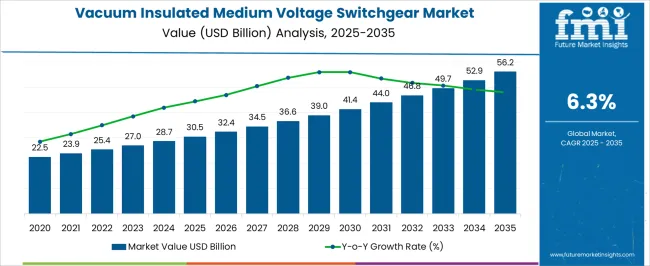

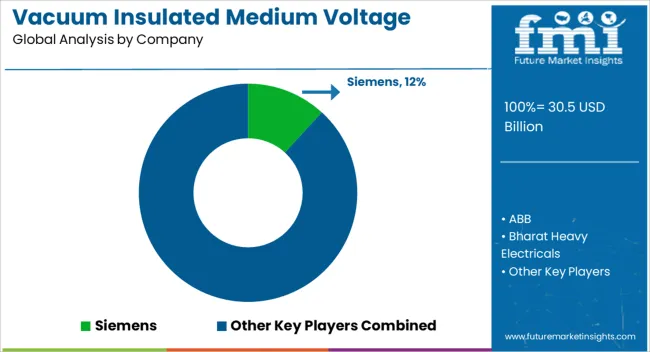

The vacuum insulated medium voltage switchgear market is valued at USD 30.5 billion in 2025 and is expected to reach USD 56.2 billion by 2035, with a CAGR of 6.3%. From 2021 to 2025, the market is projected to grow from USD 22.5 billion to USD 30.5 billion, with annual increments of USD 23.9 billion, USD 25.4 billion, USD 27.0 billion, and USD 28.7 billion. This initial phase shows consistent growth, driven by increased demand for energy-efficient and compact switchgear solutions, especially in industries like power generation, distribution, and renewable energy.

The market is further supported by the need for safe and reliable electrical infrastructure, particularly in emerging economies where electricity networks are expanding. Between 2026 and 2030, the market is expected to continue its steady ascent, growing from USD 30.5 billion to USD 41.4 billion, passing through USD 32.4 billion, USD 34.5 billion, USD 36.6 billion, and USD 39.0 billion. The accelerated adoption of vacuum insulated switchgear in industrial and residential applications, as well as advancements in smart grid technologies, contributes to this growth. From 2031 to 2035, the market reaches USD 56.2 billion, progressing through USD 44.0 billion, 46.8 billion, 49.7 billion, and 52.9 billion. This final phase reflects the widespread deployment of vacuum insulated switchgear as industries increasingly focus on sustainability, energy efficiency, and long-term operational cost reduction, maintaining a strong CAGR throughout the forecast period.

| Metric | Value |

|---|---|

| Vacuum Insulated Medium Voltage Switchgear Market Estimated Value in (2025 E) | USD 30.5 billion |

| Vacuum Insulated Medium Voltage Switchgear Market Forecast Value in (2035 F) | USD 56.2 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The electrical equipment market is the largest contributor, accounting for approximately 35-40% of the market. Vacuum insulated medium voltage switchgear is widely used in electrical substations and distribution networks to manage power distribution safely and efficiently. The energy and utilities market contributes around 25-30%, as these switchgears are critical in ensuring reliable power transmission and distribution in electrical grids, particularly in regions focused on enhancing grid infrastructure and energy efficiency. The industrial automation market holds about 15-18%, as vacuum insulated switchgear is increasingly integrated into automated systems for managing electrical power in factories, processing plants, and large manufacturing facilities.

The renewable energy market adds approximately 10-12%, with vacuum insulated medium voltage switchgear being essential in solar and wind power generation systems to ensure safe and efficient power conversion and distribution. The construction and infrastructure market contributes around 5-8%, as these switchgears are used in new commercial, residential, and industrial buildings to support electrical systems with enhanced safety and reliability.

The vacuum insulated medium voltage switchgear market is witnessing steady expansion, supported by rising electricity demand, grid modernization initiatives, and the growing need for reliable and safe power distribution systems. Increased adoption is being driven by the replacement of aging infrastructure with more compact, efficient, and environmentally friendly switchgear solutions.

The integration of renewable energy sources into the grid has further accelerated deployment, as utilities and industries require equipment capable of managing variable load conditions while minimizing operational risks. The vacuum insulation technology offers advantages such as reduced maintenance, enhanced safety, and elimination of greenhouse gas emissions associated with SF₆-based systems, aligning with global decarbonization goals.

Additionally, industrialization in emerging economies and urban infrastructure upgrades in developed markets are boosting installation rates. Over the forecast period, the market is expected to benefit from regulatory mandates favoring sustainable switchgear technologies, coupled with the growing penetration of smart grid solutions that demand advanced medium voltage systems for enhanced operational reliability and efficiency.

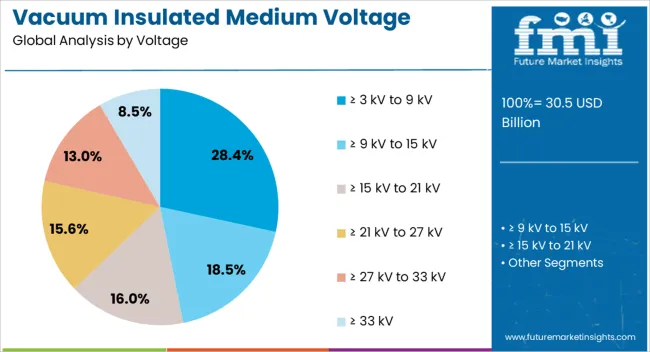

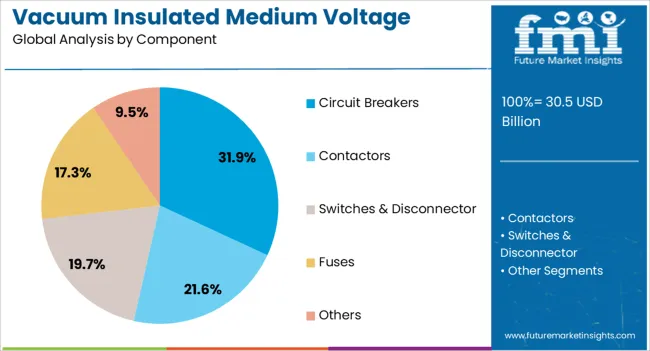

The vacuum insulated medium voltage switchgear market is segmented by voltage, component, end use, application, and geographic regions. By voltage, vacuum insulated medium voltage switchgear market is divided into ≥ 3 kV to 9 kV, ≥ 9 kV to 15 kV, ≥ 15 kV to 21 kV, ≥ 21 kV to 27 kV, ≥ 27 kV to 33 kV, and ≥ 33 kV. In terms of component, vacuum insulated medium voltage switchgear market is classified into Circuit Breakers, Contactors, Switches & Disconnector, Fuses, and Others.

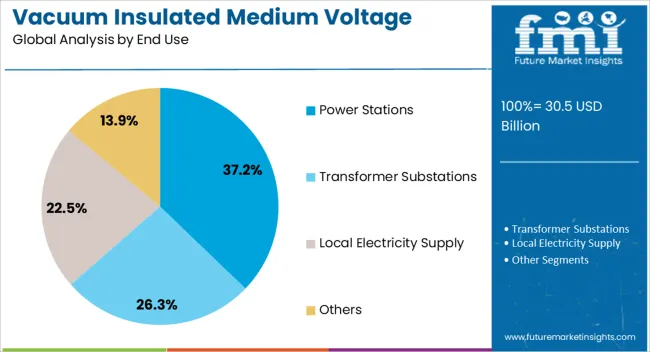

Based on end use, vacuum insulated medium voltage switchgear market is segmented into Power Stations, Transformer Substations, Local Electricity Supply, and Others. By application, vacuum insulated medium voltage switchgear market is segmented into Industrial, Residential, Commercial, and Utility. Regionally, the vacuum insulated medium voltage switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≥ 3 kV to 9 kV voltage range accounts for approximately 28.4% of the vacuum insulated medium voltage switchgear market, driven by its suitability for a broad spectrum of distribution and industrial applications. This segment has gained traction in commercial facilities, small to mid-sized industrial plants, and localized grid distribution networks where medium voltage capacity is required without the complexities of higher voltage systems.

Its adoption has been reinforced by the segment’s balance of cost-efficiency and operational performance, making it a preferred choice for projects with moderate power demand. Additionally, this voltage range is well-aligned with the requirements of decentralized energy generation facilities, including renewable energy plants and microgrids.

The segment’s growth is also influenced by regulatory support for energy-efficient infrastructure upgrades, ensuring continued demand. With technological advancements in vacuum insulation and modular designs, the ≥ 3 kV to 9 kV segment is expected to maintain a stable growth trajectory within both utility and industrial applications.

The circuit breakers segment leads the vacuum insulated medium voltage switchgear market in terms of components, holding around 31.9% of the total share. This dominance is underpinned by the critical role circuit breakers play in ensuring operational safety, fault isolation, and uninterrupted power supply. The adoption of vacuum circuit breakers has been accelerated by their long service life, minimal maintenance requirements, and superior arc-quenching capabilities, which contribute to enhanced system reliability.

Demand has been further supported by their application versatility, spanning from utility substations to industrial facilities and transportation infrastructure. Additionally, the replacement of conventional switchgear with vacuum-based systems has strengthened this segment’s market share, particularly in regions where sustainability regulations are stringent.

Continuous product innovations, such as compact designs and integrated monitoring features, are enhancing operational efficiency and safety. Given their indispensable role in medium voltage systems, circuit breakers are expected to retain their leadership position throughout the forecast period.

The power stations segment represents approximately 37.2% of the vacuum-insulated medium voltage switchgear market, benefiting from the ongoing expansion and modernization of electricity generation facilities. This segment’s demand is driven by the critical need for reliable medium voltage systems capable of managing high-capacity outputs and ensuring uninterrupted grid connectivity.

Vacuum insulated switchgear is increasingly favored in power stations for its compact footprint, environmental safety, and operational durability, particularly under high-load conditions. The integration of renewable energy projects, including solar and wind farms, has further boosted demand, as these facilities require switchgear solutions that can accommodate variable and distributed generation sources.

Moreover, heightened focus on minimizing downtime and extending equipment lifespan has led to the preference for vacuum-based systems over traditional gas-insulated alternatives. With continued investments in both conventional and renewable power generation, the power stations segment is positioned to remain the dominant end-use category in the foreseeable future.

The vacuum insulated medium voltage switchgear market is expanding as industries increasingly seek efficient, reliable, and compact solutions for medium voltage electrical distribution. Demand is driven by the need for enhanced safety, reduced footprint, and improved reliability in power distribution networks, especially in sectors like energy, construction, and manufacturing. Challenges include the high initial investment costs, regulatory hurdles, and the complexity of integrating new systems into existing infrastructure. Opportunities lie in the development of smart, digitally integrated vacuum switchgear solutions that can offer real-time monitoring and diagnostics. Trends highlight the growing adoption of vacuum technology for improved switching performance, along with a shift towards more energy-efficient, space-saving switchgear designs.

The vacuum insulated medium voltage switchgear market is being driven by the growing demand for compact, reliable, and efficient electrical distribution systems. Vacuum technology offers superior insulation, enhanced switching performance, and improved safety compared to traditional air-insulated and gas-insulated switchgear. This makes vacuum insulated switchgear an attractive option for industries looking to reduce operational downtime, prevent faults, and minimize maintenance costs. Moreover, the increasing need for energy-efficient power distribution solutions in sectors such as construction, power generation, and industrial manufacturing is further propelling the market. As industries look to modernize their electrical grids and reduce energy consumption, vacuum insulated medium voltage switchgear is becoming a preferred choice.

The vacuum insulated medium voltage switchgear market faces challenges, primarily in terms of high upfront costs associated with production, installation, and integration into existing electrical systems. While these systems offer long-term savings and increased reliability, the initial capital investment can be a barrier for smaller businesses or organizations with limited budgets. Regulatory compliance in terms of safety standards, environmental impact, and certification requirements adds to the complexity and cost of manufacturing. The technical challenges involved in ensuring that vacuum insulated switchgear performs optimally under varying environmental conditions, such as extreme temperatures or humidity levels, create further constraints. Buyers are increasingly seeking vendors that can provide customizable solutions, technical support, and seamless integration into existing infrastructures.

Growing opportunity in integrating vacuum insulated medium voltage switchgear with smart grid solutions, offering real-time monitoring, diagnostics, and predictive maintenance capabilities. This integration allows operators to monitor performance, anticipate failures, and optimize system performance, resulting in improved reliability and reduced operational costs. The market for digitally integrated vacuum switchgear is expected to expand as more industries adopt automation and remote monitoring to enhance operational efficiency. Opportunities exist in the power generation and renewable energy sectors, where the demand for efficient and compact electrical solutions is growing. Suppliers who can offer digitally enabled switchgear with enhanced connectivity, control, and automation features will have a significant competitive advantage.

The vacuum insulated medium voltage switchgear market is witnessing a trend toward more compact, space-saving designs that are easier to install and maintain, particularly in urban environments where space is limited. The emphasis on energy efficiency is also becoming more prominent, as companies seek solutions that minimize energy losses and improve overall system performance. The shift towards smaller, more efficient systems is driving innovation in vacuum switchgear technology, with suppliers focusing on reducing the footprint of their products while maintaining or improving their performance. As industries continue to prioritize energy efficiency and cost-effectiveness, the demand for compact, high-performance vacuum insulated switchgear is expected to increase.

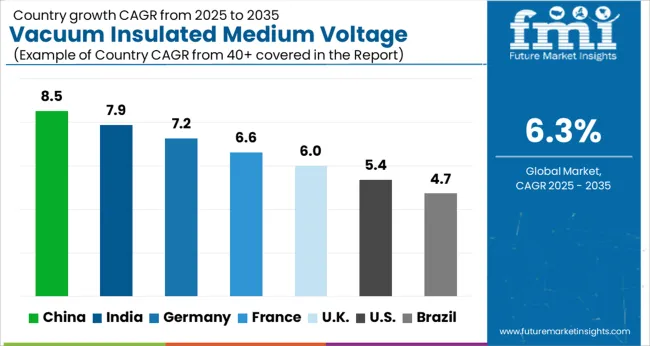

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global vacuum insulated medium voltage switchgear market is expected to grow at a CAGR of 6.3% from 2025 to 2035. China leads the market with a CAGR of 8.5%, followed by India at 7.9%, and France at 6.6%. The market is driven by increasing urbanization, industrialization, and government initiatives to modernize power grids. The rising demand for energy-efficient solutions, the integration of renewable energy sources, and advancements in grid technologies are all contributing factors to the market’s growth. As infrastructure modernizes globally, the vacuum insulated switchgear market is expected to continue its upward trajectory. The analysis includes over 40+ countries, with the leading markets detailed below.

The vacuum insulated medium voltage switchgear market in China is expected to grow at a CAGR of 8.5% from 2025 to 2035, driven by rapid urbanization, infrastructure development, and the growing demand for reliable electrical power distribution systems. The country’s expanding power grid, alongside significant investments in renewable energy and industrialization, is contributing to the adoption of advanced electrical equipment, such as vacuum insulated switchgear, to ensure safety and efficiency. China’s increasing focus on power infrastructure modernization is a key driver for this market, as companies seek to upgrade their equipment to improve grid reliability and reduce maintenance costs. The growing demand for renewable energy solutions, including wind and solar power, is also increasing the need for vacuum insulated medium voltage switchgear, which is crucial in integrating these energy sources into the grid.

The vacuum insulated medium voltage switchgear market in India is projected to grow at a CAGR of 7.9% from 2025 to 2035, supported by the country’s expanding industrial base, growing electricity demand, and government efforts to modernize electrical grids. With increasing urbanization and industrialization, India’s power distribution systems are under pressure, driving the need for efficient and reliable switchgear. Vacuum insulated switchgear offers significant advantages, such as compact size, reliability, and minimal maintenance, making it an ideal solution for modernizing electrical grids. The Indian government’s push towards renewable energy, coupled with a strong focus on improving grid infrastructure, is expected to drive further demand for these systems. The expanding power transmission and distribution network across rural areas is contributing to market growth. With significant investments in smart grid technologies and energy efficiency, the market for vacuum insulated switchgear is poised for substantial growth in the coming years.

The vacuum insulated medium voltage switchgear market in France is expected to grow at a CAGR of 6.6% from 2025 to 2035, supported by a stable demand for energy-efficient electrical equipment. The French government’s focus on modernizing its energy infrastructure and adopting advanced technologies for power distribution is driving the market. With a strong emphasis on renewable energy integration and grid reliability, the demand for vacuum insulated switchgear is expected to rise significantly. These systems are gaining popularity due to their ability to reduce space requirements, lower maintenance, and enhance safety. France’s commitment to improving the efficiency of its electrical grid systems, including the transition to smart grids, is likely to continue supporting market growth. As the country works towards its energy transition goals, the need for efficient medium voltage switchgear solutions will rise.

The UK vacuum insulated medium voltage switchgear market is projected to grow at a CAGR of 6.0% from 2025 to 2035, driven by the increasing demand for energy-efficient and space-saving electrical distribution systems. As the UK continues to modernize its energy infrastructure and integrate renewable energy sources, the demand for vacuum insulated switchgear is rising. The UK government’s focus on enhancing grid resilience and reducing maintenance costs is another factor contributing to market growth. With a strong push towards smart grid technologies, the need for advanced switchgear solutions to support the efficient flow of electricity is accelerating. The market is also benefiting from increasing industrial and commercial adoption, particularly in sectors like manufacturing and data centers, where reliability is critical.

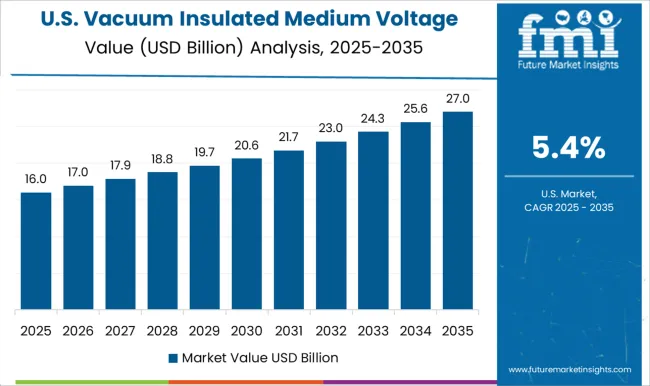

The USA vacuum insulated medium voltage switchgear market is expected to grow at a CAGR of 5.4% from 2025 to 2035, driven by the growing need for advanced power distribution systems to enhance grid efficiency. With increasing power consumption and the demand for reliable electrical infrastructure, the market for vacuum insulated switchgear is expanding. These systems offer significant advantages, including reduced size, higher reliability, and minimal maintenance, making them ideal for modernizing aging power grids. Additionally, the USA is focusing on increasing the share of renewable energy in its energy mix, which requires efficient switchgear systems to ensure seamless integration. The ongoing upgrades to smart grids and the expansion of the electric vehicle infrastructure are also contributing to the growth of the market.

In the vacuum insulated medium voltage switchgear market, competition is shaped by technological innovation, reliability, and energy efficiency. Siemens leads by offering cutting-edge vacuum circuit breakers and switchgear solutions designed for high performance and safety in demanding environments. The company focuses on delivering compact, robust switchgear that optimizes space and reduces operational costs, while ensuring seamless integration with existing electrical infrastructure. ABB competes by providing energy-efficient switchgear solutions with advanced vacuum insulation technology, emphasizing modular designs and ease of maintenance for industrial, commercial, and utility applications. ABB's products are known for their long lifespan and reliability in high-voltage environments. Bharat Heavy Electricals and CG Power and Industrial Solutions focus on catering to the growing demand for vacuum insulated switchgear in emerging markets. Both companies emphasize cost-effective solutions that provide safety, reliability, and ease of use.

E + I Engineering competes with custom-engineered, high-quality switchgear designed to meet specific customer requirements in power distribution. Eaton, with its global presence, offers vacuum insulated switchgear that integrates seamlessly into smart grids, focusing on energy efficiency, smart monitoring, and predictive maintenance for improved operational performance. Fuji Electric competes by providing high-performance switchgear systems that combine vacuum insulation with advanced protection and control features, targeting industrial and utility sectors. General Electric, HD Hyundai Electric, and Hitachi offer advanced switchgear solutions that emphasize compact design, safety, and long-term sustainability. These companies focus on providing reliable products with low environmental impact. Hyosung Heavy Industries and Mitsubishi Electric offer vacuum insulated switchgear products that cater to both high-end industrial applications and power distribution networks. Ormazabal and Schneider Electric emphasize their intelligent switchgear systems that incorporate digital monitoring and IoT capabilities, providing enhanced asset management and operational optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.5 Billion |

| Voltage | ≥ 3 kV to 9 kV, ≥ 9 kV to 15 kV, ≥ 15 kV to 21 kV, ≥ 21 kV to 27 kV, ≥ 27 kV to 33 kV, and ≥ 33 kV |

| Component | Circuit Breakers, Contactors, Switches & Disconnector, Fuses, and Others |

| End Use | Power Stations, Transformer Substations, Local Electricity Supply, and Others |

| Application | Industrial, Residential, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, and Schneider Electric |

| Additional Attributes | Dollar sales by switchgear type (vacuum, air-insulated, gas-insulated), application (industrial, commercial, utility), and voltage class (low, medium, high). Demand dynamics are driven by the rise of smart grids, automation in power systems, and the increasing need for compact, reliable solutions in energy distribution. Regional growth is prominent in Asia-Pacific, North America, and Europe, supported by investments in renewable energy infrastructure, smart grid technology, and power network upgrades. |

The global vacuum insulated medium voltage switchgear market is estimated to be valued at USD 30.5 billion in 2025.

The market size for the vacuum insulated medium voltage switchgear market is projected to reach USD 56.2 billion by 2035.

The vacuum insulated medium voltage switchgear market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in vacuum insulated medium voltage switchgear market are ≥ 3 kv to 9 kv, ≥ 9 kv to 15 kv, ≥ 15 kv to 21 kv, ≥ 21 kv to 27 kv, ≥ 27 kv to 33 kv and ≥ 33 kv.

In terms of component, circuit breakers segment to command 31.9% share in the vacuum insulated medium voltage switchgear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Heat Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA