The vacuum packing industry is harnessing new developments for the preservation of food, safety in pharmaceuticals, and industrial applications, thus witnessing investments. Vacuum-sealed packages gain shelf life, maintain integrity, and preserve a barrier against contamination; hence, demand is driving. Companies are opting to use thicker barriers, advanced vacuum-sealing technologies, and sustainable materials to reduce plastic wastage.

Multi-layer films, recyclable vacuum pouches, and modified atmosphere packaging (MAP) are being traversed by manufacturers in improving food safety and logistics efficiency. AI-integrated quality control systems and tamper-proof designs are being coupled with biodegradable vacuum bags in line with regulations and changing consumer preferences. The industry is slowly transitioning towards flexible, lightweight, and sustainable solutions for vacuum packaging across many applications.

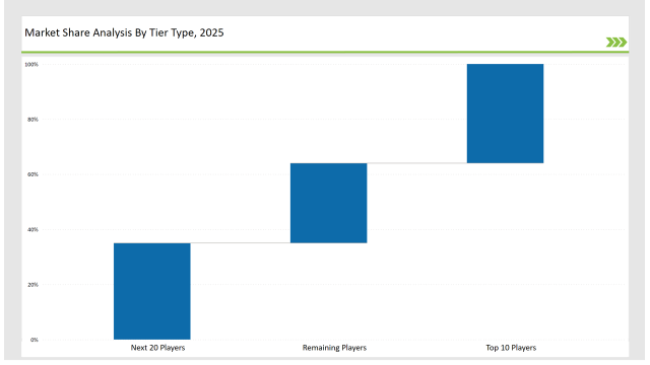

The first-tier players lead the pack in technology, global supply chain integration, and high-performance vacuum-sealed films-owning 36% of the market.

The second-tier companies Mondi Group, Winpak, and Coveris take 35% of the market, serving with cost-effective, innovative, and sustainable vacuum-packaging solutions for food, medical, and industrial applications.

Third-tier players consist of the regional and niche players specialized in biodegradable vacuum bags, smart vacuum sealing systems, and custom-printed vacuum pouches, with a share of 29% in the market. These companies focus primarily on local production, sustainable packaging innovations, and bespoke solutions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Berry Global) | 17% |

| Rest of Top 5 (Mondi Group, Winpak) | 11% |

| Next 5 of Top 10 (Coveris, Bemis, Schur Flexibles, Linpac Packaging, ULMA Packaging) | 8% |

The vacuum packaging industry serves multiple sectors where shelf life, product safety, and cost efficiency are essential. Companies are innovating vacuum packaging to meet high industry standards.

Manufacturers are optimizing vacuum packaging with advanced sealing technology, high-barrier films, and smart packaging solutions.

Sustainability and automation are the new norm in the vacuum packaging industry. Companies are implementing AI-assisted inspection, green films, and automated vacuum-sealing lines into their production processes to improve efficiencies. Moreover, companies are focusing on the introduction of high-barrier biodegradable packages to replace one-time single-use plastics. Manufactures are extending modified atmosphere packaging (MAP) solutions in order to ensure product freshness and safety. Additionally, organizations are offering intelligent vacuum-sealed packaging using embedded sensors for real-time monitoring.

Year-on-Year Leaders

Technology suppliers should focus on automation, sustainable materials, and digital monitoring to support the evolving vacuum packaging market. Partnering with food processors, pharmaceutical companies, and logistics firms will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Berry Global |

| Tier 2 | Mondi Group, Winpak, Coveris |

| Tier 3 | Bemis, Schur Flexibles, Linpac Packaging, ULMA Packaging |

Leading manufacturers are advancing vacuum packaging technology with smart monitoring, biodegradable materials, and high-efficiency sealing solutions.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched recyclable vacuum-sealed packaging in March 2024. |

| Sealed Air | Developed AI-powered automated vacuum-sealing in April 2024. |

| Berry Global | Expanded sustainable vacuum-sealed films in May 2024. |

| Mondi Group | Released biodegradable vacuum bags for meats in June 2024. |

| Winpak | Strengthened tamper-evident pharmaceutical packaging in July 2024. |

| Coveris | Introduced resealable vacuum pouches in August 2024. |

| Bemis | Pioneered smart IoT-enabled vacuum packaging in September 2024. |

The vacuum packaging market is evolving as companies invest in sustainability, automation, and smart packaging technologies.

AI integrated sealing systems, intelligent tracking, and high barrier sustainable films are expected to be integrated continuously into the industry. The industry will also refine compostable and recyclable vacuum bags to meet environmental regulations. Intelligent packaging with temperature and freshness sensors will be adopted by a business. Innovations that enhance convenience and shelf life will be adopted in vacuum packaging. Product traceability will grow digitally. In addition, the vacuum packaging will be intensively extended by companies to emerging economies for improved food security and waste reduction.

Based on the material, the vacuum packaging market can be divided into Polyethylene (PE), Polypropylene (PP), Polyamide (PA), Ethylene Vinyl Alcohol (EVOH), and Polyethylene terephthalate (PET).

Based on the end use, the vacuum packaging market is divided into food and non-food. The food segment is further subdivided into meat, poultry, seafood, dairy products, fresh produce, ready meals, and preserved food.

Based on the film structure, the vacuum packaging market can be divided into the following segments: monolayer, 3 layers, 5 layers, 7 layers, and more than 7 layers.

The sector has been analyzed with the following regions covered: North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

Leading players include Amcor, Sealed Air, Berry Global, Mondi Group, Winpak, Coveris, and Bemis.

The top 3 players collectively control 17% of the global market.

The market shows medium concentration, with top players holding 36%.

Key drivers include sustainability, smart packaging, automation, and food safety.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Vacuum Skin Packaging Providers

Key Companies & Market Share in the Vacuum Thermoformed Packaging Sector

Vacuum Packaging Market Trends, Growth, Forecast 2024 to 2034

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Sealed Packaging Market Size, Share & Forecast 2025 to 2035

Vacuum Chamber Packaging Machines Market

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Global Packaging Tapes Market Share Analysis – Size, Growth & Forecast 2025–2035

Market Share Distribution Among Packaging Films Suppliers

Market Share Insights of Leading Packaging Tube Providers

Competitive Breakdown of Tea Packaging Providers

Market Leaders & Share in the Egg Packaging Industry

Industry Share & Competitive Positioning in Packaging Laminate Market

Analyzing Meat Packaging Market Share & Industry Growth

Competitive Overview of Gift Packaging Companies

Breaking Down Market Share in FMCG Packaging

Competitive Overview of Shoe Packaging Companies

Assessing Dry Vacuum Pumps Market Share & Key Insights

Market Share Distribution Among Cider Packaging Companies

Market Share Breakdown of AI in Packaging Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA