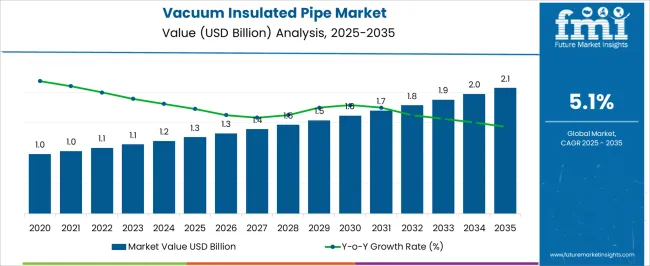

The vacuum insulated pipe market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

From 2021 to 2025, the market grows from USD 1.0 billion to USD 1.3 billion, with incremental growth through values of USD 1.0 billion, 1.1 billion, and 1.2 billion. This phase reflects steady adoption as industries, including chemical processing, oil and gas, and food storage, increase their demand for efficient thermal insulation solutions. The market share remains stable as traditional insulation methods continue to compete, but vacuum insulated pipes begin gaining ground due to their superior performance in terms of energy efficiency and space savings. Between 2026 and 2030, the market strengthens further, rising from USD 1.3 billion to USD 1.9 billion.

During this period, market share gain is observed as vacuum insulated pipes become increasingly favored over conventional solutions, driven by demand for high-performance, lightweight, and environmentally-friendly options. The market value progresses from USD 1.4 billion to USD 1.5 billion, 1.6 billion, 1.7 billion, and 1.8 billion. By 2035, the market reaches USD 2.1 billion, reflecting a steady increase in adoption across various industrial applications. The share of vacuum insulated pipes continues to gain as manufacturers innovate to reduce production costs and improve efficiency, while conventional alternatives see slower growth, resulting in an overall market share shift in favor of vacuum insulation technologies.

| Metric | Value |

|---|---|

| Vacuum Insulated Pipe Market Estimated Value in (2025 E) | USD 1.3 billion |

| Vacuum Insulated Pipe Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The piping and tubing market plays a significant role, contributing around 25-30%, as vacuum insulated pipes are integral to industrial piping systems that require thermal insulation to reduce heat loss. The energy and power market is another major driver, accounting for approximately 20-25%, as these pipes are commonly used in power plants, refineries, and chemical processing facilities, where effective heat management is crucial for efficiency. The oil and gas industry market contributes about 15-20%, with vacuum insulated pipes being essential for the transportation and storage of cryogenic liquids, such as liquefied natural gas (LNG), that require strict temperature control to remain in a liquid state.

The construction and infrastructure market plays a role, contributing around 10-15%, as vacuum insulated pipes are used in HVAC systems and district heating and cooling applications in large commercial and residential buildings. Lastly, the cryogenics and refrigeration market accounts for approximately 8-10%, as these pipes are critical for maintaining low temperatures in cryogenic applications, including the storage and transport of gases like nitrogen and oxygen. These parent markets highlight the widespread application of vacuum insulated pipes, particularly in industries focused on energy efficiency, cryogenic technology, and temperature-sensitive operations.

The vacuum insulated pipe market is experiencing significant growth, driven by increasing demand for efficient thermal insulation in the storage and transportation of cryogenic liquids. The market’s momentum is being supported by the expansion of liquefied natural gas infrastructure, growth in industrial gas production, and rising use of cryogenic systems in healthcare, food processing, aerospace, and scientific research sectors. As industries prioritize minimizing thermal losses and enhancing energy efficiency, vacuum insulated pipes are gaining preference due to their superior insulation performance compared to conventional piping systems.

Advancements in pipe design, material engineering, and multilayer insulation technologies are also contributing to performance improvements and broader applicability. Growing regulatory emphasis on safety and efficiency in cryogenic handling is encouraging the adoption of vacuum insulated solutions across critical industries.

The market is further benefiting from increasing investments in hydrogen economy projects and space exploration programs, where temperature control is essential With demand rising globally for cryogenic fluid management and sustainable energy systems, the vacuum insulated pipe market is poised for continued expansion across both established and emerging economies.

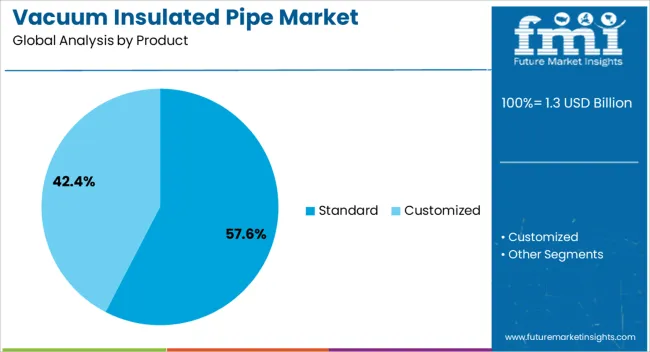

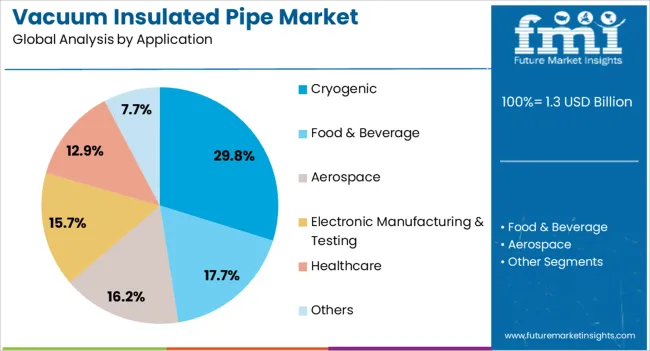

The vacuum insulated pipe market is segmented by product, application, and geographic regions. By product, vacuum insulated pipe market is divided into standard and customized. In terms of application, vacuum insulated pipe market is classified into cryogenic, food & beverage, aerospace, electronic manufacturing & testing, healthcare, and others. Regionally, the vacuum insulated pipe industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The standard product segment is projected to account for 57.6% of the vacuum insulated pipe market revenue share in 2025, establishing itself as the dominant product category. Its widespread adoption is being attributed to the cost-effectiveness, proven reliability, and ease of installation offered by standard pipe configurations in a wide range of applications. These pipes are engineered to deliver efficient thermal insulation while accommodating diverse cryogenic fluids, making them a versatile choice across industries.

The standard product segment benefits from streamlined manufacturing processes and established supply chains, which contribute to reduced lead times and favorable pricing. In industrial gas production, liquefied natural gas transport, and healthcare cryogenic systems, standard vacuum insulated pipes are preferred for their ability to maintain low boil-off rates and minimize product losses.

The segment’s growth is further supported by increased demand from small and mid-scale facilities seeking scalable and maintenance-friendly solutions As industries continue to seek efficient cryogenic infrastructure, standard vacuum insulated pipes are expected to retain their dominant position due to their balance of performance, availability, and cost efficiency.

The cryogenic application segment is expected to represent 29.8% of the vacuum insulated pipe market revenue share in 2025, making it the leading application area. Its leadership is being driven by the critical need for ultra-low temperature management in the storage and transport of liquefied gases such as nitrogen, oxygen, argon, hydrogen, and liquefied natural gas. These applications require high-performance piping systems that can maintain cryogenic temperatures over long distances without significant thermal losses or safety risks.

Vacuum insulated pipes offer exceptional thermal insulation and vapor containment, making them essential in cryogenic processes across industries including energy, medical, aerospace, and scientific research. Increased investment in liquefied gas infrastructure, especially in emerging markets and clean energy projects, is further accelerating the use of vacuum insulated piping systems.

The segment is also benefiting from the growth of the hydrogen economy and space programs, where temperature-sensitive fluid handling is paramount As cryogenic technology continues to advance and expand its industrial footprint, the demand for reliable and efficient vacuum insulated pipe systems in these applications is expected to grow steadily.

The vacuum insulated pipe market is experiencing growth due to the rising demand for energy-efficient solutions in industries such as oil and gas, chemicals, and food and beverage. Vacuum insulated pipes (VIPs) are designed to minimize thermal losses in the transport of cryogenic liquids and gases, making them ideal for use in high-energy demanding applications. Demand is primarily driven by the need for cost-effective, efficient thermal insulation in transportation and storage systems. Challenges include high manufacturing costs, complex design requirements, and the need for continuous innovation in materials and technologies. Opportunities lie in the growing adoption of VIPs in new sectors, such as renewable energy and data centers, which require advanced insulation solutions. Trends include innovations in insulation materials, the integration of advanced coatings for enhanced durability, and the demand for VIPs in emerging markets. Suppliers that focus on high-quality, energy-efficient, and cost-effective VIP solutions are well-positioned for growth.

The vacuum insulated pipe market is being driven by the increasing demand for energy-efficient thermal insulation solutions, particularly in industries that deal with the transportation and storage of cryogenic liquids. VIPs provide superior insulation by reducing heat loss, which is essential for maintaining the temperature of materials like liquefied natural gas (LNG), oxygen, and nitrogen. The need for energy-efficient infrastructure is growing in sectors such as oil and gas, healthcare, chemicals, and food and beverage, where temperature-sensitive products must be stored and transported over long distances. As global energy regulations become stricter, VIPs are gaining popularity due to their ability to reduce energy consumption and improve process efficiency in storage and transportation systems. The push for sustainability and energy efficiency further drives the demand for these advanced insulation systems.

The vacuum insulated pipe market faces challenges related to high production costs, particularly due to the complex manufacturing processes involved in producing VIPs. The cost of specialized materials, such as high-quality vacuum insulation and durable coatings, contributes to the high price of VIPs. Additionally, the supply of raw materials needed for manufacturing VIPs, such as metals, can be subject to market fluctuations, further influencing costs. Regulatory compliance for thermal insulation, especially for cryogenic applications, adds to the technical complexity, requiring manufacturers to meet stringent safety and performance standards. The intricate design and installation of vacuum-insulated pipes can lead to long lead times and higher costs for end users. Manufacturers are focusing on cost-effective production methods and innovations in materials to reduce these challenges while maintaining high performance and durability.

Opportunities in the vacuum insulated pipe market are growing in emerging sectors such as renewable energy, data centers, and industrial refrigeration, where efficient thermal management is increasingly important. VIPs are being adopted in renewable energy projects, particularly in the storage and transportation of hydrogen and other cryogenic fuels, which are essential for the green energy transition. Additionally, data centers, which require advanced cooling systems to maintain optimal operating temperatures, are turning to VIPs for energy-efficient insulation. As these industries continue to grow, there is a significant opportunity for VIP suppliers to expand their product offerings and cater to the rising demand for energy-efficient and cost-effective thermal solutions. The growing adoption of VIPs in emerging markets, particularly in Asia-Pacific and Latin America, further supports this growth potential.

The vacuum insulated pipe market is trending toward innovations in insulation materials and coatings that enhance the durability and performance of VIPs. Manufacturers are increasingly incorporating advanced insulation materials, such as aerogels and vacuum panels, to provide superior thermal resistance and reduce the weight of the pipes. The integration of protective coatings and corrosion-resistant materials is also becoming more common, extending the lifespan of VIPs, particularly in harsh environments like offshore platforms or chemical plants. Additionally, there is a growing trend toward the development of VIPs that can withstand extreme pressure and temperature conditions, making them suitable for a broader range of applications. These innovations are helping manufacturers meet the increasing demand for high-performance, durable, and energy-efficient thermal solutions in industries such as oil and gas, chemicals, and healthcare.

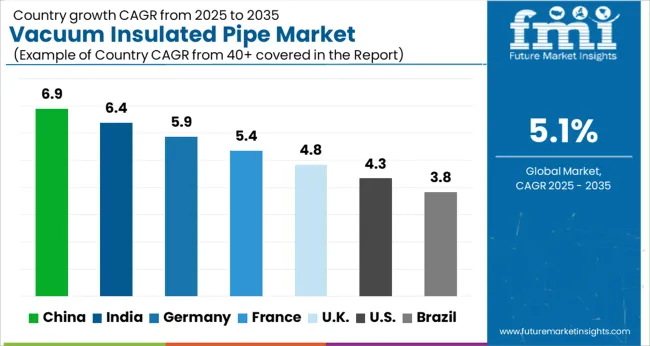

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

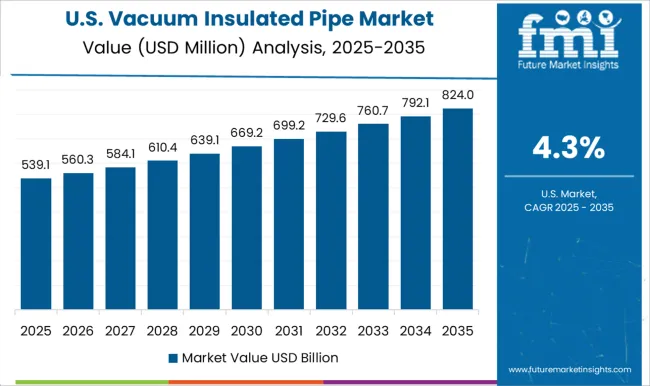

| USA | 4.3% |

| Brazil | 3.8% |

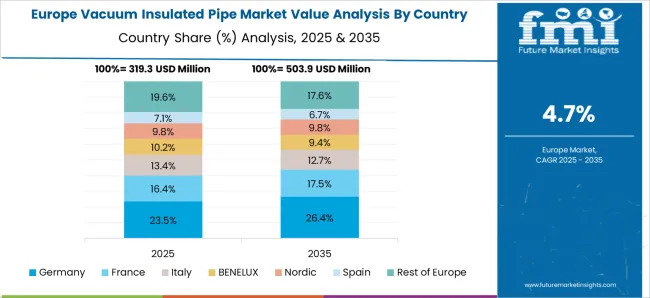

The global vacuum insulated pipe market is expected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with a growth rate of 6.9%, followed by India at 6.4%, and France at 5.4%. The UK and USA show moderate growth rates of 4.8% and 4.3%, respectively. The market is driven by growing energy efficiency demands, the adoption of cryogenic technologies, and infrastructure development across industries like oil, gas, and chemicals. Government initiatives and the rise of e-commerce further support market expansion, providing opportunities for vacuum insulated pipe manufacturers globally. The analysis spans over 40+ countries, with the leading markets shown below.

China’s vacuum insulated pipe market is expected to grow at a CAGR of 6.9% from 2025 to 2035. The country’s booming industrial sectors, particularly in energy and manufacturing, are driving the demand for vacuum insulated pipes. With China’s increasing focus on energy efficiency, advanced technologies for thermal insulation are becoming more important across various industries, such as oil and gas, chemicals, and industrial refrigeration. The rising demand for energy-efficient infrastructure and high-performance insulation materials in sectors like LNG (liquefied natural gas) and cryogenics is boosting the vacuum insulated pipe market. China’s significant investments in industrial and residential construction projects and the growing focus on environmental regulations are driving demand for such products. The e-commerce sector’s expansion is also making vacuum insulated pipes more accessible to a broader range of industries and consumers, providing substantial growth opportunities.

The vacuum insulated pipe market in India is projected to grow at a CAGR of 6.4% from 2025 to 2035. The country’s rapidly growing industrial sectors, especially in the energy, chemical, and HVAC industries, are driving the demand for vacuum insulated pipes. As India’s infrastructure continues to develop and modernize, there is an increasing need for high-performance materials that enhance energy efficiency. Vacuum insulated pipes, known for their ability to reduce energy loss and provide reliable insulation, are becoming a key component in the energy and manufacturing sectors. The growth in the use of liquefied natural gas (LNG) and the adoption of cryogenic applications are also major drivers of the market. Government initiatives promoting energy efficiency and sustainable infrastructure are contributing to the adoption of advanced insulation materials. The rise in domestic production of energy-efficient equipment further supports the demand for vacuum insulated pipes in India’s industrial and residential sectors.

The vacuum insulated pipe market in France is expected to grow at a CAGR of 5.4% from 2025 to 2035. France’s focus on industrial efficiency, particularly in energy-intensive industries like oil and gas, chemicals, and cryogenics, is driving the demand for vacuum insulated pipes. The country's commitment to reducing energy consumption and improving infrastructure is resulting in a higher demand for advanced insulation solutions. As France continues to adopt environmentally friendly building standards and enhance its energy performance in both residential and industrial sectors, the need for efficient insulation materials such as vacuum insulated pipes is expected to grow. The increasing use of vacuum insulated pipes in the transportation and storage of liquefied natural gas (LNG) and other cryogenic materials is also supporting the market’s expansion.

The UK vacuum insulated pipe market is projected to grow at a CAGR of 4.8% from 2025 to 2035. The country’s industrial sectors, including chemicals, pharmaceuticals, and energy, are driving the demand for advanced insulation materials, such as vacuum insulated pipes, which are essential for maintaining energy efficiency in complex systems. The UK’s increasing focus on reducing industrial energy consumption and enhancing sustainability in manufacturing processes is fueling the demand for energy-efficient solutions. The rise in the usage of cryogenic applications and LNG infrastructure is further contributing to market growth. As the UK continues to focus on improving infrastructure and adopting modern, energy-efficient technologies, the need for vacuum insulated pipes across industries, including transport, storage, and energy production, is on the rise.

The USA vacuum insulated pipe market is projected to grow at a CAGR of 4.3% from 2025 to 2035. As the USA continues to focus on reducing energy consumption and improving industrial efficiency, the demand for advanced thermal insulation solutions like vacuum insulated pipes is increasing. The energy sector, particularly oil and gas, chemicals, and cryogenic storage, is driving the market’s growth. Vacuum insulated pipes are essential in these industries for reducing heat loss and ensuring the safe transportation and storage of LNG and other cryogenic materials. As USA infrastructure continues to modernize, there is a growing need for energy-efficient materials, which is propelling the demand for vacuum insulated pipes in residential, commercial, and industrial applications. The market is also supported by rising government initiatives aimed at increasing energy efficiency and reducing environmental impacts in the manufacturing and construction sectors.

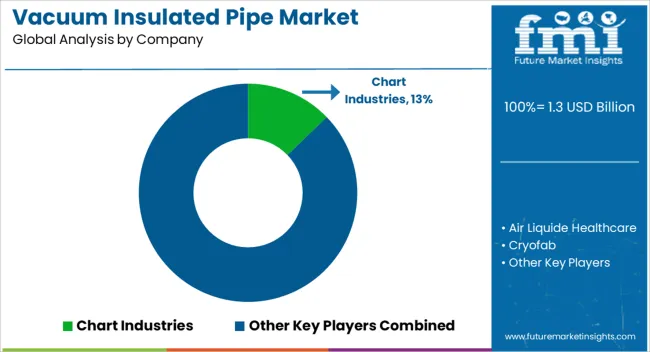

The vacuum insulated pipe (VIP) market is highly competitive, driven by the need for efficient, energy-saving solutions in industries such as cryogenics, LNG, and healthcare. Chart Industries is a major player in the market, offering advanced vacuum insulated pipe systems for cryogenic applications. The company’s solutions are widely used for transporting liquid gases and are known for their high thermal insulation properties, durability, and low maintenance requirements. Air Liquide Healthcare, a key competitor, focuses on providing VIP solutions for medical and healthcare applications, ensuring high-quality, insulated pipes for medical gas transportation in hospitals and healthcare facilities.

Cryofab and Cryospain compete by providing specialized VIP systems for cryogenic and industrial applications, with a focus on performance and reliability in extreme conditions. Cryofab, for instance, is known for offering custom-engineered solutions for LNG, nitrogen, and oxygen storage and distribution. Brugg Pipes offers a range of VIP products with advanced materials designed for transporting liquefied gases at low temperatures. The company’s pipes are used in various industries, including petrochemical, energy, and food processing, where low thermal conductivity is crucial. Perma-Pipe International Holdings focuses on supplying insulated piping solutions for the global energy sector, including systems for transporting cryogenic liquids. Vacuum Barrier Corporation and Vacree Technologies provide reliable VIP solutions with an emphasis on customized designs and high-performance materials. Demaco and Shell-n-Tube, focusing on industrial and cryogenic applications, are known for their robust systems that deliver excellent thermal insulation and resistance to mechanical stress.

These companies differentiate themselves with advanced engineering, custom solutions, and consistent performance. Product brochures highlight features such as superior thermal efficiency, high strength, corrosion resistance, and suitability for extreme temperature applications. Competitive strategies emphasize innovation in pipe design, installation efficiency, and material quality to meet the needs of the growing cryogenic, LNG, and healthcare industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 billion |

| Product | Standard and Customized |

| Application | Cryogenic, Food & Beverage, Aerospace, Electronic Manufacturing & Testing, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chart Industries, Air Liquide Healthcare, Cryofab, Cryospain, Brugg Pipes, Cryogas Equipment, Cryoworld, Cryo Anlagenbau, Perma-Pipe International Holdings, Vacree Technologies, Vacuum Barrier Corporation, Demaco, Shell-n-Tube, Ability Engineering Technology, Butting CryoTech, SPS Cryogenics, Thames Cryogenics, and Maxcon Industries |

| Additional Attributes | Dollar sales by pipe type (single, multi-layer), material (stainless steel, carbon steel, copper), and application (cryogenic gases, industrial, healthcare, food). Demand dynamics are driven by the rising need for cryogenic storage solutions, advancements in energy-efficient transport, and the expansion of industries using liquefied gases. Regional trends highlight growth in North America, Europe, and Asia-Pacific, with increasing investments in the cryogenic industry and growing healthcare and industrial applications requiring advanced thermal insulation technologies. |

The global vacuum insulated pipe market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the vacuum insulated pipe market is projected to reach USD 2.1 billion by 2035.

The vacuum insulated pipe market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in vacuum insulated pipe market are standard and customized.

In terms of application, cryogenic segment to command 29.8% share in the vacuum insulated pipe market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Sealed Packaging Market Size, Share & Forecast 2025 to 2035

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA