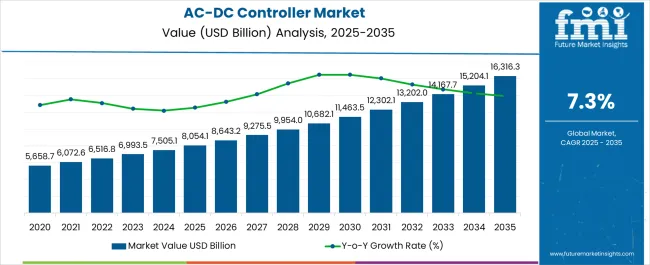

The AC-DC Controller Market is estimated to be valued at USD 8054.1 billion in 2025 and is projected to reach USD 16316.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

| Metric | Value |

|---|---|

| AC-DC Controller Market Estimated Value in (2025 E) | USD 8054.1 billion |

| AC-DC Controller Market Forecast Value in (2035 F) | USD 16316.3 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The AC DC controller market is experiencing steady expansion as demand for efficient power conversion and energy optimization grows across multiple industries. Increasing integration of electronics in automotive systems, rising adoption of renewable energy, and the proliferation of consumer electronics are driving adoption of advanced controller solutions.

Innovations in wide bandgap semiconductors and improved thermal management have enhanced performance, making AC DC controllers more reliable and compact. Regulatory standards promoting energy efficiency and sustainability are accelerating deployment, particularly in automotive and industrial applications where precise power management is essential.

The future outlook remains positive as industries continue transitioning toward electrification, digitalization, and connected systems, creating consistent demand for scalable and efficient AC DC controller technologies.

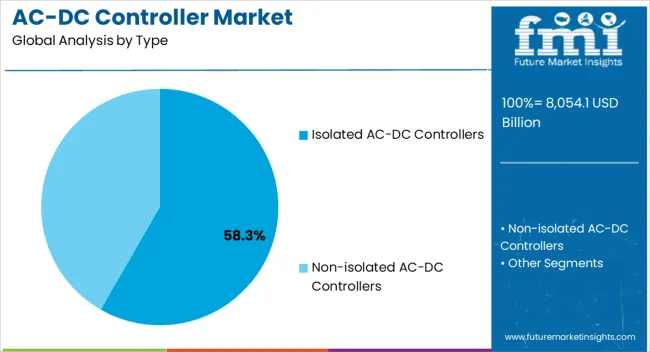

The isolated AC DC controllers segment is expected to hold 58.30% of total market revenue by 2025, making it the leading type segment. Growth has been supported by its suitability for high performance environments requiring safety, voltage isolation, and system reliability.

These controllers are extensively deployed in power supplies for industrial automation, medical equipment, and energy systems where isolation ensures operational stability. The increasing complexity of power architectures in modern electronics has reinforced the reliance on isolated solutions, while advancements in isolation materials and integration techniques have reduced cost and improved efficiency.

This has positioned isolated AC DC controllers as the most preferred technology within the type category.

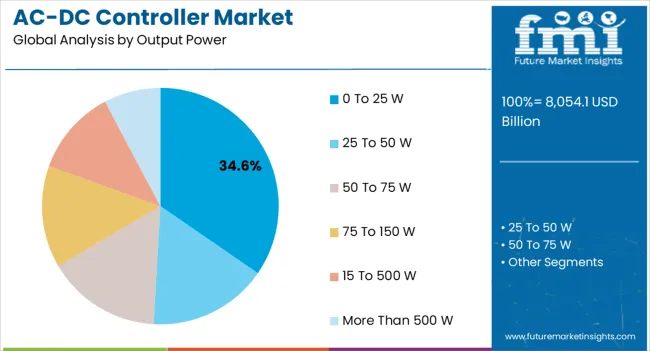

The 0 to 25 W output power segment is projected to represent 34.60% of the market share in 2025, making it the dominant output range. Its popularity is attributed to widespread use in compact devices, consumer electronics, and low power industrial systems where efficient energy conversion is essential.

Demand has been further accelerated by the rising penetration of connected devices and IoT systems that require low wattage but reliable controllers. The segment benefits from ongoing design improvements that enhance energy efficiency, reduce standby power consumption, and enable miniaturization.

As industries continue prioritizing cost effective and energy conscious solutions, this output range is expected to remain the leading category.

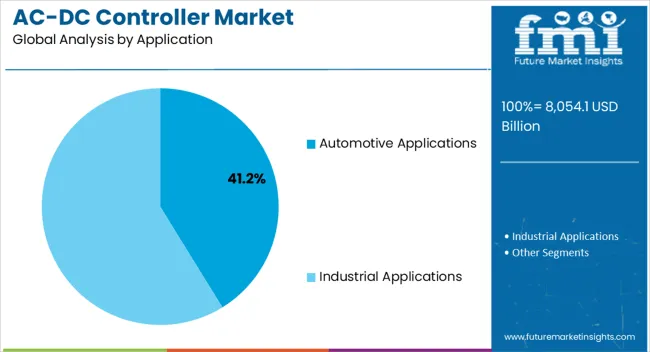

The automotive applications segment is estimated to capture 41.20% of market revenue by 2025, positioning it as the top application area. Growth is being driven by rapid electrification of vehicles, expansion of hybrid and electric vehicle production, and the rising use of electronic control units across vehicle systems.

AC DC controllers are increasingly utilized in on board chargers, infotainment, and advanced driver assistance systems, all of which demand efficient and stable power management. Regulatory requirements to improve vehicle energy efficiency and reduce emissions have further accelerated deployment.

Continuous innovation in vehicle electronics and safety systems has reinforced the necessity of high performance controllers, securing the automotive sector’s leading position in the application category.

The market for AC-DC controllers is expected to grow rapidly due to rising disposable income and a shift in consumer behavior. Nowadays, consumers have access to a wide range of products owing to internet shopping, and LED lighting is one of the most popular online purchases. As a result, the growing use of AC-DC controllers in LED lighting applications is propelling the AC-DC controller market forward.

The overall market for smartphones and electronic devices is increasing rapidly. New, innovative, and highly advanced electronic devices are becoming increasingly popular. This trend is predicted to boost the production and supply of AC-DC controllers, which are needed to charge and operate these electronic devices.

Another reason driving the increase in AC-DC controller manufacture is the supply-demand connection. China is leading in terms of registered producers, the country's switching power supply sector is continually expanding. The AC-DC controller market is increasing globally as a consequence of the rising demand for electronic products that require AC-DC controllers.

The global market for smartphones and electronic gadgets is rapidly expanding. The popularity of new, innovative, and technologically advanced electronic products is also growing. This trend is expected to increase the production and supply of AC-DC controllers used in the charging and operation of these electronic devices.

The domestic electric appliance industry in various countries has grown steadily in recent years. The trend is expected to continue in the near future. As the industry's competition heats up due to the adoption of new mobile phones and other electronic devices, enterprises are seeing transformation and improvements in AC-DC controllers.

The relationship between supply and demand is another factor driving the increase in the production of AC-DC controllers. Despite the fact that there are numerous registered manufacturers in China, the country's switching power supply industry is still growing. As a result of the increased demand for electronic devices that require AC-DC controllers, the AC-DC controller market is growing worldwide.

Most AC-DC controller companies need help to increase efficiency across the load terminals. Furthermore, alternating voltages are incompatible with some purposes, such as electroplating, battery charging, and electric traction.

Local manufacturers utilize established brands' trademarks, branding, emblems, software, or other proprietary information without their permission to deceive buyers into believing they are purchasing legitimate products. These imitation goods are of lesser quality and are often marketed at significantly lower prices than authentic goods. AC-DC controller supply adapters are available from a range of worldwide and local suppliers. As a result, the limitations mentioned earlier hinder market expansion. These local producers are satisfying the demand for local products and boosting their supply in the foreign arena.

As AC-DC controllers are composed of low-quality components, the end products are equally low-quality. This has an adverse effect on the global market for AC-DC controllers.

| Segment | Isolated AC-DC Controllers |

|---|---|

| Market Share % (2025) | 65.5% |

During the projected period, isolated AC-DC controllers are expected to grow at a maximum CAGR of 6.6%. Isolated AC-DC Controllers are likely to lead the market over the projection period due to their ability to prevent direct current.

The isolated goods have improved security measures. When it comes to safety, the insulation grade must also be addressed. Safety regulations should be studied to establish what level of insulation is required for a certain application. Insulation grade is classified into functional, basic, supplementary, and reinforced categories. As a result, greater safety in this segment is likely to drive AC-DC controller demand throughout the projection period.

| Segment | Industrial Applications |

|---|---|

| Market Share % (2025) | 34.4% |

By application, the industrial segment is projected to exhibit a CAGR of 6.5% and lead the market during the forecast period. The escalating use of AC-DC controllers in commercial processes is also expected to encourage the adoption of AC-DC controllers throughout the projected period.

| Region | North America |

|---|---|

| Market Share % (2025) | 29.4% |

In terms of market share and revenue, the North American market is expected to be the most lucrative market during the projection period. The analysts at Future Market Insights predict that by 2025, the market of AC-DC controllers in North America is expected to acquire a global market size of more than 29.4%.

This is because of rigorous government measures designed to reduce the greenhouse effect during the projected period. Factors such as expanding consumer electronics and automotive demand in the region, increasing vehicle electrification, and increased investments in smart cities are driving the growth of this market.

Due to the high concentration of the large-scale semiconductor sector in this area, the AC-DC controller market in North America is predicted to have the greatest market share throughout the projection period.

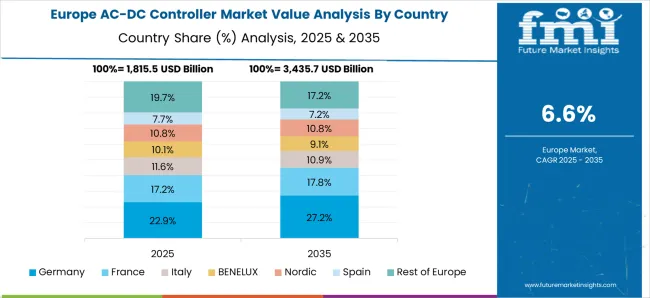

| Region | Europe |

|---|---|

| Market Share % (2025) | 25.6% |

In 2025, Europe held around 25.6% of the global market share. This region is expected to steadily grow the global AC-DC controller market during the forecast period.

During the projected period, Europe is expected to be the second-leading market for AC-DC power conversion. This is due to the growing automobile industry in European countries.

European automakers are progressively adopting AC-DC power conversion in cars and other vehicles. The advantages of adopting AC-DC power converters include higher fuel efficiency, increased safety, and lower maintenance costs. Some of the primary applications of AC-DC power conversion in the automobile sector include electric power steering (EPS), which is a growing trend in the industry. An electric motor is used by EPS to aid the driver in steering the vehicle. As a result, such developments are projected to drive demand in this region during the projection period.

The Asia Pacific market for AC-DC controllers is expected to be one of the fastest-growing markets in the world. The regional market comprises emerging economies such as China, India, and Japan, whose commercial as well as industrial developments are taking place at a higher rate than other developing nations throughout the world. This region is also predicted to increase at a CAGR greater than 6% due to the rising construction and industrial sectors during the forecast period.

The key players of this market include ON Semiconductor, NXP Semiconductors, Infineon Technologies, Inc., Texas Instruments Incorporated, Diodes Incorporated, Campbell Scientific, Inc., Rockwell Automation, TDK-Lambda Americas Inc., ROHM Semiconductor, Richtek Technology, and Curtiss-Wright.

| Attribute | Details |

|---|---|

| Growth Rate | 7.3% CAGR from 2025 to 2035 |

| Market Value for 2025 | USD 8054.1 billion |

| Market Value for 2035 | USD 116316.3 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million for Value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Output Power, Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; The Middle East and Africa |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, The United Kingdom, Italy, BENELUX, Nordic Countries, Russia, China, Japan, South Korea, GCC Countries, South Africa |

| Key Companies Profiled | ON Semiconductor; NXP Semiconductors; Infineon Technologies, Inc.; Texas Instruments Incorporated; Diodes Incorporated; Campbell Scientific, Inc.; ROHM Semiconductor; Richtek Technology; Curtiss-Wright |

| Report Customization & Pricing | Available upon Request |

The global AC-DC controller market is estimated to be valued at USD 8,054.1 billion in 2025.

The market size for the AC-DC controller market is projected to reach USD 16,316.3 billion by 2035.

The AC-DC controller market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in AC-DC controller market are isolated AC-DC controllers and non-isolated AC-DC controllers.

In terms of output power, 0 to 25 w segment to command 34.6% share in the AC-DC controller market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Microcontroller Unit Market Size and Share Forecast Outlook 2025 to 2035

Microcontroller Socket Market – Trends & Forecast 2025 to 2035

Door Controller Systems Market

Robot Controller, Integrator and Software Market Size and Share Forecast Outlook 2025 to 2035

Touch Controller IC Market Size and Share Forecast Outlook 2025 to 2035

Charge Controller System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Motion Controllers Market

Pipette Controller Market – Trends & Forecast 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Embedded Controllers Market Size and Share Forecast Outlook 2025 to 2035

SCR Power Controllers Market

Single Loop Controller Market Size, Growth, and Forecast 2025 to 2035

Touchscreen Controller Market Growth - Trends & Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Digital Pump Controller Manufacturers

Wireless LAN Controller Market

Optical Microcontrollers Market

Solar Charge Controller Market Growth – Trends & Forecast 2022-2032

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA