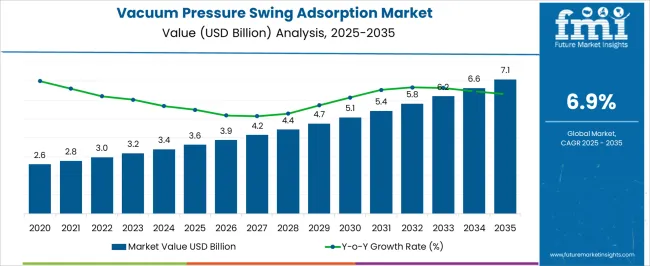

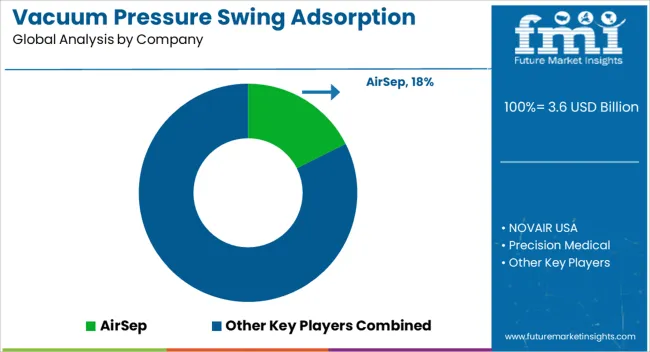

The Vacuum Pressure Swing Adsorption Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. This growth is fueled by increasing demand for efficient gas separation technologies, particularly for oxygen generation in healthcare, industrial processes, and environmental applications. From 2020 to 2024, the VPSA market was in its early adoption phase, with uptake primarily driven by healthcare oxygen generation and select industrial applications.

Technological innovation and rising awareness of cost efficiency compared to conventional methods supported this phase. Between 2025 and 2030, the market enters the scaling stage, characterized by broader adoption across industries such as metallurgy, petrochemicals, and wastewater treatment. Growing environmental regulations and industrial decarbonization initiatives are expected to accelerate demand. During this phase, capacity expansion projects and cost optimization strategies dominate.

By 2030–2035, the VPSA market transitions into consolidation, where competition intensifies, and technology providers focus on differentiation through system efficiency, modularity, and integration with renewable energy sources. In terms of technology lifecycle mapping, hydraulic systems remain in the mature stage, electric hydraulic systems are transitioning into growth due to efficiency advantages, while EPS-like advanced VPSA systems are in the innovation phase, poised for long-term adoption.

| Metric | Value |

|---|---|

| Vacuum Pressure Swing Adsorption Market Estimated Value in (2025 E) | USD 3.6 billion |

| Vacuum Pressure Swing Adsorption Market Forecast Value in (2035 F) | USD 7.1 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The vacuum pressure swing adsorption (VPSA) market is advancing steadily, supported by increased demand for high-purity gas generation in healthcare, metallurgy, and chemical processing industries. The shift toward decentralized gas production, rising cost-efficiency requirements, and regulatory emphasis on oxygen self-sufficiency are propelling technology adoption.

VPSA systems offer significant energy savings compared to traditional cryogenic methods, which has expanded their usage in both developing and developed economies. Manufacturers are focusing on compact modular designs and smart control integration, enabling continuous and automated operation under fluctuating demand conditions.

Strategic investments in industrial automation, coupled with a growing need for uninterrupted gas supply in medical and industrial zones, are expected to drive long-term market growth. Advancements in adsorption materials and membrane durability are further enhancing the operational reliability of VPSA units, opening new opportunities for small and mid-scale deployment.

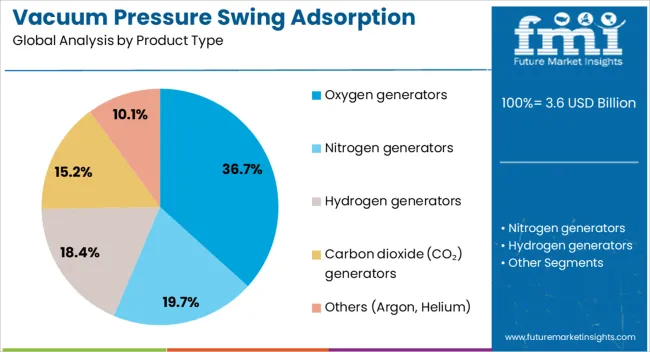

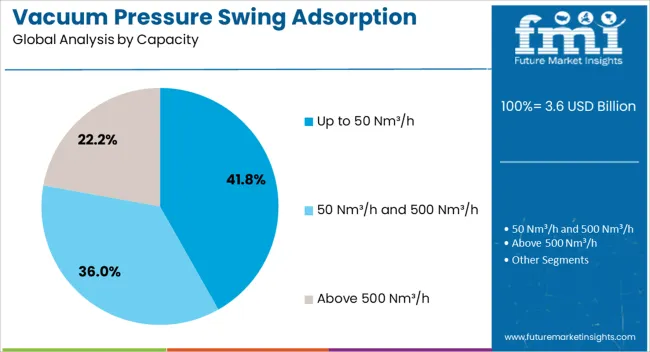

The vacuum pressure swing adsorption market is segmented by product type, operation, capacity, end-use, distribution channel, and geographic regions. By product type, the vacuum pressure swing adsorption market is divided into Oxygen generators, Nitrogen generators, Hydrogen generators, Carbon dioxide (CO₂) generators, and Others (Argon, Helium). In terms of operation, the vacuum pressure swing adsorption market is classified into Automatic and Semi-automatic. The vacuum pressure swing adsorption market capacity is segmented into Up to 50 Nm³/h, 50 Nm³/h and 500 Nm³/h, and Above 500 Nm³/h.

The vacuum pressure swing adsorption market is segmented by end-use into Healthcare, Industrial, Chemical, Environmental, Oil & gas, Energy & power, and Other (Food & Beverages, Metallurgy, etc.). The distribution channel of the vacuum pressure swing adsorption market is segmented into Direct and Indirect. Regionally, the vacuum pressure swing adsorption industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Oxygen generators are expected to account for 36.70% of the total market revenue in 2025, making them the dominant product segment. This leadership is attributed to the widespread requirement for on-site oxygen generation in medical and metallurgical applications, where consistent purity and flow rates are essential.

The ability of VPSA systems to deliver cost-effective, scalable oxygen solutions with minimal infrastructure has positioned them as a preferred alternative to bulk cylinder supply. Increasing hospital infrastructure expansion, along with emergency preparedness strategies post-pandemic, has accelerated investments in autonomous oxygen generation systems.

Moreover, long-term maintenance savings and reduced logistical dependence have solidified their preference among end users seeking supply security and compliance with healthcare standards.

Automatic operation is projected to contribute 59.40% of the total market revenue in 2025, placing it as the leading segment by operation mode. The need for operational consistency is driving growth of this segment, reduced human error, and enhanced system responsiveness under varying load conditions.

Automation allows for real-time monitoring, remote diagnostics, and performance optimization, which is critical in industries requiring continuous gas flow with minimal downtime. Integration of programmable logic controllers (PLCs) and IoT-based management platforms has further increased adoption by enabling predictive maintenance and centralized control.

In facilities with limited skilled manpower, automatic systems are increasingly being chosen for their self-regulating and fail-safe features, making them indispensable in high-dependability applications such as pharmaceuticals and energy.

Systems with up to 50 Nm³/h capacity are anticipated to hold 41.80% of the market share in 2025, leading the capacity-based segmentation. This preference is being driven by the growing demand for compact, small-scale VPSA units across localized healthcare centers, laboratories, and mid-sized manufacturing facilities.

These units offer the benefit of easy installation, low maintenance, and quick commissioning, making them ideal for point-of-use gas generation. Their deployment has become particularly prominent in regions lacking centralized gas distribution infrastructure, where self-sufficiency and low capital expenditure are key decision factors.

The scalability of these systems also supports phased capacity expansion, making them suitable for SMEs aiming to enhance reliability without large upfront investments. As demand for decentralized and mobile oxygen generation grows, this capacity range is expected to maintain its leadership.

The vacuum pressure swing adsorption (VPSA) market is expanding as industries seek efficient solutions for separating gases such as oxygen and nitrogen from air. VPSA systems are widely used in steel manufacturing, glass production, chemical processing, and healthcare applications due to their ability to provide high-purity gases with lower energy consumption compared to traditional methods. Rising demand for reliable oxygen supply in medical facilities and industrial growth in emerging regions further fuel adoption, supported by increasing investments in air separation technologies.

The need for reliable oxygen generation is accelerating across healthcare facilities, steel plants, and glass manufacturers. VPSA systems enable on-site production, reducing dependence on external supply chains and lowering transportation costs. Hospitals increasingly favor VPSA technology to ensure uninterrupted oxygen availability during emergencies. Industrial users benefit from stable supply for combustion processes and oxidation applications. By offering cost efficiency and operational independence, VPSA units meet critical demand for oxygen in both developed and emerging economies, driving steady market adoption across multiple sectors.

Expanding industries such as chemicals, refining, metallurgy, and glass manufacturing are strengthening demand for VPSA systems. These industries rely on high-purity oxygen or nitrogen to improve process efficiency and product quality. VPSA units are favored for their adaptability to various plant sizes and their ability to handle continuous gas demand. As industrial production scales up in Asia-Pacific and the Middle East, investment in VPSA installations grows accordingly. The technology’s ability to deliver consistent gas purity and reduce operational costs makes it attractive for long-term integration in large-scale industrial facilities.

A key advantage of VPSA technology lies in its lower operating costs compared to conventional cryogenic methods. By operating under vacuum conditions, these systems minimize energy usage during adsorption and desorption cycles. Industrial operators are increasingly drawn to VPSA solutions because they reduce electricity costs while maintaining high output. Lower energy needs translate into quicker payback periods, making VPSA systems a preferred choice for medium- and large-scale applications. This balance of efficiency and affordability continues to position VPSA as a cost-effective alternative in global air separation markets.

Regional trends strongly influence VPSA market development. North America and Europe remain established markets with widespread adoption across steel, chemical, and glass industries. Meanwhile, Asia-Pacific is experiencing rapid growth due to rising industrial output and increased healthcare infrastructure development. Governments in the region are supporting oxygen generation systems to meet hospital requirements and industrial demand. Additionally, local manufacturers are entering the market with region-specific designs, enhancing accessibility. This regional investment focus ensures long-term growth prospects, with Asia-Pacific expected to remain a key driver of global VPSA market expansion.

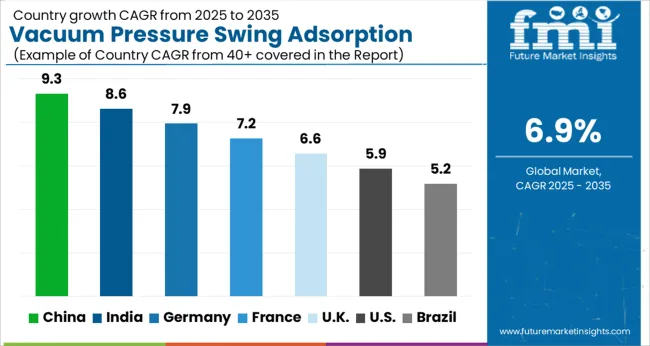

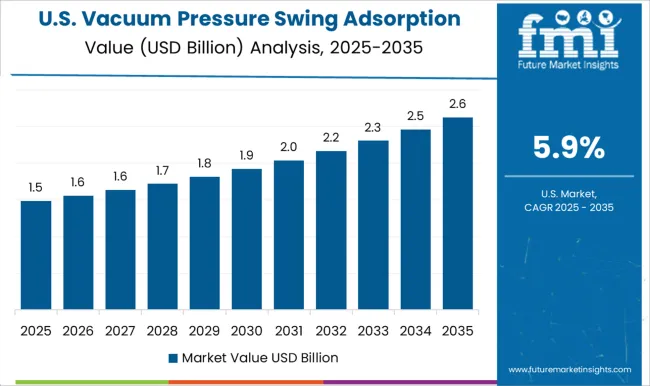

The global vacuum pressure swing adsorption (VPSA) market is projected to expand at a CAGR of 6.9%, reflecting increasing adoption in industries such as chemicals, metallurgy, and healthcare where efficient oxygen and nitrogen separation is critical. China is at the forefront with a robust 9.3% CAGR, supported by large-scale industrial applications and expanding energy projects. India follows closely at 8.6%, driven by demand in steel and healthcare sectors. Germany records 7.9%, supported by advancements in industrial gas usage and strong infrastructure. The UK demonstrates moderate growth at 6.6%, while the USA shows steady progress at 5.9%, attributed to rising healthcare oxygen demand and manufacturing activities. This report includes insights on 40+ countries; the top countries are shown here for reference.

China dominates the VPSA market with a 9.3% growth rate, driven by rapid industrialization and growing demand for high-purity oxygen and nitrogen across multiple sectors. The steel, glass, and petrochemical industries rely heavily on VPSA technology for cost-efficient gas separation, fueling consistent adoption. Compared to India, China’s stronger infrastructure and larger manufacturing base enable faster deployment of large-scale systems. Environmental regulations pushing for cleaner industrial processes further accelerate technology penetration. Chinese manufacturers focus on affordable and scalable VPSA units to meet the needs of both SMEs and large enterprises. Moreover, government investments in renewable energy and healthcare strengthen opportunities for VPSA expansion. With robust supply chains, rising energy demand, and supportive policies, China continues to lead the global VPSA market and set technological standards for efficiency and sustainability.

vacuum pressure swing adsorption market in India records an 8.6% growth rate, propelled by increasing applications in healthcare, pharmaceuticals, and chemical industries. The pandemic underscored the importance of oxygen supply, which significantly accelerated VPSA adoption in hospitals and clinics. Compared to Germany, India’s emphasis lies in cost-effective solutions and modular systems, which are ideal for SMEs and smaller facilities. Expanding pharmaceutical manufacturing also drives strong demand for reliable oxygen generation technologies. Industrial growth in steel, glass, and food processing sectors further supports VPSA usage. Indian manufacturers invest in portable VPSA designs, enabling wider deployment across semi-urban and rural locations. Government initiatives encouraging domestic manufacturing and investments in healthcare infrastructure provide a strong push for adoption. India’s combination of affordability, industrial expansion, and healthcare focus positions it as a rapidly emerging VPSA market with long-term growth potential.

The United Kingdom Vacuum pressure swing adsorption market grows at 6.6%, with demand primarily driven by healthcare, pharmaceuticals, and specialty manufacturing. Compared to the United States, the UK emphasizes compact, energy-efficient system designs suitable for urban industrial environments. Medical oxygen generation remains a critical driver, especially in hospitals and clinics. Food and beverage industries also rely on VPSA systems for nitrogen production, supporting controlled atmosphere packaging. Manufacturers are increasingly focusing on compliance with stringent emission and sustainability standards, ensuring market credibility. Collaborations with European suppliers strengthen supply chain stability and technology exchange. While growth is modest compared to Asia, the UK’s regulatory environment, healthcare requirements, and focus on sustainable solutions maintain steady demand. This positions the UK as a niche yet reliable market for advanced VPSA applications tailored to specific industrial needs.

The United Kingdom VPSA market grows at 6.6%, with demand primarily driven by healthcare, pharmaceuticals, and specialty manufacturing. Compared to the United States, the UK emphasizes compact, energy-efficient system designs suitable for urban industrial environments. Medical oxygen generation remains a critical driver, especially in hospitals and clinics. Food and beverage industries also rely on VPSA systems for nitrogen production, supporting controlled atmosphere packaging. Manufacturers are increasingly focusing on compliance with stringent emission and sustainability standards, ensuring market credibility. Collaborations with European suppliers strengthen supply chain stability and technology exchange. While growth is modest compared to Asia, the UK’s regulatory environment, healthcare requirements, and focus on sustainable solutions maintain steady demand. This positions the UK as a niche yet reliable market for advanced VPSA applications tailored to specific industrial needs.

The United States VPSA market advances at 5.9%, driven by demand from healthcare, petrochemical, and refining industries. Compared to China, the US market prioritizes technological innovation, automation, and high system reliability. Hospitals and medical facilities are key consumers, requiring consistent oxygen generation capabilities. The oil refining and glass production industries also contribute significantly to demand. American manufacturers focus on integrating advanced materials and energy-efficient designs to reduce operating costs and improve environmental performance. Export potential across Latin America and Canada supports further market expansion. Despite slower growth than Asia, the US maintains competitiveness through premium-quality systems and advanced engineering expertise. A strong focus on sustainability and automation ensures long-term adoption across diverse industrial sectors, solidifying its place in the global VPSA market.

The Vacuum Pressure Swing Adsorption (VPSA) Market plays a vital role in gas separation technologies, primarily for oxygen and nitrogen generation. VPSA systems use pressure and vacuum cycles with adsorbent materials to efficiently separate gases, offering energy-efficient and cost-effective alternatives to traditional cryogenic processes. Growing demand for oxygen in healthcare, steelmaking, chemical processing, and wastewater treatment, along with the rising need for nitrogen in industrial applications, is driving significant market expansion. Additionally, the emphasis on energy efficiency and on-site gas generation is further fueling adoption. AirSep and NOVAIR USA are among the leading players, providing advanced VPSA systems tailored for healthcare and industrial applications. Precision Medical specializes in oxygen solutions, supporting the growing medical demand for efficient oxygen generation. Air Products and Chemicals and Linde, as global leaders in industrial gases, leverage their technological expertise and broad distribution networks to dominate large-scale VPSA deployments. Praxair Technology and Messer Group also hold strong market positions, offering energy-efficient gas separation technologies. Emerging companies such as PKU Pioneer, Chenrui Air Separation Technology, and Oxymat are expanding their footprint, particularly in Asia-Pacific and Europe, with customized and modular VPSA systems. PCI Gases and CAIRE cater to specialized applications, including portable oxygen generation and defense-related uses. Adsorption Research and Valmet contribute with innovations in adsorbent materials and process optimization, enhancing system efficiency. The market is expected to grow steadily as industries and healthcare facilities seek sustainable, cost-effective, and on-site gas generation solutions. VPSA technology’s ability to balance efficiency and scalability makes it a cornerstone in the future of industrial gas supply.

Companies are focusing on improving the adsorbent materials used in VPSA systems to enhance their capacity and selectivity for gas adsorption. New types of adsorbents, such as zeolite-based and carbon molecular sieves, are being developed to increase the efficiency of gas separation processes. These advancements allow for better performance, extended lifespans of the adsorbent beds, and lower maintenance costs.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Product Type | Oxygen generators, Nitrogen generators, Hydrogen generators, Carbon dioxide (CO₂) generators, and Others (Argon, Helium) |

| Operation | Automatic and Semi-automatic |

| Capacity | Up to 50 Nm³/h, 50 Nm³/h and 500 Nm³/h, and Above 500 Nm³/h |

| End-Use | Healthcare, Industrial, Chemical, Environmental, Oil & gas, Energy & power, and Other (Food & Beverages, Metallurgy, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AirSep, NOVAIR USA, Precision Medical, Air Products and Chemicals, PKU Pioneer, Adsorption Research, Valmet, NES Company, Chenrui Air Separation Technology, CAIRE, Linde, Praxair Technology, Messer Group, Oxymat, and PCI Gases |

| Additional Attributes | Dollar sales vary by product type including oxygen, nitrogen, and other gas generators, application across healthcare, chemical, and industrial sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for on-site gas generation, healthcare oxygen supply, and cost-effective separation technologies. |

The global vacuum pressure swing adsorption market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the vacuum pressure swing adsorption market is projected to reach USD 7.1 billion by 2035.

The vacuum pressure swing adsorption market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in vacuum pressure swing adsorption market are oxygen generators, nitrogen generators, hydrogen generators, carbon dioxide (co₂) generators and others (argon, helium).

In terms of operation, automatic segment to command 59.4% share in the vacuum pressure swing adsorption market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA