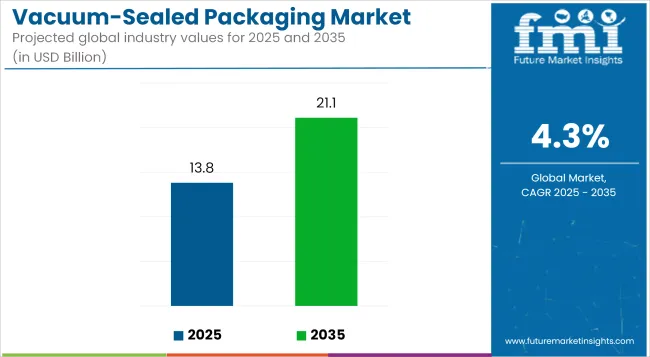

The Vacuum-Sealed Packaging Market is projected to grow from USD 13.8 billion in 2025 to USD 21.1 billion by 2035, registering a CAGR of 4.3% during the forecast period. Sales in 2024 reached USD 13.2 billion, reflecting steady growth driven by increasing demand for extended shelf life and improved freshness of products.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 13.8 billion |

| Industry Value (2035F) | USD 21.1 billion |

| CAGR (2025 to 2035) | 4.3% |

This growth is attributed to heightened awareness about food waste reduction and sustainability, prompting widespread adoption of vacuum-sealed packaging technologies. The market's expansion is further supported by innovations in packaging materials and technologies, enhancing their efficiency and appeal to various industries.

In March 2025, Amcor, a global leader in developing and producing responsible packaging solutions, is the proud recipient of two Silver Flexible Packaging Achievement Awards in the category of Sustainability. The Amcor Moda vacuum packaging solution is a streamlined tubular roll stock and on-demand bag-making system for fresh meat processors.

The Moda system includes more sustainable film options. Amcor Eco-Tite® recycle-ready tube stock replaces traditional shrink bag material. “We are honored to be recognized by the FPA for innovations that are making a difference for our customers and the environment,” said Brian Carvill, vice president of research and development at Amcor Flexibles North America. “Amcor’s winning packaging and equipment demonstrate how we apply our capabilities in material science and packaging technology to unlock growth for our customers and deliver more sustainable solutions.”

Sustainability is a key driver in the vacuum-sealed packaging market, with manufacturers focusing on producing packaging made from recyclable and eco-friendly materials. Innovations include the development of lightweight yet durable materials, integration of smart features such as improved sealing technologies, and ergonomic designs for enhanced user comfort.

These advancements align with global sustainability goals and regulatory requirements, making vacuum-sealed packaging an attractive option for environmentally conscious consumers. Additionally, the development of modular and customizable packaging solutions has enhanced efficiency and convenience for users, further driving market growth.

The vacuum-sealed packaging market is poised for significant growth, driven by increasing demand in food, pharmaceutical, and manufacturing industries for efficient and sustainable packaging solutions. Companies investing in innovative, eco-friendly technologies are expected to gain a competitive edge.

The market's expansion is further supported by the growing e-commerce sector and the shift towards compact and efficient packaging solutions. With continuous advancements in materials and manufacturing processes, the vacuum-sealed packaging market is set to offer lucrative opportunities for stakeholders over the forecast period.

The market is segmented by material type, end-use industry, and region. By material type, the market comprises plastic materials including polyethylene (PE), polypropylene (PP), polyvinylidene chloride (PVDC), ethylene vinyl alcohol (EVOH), polyamide (PA), and others such as PET and PVC. In terms of end-use industry, the market is categorized into food, pharmaceuticals, electronics, industrial goods, and consumer goods.

From a regional perspective, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

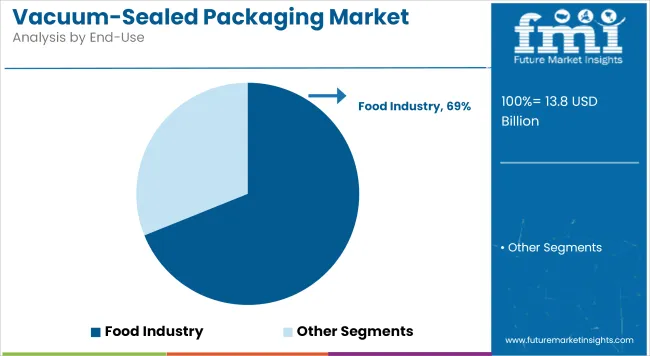

The food industry has been estimated to account for 68.9% of the global vacuum-sealed packaging market by 2025, driven by its critical need to preserve freshness, extend shelf life, and prevent microbial contamination across perishable and processed food categories. Vacuum-sealed formats have been extensively deployed for meat, poultry, seafood, dairy, bakery items, and ready-to-eat meals.

Multilayer barrier films incorporating EVOH, nylon, and PE have been utilized to provide optimal oxygen transmission rates and moisture resistance. Thermoforming and pre-formed pouch systems have been widely used in combination with vacuum chamber or inline systems, ensuring minimal product deformation and high vacuum efficiency.

Food processors and cold-chain logistics providers have adopted vacuum-sealed packaging to support clean-label trends, portion-controlled retail offerings, and export-grade preservation standards. Modified atmosphere packaging (MAP) integration and vacuum skin packaging (VSP) variants have gained traction for premium SKU differentiation and product visibility. Compliance with HACCP, USDA, and EU food safety regulations has further reinforced the adoption of vacuum-sealed systems in global food supply chains. Sustainability mandates have encouraged the development of recyclable vacuum pouches and bio-based film alternatives, aligning with corporate ESG targets and shifting consumer expectations.

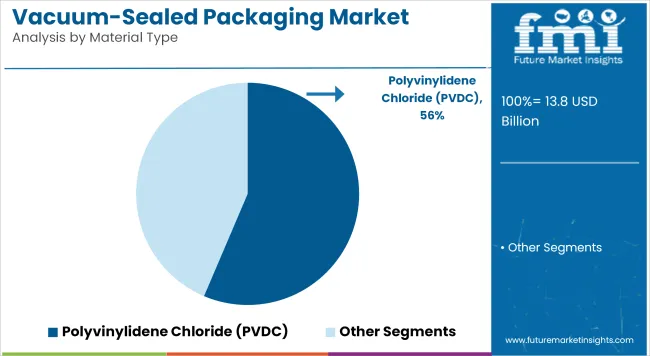

Polyvinylidene Chloride (PVDC) equipment has been projected to contribute 56.4% of the global vacuum-sealed packaging system installations by 2025, owing to its suitability for high-volume, continuous packaging operations in food and pharmaceutical facilities. PVDC have been adopted for their integrated forming, filling, sealing, and cutting processes that reduce manual intervention and improve sanitation.

Vacuum sealing efficiency has been enhanced through programmable vacuum levels, in-line leak detection, and customizable die configurations. Materials such as PA/PE, PET/PE, and laminate structures have been used to achieve high seal integrity and mechanical strength during vacuum application.

Global FMCG manufacturers and co-packers have relied on PVDC lines to deliver scalable packaging capacity with rapid changeovers and low operating costs. Dual-lane configurations and servo-driven systems have further optimized throughput in multipack and portion-pack formats.

Investments in hygienic machine designs, robotic loading systems, and smart diagnostics have supported adoption in highly regulated environments. Integration with Industry 4.0 protocols and sustainability-aligned packaging formats has positioned PVDC as a future-proof solution in vacuum-sealed packaging.

| Key Drivers | Key Restraints |

|---|---|

| Rising Need for Increased Shelf Life: Customers' interest in fresh and durable products compels the use of vacuum-packaging, which serves to lock up food perfectly by eliminating air and preventing the growth of microorganisms. | Environmental Issues: The application of some of the plastic materials in vacuum packaging poses environmental sustainability concerns, hence resulting in high pressure for environmentally friendly substitutes. |

| Expansion in Logistics and E-commerce: The increasing popularity of online shopping creates the demand for strong packaging to preserve products during transportation, thus vacuum-sealing packaging emerges as the packaging of choice to maintain product quality. | High Initial Setup Costs: Vacuum-sealed packaging technology necessitates the use of specific equipment and materials, which creates high initial costs that might discourage small and medium-sized businesses. |

| Technological developments: New advancements in packaging technology have enabled faster and less expensive vacuum-sealing packaging alternatives that improve the look and shelf life of the product. | Consumer Misconceptions: Other consumers view vacuum-sealed packaging as excessive or unnecessary, perhaps slowing its broader acceptance. |

| Stricter Food Safety Laws: Adherence to food safety regulations inspires producers to use vacuum-sealed packaging to avoid contamination and spoilage and ensure the safety of their products. | Competition from Other Packaging Solutions: Presence of other packaging technologies that provide comparable advantages creates challenges, necessitating ongoing innovation to remain relevant in the industry. |

| Key Drivers | Impact Level |

|---|---|

| Increasing Demand for Extended Shelf Life | High |

| Growth in E-commerce and Logistics | High |

| Technological Advancements | Medium |

| Stringent Food Safety Regulations | High |

| Key Restraints | Impact Level |

|---|---|

| Environmental Concerns | High |

| High Initial Setup Costs | Medium |

| Consumer Misconceptions | Low |

| Competition from Alternative Packaging Solutions | Medium |

The United States is still among the biggest sectors for vacuum-sealed packaging, spurred by robust demand in the food and non-food industries. Growing demand for fresh and minimally processed food drives the use of vacuum-sealed packaging in meat, dairy, and ready-to-eat meals. The rise of e-commerce also fuels industry growth, as companies look for dependable packaging solutions for product safety and longer shelf life.

Environmental sustainability issues compel manufacturers to create biodegradable and recyclable vacuum-sealed packaging solutions. Stringent packaging regulations by regulatory agencies promote innovation in biodegradable and high-barrier packaging materials.

Increasing automation in the packaging sector increases efficiency and cost savings, and thus vacuum-sealed solutions become increasingly attractive to companies. Ongoing technological developments in the USA industry are expected to experience steady growth during the forecast period.

The United Kingdom's vacuum-sealed packaging industry is constantly growing, driven by growing consumer interest in reducing food waste and environmentally friendly packaging solutions. The food sector is still the main driving force, with growing demand for vacuum-sealed packaging in fresh produce, dairy, and frozen foods. Retailers focus on longer shelf life and enhanced product safety, leading to increased vacuum-sealed packaging adoption.

The government pressure for sustainability forces a transition toward recyclable and biodegradable packaging. Specialized packaging techniques, including high-barrier films and modified atmosphere packaging, emerge as companies embrace efficiency.

Vacuum-sealed packaging is further assisted by the growing online grocery delivery, providing for safe and stable food storage. The non-food sector, comprised of pharmaceutical and electronics, plays its part as well, increasing industry demand by demonstrating the broad applicability of vacuum-sealed solutions.

China's vacuum-sealed packaging industry is anticipated to expand at a CAGR of 4.9%, spurred by the growth of the food processing sector in the country and urbanization. The expanding middle-class base demands convenient and durable packaged food, which stimulates the demand for vacuum-sealed packaging. Government initiatives towards ensuring food safety and stringent regulatory guidelines also fuel industry growth.

The development of e-commerce and online food delivery sites creates a higher demand for safe packaging materials to maintain product integrity. Concerns with sustainability encourage manufacturers to create biodegradable and recyclable vacuum-sealed packaging, which is in line with China's green packaging program.

The non-food industry, which includes pharmaceuticals and industrial products, also witnesses greater use of vacuum-sealed packaging to advance product protection. With ongoing innovations and changing consumer needs, China is still a major player in the international vacuum-sealed packaging industry.

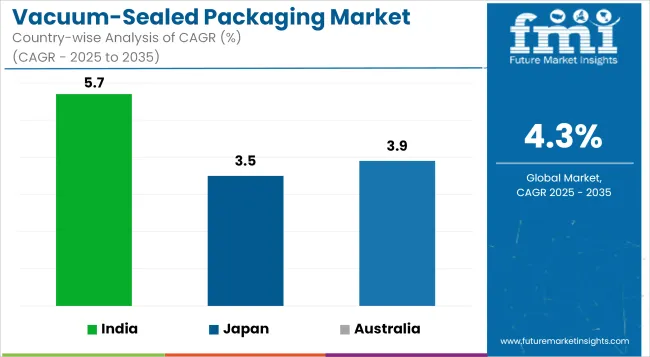

India's vacuum-sealed packaging industry is expected to develop at a CAGR of 5.7%, ranking among the fastest-growing sectors. The food processing sector is growing at a fast pace, increasing disposable incomes, and shifting lifestyles drive demand for vacuum-sealed packaging.

Urbanization and the trend towards packaged and processed foods drive industry growth. Government programs focusing on food safety and packaging standards boost business towards vacuum-sealed solutions.

The growth in food ordering and food delivery platforms requires more efficient packaging that will maintain freshness and provide longer shelf life. Environment concerns propel companies to seek eco-friendly options, such as bio-based vacuum-sealed packaging. The non-food industry, such as pharmaceuticals and consumer electronics, also adds to the growth in the sector. As technology improves and consumer consciousness heightens, India's vacuum-sealed packaging sector will follow an upward trend.

Japan's vacuum-sealed packaging industry is expected to record a CAGR of 3.5% through its highly developed food sector and tremendous innovation focus. Japan's high demand for fresh and lightly processed food catalyzes the growth of vacuum-sealed packaging among meat, seafood, and convenience meals. Latest packaging technologies like high-barrier films and smart packaging solutions boost the sector attractiveness.

Rigid food safety policies and consumer expectation for high-quality products compel companies to embrace vacuum-sealed packaging for maximum protection. Sustainability is a prime consideration, and as a result, manufacturers are now coming up with recyclable and biodegradable packaging materials.

Non-food items, such as electronics and drugs, also stand to gain from vacuum-sealed solutions, keeping products stable and long-lasting. As technology progresses on a steady basis, the sector for vacuum-sealed packaging in Japan will continue to grow steadily.

Australia's vacuum-sealed packaging industry is anticipated to register a CAGR of 3.9% due to rising consumer interest in sustainable and high-quality packaging materials. The food sector is the largest domain, with vacuum-sealed packaging being extensively applied in fresh fruits and vegetables, dairy products, and meat. The nation's high emphasis on minimizing food waste and encouraging eco-friendly packaging materials fuels domain growth.

The rise in popularity of grocery shopping online and food delivery enhances the demand for effective and long-lasting vacuum-sealed packaging. Government policies push the use of environmentally friendly packaging materials, making manufacturers invest in biodegradable and recyclable packaging.

Non-food applications such as pharmaceuticals and industrial packaging also add to industry growth. With an increased focus on eco-friendliness, the Australian industry is likely to grow steadily during the forecast period.

Germany continues to be a leader in the vacuum-sealed packaging industry, with high demand from various industries. The advanced food processing industry in Germany fuels the usage of vacuum-sealed packaging for maintaining prolonged shelf life and quality.

The emphasis on sustainability promotes the generation of recyclable and compostable vacuum-sealed products. Tight packaging standards and customer demand for eco-friendly solutions drive companies to invest in high-barrier and light-weight packaging technologies.

Growth is further fueled by the growth of e-commerce, with companies focusing on protective packaging solutions for secure transportation of products. The non-food industry, such as automotive, pharmaceuticals, and electronics, increasingly uses vacuum-sealed packaging for better protection of products. With a focus on technological innovation and sustainability, Germany continues to influence the international vacuum-sealed packaging industry.

South Korea's vacuum-sealed packaging industry continues to grow with the support of a robust food industry and rising consumer demand for quality packaging solutions. The nation's inclination toward fresh and ready-to-consume meals drives the growth of vacuum-sealed packaging in food retail and food delivery services. Growth in online shopping and food delivery platforms enhances the demand for secure and efficient packaging.

Sustainability issues propel developments in biodegradable and recyclable vacuum-sealed packaging materials. The government's emphasis on food safety and packaging regulations also pushes companies to implement sophisticated vacuum-sealing technologies.

The non-food industry, such as cosmetics, pharmaceuticals, and industrial uses, also experiences increasing demand for vacuum-sealed products. As South Korea continues to adopt smart and sustainable packaging technologies, the vacuum-sealed packaging industry is likely to experience steady growth.

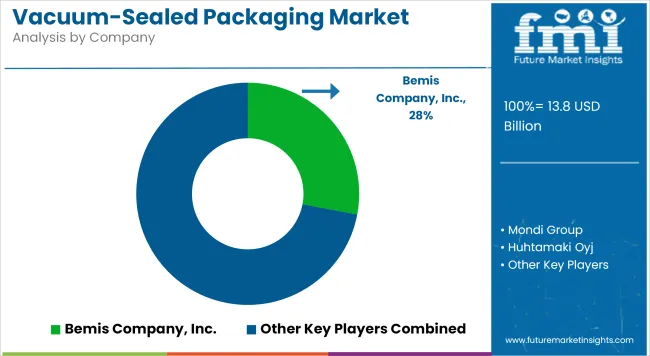

The industry for vacuum-sealed packaging is fairly concentrated with a combination of powerful global players and a large number of regional producers. Dominant players have a strong hold on the sector with their sophisticated technology, well-established distribution channels, and strong R&D facilities. The sector is also fragmented in some regions, where small producers meet local demand with low-cost solutions.

Consolidation in the industry is fueled by high upfront costs of investment in specialized technology and equipment. The big companies achieve economies of scale, which help them provide low prices and new solutions. Regulatory requirements for high food safety standards and eco-friendly packaging also pressure smaller companies to merge with the big players or get out of business.

Fragmentation remains in countries with relatively lower entry barriers where small players are able to maintain profitability efficiently through concentration in specialized applications or geographies.

Funds available to financing packaging start-ups, especially in emerging countries, enable the existence of new competitors. However, accelerating rates in automation technology and eco-friendliness offer technical barriers benefiting well-established corporations.

With demand for environmentally friendly and high-performance packaging increasing, concentration in the sector will probably rise, as large companies acquire innovative firms to develop their strengths.

From 2025 to 2035, incumbent players emphasize technological innovation, sustainability, and strategic mergers and acquisitions to consolidate market leadership. They heavily invest in automation, high-barrier materials, and intelligent packaging solutions to improve efficiency and address changing regulatory requirements.

Widening distribution networks globally and partnerships with retailers and e-commerce platforms reinforce their competitiveness. Sustainability is prioritized through investments in biodegradable and recyclable materials to adapt to environmental rules and consumer preference.

Upcoming startups shake up the industry with creative, low-cost solutions designed for niche sectors. They focus on sustainable packaging, using bio-based materials and simple designs to resonate with consumers concerned about the environment.

Digitalization is important, with startups using AI-powered manufacturing methods and direct-to-consumer platforms to keep costs down and make products more accessible.

Several new entrants are able to attract venture capital funding, allowing them to expand operations and take on bigger players. The sector witnesses greater interplays among startups and large firms to expedite innovation.

Growing consumer preference for longer shelf life, food freshness, and sustainability is fueling demand across various industries.

The food industry dominates, followed by pharmaceuticals, electronics, and industrial components.

Companies are investing in recyclable materials, biodegradable films, and energy-efficient production to meet environmental regulations and consumer expectations.

High initial costs, evolving regulatory standards, and competition from alternative packaging solutions pose key challenges.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA