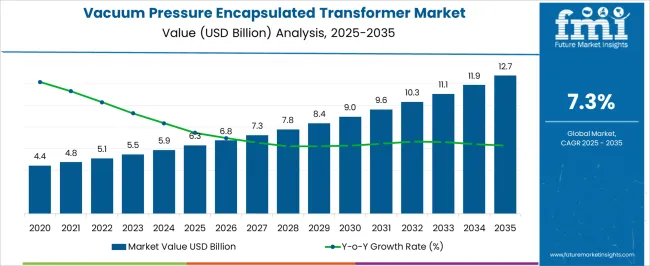

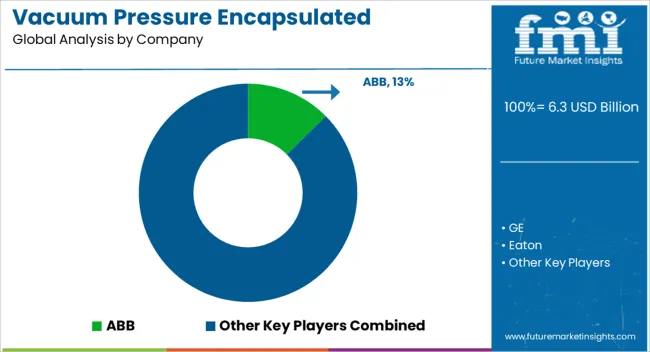

The vacuum pressure encapsulated transformer market, valued at USD 6.3 billion in 2025 and projected to reach USD 12.7 billion by 2035 at a CAGR of 7.3%, shows uneven regional growth patterns between Asia Pacific, Europe, and North America. Asia Pacific is positioned as the dominant growth driver, supported by expanding electricity infrastructure, urban power distribution upgrades, and rising renewable energy integration.

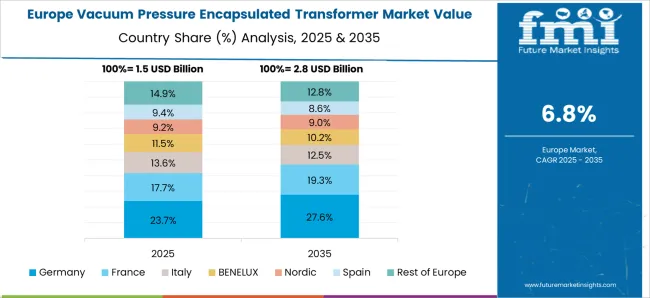

Countries such as China and India are expected to contribute significantly, leveraging large-scale grid modernization and industrial power demand, leading to the region posting the fastest growth rates. Europe, while growing steadily, is shaped by regulatory frameworks, renewable deployment, and grid reliability requirements. The push for energy efficiency, decarbonization, and replacement of aging transmission infrastructure drives adoption. However, growth will remain moderate compared to Asia Pacific due to market saturation in key economies like Germany, France, and the United Kingdom. North America reflects a middle path, with strong demand from smart grid investments and resilience requirements in the United States and Canada.

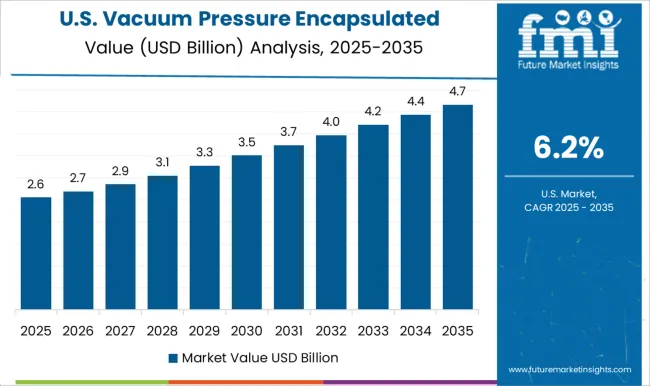

The replacement of traditional transformers with vacuum pressure-encapsulated systems in the commercial and industrial sectors will provide sustained momentum. Nonetheless, North America’s growth pace will trail Asia Pacific but remain ahead of Europe in absolute capacity expansion by 2035.

| Metric | Value |

|---|---|

| Vacuum Pressure Encapsulated Transformer Market Estimated Value in (2025 E) | USD 6.3 billion |

| Vacuum Pressure Encapsulated Transformer Market Forecast Value in (2035 F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The vacuum pressure encapsulated transformer market is recognized as a specialized category within the electrical equipment industry, known for its reliability in harsh operating environments. Within the broader transformer market, this segment accounts for nearly 4.1%, supported by demand in industrial and infrastructure applications. In the dry type transformer category, it holds about 6.5%, emphasizing its durability and low maintenance features. Across the medium voltage electrical equipment market, the share is estimated at 3.8%, driven by increasing installation in commercial and utility-scale projects. In the power distribution equipment sector, it represents around 2.9%, showcasing its growing relevance for resilient grid operations. Within the renewable energy integration equipment market, the share is approximately 2.2%, reflecting adoption in solar and wind projects where environmental resilience is critical. Recent developments in the vacuum pressure encapsulated transformer market highlight innovation in insulation technology, material science, and digital monitoring.

Groundbreaking strategies have included the use of advanced epoxy resin formulations for improved thermal endurance and extended service life. Manufacturers are adopting smart sensors and IoT-based monitoring to predict failures and improve efficiency. Strategic partnerships between utilities and equipment providers have been established to deploy these transformers in offshore wind and desert solar farms, where reliability under extreme conditions is crucial. Modular designs that allow compact installation in space-constrained facilities are gaining traction. The investment is being made in eco-friendly insulation materials and recyclable components to meet tightening regulatory frameworks and customer preferences for sustainable equipment solutions.

The vacuum pressure encapsulated transformer market is witnessing steady growth, propelled by the increasing need for reliable, low-maintenance transformers in industrial and commercial power distribution systems. Enhanced operational safety, moisture resistance, and extended service life are key factors driving adoption, especially in harsh operating environments. The current market is supported by infrastructure modernization, renewable energy integration, and the rising emphasis on operational efficiency in energy systems.

Compact design and low noise emissions further contribute to their suitability in space-constrained installations. Manufacturers are focusing on enhancing thermal performance and mechanical durability to meet the diverse needs of various applications.

Investments in industrial automation, urban infrastructure, and decentralized power generation will reinforce growth. The combination of technical advantages and expanding application scope positions vacuum pressure encapsulated transformers as a preferred solution in multiple end-use sectors.

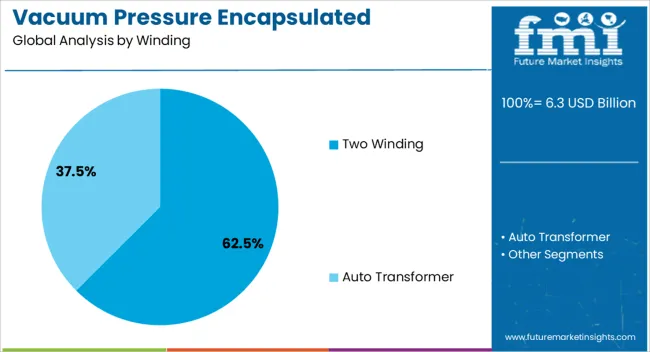

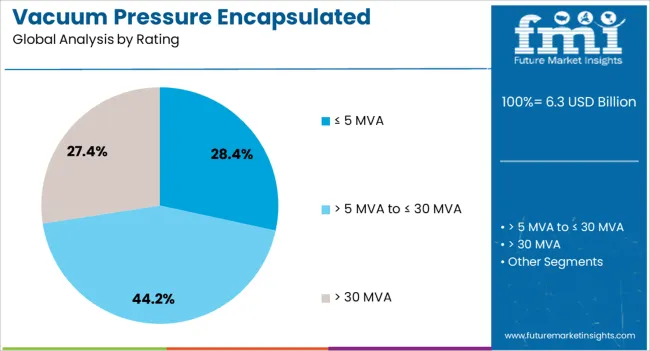

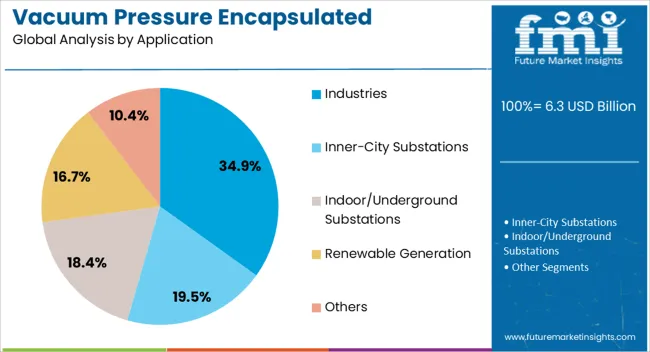

The vacuum pressure encapsulated transformer market is segmented by winding, rating, application, and geographic regions. By winding, vacuum pressure encapsulated transformer market is divided into Two Winding and Auto Transformer. In terms of rating, vacuum pressure encapsulated transformer market is classified into ≤ 5 MVA, > 5 MVA to ≤ 30 MVA, and > 30 MVA. Based on application, vacuum pressure encapsulated transformer market is segmented into Industries, Inner-City Substations, Indoor/Underground Substations, Renewable Generation, and Others. Regionally, the vacuum pressure encapsulated transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The two winding segment leads the winding category in the vacuum pressure encapsulated transformer market, holding approximately 62.5% share. This dominance is attributed to the segment’s cost-efficiency, robust performance, and suitability for a wide range of voltage transformation applications.

Two winding designs provide effective electrical isolation between primary and secondary circuits, ensuring safety and reliability in industrial and utility operations. The segment’s prominence is further supported by its adaptability across low and medium voltage requirements, enabling broad adoption in manufacturing plants, commercial facilities, and renewable energy projects.

Manufacturing processes for two winding transformers are well-established, allowing for competitive pricing and consistent quality. With the ongoing expansion of industrial capacity and infrastructure upgrades in emerging markets, the segment is expected to maintain its leadership, supported by sustained demand for durable, low-maintenance transformer solutions.

The ≤ 5 MVA segment dominates the rating category, accounting for approximately 28.4% of the market share. Its leadership is driven by the widespread use of transformers in small to medium-scale industrial, commercial, and institutional power distribution systems.

The segment benefits from lower installation costs, reduced maintenance requirements, and operational suitability for decentralized energy systems. Increasing adoption in renewable energy projects, where compact and efficient transformers are required, has reinforced its position.

The segment also aligns well with the growing trend toward localized power generation and microgrids, where smaller capacity transformers provide operational flexibility. With ongoing investments in distributed energy infrastructure and commercial facility upgrades, demand for ≤ 5 MVA transformers is expected to remain strong, sustaining its position in the overall market landscape.

The industries segment leads the application category, representing approximately 34.9% share of the vacuum pressure encapsulated transformer market. This dominance is due to the segment’s reliance on reliable and durable transformers for uninterrupted operations in manufacturing, processing, and heavy-duty industrial environments.

The moisture resistance and thermal stability of vacuum pressure encapsulated designs make them ideal for challenging industrial settings, ensuring consistent performance and extended service life. Industries also benefit from the reduced fire risk and maintenance costs associated with these transformers, making them a cost-effective long-term investment.

Growth in industrial automation, expansion of manufacturing capacity in emerging economies, and stricter safety standards have further supported demand. With continued investment in industrial infrastructure and the need for reliable power distribution systems, the industries segment is projected to sustain its leading share over the forecast period.

The market has been expanding due to increasing demand for compact, reliable, and thermally efficient power solutions across industrial, commercial, and residential sectors. These transformers are manufactured by encapsulating windings with epoxy resin under vacuum pressure, ensuring mechanical strength, moisture resistance, and extended operational life. Their ability to function in harsh environments such as chemical plants, marine applications, and renewable energy installations has made them widely preferred. Growing emphasis on safety, reduced maintenance, and improved performance is boosting adoption. Market expansion is also being shaped by advancements in insulation technologies and the rising integration of smart grid infrastructure worldwide.

Vacuum pressure encapsulated transformers are being increasingly used in challenging industrial environments due to their superior durability. Their epoxy resin encapsulation provides excellent protection against moisture, dust, and corrosive agents, making them suitable for marine operations, oil and gas facilities, and chemical plants. Industrial users prefer them over conventional designs because of reduced downtime and longer service cycles. Their compact structure ensures space efficiency in confined industrial settings. The ability to withstand thermal and electrical stress has positioned these transformers as reliable choices for heavy-duty applications. This industrial demand is expected to remain one of the strongest contributors to the market growth.

The development of advanced resin materials and improved insulation techniques has enhanced the performance of vacuum pressure encapsulated transformers. Manufacturers are adopting epoxy resin formulations with higher thermal resistance, improving operational stability under fluctuating load conditions. Enhanced material technology also allows better mechanical shock absorption, contributing to extended service life. These advancements ensure consistent operation in both indoor and outdoor environments. With electrical safety regulations becoming stricter, the focus on high-performance insulation is intensifying. These innovations not only improve reliability but also reduce the risk of failures, reinforcing the suitability of these transformers for demanding industrial and utility applications globally.

The market for vacuum pressure encapsulated transformers is benefitting from the global expansion of renewable energy systems. Solar, wind, and hydroelectric projects require reliable transformers capable of functioning in outdoor and humid conditions without frequent maintenance. The encapsulated design protects windings from environmental stress, ensuring uninterrupted operation in renewable installations. Compactness and ease of installation also add to their appeal for distributed renewable projects. Grid operators are adopting these transformers to improve resilience in renewable-heavy networks. With renewable capacity rising worldwide, demand for reliable transformer technology is increasing, reinforcing the role of vacuum pressure encapsulated transformers in sustainable power distribution networks.

Smart grid deployment and modern infrastructure projects are driving the adoption of vacuum pressure encapsulated transformers. Their ability to deliver stable performance in compact footprints suits modern distribution networks. Urban projects involving high-rise buildings, metro systems, and commercial complexes rely on reliable and low-maintenance transformers for uninterrupted power. Their fire resistance and safety features align well with building codes and electrical standards. Integration with monitoring technologies also allows predictive maintenance, reducing operational costs for utilities and facility operators. The growing need for reliable power distribution in rapidly modernizing cities positions vacuum pressure encapsulated transformers as critical components in future electrical infrastructure planning.

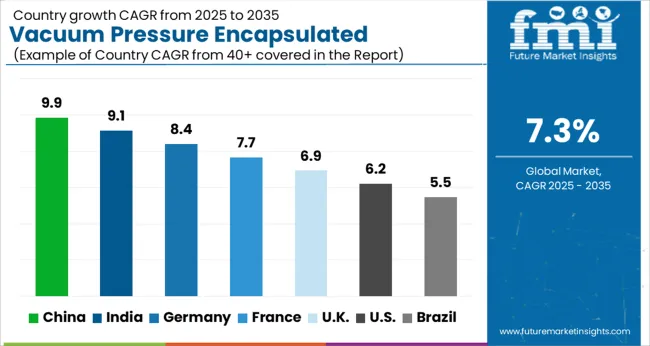

| Countries | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The market is forecast to grow at a CAGR of 7.3% between 2025 and 2035, supported by rising demand for reliable power distribution and enhanced transformer protection in industrial and commercial sectors. China leads with 9.9%, as significant investments in power infrastructure modernization drive transformer adoption. India follows at 9.1%, propelled by grid expansion and emphasis on energy-efficient solutions. Germany stands at 8.4%, where industrial automation and renewable integration are advancing deployment. The UK records 6.9%, supported by grid reinforcement initiatives, while the USA at 6.2% benefits from upgrades in power transmission and distribution systems. Growing need for compact, durable, and maintenance-friendly transformers is expected to influence adoption across global markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

China advanced at a 9.9% CAGR, propelled by the rapid expansion of power distribution infrastructure and rising demand for durable electrical equipment. Vacuum pressure encapsulated transformers gained preference due to their high insulation strength, reliability under fluctuating load conditions, and reduced maintenance requirements. Domestic manufacturers invested in localized production facilities while also exporting to neighboring Asian markets. Competitive strategies emphasized compact designs, improved thermal performance, and compliance with international standards to serve industrial and commercial applications. Strong investments in renewable energy grids and smart power distribution encouraged further adoption of these transformers across China.

India registered a 9.1% CAGR, driven by increasing electrification initiatives, renewable energy integration, and a focus on reliable power distribution. Vacuum pressure encapsulated transformers were adopted in industrial, commercial, and residential applications due to their safety features and operational longevity. Domestic players emphasized cost-effective designs while partnering with international firms to upgrade insulation and efficiency standards. Rising investment in solar and wind power grids further accelerated adoption, as encapsulated transformers offered resistance to environmental stress and fluctuating loads. Government policies promoting energy reliability and efficiency encouraged wider adoption across state and private utility networks.

Germany moved forward at an 8.4% CAGR, supported by industrial automation, renewable energy expansion, and demand for compact power distribution solutions. Vacuum pressure encapsulated transformers were favored in applications requiring high operational reliability, reduced maintenance, and resistance to harsh environments. German manufacturers focused on precision engineering, energy efficiency, and digital monitoring integration for improved system performance. Adoption was driven by the growing shift toward decentralized energy grids, electric mobility infrastructure, and industrial efficiency programs. Export competitiveness was enhanced by strict adherence to European energy standards, making German products a benchmark for quality in global markets.

The United Kingdom recorded a 6.9% CAGR, influenced by investments in power grid modernization and renewable energy transition. Vacuum pressure encapsulated transformers were adopted for their ability to operate safely in confined environments with minimal maintenance. Local utilities and industries invested in high efficiency designs to reduce operational losses. Competitive strategies involved collaborations with global suppliers to integrate advanced insulation materials and compact configurations. Demand was also supported by the expansion of offshore wind energy projects and urban power distribution requirements. UK policies emphasizing energy efficiency and reliability encouraged adoption in both public and private power networks.

The United States posted a 6.2% CAGR, influenced by infrastructure modernization and the rising need for reliable energy distribution. Vacuum pressure encapsulated transformers gained preference in industrial facilities, renewable energy projects, and urban networks due to their operational reliability and reduced maintenance. American manufacturers and utilities emphasized higher efficiency ratings, environmentally safe insulation materials, and integration with digital monitoring platforms. Competitive strategies included collaborations with renewable energy developers and grid operators to ensure compatibility with modern power systems. Government incentives for renewable energy and smart grids also encouraged wider adoption across diverse end-user segments.

The market has been driven by global electrical equipment leaders and regional specialists, competing on reliability, safety, and energy efficiency. ABB, Siemens Energy, and Schneider Electric have focused on advanced encapsulation processes that enhance insulation, thermal performance, and operational life. GE, Eaton, and Hitachi Energy Ltd. have targeted industrial and utility applications, emphasizing compact design, reduced maintenance, and high efficiency under demanding operating conditions. CG Power & Industrial Solutions and Toshiba Energy Systems have strengthened their positions by addressing regional infrastructure requirements with cost-efficient yet technically advanced solutions. Bharat Heavy Electricals Limited, Raychem RPG, URJA Techniques, and WEG have leveraged strong local manufacturing capabilities, supplying custom-built transformers for power distribution and industrial networks. Fuji Electric and TMC Transformers S.P.A. highlight specialized encapsulation technologies for improved dielectric strength and resistance to moisture and dust. SGB SMIT has emphasized performance stability and adaptability across diverse grid conditions. Product brochures consistently showcase benefits such as high mechanical strength, resistance to environmental stress, and operational safety in critical installations.

Competition in the market revolves around durability, installation flexibility, and lifecycle efficiency. ABB and Siemens emphasize digital monitoring and smart grid integration, while GE and Eaton highlight low operational losses. TMC Transformers and Fuji Electric position themselves on innovation in resin and vacuum encapsulation technologies, while URJA Techniques and Raychem RPG focus on tailored solutions for regional markets. Brochures serve as strategic communication tools, underlining thermal resilience, compact dimensions, and compliance with international safety standards. The market has evolved toward reliability, performance assurance, and technological differentiation as primary drivers of customer preference.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.3 Billion |

| Winding | Two Winding and Auto Transformer |

| Rating | ≤ 5 MVA, > 5 MVA to ≤ 30 MVA, and > 30 MVA |

| Application | Industries, Inner-City Substations, Indoor/Underground Substations, Renewable Generation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, GE, Eaton, Schneider Electric, Siemens Energy, Hitachi Energy Ltd., CG Power & Industrial Solutions Ltd., Toshiba Energy Systems & Solutions Corporation, Bharat Heavy Electricals Limited (BHEL), Raychem RPG Private Limited, Fuji Electric Co., Ltd., WEG, URJA Techniques, TMC Transformers S.P.A., and SGB SMIT |

| Additional Attributes | Dollar sales by transformer type and application, demand dynamics across industrial, commercial, and utility sectors, regional trends in compact and energy-efficient transformer adoption, innovation in vacuum pressure encapsulation, insulation, and thermal management, environmental impact of material use and energy efficiency, and emerging use cases in renewable integration, smart grids, and high-reliability power distribution. |

The global vacuum pressure encapsulated transformer market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the vacuum pressure encapsulated transformer market is projected to reach USD 12.7 billion by 2035.

The vacuum pressure encapsulated transformer market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in vacuum pressure encapsulated transformer market are two winding and auto transformer.

In terms of rating, ≤ 5 mva segment to command 28.4% share in the vacuum pressure encapsulated transformer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Heat Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA