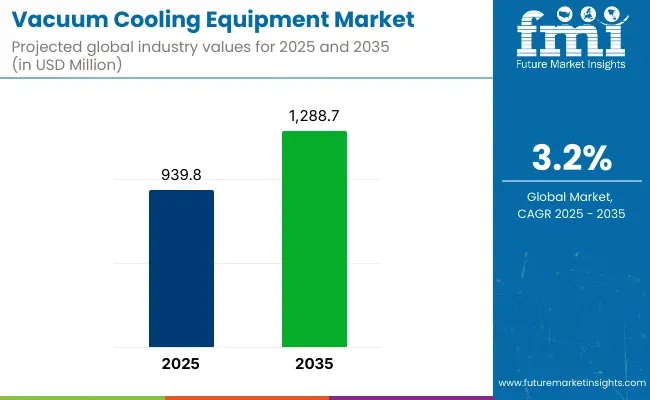

The global vacuum cooling equipment market is projected to grow from USD 939.8 million in 2025 to USD 1,288.7 million by 2035, reflecting a CAGR of 3.2% over the forecast period. This growth is largely driven by the increasing demand for advanced cooling solutions in industries such as food processing, packaging, and pharmaceuticals.

Vacuum cooling technology, which is known for its ability to rapidly reduce the temperature of various products, is increasingly being adopted to enhance production efficiency and product quality. The growing focus on minimizing energy consumption and optimizing cooling times is expected to drive the widespread adoption of vacuum cooling systems across various sectors.

The demand for vacuum cooling equipment is primarily influenced by the need for faster and more energy-efficient cooling solutions in food production, especially in the bakery and meat processing industries. As emphasized by Weber Cooling, vacuum cooling is pivotal in reducing cooling times, with the cooling of baked goods, for example, being shortened from hours to minutes.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 939.8 million |

| Market Size in 2035 | USD 1,288.7 million |

| CAGR (2025 to 2035) | 3.2% |

This not only improves product quality but also boosts productivity significantly, enabling companies to streamline operations and enhance overall efficiency. The ability of vacuum cooling to retain the freshness and nutritional content of food products has made it an indispensable technology in the food industry, particularly in the preservation of perishable items.

In 2024, Dekker Vacuum Technologies Inc. introduced the Gryphon Dry Claw Vacuum Pumps, expanding their product line to offer robust, plug-and-play solutions with minimal maintenance requirements, catering to various industrial applications. Additionally, Dekker developed custom-engineered vacuum cooling systems with a capacity of 2000 CFM, specifically designed to preserve fresh vegetables, addressing environmental concerns associated with older systems.

Dongguan COLDMAX Ltd. also made strides in international expansion, installing a pallet vacuum pre-cooler in Toronto, Canada, in November 2024, marking a significant step in expanding their market presence beyond China. These innovations reflect the ongoing advancements in vacuum cooling technology, contributing to the market’s continued growth.

The vacuum cooling equipment market is expected to grow significantly, driven by key segments such as vertical vacuum cooling equipment and applications in bakery products. Vertical vacuum cooling equipment is projected to dominate the market, while bakery products will continue to be a major application segment due to the increasing demand for efficient cooling solutions in the food industry.

Vertical vacuum cooling equipment is expected to capture 55% of the market share by 2025. Vertical vacuum cooling is widely used in various industries for rapid cooling of heat-sensitive products, especially in the food sector. This technology helps to preserve the freshness, texture, and color of food products by quickly reducing their temperature.

Vertical vacuum coolers are ideal for products that require uniform cooling and are commonly used for cooling bakery items, vegetables, and other perishable food items. Companies such as TOMRA, Ishida, and Cryovac are major players in providing vertical vacuum cooling solutions, offering efficient equipment that enhances production speeds and improves product quality.

The versatility of vertical vacuum coolers, which can be used for a wide range of food products, has contributed to their growing popularity. As the demand for fresh and high-quality food products increases, vertical vacuum cooling equipment is expected to remain the dominant technology in the market, supporting the growth of the vacuum cooling equipment segment.

Bakery products are projected to capture 40% of the vacuum cooling equipment market share by 2025. The bakery industry is one of the largest consumers of vacuum cooling equipment due to the high demand for fresh, high-quality baked goods with preserved textures and flavors. Vacuum cooling technology rapidly cools bakery products, such as bread, cakes, and pastries, helping maintain their quality and extending shelf life without compromising taste and appearance.

Leading bakery brands and commercial bakeries are increasingly adopting vacuum cooling systems to optimize production processes and improve efficiency. Companies like Bimbo Bakeries, Grupo Bimbo, and Aryzta are investing in vacuum cooling equipment to enhance their production capabilities and meet consumer demand for fresh bakery items.

The growing demand for convenience foods, combined with the need for faster cooling to prevent spoilage, is expected to further drive the market for vacuum cooling equipment in the bakery sector. As the bakery industry continues to evolve, the use of vacuum cooling systems will remain a crucial component in ensuring product quality and operational efficiency.

The USA Vacuum Cooling Equipment Market to Benefit from Growing Consumption of Fresh Fruits and Veggies

The vacuum cooling equipment market in the USA is estimated to reach a valuation of USD 228.1 Million by 2025, as per FMI. The USA vacuum cooling equipment market is projected to account for 68% of sales in North America. Demand in the country is predicted to rise due to the rising consumption of fresh vegetables and fruits.

As these product needs to be vacuum-cooled and stored as quickly as possible, the demand for vacuum-cooling equipment is predicted to burgeon. In the USA, the vacuum cooling equipment market is anticipated to witness steady expansion due to the exponential rise of the supermarket culture in the USA Further, technological advancement in food science will aid the demand for the vacuum cooling equipment Market.

Strong Presence of Vacuum Cooling Equipment Manufacturers in the UK to Fuel Demand

The UK vacuum cooling equipment market in the UK is expected to reach nearly USD 77.7 Million by 2025. The UK is projected to contribute around 22% of revenue in the Europe vacuum cooling equipment market. Demand in the market is attributed to the growing sales of baked and packaged meat products.

With the rapid expansion of the food industry in the UK, the market is expected to witness steady growth over the assessment period. Also, the presence of numerous leading players in the UK will aid the sales in the market. For instance, in 2020, Curtiss -Wright Surface Technologies announced the addition of in-house vacuum brazing, sintering, and heat treatment within our component coating and repair facility in Alfreton Derbyshire UK The facility is fitted with a sealed cooling system adhering to stringent environmental regulations.

Rising Export of Vacuum Cooling Equipment in Other Countries to Propel the Sales

According to FMI, China's vacuum cooling equipment market is expected to total USD 50.8 Million, accounting for 32% of the Asia Pacific vacuum cooling equipment market. This is due to the presence of leading players and the availability of cost-effective raw materials in China.

For instance, the leading manufacturer, of COLDMAX, in China is focusing on quality and innovation for optimal cooling speed with minimal energy consumption. The company is exporting 4 pallets of vacuum pre-coolers on average a day to countries such as Canada and others. Such developments in the country are expected to boost the market.

Leading players in the market are adopting several inorganic and organic strategies to gain a competitive edge in the market. Some of the players are investing in research and development to expand their product portfolio. Meanwhile, other players are introducing advanced cooling systems to strengthen their footprint in the industry.

For instance:

Future of Cooling: Reduce Food Waste with Dekker Vacuum Technologies, Dongguan COLDMAX, and Dongguan Huaxian Vacuum Cooling Equipment

The vacuum cooling equipment utilized by Dekker, Dongguan COLDMAX, and Dongguan Huaxian has applications for numerous companies. Technology is a great way to keep large volumes of food cold without using large amounts of energy. Vacuum cooling equipment is also becoming popular for transporting sensitive medical devices. Vacuum cooling equipment continues to grow in popularity due to its economic efficiency and high-quality performance.

Dekker Vacuum Technologies, headquartered in Michigan City, Indiana, is a market leader in producing durable and efficient vacuum systems. Dekker vacuum solutions are essential in demanding production processes like woodworking, food processing, medical, plastics, and power generation.

Recently, Dekker has made great strides to innovate its product offerings. The company has introduced a new line of compressors to meet the needs of customers looking for smaller-footprint designs. They have also launched a full range of vacuum pumps designed for specific applications such as production process cooling, cold storage temperature control, and power generation applications.

The new refrigeration series from Dekker is engineered with durability and efficiency as top priorities. The products are designed to keep up with even the most challenging conditions without sacrificing performance or quality. Each compressor features over 150 innovations that help it be more efficient and reliable than ever.

Dekker vacuum technologies Inc has recently seen immense success with its product launch. To further expand the product line, they will continue to focus on innovation and developing new ways to reduce energy consumption. Dekker will also continue their legacy of delivering high-quality and innovative products.

Another key player, COLDMAX has been the leading manufacturer of vacuum coolers, cold rooms, ice machines, and other sophisticated farm equipment since 2002 and is CE and CSA certified!

Recently, Dongguan Coldmax launched a new product, Dekker, which is a high-performance product that retains temperature. The company's partnership with top Chinese car manufacturer Geely Automobile has also brought innovation to the industry. To continue being at the forefront of technology, it plans on launching a dozen more innovative products by 2020.

These new innovations will have major breakthroughs in product design, quality control, performance, and reliability. With over 40 years of experience producing refrigeration equipment, Dongguan COLDMAX continues to lead the way for those looking for vacuum cooling equipment.

Additionally, HUAXIAN company is dedicated to being a leading supplier of new care solutions worldwide, serving agricultural, fisheries, and food industries with sophisticated, fresh reservation technology to produce the most commercial value for clients by enhancing new quality.

Since 2019, Dogguan has been steadily launching new products to meet market needs, expanding partnerships with other companies, and adding more product offerings to its line. One of these new products is a new vacuum pump that can handle high-temperature environments. This innovation will allow for the continued growth of industries such as chemical processing or oil refining, where cooling equipment is needed.

Another new product launched by Dekker is the KRYTON - a fully closed water-cooled vacuum pump with high energy efficiency, long service life, and low noise levels. In addition to these innovations, Dekker and Dongguan COLDMAX have partnered to distribute products across China and abroad.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 939.8 million |

| Market Size in 2035 | USD 1,288.7 million |

| CAGR (2025 to 2035) | 3.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed | Vertical Vacuum Cooling Equipment, Horizontal Vacuum Cooling Equipment |

| Cooling Types Analyzed | Air Cooled Screw Vacuum Pump, Water Cooled Screw Vacuum Pump |

| Applications Analyzed | Bakery Products, Meat Products, Fruit and Vegetables, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Key Players influencing the Market | BVT, Bakery Services BV, Dekker Vacuum Technologies Inc, Dongguan COLDMAX Ltd, Dongguan Huaxian Technology Co Ltd, KoolJet, SHENZHEN ALLCOLD Co Ltd, Southern Vacuum Cooling Inc, ULVAC Inc, Weber Cooling International BV, Ashland, CP Kelco, Archer Daniels Midland Company, BASF SE, Others (on demand) |

| Additional Attributes | Dollar sales by product type (vertical vs horizontal), Dollar sales by cooling type (air cooled vs water cooled), Growth trends in vacuum cooling demand across bakery and meat product sectors, Regional dynamics in vacuum cooling equipment adoption across North America, Europe, and Asia-Pacific |

The vacuum cooling equipment market size is assessed to be USD 939.8 million currently.

The vacuum cooling equipment market is expected to rise at a CAGR of 3.2%.

The USA, China, the UK, Germany, and Mexico are the key countries driving demand for the vacuum cooling equipment market.

BVT, Bakery Services BV, Dekker Vacuum Technologies Inc, Dongguan COLDMAX Ltd, and Dongguan Huaxian Technology Co Ltd are expected to be the top players driving the market growth.

The global vacuum cooling equipment market is forecasted to surpass USD 1,288.7 million by the end of 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA