The vacuum cleaner filter market is likely to grow at a steady pace in the coming decade owing to increasing consciousness regarding indoor air quality, rising acceptance for high-efficiency particulate filtration, and implementing vacuum cleaners with residential, commercial, and industrial segment.

All of these filter types are critical elements to aid vacuum cleaners function more hygienically and effectively by trapping allergens, ultra-fine dirt, and air pollution. Urban and pet owner households continue to draw towards vacuum cleaners with HEPA-certified filtration or multi-layer filtration systems.

Mechanical advance in filter media including nano-fiber membranes, activated carbon layers and washable, reusable materials they would reshape the landscape. The increasing regulations on particulate emissions and occupational safety across commercial sectors propel the demand for effective filtration systems.

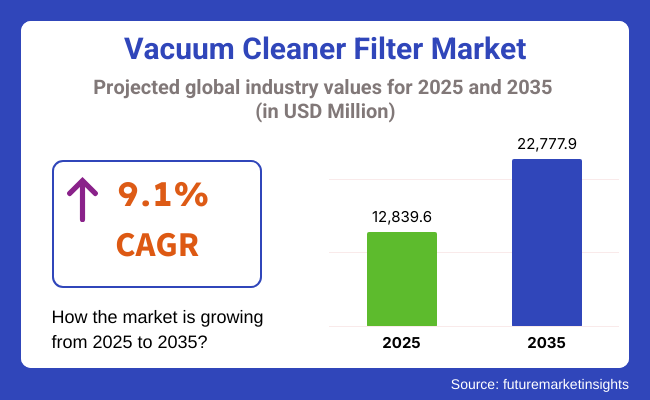

The global vacuum cleaner filter market is projected to grow at an astonishing CAGR of 9.1%, from USD 12,839.6 Million in 2025 to USD 22,777.9 Million by 2035, as technological advances in smart homes, robotic vacuums, and sustainable filtration solutions gain acceptance.

The vacuum cleaner filters market is dominated by North America, followed by Europe, owing to the high adoption of residential and commercial vacuum systems, especially in the USA With increasing awareness on respiratory health, especially among people prone to allergies, the demand for vacuum cleaner filters is seeing an uptrend. We expect to see continued growth in sales of robotic and cordless vacuum in both categories, with demand for compact and replaceable filter units across the entire RSI region.

The vacuum cleaner filter market in Europe is driven by the strict regulations regarding indoor air quality, energy labeling, and sustainability goals. Such HEPA and EPA-rated filters are particularly emphasized in countries like Germany, the UK, and in the Nordic region for both residential and healthcare environments. Regional growth also benefits from the rising usage of vacuum systems in offices, public transport, and cleanrooms.

The Asia-Pacific region is the fastest growing, due to the fast pace of what is essentially urbanisation, rising disposable incomes, and proliferation of mid-range to premium vacuum cleaner range in countries like China, India, Japan, and South Korea. The increasing adoption of vacuum units with multi-stage filtration and washable filters has been supporting demand for the segment, while local manufacturing enables the presence of aftermarket filters at retail and e-commerce outlets.

Challenges

Performance consistency, price sensitivity, and environmental concerns hinder market scalability

Prolonged usage affects filtration efficacy in the market, as low-cost disposable filters tend to degrade quickly. OEMs have long found it difficult to explore a balance of cost-effectiveness against quality, particularly as price-sensitive consumers flood the emerging markets. In addition, increasing waste from single-use filters and non-recyclable materials is drawing fire from environmental within and sustainability advocates.

Lack of consistency in changing filters in industrial and commercial environments leads to equipment issues, energy wastage and includes poor air quality. While standardizing maintenance routines and user education on filter replacement are a priority, especially in decentralized or small-business spaces where vacuum cleaners aren't managed as a professional scale. This gap also causes brand reputation issues to manufacturers whose units end up underperforming due to missed filter cleaning cycles.

Opportunities

Washable filters, antimicrobial coatings, and integration with smart vacuums create new avenues

There are opportunities in the development of long-life, washable, and reusable filters that can achieve minimal cost and waste while preserving filtration efficiency. A HEPA filter with activated charcoal to control odor is trending, particularly in pet homes and the hospitality industry. Healthcare, schools, and cleanrooms are other applications where filters with antimicrobial properties are gaining demand.

Smart vacuum systems are changing the consumer experience by integrating filter health indicators and filter replacement alerts. As robotic vacuums are taking off, the space for small, high-performance filter cartridges is growing. In addition, partnerships with e-commerce platforms for auto-replacement subscriptions, customization and DTC aftermarket kit for one and all filters will create more scalable revenue streams for the manufacturers and third-party brands.

The period from 2020 to 2024 experienced significant market shaping, mainly due to greater hygiene awareness from the onset of the COVID-19 pandemic, leading to increased demand for advanced vacuum filtration systems in households, offices, and healthcare facilities. Premium models then adopted HEPA filters as standard assuage concerns, and OEMs promoted multi-layer filtration as a way to enhance perceived value. However, a lack of consumer education on filter management in some cases caused filters to fall short of their potential.

Starting from 2025 until 2035, the market will shift to the smart filtration ecosystem. Filters will need to both be more performant (last longer, produce less microplastic dust, meet sustainability expectations, etc.) and cleaner (not use chemical agents, etc.) to remain attractive to consumers. Smart filter alerts, automated filter ordering, app-based maintenance tracking integration will all transform aftermarket engagement. In industrial environments, predictive filter diagnostics will help minimize downtime and allow for better adherence to air quality standards.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emphasis on HEPA compliance and hygiene post-pandemic |

| Consumer Trends | Surge in HEPA demand and multi-stage filtration |

| Industry Adoption | Strong in residential and healthcare vacuums |

| Supply Chain and Sourcing | Reliance on Asia-based filter suppliers |

| Market Competition | OEM filter dominance with few aftermarket players |

| Market Growth Drivers | Indoor air quality concerns, allergy control, pandemic hygiene |

| Sustainability and Impact | Growing scrutiny over disposable filters |

| Smart Technology Integration | Limited to filter change indicators |

| Sensorial Innovation | Emphasis on odor capture and allergen filtration |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Focus on eco-certification, emissions limits, and sustainable disposal |

| Consumer Trends | Shift to reusable, smart, and antimicrobial filter systems |

| Industry Adoption | Expanding in industrial, commercial, hospitality, and robotic segments |

| Supply Chain and Sourcing | Diversification toward localized, eco-friendly filter production |

| Market Competition | Rise of DTC filter startups, subscription-based models, and bundling |

| Market Growth Drivers | Smart home integration, long-life filters, and energy-efficient cleaning |

| Sustainability and Impact | Growth in biodegradable materials, recyclable cartridges, and waste tracking |

| Smart Technology Integration | App-controlled filter status, auto-replenishment, and IoT diagnostics |

| Sensorial Innovation | Next-gen filters with aroma therapy, anti-viral coatings, and self-cleaning layers |

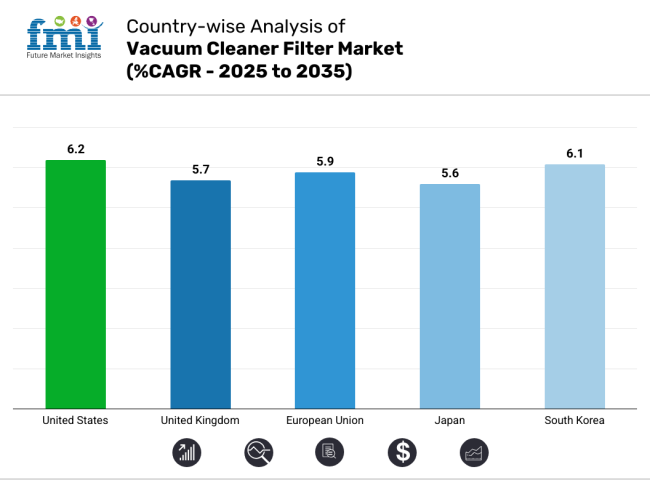

With consumers increasingly focused on indoor air quality and allergen control, the USA vacuum cleaner filter market is growing, particularly among urban and suburban households. The residential segments are led by HEPA certified filters, while advanced multi-stage filters are in demand in industrial and commercial cleaning systems.

But smart vacuum brands are building in long-life, washable filters that work with app-driven air quality monitoring. Tough EPA regulations and OSHA standards are accelerating adoption in public facilities, hospitals, and schools. Major companies are developing nanofiber-based filtration materials that improve dust capture, while maintaining airflow effectiveness.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

In the UK, increasing awareness of respiratory system conditions and eco-conscious cleaning habits are fueling demand for high-performance vacuum cleaner filters. Bagless and upright vacuums often have HEPA and carbon filters, and as they become cheaper, more households, especially those with pets, are using them. Some local retailers and e-commerce sites are touting reusable and biodegradable filter alternatives.

Manufacturers are innovating antimicrobial filter technologies for healthcare and hospitality applications. EU-derived clean air targets, Regional R&D centers experimenting with hybrid filters that incorporate activated charcoal with electrostatic layers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

Filters are being mandatorily adopted by EU countries as a part of wider national green cleaning and indoor air quality improvement strategies. Germany, France and Sweden: Significant Growth of Ultra-Fine Particulate And Anti-Bacterial Vacuum Filter Usage in the Consumer and Institutional Sector Eco-design directives are asking vacuum manufacturers to make filters more durable, recyclable and efficient.

There are the EU research grants dedicated to projects for lightweight nanocomposite filter media. M-class and H-class filters are also seeing increased use in industrial applications with increased workplace safety and dust exposure limits applied to all job sites within Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.9% |

The trends in Japan’s vacuum cleaner filter market are developing based on the innovations in low-noise filtration and miniaturization. Japanese brands combine washable HEPA filters and multi-cyclonic cleaning systems with robotic vacuums. Demand is particularly strong among small urban residences and older households that are sensitive to dust.Its AI sensors enable global manufacturers in Tokyo to track filter wear and replacement cycles for greater operational life and energy efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

South Korea is seeing a surge in demand for vacuum cleaner filters owing to its tech-savvy population, the rise of pet ownership, and a greater emphasis on household hygiene. Robotic vacuum cleaners and stick vacuum cleaners usually include HEPA and multi-layer microfiber filters. Urban buyers remain trendier, turning to replaceable and eco-friendly filters that can absorb odors.

Government work to tackle air pollution is underpinning demand for high-efficiency indoor cleaning devices. Manufacturers based in Seoul are at the forefront of developing electrospun nanofiber filters to enhance the capture of fine dust in both domestic and industrial settings.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

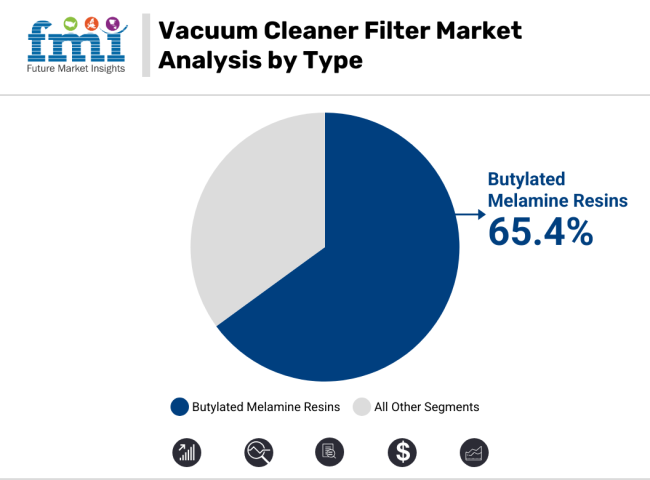

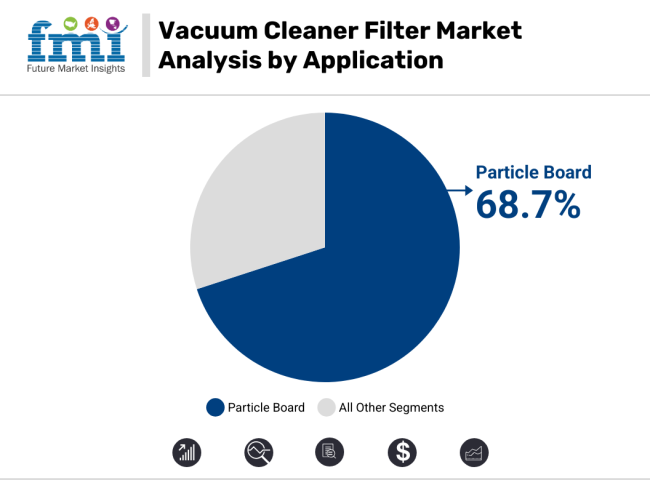

Dominating the market shares of the resin types and their application areas are butylated melamine resins and their use in particle board manufacturing, due to superior qualities such as crosslinking, water resistance, and compatibility with high-pressure molding processes. These segments lay the foundation for durable, scratch-resistant finishes as well as long-term dimensional stability and are key in construction, furniture as well as interior applications.

Vacuum Cleaner Filter market are integral in binding and finishing wood products. Permuted, producers of high-performance coatings slowly begin to prefer melamine-modified derivatives, with particle board as a steady outlet from its use in standardized modular and flat-pack furniture generations.

Butylated melamine resins gain traction due to enhanced thermal stability, gloss retention, and scratch resistance

The vacuum cleaner filter market is led by butylated melamine resins owing to its superior performance in high end coating systems and wood panel applications. These resins offer high hardness, UV stability, and chemical resistance the key to automotive finishes, appliance coatings and decorative laminates.

On metal and wood substrates, manufacturers recommend butylated melamine resins for formulation with alkyds, acrylics, and polyesters to yield crosslinked thermoset coatings that provide long-lasting finishes. They are widely used for industrial and architectural applications thanks to their rapid curing times and high-gloss results.

Melamine variants generally provide better water and heat resistance than butylated urea resins, making them more appropriate for exterior or heavy-use surfaces. This rise guarantees their dominant market share owing to their concentration in OEM (original equipment manufacturer) and engineered wood segments.Butylated urea resins remain prevalent as a lower-cost option for interior applications, while melamine-based resins are used for high-end applications, where performance is the primary consideration.

Particle board drives market use through high-volume engineered wood production, cost-efficiency, and adhesive compatibility

Particle board accounts for the leading share of amino resin applications, as it is a significant engineered wood product for furniture, cabinetry, and flooring substrates. Evidently, amino resins especially urea-formaldehyde and melamine-urea-formaldehyde work as excellent binders that provide significant adhesive strength as well as resistance against moisture for wood particles during adhesion.With its low price and large aesthetic, particle board becomes the go-for material for flat pack- and modular furniture. Amino resins allow for even bonding throughout the layers and are resistant to delamination, creating durable, warp-free panels.

Moreover, the low-emission particle board resins are also in alignment with the global environmental standards of CARB and E0/E1 certifications further contributing to its capabilities in the eco-conscious segments.Although plywood uses amino resins in an adhesive application, particularly in the case of interior-grade panels, particle board is its largest application, driven by their lower material cost, uniform surface finishing, and higher demand in the production of residential and commercial furniture.

Driven by growing demand in end-use industries such as wood adhesives, laminates, coatings, molded plastics, and paper finishing applications, the vacuum cleaner filter market is progressing steadily. The field is commanded by the melamine-formaldehyde (MF), urea-formaldehyde (UF), and melamine-urea-formaldehyde (MUF) resins due to their strong bond, thermal resistance, and economic value.

Increased construction, furniture manufacturing and automotive sector activity particularly in Asia and Eastern Europe is boosting consumption. Simultaneously, environmental regulations on formaldehyde emissions are encouraging low-emission and bio-based alternatives. Formaldehyde-free formulations, performance tuning, and process integration with sustainable materials are key focus areas for manufacturers.

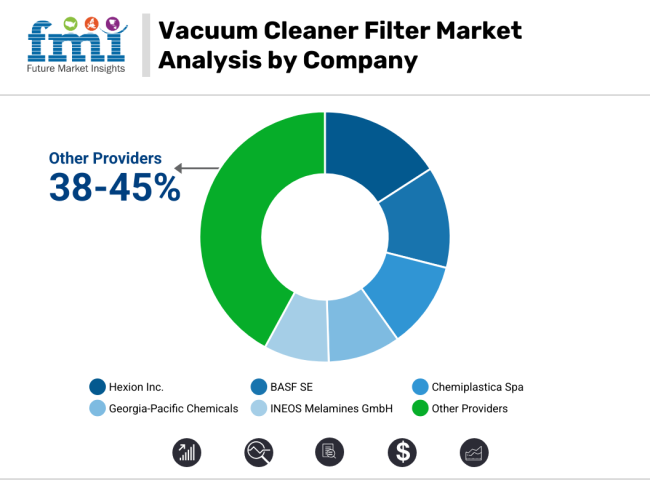

Market Share Analysis by Key Players & Vacuum Cleaner Filter Market Providers

| Company Name | Key Offerings/Activities |

|---|---|

| Hexion Inc. | In 2024 , launched ultra-low formaldehyde UF resins for particleboard; in 2025 , introduced high-durability MF resins for high-pressure laminates. |

| BASF SE | In 2024 , expanded its Kaurit® range with MUF systems for engineered wood; in 2025 , released bio-modified amino resins for eco-labeled furniture. |

| Chemiplastica Spa | In 2024 , introduced UF resins for molded electrical applications; in 2025 , developed low-viscosity MF grades for decorative laminates. |

| Georgia-Pacific Chemicals | In 2024 , upgraded LEAF® UF resin series for cabinetry and panels; in 2025 , rolled out MUF adhesives with formaldehyde emissions below global thresholds. |

| INEOS Melamines GmbH | In 2024 , enhanced melamine resin concentrates for export markets; in 2025 , invested in pilot-scale bio-resin integration with pulp and paper producers. |

Key Market Insights

Hexion Inc. (14-17%)

By leveraging cutting-edge chemistry and environmental responsibility, Hexion is the market leader in vaccum cleaner. In 2024, the company introduced ultra-low formaldehyde-emitting urea-formaldehyde resins depending on particleboard applications to comply with stricter indoor air quality proposals.

It launched high-performance melamine-formaldehyde systems for high-pressure laminates in furniture and flooring in 2025. With a global manufacturing footprint and ongoing R&D surrounded by ample industry relationships, Hexion is well-equipped to customize for the region, keeping pace with evolving emission norms such as CARB Phase 2 and E1.

BASF SE (11-14%)

BASF maintains a stronghold in engineered wood and formaldehyde-based chemistry through its Kaurit® vaccum cleaner product family. In 2024, BASF expanded this range with improved MUF systems that offer enhanced bonding for plywood and LVL applications. By 2025, it introduced bio-based modifiers into its amino resins to qualify for eco-labels in the European furniture sector. BASF's technical service and regulatory advisory teams also support clients in meeting sustainability certifications like Blue Angel and Nordic Swan.

Chemiplastica Spa (9-12%)

From wood adhesives to molded thermoset parts, Chemiplastica is expanding its amino resin applications. Multinational special chemical company Hexion, LLC progressed in 2024 with UC resin grades capable of making electrical appliance housing highly flame resistant while also enhancing dielectric properties.

In 2025, it developed low-viscosity melamine-formaldehyde resins, which are used for decorative paper laminates in interiors and office furniture. The company's strong B2B partnerships across Europe and the Middle East are sustained by its consistent focus on formulation flexibility and REACH-compliant production.

Georgia-Pacific Chemicals (7-10%)

Georgia-Pacific focuses on North American wood panel and cabinetry markets with a range of low-emission amino resin adhesives. In 2024, it updated its LEAF® UF resin line for improved press cycle efficiency and structural durability. In 2025, it launched next-gen MUF resins with emissions significantly below global benchmarks, addressing LEED and GreenGuard compliance requirements. Georgia-Pacific’s vertically integrated forest product operations allow it to provide holistic solutions from raw wood to final bonded panels.

INEOS Melamines GmbH (6-9%)

INEOS Melamines emphasizes export resilience and resin performance optimization. In 2024, it boosted output of melamine concentrates used in resin production across Southeast Asia and South America. In 2025, the company invested in a pilot bio-integration platform, working with pulp producers to incorporate natural fibers into amino resin formulations. With a strong legacy in melamine derivatives, INEOS is also exploring thermoset biocomposites for future automotive and industrial applications.

Other Key Players (38-45% Combined)

A wide mix of regional players, niche resin developers, and sustainability-focused startups are reshaping the vaccum cleaner filter market with specialty solutions. These include:

The overall market size for the vacuum cleaner filter market was USD 12,839.6 Million in 2025.

The vacuum cleaner filter market is expected to reach USD 22,777.9 Million in 2035.

The demand for amino resins is rising due to their widespread use in wood adhesives, coatings, and laminates, particularly in construction and furniture manufacturing. Increasing production of particle boards and rising adoption of butylated melamine resins for improved durability and water resistance are further fueling market growth.

The top 5 countries driving the development of the vacuum cleaner filter market are China, the USA, Germany, India, and Japan.

Butylated melamine resins and particle board applications are expected to command a significant share over the assessment period.

Table 01: Global Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Filter Type

Table 02: Global Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Vacuum Cleaner Type

Table 03: Global Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by Sales Channel

Table 04: Global Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End Use Industry

Table 05: Global Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Region

Table 06: North America Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Filter Type

Table 07: North America Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Vacuum Cleaner Type

Table 08: North America Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by Sales Channel

Table 09: North America Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End Use Industry

Table 10: Latin America Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Filter Type

Table 11: Latin America Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Vacuum Cleaner Type

Table 12: Latin America Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by Sales Channel

Table 13: Latin America Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End Use Industry

Table 14: Europe Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Type

Table 15: Europe Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Vacuum Cleaner Type

Table 16: Europe Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by Sales Channel

Table 17: Europe Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End Use Industry

Table 18: East Asia Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Filter Type

Table 19: East Asia Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Vacuum Cleaner Type

Table 20: East Asia Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by Sales Channel

Table 21: East Asia Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End Use Industry

Table 22: South Asia & Pacific Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Filter Type

Table 23: South Asia & Pacific Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Vacuum Cleaner Type

Table 24: South Asia & Pacific Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by Sales Channel

Table 25: South Asia & Pacific Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End Use Industry

Table 26: Middle East and Africa Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Filter Type

Table 27: Middle East and Africa Market Value (US$ million) and Volume ('000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Vacuum Cleaner Type

Table 28: Middle East and Africa Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by Sales Channel

Table 29: Middle East and Africa Market Value (US$ million) and Volume (‘000 Units) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End Use Industry

Figure 01: Global Market Historical Volume (‘000 Units), 2017 to 2021

Figure 02: Global Market Volume (‘000 Units) Forecast, 2022 to 2032

Figure 03: Global Market Historical Value (US$ million), 2017 to 2021

Figure 04: Global Market Value (US$ million) Forecast, 2022 to 2032

Figure 05: Global Market Absolute $ Opportunity, 2021 to 2032

Figure 06: Global Market Share and BPS Analysis by Type- 2022 to 2032

Figure 07: Global Market Y-o-Y Growth Projections by Type, 2021 to 2032

Figure 08: Global Market Attractiveness by Type, 2022 to 2032

Figure 09: Global Market Absolute $ Opportunity, 2021 to 2032, by Bag Filters Segment

Figure 10: Global Market Absolute $ Opportunity, 2021 to 2032, by Foam Filters Segment

Figure 11: Global Market Absolute $ Opportunity, 2021 to 2032, by Seventeen Segment

Figure 12: Global Market Absolute $ Opportunity, 2021 to 2032, by Cartridge Filters Segment

Figure 13: Global Market Absolute $ Opportunity, 2021 to 2032, by Cloth Filters Segment

Figure 14: Global Market Absolute $ Opportunity, 2021 to 2032, by Others Segment

Figure 15: Global Market Share and BPS Analysis by Vacuum Cleaner Type- 2022 to 2032

Figure 16: Global Market Y-o-Y Growth Projections by Vacuum Cleaner Type, 2021 to 2032

Figure 17: Global Market Attractiveness by Vacuum Cleaner Type, 2022 to 2032

Figure 18: Global Market Absolute $ Opportunity, 2021 to 2032, by Upright Segment

Figure 19: Global Market Absolute $ Opportunity, 2021 to 2032, by Canister Segment

Figure 20: Global Market Absolute $ Opportunity, 2021 to 2032, by Central Segment

Figure 21: Global Market Absolute $ Opportunity, 2021 to 2032, by Wet/Dry Segment

Figure 22: Global Market Absolute $ Opportunity, 2021 to 2032, by Robotic Segment

Figure 23: Global Market Absolute $ Opportunity, 2021 to 2032, by Others Segment

Figure 24: Global Market Share and BPS Analysis by Sales Channel- 2022 to 2032

Figure 25: Global Market Y-o-Y Growth Projections by Sales Channel, 2021 to 2032

Figure 26: Global Market Attractiveness by Sales Channel, 2022 to 2032

Figure 27: Global Market Absolute $ Opportunity 2021 to 2032, by OEM (First Fit) segment

Figure 28: Global Market Absolute $ Opportunity 2021 to 2032, by Aftermarket (Replacement) segment

Figure 29: Global Market Share and BPS Analysis by End Use - 2022 to 2032

Figure 30: Global Market Y-o-Y Growth Projections by End Use, 2021 to 2032

Figure 31: Global Market Attractiveness by End Use, 2022 to 2032

Figure 32: Global Market Absolute $ Opportunity, 2021 to 2032, by Industrial segment

Figure 33: Global Market Absolute $ Opportunity, 2021 to 2032, by Residential segment

Figure 34: Global Market Absolute $ Opportunity, 2021 to 2032, by Commercial segment

Figure 35: Global Market Share and BPS Analysis by Region- 2022 to 2032

Figure 36: Global Market Y-o-Y Growth Projections by Region, 2021 to 2032

Figure 37: Global Market Attractiveness by Region, 2022 to 2032

Figure 38: North America Market Absolute $ Opportunity, 2021 to 2032

Figure 39: Latin America Market Absolute $ Opportunity, 2021 to 2032

Figure 40: Europe Market Absolute $ Opportunity, 2021 to 2032

Figure 41: East Asia Market Absolute $ Opportunity, 2021 to 2032

Figure 42: South Asia & Pacific Market Absolute $ Opportunity, 2021 to 2032

Figure 43: Middle East and Africa Market Absolute $ Opportunity, 2021 to 2032

Figure 44: North America Market Share and BPS Analysis by Filter Type- 2022 to 2032

Figure 45: North America Market Y-o-Y Growth Projections by Type, 2021 to 2032

Figure 46: North America Market Attractiveness by Filter Type, 2022 to 2032

Figure 47: North America Market Share and BPS Analysis by Vacuum Cleaner Type- 2022 to 2032

Figure 48: North America Market Y-o-Y Growth Projections by Vacuum Cleaner Type, 2021 to 2032

Figure 49: North America Market Attractiveness by Vacuum Cleaner Type, 2022 to 2032

Figure 50: North America Market Share and BPS Analysis by Sales Channel- 2022 to 2032

Figure 51: North America Market Y-o-Y Growth Projections by Sales Channel, 2021 to 2032

Figure 52: North America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 53: North America Market Share and BPS Analysis by End Use Industry - 2022 to 2032

Figure 54: North America Market Y-o-Y Growth Projections by End Use Industry, 2021 to 2032

Figure 55: North America Market Attractiveness by End Use Industry, 2022 to 2032

Figure 56: Latin America Market Share and BPS Analysis by Filter Type- 2022 to 2032

Figure 57: Latin America Market Y-o-Y Growth Projections by Filter Type, 2021 to 2032

Figure 58: Latin America Market Attractiveness by Filter Type, 2022 to 2032

Figure 59: Latin America Market Share and BPS Analysis by Vacuum Cleaner Type- 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth Projections by Vacuum Cleaner Type, 2021 to 2032

Figure 61: Latin America Market Attractiveness by Vacuum Cleaner Type, 2022 to 2032

Figure 62: Latin America Market Share and BPS Analysis by Sales Channel- 2022 to 2032

Figure 63: Latin America Market Y-o-Y Growth Projections by Sales Channel, 2021 to 2032

Figure 64: Latin America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 65: Latin America Market Share and BPS Analysis by End Use Industry - 2022 to 2032

Figure 66: Latin America Market Y-o-Y Growth Projections by End Use Industry, 2021 to 2032

Figure 67: Latin America Market Attractiveness by End Use Industry, 2022 to 2032

Figure 68: Europe Market Share and BPS Analysis by Filter Type- 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth Projections by Filter Type, 2021 to 2032

Figure 70: Europe Market Attractiveness by Filter Type, 2022 to 2032

Figure 71: Europe Market Share and BPS Analysis by Vacuum Cleaner Type- 2022 to 2032

Figure 72: Europe Market Y-o-Y Growth Projections by Vacuum Cleaner Type, 2021 to 2032

Figure 73: Europe Market Attractiveness by Vacuum Cleaner Type, 2022 to 2032

Figure 74: Europe Market Share and BPS Analysis by Sales Channel- 2022 to 2032

Figure 75: Europe Market Y-o-Y Growth Projections by Sales Channel, 2021 to 2032

Figure 76: Europe Market Attractiveness by Sales Channel, 2022 to 2032

Figure 77: Europe Market Share and BPS Analysis by End Use Industry - 2022 to 2032

Figure 78: Europe Market Y-o-Y Growth Projections by End Use Industry, 2021 to 2032

Figure 79: Europe Market Attractiveness by End Use Industry, 2022 to 2032

Figure 80: East Asia Market Share and BPS Analysis by Filter Type- 2022 to 2032

Figure 81: East Asia Market Y-o-Y Growth Projections by Filter Type, 2021 to 2032

Figure 82: East Asia Market Attractiveness by Filter Type, 2022 to 2032

Figure 83: East Asia Market Share and BPS Analysis by Vacuum Cleaner Type- 2022 to 2032

Figure 84: East Asia Market Y-o-Y Growth Projections by Vacuum Cleaner Type, 2021 to 2032

Figure 85: East Asia Market Attractiveness by Vacuum Cleaner Type, 2022 to 2032

Figure 86: East Asia Market Share and BPS Analysis by Sales Channel- 2022 to 2032

Figure 87: East Asia Market Y-o-Y Growth Projections by Sales Channel, 2021 to 2032

Figure 88: East Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 89: East Asia Market Share and BPS Analysis by End Use Industry - 2022 to 2032

Figure 90: East Asia Market Y-o-Y Growth Projections by End Use Industry, 2021 to 2032

Figure 91: East Asia Market Attractiveness by End Use, 2022 to 2032

Figure 92: South Asia & Pacific Market Share and BPS Analysis by Filter Type- 2022 to 2032

Figure 93: South Asia & Pacific Market Y-o-Y Growth Projections by Filter Type, 2021 to 2032

Figure 94: South Asia & Pacific Market Attractiveness by Filter Type, 2022 to 2032

Figure 95: South Asia & Pacific Market Share and BPS Analysis by Vacuum Cleaner Type- 2022 to 2032

Figure 96: South Asia & Pacific Market Y-o-Y Growth Projections by Vacuum Cleaner Type, 2021 to 2032

Figure 97: South Asia & Pacific Market Attractiveness by Vacuum Cleaner Type, 2022 to 2032

Figure 98: South Asia & Pacific Market Share and BPS Analysis by Sales Channel- 2022 to 2032

Figure 99: South Asia & Pacific Market Y-o-Y Growth Projections by Sales Channel, 2021 to 2032

Figure 100: South Asia & Pacific Market Attractiveness by Sales Channel, 2022 to 2032

Figure 101: South Asia & Pacific Market Share and BPS Analysis by End Use Industry - 2022 to 2032

Figure 102: South Asia & Pacific Market Y-o-Y Growth Projections by End Use Industry, 2021 to 2032

Figure 103: South Asia & Pacific Market Attractiveness by End Use Industry, 2022 to 2032

Figure 104: Middle East and Africa Market Share and BPS Analysis by Filter Type- 2022 to 2032

Figure 105: Middle East and Africa Market Y-o-Y Growth Projections by Filter Type, 2021 to 2032

Figure 106: Middle East and Africa Market Attractiveness by Filter Type, 2022 to 2032

Figure 107: Middle East and Africa Market Share and BPS Analysis by Vacuum Cleaner Type- 2022 to 2032

Figure 108: Middle East and Africa Market Y-o-Y Growth Projections by Vacuum Cleaner Type, 2021 to 2032

Figure 109: Middle East and Africa Market Attractiveness by Vacuum Cleaner Type, 2022 to 2032

Figure 110: Middle East and Africa Market Share and BPS Analysis by Sales Channel- 2022 to 2032

Figure 111: Middle East and Africa Market Y-o-Y Growth Projections by Sales Channel, 2021 to 2032

Figure 112: Middle East and Africa Market Attractiveness by Sales Channel, 2022 to 2032

Figure 113: Middle East and Africa Market Share and BPS Analysis by End Use Industry - 2022 to 2032

Figure 114: Middle East and Africa Market Y-o-Y Growth Projections by End Use Industry, 2021 to 2032

Figure 115: Middle East and Africa Market Attractiveness by End Use Industry, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Sealed Packaging Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA