The global vacuum evaporators market is expected to witness robust growth, rising from USD 3.24 billion in 2025 to USD 6.49 billion by 2035. This expansion, marked by a CAGR of 7.5%, is fueled by surging demand from water-intensive industries such as pharmaceuticals, chemicals, and food processing. North America, particularly the United States, leads in adoption due to high industrial R&D spend, while Asia Pacific, led by China and South Korea, is fast becoming a volume-driven growth hub.

Key drivers include the global push for zero liquid discharge (ZLD) compliance, regulatory mandates on wastewater treatment, and heightened awareness around circular water reuse. MVR-based evaporators dominate due to their superior energy recovery capabilities, while heat pump systems are gaining favor in temperature-sensitive applications like food and beverages. Despite their affordability, thermal evaporators are losing ground to newer technologies that offer lower operating costs and better efficiency.

Looking ahead, innovations such as AI-based failure detection, modular hybrid systems, and space-saving designs are reshaping the industry landscape. The transition to stainless steel alternatives and composite-based evaporators is accelerating, especially in Europe, due to carbon footprint concerns.

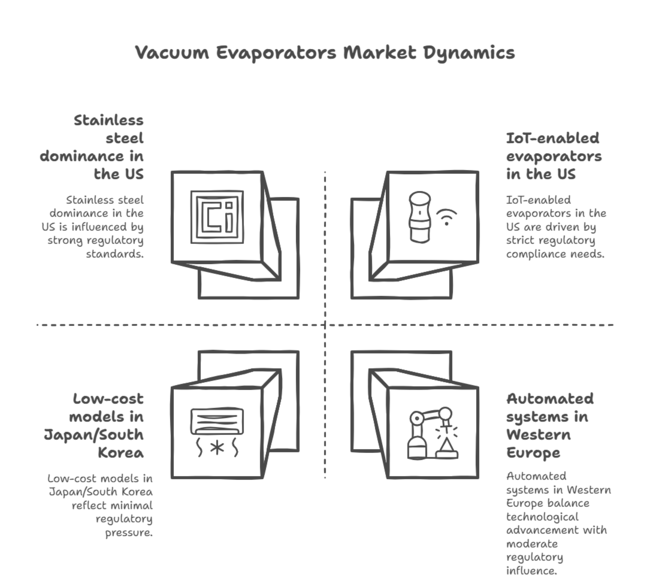

Furthermore, compact units for small-scale applications are gaining popularity in Japan and South Korea, while modular, high-capacity systems are prioritized in the USA and China. Companies are focusing on automation, predictive maintenance, and smart diagnostics to deliver long-term ROI and operational resilience.

The vacuum evaporators market is also shaped by evolving material preferences and smart system integration. Globally, stainless steel remains the preferred construction material due to its durability and corrosion resistance; however, regions like Western Europe are increasingly adopting composite and hybrid alternatives to meet sustainability goals.

Meanwhile, the integration of IoT-enabled sensors and automated control systems is gaining momentum-particularly in the USA and Germany-where regulatory frameworks emphasize real-time compliance monitoring. Although upfront capital investment remains a barrier in price-sensitive markets like Japan and Southeast Asia, modular and leasing-based solutions are enabling broader penetration across mid-sized facilities and industrial parks.

Among thermal, heat pump, and mechanical vapor recompression (MVR) technologies, MVR systems are the fastest-growing and most widely adopted due to their ability to recycle vapor for heat, significantly reducing operational energy consumption.

These systems are especially preferred in sectors like pharmaceuticals, chemicals, and food processing where utilities account for a major share of operating costs. Heat pump evaporators are gaining traction for low-temperature, heat-sensitive applications, such as flavor and dairy processing. Although thermal evaporators remain relevant due to low upfront costs, their higher energy consumption limits growth in regions focused on carbon neutrality and sustainability.

| Technology | CAGR (2025 to 2035) |

|---|---|

| Mechanical Vapor Recompression | 8.4% |

Driven by rising zero liquid discharge (ZLD) mandates and industrial wastewater regulations, the wastewater treatment application is forecast to expand the fastest. Industries such as semiconductors, chemicals, and power are under pressure to reduce effluent discharge and recover valuable resources.

Product processing applications in food & beverage, pharma, and chemicals also show strong growth due to increasing purity requirements and solvent recovery initiatives. Other emerging applications-like metal recovery, desalination, and niche waste streams-are gaining relevance in resource-scarce geographies, offering long-term opportunity pipelines.

| Application | CAGR (2025 to 2035) |

|---|---|

| Wastewater Treatment | 9.1% |

Among end users, the food and beverage industry leads in growth due to its extensive use of vacuum evaporators for juice concentration, dairy processing, and flavor extraction-where energy-efficient evaporation under low temperatures is essential.

Electronics and semiconductor sectors follow closely due to their reliance on ultrapure water and precision chemical recovery. The chemical and petrochemical industries continue to adopt evaporators for both wastewater minimization and solvent recovery. Meanwhile, automotive and energy sectors are experiencing gradual uptake driven by evolving environmental compliance requirements.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Food & Beverage | 8.7% |

Key Priorities of Stakeholders

Regional Variance:

Adoption of Smart & Automated Vacuum Evaporators

Material Preferences for Vacuum Evaporators

Price Sensitivity & Cost Challenges

Supply Chain & Value Chain Challenges

Future Investment Priorities

Regulatory Landscape & Compliance Challenges

Conclusion: Regional Variance vs. Industry Consensus

| Country | Regulation |

|---|---|

| United States | The Environmental Protection Agency (EPA) enforces wastewater treatment and zero-liquid discharge (ZLD) regulations, driving demand for high-efficiency vacuum evaporators. The Department of Energy (DOE) promotes energy-efficient industrial equipment, influencing evaporator design. |

| Canada | The Canadian Council of Ministers of the Environment (CCME) sets industrial effluent discharge limits, encouraging the adoption of advanced evaporation technologies. The ENERGY STAR Canada program supports energy-efficient evaporator systems. |

| India | The Central Pollution Control Board (CPCB) regulates industrial wastewater discharge, pushing industries to adopt vacuum evaporation solutions. Government initiatives promote sustainable and resource-efficient evaporator technologies. |

| European Union | The EU Water Framework Directive and Industrial Emissions Directive (IED) enforce strict wastewater treatment standards, driving innovation in low-energy vacuum evaporators. The Ecodesign Directive mandates energy-efficient evaporator designs. |

| China | The China Compulsory Certification (CCC) requires quality control and compliance for vacuum evaporators used in industrial wastewater treatment. Environmental policies encourage the adoption of recyclable materials and energy-saving evaporation technologies. |

| 2020 to 2024 (Past Industry Trends) | 2025 to 2035 (Future Industry Projections) |

|---|---|

| Moderate growth with a CAGR of ~7.5%, driven by regulatory compliance and industrial wastewater treatment needs. | Accelerated growth due to stricter environmental regulations, adoption of ZLD systems, and technological advancements. |

| Adoption of multi-effect and mechanical vapor recompression (MVR) evaporators for energy savings. | AI-powered automation, IoT-enabled monitoring, and hybrid evaporation technologies for improved efficiency. |

| Compliance with regional wastewater discharge laws, driving demand for high-efficiency systems. | Stricter global regulations on industrial emissions, water reuse, and carbon neutrality mandate advanced vacuum evaporator adoption. |

| Key industries: chemical processing, pharmaceuticals, food & beverage. Adoption driven by wastewater treatment needs. | Wider adoption in semiconductors, electronics, and energy sectors, focusing on water recycling and sustainability. |

| Predominantly stainless-steel evaporators for corrosion resistance. | Increased use of hybrid materials (composites & alloys) for lighter, energy-efficient designs. |

| Limited automation and predictive maintenance capabilities. | High adoption of real-time monitoring, AI-based efficiency optimizations, and predictive failure detection. |

| Energy-efficient designs emerging, but adoption remains limited due to cost concerns. | Strong emphasis on low-energy, carbon-neutral evaporators driven by government incentives and sustainability goals. |

| North America & Europe lead adoption due to regulatory pressures; Asia-Pacific growing due to industrial expansion. | Asia-Pacific dominates growth with rising industrial wastewater regulations, while Europe focuses on carbon-neutral systems. |

| High initial CAPEX concerns slow adoption, with a preference for low-cost models. | Greater investment in advanced, automated evaporators with a focus on long-term ROI and operational savings. |

The market in North America is being dominated by the United States due to the presence of a large consumer base, large-scale industrial vacuum evaporator manufacturers, and strong demand from end-user industries.

Companies are focusing on upgrading their facilities with technological advancements and sustainability in a rapidly changing industry environment.

The USA industrial sector is well-capitalized and invests heavily in research and development to enhance both product efficiency and environmental compliance. The vacuum evaporators landscape in the USA also benefits from the presence of key players as well as an established supply chain.

FMI opines that the United States vacuum evaporators sales will grow at nearly 6.8% CAGR through 2025 to 2035.

The UK vacuum evaporators landscape will contributing to the growth and continued success of established industry players and providing opportunities for companies to secure segment share.

Predictive analytics work well for customer behavior and industry strategies, and innovative product offerings and a profound understanding of consumer preferences have all contributed to this upward trend.

The UK also has a strong commitment to environmental protection, prompting companies to develop energy-saving and environmentally friendly vacuum evaporator solutions. This excellent combination of technology and regulatory standards makes it an easier entry point to the UK than other sectors.

FMI opines that the United Kingdom vacuum evaporators sales will grow at nearly 6.5% CAGR through 2025 to 2035.

The result of ongoing economic growth, government support, and a stable workplace, France is anticipated to represent one of the higher growth rates in the European vacuum evaporators sector.

The International Monetary Fund, creating a steady level of consumer confidence and enhancing the prospects of the segment. More companies are looking for long-term growth opportunities through investment in next-gen technologies and growing product mixes for industrial needs.

A range of sectors are adopting advanced vacuum evaporator systems due to France's focus on environmental regulations and sustainability.

FMI opines that the France vacuum evaporators sales will grow at nearly 7.0% CAGR through 2025 to 2035.

Post-pandemic recovery of Germany in the vacuum evaporators landscape is anticipated in 2025. The German industry keeps adjusting to changing segment conditions, as it expects GDP growth of 0.9%.

This places companies adopting sustainability at a significant advantage in the country, with its robust process engineering capabilities and an ethos for environmentally friendly solutions.

When it comes to high-quality vacuum evaporators, many manufacturers have German influences. Germany emphasizes energy efficiency and compliance with strict environmental standards.

FMI opines that the Germany vacuum evaporators sales will grow at nearly 7.2% CAGR through 2025 to 2035.

The strong process engineering capabilities, affordable manufacturing, and availability of deep skilled labor enable a strong outlook for Italy's vacuum evaporators landscape. Pulling from the country's industrial legacy and machinery sector expertise, vacuum evaporators are made at high standards.

To gain global competitive advantages, Italian companies are working towards creating innovation and customized solutions that serve specific needs of the industry. Moreover, their focus on sustainable manufacturing practices and compliance with strict European Union regulations only strengthens their position in the sector.

FMI opines that the Italy vacuum evaporators sales will grow at nearly 6.8% CAGR through 2025 to 2035.

The South Korea Vacuum Evaporators landscape is growing, with top players launching new innovations and expanding their product portfolios to address the differing needs of customers. Increasing numbers of brands are entering new segments, resulting in increased variety and growing potential consumer bases.

Their highly tech-driven economy and emphasis on innovation are giving rise to advanced vacuum evaporator systems in Korea. Sustainable energy and energy efficiency are not just slogan, but rather the keystone of global building practices that enhance Korea's competitiveness in the global sector.

FMI opines that the South Korea vacuum evaporators sales will grow at nearly 8.2% CAGR through 2025 to 2035.

Impellers of growth in a changing environment as companies adapt to changing economic dynamics and consumer preferences, they are finding opportunities to seize them. The focus on quality control, attention to detail, and precision that Japan is known for means that any vacuum evaporator produced in this country will be reliable and efficient.

However, the combination of advanced technologies and strict environmental regulations gives Japan an important segment presence. Innovation and industry expansion are further propelled through collaborations between industry and academia.

FMI opines that the Japan vacuum evaporators sales will grow at nearly 6.5% CAGR through 2025 to 2035.

China is one of the key geographies for the vacuum evaporators, attracting both domestic and international manufacturers. Due to continuous investment in technology and a strong supply chain, the industry is expected to account for one of the fastest-growing growth rates in the region.

As China emphasizes industrial modernization and the need for environmental sustainability, the use of advanced vacuum evaporator systems is gaining traction. When combined with favorable government policies and initiatives that support this sector, the segment becomes even more attractive to stakeholders and creates lucrative opportunities.

FMI opines that the China vacuum evaporators sales will grow at nearly 9.0% CAGR through 2025 to 2035.

Australia and New Zealand's focus on environmental sustainability and technological intervention drives the market for evaporators and vacuums. The strong industrial presence in these countries necessitates innovative solutions for industrial wastewater treatment and resource recovery, thereby driving the demand for vacuum evaporators.

Stress on compliance with stringent environmental and safety regulations, as well as the demand for energy-efficient technologies, is fostering industry growth. Partnerships with global manufacturers and investments in research and development enhance the local industry's capabilities for modern vacuum evaporator designs.

FMI opines that the Australia and New Zealand vacuum evaporators sales will grow at nearly 6.5% CAGR through 2025 to 2035.

Major players in the vacuum evaporators industry are embracing a combination of innovation, strategic alliances, geographic expansion, and competitive pricing to improve their industry shares. As demand for energy-efficient and sustainable technologies increases, top players are spending on R&D to improve evaporation efficiency and lower operating expenses. Customization and modular system designs are also on the rise, enabling companies to serve varied industry requirements, ranging from wastewater treatment to food & beverage processing.

Strategic acquisitions and partnerships are becoming essential to expand technological capabilities and geographical reach. Companies such as GEA Group, Veolia, and SPX Flow are collaborating with regional distributors to grow their foothold in the developing sectors. Expansion plans include opening new manufacturing sites and service facilities in high-growth sectors, including China, India, and Southeast Asia.

The vacuum evaporators industry lies in the industrial equipment and environmental technology segment broadly and is connected closely with segments. Industry growth depends on industrialization, environmental rules and regulations, infrastructure, and the economic cycle of different sectors.

General rises in GDP across global landscape, industry production levels as well as capital spending (capex), which makes significant contributions to demand. With governments globally cracking down on environmental controls in terms of wastewater disposal and industrial emissions, companies are turning towards vacuum evaporators as environmentally friendly solutions to waste minimization and water reuse.

Inflation and volatility in raw material prices (e.g., stainless steel, energy prices) also influence capital investment choices. Beneficial government policies, subsidies, and sustainability programs, primarily in Europe and North America, favor the industry. As the circular economy becomes more popular, businesses are looking for better evaporators that make better use of energy, produce fewer waste products, and recycle useful byproducts.

The landscape for vacuum evaporators offers substantial growth prospects, led by the growing demand for industrial wastewater treatment technologies. Global tightening of environmental regulations and efforts to adopt zero liquid discharge (ZLD) systems are forcing industries to invest in sophisticated evaporation technologies. China, India, and Southeast Asia provide sectors with strong growth opportunities through fast-paced industrialization and government initiatives to promote reuse of wastewater.

New players require a specific strategy to build momentum in the sector and contend against required competitors. New companies can concentrate on specialized niches, like recycling batteries, processing food, or small-scale evaporators for plants with limited space. Modular, customizable products will also offer benefits, especially within sectors like South Korea and Japan, where companies need high-performance and custom solutions. By distinguishing themselves based on innovation, service quality, and local orientation, new players can gain a solid foundation in this dynamic sector.

Thermal, Heat Pump, and Mechanical Vapor Recompression

Wastewater Treatment, Product Processing, and Other

Automotive, Chemical & Petrochemical, Electronics & Semiconductor, Energy & Power, Food & Beverage, Pharmaceutical, and Others

North America, Latin America, Western Europe, Eastern Europe, Russia and Belarus, Balkan and Baltic Countries, Central Asia, East Asia, South Asia and Pacific, and Middle East and Africa

Table 1: Global Market Value (US$ billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ billion) Forecast by Technology, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 5: Global Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ billion) Forecast by Technology, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 13: North America Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ billion) Forecast by Technology, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 21: Latin America Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ billion) Forecast by Technology, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 29: Western Europe Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ billion) Forecast by Technology, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ billion) Forecast by Technology, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ billion) Forecast by Technology, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 53: East Asia Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ billion) Forecast by Technology, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ billion) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ billion) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ billion) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ billion) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ billion) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ billion) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ billion) Analysis by Technology, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 13: Global Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Technology, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ billion) by Technology, 2023 to 2033

Figure 26: North America Market Value (US$ billion) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ billion) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ billion) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ billion) Analysis by Technology, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 37: North America Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Technology, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ billion) by Technology, 2023 to 2033

Figure 50: Latin America Market Value (US$ billion) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ billion) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ billion) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ billion) Analysis by Technology, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 61: Latin America Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ billion) by Technology, 2023 to 2033

Figure 74: Western Europe Market Value (US$ billion) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ billion) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ billion) Analysis by Technology, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 85: Western Europe Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ billion) by Technology, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ billion) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ billion) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ billion) Analysis by Technology, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ billion) by Technology, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ billion) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ billion) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ billion) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ billion) Analysis by Technology, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ billion) by Technology, 2023 to 2033

Figure 146: East Asia Market Value (US$ billion) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ billion) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ billion) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ billion) Analysis by Technology, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 157: East Asia Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ billion) by Technology, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ billion) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ billion) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ billion) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ billion) Analysis by Technology, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ billion) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Vacuum evaporators find extensive applications in wastewater treatment, food & beverage processing, pharmaceuticals, chemicals, electronics, and power generation for effective liquid concentration and waste reduction are the primary industries that employ vacuum evaporators.

These systems enable industries to save water, recover valuable byproducts, and reduce liquid waste disposal, aiding zero liquid discharge (ZLD) programs and environmental regulations.

The main drivers are energy efficiency, operational expenses, regulatory compliance, available space, and industry process needs. Higher levels of automation and IoT integration are also increasing adoption.

Heavy demand is seen in Asia-Pacific, Europe, and North America, specifically in the USA, China, Germany, and Japan, where process efficiency and treatment of industrial wastewater is a major priority.

Advancements come in the form of mechanical vapor recompression (MVR), heat pump evaporation, and intelligent monitoring systems, enhancing energy savings, process control, and system life in general.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA