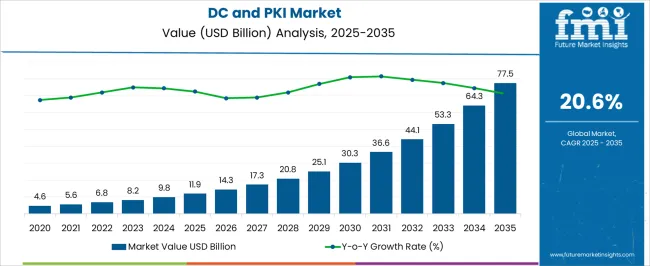

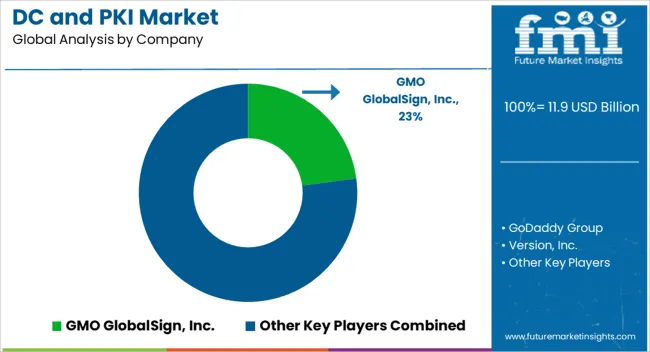

The DC and PKI Market is estimated to be valued at USD 11.9 billion in 2025 and is projected to reach USD 77.5 billion by 2035, registering a compound annual growth rate (CAGR) of 20.6% over the forecast period.

| Metric | Value |

|---|---|

| DC and PKI Market Estimated Value in (2025 E) | USD 11.9 billion |

| DC and PKI Market Forecast Value in (2035 F) | USD 77.5 billion |

| Forecast CAGR (2025 to 2035) | 20.6% |

The DC and PKI market is expanding steadily as enterprises prioritize secure digital communication, authentication, and compliance across critical sectors. Rising incidences of cyber threats and increasing reliance on digital identities are fueling the adoption of robust cryptographic infrastructure.

Regulatory mandates around data protection and privacy, combined with organizational needs for scalable identity management, are accelerating the deployment of PKI solutions across both cloud and on premise environments. Advances in hardware security modules, integration of AI driven threat detection, and automation of certificate lifecycle management are further strengthening adoption trends.

The outlook remains optimistic as organizations invest in comprehensive security frameworks to safeguard customer trust, operational continuity, and regulatory compliance in a rapidly digitizing ecosystem.

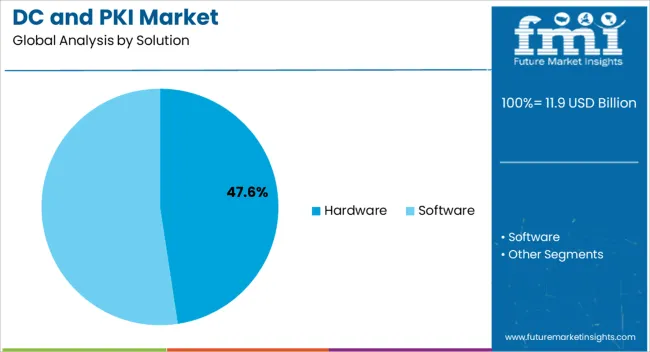

The hardware solution segment is projected to account for 47.60% of market revenue by 2025, making it the leading category under solution. Its dominance is being driven by the need for high performance, tamper resistant, and secure hardware modules that safeguard cryptographic keys and digital certificates.

Hardware solutions provide enhanced physical security, low latency, and reliable protection against sophisticated attacks, making them essential for large scale enterprise and government deployments.

Growing demand for dedicated hardware security modules in critical sectors such as defense, telecom, and finance has further reinforced this segment’s leadership.

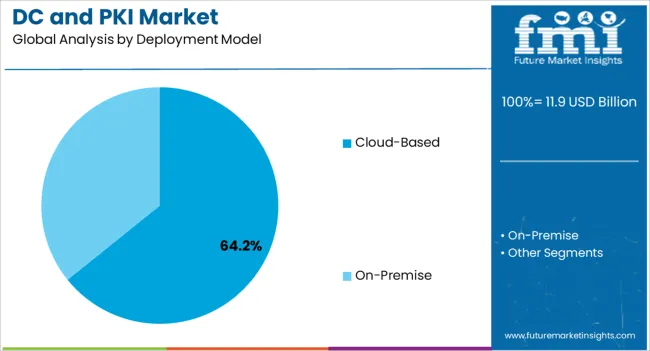

The cloud based deployment model is expected to represent 64.20% of market revenue by 2025, establishing it as the dominant deployment approach. This share is supported by the increasing shift of enterprises toward cloud infrastructure for scalability, flexibility, and cost efficiency.

Cloud based PKI enables centralized certificate management, rapid provisioning, and seamless integration with diverse enterprise applications. Organizations are adopting this model to address the challenges of distributed workforces and hybrid IT environments while maintaining regulatory compliance.

Continuous innovation by cloud service providers has further strengthened trust and adoption, positioning this deployment model at the forefront of the market.

The global DC and PKI industry size developed at a CAGR of 19.5% from 2020 to 2025. In 2020, the global market size stood at USD 3,275.1 million. In the following years, the market witnessed significant growth, accounting for USD 6,689.9 million in 2025.

Organizations need reliable and scalable data center infrastructure due to the growth of digital data and the rising demand for cloud computing. Massive volumes of data need to be stored, processed, and managed, and data centers provide the foundation for doing this. Further, they also offer the processing power and storage space required to satisfy the rising demands of enterprises.

The advent of virtualization and cloud computing technologies has had a big influence on the DC industry. To provide Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS) solutions, cloud service providers and businesses rely on data centers. The growth of the market is being fueled by the rising demand for cloud services and the requirement for a dependable and effective data center infrastructure.

Public key encryption solutions have become an essential part of every online business as cyber-attacks have become a regular incidence in recent years. Prevention of such incidents and protection of sensitive data have provided the necessary impetus for the growth of the market.

The rise in the number of e-commerce sites over online platforms has created a competitive retail market in the present world. Furthermore, digital verification technologies have emerged as a relief in such situations for the protection of online assets and the interests of customers. Many e-commerce websites have also adopted online messaging services to establish a direct channel with consumers increasing the vulnerability of fraudulent transactions and forged practices.

As per the market analysis report, the public key infrastructure market is estimated to experience huge growth in the coming years owing to the growing volume of the online retail market.

Growth in digital literacy and the number of internet users in developing countries is expected to play an indirect role in the growth of the global market from 2025 to 2035. Further, the introduction of other digital technologies such as the Internet of Things or IoT and industrial Internet of Things or IoT is expected to create a huge demand for PKI in IoT that can further augment the global public key infrastructure market.

Limited awareness and knowledge about the PKI for digital signature technology among the public as well as business entities are predicted to hamper the growth of the global market for some years ahead.

Other economic downturns leading to lower traffic of customers on the online portals of the e-commerce website can also have a significant negative impact on the PKI for digital signature service providers.

The establishment of private certification authorities or the use of self-signed certificates by many organizations is a prominent challenge faced by dedicated PKI document-signing service providers in the market. Small and medium enterprises mostly prefer to obtain certificate encryption through such private entities due to a lack of sufficient funds or other reasons.

The inability of SMEs to obtain digital certification services from global players is anticipated to restrain the growth of the global market during the forecast period.

What are the Different Segments of the Market Based on the Solution

As the provision of digital certificates is prominently based on online channels so the software solution is the dominating segment in the process and implementation of PKI document signing. Furthermore, with the advent of Cloud systems, the use of hardware security modules has dropped significantly in the recent past.

With the further development of cloud PKI solutions, the software segment is expected to witness huge demand that can drive the market segment at a CAGR of 22.3% as per the report. Nonetheless, the demand for the hardware segment by solutions is likely to remain high during the forecast period. In 2025, the hardware segment captured a 59.3% share of the global market.

Implementation of software solutions on local servers for using PKI as a service is the first stage of development in the market that is still used by many business operators. However, due to the advantages associated with cloud-based systems and affordable data prices, many companies are upgrading their systems to cloud PKI solutions for better results.

During the forecasted years, it is estimated that the cloud segment can dominate the private key infrastructure market by completely replacing the on-premises segment.

The on-premise segment is predicted to gain dominance during the forecast period. In 2025, the on-premise deployment segment garnered a 54.4% share of the global market.

Among the different verticals based on the various applications of the PKI for security services, Banking, Financial Services and Insurance (BFSI) are the prominent users. As per the data records obtained by the FMI, this segment was estimated to be contributing nearly USD 1.47 billion to the global private key infrastructure market.

Digitization of the existing financial infrastructure in every country is propelling the growth of this segment which is expected to witness a CAGR of 24.8% over the forecast timeframe. Other prominent verticals having a high application of PKI for digital signatures are the government & defense sector and the manufacturing sector.

Given the sensitivity of the data, government and defense, sectors contribute a prominent portion of the global DC and PKI market size. But the manufacturing sector contributes a high volume of traffic on websites and portals also making it an essential segment of the global market.

Based on the broad geographical division of the global digital certificate and private key infrastructure market, North America dominates the market. Moreover, this region is poised to continue the leading position in the global market during the forecast period due to the factors such as:

As per the market analysis report of FMI, the market in the United States alone is estimated to value at around USD 77.5 billion by the year 2035. In 2025, The United States captured an 18.1% share of the global market.

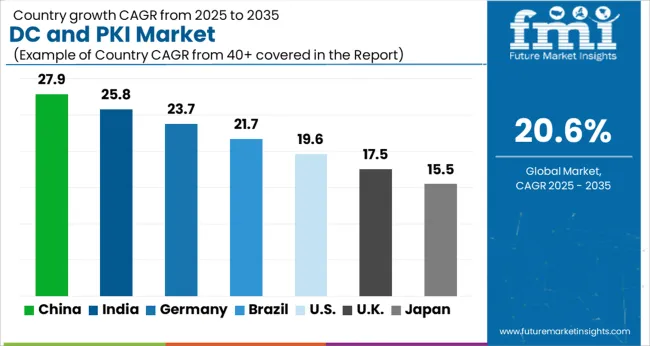

The region of Asia Pacific is also turning out to be a prominent attraction for the market players providing PKI user certificates in recent times. Booming IT industries and high government spending on strengthening the digital infrastructure in emerging economies is the prominent reason for the high growth rate in the use of PKI as a service in this region. In 2025, China, India, and Japan captured 20.8%, 25.2%, and 5.4% shares in the global market.

| Countries | CAGR Share in Global Market (2025) |

|---|---|

| The United States | 18.1% |

| The United Kingdom | 23.8% |

| China | 20.8% |

| Japan | 5.4% |

| India | 25.2% |

How Strong Is the Competition in the Global Market?

Over the years. Several players have emerged in different regions making the global public key infrastructure market highly competitive these days. The top players such as Microsoft PKI infrastructure or even the Sectigo private PKI have built a trusted name over the years in this domain.

Collaboration and long-term agreements with software development companies is the prominent strategy adopted by most of the players in the global market.

Recent Developments Observed by FMI:

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; The Middle East & Africa (MEA) |

| Key Countries Covered | The United States, Canada, Germany, The United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASIAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Solution, Deployment Model, Application, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global dc and pki market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the dc and pki market is projected to reach USD 77.5 billion by 2035.

The dc and pki market is expected to grow at a 20.6% CAGR between 2025 and 2035.

The key product types in dc and pki market are hardware and software.

In terms of deployment model, cloud-based segment to command 64.2% share in the dc and pki market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Electromagnetic Brakes Market Size and Share Forecast Outlook 2025 to 2035

DCIM Market Size and Share Forecast Outlook 2025 to 2035

DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

DC Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

DC BEV On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

DC Motor Control Devices Market Size and Share Forecast Outlook 2025 to 2035

DC Powered Servers Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

DC Drive Market Size, Share, Trends & Forecast 2024-2034

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

PDC Drill Bits Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA