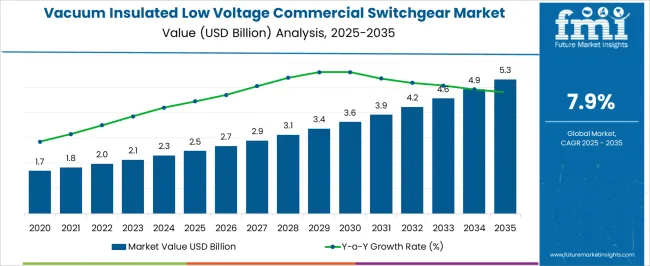

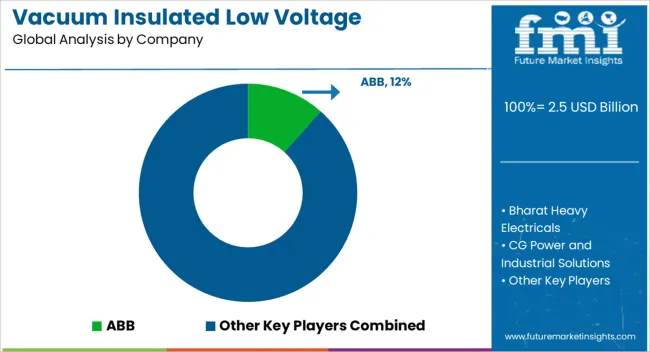

The vacuum insulated low voltage commercial switchgear market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The market expansion is primarily fueled by the adoption of vacuum interrupter-based switchgear, which contributes significantly due to its compact design, high dielectric strength, low maintenance requirements, and enhanced operational safety. This technology dominates the market by providing reliability in commercial electrical distribution systems and minimizing arc flash risks, which remains a crucial consideration for building operators and facility managers.

Alternative technologies, including air-insulated and gas-insulated configurations, also contribute to overall market value but at a relatively lower pace. Air-insulated switchgear offers cost advantages in low-load applications but faces limitations in space-constrained environments, whereas gas-insulated solutions provide high voltage capabilities yet require higher installation and compliance costs. The forecast data indicates that vacuum technology steadily captures a larger share of incremental market value, reflecting preference trends among technology-conscious buyers and regulatory-driven efficiency standards.

The year-on-year growth progression shows incremental adoption across all technology segments, yet the contribution of vacuum-based solutions is the most pronounced, forming the backbone of market expansion. Technological differentiation continues to dictate procurement decisions, with innovation in compact modular designs, integration with smart monitoring, and energy efficiency serving as critical value drivers in shaping long-term technology contributions in the market.

| Metric | Value |

|---|---|

| Vacuum Insulated Low Voltage Commercial Switchgear Market Estimated Value in (2025 E) | USD 2.5 billion |

| Vacuum Insulated Low Voltage Commercial Switchgear Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The vacuum insulated low voltage commercial switchgear market represents a specialized segment within the global electrical distribution and low-voltage switchgear industry, emphasizing safety, compact design, and reliable performance. Within the broader commercial switchgear sector, it accounts for about 3.6%, driven by adoption in commercial buildings, data centers, and industrial complexes. In the low-voltage switchgear segment, its share is approximately 4.2%, reflecting demand for space-saving, fire-resistant, and maintenance-friendly solutions.

Across the electrical distribution and power management market, it contributes around 3.8%, supporting efficient power delivery and operational safety. Within the smart building and automated electrical infrastructure category, it represents 3.1%, highlighting integration with monitoring, protective relays, and remote control systems. In the overall commercial electrical equipment ecosystem, the market contributes about 2.9%, emphasizing durability, regulatory compliance, and operational efficiency. Recent developments in the vacuum insulated low voltage commercial switchgear market have focused on advanced insulation, digital monitoring, and eco-efficient solutions. Groundbreaking trends include compact vacuum interrupter technology, modular switchgear designs, and IoT-enabled remote diagnostics for real-time monitoring and predictive maintenance.

Key players are collaborating with commercial developers and technology providers to implement scalable and smart switchgear systems. Adoption of low-loss materials, enhanced arc quenching, and improved safety features is gaining traction. The integration with energy management platforms, digital metering, and cloud-based monitoring is enabling improved load control and operational efficiency. These innovations demonstrate how technology, safety, and digitalization are shaping the market.

The vacuum insulated low voltage commercial switchgear market is gaining traction due to rising concerns over energy efficiency, safety, and compact system design across commercial facilities. The need for reliable electrical distribution and protection in modern infrastructure projects has intensified demand for advanced switchgear systems that can ensure uninterrupted operation while minimizing maintenance.

Growing urbanization, digitalization of electrical networks, and the integration of smart building technologies have further increased the adoption of vacuum insulated systems, known for their arc-extinguishing capabilities and environmentally friendly operation. Market expansion is being supported by ongoing upgrades to aging electrical infrastructure, particularly in densely populated commercial hubs, and by the increasing prioritization of space-saving equipment with low lifecycle costs.

As regulatory frameworks tighten around safety and emissions, vacuum insulated low voltage solutions are positioned as a preferred choice for new installations, signaling strong long-term growth potential

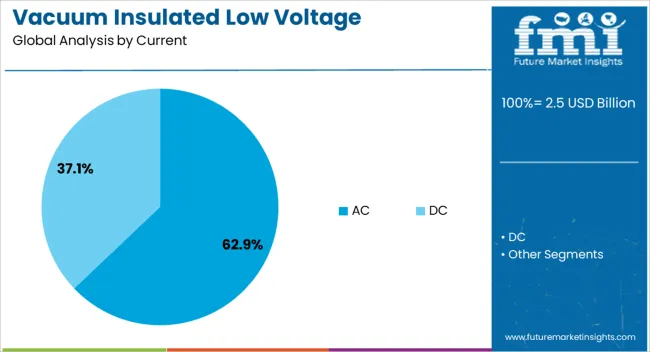

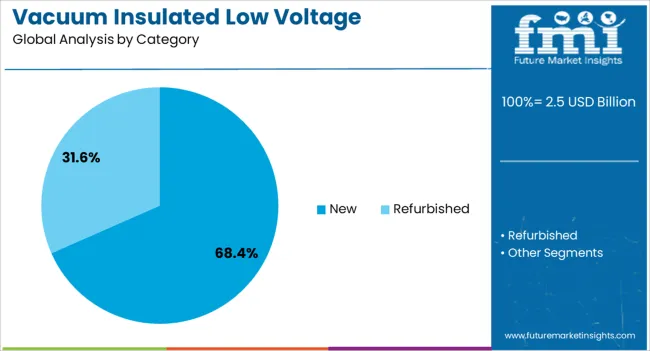

The vacuum insulated low voltage commercial switchgear market is segmented by current, category, and geographic regions. By current, vacuum insulated low voltage commercial switchgear market is divided into AC and DC. In terms of category, vacuum insulated low voltage commercial switchgear market is classified into new and refurbished. Regionally, the vacuum insulated low voltage commercial switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AC current segment dominates the market with a 62.9% share, reflecting its widespread adoption in commercial electrical systems worldwide. AC systems are favored for their transmission efficiency, lower cost, and compatibility with standard commercial power grids, making them the default choice for most low voltage switchgear applications.

The segment has gained further traction as buildings and commercial establishments increasingly rely on AC-powered infrastructure for lighting, HVAC, elevators, and automation systems. Vacuum insulated switchgear designed for AC current offers advantages such as enhanced arc interruption, minimal maintenance, and compact design, which align with the performance and safety demands of modern commercial environments.

The integration of AC systems with renewable energy sources and grid-connected installations has further boosted the demand for reliable and durable AC-compatible switchgear. Continued investments in commercial real estate development and energy optimization initiatives are expected to reinforce the segment’s leading position in the coming years

The new category segment holds a commanding 68.4% share of the market, driven by rising installations of vacuum insulated switchgear in newly constructed commercial buildings and infrastructure projects. Developers and contractors are increasingly specifying advanced switchgear solutions at the design stage to meet contemporary safety standards, reduce operational risks, and ensure long-term system reliability.

The preference for new over retrofit installations is influenced by the availability of flexible, modular, and space-efficient products that can be seamlessly integrated into modern building layouts. Moreover, the incorporation of smart monitoring features in new switchgear systems supports energy management and fault diagnostics, adding value for commercial end users.

As green building certifications and safety compliance become more critical, demand for cutting-edge switchgear technologies in new projects is expected to remain high. This segment is poised for sustained growth as commercial infrastructure continues to expand in response to urbanization and digital transformation trends

The market has witnessed notable expansion due to its enhanced safety, compact design, and reliability in power distribution networks. These systems utilize vacuum technology for arc quenching, reducing maintenance requirements, and improving operational efficiency. Their applications span commercial buildings, industrial facilities, and utility substations where secure and uninterrupted power supply is essential. Increased electrification, modernization of power infrastructure, and stringent safety regulations have driven adoption. Integration with smart monitoring and automation solutions allows real-time fault detection, predictive maintenance, and energy optimization.

Vacuum insulated low voltage switchgear is increasingly deployed in commercial complexes, data centers, hospitals, and industrial plants. The compact footprint and high reliability enable optimal utilization of electrical rooms, while minimizing downtime due to maintenance. The technology ensures safe operation by rapidly interrupting fault currents and preventing arc hazards, which is critical in high-occupancy areas and sensitive industrial operations. Integration with building management systems allows remote monitoring, fault diagnostics, and load management. Growth in commercial infrastructure, industrial expansion, and urban development initiatives have significantly boosted demand for these switchgear solutions. Companies are investing in modular, scalable designs to cater to varying power distribution needs, supporting long-term adoption in diverse facility types.

Technological innovations have enhanced the performance, efficiency, and safety of vacuum insulated low voltage switchgear. Digital monitoring, remote operation, and predictive maintenance capabilities are increasingly integrated to improve uptime and reduce operational costs. Advanced vacuum interrupters allow faster fault clearance and lower energy losses, while modular architectures support easy customization and future expansion. Integration with IoT and SCADA systems enables energy management, remote diagnostics, and grid analytics. The adoption of environmentally friendly materials and low-GWP insulation solutions aligns with sustainability initiatives. These developments have made switchgear more competitive compared to conventional air-insulated or oil-insulated alternatives, driving preference in modern commercial and industrial power distribution networks.

Energy efficiency and compliance with regulatory standards play a pivotal role in market growth. Vacuum insulated switchgear reduces electrical losses and eliminates the need for oil-based insulation, lowering operational risks and environmental impact. International standards for electrical safety, fire prevention, and insulation performance influence product development and adoption. Commercial building codes and industrial safety regulations increasingly mandate advanced low voltage switchgear for critical power distribution systems. Companies focus on providing certified products that meet local and global safety requirements, while optimizing energy use. These regulatory pressures, combined with cost savings from reduced maintenance and downtime, have reinforced the adoption of vacuum insulated low voltage commercial switchgear in multiple markets.

Global modernization of electrical infrastructure, including retrofitting and upgrading aging distribution networks, has accelerated demand for vacuum insulated switchgear. Growing construction of commercial complexes, industrial plants, hospitals, and data centers has created substantial opportunities. The modular and compact designs allow deployment in urban areas with limited space, while enhancing electrical reliability and safety. Manufacturers are strategically investing in emerging markets to address rising demand for advanced switchgear technologies. The push for smart grids and energy-efficient solutions has encouraged utilities and facility operators to adopt vacuum insulated systems. This trend is expected to sustain growth, positioning the market as a key contributor to modern power distribution solutions worldwide.

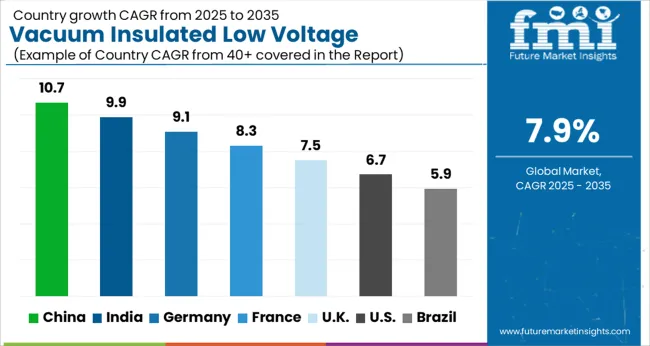

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

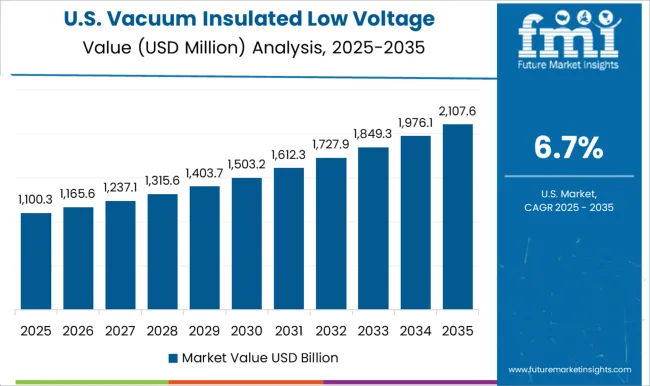

| USA | 6.7% |

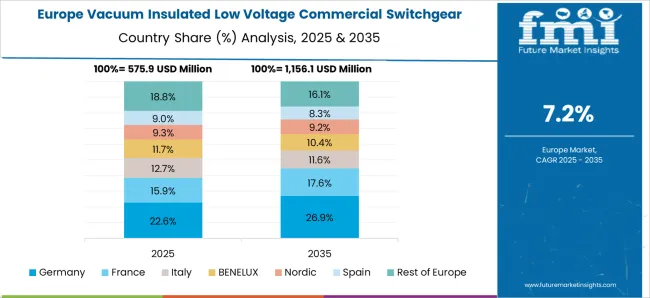

| Brazil | 5.9% |

The market is projected to grow at a CAGR of 7.9% from 2025 to 2035, reflecting increasing adoption of compact and efficient electrical distribution systems. China leads with 10.7%, driven by ongoing industrial expansion and modernization of electrical infrastructure. India follows at 9.9%, supported by rising demand in commercial and industrial facilities. Germany records 9.1%, reflecting advanced manufacturing standards and integration of smart switchgear solutions. The UK stands at 7.5%, influenced by upgrades in commercial power distribution networks. The USA registers 6.7%, where energy efficiency and reliability considerations propel market adoption. Regional infrastructure development and regulatory emphasis on modern switchgear solutions are key factors driving growth. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is experiencing a CAGR of 10.7%, fueled by rapid industrialization, urban infrastructure expansion, and modernization of commercial electrical networks. The adoption of vacuum-insulated low voltage switchgear ensures safety, compact installation, and high reliability in densely populated urban centers. Chinese manufacturers are focusing on integrating smart monitoring, energy efficiency, and IoT-enabled diagnostics in switchgear solutions. Domestic collaborations with international technology providers have accelerated deployment in commercial buildings, industrial plants, and data centers. Government initiatives promoting energy-efficient and safe power distribution systems further drive market penetration.

India is projected to grow at a CAGR of 9.9%, supported by modernization of industrial parks, IT infrastructure, and commercial complexes. Vacuum-insulated low voltage switchgear is preferred for its compact design, enhanced safety, and minimal maintenance requirements. Local manufacturers are investing in digital monitoring and remote control features to meet the evolving demands of smart commercial networks. Renewable energy integration in industrial setups and rising electricity distribution standards also stimulate demand. Collaborative projects with global technology firms enable access to advanced switchgear solutions for medium and large-scale commercial applications.

Germany is witnessing a CAGR of 9.1%, driven by demand in industrial plants, commercial complexes, and renewable energy-based facilities. The focus is on high-quality, compact, and energy-efficient switchgear solutions that comply with European safety standards. Advanced automation and monitoring features are increasingly integrated for predictive maintenance and operational reliability. Germany also serves as a hub for research and development, promoting innovation in vacuum insulation technologies, smart diagnostics, and environmental compliance. Export of high-end switchgear systems to other European countries strengthens the market further.

The United Kingdom is growing at a CAGR of 7.5%, driven by modern commercial and industrial infrastructure projects. VLVCS solutions are valued for compactness, safety, and integration with smart building management systems. The UK market emphasizes energy efficiency and low maintenance, making vacuum-insulated switchgear suitable for data centers, hospitals, and high-rise commercial buildings. Collaborations with European technology providers enable adoption of advanced monitoring, remote diagnostics, and modular designs. Increasing replacement of conventional air-insulated systems with vacuum-insulated solutions contributes to market expansion.

The United States is expanding at a CAGR of 6.7%, supported by industrial modernization, commercial facility growth, and demand for energy-efficient power distribution. VLVCS solutions are increasingly deployed in commercial buildings, IT infrastructure, and healthcare facilities due to safety, compact footprint, and enhanced operational reliability. The market is driven by regulatory standards for low-voltage systems and integration with renewable energy sources. Major multinational switchgear manufacturers focus on automation, IoT-enabled diagnostics, and high-performance vacuum-insulated systems tailored for the US commercial sector.

The market is dominated by global electrical engineering leaders and regional power equipment specialists that deliver high-reliability, compact, and safe switchgear solutions. ABB, Siemens, Schneider Electric, Eaton, and General Electric lead through extensive product portfolios, technological innovation in vacuum insulation, and integrated automation capabilities. Their global service networks and strong R&D focus on enhancing operational efficiency, reducing maintenance, and ensuring compliance with international safety standards provide a competitive edge.

Regional and emerging players such as Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, and HD Hyundai Electric offer tailored solutions for localized applications, emphasizing cost efficiency, modular designs, and faster deployment. Companies like Fuji Electric, Hitachi, Hyosung Heavy Industries, and Mitsubishi Electric leverage technological advancements in compact vacuum interrupters and intelligent monitoring systems, which support reliability and energy management in commercial installations.

Additional competitors including Lucy Group, Ormazabal, Skema, and Toshiba strengthen the market through specialized switchgear offerings, lifecycle support services, and integration with smart grid infrastructure. The competitive landscape is shaped by innovation in vacuum insulation technology, adoption of digital monitoring, compliance with regulatory standards, and strategic partnerships, positioning these companies to meet the evolving demands of commercial power distribution.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 billion |

| Current | AC and DC |

| Category | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Siemens, Skema, and Toshiba |

| Additional Attributes | Dollar sales by switchgear type and application, demand dynamics across commercial buildings, industrial facilities, and data centers, regional trends in low-voltage adoption, innovation in vacuum insulation, compact design, and smart monitoring, environmental impact of energy efficiency and material use, and emerging use cases in renewable integration, building automation, and critical power distribution. |

The global vacuum insulated low voltage commercial switchgear market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the vacuum insulated low voltage commercial switchgear market is projected to reach USD 5.3 billion by 2035.

The vacuum insulated low voltage commercial switchgear market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in vacuum insulated low voltage commercial switchgear market are ac and dc.

In terms of category, new segment to command 68.4% share in the vacuum insulated low voltage commercial switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Sealed Packaging Market Size, Share & Forecast 2025 to 2035

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA