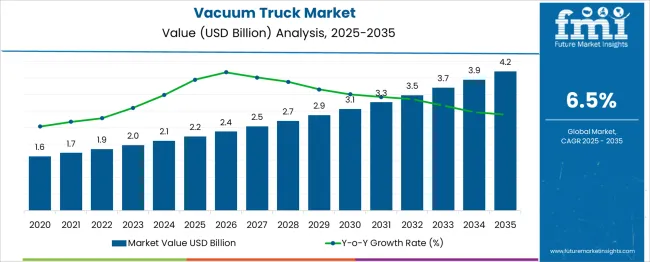

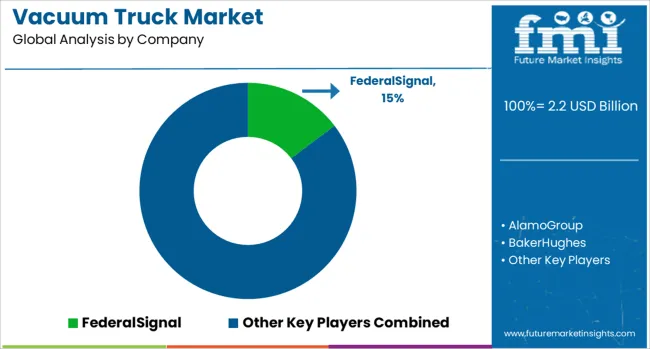

The Vacuum Truck Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

From 2025 to 2030, the market is expected to reach around USD 3.0 billion, marking a five-year absolute gain of USD 800 million. This steady value expansion reflects growing demand across sectors such as industrial waste handling, municipal sewer cleaning, and environmental remediation.

Much of the absolute dollar opportunity is being generated in high-utilization industries where vacuum trucks are critical for regulatory compliance, operational efficiency, and safe hazardous material management. In addition to traditional end-users in oil & gas and construction, increased adoption is seen in utility maintenance and emergency response applications. Market value is also rising due to higher-specification units equipped with larger tank capacities, integrated safety controls, and advanced suction systems.

As regulatory enforcement tightens across wastewater and sludge disposal protocols, especially in North America and the EU, procurement of modern, emission-compliant fleets is accelerating. This predictable growth path supports long-term equipment investments and stable value creation across the vacuum truck supply chain.

| Metric | Value |

|---|---|

| Vacuum Truck Market Estimated Value in (2025 E) | USD 2.2 billion |

| Vacuum Truck Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The vacuum truck market is experiencing consistent growth, supported by the increasing demand for efficient waste collection, hazardous material handling, and industrial cleaning services. A notable shift toward infrastructure maintenance, urban sanitation, and environmental cleanup initiatives has intensified the deployment of vacuum trucks across both municipal and private sectors. The incorporation of advanced hydraulics, remote-controlled booms, and real-time monitoring systems into vacuum trucks has significantly elevated their functional reliability and operational safety.

With growing environmental regulations and stricter compliance for liquid waste disposal, industries are actively investing in high-performance vehicles tailored for multi-site use and high-volume extraction. Expansion in the petrochemical, food processing, and utility maintenance industries is also contributing to heightened utilization rates.

Future market momentum is expected to stem from technological advancements in chassis integration, fuel optimization, and automation, all of which are being reinforced through collaborative developments between truck body manufacturers and industrial solution providers. The demand for productivity, safety, and emission compliance will remain central to the market’s growth outlook.

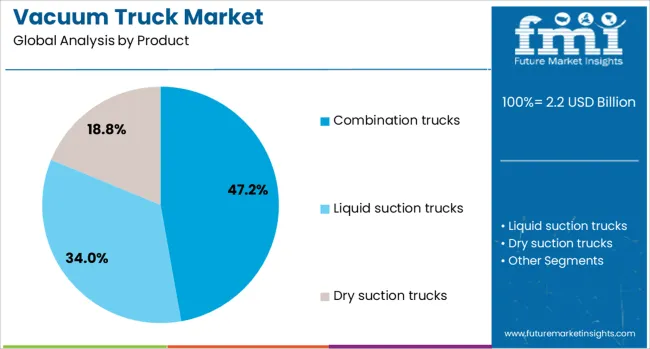

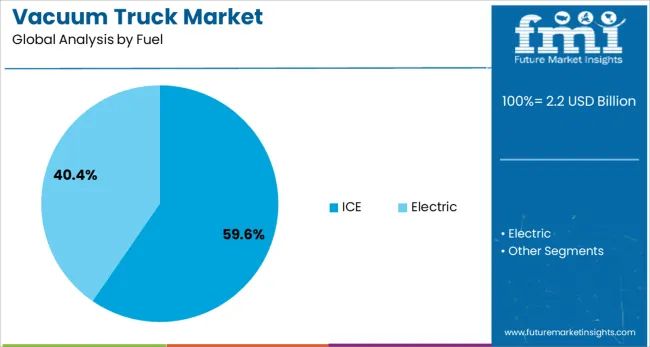

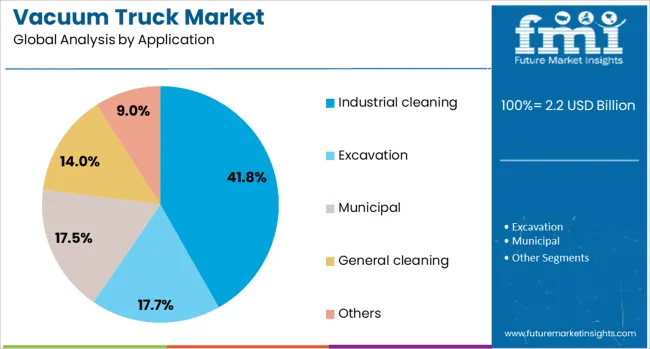

The vacuum truck market is segmented by product, fuel, application, capacity, and geographic regions. The vacuum truck market is divided into Combination trucks, Liquid suction trucks, and Dry suction trucks. In terms of fuel, the vacuum truck market is classified into ICE and Electric. Based on the application, the vacuum truck market is segmented into Industrial cleaning, Excavation, Municipal, General cleaning, and Others. The vacuum truck market is segmented by capacity into Medium capacity, Small capacity, and Large capacity.

Regionally, the vacuum truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Combination trucks are expected to capture 47.2% of the vacuum truck market revenue share in 2025, making them the leading product category. Their dominance is being driven by their multifunctional utility, which allows both suction and jetting operations within a single system. This dual functionality has proven to be essential for high-demand industrial environments where time efficiency and operational flexibility are prioritized.

The preference for combination trucks has been further supported by their ability to handle a wide variety of materials, including sludge, grease, and debris, across construction, municipal, and refinery applications. Manufacturers have increasingly incorporated automation technologies, such as self-cleaning filtration systems and real-time diagnostics, enhancing their field performance.

Investment in operator safety and ease of use through ergonomic control panels and advanced maneuvering systems has further strengthened market uptake. As industries continue to pursue equipment that reduces operational downtime and enhances ROI, combination trucks are being widely favored for their cost-efficiency and productivity gains in large-scale field operations.

Internal combustion engine-powered vacuum trucks are projected to hold 59.6% of the revenue share in the vacuum truck market in 2025. This leading position is being supported by the widespread infrastructure, reliability, and maturity of ICE technology across global markets. The segment’s strength lies in its established fueling networks, higher payload capabilities, and suitability for long-duty cycles in remote or heavy-use conditions.

ICE vacuum trucks have remained the preferred option for operators seeking proven performance in demanding environments such as oilfields, mining, and chemical facilities. The development of cleaner combustion engines compliant with modern emission norms has allowed continued adoption despite the growing interest in alternative power sources. In regions where electrification infrastructure remains underdeveloped, ICE vehicles continue to offer the most practical and cost-effective solution.

Enhanced power output, durability, and ease of refueling further contribute to the resilience of this segment. Until charging networks scale sufficiently and battery technology matures for heavy applications, ICE vacuum trucks are expected to retain their dominant role in the industry.

The industrial cleaning segment is estimated to contribute 41.8% of the total revenue share in the vacuum truck market in 2025, highlighting its significant demand across multiple heavy-use sectors. This growth has been influenced by the expanding scope of plant maintenance, refinery operations, and pipeline integrity management across global industries. Vacuum trucks designed for industrial cleaning are being utilized for removal of sludge, slurry, and non-hazardous waste in confined and complex industrial environments.

The rise in scheduled maintenance activities and stricter regulatory enforcement for workplace safety and cleanliness has led to increased service cycles. Additionally, the need for non-disruptive cleaning during ongoing production has supported the preference for mobile and high-capacity cleaning systems.

Industrial clients are increasingly adopting vacuum trucks that offer remote operation, precision controls, and high-efficiency filtration systems, reducing manual intervention and safety risks. As operational uptime and regulatory compliance remain critical KPIs in industrial environments, the demand for specialized vacuum trucks tailored for cleaning applications is expected to maintain strong momentum.

The vacuum trucks are equipped with powerful suction systems for removing liquids, sludge, and other debris, making them crucial for maintaining clean and safe environments. The rising focus on environmental regulations, the growth of the oil and gas industry, and increasing urbanization are contributing to the market expansion. Despite challenges like high operational costs and the complexity of maintenance, there are opportunities in expanding construction, infrastructure projects, and advancements in truck technology.

The rising demand for efficient waste management and industrial cleaning services is driving the vacuum truck market. As urbanization accelerates and industrial activities expand, the need for regular cleaning of sewers, pipelines, and storage tanks increases. Vacuum trucks, with their ability to remove liquids, sludge, and debris, play an essential role in maintaining cleanliness and safety in industrial facilities, construction sites, and urban infrastructures. The stricter environmental regulations regarding waste disposal and contamination control are pushing municipalities and industries to adopt vacuum truck solutions that ensure proper waste management. The increasing demand for these services in the oil and gas, construction, and municipal sectors is fueling market growth.

The vacuum truck market faces challenges such as high operational costs and maintenance requirements. Vacuum trucks are complex machines that require regular maintenance to ensure reliable and efficient performance. The high cost of spare parts, especially for the suction systems and engines, can increase operational expenses. The fuel costs associated with the trucks' large engines can be significant. Operators also face challenges in terms of labor costs, as specialized personnel are required to operate and maintain the trucks. Furthermore, as these vehicles are used in harsh environments, wear and tear on components can lead to frequent repairs, adding to the overall cost of ownership. These challenges may deter some potential customers, particularly smaller businesses with budget constraints.

The vacuum truck market presents significant opportunities through technological advancements and market expansion. Innovations such as improved suction systems, advanced filtration technologies, and energy-efficient engines are making vacuum trucks more cost-effective and environmentally friendly. The development of automated systems for waste collection and tank cleaning is also enhancing the functionality and efficiency of vacuum trucks, attracting more users. The growing infrastructure development in emerging economies, coupled with increasing investments in environmental maintenance and waste management, is opening up new opportunities in these regions. The rise in demand for vacuum trucks in the oil and gas industry, where they are used for cleaning tanks and removing sludge, is further driving market expansion. These technological innovations and growing market applications present promising growth opportunities.

A significant trend in the vacuum truck market is the adoption of eco-friendly and smart technologies. Environmental concerns are pushing manufacturers to develop vacuum trucks with lower emissions and reduced environmental impact. This includes the use of cleaner engines and fuel-efficient systems that comply with stringent emissions standards. Furthermore, the integration of smart technologies such as GPS tracking, real-time monitoring, and automated waste management systems is gaining traction. These technologies enable better fleet management, improved efficiency, and enhanced data collection for maintenance and performance optimization. As municipalities and industries increasingly prioritize sustainability and operational efficiency, the demand for these advanced vacuum trucks is expected to rise, shaping the future of the market.

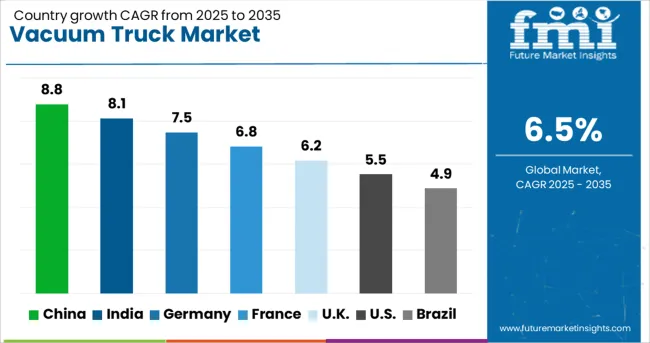

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

China, from the BRICS group, is projected to grow at an 8.8% CAGR from 2025 to 2035, led by rising deployment across industrial zones and waste treatment facilities handling hazardous and sludge materials. India follows at 8.1%, where municipal investments and infrastructure upgrades are increasing the fleet of vacuum trucks for sewage management and septic services, especially in tier-1 and tier-2 cities. Among OECD countries, Germany is advancing at 7.5%, supported by consistent replacement demand in municipal utility fleets and widespread use in industrial cleaning and oil recovery applications.

France, at 6.8%, shows growth through rising public sanitation contracts and regional procurement in wastewater services. The United Kingdom, growing at 6.2%, continues to expand its usage across environmental services firms and commercial waste operators managing liquid and semi-solid material collection. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is leading the global vacuum truck market with a CAGR of 8.8 %, driven by rapid industrialization, urban waste management, and construction activity. Municipal bodies are deploying vacuum trucks for sewer maintenance, sludge removal, and flood control in large cities. Domestic manufacturers are scaling up production with features such as high-capacity tanks, improved suction units, and energy-efficient engines. The use of vacuum trucks is expanding into sectors like petrochemicals, agriculture, and mining due to their adaptability. Regional governments are supporting the shift toward environmentally responsible waste management, further boosting demand. Vacuum truck fleets are being upgraded to meet emission norms and operational efficiency targets. Online procurement platforms are helping municipalities and private contractors source specialized vehicles. China remains central to both domestic usage and the export of vacuum trucks to Asia, the Middle East, and Africa.

In India, vacuum truck market is growing at a CAGR of 8.1 %, supported by government sanitation programs and rising demand for modern waste collection vehicles. Urban local bodies are increasingly using vacuum trucks for sewer cleaning, septic tank emptying, and stormwater management. Domestic manufacturers are introducing cost-effective models that comply with local emission standards and operational requirements. The Swachh Bharat Mission and Smart Cities initiative have accelerated procurement by municipal agencies across the country. Private waste management firms are adopting vacuum trucks for faster service delivery in both residential and commercial sectors. Growth is also being driven by the need for efficient solid-liquid waste separation in industrial zones. Regional production centers are focusing on improving durability and suction capacity. Aftermarket services and easy availability of spare parts are encouraging fleet expansion among small and mid-sized contractors.

In Germany, vacuum truck market is expanding at a CAGR of 7.5 %, supported by strong environmental regulations and advanced waste handling technologies. Municipalities and industrial sectors are using vacuum trucks for applications such as sewer cleaning, chemical spill containment, and hazardous material transport. German manufacturers are producing vehicles with precision engineering, automated control systems, and multi-tank configurations. Emphasis on sustainable operation is encouraging the development of low-emission and electric-powered vacuum trucks. Wastewater treatment plants and construction sites are relying on these vehicles for safe and efficient material transport. Vacuum trucks are also being integrated into emergency response systems for rapid environmental cleanup. With strict compliance standards across the European Union, demand remains high for certified vacuum trucks. Continued investment in fleet modernization and data-integrated operations is shaping the future of the market in Germany.

France is recording a CAGR of 6.8 % in the vacuum truck market, driven by urban infrastructure upgrades and environmental preservation goals. Public and private stakeholders are using vacuum trucks for sewer line maintenance, stormwater drainage, and industrial waste handling. Local manufacturers are focusing on compact, high-efficiency models designed for narrow city streets and limited-access work zones. Upgrades in wastewater networks are prompting investments in modern vacuum truck fleets with high-capacity suction and water recycling features. The growing use of trucks in agriculture for slurry management and irrigation waste handling is also influencing demand. Municipal authorities are deploying vehicles equipped with real-time data systems to optimize routing and reduce operational costs. Eco-friendly and quiet-operating trucks are gaining attention for use in densely populated areas. Compliance with EU regulations on vehicle safety and emissions supports sustainable market growth.

The United Kingdom is witnessing a 6.2 % CAGR in the vacuum truck market, propelled by rising investments in waste infrastructure and flood prevention. Vacuum trucks are essential for sewer desilting, drain cleaning, and emergency floodwater removal across urban and rural regions. Domestic suppliers are offering customized models suited for varied terrain and application needs. There is growing interest in hybrid and low-emission trucks as municipalities strive to meet climate targets. Private utilities and industrial service firms are expanding their vacuum truck fleets to manage hazardous and non-hazardous waste streams efficiently. Vehicle design is evolving with noise reduction features, automated controls, and modular tank configurations. Procurement is being supported by public sector contracts and long-term waste management tenders. The trend toward digital fleet management tools is helping operators improve utilization and lower lifecycle costs.

The vacuum truck market is composed of a broad range of industrial equipment manufacturers segmented into Tier 1, Tier 2, and Tier 3 suppliers, reflecting variations in scale, specialization, and regional reach. Tier 1 suppliers are global leaders with comprehensive product lines and strong brand recognition, delivering high-capacity, multi-functional vacuum trucks suitable for municipal, industrial, and environmental applications.

These companies focus on performance, durability, and regulatory compliance, offering vehicles equipped for hydro excavation, hazardous waste recovery, and sewer cleaning. Their designs emphasize high suction power, advanced filtration systems, and robust safety features to support large-scale sanitation, infrastructure maintenance, and emergency response operations. Tier 2 suppliers concentrate on versatile, configurable vacuum systems that cater to mid-size operations in utilities, oil and gas, and construction.

These manufacturers prioritize flexibility offering modular designs for wet and dry applications, dual-purpose units, and systems that can be customized for confined spaces or specialty materials. They often serve as OEM partners or fleet providers for private contractors and industrial service companies, balancing innovation with cost-efficiency. Their vacuum trucks are commonly optimized for maneuverability, easy maintenance, and reduced emissions.

Tier 3 suppliers serve regional or niche markets with competitively priced vacuum trucks tailored for local regulations and operational conditions. These companies typically emphasize affordability, simplified controls, and strong aftersales support to meet the needs of small municipalities and emerging markets. Across all tiers, the vacuum truck industry is evolving toward greater operator comfort, fuel efficiency, and automation, driven by rising demand from infrastructure development, environmental cleanup, and urban sanitation initiatives.

On July 4, 2024, Volvo Trucks UK published that Dawsongroup EMC took delivery of seven electric Volvo trucks: four Volvo FMX Electric 6×2 vacuum tankers and three Volvo FE Electric 4×2 medium volume combination vehicles (MVCs), all with Whale bodywork, for municipal cleaning tasks such as sewer and gully maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Product | Combination trucks, Liquid suction trucks, and Dry suction trucks |

| Fuel | ICE and Electric |

| Application | Industrial cleaning, Excavation, Municipal, General cleaning, and Others |

| Capacity | Medium capacity, Small capacity, and Large capacity |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FederalSignal, AlamoGroup, BakerHughes, Cappellotto, SuperProducts, GapVax, DISABVacuumTechnology, FulongmaGroup, DongzhengSpecialPurposeVehicle, and AmphitecBV |

| Additional Attributes | Dollar sales by truck configuration such as skid‑mounted, rear‑discharge, and remote‑control units, by application including sewer cleaning, industrial waste removal, hydro excavation, and emergency spill response, and by industry end‑use such as municipal, oil & gas, and construction; demand propelled by regulatory safety standards, urban utility network modernization, and environmental cleanup needs; innovation in trailer integration, telematics monitoring, and low‑emission engines; cost influenced by chassis type and operational fleet size; and rising use in green infrastructure maintenance and petrochemical asset cleaning. |

The global vacuum truck market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the vacuum truck market is projected to reach USD 4.2 billion by 2035.

The vacuum truck market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in vacuum truck market are combination trucks, liquid suction trucks and dry suction trucks.

In terms of fuel, ice segment to command 59.6% share in the vacuum truck market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA