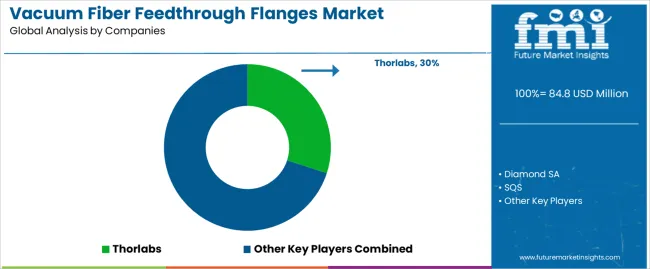

The global vacuum fiber feedthrough flanges market is valued at USD 84.8 million in 2025. It is slated to reach USD 133 million by 2035, recording an absolute increase of USD 48.2 million over the forecast period. This translates into a total growth of 56.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.57X during the same period, supported by increasing demand for precision vacuum components in semiconductor manufacturing and advanced research applications, growing adoption of fiber optic sensing systems in controlled environments, and rising emphasis on hermetic sealing solutions that maintain vacuum integrity across diverse medical equipment, aerospace, and scientific instrumentation applications.

Between 2025 and 2030, the vacuum fiber feedthrough flanges market is projected to expand from USD 84.8 million to USD 106.2 million, resulting in a value increase of USD 21.4 million, which represents 44.4% of the total forecast growth for the decade. This phase of development will be shaped by increasing semiconductor fabrication capacity expansion requiring vacuum chamber instrumentation, rising adoption of fiber optic monitoring systems in medical devices, and growing utilization of vacuum feedthrough technologies in aerospace testing facilities. Equipment manufacturers and research institutions are expanding their vacuum system capabilities to address the growing demand for reliable fiber transmission solutions that ensure signal integrity and environmental isolation while meeting stringent contamination control requirements.

From 2030 to 2035, the market is forecast to grow from USD 106.2 million to USD 133 million, adding another USD 26.8 million, which constitutes 55.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of quantum computing research requiring specialized vacuum environments with optical access, the development of advanced space instrumentation utilizing fiber optic telemetry systems, and the growth of precision manufacturing applications incorporating real-time fiber sensing in vacuum processes. The growing adoption of Industry 4.0 technologies and smart manufacturing systems will drive demand for vacuum fiber feedthrough flanges with enhanced performance characteristics and customization capabilities.

Between 2020 and 2025, the vacuum fiber feedthrough flanges market experienced steady growth, driven by increasing semiconductor industry investment in advanced manufacturing equipment and growing recognition of fiber feedthrough flanges as essential components for enabling optical measurements, sensor integration, and data transmission in vacuum environments. The market developed as process engineers and instrumentation specialists recognized the potential for hermetic fiber feedthrough technology to provide reliable optical access to vacuum chambers while maintaining pressure integrity, preventing contamination ingress, and supporting critical measurement requirements. Technological advancement in sealing technologies and optical interface designs began emphasizing the critical importance of maintaining transmission efficiency and mechanical stability in demanding vacuum applications and thermal cycling conditions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 84.8 million |

| Forecast Value in (2035F) | USD 133 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

Market expansion is being supported by the increasing global demand for advanced semiconductor manufacturing equipment and scientific research instrumentation driven by technology miniaturization and performance requirements, alongside the corresponding need for specialized vacuum components that can enable fiber optic communication, integrate sensor systems, and maintain hermetic sealing across various thin film deposition, plasma processing, and analytical instrument applications. Modern semiconductor fabs and research laboratories are increasingly focused on implementing vacuum fiber feedthrough solutions that can provide reliable optical access, support multi-fiber configurations, and deliver consistent performance in high vacuum and ultra-high vacuum environments.

The growing emphasis on process monitoring and real-time diagnostics is driving demand for vacuum feedthrough flanges that can support in-situ measurement systems, enable remote sensing capabilities, and ensure comprehensive data collection without compromising vacuum integrity. Equipment manufacturers' preference for components that combine hermetic sealing performance with optical transmission efficiency and installation flexibility is creating opportunities for innovative feedthrough implementations. The rising influence of space exploration initiatives and quantum technology development is also contributing to increased adoption of vacuum fiber feedthroughs that can provide reliable optical connections without compromising system cleanliness or measurement accuracy.

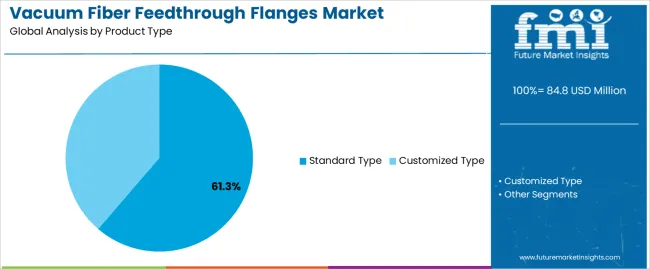

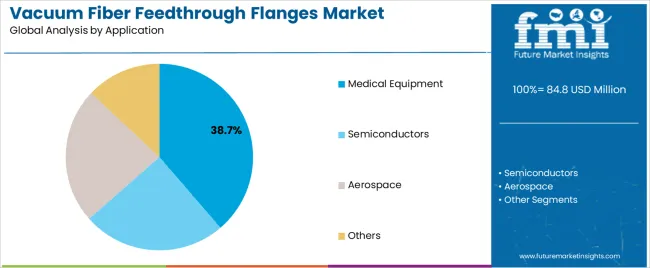

The market is segmented by product type, application, and region. By product type, the market is divided into standard type and customized type. Based on application, the market is categorized into medical equipment, semiconductors, aerospace, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The standard type segment is projected to maintain its leading position in the vacuum fiber feedthrough flanges market in 2025 with a 61.3% market share, reaffirming its role as the preferred product configuration for common vacuum system requirements and general-purpose applications. Research laboratories and equipment manufacturers increasingly utilize standard feedthrough flanges for their compatibility with industry-standard vacuum flanges, readily available specifications, and proven reliability in routine vacuum applications while offering cost-effective solutions. Standard type technology's established design parameters and broad applicability directly address the market requirements for reliable fiber transmission across diverse vacuum systems and pressure ranges without requiring specialized engineering or extended delivery times.

This product type segment forms the foundation of vacuum system instrumentation, as it represents the configuration with the greatest installed base and established supply channels across multiple research facilities and manufacturing operations. Scientific equipment investments in vacuum technology infrastructure continue to strengthen adoption among equipment integrators and end-users. With increasing demand for standardized components that reduce procurement complexity and support interchangeability, standard type feedthroughs align with both operational efficiency objectives and inventory management requirements, making them the central component of comprehensive vacuum system strategies.

The medical equipment application segment is projected to represent the largest share of vacuum fiber feedthrough flanges demand in 2025 with a 38.7% market share, underscoring its critical role as the primary driver for feedthrough adoption across analytical instruments, diagnostic systems, and therapeutic equipment requiring fiber optic sensing and vacuum environments. Medical device manufacturers prefer vacuum fiber feedthrough flanges due to their hermetic sealing capabilities for sterile environments, biocompatibility of sealing materials, and ability to integrate fiber optic monitoring systems while supporting regulatory compliance and patient safety requirements. Positioned as essential components for advanced medical instrumentation, vacuum fiber feedthrough flanges offer both functional performance and quality assurance benefits.

The segment is supported by continuous innovation in medical diagnostic technologies and the growing implementation of fiber optic sensing systems that enable minimally invasive procedures with enhanced measurement capabilities and real-time monitoring functions. Additionally, medical equipment manufacturers are investing in sophisticated instrumentation programs to support precision therapy delivery, advanced imaging modalities, and diagnostic accuracy improvements that require reliable vacuum-to-atmosphere fiber transitions. As medical technology advances and diagnostic capabilities expand, the medical equipment application will continue to dominate the market while supporting advanced sensing integration and equipment performance optimization strategies.

The vacuum fiber feedthrough flanges market is advancing steadily due to increasing demand for semiconductor process equipment driven by chip manufacturing capacity expansion and growing adoption of fiber optic sensing technologies in vacuum environments that require specialized components providing hermetic sealing and optical transmission capabilities across diverse thin film deposition, analytical instrumentation, medical diagnostics, and aerospace testing applications. The market faces challenges, including high precision manufacturing requirements and associated production costs, competition from alternative vacuum transmission methods and wireless sensing solutions, and technical constraints related to thermal expansion compatibility and long-term sealing reliability in extreme operating conditions. Innovation in sealing materials and fiber interface technologies continues to influence product development and market expansion patterns.

The growing expansion of semiconductor fabrication facilities is driving demand for specialized vacuum feedthrough components that enable in-situ process monitoring, support advanced metrology systems, and facilitate real-time plasma diagnostics in deposition and etching chambers. Semiconductor applications require vacuum fiber feedthroughs that maintain ultra-high vacuum integrity while delivering low signal attenuation and minimal outgassing characteristics suitable for cleanroom environments. Equipment manufacturers are increasingly recognizing the advantages of fiber optic instrumentation for electromagnetic interference immunity, temperature monitoring capabilities, and remote sensing applications, creating opportunities for specialized feedthrough designs optimized for semiconductor tool integration and process control requirements.

Modern vacuum feedthrough manufacturers are incorporating advanced glass-to-metal sealing techniques, specialized epoxy formulations, and engineered ceramic materials to enhance hermetic performance, extend temperature operating ranges, and support comprehensive reliability requirements through optimized thermal expansion matching and stress management. Leading companies are developing proprietary sealing processes for multi-fiber configurations, implementing quality control protocols for leak detection and verification, and advancing material selections that accommodate various fiber types and connector interfaces. These developments improve product capabilities while enabling new market opportunities, including cryogenic applications, high-temperature processing environments, and radiation-resistant instrumentation systems. Advanced material integration also allows manufacturers to support comprehensive performance specifications and application diversity beyond traditional vacuum component limitations.

The expansion of quantum computing research, space exploration missions, and advanced physics experiments is driving demand for customized vacuum fiber feedthrough designs that address unique environmental challenges, accommodate specific mounting configurations, and support specialized fiber types including single-mode, multi-mode, and specialty optical fibers. These applications require engineering collaboration for custom flange sizes, multiple fiber arrangements, and integrated connector systems that meet specific performance criteria, creating premium market segments with differentiated technical requirements and service models. Manufacturers are investing in application engineering capabilities and prototyping resources to serve emerging technology sectors while supporting innovation in scientific research and space instrumentation development.

| Country | CAGR (2025-2035) |

|---|---|

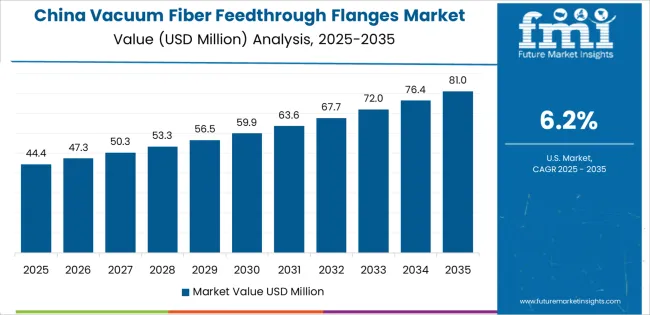

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| United States | 4.4% |

| United Kingdom | 3.9% |

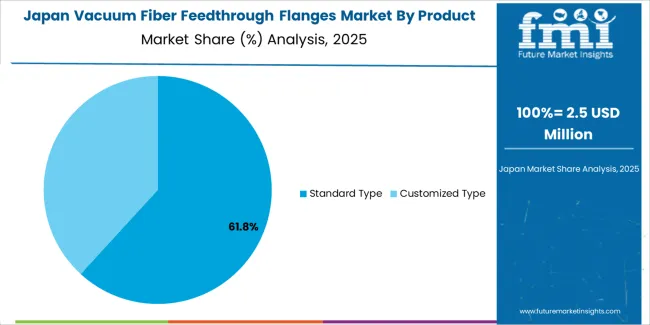

| Japan | 3.5% |

The vacuum fiber feedthrough flanges market is experiencing solid growth globally, with China leading at a 6.2% CAGR through 2035, driven by expanding semiconductor manufacturing capacity, growing scientific research infrastructure, and increasing investment in advanced instrumentation systems. India follows at 5.8%, supported by developing semiconductor fabrication facilities, expanding medical device manufacturing, and rising research institution capabilities. Germany shows growth at 5.3%, emphasizing precision manufacturing excellence, photonics industry strength, and advanced vacuum technology development. Brazil demonstrates 4.8% growth, supported by scientific research expansion, medical equipment production, and aerospace industry development.

The United States records 4.4%, focusing on semiconductor manufacturing leadership, space exploration programs, and advanced research facility investments. The United Kingdom exhibits 3.9% growth, emphasizing scientific research capabilities, medical technology innovation, and precision engineering expertise. Japan shows 3.5% growth, supported by semiconductor equipment manufacturing, scientific instrumentation excellence, and quality-focused production standards.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from vacuum fiber feedthrough flanges in China is projected to exhibit exceptional growth with a CAGR of 6.2% through 2035, driven by massive semiconductor manufacturing capacity expansion and rapidly growing scientific research infrastructure supported by government Made in China 2025 initiatives and national technology development programs. The country's substantial investment in advanced manufacturing equipment and increasing emphasis on indigenous technology development are creating significant demand for vacuum component solutions. Major semiconductor equipment manufacturers and research institutions are establishing comprehensive supply chains to serve both domestic production facilities and international markets.

Revenue from vacuum fiber feedthrough flanges in India is expanding at a CAGR of 5.8%, supported by the country's developing semiconductor fabrication capabilities, expanding medical device manufacturing sector, and increasing investment in scientific research infrastructure across government laboratories and academic institutions. The country's comprehensive technology development programs and rising emphasis on advanced manufacturing are driving demand for specialized vacuum components throughout emerging technology sectors. Leading equipment manufacturers and research organizations are establishing procurement channels and technical partnerships to address growing instrumentation requirements.

Revenue from vacuum fiber feedthrough flanges in Germany is expanding at a CAGR of 5.3%, supported by the country's photonics industry excellence, precision vacuum component manufacturing, and strong research infrastructure serving advanced physics experiments and industrial process development. The nation's engineering capabilities and technology innovation focus are driving sophisticated vacuum feedthrough implementations throughout research and industrial sectors. Leading vacuum technology companies and research institutions are investing extensively in component development and application engineering for specialized requirements.

Revenue from vacuum fiber feedthrough flanges in Brazil is expanding at a CAGR of 4.8%, supported by the country's expanding scientific research capabilities, developing medical equipment manufacturing sector, and growing aerospace industry requiring vacuum testing facilities. Brazil's research infrastructure development and technology sector growth are driving demand for vacuum component solutions. Research institutions and medical device companies are investing in equipment capabilities to serve domestic research programs and regional manufacturing operations.

Revenue from vacuum fiber feedthrough flanges in the United States is expanding at a CAGR of 4.4%, supported by the country's semiconductor manufacturing leadership, extensive space exploration programs, and comprehensive research infrastructure spanning national laboratories, universities, and private research facilities. The nation's technology innovation ecosystem and advanced manufacturing capabilities are driving demand for sophisticated vacuum feedthrough solutions. Semiconductor equipment manufacturers and aerospace companies are investing in component procurement and custom development to serve both commercial and government applications.

Revenue from vacuum fiber feedthrough flanges in the United Kingdom is expanding at a CAGR of 3.9%, driven by the country's scientific research capabilities, medical technology innovation, and precision engineering expertise supporting advanced instrumentation development for research and industrial applications. The United Kingdom's research institution strength and technology sector capabilities are driving demand for specialized vacuum components. University research groups and medical device developers are investing in advanced instrumentation systems incorporating fiber optic sensing technologies.

Revenue from vacuum fiber feedthrough flanges in Japan is expanding at a CAGR of 3.5%, supported by the country's semiconductor equipment manufacturing leadership, scientific instrumentation excellence, and precision component production capabilities serving domestic and international markets. Japan's technological sophistication and quality manufacturing standards are driving demand for high-precision vacuum feedthrough products. Leading equipment manufacturers and research institutions are investing in component integration for advanced systems and specialized applications.

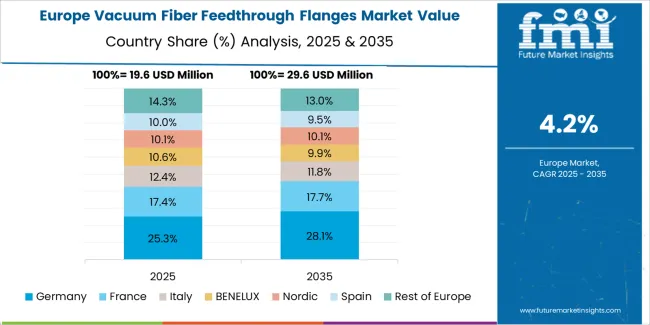

The vacuum fiber feedthrough flanges market in Europe is projected to grow from USD 29.2 million in 2025 to USD 44.5 million by 2035, registering a CAGR of 4.3% over the forecast period. Germany is expected to maintain leadership with a 31.4% market share in 2025, moderating to 30.9% by 2035, supported by photonics industry strength, precision vacuum component manufacturing, and advanced research infrastructure.

The United Kingdom follows with 18.7% in 2025, projected at 18.4% by 2035, driven by scientific research excellence, medical technology development, and precision engineering capabilities. France holds 16.2% in 2025, rising to 16.4% by 2035 on the back of research facility investments, aerospace industry requirements, and semiconductor development initiatives. Italy commands 11.5% in 2025, increasing slightly to 11.7% by 2035, while Spain accounts for 8.3% in 2025, reaching 8.5% by 2035 aided by research infrastructure expansion and medical equipment production.

The Netherlands maintains 4.9% in 2025, up to 5% by 2035 due to photonics research capabilities and precision manufacturing expertise. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 9% in 2025 and 9.1% by 2035, reflecting steady advancement in research infrastructure, semiconductor manufacturing development, and scientific instrumentation adoption.

The vacuum fiber feedthrough flanges market is characterized by competition among specialized vacuum component manufacturers, precision optics companies, and diversified instrumentation suppliers. Companies are investing in sealing technology development, custom engineering capabilities, product portfolio expansion, and quality assurance systems to deliver reliable, high-performance, and application-specific vacuum fiber feedthrough solutions. Innovation in hermetic sealing methods, multi-fiber configurations, and thermal management designs is central to strengthening market position and competitive advantage.

Thorlabs leads the market with comprehensive photonics and optomechanical components with a focus on vacuum-compatible fiber optics, standardized feedthrough products, and global distribution capabilities across diverse research and industrial applications. Diamond SA provides precision hermetic sealing solutions with emphasis on custom feedthrough designs, multi-fiber configurations, and aerospace-grade components. SQS delivers specialized vacuum feedthrough products with focus on semiconductor applications and high-vacuum performance. Hositrad offers fiber optic feedthrough systems with emphasis on medical equipment integration and regulatory compliance. Engionic provides engineered vacuum components with focus on custom solutions and application engineering support.

Solid Sealing Technology specializes in hermetic sealing components for vacuum and pressure applications. SEDI-ATI Fibres Optiques focuses on fiber optic component manufacturing including vacuum feedthrough solutions. OEfind provides precision optical components and vacuum-compatible fiber products. Deben UK offers scientific instrumentation components including specialized feedthrough designs. Shenzhen Xinray Technology emphasizes vacuum component manufacturing for Asian markets. Shanghai YiNGUAN Semiconductor Technology provides semiconductor equipment components including fiber feedthrough systems. Photon Technology delivers photonics components and vacuum-compatible optical solutions for research applications.

Vacuum fiber feedthrough flanges represent a specialized component segment within vacuum technology and optical instrumentation, projected to grow from USD 84.8 million in 2025 to USD 133 million by 2035 at a 4.6% CAGR. These precision-engineered components serve as critical interface elements enabling fiber optic signal transmission into vacuum environments where hermetic sealing, optical transmission integrity, and environmental isolation are essential. Market expansion is driven by increasing semiconductor manufacturing capacity, growing adoption of fiber optic sensing systems, expanding space exploration programs, and rising implementation of advanced diagnostic technologies across diverse medical equipment, semiconductor processing, aerospace testing, and scientific research applications.

How Industry Regulators Could Strengthen Quality Standards and Application Safety?

How Industry Associations Could Advance Technical Knowledge and Best Practices?

How Feedthrough Manufacturers Could Drive Innovation and Customer Success?

How End-User Organizations Could Optimize Component Selection and System Performance?

How Research Institutions Could Enable Technology Advancement?

How Equipment Integrators Could Support Market Development?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 84.8 million |

| Product Type | Standard Type, Customized Type |

| Application | Medical Equipment, Semiconductors, Aerospace, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Thorlabs, Diamond SA, SQS, Hositrad, Engionic |

| Additional Attributes | Dollar sales by product type and application category, regional demand trends, competitive landscape, technological advancements in hermetic sealing, custom design capabilities, optical performance optimization, and application integration strategies |

The global vacuum fiber feedthrough flanges market is estimated to be valued at USD 84.8 million in 2025.

The market size for the vacuum fiber feedthrough flanges market is projected to reach USD 133.0 million by 2035.

The vacuum fiber feedthrough flanges market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in vacuum fiber feedthrough flanges market are standard type and customized type.

In terms of application, medical equipment segment to command 38.7% share in the vacuum fiber feedthrough flanges market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA