeking to align operations with ESG targets while managing soaring computational workloads.

Looking forward, the convergence of high-performance computing, edge data center deployments, and innovations in power distribution architectures is expected to unlock further growth opportunities, paving the path toward broader industry adoption and standardization.

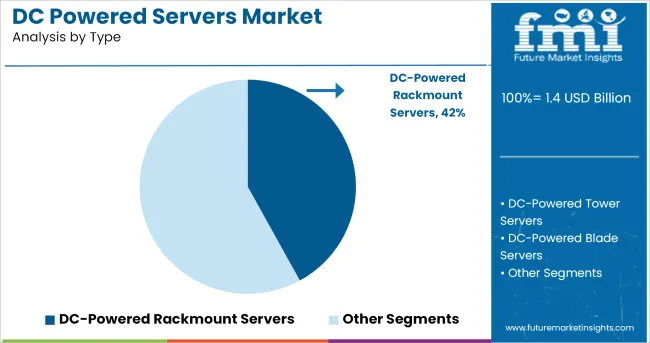

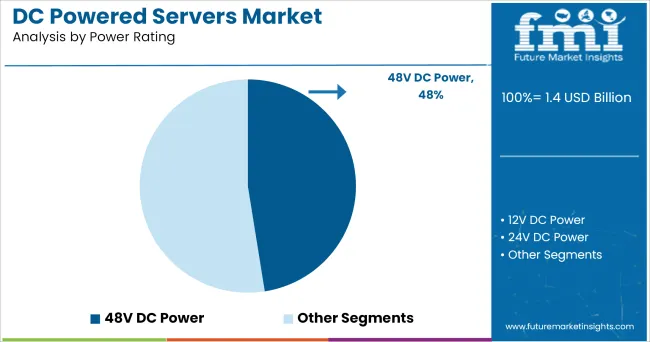

The market is segmented by Type, Power Rating, and Application and region. By Type, the market is divided into DC-Powered Rackmount Servers, DC-Powered Tower Servers, and DC-Powered Blade Servers. In terms of Power Rating, the market is classified into 48V DC Power, 12V DC Power, and 24V DC Power.

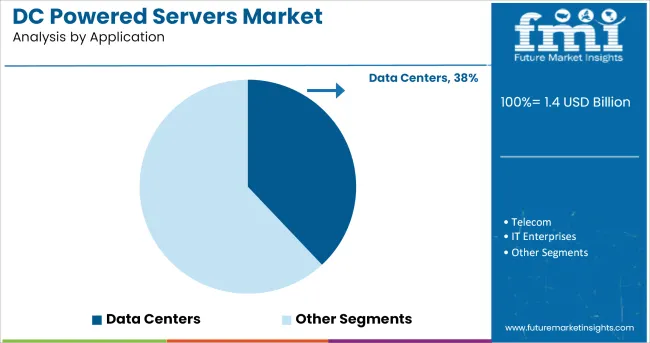

Based on Application, the market is segmented into Data Centers, Telecom, IT Enterprises, Government, Energy & Utilities, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, DC-powered rackmount servers are projected to hold 42.0% of the total market revenue in 2025, positioning themselves as the leading type segment. This leadership has been attributed to their modular design, scalability, and compatibility with existing rack infrastructures, which has facilitated seamless deployment in both new and retrofitted facilities.

As noted in data center engineering publications and corporate presentations, rackmount configurations have been preferred for their standardized form factor, which supports efficient airflow management, hot swappable components, and simplified maintenance in high-density environments.

The ability to accommodate custom power distribution units and integrate easily with DC bus architectures has further strengthened their appeal. Enhanced durability and reduced complexity compared to blade or tower servers have also improved their cost-effectiveness, supporting their prominent market position in facilities where reliability and serviceability are paramount.

Segmented by power rating, the 48V DC power segment is expected to account for 47.5% of the market revenue in 2025, making it the leading power rating segment. This dominance has been supported by its optimal balance between safety, efficiency, and standardization, which has made it the preferred choice for modern data centers.

According to power electronics journals and manufacturers’ investor disclosures, 48V systems offer superior energy conversion efficiency, lower cable losses, and reduced heat generation compared to higher or lower voltage alternatives.

Adoption has also been facilitated by industry-wide standardization around 48V infrastructure, enabling interoperability between equipment from different vendors and simplifying design and procurement processes. Furthermore, the compatibility of 48V systems with renewable energy sources and battery storage solutions has aligned with operators’ sustainability goals, reinforcing its leadership as the most practical and future ready power rating in the market.

When segmented by application, data centers are forecast to capture 38.0% of the market revenue in 2025, securing their position as the leading application segment. This prominence has been reinforced by the exponential growth in cloud computing, artificial intelligence, and digital services, which has intensified the need for energy efficient and resilient server infrastructure in data centers.

Industry association whitepapers and operator sustainability reports highlight how DC powered servers are being deployed to reduce energy waste, improve power usage effectiveness (PUE), and support high-density workloads in colocation, hyperscale, and enterprise data centers.

The integration of DC architectures has also enabled easier implementation of renewable energy and energy storage systems, aligning operations with carbon reduction commitments. Enhanced reliability and reduced total cost of ownership have further bolstered adoption among data center operators, cementing the segment’s leadership as the primary driver of demand for DC powered servers.

With trailblazing technologies dramatically altering the global virtual ecosystem, the DC powered servers landscape has been experiencing aggrandizing sales and enhanced revenue shares. Until 2020, the market experienced a historical CAGR of over 5%, reaching USD 1.3 Billion in value.

As business volumes expand, corporate entities are faced with numerous data storage and assimilation challenges. For example, the United States alone generates over 3 million gigabytes of data each minute. Naturally, reliance on big data analytics is surging, leading to an increasing demand for DC powered servers.

Moreover, high reliance on cloud platforms and virtualization is prompting server providers to compartmentalize multiple users on a single platform. Key industries ranging from information technology and data centers to government entities are likely to exploit DC powered servers.

Thus, the importance of DC powered servers has been underscored significantly, with FMI projecting the market to remain bullish, registering a staggering 8.2% CAGR through 2035.

Burgeoning demand for lighting fast connectivity has prompted adoption of 5G networks by prominent organizations. While presently operating on a low-spectrum range, maturing technologies and infrastructure are paving way for its escalation across key application areas. This growing adoption is expected to generate fresh revenue ecosystems for DC powered servers.

Studies suggest that nearly two out of five internet users are likely to incorporate 5G networks until 2025, with over a billion mobile subscriptions. 5G networks are poised to handle nearly a quarter of all mobile traffic data. Unlike the existing 4G networks, 5G infrastructure is touted to support millions of devices per square mile.

Significant developments are occurring in this regard. In January 2024, the Ooredo Group and Ericsson entered a 5-year strategic 5G agreement wherein the companies have agreed to make significant breakthroughs by launching new functionalities. The deal includes the Ericsson Radio System, Ericsson Cloud Core, Cloud Infrastructure, Cloud Communication and microwave solutions.

Data suggests that the global cloud computing market is expanding at over two-fifth of the global virtual landscape, with over three out of five data analytics software being cloud-based. The deployment of IBM’s Cloud for Financial Services is just one among innumerable instances of effective cloud integration in data management.

Unveiled in 2024, the platform is designed to facilitate a transparent public cloud ecosystem with enhanced security, compliance and resiliency features which all financial institutions require. This is expected to enable numerous innovations and deliver highly personalized customer experiences.

As demand for new on demand technology services increase, the costs associated with deploying the same continue to skyrocket. To effectively manage such aggrandizing costs, complicated deployments and uptime, data managers require access to information which may not be readily available.

Managing server information often requires data centers to maintain spreadsheets, which is a painstaking task. Furthermore, such information must be periodically updated. As a result, these centers exhaustively utilize DC powered servers of varying power consumption ranges.

These DC powered servers consume excessive amounts of electricity. Between 2000 and 2005, electricity consumption by servers represented almost a twofold increase, growing from 12 billion kWh to 23 billion kWh. By 2008, individual server power consumption averaged up to 250 watts. These trends are likely to hinder adoption of DC powered servers in the future.

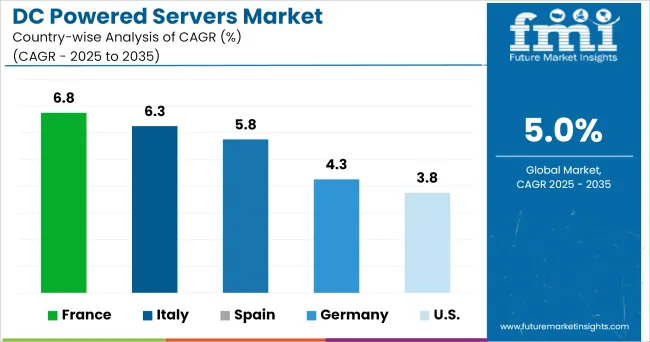

Until 2020, DC powered servers sales across the United States were limited, registering annual growth of just 2.4%. However, prospects are likely to widen, experiencing a CAGR of 4.2% through 2035. Extensive adoption of servers attributed to increasing data processing volumes is likely to drive demand.

Estimates reveal that servers shipment in USA increased by 3% due to increasing popularity of moving localized data center activity to colocation or cloud facilities. Consequently, there has been an increase in the number of colocation service providers across the region.

The top five prominent service providers include, CenturyLink, Digital Reality, Verizon, Equinix and AT&T respectively. Including these aforementioned service providers, a total of nearly 1800 colocation service providers are present across the landscape.

Based on current trend estimates, USA data centers are projected to consume approximately 1.3 billion kWh in 2024. Adoption of DC DC powered servers has increased for hyper scale data centers where servers are often configured for maximum productivity and operated at high utilization rates.

The UK DC powered servers market is expected to be the most lucrative across Europe, expanding at a value CAGR of 9% throughout the forecast period. Increasing scramble by data centers and business entities in the wake of growing security threats is driving the market on an impressive trajectory.

The Data Protection Act of 2020 is a landmark achievement in the UK’s endeavor to implement a pan-national general data protection regulation. The Act offers a strong legal safeguard against possible personal and classified data breach and provides for fair, lawful and transparent use of such information for limited purposes.

Consequently, business organizations are increasingly adopting colocation services, such as Sungard which offers private colocation, network services and cloud connectivity solutions. In October 2024, it partnered with global Network as a Service (NaaS) leader Megaport which would enable the former to expand its Software Defined Cloud Interconnection (SDCI) capabilities.

Likewise, companies also effectively leverage IBM’s Hybrid Data Management AI-enabled solutions, permitting them to gather data based on any type, source and structure to make it easily accessible across multiple vendors, workloads and deployments.

The telecommunications industry across Germany is highly developed. According to Deutsche Telekom, developments are especially extensive across the high-speed broadband domain. In 2020, fixed network data traffic expanded by three-tenths worldwide, out of which Germany accounted for a significant share.

In 2024, the number of broadband connections was expected to grow at over 2%, reaching approximately 37 million connections. Most of this growth is facilitated by companies possessing robust internet infrastructure, which has facilitated an increase in deployment of high-bandwidth lines. Therefore, investments in DC powered servers is likely to aggrandize across the German market.

As per Future Market Insights’ projections, an annual increase of above 7% is expected across the German DC powered servers market for the next two years, generating over 20% of the revenue share across the aforementioned period.

India is expected to witness astounding growth in the DC powered servers market, registering a value CAGR exceeding 16% across the 2024 to 2035 assessment period. This growth is majorly credited to an ever mushrooming information and communications technology segment in recent years.

The India Brand Equity Foundation advocates that India is a leading sourcing destination in the world. During FY 2020-20, the country yielded USD 200-250 billion, contributing to over 50% market revenue. Also, in FY20, the IT-BPM industry’s revenue was valued at USD 191 billion.

Going by these trends, key powered server providers have found lucrative revenue pools, prompting them to increase their foray into the Indian market. HPE is a prominent global level market player across the country, manufacturing the HPE Apollo 80 System and the HPE Superdome Flex 280 Server, especially suitable for medium sized enterprises.

By server type, DC-powered blade servers are expected to register strong yearly expansion, expanding at nearly 10% annual growth rate by 2024. Reduced power consumption, easy swapping of defective blades and enhanced processing power are some key growth catalyzers. Moreover, they only rely on a single chassis to provide power.

However, DC-powered rackmount servers are expected to generate the highest revenue, capturing over two-fifths of the total market share by 2024-end. Businesses are increasingly leveraging these servers due to perceived benefits regarding security, access and organization and airflow. The segment shall reach nearly USD 700 Million in the current year.

In terms of power rating, the 48V DC-DC powered servers are slated to experience double-digit Y-o-Y growth exceeding 10% until 2035, accounting for over a quarter of the revenue share. High data center energy efficiency is prompting enterprises to switch over to 48V servers. Additionally, it uses zero-voltage switching and current switching, offering reduced noise emission.

At the same time, 12V DC-powered serves are likely to retain lucrativeness, accounting for over 40% revenue for the next half-a-decade. Research indicates that utilizing 12V servers enhances efficacies by around 7 percentage points compared to conventional ones. Moreover, the standard prescribed rating has always been 12V, leading to its enhanced uptake.

Over the years, data centers have emerged as important storehouses for information assimilation and storage. Featuring state-of-the-art high density servers and revolutionary cooling systems, data centers are fast attracting the attention of key service providers, causing it to expand at a historical CAGR of nearly 5%.

Amongst all data services, the colocation data segment is expected to garner key investments as they allow small and medium sized enterprises to effectively manage their data assimilation projects. Besides data centers, IT enterprises are expected to generate equally high opportunities as they increasingly seek to incorporate 5G connectivity solutions.

The DC powered servers landscape is dominated by the below mentioned prominent players

*This list is indicative- full details about DC powered servers market players is available upon request.

A combination of strategies such as capacity expansion, strategic collaborations, acquisitions, product launches and strengthening of regional and global level distribution networks constitute the aforementioned players’ key expansion tactics, providing market leaders with a significant competitive edge.

In January 2024, IBM Corporation acquired 7Summits, thereby extending its Salesforce services portfolio and experience design capabilities. This acquisition has enhanced IBM’s hybrid cloud and AI strategy domains respectively.

With respect to product offerings, Dell Technologies offers a broad range of DC powered servers. One of its recent offerings includes the EMC PowerEdge Rack Servers consisting of three ranges: R840, R940 and R940xa respectively. These servers are specifically designed for four socket rack servers.

As part of its commitment to continually incorporate novel offerings, Lenovo has unveiled its new Innovation Vision 2024 with the objective of redefining meaningful technological innovations to help improve workflow, acting as a catalyst to introduce meaningful breakthroughs. This initiative is likely to boost prospects for powered server sales.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value & ‘000 Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific and Middle East & Africa |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, Italy, France, UK, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia & New Zealand, GCC, Turkey and South Africa |

| Key Segments Covered | Type, Power Rating & Application |

| Key Companies Profiled | Dell Technologies; IBM Corporation; HPE; Intel Corporation; Lenovo; Vertiv and Perle |

| Report Coverage | Market Overview, Key Market Trends, Market Structure Analysis, Demand Analysis, Market Background, Segmental Analysis, Regional Profiling & Competition Analysis |

| Customization & Pricing | Available upon Request |

The global DC Powered Servers Market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the DC Powered Servers Market is projected to reach USD 2.2 billion by 2035.

The DC Powered Servers Market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in DC Powered Servers Market are DC-powered rackmount servers, DC-powered tower servers and DC-powered blade servers.

In terms of power rating, 48v DC power segment to command 47.5% share in the DC Powered Servers Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DC and PKI Market Size and Share Forecast Outlook 2025 to 2035

DCIM Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

DC Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

DC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Motor Control Devices Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

DC Drive Market Size, Share, Trends & Forecast 2024-2034

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA