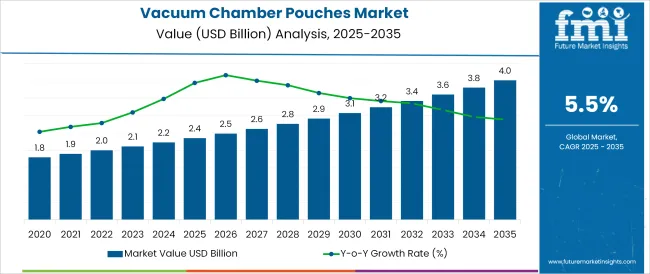

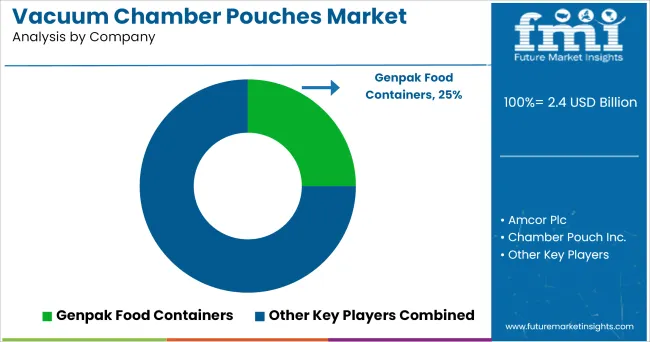

The Vacuum Chamber Pouches Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The vacuum chamber pouches market is undergoing steady growth, driven by rising demand for extended shelf-life packaging, particularly in the food, pharmaceutical, and industrial sectors. As consumer awareness around food safety and product freshness continues to grow manufacturers are prioritizing barrier-resistant, puncture-proof materials that ensure optimal preservation.

Technological advancements in multilayer film construction and heat-sealing capabilities have elevated the performance of vacuum pouches in moisture, oxygen, and aroma protection. The shift toward sustainable packaging is also shaping material innovations, with a focus on recyclable and lightweight polymers.

Growth is further influenced by the proliferation of ready-to-eat meals, frozen foods, and vacuum-sealed bulk products in retail and institutional channels. Digital printing and customizable pouch formats are being widely adopted to enhance brand appeal, product differentiation, and compliance with labelling standards. Looking forward, demand is expected to surge across emerging economies and convenience-driven markets, supported by innovations in automated vacuum packaging machinery and logistics integration.

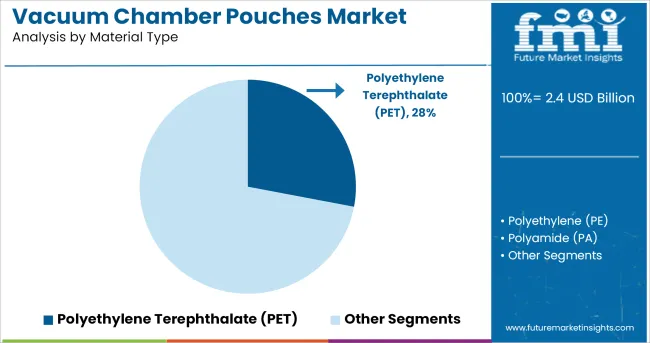

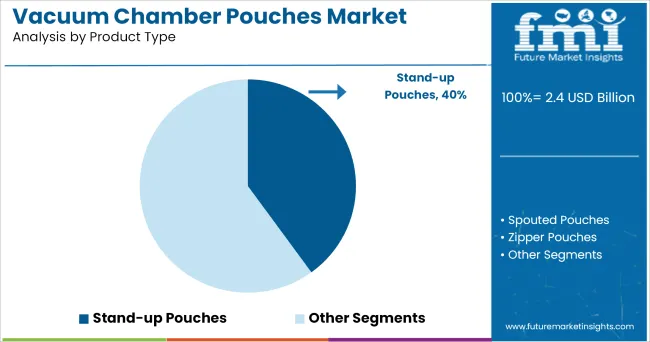

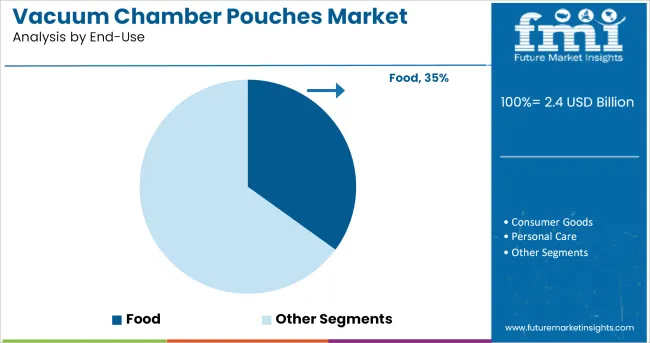

The market is segmented by Material Type, Product Type, and End-Use and region. By Material Type, the market is divided into Polyethylene Terephthalate (PET), Polyethylene (PE), Polyamide (PA), Cast Polypropylene (CPP), and Others Plastics. In terms of Product Type, the market is classified into Stand-up Pouches, Spouted Pouches, Zipper Pouches, and Tear Notch Pouches. Based on End-Use, the market is segmented into Food, Consumer Goods, Personal Care, Home Care, and Confectionary. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene Terephthalate (PET) is anticipated to account for 28.0% of the revenue share in 2025 under the material type segment, making it the leading material in the vacuum chamber pouches market. This is driven by its excellent strength-to-weight ratio, barrier resistance, and ability to withstand vacuum pressure without compromising seal integrity.

PET’s compatibility with lamination and co-extrusion processes enables it to be combined with other substrates, further enhancing puncture resistance and thermal stability. Its clarity and printability have also contributed to its use in high-visibility packaging, particularly for consumer-facing food products.

Moreover, the recyclability and cost-efficiency of PET compared to alternative materials have strengthened its position as a preferred option among manufacturers focused on sustainability and mass production.

Stand-up pouches are expected to lead the product type segment with a 40.1% share in 2025. Their dominance stems from their high convenience factor, space-saving storage benefits, and increased shelf visibility, all of which align with evolving retail and consumer demands.

The format offers stability for display and improved usability for re-sealable vacuum packaging, making it highly attractive in retail food packaging and promotional applications.

Additionally, the structural flexibility of stand-up pouches supports integration with oxygen and moisture barriers, enabling efficient product preservation while minimizing material usage. The rise in ready-to-cook, deli, and snack food segments has accelerated demand for user-friendly packaging solutions, reinforcing the segment’s leadership position.

The food end-use segment is projected to contribute 35.0% of total market revenue in 2025, securing its role as the dominant application area for vacuum chamber pouches. This is being driven by the increasing need to maintain product integrity, prevent spoilage, and extend shelf life across perishable food categories.

From meats and dairy to frozen and processed goods, vacuum chamber pouches are being adopted for their ability to reduce oxidation, inhibit bacterial growth, and improve overall food safety. Regulatory standards around packaging hygiene and traceability have further catalysed adoption, particularly in retail and industrial food supply chains.

Additionally, the proliferation of e-commerce grocery platforms and cold-chain logistics has necessitated durable, tamper-resistant vacuum pouches, solidifying the food segment’s commanding share in the overall market.

Compared to the usual packaging solutions, vacuum chamber pouches bestows an added advantage of carrying and storing two different products and also allows an extended shelf life as it provides a barrier to air, UV light and retains the moisture inside the package.

The vacuum chamber pouches also provide a flexible packaging solution that reduces the production cost, transportation cost and also acquires less space and minimizes the damages.

Owing to the speedy urbanization and a healthy growth rate in the pharmaceutical, and food & beverages industry is boosting the growth rate of the vacuum chamber pouches market.

The main challenges faced by the vacuum chambers pouches market are the initial production cost that is high as compared to the other packaging production. The demand of the modified atmosphere packaging market might hamper the growth of the vacuum chamber pouches market as the packaging is not quite resistant to temperature once the seal is opened.

Consumer preference for lightweight, re-closable packaging, portable, moisture resistant, recyclable products is attracting the attention of customers towards the vacuum chamber pouches. This is creating various opportunities for the manufacturers to provide unique packaging solutions that will make the customers switch from conventional packaging options to vacuum packaging.

These attributes create a better growth opportunity for the vacuum chamber pouches in the pharmaceutical industry owing to the advantages provided by the vacuum chamber pouches of storing two different items together without affecting the other item stored and maintaining the freshness too.

According to the Ministry of Food Processing Industries India, the food processing sector has an annual growth of 8.12%. Owing to the demand for pre-processing packaged food across the world due to the change in lifestyle and buying patterns of consumers the vacuum chamber pouches market is expected to grow at a high pace in the Asia Pacific market specifically India and China.

The growing consumption and availability of frozen or pre-processed foods even in the rural areas are benefiting the vacuum chamber market to grow tremendously. Key players are also looking for expansion of the business in the untapped market of the developing countries to attract customers and also benefits the business.

Key players in the Asia Pacific region of the Vacuum Chamber Pouches Market:

The global vacuum chamber pouches market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the vacuum chamber pouches market is projected to reach USD 4.0 billion by 2035.

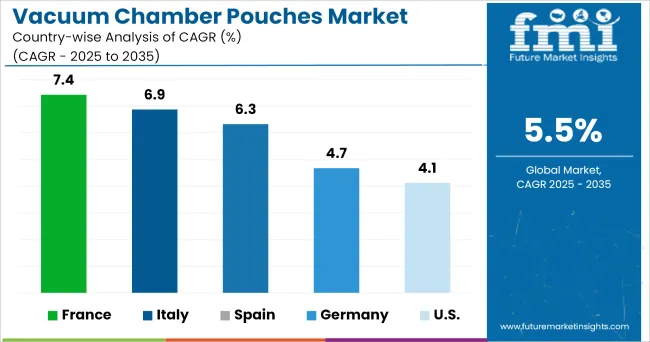

The vacuum chamber pouches market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in vacuum chamber pouches market are polyethylene terephthalate (pet), polyethylene (pe), polyamide (pa), cast polypropylene (cpp) and others plastics.

In terms of product type, stand-up pouches segment to command 40.0% share in the vacuum chamber pouches market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA