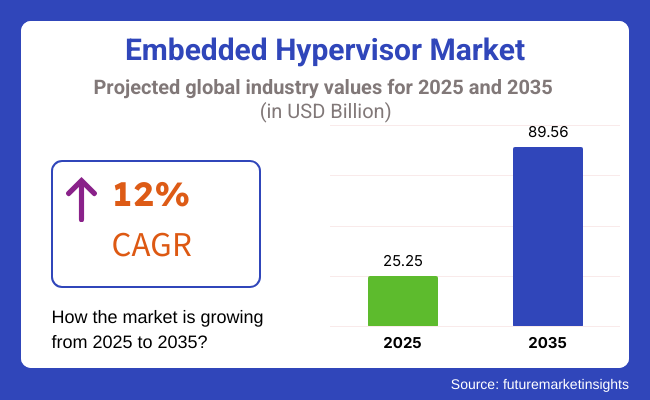

The global embedded hypervisor market is expected to grow from USD 25.25 billion in 2025 to USD 89.56 billion by 2035 at a CAGR of 12% during the forecast period. Embedded hypervisors software layers enabling multiple operating systems to run concurrently on a single hardware platform are gaining rapid traction, particularly within automotive, industrial automation, aerospace, and telecommunications industries, due to their capabilities in enhancing virtualization performance, security, and real-time responsiveness.

In automotive applications, embedded hypervisors are becoming indispensable for next-generation vehicles that rely on sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and autonomous driving technology. Vehicle software and electronics market segments are experiencing double-digit growth, highlighting significant investment into embedded virtualization to ensure isolation, security, and real-time operational stability. Prominent OEMs such as Volkswagen, BMW, and General Motors have announced strategic partnerships with hypervisor technology providers, including BlackBerry QNX, Wind River, and Green Hills Software, underscoring heightened industry momentum.

Industrial automation also contributes substantially to embedded hypervisor adoption, fueled by Industry 4.0 initiatives that demand robust virtualization to manage real-time analytics, secure edge computing, and integrated control systems. Increasing deployment of embedded hypervisors within smart manufacturing environments, driven by enhanced operational flexibility, cost-efficiency, and reliability.

In aerospace and defense sectors, embedded hypervisors support safety-critical avionics and defense systems, allowing precise resource allocation and stringent security through isolation of critical and non-critical functions. Recent FAA and EASA certifications of hypervisor-based avionic platforms further validate market credibility, reinforcing trust among regulatory bodies and industry stakeholders.

Telecommunications companies are similarly embracing embedded hypervisors, particularly within 5G infrastructure, to manage virtual network functions and deliver real-time, scalable network performance. Hypervisors enable operators like Ericsson, Nokia, and Huawei to efficiently deploy, manage, and secure virtualized 5G networks while ensuring minimal latency and improved operational continuity.

In 2025, RTOS is projected to hold a 36.2% share of the electronic cartography market, driven by the demand for real-time geospatial data processing in applications such as autonomous vehicles, aeronautical navigation, and defense operations. RTOS enables deterministic task scheduling, ensuring timely and reliable system responses essential for mission-critical applications.

Companies like Garmin Ltd., Thales Group, and Honeywell Aerospace are at the forefront, offering RTOS-integrated solutions that enhance navigation accuracy and system responsiveness. For instance, Honeywell's embedded flight management systems provide real-time navigation capabilities, improving safety and operational efficiency in both commercial and military aircraft.

Managed services are anticipated to dominate the market with a 53.5% share in 2025, fueled by the growing adoption of AI-driven navigational services and cloud-based mapping solutions. These services offer real-time data updates, enhanced security, and advanced analytics, enabling organizations to minimize reliance on physical infrastructure.

Leading providers such as HERE Technologies, TomTom, and Esri deliver scalable managed services for applications including fleet management, smart city planning, and military logistics. TomTom's cloud-powered navigation systems, for example, offer real-time traffic conditions and route optimization, benefiting logistics companies and urban planners.

The industry is growing due to the swift growth of virtualization in high-end applications of automotive, aerospace, industrial automation, and healthcare industries. Real-time efficiency and safety are an imperative in the automotive industry, particularly for autonomous and connected car applications.

Mission-critical functions are currently given prime importance by the aerospace & defence industry as far as compliance, security, and real-time processing capabilities are concerned. Cost-effectiveness and scalability are key factors in industrial automation that require the implementation of hypervisors that enable IoT-based smart manufacturing. Additionally, consumer electronics emphasize cost-effectiveness and scalability as the main goal for devices to perform better and at a lower energy consumption level.

Ensuring high security and compliance in medical devices and patient monitoring systems. Healthcare applications require finding ways to guarantee data integrity with the help of high-security measures and compliance. For example, Fraction of resources used to expand the industry among companies that increasingly incorporate AI, IoT, and cloud computing.

| Company | Contract Value (USD Billion) |

|---|---|

| Broadcom Inc. | Approximately USD 60 - USD 62 |

| KKR & Co. Inc. | Approximately USD 3.8 - USD 4.2 |

In November 2023, Broadcom Inc. completed the acquisition of VMware for approximately USD 60 - USD 62 billion, integrating VMware's virtualization technologies, including them, into its portfolio. This strategic move aims to enhance Broadcom's software offerings and expand its presence in the virtualization industry.

Subsequently, in February 2024, KKR & Co. Inc. agreed to acquire Broadcom's End-User Computing (EUC) Division, which includes VMware's Horizon and Workspace ONE products, for approximately USD 3.8 - USD 4.2 billion. This acquisition is set to bolster KKR's position in the virtualization and embedded hypervisor industry.

These developments reflect significant consolidation in the industry, with major players engaging in strategic acquisitions to enhance their technological capabilities and industry positions.

Between 2020 and 2024, the industry grew with industries embracing virtualization to improve security, resource utilization, and real-time system management. The development of autonomous vehicles, industrial automation, and edge computing pushed demand for hypervisors with safe partitioning of non-critical and critical workloads.

Firms into automotive control units, medical devices, and IoT devices to maximize performance and lower hardware costs. 5G and software-defined networking (SDN) continued to propel hypervisor use in telco and cloud-edge ecosystems.

AI-facilitated workload management further enhanced efficiency by incorporating perception intelligence into workload management. Automotive safety and industrial security regulation compliance impacted hypervisor design. Despite improvement, system complexities and real-time performance limits discouraged adoption, leading to investment in lightweight architecture and AI-driven security frameworks.

Hypervisors in 2025 to 2035 will get infused with AI automation, quantum-secure virtualization, and edge computing based on decentralized methodologies. AI-enabled hypervisors will guarantee optimal workload scheduling in real-time to use the least power. Protection against quantum computer-based attacks will be augmented with quantum-resistant cryptography, while blockchain technology will ensure immutable audit trails.

Autonomous system growth will require ultra-low-latency hypervisors for enabling mission-critical workloads. Predictive maintenance using AI will enhance system reliability, with energy-efficient architectures reducing computational overhead, thus supporting sustainability in embedded computing.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter security requirements (ISO 26262, IEC 61508, DO-178C, GDPR) made embedded hypervisor necessary for secure partitioning and real-time compliance for safety-critical applications. | AI-driven, zero-trust hypervisor architectures deliver real-time regulatory compliance, security verification automation, and decentralized runtime monitoring for mission-critical embedded systems. |

| AI-based embedded hypervisor improved resource allocation. enhanced workload balancing, and predictive failure analysis. | AI-born, self-aware hypervisors automatically optimize hardware usage, allow real-time adaptive virtualization, and increase security with AI-powered anomaly detection. |

| The growing application in vehicle ECUs, industrial automation, and robotics increased system dependability and functional safety. | AI-accelerated, real-time embedded hypervisor support autonomous vehicle safety monitoring, AI-enabled predictive maintenance, and transparent multi-OS integration for smart automation. |

| They allowed multi-core operation, supporting safe execution of mixed-criticality workloads on automotive, aerospace, and defense systems. | Heterogeneous, AI-driven hypervisor architectures dynamically schedule mixed-criticality workloads, dynamically partition resources, and offer ultra-reliable real-time computing for future cyber-physical systems. |

| The advent of edge computing necessitated low-latency, high-performance virtualization support in them for IoT and AI workloads. | AI-based, edge-native hypervisors provide real-time, self-governing workload management, anticipatory AI inference optimization, and lightning-fast data processing for distributed computing environments. |

| Embedded virtualization platforms followed rigorous automotive (ISO 26262 ASIL-D) and avionics (DO-178C DAL-A) safety certifications. | Compliance-based, AI-powered hypervisor platforms self-certify real-time system integrity, support AI-driven fault tolerance, and provide high-assurance system partitioning for safety-critical applications. |

| Growing cyber threats resulted in more widespread use of hardware-based security features, encrypted hypervisor layers, and AI-based security monitoring. | AI-native, quantum-safe hypervisors automatically identify security vulnerabilities, impose real-time encryption, and provide AI-based self-healing virtualization for cyber-resilient embedded systems. |

| Increased connectivity improved real-time virtualization for autonomous vehicles, industrial robots, and high-speed networks. | AI-driven, 6G-hypervisors provide ultra-low latency edge computing, SDN with AI-driven software programming, and real-time workload scheduling for next-gen intelligent infrastructure. |

| Firms optimized them to be power-optimized, powering green computing across IoT, automobiles, and industry automation. | Carbon-aware, AI-driven hypervisors intelligently manage power distribution, provide real-time power-efficient virtualization, and can be integrated into renewable-powered edge devices for efficient embedded computing. |

| Enterprises investigated blockchain-secured hypervisor platforms for tamper-resistant data integrity, secure software delivery, and trusted execution environments. | AI-driven, decentralized hypervisors provide trustless real-time workload management, smart contract security enforcement, and AI-driven distributed system authentication for mission-critical infrastructure. |

The industry clearly shows its distinctive risks since it is integrated into automotive, industrial automation, aerospace, and IoT systems. The main risk factors are the increased hacking chances, the problems regarding real-time-performance, the need for compliance, and the rapid decomposition of technology.

One important issue is the cybersecurity risks. An embedded hypervisor controls multiple VMs on a single hardware unit thus it is very attractive to the hackers including malware, unauthorized access, and system breaches. As they are widely used in the critical infrastructure, automobiles control units, and the medical devices, any security issues can lead to data leaks, system malfunctions, or even the life of people.

Another problem is the real-time performance reliability. Many fields such as automotive (such as ADAS systems) and industrial automation require an environment with low-latency and high-reliability. If an embedded hypervisor introduces the latency or performance bottleneck, it will lead to malfunctions, safety, and compliance failures in mission-critical applications.

Pressure for regulatory compliance is yet another significant risk. Embedded hypervisor in aviation, automotive, and healthcare must adhere to various industry standards such as ISO 26262 for automotive safety, DO-178C for avionics software, and IEC 62304 for medical devices among others. If this not met, there can be product recalls, punitive damage, and dwindled business.

Technological development is also a danger. Through the course of time, the embedded systems that are used, for instance, the Polish start-ups that develop sustainable energy, will require to be rebuilt by using new processor architectures, AI-based automation, and have a demand for edge computing. Vendors that turn a blind eye to adapt and develop might, in the end, have their products obsolete, hence losing their industry relevance.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.8% |

| UK | 9.5% |

| European Union | 9.6% |

| Japan | 9.7% |

| South Korea | 9.9% |

The USA industry increases significantly as businesses adopt virtualization solutions to improve security, enhance resource utilization, and boost real-time processing capacity. The automotive sector employs them to facilitate real-time processing in advanced driver-assistance systems (ADAS) and electric vehicle (EV) designs.

Industrial automation vendors implement these solutions to provide faultless operation in robotics and smart manufacturing systems. The telecommunication sector uses them for network function virtualization (NFV) and 5G infrastructure.

Security and protection of critical infrastructure policies are also propelling industry growth. For instance, the National Institute of Standards and Technology (NIST) issues guidelines for embedded security to direct companies to invest in secure hypervisor solutions. Additionally, enhanced multi-core processing and edge computing enhance the adoption of embedded virtualization across various industries.

FMI is of the opinion that the USA industry is slated to grow at 9.8% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Growth in the Automotive Industry | ADAS and EVs require virtualization in real time to ensure enhanced system performance. |

| Industrial Automation | Intelligent factories and robotics require hypervisors for multi-OS, secure operations. |

| 5G and Telecommunications | They make NFV and edge computing a reality in next-generation networks. |

The UK industry expands as companies embrace AI-based virtualization to enhance embedded system security and operation efficiency. The automotive industry uses them in backing autonomous car development and in-car infotainment. Virtualization helps in the IoT industry by optimizing the use of resources in smart city deployments, connected healthcare devices, and industrial IoT (IIoT) solutions.

Government policies involving cybersecurity and digitalization promote hypervisor adoption. Organizations are now using these products in financial sectors and defense as secure multi-OS infrastructure becomes a priority. AI-driven automation also boosts the demand for them in data analysis and processing.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Autonomous Cars | They enable secure real-time system control. |

| IoT & Smart Cities | Virtualization allows for optimal resource utilization in smart city development. |

| Cybersecurity Regulations | Government policies necessitate safe computer systems. |

The industry grows as businesses embrace real-time virtualization, artificial intelligence-based security, and cloud computing. Germany, France, and Italy dominate the industry with the application of them in automobile safety systems, industrial control systems, and intelligent infrastructure.

Virtualization in the automotive sector is employed by car manufacturers to enhance electronic control units (ECUs) and facilitate over-the-air (OTA) software updates. Industrial automation gains from them to enhance operating effectiveness and safety for smart factories.

Stricter cyber security and data protection laws throughout the EU lead businesses to adopt secure, high-performance embedded virtualization platforms. The perpetual trend away from multi-core processors as an adopted architecture also encourages the embedding of such technologies throughout strategic industry verticals.

FMI is of the opinion that the European Union industry is slated to grow at 9.6% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Car Industry Innovation | Efficiency and capability of ECU of hypervisors, as well as over-the-air update features. |

| Industrial Control Systems | Virtualization is applied for optimization in smart factories. |

| Data Protection Laws | Companies follow strict security laws. |

The industry expands with the injection of real-time virtualization, artificial intelligence-driven system control, and secure software-defined space in various industries. They contribute to autonomous vehicle technology, which offers multi-OS and real-time processing support by auto vendors.

Virtualization facilitates the industrial robotics industry in machine performance optimization and predictive maintenance. Consumer electronics firms also use them to facilitate smarter appliance connectivity and communication.

Japan's emphasis on high-performance computing and cybersecurity powers widespread adoption. Financial and defense sectors also leverage them to make data more secure and digitize infrastructure.

FMI is of the opinion that the Japanese industry is slated to grow at 9.7% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Smart & Autonomous Vehicles | Hypervisors provide real-time support in autonomous applications. |

| Industrial Robots | Virtualization by AI reinforces robotic automation. |

| Consumer Electronics | Embedded solutions help smart home connections. |

The industry experiences robust growth due to the uptake of AI-driven virtualization, IoT security software, and high-speed computing platforms. The government encourages the development of smart technologies, leading to increased use of them in automotive, telecom, and industrial applications. Businesses implement real-time multi-OS virtualization and secure containerization to enhance the performance of embedded systems.

Expansion of 5G network infrastructure and edge computing increase the need for telco and cloud hypervisor applications. Automotive companies produce next-gen vehicles with hypervisor-enabled safety features and infotainment systems. Smart manufacturing companies simplify operations with virtualized industrial control systems.

FMI is of the opinion that the South Korean industry is slated to grow at 9.9% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| 5G & Edge Computing | Hypervisors enhance telecommunication and cloud applications. |

| Automotive Safety Systems | Virtualization enhances real-time automotive performance. |

| Smart Manufacturing | Industrial IoT is underpinned by secure and effective hypervisors. |

The industry is steadily building momentum as its client industries seek to consolidate their virtualization solutions while providing greater security, efficiency, and real-time processing capabilities to the respective embedded systems.

Thus, they find crucial applications for the isolation of critical workloads, for the enablement of multi-OS environments, and for the enhancement of system reliability in industries such as automotive, aerospace, industrial automation, and telecommunications.

Major dominators in this industry include Wind River, SYSGO (Thales Group), Green Hills Software, BlackBerry QNX, and Siemens (Mentor Graphics) with their real-time hypervisors, secure virtualization frameworks, and AI-based solutions for workload management. Meanwhile, lighting up the business are startups and niche providers in lightweight hypervisors, open-source virtualization, and hardware-assisted security for embedded applications.

The competition in the marketplace has heightened due to the increased adoption of software-defined vehicles, IoT-enabled industrial automation, and cybersecurity-based hypervisor solutions. Companies are investing in cloud-integrated embedded virtualization, AI-based hypervisor management, and ARM-based hypervisor optimizations for performance and scalability.

Factors like the rising demand for automotive hypervisors in connected and autonomous vehicles, aerospace & defense applications requiring certified security, and industrial IoT solutions demanding real-time processing are intensifying the competition. The companies are working on low-latency virtualization, edge-computing integration, and hypervisor-based security architectures to stay at the forefront in this fast-evolving landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Wind River Systems | 20-25% |

| SYSGO (Thales Group) | 15-20% |

| Green Hills Software | 12-17% |

| Blackberry QNX | 8-12% |

| Siemens (Mentor Graphics) | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Wind River Systems | Develops real-time embedded hypervisors, AI-powered workload management, and secure virtualization solutions. |

| SYSGO (Thales Group) | Provides real-time, safety-critical hypervisors for aerospace, automotive, and industrial applications. |

| Green Hills Software | Specializes in high-security embedded virtualization, multi-core processing, and OS partitioning. |

| Blackberry QNX | Focuses on automotive-grade embedded hypervisors, real-time OS integration, and cybersecurity solutions. |

| Siemens (Mentor Graphics) | Offers cloud-based embedded hypervisors, real-time computing solutions, and industrial automation support. |

Key Company Insights

Wind River Systems (20-25%)

AI-driven workload management, real-time virtualization, and cloud-based hypervisor solutions constitute Wind River Systems' offerings for the industry.

SYSGO (Thales Group) (15-20%)

SYSGO is a specialist in safety-critical hypervisors integrated into real-time operating systems with security-oriented virtualization for aerospace and automotive applications.

Green Hills Software (12-17%)

With high-assurance embedded virtualization, multi-core processing, and OS partitioning, Green Hills software improves security and enables high performance.

Bob QNX (8-12%)

With the integration of cybersecurity, Blackberry QNX powers ideal embedded hypervisor provision for automotive, IoT, and mission-critical applications.

Siemens (Mentor Graphics) (5-9%)

Siemens (Mentor Graphics) has a cloud-based embedded hypervisor, industrial automation provision, and AI-embedded virtualization tools.

Other Key Players (20-30% Combined)

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 25.25 billion |

| Projected Industry Size (2035) | USD 89.56 billion |

| CAGR (2025 to 2035) | 12% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2023 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Solutions | Embedded Hypervisor Software, Bare-Metal Hypervisors (Type 1), Hosted Hypervisors (Type 2), Real-Time Operating Systems (RTOs), Services, Professional Services (Consulting, Integration & Deployment, Support & Maintenance), Managed Services |

| Technologies | Server Virtualization, Desktop Virtualization, Data Center Virtualization |

| Enterprise Sizes | Small & Medium Enterprises (SMEs), Large Enterprises |

| Industries | BFSI, Automotive, Aerospace & Defense, Consumer Electronics, Healthcare & Medical Devices, Industrial Automation, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA) |

| Key Players | Wind River Systems, SYSGO (Thales Group), Green Hills Software, Blackberry QNX, Siemens (Mentor Graphics), Lynx Software Technologies, Red Hat (IBM), VMware (Broadcom), RTI (Real-Time Innovations), TenAsys |

| Additional Attributes | Rise of secure virtualization layers in mission-critical systems, deployment trends in multi-core architectures, real-time performance in IIoT and automotive, regulatory compliance for aerospace systems, and evolving enterprise cloud-hypervisor convergence. |

| Customization & Pricing | Available upon Request |

By solution, the industry is divided into embedded hypervisor software, bare-metal hypervisors (Type 1), hosted hypervisors (Type 2), real-time operating systems (RTOs), services, professional services (consulting, integration & deployment, support & maintenance), and managed services.

By technology, the industry includes server virtualization, desktop virtualization, and data center virtualization.

By enterprise size, the industry is classified as small & medium enterprises (SMEs) and large enterprises.

The industry is classified into BFSI, Automotive, Aerospace & Defense, Consumer Electronics, Healthcare & Medical Devices, Industrial Automation, and Others.

By region, the industry spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa (MEA).

The industry is slated to reach USD 25.25 billion in 2025.

The industry is predicted to reach a size of USD 89.56 billion by 2035.

IBM Corporation, Microsoft Corporation, VMware, Inc., QNX Software Systems Limited, SYSGO AG, Siemens EDA, WindRiver Systems, Inc., ENEA, Sierraware, TenAsys Corporation, Lynx Software Technologies, Inc., Green Hills Software, Acontis Technologies GmbH, Citrix Systems, Inc., Proxmox Server Solutions GmbH, Real-Time Innovations (RTI), DDC-I, and CoreAVI are the key players in the industry.

South Korea, with a CAGR of 9.9%, is expected to record the highest growth during the forecast period.

Managed services are among the most widely used solutions in the industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Solution, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Solution, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 24: Global Market Attractiveness by Industry, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 46: North America Market Attractiveness by Solution, 2023 to 2033

Figure 47: North America Market Attractiveness by Technology, 2023 to 2033

Figure 48: North America Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 49: North America Market Attractiveness by Industry, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Solution, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 96: Europe Market Attractiveness by Solution, 2023 to 2033

Figure 97: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 98: Europe Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 99: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Solution, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 124: South Asia Market Attractiveness by Industry, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Solution, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 149: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Solution, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Industry, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Solution, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 174: Oceania Market Attractiveness by Industry, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Solution, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 196: MEA Market Attractiveness by Solution, 2023 to 2033

Figure 197: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 198: MEA Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 199: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Embedded Banking Market Size and Share Forecast Outlook 2025 to 2035

Embedded Lending Market Size and Share Forecast Outlook 2025 to 2035

Embedded AI Market Size and Share Forecast Outlook 2025 to 2035

Embedded Universal Integrated Circuit Card (eUICC) Market Size and Share Forecast Outlook 2025 to 2035

Embedded Finance Market Size and Share Forecast Outlook 2025 to 2035

Embedded Controllers Market Size and Share Forecast Outlook 2025 to 2035

Embedded Multimedia Card Market Size and Share Forecast Outlook 2025 to 2035

Smart Embedded Systems – AI-Optimized for IoT & 5G

Embedded Intelligence Market Growth – Trends & Industry Forecast 2023-2033

Embedded Business Intelligence Market Growth – Trends & Forecast 2023-2033

Embedded Smart Cameras Market Growth – Trends & Forecast 2023-2033

Embedded Security for IoT Market Report – Trends & Forecast 2017-2027

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Europe Embedded Finance Market – Trends & Forecast 2025 to 2035

Europe Embedded Banking Market - Trends & Forecast 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Low-Code Embedded Analytics Market Growth - Trends & Forecast 2025 to 2035

Industrial Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Embedded System Market Growth - Trends & Forecast 2024 to 2034

Hypervisor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA