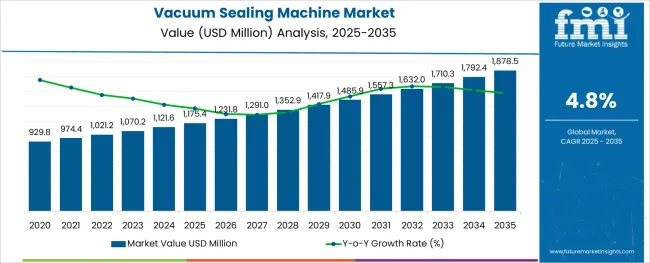

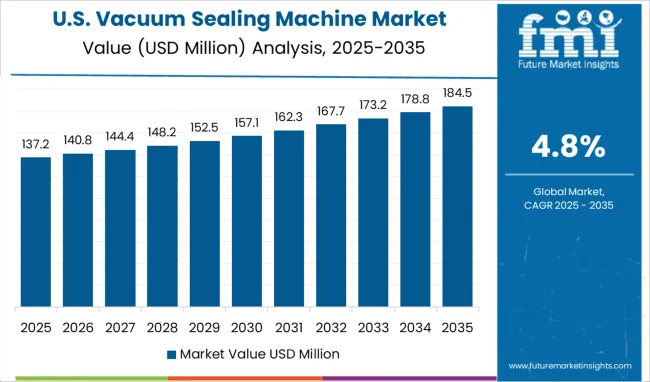

The Vacuum Sealing Machine Market is estimated to be valued at USD 1175.4 million in 2025 and is projected to reach USD 1878.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The vacuum sealing machine market is witnessing consistent growth driven by rising demand for food preservation, enhanced packaging aesthetics, and waste reduction across industrial and commercial applications. Advancements in automation, sensor-based sealing, and integration of MAP technologies are enabling efficient air extraction and sealing precision, which improves product shelf-life and minimizes spoilage.

Growing focus on sustainability and hygiene, particularly in food processing and medical packaging, has encouraged adoption of vacuum sealers that support low-oxygen environments and tamper-evident solutions. Moreover, consumer-driven demand for portion control, sous-vide cooking, and compact home storage is expanding use across residential settings.

As regulations surrounding packaging safety and labeling accuracy tighten globally, manufacturers are increasingly investing in multi-format machines with digital controls and compliance-ready features. Future growth is anticipated through expanding applications in pharmaceuticals, electronics, and non-food goods, where product longevity and protective sealing are critical performance metrics.

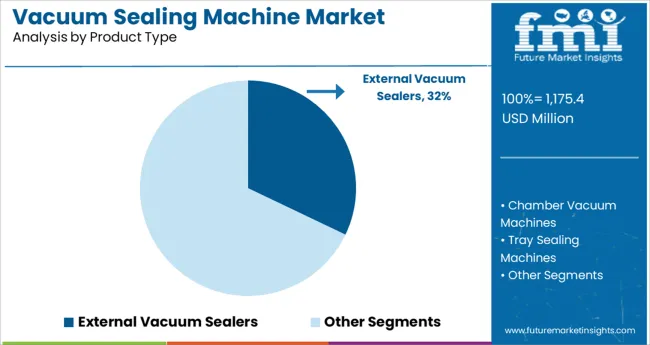

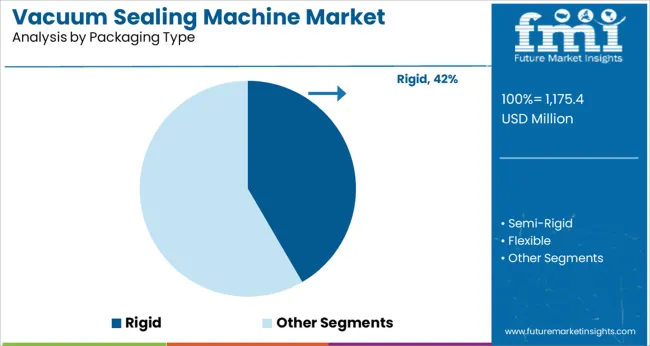

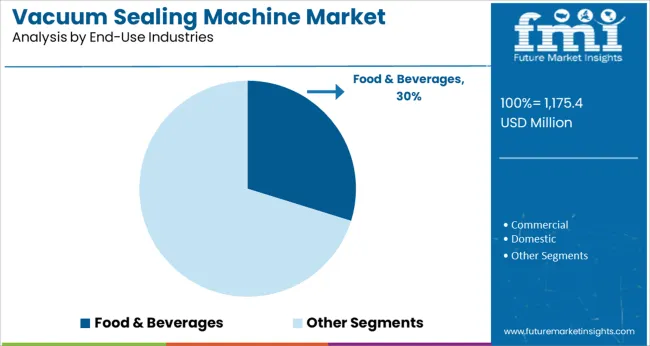

The market is segmented by Product Type, Packaging Type, End-Use Industries, and Automation and region. By Product Type, the market is divided into External Vacuum Sealers, Chamber Vacuum Machines, Tray Sealing Machines, and Others. In terms of Packaging Type, the market is classified into Rigid, Semi-Rigid, and Flexible. Based on End-Use Industries, the market is segmented into Food & Beverages, Commercial, Domestic, Consumer Goods, Automotive, Personal Care & Cosmetics, and Others.

By Automation, the market is divided into Fully Automatic, Semi-Automatic, and Manual. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The external vacuum sealers product segment is expected to account for 32.1% of market revenue in 2025, leading among product types. This position has been driven by its operational simplicity, lower cost of entry, and strong uptake in small businesses and household applications.

External sealers are particularly favored where lower to medium throughput is sufficient, making them suitable for delis, butcher shops, and artisanal producers. Their ability to accommodate various bag sizes without requiring internal vacuum chambers adds to flexibility in packaging operations.

Technological improvements in digital sealing controls, thermal safety, and user-friendly interface designs have enhanced usability and broadened their appeal. Continued preference for compact equipment with reliable performance and reduced maintenance requirements is likely to maintain external vacuum sealers as the dominant choice in entry and mid-tier market segments.

Rigid packaging is projected to contribute 41.6% of total revenue in 2025 within the packaging type category, ranking it as the leading format. Its dominance stems from the structural integrity, protection, and brand presentation advantages it offers, particularly in high-value food and consumer goods.

Vacuum sealing machines tailored for rigid formats are widely used in dairy, meat, ready-to-eat meals, and premium grocery segments where product safety, contamination prevention, and extended freshness are essential. Rigid containers also facilitate stackability and transport efficiency, which are crucial in retail distribution.

Manufacturers are incorporating vacuum sealing functionality in thermoforming and tray-sealing systems to handle rigid formats with precision and compliance. Growing consumer preference for resealable, microwaveable, and tamper-evident packaging has further strengthened the case for rigid vacuum-sealed formats in both chilled and ambient product categories.

The food and beverages industry is anticipated to generate 29.8% of the vacuum sealing machine market’s revenue in 2025, positioning it as the largest end-use sector. This leadership is fueled by escalating demand for extended product shelf-life, reduced food waste, and compliance with evolving safety regulations.

Vacuum sealing enables oxygen removal and microbial growth reduction, which is particularly valuable in perishable goods such as meats, cheeses, and ready-to-eat meals. The rise of e-commerce in grocery delivery and D2C models has increased the need for durable and protective packaging formats, supporting further adoption.

Food manufacturers are also adopting smart vacuum sealing systems with integrated weighing, labeling, and temperature monitoring functions to streamline operations and ensure regulatory traceability. As consumer habits shift toward portioned packaging and convenience meals, demand from the food and beverages sector is expected to remain the primary growth anchor for vacuum sealing technologies.

Demand for packaged food and beverages to govern the future of the market.

The prime factor driving the demand for vacuum sealing machines is the rapidly rising demand for packaged food across most geographies. Further, as the need for extended shelf life is becoming a prominent concern for most food and beverage manufacturers, the adoption of Modified Atmosphere Packaging (MAP) is on the rise.

Due to the boom in vacuum sealer usage in the food service industry, it has experienced an overall expansion. Therefore, the market players modified and improved vacuum sealers so that they could be used for a variety of purposes. In response, food vacuum sealers were developed that allow end users to select the desired vacuum percentage and time duration. As a result, the vacuum sealer market was uplifted, and residential and commercial vacuum sealer applications were more widespread. Freshly cooked food has been transitioning to preserved or packaged foods, which has fuelled the growth of the vacuum sealers market.

Mounting overheads to be a buzz killer.

While food vacuum machines are growing at a steady pace during the forecast period, high set-up and operational costs are expected to stifle growth in some areas. Further, the high manufacturing cost of foils and packets, which are integral to packaging processes, is limiting the adoption rate among SMEs, thereby limiting the market growth.

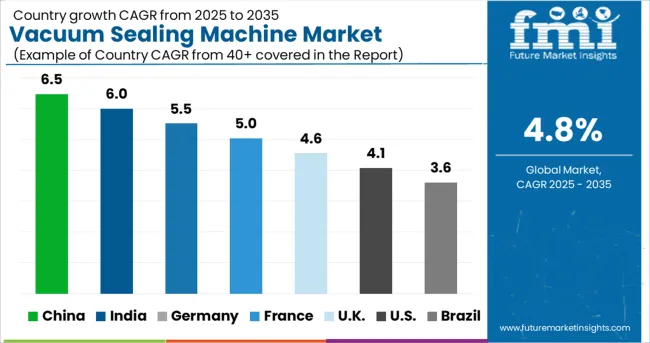

North America is estimated to capture a moderate share of the vacuum sealing machine market, accounting for 22% of the overall market share.

High demand for packaged foods and beverages alongside the trend of consuming ready-to-eat food is likely to increase the vacuum sealing machines market size during the forecast period. This market is expected to witness unprecedented growth and can be the prime factor fuelling the North American vacuum sealing machine market.

Due to the increasing use of RTE foods and the need to preserve fresh seafood and meat, Europe is estimated to hold a significant share of 26% of the global vacuum sealing machine market. In contrast to other countries, manufacturers operating in Germany and Italy offer very high-quality and technologically advanced packaging machinery.

The high presence of international and domestic food vacuum machine providers, including Ulma Packaging Limited, Electrolux Professional Limited and others in the region is expected to continue to support market growth in the Europe region.

The Asia Pacific is expected to dominate in terms of sales volume and revenue in the global vacuum sealing machine market owing to hundreds of small-sized and unorganized manufacturers in the region.

This is attributed to the supply of vacuum sealing machines at affordable rates and ease of availability. Chinese manufacturers compete based on the per unit cost of the machinery as they offer average-quality machinery at a lower cost.

However, it is also observed that some of the companies in the region are not willing to compromise on quality over price. Therefore, these companies import high-quality machinery from Germany and Italy, which creates enormous growth opportunities for vacuum sealing machine manufacturers in the Asia Pacific region.

Spend on Marketing to Raise Awareness to Remain a Key Strategy

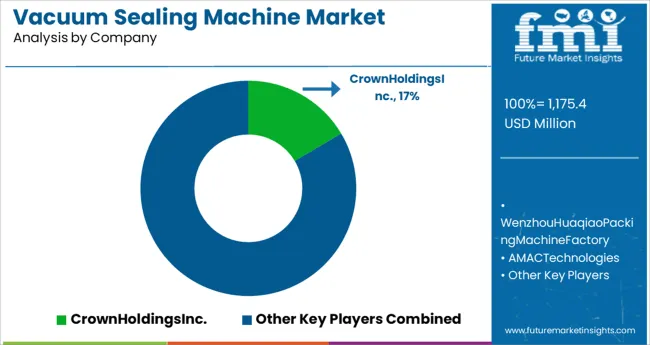

The vacuum sealers market is highly fragmented, with a diverse range of players at local and international levels vying to capture a large market share. These new players invest heftily in research and development activities for finding novel methods and technologies that offer added convenience to the end-users.

The players also strive to make their products cost-effective to increase their consumer base. Attractive advertising campaigns are often used to explain the benefits of vacuum sealers. In addition, social media marketing plays an imperative role in increasing sales.

Vacuum Sealing Machine Market: Key Contracts/ Agreements/ Acquisitions

The global vacuum sealing machine market is fairly fragmented, with several large and medium-sized market players accounting for a majority revenue share. Key players in the vacuum sealing machine market are deploying various strategies, entering into mergers and acquisitions, strategic agreements, and contracts, and adopting automated technologies. This is likely to enhance the pace of packaging and introduce more efficient and technologically-advanced machines to the market.

Recent Developments in the Vacuum Sealing Machine Market

Nowadays, vacuum sealing machines come with different features and upgrades that offer complete convenience to the user. The vacuum sealing market is experiencing a plethora of latest product launches with additional features.

Products are being revamped and tested to offer more packaging and reduce overheating. The NESCO VS-02 vacuum sealer, for example, has a feature that eliminates air and keeps food fresh. In addition, the sealing time is also optimized for more output.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.8% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Packaging Type, End-Use Industries, Automation, Region |

| Regions Covered | North America, Latin America, The Asia Pacific, MEA, Europe |

| Key Countries Profiled | The USA, Canada, Brazil, Argentina, Germany, The UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC, South Africa |

| Key Companies Profiled | Crown Holdings, Inc.; Wenzhou Huaqiao Packing Machine Factory; AMAC Technologies; ULMA Packaging Limited; John Bean Technologies Corporation Limited; Electrolux Professional Limited; Henkelman Vacuum; Henkovac International B.V.; Promarksvac Corporation Limited; Nutri Chef Kitchen, LLC; Metos Oy Ab; Astrapac Midlands Limited; Multivac Inc |

| Customization | Available Upon Request |

The global vacuum sealing machine market is estimated to be valued at USD 1,175.4 million in 2025.

It is projected to reach USD 1,878.5 million by 2035.

The market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types are external vacuum sealers, chamber vacuum machines, tray sealing machines and others.

rigid segment is expected to dominate with a 41.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Vacuum Sealing Machine Providers

Vacuum/Gas Flushing And Sealing Machine Market

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA