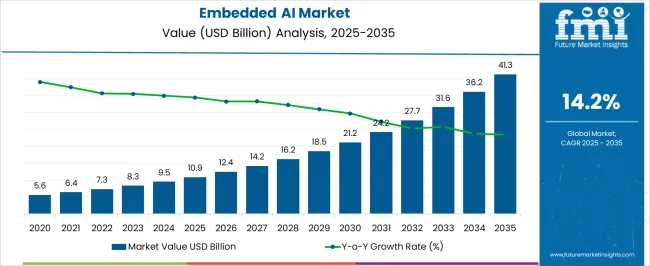

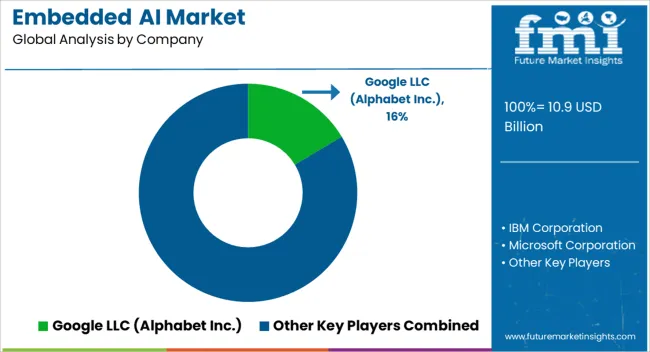

The Embedded AI Market is estimated to be valued at USD 10.9 billion in 2025 and is projected to reach USD 41.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.2% over the forecast period.

| Metric | Value |

|---|---|

| Embedded AI Market Estimated Value in (2025 E) | USD 10.9 billion |

| Embedded AI Market Forecast Value in (2035 F) | USD 41.3 billion |

| Forecast CAGR (2025 to 2035) | 14.2% |

The embedded AI market is advancing at a strong pace, driven by the convergence of intelligent computing and edge-based applications. Growing demand for low-latency decision-making, reduced reliance on cloud connectivity, and improved hardware-software integration are accelerating adoption across industries.

The current market scenario reflects increasing deployment of embedded AI in consumer electronics, industrial automation, automotive systems, and smart healthcare devices. Real-time analytics, combined with energy-efficient processing units, have strengthened the market’s growth rationale by enabling intelligent functions at the device level.

The market outlook remains promising, supported by rising investments in chip design, AI accelerators, and edge inference frameworks. With security, privacy, and operational efficiency becoming strategic priorities for enterprises, embedded AI is expected to play a central role in shaping next-generation IoT ecosystems.

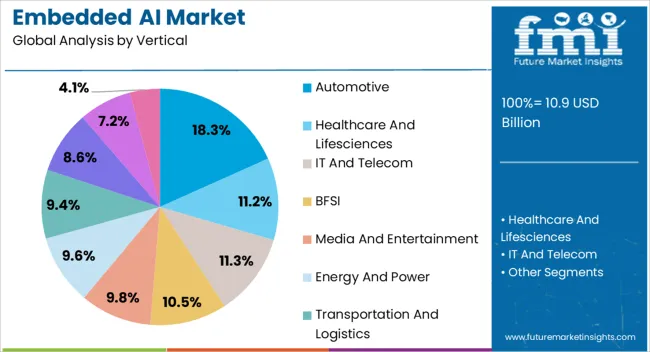

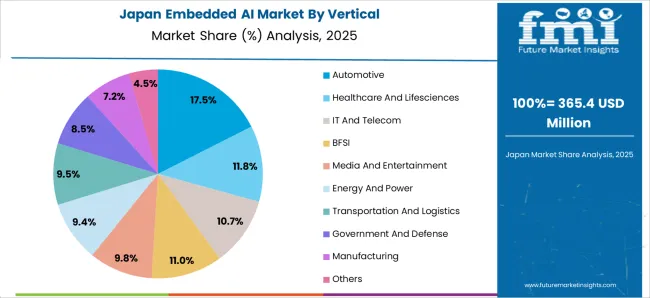

The automotive segment leads the vertical category, contributing approximately 18.3% share in the embedded AI market. Its leadership is reinforced by the integration of intelligent systems in advanced driver-assistance systems, predictive maintenance, and in-vehicle infotainment platforms.

Embedded AI enables real-time decision-making critical for autonomous and semi-autonomous vehicle functionalities, enhancing safety and driving efficiency. The segment benefits from continuous investment by automakers in smart mobility and electrification, where AI-enabled embedded solutions optimize energy management and operational control.

With the growing adoption of connected vehicles and government regulations mandating advanced safety systems, the automotive vertical is expected to retain its position as a leading adopter of embedded AI technologies.

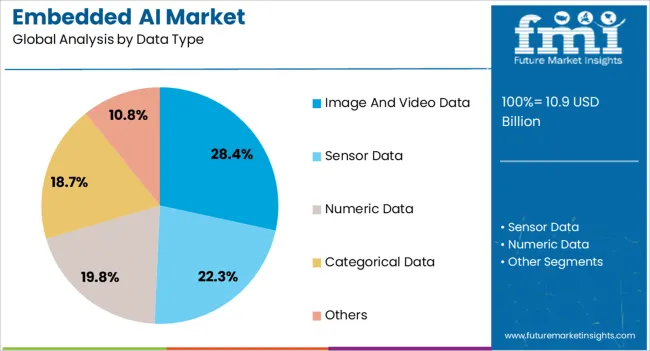

The image and video data segment dominates the data type category with approximately 28.4% share, reflecting its pivotal role in enabling intelligent recognition and analysis functions. Embedded AI systems process high-resolution visual inputs in real time, supporting applications such as facial recognition, surveillance, medical imaging, and quality inspection in manufacturing.

The segment’s growth is reinforced by advancements in edge-based vision processors and neural network accelerators, which enhance efficiency and accuracy. With image-driven applications expanding in consumer, automotive, and industrial domains, demand for optimized embedded AI solutions tailored to video analytics is projected to grow steadily.

This positioning ensures the segment’s continued relevance and expansion across diverse end-use markets.

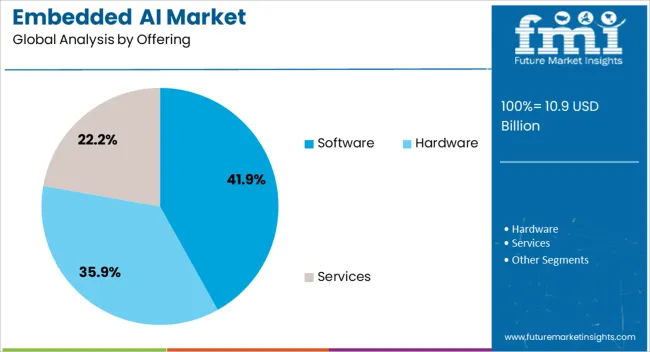

The software segment accounts for approximately 41.9% share in the offering category of the embedded AI market, underscoring the growing demand for AI frameworks, algorithms, and development kits that power hardware platforms. Software enables customization, scalability, and real-time updates, making it integral to the efficient functioning of embedded AI systems.

Its dominance is supported by rising adoption of machine learning models at the edge and demand for middleware solutions that facilitate interoperability across devices. Software-based optimization also plays a key role in enhancing inference speed, reducing energy consumption, and ensuring data security.

With the proliferation of edge devices and continuous AI model upgrades, the software segment is expected to maintain its leadership as the backbone of embedded AI deployments.

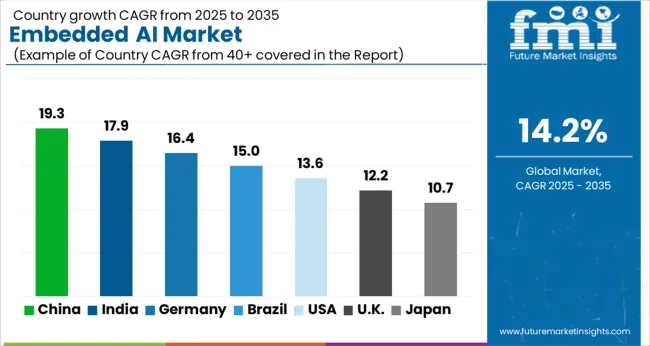

The scope for embedded AI rose at a 17.8% CAGR between 2020 and 2025. The global market for embedded AI is anticipated to grow at a moderate CAGR of 14.3% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025, owing to continued growth in IoT adoption, which led to increased demand for embedded AI in devices.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. Ongoing developments in AI algorithms, especially those optimized for edge computing, are expected to enhance the capabilities of embedded AI solutions. Improved algorithms will contribute to better performance and efficiency.

Embedded AI is closely tied to edge computing, where processing is done closer to the source of data rather than relying on centralized cloud servers, which is particularly important for applications that require low latency, such as autonomous vehicles, IoT devices, and robotics.

The integration of AI in embedded systems often involves the processing and analysis of sensitive data. Concerns related to data privacy and security can hinder adoption, especially in industries where safeguarding personal or confidential information is critical.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by the United Kingdom and Korea. The countries are expected to lead the market through 2035.

The embedded AI market in the United States expected to expand at a CAGR of 14.5% through 2035. The United States has a strong presence in industries such as technology, finance, healthcare, manufacturing, and automotive. The adoption of embedded AI in these key sectors, driven by the need for innovation and efficiency, contributes to market growth.

The embedded AI market in the United Kingdom is anticipated to expand at a CAGR of 15.4% through 2035. The United Kingdom has been actively pursuing digital transformation across various industries. Embedded AI is a key enabler of digitalization efforts, providing intelligent solutions for automation, data analytics, and enhanced decision making.

Embedded AI trends in China are taking a turn for the better. A 14.8% CAGR is forecast for the country from 2025 to 2035. Rapid urbanization in the country has led to the development of smart cities, where embedded AI plays a crucial role in applications such as urban management, transportation optimization, and environmental monitoring.

The embedded AI market in Japan is poised to expand at a CAGR of 14.9% through 2035. Japan is a global leader in robotics and automation. Embedded AI is integrated into robotic systems for tasks such as image recognition, object manipulation, and decision making, contributing to the growth of the market.

The embedded AI market in Korea is anticipated to expand at a CAGR of 15.1% through 2035. The country is a leader in 5G technology, and the deployment of 5G infrastructure facilitates the growth of embedded AI applications. High speed and low latency connections enable advanced AI processing at the edge.

The below table highlights how BFSI segment is projected to lead the market in terms of vertical, and is expected to account for a CAGR of 14.1% through 2035.

Based on data type, the numeric data segment is expected to account for a CAGR of 13.8% through 2035.

| Category | CAGR through 2035 |

|---|---|

| BFSI | 14.1% |

| Numeric Data | 13.8% |

Based on vertical, the BFSI segment is expected to continue dominating the Embedded AI market. Embedded AI systems are crucial for enhancing fraud detection and prevention capabilities in the BFSI sector. Machine learning algorithms can analyze patterns, detect anomalies, and identify potentially fraudulent transactions in real time, improving the security of financial transactions.

In terms of data type, the numeric data segment is expected to continue dominating the Embedded AI market. The proliferation of IoT sensors and devices that generate numeric data is a key driver. Embedded AI is used to analyze and derive insights from the vast amounts of numeric data generated by sensors in applications like smart cities, industrial IoT, and healthcare.

The embedded AI market is characterized by intense competition and dynamic innovation as companies strive to harness the power of artificial intelligence within embedded systems. Various players, ranging from established technology giants to innovative startups, contribute to the competitive ecosystem.

Recent Development

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 9.5 billion |

| Projected Market Valuation in 2035 | USD 36.2 billion |

| Value-based CAGR 2025 to 2035 | 14.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Vertical, Data Type, Offering, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Google LLC (Alphabet Inc.); IBM Corporation; Microsoft Corporation; Amazon Web Services Inc. (Amazon.com Inc.); NVIDIA Corporation; Intel Corporation; Qualcomm, Inc.; Salesforce Inc.; Siemens AG; Oracle Corporation |

The global embedded AI market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the embedded AI market is projected to reach USD 41.3 billion by 2035.

The embedded AI market is expected to grow at a 14.2% CAGR between 2025 and 2035.

The key product types in embedded AI market are automotive, healthcare and lifesciences, it and telecom, bfsi, media and entertainment, energy and power, transportation and logistics, government and defense, manufacturing and others.

In terms of data type, image and video data segment to command 28.4% share in the embedded AI market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI-Powered Embryo Selection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

Embedded Banking Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

Embedded Lending Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA