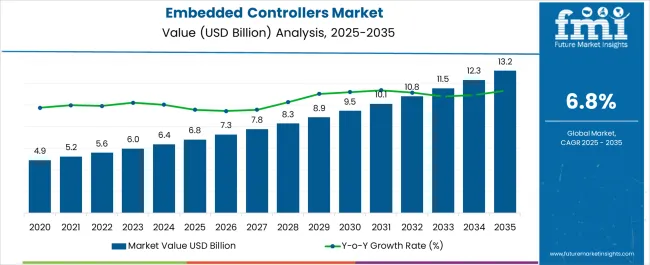

The Embedded Controllers Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 13.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Embedded Controllers Market Estimated Value in (2025 E) | USD 6.8 billion |

| Embedded Controllers Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The embedded controllers market is witnessing steady expansion, driven by the proliferation of connected devices, automation in manufacturing, and increasing integration of smart electronics in consumer and industrial applications. Industry journals and company disclosures have underscored the critical role of embedded controllers in managing real-time operations, optimizing energy consumption, and enhancing overall system performance.

The automotive sector has been a strong demand driver, with the rise of electric vehicles, advanced driver-assistance systems, and infotainment platforms requiring more sophisticated embedded control solutions. At the same time, consumer electronics and industrial automation continue to expand the addressable market, fueled by digitalization and the Internet of Things (IoT).

Advancements in chip architecture, miniaturization, and programmable flexibility have enabled controllers to adapt across diverse use cases, from energy management to robotics. Future growth is expected to accelerate as industries move toward 5G adoption, cloud-based integration, and edge computing, reinforcing embedded controllers as essential components across next-generation electronic systems.

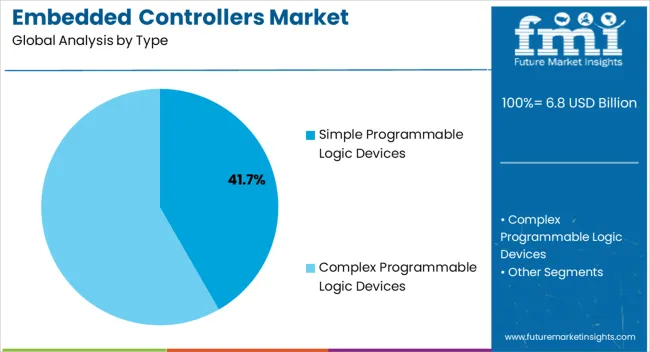

The Simple Programmable Logic Devices segment is projected to hold 41.7% of the embedded controllers market revenue in 2025, establishing itself as the largest type category. This dominance has been supported by their cost-effectiveness, ease of programming, and adaptability across multiple low- to mid-complexity applications.

Manufacturers have widely adopted simple programmable devices for tasks requiring flexible logic implementation without the expense of more advanced integrated circuits. Their smaller footprint and low power consumption have made them particularly relevant in embedded systems for consumer devices, industrial machinery, and automotive sub-systems.

Continuous enhancements in device architecture have extended their usability in areas demanding higher integration density. Despite competition from complex programmable logic devices, the balance of affordability, performance, and design flexibility has sustained the prominence of this segment.

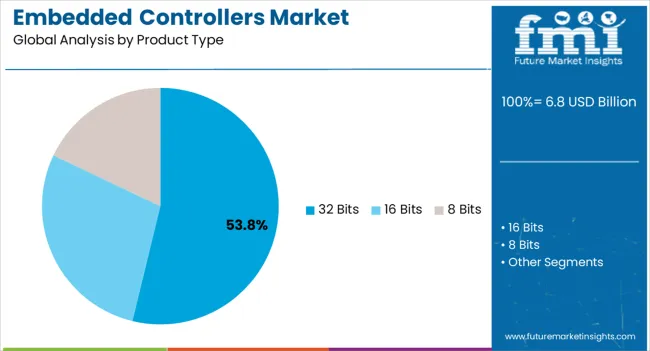

The 32 Bits segment is projected to account for 53.8% of the embedded controllers market revenue in 2025, holding the leading share among product types. Growth in this segment has been attributed to its optimal balance between processing power, energy efficiency, and cost, making it the preferred choice for diverse embedded applications.

Industry disclosures have highlighted that 32-bit controllers offer sufficient computational capability for advanced functions such as connectivity, signal processing, and sensor fusion, which are essential in automotive, industrial, and consumer electronics.

Their widespread adoption has been reinforced by robust developer ecosystems, software libraries, and compatibility with modern operating systems, which have streamlined product development cycles. Additionally, the scalability of 32-bit platforms has allowed manufacturers to standardize across product families, reducing design complexity and production costs. These advantages have secured the continued dominance of the 32 Bits segment in the global market.

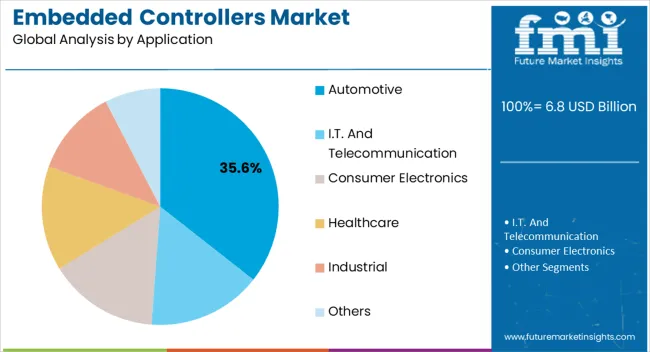

The Automotive segment is projected to contribute 35.6% of the embedded controllers market revenue in 2025, maintaining its position as the leading application category. This growth has been driven by the increasing complexity of automotive electronics, where embedded controllers manage critical systems ranging from engine control units and transmission systems to advanced driver assistance and in-vehicle connectivity.

Press releases and automotive technology forums have emphasized the rising demand for controllers that enable energy efficiency, safety compliance, and digital integration in modern vehicles.

The electrification of transport and adoption of autonomous driving technologies have further expanded the reliance on embedded controllers to manage real-time operations and ensure reliability under stringent conditions. With automakers investing heavily in smart mobility platforms and integrated electronic systems, the automotive sector continues to dominate application demand, reinforcing the embedded controllers market as a cornerstone of next-generation vehicle design and production.

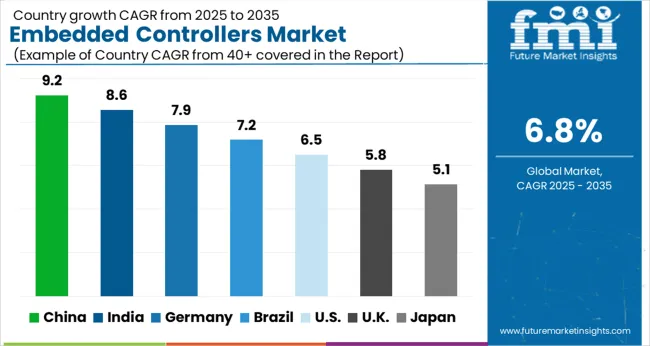

As per the embedded controllers market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2025, the market value of the embedded controllers market increased at around 9.4% CAGR. The embedded system industry has more demand for hybrid and electric vehicles as people become more concerned about the environment's depletion.

Consumer demand for smart homes and a surge in wearable device use are predicted to drive market expansion in the future. In the semiconductor industry, the embedded controller market also benefits from the rising demand for smartphones and tablets. The embedded controller market is predicted to increase due to key advantages such as real-time operation, reliability, and small size. Great energy efficiency, as well as high safety and dependability, are predicted to drive market expansion.

These control devices are being used to monitor and control equipment connected to the outside world. The embedded controller is the foundation of PLC, Distributed control system is the embedded controller, which allows the application to run even if its umbilical connection to the outside world is removed. Self-configuration, self-restoration, distributed control, and customization are projected to propel the embedded controller market.

The protection of embedded devices is one of the primary issues that has restricted the development of the embedded system business. Armed units, banks, server farms, and healthcare systems all store information in embedded devices. As a result, safeguarding such systems from cybersecurity attacks is important. Embedded systems are vulnerable to cyber-attacks caused by irregular security updates, a long device lifespan, remote installation, and attack replication. As a result, the embedded system's market expansion is projected to be limited by its vulnerability to cyber-attacks and security breaches.

Cyber risks and security breaches are a concern for embedded systems and are the factors that restrain the growth of the embedded controllers market. Also, over the next few years, the embedded controllers market is projected to be restricted by a lack of awareness, a difficult installation process, negative macroeconomic conditions, and fierce competition.

The development of 5G technology is projected to benefit the embedded system market. As a result, the manufacturing of embedded devices depending on fifth-generation technology is expected to increase. The algorithms in modern smart video surveillance systems installed in new vehicles offer real-time performance. Since 5G networks improve the functionality of imaging devices used in manufacturing and agriculture, the use of these systems will likely increase. As a result, 5G facilities that incorporate embedded infrastructure will contribute significantly to the embedded system market.

The compact embedded systems, which allow them to contain multiple functionalities, may result in design structures that are complex. This increases the energy consumption of embedded systems. The total lifespan of embedded devices is often harmed by high energy consumption. The temperature of the embedded device affects energy consumption, which increases as the temperature rises. This has an impact on the embedded system's overall performance.

Due to the high implementation of innovations and the presence of large vendors in the region, the North American region is likely to occupy a significant proportion of the market. Furthermore, the market for embedded computing devices has surged with the development of robotics and IoT-based products in the region. The key players in the healthcare sector in this region are shifting to graphical and high computational applications, including advanced computer technologies in all surgical units, diagnostic workstations, bedside monitors with graphics, and enhanced nursing stations. Furthermore, the market is likely to grow in demand throughout the forecast period as factory automation and IoT systems become more popular.

The embedded system market in Asia is growing due to rising per capita income and continuous large-scale urbanization and industrialization. Furthermore, access to low electronic products in the Asia Pacific is likely to contribute to the growth in the region's consumption of microprocessors and microcontrollers. The increasing use of autonomous robotics and embedded vision systems in Asia Pacific is expected to boost the market for embedded system equipment such as microprocessors and microcontrollers for industrial applications.

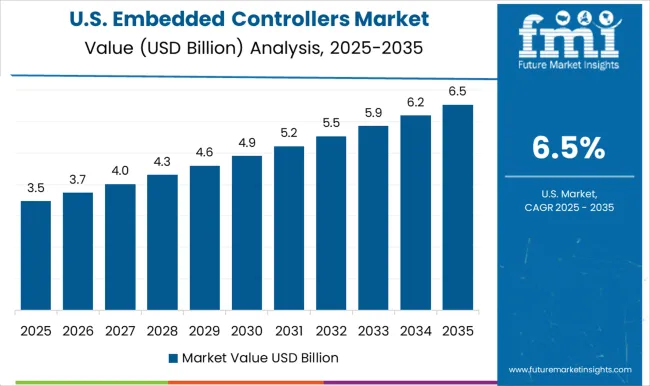

The United States is expected to account for the largest market share of USD 13.2 billion by the end of 2035. Several advancements in electrical and electronics have occurred in the United States. Freescale semiconductor devices, Texas Instruments, and Intel Corporation are some of the world's leading technology corporations based in the United States. The country's R&D sector is likewise a key driver supporting the embedded systems market.

The USA Department of Defense declared an open embedded computing standard called Sensor Open Systems Architecture (SOSA) in October 2020, which will allow the USA Army to clearly state embedded computer systems that are cost-effective, strong, upgradable, and competitive by mid-2024. Users must face concerns such as affordability, adaptability, and capacities as sensor systems grow in quantity, applications, cost, and complexity. A larger number of stakeholders should be able to quickly reconfigure and reuse sensor systems. The SOSA Consortium brings together government and businesses to encourage positive standards and best practices to enable, improve, and expedite the implementation of affordable, capable, and interoperable sensor systems.

The simple programmable logic devices segment is expected to account for a CAGR of 7.0% by the end of 2035. SPLDs (simple programmable logic devices) are the simplest, smallest, and most affordable programmable logic devices.

The architectures of SPLD are built on the use of dual logic gate array configurations. The first array contains Boolean ANDs, whereas the second contains Boolean O.R.s. These arrays can be combined to create a summation of products that can solve the needed Boolean logic problems. Input and output blocks and constrained programmable internal data routing channels that can allow output signal feedback are included in these devices. One of the most important features of SPLDs is that they can be used to compact electronic devices and automobiles. It can also decrease significant weight and improve the form factor since it provides space for adding other features and increases the price-quality ratio. For example, SPLDs, such as the 7400-series TTL, can be used on boards to substitute basic logic circuits (AND, OR, and NOT gates).

Market revenue through I.T. and Telecommunication sector is forecasted to grow at the highest CAGR of over 6.9% from 2025 to 2035. One of the primary aspects that are propelling the I.T. and Telecommunication sector is spending on 5G infrastructure installation due to the shift in customer preference for future technologies and smartphone devices. The expanding number of mobile subscribers, soaring need for high-speed data connectivity, and rising demand for value-added business solutions are some of the key factors that are boosting the growth of the I.T. and telecommunications sectors in the embedded controller market. Over the last few decades, the I.T. and telecommunications sectors have been one of the key areas for continuing technological advancements.

Embedded hardware is set to support the food networking environment. Technology is suitable for equipping intranet structures with router devices, Ethernet networks, WLAN devices, and protocol converters. Electronic hardware is also present in developing and manufacturing SDN artifacts, such as Field Programmable Gate Arrays and an application-specific integrated circuit. Independent hardware vendors (IHVs) frequently embed navigation bars, 1000BASE-T Ethernet, and 3550 transceivers to perform such tasks as PCI Express, 100G Ethernet, and DDR3 for interfacing. IHVs also use price-efficient and power-efficient technologies like eASIC in radio access network products.

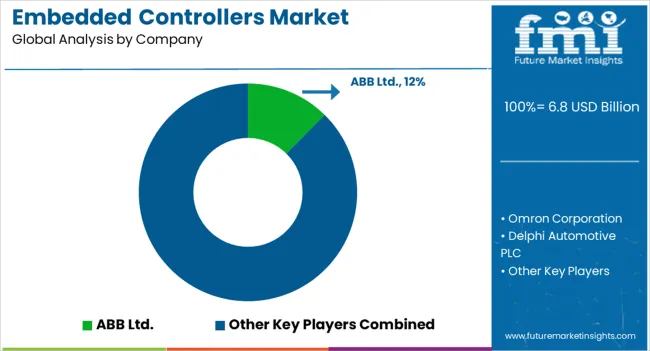

The market is likely to be moderately consolidated, with the key firms pursuing product innovation processes and mergers & acquisitions. Some of the key companies include ABB Ltd., Omron Corporation, Delphi Automotive PLC, Honeywell International Inc., STMicroelectronics, N.V., Freescale Semiconductor Ltd., Robert Bosch GmbH, and Schneider Electric S.E.

Some of the recent developments in the embedded controllers market are:

The global embedded controllers market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the embedded controllers market is projected to reach USD 13.2 billion by 2035.

The embedded controllers market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in embedded controllers market are simple programmable logic devices and complex programmable logic devices.

In terms of product type, 32 bits segment to command 53.8% share in the embedded controllers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Embedded Lending Market Size and Share Forecast Outlook 2025 to 2035

Embedded AI Market Size and Share Forecast Outlook 2025 to 2035

Embedded Universal Integrated Circuit Card (eUICC) Market Size and Share Forecast Outlook 2025 to 2035

Embedded Finance Market Size and Share Forecast Outlook 2025 to 2035

Embedded Multimedia Card Market Size and Share Forecast Outlook 2025 to 2035

Embedded Hypervisor Market Report – Trends, Demand & Industry Forecast 2025–2035

Smart Embedded Systems – AI-Optimized for IoT & 5G

Embedded Banking Market Insights – Growth & Forecast 2024-2034

Embedded Intelligence Market Growth – Trends & Industry Forecast 2023-2033

Embedded Business Intelligence Market Growth – Trends & Forecast 2023-2033

Embedded Smart Cameras Market Growth – Trends & Forecast 2023-2033

Embedded Security for IoT Market Report – Trends & Forecast 2017-2027

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Europe Embedded Banking Market - Trends & Forecast 2025 to 2035

Europe Embedded Finance Market – Trends & Forecast 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Low-Code Embedded Analytics Market Growth - Trends & Forecast 2025 to 2035

Industrial Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Embedded System Market Growth - Trends & Forecast 2024 to 2034

Motion Controllers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA