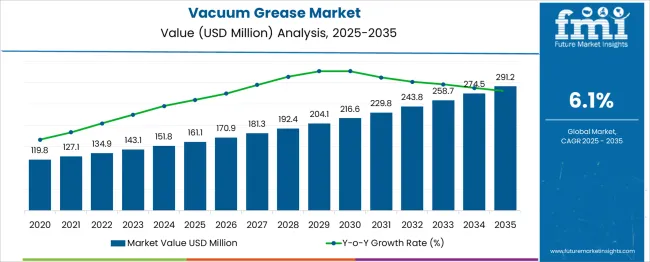

The Vacuum Grease Market is estimated to be valued at USD 161.1 million in 2025 and is projected to reach USD 291.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. Rolling CAGR analysis highlights a steady yet incremental trajectory, reflecting balanced demand across laboratory, industrial, and semiconductor applications. In the first phase (2025–2030), the market expands from USD 161.1 million to USD 216.6 million, adding USD 55.5 million, supported by robust adoption in vacuum systems for analytical instruments, freeze-drying equipment, and space simulation chambers.

Rolling CAGR during this period hovers between 6.0% and 6.2%, signifying strong and consistent demand driven by R&D investments and manufacturing upgrades in electronics and aerospace sectors. From 2030 to 2035, growth accelerates slightly as the market rises to USD 291.2 million, adding USD 74.6 million, a larger contribution compared to the earlier period, boosted by miniaturization trends in semiconductors and the expansion of clean energy technologies requiring high-performance vacuum environments. Manufacturers emphasizing synthetic and fluorinated grease formulations with enhanced thermal stability, oxidation resistance, and low vapor pressure will dominate competitive positioning, as industry demand intensifies for solutions capable of ensuring system integrity in increasingly extreme operating conditions.

| Metric | Value |

|---|---|

| Vacuum Grease Market Estimated Value in (2025 E) | USD 161.1 million |

| Vacuum Grease Market Forecast Value in (2035 F) | USD 291.2 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The vacuum grease market plays a specialized yet strategically important role across various parent industries. Within the broader lubricants & specialty greases market, it accounts for about 1–2%, owing to its niche use compared to bulk industrial and automotive greases. In the industrial vacuum equipment sector, vacuum grease captures around 5–6%, given its role in sealing and lubrication of vacuum pumps, chambers, and flange assemblies. In the laboratory & analytical instruments domain, vacuum grease holds a dominant position, contributing nearly 30–35% driven by widespread use in high-purity vacuum systems, analytical instrumentation, and cleanroom environments. The food processing and packaging machinery market sees a 10–12% share, attributed to the use of certified food-grade greases to maintain airtight seals in packaging and vacuum processing lines.

In the automotive and aerospace sealing solutions market, vacuum grease accounts for approximately 8–10%, serving specialized applications within engine vacuum systems, sensors, turbochargers, and oxygen sensors where extreme temperature and chemical resistance are critical. Demand is fueled by growth in semiconductor manufacturing, pharmaceuticals, food production, and high-performance vehicle systems, areas where vacuum integrity is vital. Innovations in low-vapor-pressure formulations and broad temperature tolerance continue to define the role of vacuum greases across these sectors.

The vacuum grease market is gaining momentum due to increasing demand across high-performance applications in vacuum systems, laboratory equipment, and semiconductor manufacturing. The rising sophistication of electronics, miniaturized devices, and the growing need for high-vacuum integrity in industrial operations is shaping the market.

Innovations in materials and synthetic formulations have improved the thermal stability and chemical resistance of vacuum greases, enhancing their reliability under extreme pressure and temperature. With intensified focus on equipment longevity, contamination prevention, and precision sealing, industries such as electronics, aerospace, and analytical instrumentation are adopting advanced vacuum greases as operational standards.

Sustainability initiatives and stricter contamination control regulations are also influencing purchasing patterns, especially in regulated environments.

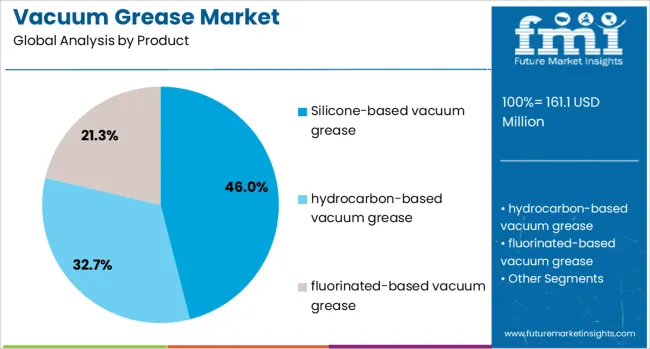

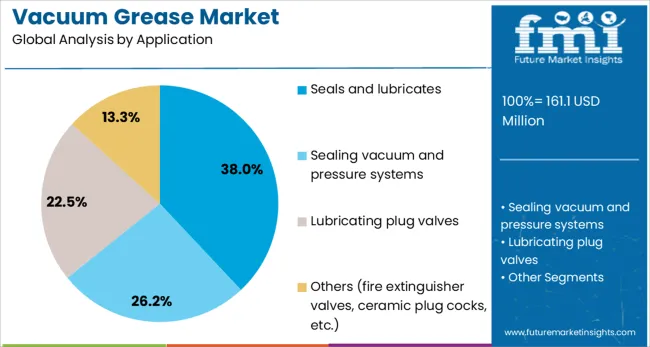

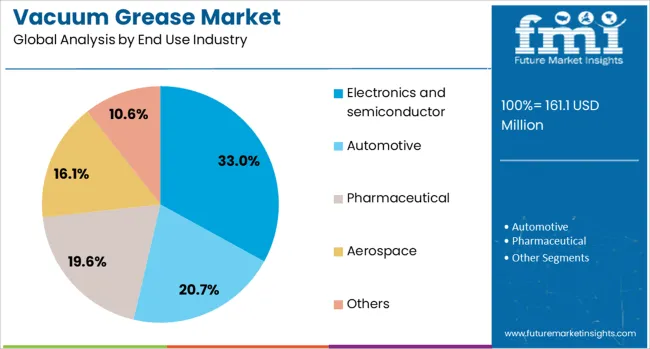

The vacuum grease market is segmented by product, application, end use industry, and geographic regions. The product of the vacuum grease market is divided into Silicone-based vacuum grease, hydrocarbon-based vacuum grease, and fluorinated-based vacuum grease. In terms of application, the vacuum grease market is classified into Seals and lubricants, sealing vacuum and pressure systems, Lubricating plug valves, and Others (fire extinguisher valves, ceramic plug cocks, etc.). Based on end-use industry, the vacuum grease market is segmented into Electronics and semiconductor, Automotive, Pharmaceutical, Aerospace, and Others. Regionally, the vacuum grease industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Silicone-based vacuum grease is expected to dominate the product segment with a 46.0% revenue share in 2025. Its leadership is being driven by superior thermal stability, chemical inertness, and non-volatile characteristics, making it ideal for high-vacuum and temperature-sensitive environments.

Compatibility with a wide range of materials and equipment has encouraged its use in laboratory instruments, optical systems, and semiconductor tools. Additionally, silicone-based greases offer extended service intervals, reducing maintenance frequency and enhancing operational uptime.

Their non-reactive nature aligns with safety protocols in cleanroom and analytical setups, further reinforcing market preference for silicone formulations in precision-critical industries.

The seals and lubricates segment is anticipated to lead the market with a 38.0% share by 2025. This dominance stems from the widespread use of vacuum grease in preventing leakage and contamination in high-vacuum assemblies, O-rings, ground glass joints, and connectors.

Effective sealing and lubrication are critical to maintaining vacuum integrity, especially in high-temperature and chemically aggressive environments. The ability of vacuum greases to prevent fusing, corrosion, and wear in dynamic assemblies has made them essential in labs, vacuum pumps, and semiconductor manufacturing lines.

As component miniaturization and precision requirements rise, sealing applications are expected to remain central to market expansion.

Electronics and semiconductor applications are projected to contribute 33.0% of total revenue by 2025, leading the end-use segment. This growth is being supported by the sector’s increasing reliance on high-vacuum conditions for wafer fabrication, coating processes, and cleanroom equipment.

As device complexity and density increase, manufacturers are adopting vacuum greases to reduce particle contamination and ensure long-term equipment reliability. Additionally, advancements in EUV lithography and MEMS technology require lubricants with superior outgassing resistance and material compatibility.

The electronics sector’s continual drive toward miniaturization and yield optimization is expected to sustain long-term demand for specialized vacuum grease formulations.

Vacuum grease is a high-viscosity, non-melting lubricant used to seal and lubricate joints in vacuum systems, preventing leaks and maintaining pressure integrity. These greases are formulated using silicone, hydrocarbon, or fluorocarbon bases to ensure chemical resistance and thermal stability. Growth has been influenced by expanding applications in laboratory equipment, semiconductor fabrication, analytical instruments, and aerospace components. Manufacturers are prioritizing high-purity grades, low vapor pressure formulations, and extended operating temperature ranges to meet industry-specific requirements. Increased investment in research and precision manufacturing continues to support the adoption of advanced sealing solutions.

Adoption of vacuum grease has been driven by the rising demand for reliable sealing in scientific instrumentation, vacuum furnaces, and semiconductor manufacturing systems. Its role in minimizing gas leaks and ensuring system stability under low-pressure conditions has reinforced its importance in high-vacuum processes. Growth in the electronics and semiconductor sectors, where contamination control and thermal resistance are critical, has accelerated usage. Increased utilization in aerospace applications for component assembly and lubrication under extreme conditions has also contributed to demand. Enhanced performance in cryogenic and high-temperature environments has positioned vacuum grease as an essential material across multiple high-tech industries.

Expansion has been limited by challenges related to contamination in ultra-high-vacuum environments, where even trace outgassing from grease can compromise sensitive processes. Compatibility issues with certain solvents, gases, and reactive chemicals restrict usage in specialized applications. High-performance grades often involve higher production costs, which limits adoption in cost-sensitive markets. Maintenance complexity and the need for precise application to avoid residue buildup further add to operational challenges. Variability in performance across different temperature and pressure conditions requires rigorous validation by end-users, extending procurement cycles. These constraints collectively reduce large-scale standardization across diverse industrial applications.

Significant opportunities exist in the development of specialty vacuum greases for next-generation semiconductor manufacturing and advanced laboratory systems. Increasing miniaturization of electronic components and the growth of thin-film deposition processes are creating demand for ultra-low vapor pressure products. Customized formulations with high chemical resistance for aerospace and cryogenic applications provide additional growth prospects. Development of fluorinated greases for aggressive chemical environments and high-temperature applications is gaining traction. Strategic collaborations with research institutions and OEMs for co-developing niche formulations tailored to advanced instrumentation requirements represent another avenue for market expansion.

Recent trends include the adoption of fluoropolymer-based and perfluorinated greases offering superior thermal stability and minimal outgassing for demanding environments. Automation in precision dispensing is being integrated to reduce human error and contamination risk during application. Increased use of vacuum grease in medical imaging devices, analytical instruments, and nanotechnology setups reflects growing complexity in end-use equipment. Manufacturers are investing in cleanroom-compatible packaging and advanced rheology control for improved application consistency. Enhanced focus on lubricant traceability and compliance with industry purity standards continues to influence product development strategies, particularly in semiconductor and aerospace segments.

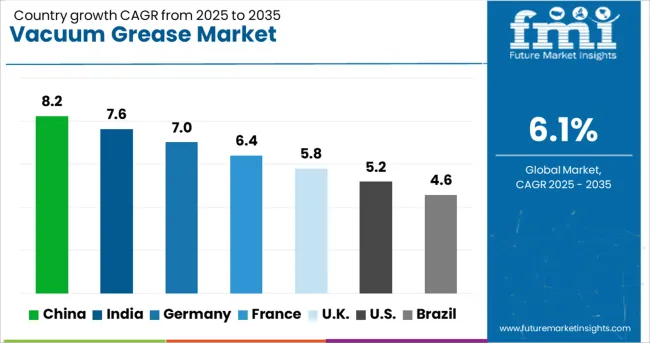

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The vacuum grease market is projected to grow at a CAGR of 6.1%. Growth is driven by rising adoption in laboratory equipment, semiconductor manufacturing, vacuum systems, and aerospace applications. China, part of the APAC group, leads with a CAGR of 8.2%, supported by rapid industrial expansion and increased R&D investments. India, also in APAC, follows at 7.6%, driven by pharmaceutical and chemical sector requirements. Among European markets, France posts 6.4%, emphasizing use in precision instruments and aerospace systems, while the United Kingdom records 5.8%, supported by advanced scientific research applications. The United States, representing North America, grows at 5.2%, driven by semiconductor and high-vacuum system deployments. The analysis includes over 40 countries, with the top five detailed below

China is forecasted to grow at a CAGR of 8.2% through 2035, supported by its leadership in semiconductor production, electronics manufacturing, and expanding chemical processing sectors. The use of vacuum grease in laboratory vacuum systems, optical instruments, and sealing applications for reactors is accelerating. Local producers are introducing silicone-based and fluorocarbon-based greases to ensure compatibility with corrosive chemicals and high-temperature conditions. Rising investments in clean energy and space research add further demand for ultra-pure and chemically stable vacuum lubricants. Collaboration with international players is advancing production technologies and compliance with global performance standards.

India is expected to achieve a CAGR of 7.6% through 2035, driven by the increasing use of vacuum grease in pharmaceuticals, petrochemicals, and analytical laboratories. Demand is rising for sealing solutions in high-vacuum and high-temperature environments, particularly in distillation and drying systems. Domestic suppliers are focusing on cost-effective silicone-based formulations, while global brands cater to premium applications requiring chemically inert greases. India’s growing emphasis on advanced research infrastructure and electronics manufacturing reinforces market expansion. Adoption in food packaging and vacuum drying processes adds niche opportunities for manufacturers offering non-toxic variants.

France is projected to grow at a CAGR of 6.4% through 2035, driven by strong adoption in aerospace, defense, and scientific instrumentation sectors. Demand for vacuum grease in cryogenic sealing and optical component assembly continues to rise, necessitating high thermal stability and low vapor pressure. French manufacturers are advancing fluorosilicone formulations to meet performance requirements in extreme temperature and pressure conditions. Expansion of R&D activities in nanotechnology and space exploration further supports the need for specialized lubricants with minimal outgassing properties. Strategic partnerships between aerospace firms and lubricant producers are reinforcing innovation pipelines.

The United Kingdom is forecasted to grow at a CAGR of 5.8% through 2035, supported by its advanced scientific research ecosystem and industrial gas handling facilities. Vacuum grease is extensively utilized in spectroscopic instruments, laboratory equipment, and vacuum sealing systems for controlled environments. Manufacturers are developing chemically inert formulations to reduce contamination risks in sensitive analytical processes. Growth in nuclear research and cryogenic testing further drives the need for greases capable of maintaining sealing integrity under extreme thermal cycles. Emphasis on performance validation and compliance with stringent quality norms is guiding supplier innovation in the UK market.

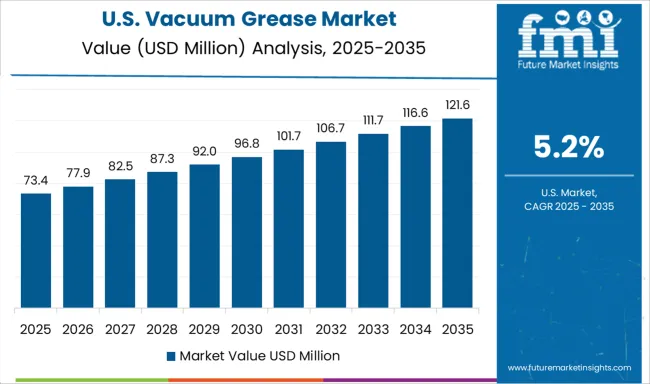

The United States is projected to grow at a CAGR of 5.2% through 2035, driven by strong demand from semiconductor fabrication facilities, aerospace programs, and vacuum metallurgy. Increased adoption of ultra-clean greases in high-vacuum deposition systems and analytical instruments supports market growth. USA suppliers are focusing on perfluoropolyether (PFPE)-based lubricants offering exceptional chemical resistance and extended life under demanding conditions. Integration of vacuum grease into cleanroom operations for chip production and space applications ensures consistent growth. Collaborations with OEMs and specialized research labs are promoting product customization and performance improvements.

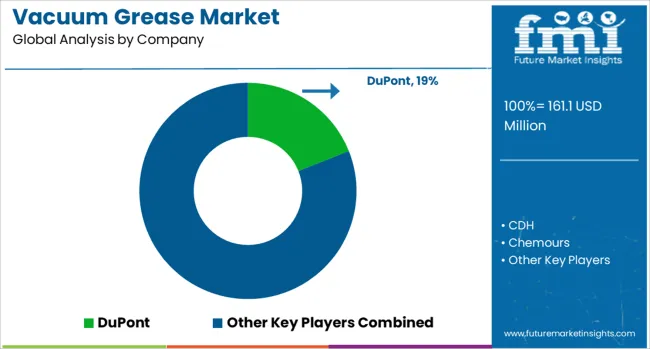

The vacuum grease market is characterized by global chemical companies and specialized lubricant manufacturers catering to industries such as electronics, aerospace, pharmaceuticals, and laboratory operations. DuPont leads with high-performance silicone and fluorinated vacuum greases designed for high-temperature stability and chemical resistance in demanding environments. Chemours, a spin-off from DuPont, focuses on PTFE-based lubricants with low vapor pressure for ultra-high vacuum applications. Merck delivers premium-grade greases used in analytical instruments, pharmaceutical manufacturing, and scientific research. Nye Lubricants and Santolubes LLC specialize in synthetic greases offering long-term thermal stability and oxidation resistance for high-vacuum systems.

Kurt J Lesker supplies a range of vacuum-compatible lubricants integrated into its vacuum hardware offerings for semiconductor and thin-film deposition applications. Inland Vacuum and Eastern Petroleum provide cost-effective solutions for industrial vacuum pumps and sealing systems, ensuring durability under extreme pressure conditions. Regional manufacturers such as Mosil Lubricant, M&I Materials, and CDH cater to niche segments with customized formulations for electronics and chemical processing sectors. Competitive differentiation depends on vapor pressure performance, chemical inertness, temperature stability, and compatibility with elastomers and metals in vacuum systems. Barriers to entry include the requirement for advanced formulation technologies and compliance with industry standards for cleanroom and contamination-sensitive applications. Strategic priorities include developing PFPE-based greases for semiconductor applications, expanding fluorosilicone-based offerings for aerospace, and introducing eco-friendly formulations with reduced environmental impact.

Key strategies in the vacuum grease market emphasize product innovation and performance optimization for critical applications in laboratories, electronics, and aerospace. Manufacturers are focusing on developing high-purity, low-vapor-pressure formulations to ensure stability under extreme temperatures and vacuum conditions.

Strategic partnerships with semiconductor and optical equipment manufacturers are being leveraged to tailor solutions for advanced technologies. Expansion into high-growth regions through localized production and distribution networks is a priority to meet rising demand. Companies are also investing in eco-compliant formulations and long-life greases to enhance efficiency. Differentiation through packaging convenience, technical support, and value-added services is driving competitive advantage in this sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 161.1 Million |

| Product | Silicone-based vacuum grease, hydrocarbon-based vacuum grease, and fluorinated-based vacuum grease |

| Application | Seals and lubricates, Sealing vacuum and pressure systems, Lubricating plug valves, and Others (fire extinguisher valves, ceramic plug cocks, etc.) |

| End Use Industry | Electronics and semiconductor, Automotive, Pharmaceutical, Aerospace, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, CDH, Chemours, Eastern Petroleum, Inland Vacuum, Kurt J Lesker, M&I Materials, Merck, Mosil Lubricant, Nye Lubricants, and Santolubes LLC |

| Additional Attributes | Dollar sales by grease type (silicone-based, PFPE-based, hydrocarbon-based) and application (laboratories, semiconductor manufacturing, chemical processing, aerospace, industrial vacuum systems). Demand dynamics are driven by growing use in vacuum sealing, lubrication of stopcocks, and maintenance of high-vacuum pumps in cleanroom environments. Regional trends highlight North America and Europe as mature markets with stringent quality requirements, while Asia-Pacific sees rapid adoption due to semiconductor and electronics manufacturing growth. |

The global vacuum grease market is estimated to be valued at USD 161.1 million in 2025.

The market size for the vacuum grease market is projected to reach USD 291.2 million by 2035.

The vacuum grease market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in vacuum grease market are silicone-based vacuum grease, hydrocarbon-based vacuum grease and fluorinated-based vacuum grease.

In terms of application, seals and lubricates segment to command 38.0% share in the vacuum grease market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Heat Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA