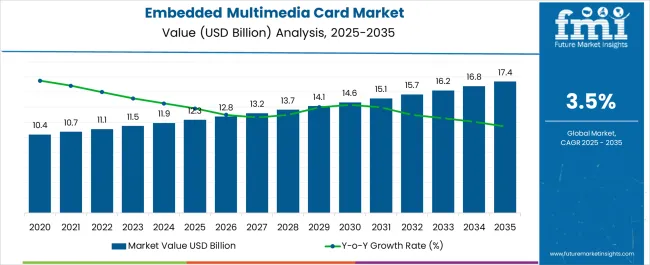

The Embedded Multimedia Card Market is estimated to be valued at USD 12.3 billion in 2025 and is projected to reach USD 17.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The embedded multimedia card market is projected to grow from USD 12.3 billion in 2025 to USD 14.6 billion by 2030, generating an incremental gain of USD 2.3 billion over the first five years, which represents 31.6% of the total incremental growth over the 10-year forecast period. This early-phase growth is driven by the increasing adoption of embedded multimedia cards in consumer electronics, automotive, and industrial applications, where compact, high-performance memory solutions are required.

The demand for faster, more reliable storage devices for mobile devices and IoT applications will further fuel this growth. The second half (2030–2035) is expected to contribute USD 4.1 billion, representing 68.4% of the total growth, driven by stronger momentum resulting from growing IoT deployments, increasing smart device adoption, and advancements in automotive systems.

Annual increments will rise from USD 0.5 billion in early years to USD 1 billion by 2035, driven by demand for high-density, energy-efficient memory solutions in both consumer and industrial sectors. Manufacturers focusing on developing high-performance, low-cost, and scalable memory products will capture the largest share of this USD 6.4 billion opportunity.

| Metric | Value |

|---|---|

| Embedded Multimedia Card Market Estimated Value in (2025 E) | USD 12.3 billion |

| Embedded Multimedia Card Market Forecast Value in (2035 F) | USD 17.4 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The embedded multimedia card market is experiencing accelerated adoption driven by the need for compact high speed memory solutions in consumer electronics, automotive systems, and industrial applications. As devices become increasingly data intensive, demand for reliable embedded storage that supports seamless performance and low power consumption has intensified.

Technological advances in flash memory architecture and integration techniques are enabling higher density and faster data processing capabilities. The market is also benefiting from the growth of connected devices and intelligent systems that require embedded memory to support edge computing and real time operations.

Regulatory emphasis on in vehicle data storage compliance and increasing digitalization across sectors are further supporting the growth trajectory. The outlook remains strong with manufacturers focusing on enhancing durability, temperature tolerance, and write endurance to meet the evolving demands of next generation electronics and mobility ecosystems.

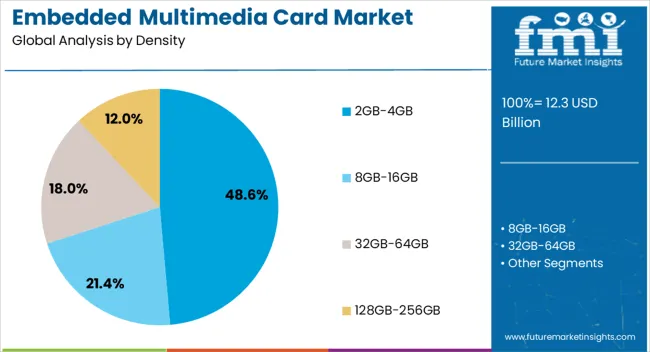

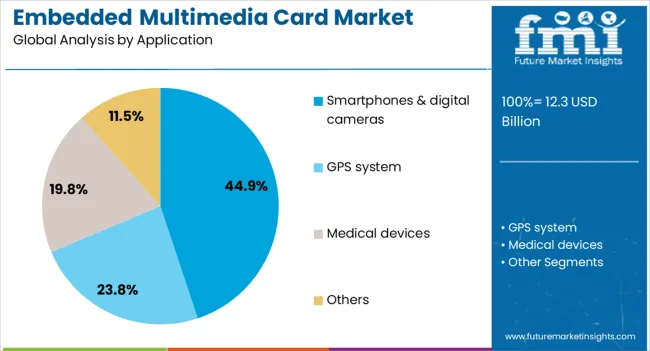

The embedded multimedia card market is segmented by density, application, end-user, and geographic regions. By density, the embedded multimedia card market is divided into 2GB-4GB, 8GB-16GB, 32GB-64GB, and 128GB-256GB. In terms of application, the embedded multimedia card market is classified into Smartphones & digital cameras, GPS systems, Medical devices, and Others.

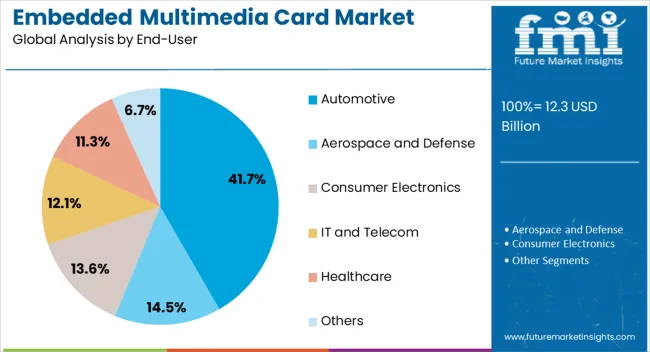

The end-users of the embedded multimedia card market are segmented into Automotive, Aerospace and Defense, Consumer Electronics, IT and Telecom, Healthcare, and Others. Regionally, the embedded multimedia card industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2GB to 4GB segment is anticipated to account for 48.60% of the total market revenue by 2025 under the density category, establishing itself as the leading segment. This dominance is attributed to its optimal balance between storage capacity and cost efficiency, making it ideal for mid-tier devices and embedded applications.

The segment is widely utilized in digital cameras, low-power computing modules, and entry-level smartphones, where efficient storage performance is critical without the need for high-density configurations. Additionally, its compatibility with legacy systems and minimal thermal footprint supports use in compact and thermally sensitive environments.

As manufacturers continue to prioritize cost optimization and broad applicability, this segment maintains a strong position in the embedded memory landscape.

The smartphones and digital cameras segment is projected to contribute 44.90% of market revenue by 2025 within the application category. This growth is being driven by the increasing functionality of mobile devices and consumer expectations for faster image processing and high-definition content storage.

Embedded multimedia cards are favored for their high reliability, low latency, and energy efficiency which are crucial in camera and smartphone operations. Compact size and seamless integration into system on chip platforms make these cards the preferred memory solution for mobile hardware designers.

The rise in digital content creation and the need for responsive storage performance further contribute to the dominance of this application segment.

The automotive segment is expected to capture 41.70% of market revenue by 2025 under the end user category, positioning it as the leading consumer of embedded multimedia cards. This growth is driven by the increasing integration of advanced infotainment systems, telematics, and driver assistance technologies that require durable and high-performance memory storage.

Embedded multimedia cards are designed to meet automotive-grade standards for temperature resilience, data integrity, and longevity. Their compact form factor and robust architecture enable reliable operation in the harsh environmental conditions typical of vehicular platforms.

As vehicles evolve into connected computing environments, demand for embedded memory capable of supporting real time data processing and storage continues to escalate, strengthening the automotive sector’s leadership in this market.

The eMMC market is driven by increasing demand for embedded storage solutions in consumer electronics, with significant opportunities in automotive and industrial applications. Emerging trends such as higher storage capacities and improved performance are reshaping the market’s future. However, price sensitivity and competitive market dynamics remain challenges. By 2025, overcoming these challenges through cost-efficient production and offering high-quality, high-performance eMMCs will be essential for sustaining growth and market expansion across various sectors.

The embedded multimedia card (eMMC) market is experiencing growth due to the increasing demand for storage solutions in consumer electronics. eMMC technology is widely used in smartphones, tablets, laptops, and wearables due to its compact size, reliable performance, and affordability. As the need for more storage in compact devices continues to rise, eMMCs are becoming an essential part of the electronic device manufacturing process. By 2025, the eMMC market is expected to continue growing as more consumer electronics require integrated storage solutions.

Opportunities in the eMMC market are expanding as industries outside of consumer electronics adopt the technology. The automotive and industrial sectors, which require high-performance embedded storage solutions, are increasingly turning to eMMCs for their reliability and cost-effectiveness. With the growing use of electronic systems in vehicles, smart infrastructure, and industrial equipment, the demand for eMMC storage in these sectors is rising. By 2025, these industries will play a key role in driving the market as they require efficient and durable embedded storage solutions.

Emerging trends in the eMMC market include the shift towards higher storage capacities and enhanced performance. As data-intensive applications become more common, such as high-definition video streaming, gaming, and AI-powered applications, the need for eMMCs with larger storage and faster data transfer rates is increasing. Manufacturers are responding by developing eMMCs with higher storage capacities, faster read/write speeds, and improved energy efficiency. By 2025, these trends will continue to dominate the market, with consumers and businesses seeking storage solutions that meet the demands of next-generation devices and applications.

Despite growth, challenges such as price sensitivity and intense competition persist in the eMMC market. While eMMCs offer affordable storage solutions, rising material costs and competitive pricing pressure from manufacturers can limit profit margins. Additionally, the presence of alternative storage technologies, such as solid-state drives (SSDs), can make it challenging for eMMC providers to maintain market share. By 2025, addressing these challenges will require companies to optimize production processes, reduce costs, and maintain the quality and performance of eMMC products.

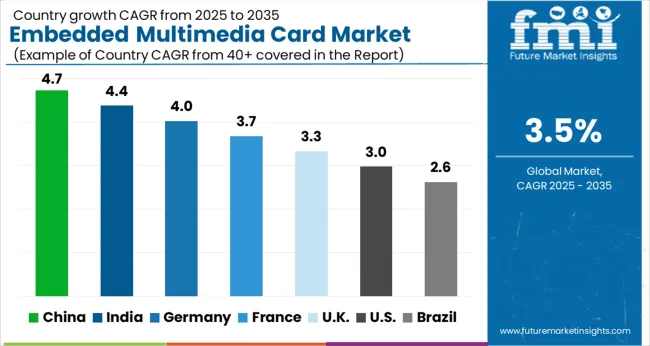

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK. | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The global embedded multimedia card (eMMC) market is projected to grow at a 3.5% CAGR from 2025 to 2035. China leads with a growth rate of 4.7%, followed by India at 4.4%, and Germany at 4%. The United Kingdom records a growth rate of 3.3%, while the United States shows the slowest growth at 3%. These varying growth rates are driven by increasing demand for eMMCs in consumer electronics, automotive, and industrial applications, the rising need for higher storage capacities, and the adoption of advanced mobile and embedded devices. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, increasing consumer electronics demand, and growing mobile phone penetration, while more mature markets like the USA and the UK see steady growth driven by technological advancements, increasing IoT applications, and innovations in automotive and industrial embedded systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The embedded multimedia card market in China is growing rapidly, with a projected CAGR of 4.7%. China’s increasing demand for consumer electronics, smartphones, and automotive applications is significantly driving the market for eMMCs. The country’s strong manufacturing base, coupled with the rising demand for mobile storage solutions, is further contributing to market growth. China’s investments in emerging technologies, including IoT and automotive applications, are fueling the adoption of eMMCs for high-performance devices. Additionally, the growing use of eMMCs in smart devices, appliances, and industrial automation systems in China further accelerates the demand for these memory cards.

The embedded multimedia card market in India is projected to grow at a CAGR of 4.4%. India’s expanding mobile phone market, along with growing adoption of consumer electronics and IoT applications, is driving the demand for eMMCs. The country’s growing middle class and increasing disposable incomes are fueling the demand for mobile storage solutions, including eMMCs. India’s focus on expanding its digital infrastructure, along with the adoption of eMMCs in automotive and industrial applications, further contributes to market growth. Additionally, the increasing demand for connected devices and smart home appliances in India is accelerating the adoption of eMMCs in a variety of applications.

The embedded multimedia card market in Germany is projected to grow at a CAGR of 4%. Germany’s increasing demand for eMMCs in automotive, industrial, and consumer electronics applications is driving steady growth. The country’s focus on developing smart infrastructure, along with the rising demand for efficient storage solutions in IoT and industrial automation, contributes to the growth of the eMMC market. Germany’s leadership in the automotive sector and the increasing integration of eMMCs in advanced vehicle infotainment systems further supports market expansion. Additionally, the growing adoption of eMMCs in industrial applications, such as robotics and automation, continues to fuel market demand.

The embedded multimedia card market in the United Kingdom is projected to grow at a CAGR of 3.3%. The UK demand for eMMCs is driven by growing adoption in consumer electronics, automotive, and IoT applications. The country’s emphasis on smart home technologies, connected devices, and renewable energy solutions is accelerating the demand for advanced storage solutions like eMMCs. Additionally, the UK strong automotive and manufacturing sectors, along with increasing investment in the industrial Internet of Things (IIoT), are contributing to steady growth in the market. The focus on sustainability and digital transformation in the UK further supports the adoption of eMMCs in various applications.

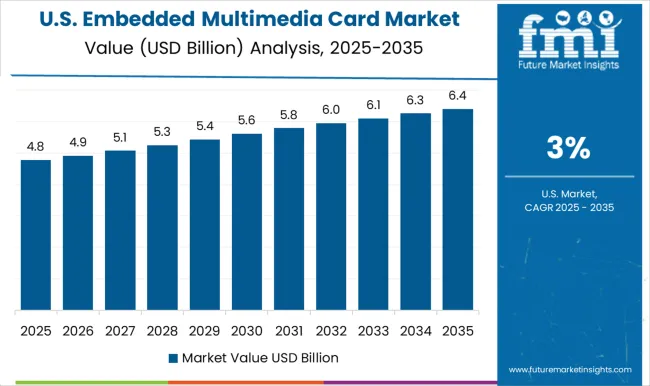

The embedded multimedia card market in the United States is expected to grow at a CAGR of 3%. The USA market is driven by the growing demand for eMMCs in a variety of applications, including consumer electronics, automotive systems, and industrial IoT. The increasing adoption of connected devices, smart home appliances, and mobile devices in the USA is fueling the demand for reliable and high-performance storage solutions. Additionally, the USA automotive industry’s adoption of advanced in-car technologies, infotainment systems, and autonomous driving solutions is contributing to the market growth. The need for energy-efficient and sustainable storage solutions further accelerates the adoption of eMMCs in the USA

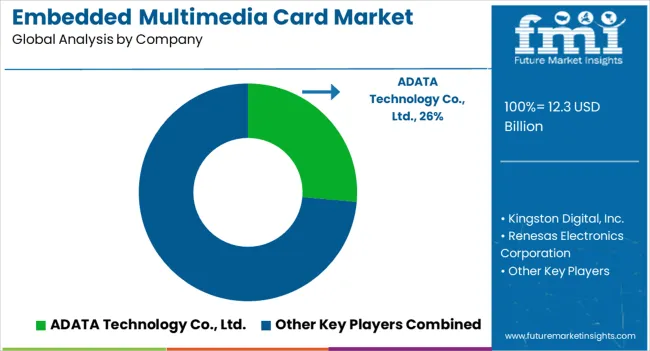

The embedded multimedia card (eMMC) market is dominated by ADATA Technology Co., Ltd., which leads with its high-performance eMMC solutions used in consumer electronics, mobile devices, and industrial applications. ADATA’s dominance is supported by its advanced storage technology, strong brand recognition, and commitment to providing reliable, cost-effective eMMC solutions that meet the needs of a wide range of devices.

Key players, including Samsung Electronics Co., Ltd., Kingston Digital, Inc., and Toshiba Memory Corporation, maintain significant market shares by offering durable, high-capacity eMMC storage products that deliver fast read/write speeds, as well as enhanced data security, for consumer and commercial devices. These companies focus on providing scalable, efficient, and affordable eMMC solutions tailored to the growing demand for mobile storage and embedded systems. Emerging players, such as Renesas Electronics Corporation and Toshiba Memory Corporation, are expanding their market presence by offering specialized eMMC products for niche applications, including automotive systems, industrial machinery, and IoT devices. Their strategies include improving storage performance, enhancing system reliability, and developing energy-efficient solutions for a variety of embedded applications.

Market growth is driven by the increasing adoption of eMMC storage in mobile phones, smart TVs, and other consumer electronics, as well as the growing demand for cost-effective storage solutions in the IoT and automotive industries. Innovations in memory technology, such as higher data throughput and miniaturization, are expected to continue shaping competitive dynamics and fuel further growth in the global embedded multimedia card market.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.3 Billion |

| Density | 2GB-4GB, 8GB-16GB, 32GB-64GB, and 128GB-256GB |

| Application | Smartphones & digital cameras, GPS system, Medical devices, and Others |

| End-User | Automotive, Aerospace and Defense, Consumer Electronics, IT and Telecom, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADATA Technology Co., Ltd., Kingston Digital, Inc., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., and Toshiba Memory Corporation |

| Additional Attributes | Dollar sales by card type and application, demand dynamics across consumer electronics, automotive, and industrial sectors, regional trends in embedded multimedia card adoption, innovation in high-speed data transfer and memory capacity, impact of regulatory standards on compatibility and security, and emerging use cases in IoT devices and smart appliances. |

The global embedded multimedia card market is estimated to be valued at USD 12.3 billion in 2025.

The market size for the embedded multimedia card market is projected to reach USD 17.4 billion by 2035.

The embedded multimedia card market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in embedded multimedia card market are 2gb-4gb, 8gb-16gb, 32gb-64gb and 128gb-256gb.

In terms of application, smartphones & digital cameras segment to command 44.9% share in the embedded multimedia card market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Embedded Universal Integrated Circuit Card (eUICC) Market Size and Share Forecast Outlook 2025 to 2035

Embedded Banking Market Size and Share Forecast Outlook 2025 to 2035

Embedded Lending Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Embedded AI Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Embedded Finance Market Size and Share Forecast Outlook 2025 to 2035

Embedded Controllers Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Valvulotome Market Size and Share Forecast Outlook 2025 to 2035

Cardamom Oil Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Prosthetic Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Ambulatory Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Carded Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA