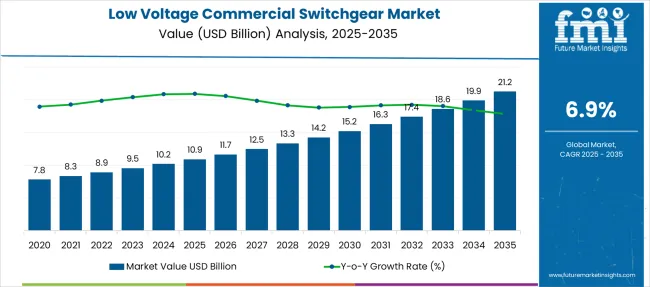

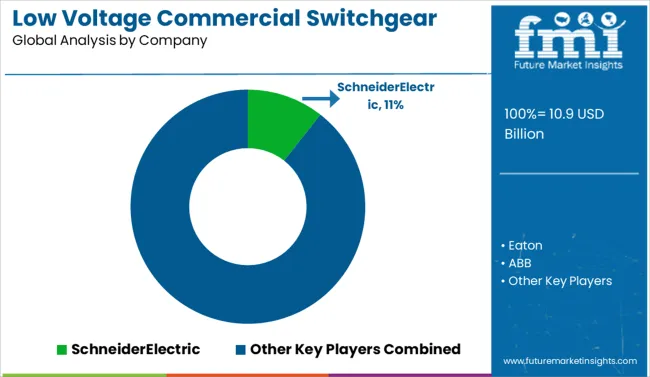

The Low Voltage Commercial Switchgear Market is estimated to be valued at USD 10.9 billion in 2025 and is projected to reach USD 21.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Low Voltage Commercial Switchgear Market Estimated Value in (2025 E) | USD 10.9 billion |

| Low Voltage Commercial Switchgear Market Forecast Value in (2035 F) | USD 21.2 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The low voltage commercial switchgear market is witnessing sustained growth fueled by rapid urbanization, infrastructure modernization, and increased integration of renewable energy sources into commercial buildings. Commercial complexes, data centers, hospitality venues, and office spaces are placing greater emphasis on energy-efficient electrical distribution systems, which has amplified the need for low voltage switchgear with advanced control and protection features.

Industry players are aligning product development with digital switchgear innovations including real-time diagnostics, predictive maintenance, and remote operability to meet the evolving expectations of commercial facility managers. Regulatory focus on safety standards and environmental sustainability is encouraging the adoption of switchgear solutions that are compact, low-loss, and environmentally safe.

Additionally, rising commercial construction activity in emerging economies and refurbishment of aging infrastructure in developed regions are collectively strengthening market fundamentals. With growing electricity demand and distributed energy systems becoming more prevalent, low voltage switchgear is expected to remain a central component of safe and reliable power delivery within commercial environments.

The low-voltage commercial switchgear market is segmented by current and insulation, and geographic regions. Currently, the low-voltage commercial switchgear market is divided into AC and DC. The low-voltage commercial switchgear market is classified into Air, Gas, Vacuum, and Others. Regionally, the low voltage commercial switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

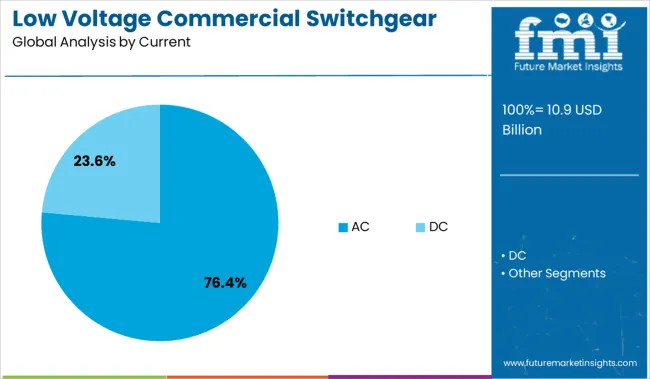

The alternating current segment is projected to account for 76.4% of the total market revenue in 2025, solidifying its position as the dominant current type in commercial low voltage switchgear systems. This dominance is being supported by the widespread adoption of AC electrical distribution systems across commercial applications where cost efficiency, ease of installation, and availability of compatible infrastructure are critical.

AC systems enable more straightforward integration of transformers, circuit breakers, and load control components that are standardized across global commercial settings. Additionally, AC switchgear is well suited to handle variable load profiles typical in commercial buildings, making it more scalable and flexible in deployment.

The lower cost of installation and maintenance when compared to direct current systems has further reinforced AC’s leadership. Regulatory codes and electrical standards in most countries are also structured around AC configurations which has ensured high compatibility and driven continued preference for AC-based switchgear products across diverse commercial projects.

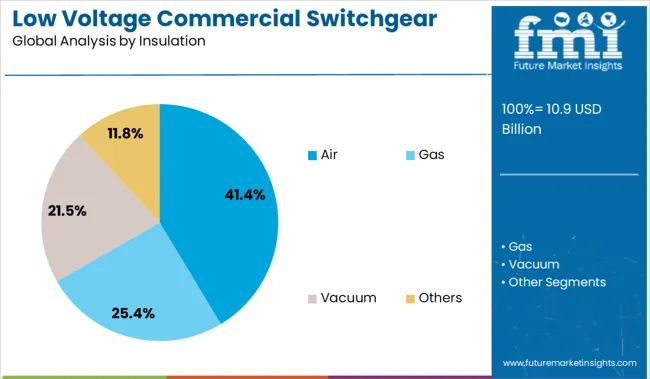

The air insulation segment is expected to contribute 41.4% of the market revenue by 2025 within the insulation category, positioning it as the leading choice among insulation types for low voltage commercial switchgear. This prominence can be attributed to the simplicity, affordability, and environmental safety that air-insulated switchgear offers in commercial installations. Air-insulated systems do not involve hazardous gases or specialized containment, making them easier to maintain and more compliant with evolving environmental standards.

Their modular design allows for flexible configurations and space optimization in commercial buildings where floor area efficiency is important. Additionally, the use of air as a dielectric medium supports reliable arc-quenching performance at low voltages, contributing to operational safety.

Advancements in arc management and compartmentalization technologies have further enhanced the performance of air-insulated switchgear, making it a viable long-term investment for building managers and developers. These factors have contributed to air insulation retaining the largest share among insulation technologies in the low voltage commercial switchgear market.

The low voltage commercial switchgear market is driven by infrastructure growth, energy efficiency needs, and safety compliance in commercial spaces. Opportunities arise from digital integration, predictive maintenance, and demand for customizable, space-saving designs in critical sectors.

Demand in the low voltage commercial switchgear segment has been influenced by the expansion of commercial real estate and infrastructure upgrades across business hubs. Higher reliance on stable electrical distribution networks in office spaces, data centers, and retail outlets has strengthened the adoption of compact and modular systems. Increased preference for integrated protection and control functions has supported the replacement of outdated units. Market growth is also driven by the rising demand for energy efficiency in commercial buildings, where optimized switchgear systems help reduce operational losses. The emphasis on safety, cost optimization, and reduced downtime has been observed as a primary decision-making factor among facility managers and electrical contractors.

Opportunities are becoming visible with the growing penetration of automation in building energy management systems and the integration of digital monitoring solutions. Adoption of low voltage switchgear with embedded communication capability has been recognized as essential for predictive maintenance and real-time fault detection in commercial environments. Demand from sectors such as healthcare facilities, educational institutions, and hospitality complexes has remained steady due to critical requirements for uninterrupted power. Regional governments encouraging safer electrical installations through compliance regulations have created an additional incentive for upgrading to advanced configurations. Manufacturers investing in customizable designs and compact architectures are expected to capture market share as commercial spaces seek space-efficient and scalable solutions.

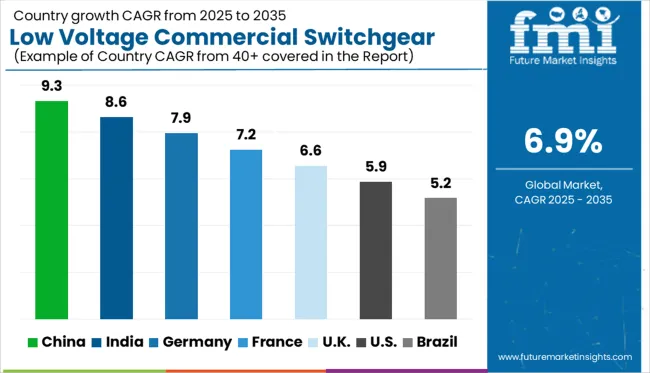

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

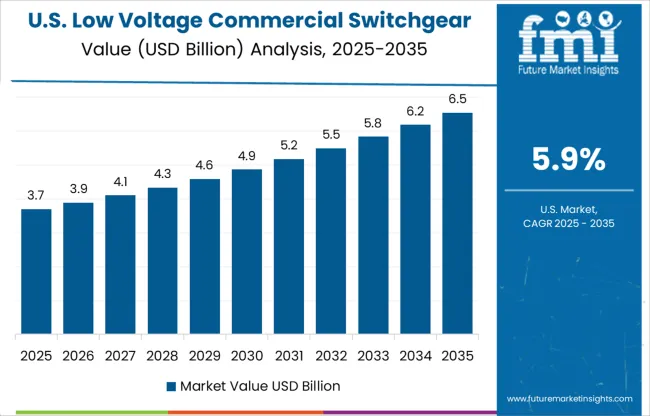

| USA | 5.9% |

| Brazil | 5.2% |

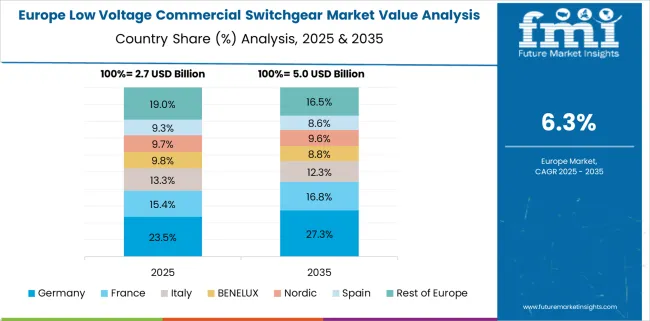

The low voltage commercial switchgear market, projected to grow at a global CAGR of 6.9% from 2025 to 2035, shows strong regional variation in growth trends. China, a BRICS member, is leading with a 9.3% CAGR, supported by expanding commercial infrastructure and large-scale urban power distribution projects. India, another BRICS member, follows with an 8.6% CAGR driven by rising construction activity and replacement of outdated electrical systems. Germany, part of the OECD, is witnessing a 7.9% CAGR due to the modernization of commercial buildings and strict compliance standards.

The United Kingdom records a 6.6% CAGR as investments in commercial real estate push demand for advanced distribution solutions. The United States, also in the OECD, shows a 5.9% CAGR, where the focus remains on energy-efficient systems and integration with building automation. The report provides insights into more than 40 countries, with the top five highlighted for reference.

The CAGR for the United States market moved from nearly 4.8% during 2020–2024 to 5.9% between 2025–2035, signaling stronger replacement cycles and demand for energy-efficient configurations in commercial facilities. The earlier phase saw moderate adoption due to cost-sensitive building operators prioritizing essential upgrades only in critical circuits. Post-2025, the inclusion of advanced monitoring functions and predictive fault management created significant opportunities for modern switchgear systems. Commercial buildings in financial hubs, healthcare institutions, and data centers invested in higher-grade configurations to reduce downtime risk. Large-scale compliance enforcement related to arc-flash safety standards encouraged facility managers to replace aging gear with digital-ready alternatives.

The United Kingdom grew from 5.1% CAGR in 2020–2024 to 6.6% during 2025–2035, supported by commercial real estate upgrades and the enforcement of stricter electrical safety codes. Initial growth was modest due to extended replacement timelines and budget allocations in pre-2024 infrastructure projects. However, from 2025 onward, large-scale office renovations and retail modernization programs accelerated the adoption of smart-ready switchgear. Electrical contractors increasingly recommended modular units to optimize wiring configurations in space-constrained environments. Commercial buildings with integrated energy management systems adopted monitoring-enabled configurations for cost control. Government-backed efficiency incentives for building operators influenced purchasing preferences for compact and automated models.

The CAGR in Germany increased from about 6.3% during 2020–2024 to 7.9% in the 2025–2035 period, propelled by rigorous compliance regulations and modernization of legacy infrastructure. The earlier period saw adoption driven by office and logistics facility upgrades, but growth was tempered by high initial costs for digital switchgear configurations. After 2025, energy efficiency mandates for commercial premises and insurance-linked safety certifications resulted in accelerated adoption of advanced protection systems. German electrical contractors focused on integrating switchgear with distributed energy systems and backup generation to minimize downtime risk. Growth in manufacturing-centric regions created higher volumes for compact assemblies suitable for automated control panels.

India’s CAGR rose from nearly 6.7% during 2020–2024 to 8.6% for 2025–2035, driven by strong investment in new commercial complexes and significant modernization of power distribution infrastructure. Earlier adoption remained limited to Tier 1 cities, where compliance requirements were most stringent. After 2025, mid-sized commercial facilities in emerging cities embraced advanced low voltage systems to manage higher energy loads and reduce operational downtime. Increased government monitoring of electrical safety compliance prompted early adoption in IT parks, malls, and healthcare facilities. Local manufacturing initiatives under industrial policies enabled lower-cost solutions, enhancing accessibility for SMEs across commercial sectors.

China’s CAGR climbed from around 7.8% during 2020–2024 to 9.3% between 2025–2035, supported by urban infrastructure expansion and integration of commercial complexes in Tier 2 and Tier 3 cities. Earlier demand was primarily driven by standardized installations in high-rise projects, but customization remained limited. Post-2025, the focus shifted toward integrated control systems compatible with building energy automation, as compliance guidelines tightened for power safety. Rising investments in commercial property development, coupled with localized production of smart-ready configurations, boosted overall adoption. Foreign firms expanded manufacturing bases in China to serve the large-scale demand for modular, space-saving systems suited for densely built environments.

In the low voltage commercial switchgear segment, dominant players are focusing on compact configurations, fault management systems, and energy-efficient designs to meet growing demand across commercial complexes, offices, and data centers. Companies like Schneider Electric, Eaton, and ABB are deploying integrated solutions that combine protection and control in modular assemblies. These firms are also promoting digital monitoring-enabled configurations that support predictive maintenance for critical commercial infrastructures. Major industrial conglomerates such as Siemens, Mitsubishi Electric, and General Electric have emphasized customized solutions for large-scale projects in finance, healthcare, and hospitality sectors. Their offerings prioritize space-saving designs and embedded communication for building energy systems. Regional leaders, including Hitachi, Bharat Heavy Electricals, and CG Power and Industrial Solutions, have been strengthening supply chains for localized switchgear production. Companies such as Toshiba, Hyosung Heavy Industries, HD Hyundai Electric, and Fuji Electric are actively expanding their global presence through partnerships and compliance-driven upgrades. E+I Engineering, Lucy Group, Skema, and Ormazabal cater to specialized projects with modular low voltage switchgear for advanced infrastructure.

In June 2025, Eaton and Siemens Energy announced a collaboration to fast-track modular data center power systems. On July 16, Eaton agreed to acquire Resilient Power Systems (solid-state transformer technology).

| Item | Value |

|---|---|

| Quantitative Units | USD 10.9 Billion |

| Current | AC and DC |

| Insulation | Air, Gas, Vacuum, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SchneiderElectric, Eaton, ABB, Siemens, MitsubishiElectric, GeneralElectric, Hitachi, BharatHeavyElectricals, CGPowerandIndustrialSolutions, Toshiba, HyosungHeavyIndustries, HDHyundaiElectric, FujiiElectric, E+IEngineering, LucyGroup, Skema, and Ormazabal |

| Additional Attributes | Dollar sales by region, share by application, competitive positioning, pricing benchmarks, growth drivers, regulatory compliance, technology adoption trends, and emerging opportunities in retrofit and digital-ready configurations. |

The global low voltage commercial switchgear market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the low voltage commercial switchgear market is projected to reach USD 21.2 billion by 2035.

The low voltage commercial switchgear market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in low voltage commercial switchgear market are ac and dc.

In terms of insulation, air segment to command 41.4% share in the low voltage commercial switchgear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA