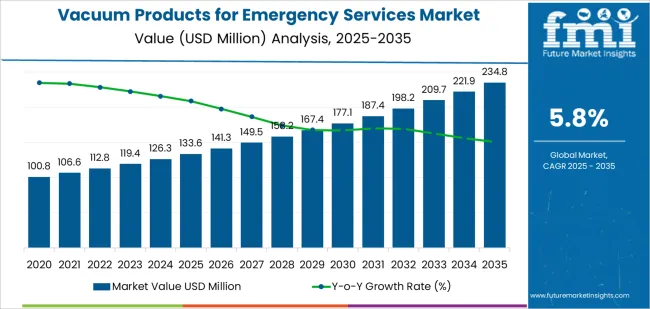

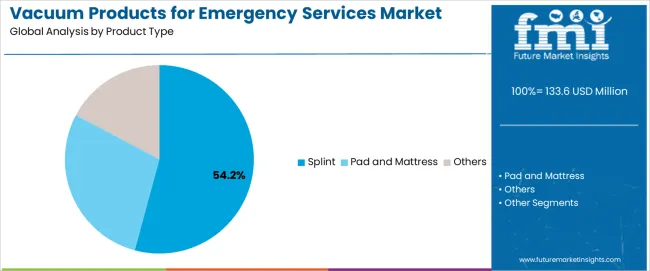

The vacuum products for emergency services market is projected to expand from USD 133.6 million in 2025 to USD 234.9 million by 2035, growing at a CAGR of 5.8% and achieving total growth of 75.8% over the decade. The rise in demand shows the growing emphasis on rapid patient immobilization, trauma care standardization, and equipment modernization across global emergency medical systems. Expansion in ambulance fleets, pre-hospital care programs, and industrial safety initiatives is fostering steady adoption of vacuum splints, pads, and mattresses designed for versatile trauma management. The splint segment, leading with a 54.2% share, remains dominant due to its clinical reliability and ease of deployment, while pad and mattress systems gain traction for comprehensive spinal immobilization and mass casualty preparedness.

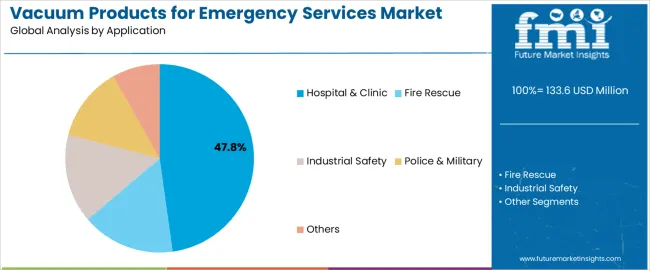

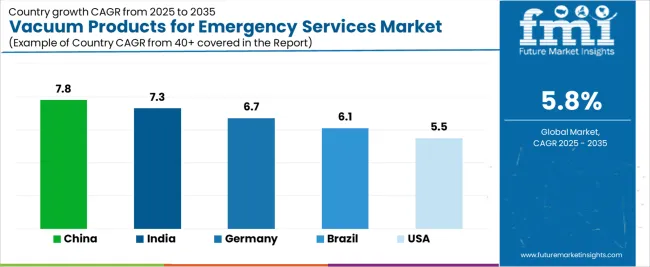

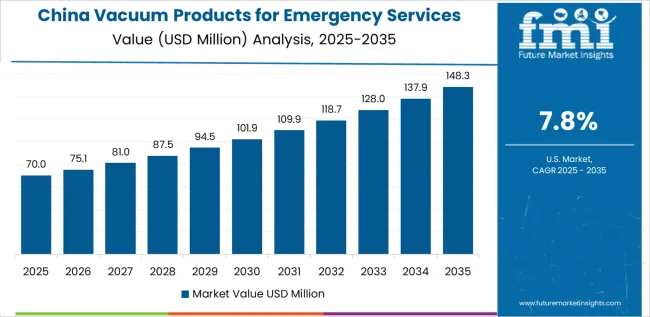

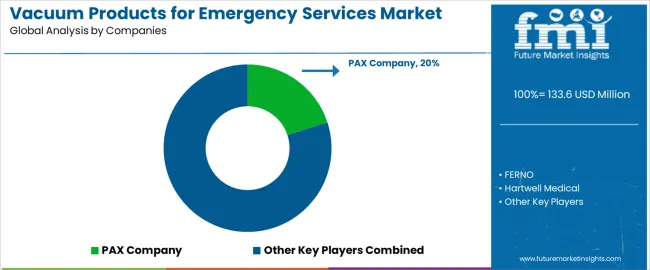

Growth in the hospital and clinic segment, which holds a 47.8% share, will continue through enhanced trauma center capabilities and emergency department equipment upgrades. The fire rescue segment will post notable adoption due to the integration of vacuum systems in confined-space rescues and vehicle extrication missions, while industrial safety applications expand alongside workplace injury preparedness programs. Asia Pacific leads regional growth, particularly in China (7.8% CAGR) and India (7.3% CAGR), driven by emergency infrastructure development and industrial compliance regulations. Germany (6.7%) maintains technological leadership through stringent trauma care standards, while Brazil (6.1%) and the United States (5.5%) sustain demand through modernization and standardization programs. Competitive dynamics are defined by established manufacturers such as PAX Company, FERNO, and Hartwell Medical, supported by specialized firms including MeBer, Royax, and Oscar Boscarol, each leveraging validated immobilization designs and durable lightweight materials.

Regional dynamics demonstrate concentrated growth in established emergency services infrastructure with mature trauma care systems and expanding industrial safety sectors. Asian markets, LED by China and India, are experiencing accelerated adoption driven by emergency services modernization and industrial safety regulation enhancement. European markets maintain steady growth supported by stringent trauma care standards and continuous protocol improvement initiatives in emergency medical services. North American operations focus on technology integration and equipment standardization across emergency response workflows.

Technology adoption patterns reflect the transition from rigid splinting devices to vacuum-based immobilization systems capable of rapid patient stabilization and comprehensive injury support. Medical equipment manufacturers are developing integrated platforms that combine multiple immobilization applications with lightweight materials, addressing emergency service requirements for operational efficiency and patient care optimization. The market faces ongoing challenges related to equipment durability requirements, maintenance standardization across emergency protocols, and cost justification for smaller emergency service operations with limited equipment budgets.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 133.6 million |

| Market Forecast Value (2035) | USD 234.9 million |

| Forecast CAGR (2025-2035) | 5.8% |

| EMERGENCY CARE EVOLUTION | REGULATORY STANDARDS | TECHNOLOGICAL ADVANCEMENT |

|---|---|---|

| Trauma Care Protocol Enhancement Continuous advancement of pre-hospital trauma management protocols across emergency medical services driving demand for specialized patient immobilization equipment and rapid stabilization capabilities. Industrial Safety Expansion Growing industrial operations and workplace safety requirements creating demand for emergency response equipment in manufacturing facilities and construction operations. Mass Casualty Preparedness Increasing emphasis on disaster response capabilities and mass casualty incident management requiring scalable immobilization equipment across emergency service organizations. |

Emergency Medical Standards Regulatory frameworks establishing mandatory equipment specifications favoring vacuum-based immobilization systems with proven patient safety performance. Occupational Safety Requirements Workplace safety regulations necessitating comprehensive emergency response capabilities and specialized medical equipment for industrial operations. Emergency Service Certification Professional certification requirements and quality standards driving investment in standardized equipment with validated clinical performance across emergency applications. |

Lightweight Material Innovation Development of advanced materials enabling durable vacuum products with reduced weight and enhanced portability for emergency response operations. Rapid Deployment Systems Quick-release valves and simplified operation procedures enabling faster patient stabilization and reduced on-scene time in emergency situations. Multi-Application Platforms Versatile vacuum splinting systems capable of supporting diverse injury patterns and patient sizes through flexible design configurations. |

| Category | Segments Covered |

|---|---|

| By Product Type | Splint, Pad and Mattress, Others |

| By Application | Hospital & Clinic, Fire Rescue, Industrial Safety, Police & Military, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Splint | Leader in 2025 with 54.2% market share projected to maintain dominance through 2035. Established immobilization protocol with standardized application procedures across ambulance services and emergency medical operations. Versatile injury stabilization capability and proven clinical performance across diverse trauma scenarios. Momentum: steady growth driven by emergency medical service expansion and trauma care protocol enhancement. Watchouts: competition from rigid splinting alternatives in specific applications and material durability requirements in high-use environments. |

| Pad and Mattress | Growing segment with 32.6% market share benefiting from spinal immobilization requirements and full-body stabilization applications. Critical for trauma transport operations and patient transfer procedures requiring comprehensive support. Adoption concentrated in hospital emergency departments and advanced life support operations. Momentum: rising through enhanced trauma care standards and mass casualty preparedness programs. Watchouts: higher equipment costs and storage space requirements compared to splinting alternatives. |

| Others | Niche segment with 13.2% market share encompassing specialized vacuum products including positioning devices and pediatric immobilization systems. Limited commercial adoption with focus on specialized emergency applications and tactical medical operations. Small installed base concentrated in advanced trauma centers and military medical units. Momentum: selective adoption in specialized rescue applications and pediatric emergency programs. Watchouts: standardization challenges and limited equipment availability from mainstream manufacturers. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Hospital & Clinic | Dominant segment at 47.8% market share in 2025 with established emergency department infrastructure and comprehensive trauma care capabilities. Critical for patient stabilization and diagnostic imaging procedures requiring precise immobilization. Mature procurement protocols with standardized equipment specifications and vendor qualification processes. Momentum: steady growth driven by emergency department expansion and trauma center development. Watchouts: budget constraints in public healthcare systems and equipment replacement cycle pressures affecting procurement timing. |

| Fire Rescue | Expanding segment with 23.4% market share driven by technical rescue operations and confined space emergency response requirements. Essential for structural collapse scenarios and vehicle extrication operations requiring rapid patient stabilization. Adoption concentrated in metropolitan fire departments and specialized rescue teams. Momentum: moderate growth through rescue capability enhancement programs and interagency response coordination. Watchouts: equipment durability requirements in harsh operational environments and training standardization across diverse rescue operations. |

| Industrial Safety | Growing segment at 14.7% share focused on workplace emergency response and occupational injury management. Premium applications requiring validated equipment performance and rapid deployment capabilities. Investment driven by regulatory compliance requirements and corporate safety programs. Momentum: strong growth driven by industrial safety regulation enhancement and workplace incident preparedness. Watchouts: cost sensitivity in commodity manufacturing sectors and variable adoption rates across different industrial categories. |

| Police & Military | Specialized segment with 9.3% market share serving tactical medical operations and battlefield casualty care. High-performance applications requiring lightweight equipment and extreme durability for combat and law enforcement environments. Adoption concentrated in special operations units and military medical services. Momentum: steady growth through tactical medical capability development and casualty care protocol advancement. Watchouts: extended procurement cycles in government acquisition and specialized certification requirements. |

| Others | Residual segment with 4.8% market share encompassing diverse applications including event medical services and wilderness rescue operations. Small volume with specialized equipment requirements and limited standardized protocols. Adoption concentrated in specific emergency service niches and volunteer rescue organizations. Momentum: flat to modest growth with application-specific requirements. Watchouts: limited equipment optimization for specialized applications and small market size constraining manufacturer investment. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Emergency Service Modernization Expanding emergency medical service infrastructure and trauma care capability enhancement driving investment in specialized patient immobilization equipment for pre-hospital operations. Industrial Safety Emphasis Growing workplace safety requirements and occupational injury management programs creating demand for emergency response equipment across manufacturing and construction sectors. Disaster Preparedness Programs Mass casualty incident planning and emergency response capability development requiring scalable immobilization equipment with rapid deployment capabilities. |

Equipment Cost Constraints High initial investment requirements and maintenance expenses limiting adoption among smaller emergency service organizations and volunteer rescue operations with limited budgets. Training Requirements Specialized knowledge needed for proper equipment application and patient assessment creating adoption barriers in organizations with limited training resources. Durability Concerns Equipment wear patterns and replacement frequency in high-use emergency operations affecting total cost of ownership and procurement decisions. |

Lightweight Material Integration Advanced polymers and composite materials enabling durable vacuum products with reduced weight supporting operational efficiency in emergency response. Modular System Design Interchangeable components and scalable configurations supporting diverse injury patterns and operational requirements across emergency applications. Color-Coded Protocols Simplified application procedures and visual identification systems reducing training requirements and supporting rapid equipment deployment. |

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| United States | 5.5% |

Revenue from Vacuum Products for Emergency Services in China is projected to exhibit strong growth with a market value of USD 48.1 million by 2035, driven by expanding emergency medical services infrastructure and comprehensive pre-hospital care system development creating substantial opportunities for medical equipment suppliers across ambulance operations, fire rescue organizations, and industrial safety programs. The country's massive urbanization initiatives and expanding emergency response capabilities are creating significant demand for patient immobilization systems supporting operational efficiency and trauma care standardization. Major emergency service providers and municipal governments are establishing comprehensive equipment procurement programs to support large-scale emergency operations and meet growing domestic safety standards.

Emergency medical service modernization programs are supporting widespread adoption of vacuum immobilization equipment across urban operations, driving demand for systems with proven clinical performance capabilities. Industrial safety enhancement initiatives and workplace emergency response development are creating substantial opportunities for equipment suppliers requiring reliable immobilization performance and cost-effective operational characteristics. Metropolitan emergency service expansion and equipment standardization programs are facilitating adoption throughout major urban regions.

Revenue from Vacuum Products for Emergency Services in India is expanding to reach USD 23.6 million by 2035, supported by extensive emergency medical services capacity expansion and comprehensive trauma care infrastructure development creating sustained demand for patient immobilization equipment across diverse emergency operations and industrial safety segments. The country's growing emergency services awareness and expanding workplace safety capabilities are driving demand for vacuum products that provide consistent clinical performance while supporting cost-effective operational requirements. Equipment suppliers and manufacturers are investing in local distribution infrastructure to support growing emergency service requirements and equipment adoption.

Emergency medical service development programs and trauma care capability enhancement initiatives are creating opportunities for immobilization equipment across diverse segments requiring reliable performance and competitive operational costs. Industrial safety modernization and workplace emergency response programs are driving investments in vacuum systems supporting injury management requirements throughout major manufacturing regions. Disaster response capacity building and mass casualty preparedness programs are enhancing demand for scalable immobilization equipment throughout emergency service facilities.

Demand for Vacuum Products for Emergency Services in Germany is projected to reach USD 16.3 million by 2035, supported by the country's leadership in emergency medical technology and advanced trauma care protocols requiring sophisticated immobilization systems for pre-hospital patient management. German emergency service organizations implement high-quality equipment procurement programs that support advanced clinical protocols, operational reliability, and comprehensive quality documentation. The market is characterized by focus on equipment performance, patient safety standards, and compliance with stringent medical device and emergency service regulations.

Emergency medical service investments are prioritizing advanced immobilization technologies that demonstrate superior patient outcomes and operational efficiency while meeting German medical device standards and trauma care protocols. Clinical excellence programs and operational optimization initiatives are driving adoption of vacuum products that support efficient emergency workflows and patient care quality. Research and development programs for emergency care advancement are facilitating adoption of specialized immobilization capabilities throughout major emergency service organizations.

Revenue from Vacuum Products for Emergency Services in Brazil is growing to reach USD 9.5 million by 2035, driven by emergency medical services expansion and urban trauma care infrastructure development creating sustained opportunities for equipment suppliers serving both public ambulance services and industrial safety contractors. The country's expanding emergency response infrastructure and growing workplace safety awareness are creating demand for immobilization equipment that supports diverse clinical requirements while maintaining operational performance standards. Manufacturers and emergency service organizations are developing procurement strategies to support equipment capability enhancement and patient care program implementation.

Emergency medical service expansion programs and trauma care protocol development initiatives are facilitating equipment adoption capable of supporting diverse clinical requirements and competitive performance specifications. Industrial safety development and workplace emergency response programs are enhancing demand for vacuum products that support operational efficiency and clinical reliability. Urban emergency service modernization and equipment standardization programs are creating opportunities for advanced immobilization capabilities across Brazilian emergency operations.

Demand for Vacuum Products for Emergency Services in United States is projected to reach USD 19.8 million by 2035, expanding at a CAGR of 5.5%, driven by emergency medical service protocol standardization and comprehensive trauma care system advancement supporting sophisticated patient management programs and equipment capabilities. The country's established emergency services infrastructure and growing interoperability emphasis are creating demand for standardized immobilization systems that support operational consistency and clinical performance standards. Equipment manufacturers and suppliers are maintaining comprehensive training support capabilities to serve diverse emergency service requirements.

Emergency medical service advancement and trauma care quality enhancement initiatives are supporting demand for vacuum immobilization equipment that meets contemporary clinical performance and reliability standards. Industrial safety sector development and workplace emergency response programs are creating opportunities for specialized vacuum products that provide comprehensive injury management capabilities. Emergency service modernization and equipment interoperability programs are facilitating adoption of standardized immobilization platforms throughout major emergency service regions.

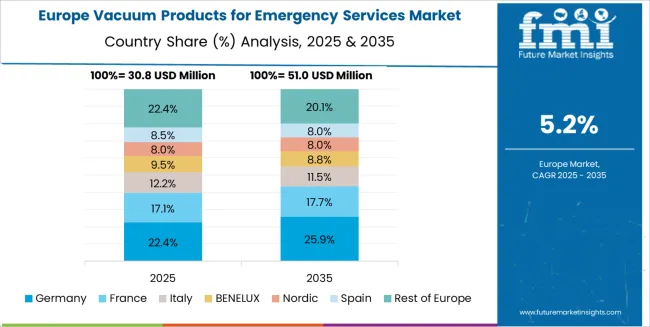

How Is the European Market Expected to Expand Through 2035?

The vacuum products for emergency services market in Europe is projected to grow from USD 32.1 million in 2025 to USD 56.4 million by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain its leadership position with a 29.7% market share in 2025, declining slightly to 28.9% by 2035, supported by its advanced emergency medical services infrastructure and comprehensive trauma care systems concentrated in major metropolitan regions.

France follows with a 22.3% share in 2025, projected to reach 22.8% by 2035, driven by comprehensive emergency response modernization and hospital equipment upgrade programs across regional healthcare systems. The United Kingdom holds a 19.4% share in 2025, expected to decrease to 18.8% by 2035 due to National Health Service budget constraints. Italy commands a 14.8% share, while Spain accounts for 8.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.6% to 6.6% by 2035, attributed to increasing emergency services capability development in Nordic countries and emerging Eastern European emergency medical operations implementing equipment standardization programs.

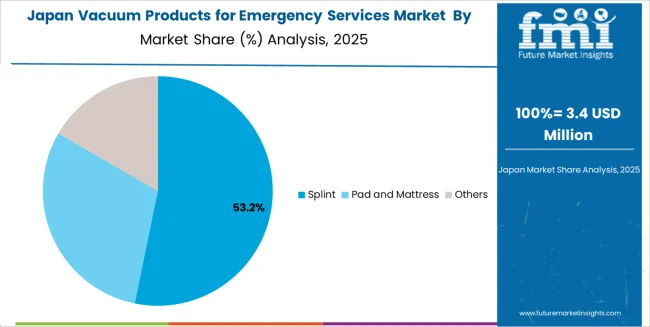

Japanese vacuum products for emergency services operations reflect the country's precise emergency medical protocols and comprehensive disaster preparedness programs. Major emergency medical service providers including Tokyo Fire Department and regional emergency response organizations require rigorous equipment qualification procedures that exceed international standards, driving demand for vacuum immobilization systems with validated performance specifications. Organizations maintain comprehensive equipment testing protocols and maintenance procedures supporting consistent patient care across emergency operations.

The disaster preparedness sector demonstrates particular strength in mass casualty response capabilities, with municipalities requiring extensive stockpiles of vacuum splinting equipment for earthquake and tsunami response operations. Regulatory oversight through the Fire and Disaster Management Agency emphasizes comprehensive equipment standardization and interagency compatibility requirements that favor established manufacturers with proven emergency service technologies.

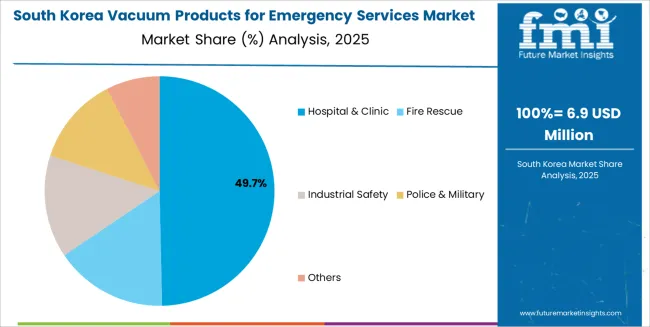

South Korean vacuum products for emergency services operations reflect the country's modern emergency medical capabilities and comprehensive industrial safety programs. Major emergency service organizations including National Fire Agency and metropolitan ambulance services implement sophisticated equipment procurement strategies supporting both urban emergency response and industrial facility safety requirements. Organizations are investing in lightweight vacuum immobilization systems to enhance operational efficiency while meeting international emergency care standards.

The industrial safety sector drives demand for specialized vacuum products capable of supporting workplace emergency response programs and occupational injury management. Korean emergency service providers prioritize equipment suppliers with comprehensive training support capabilities and established service networks supporting rapid equipment replacement and maintenance services.

Market dynamics favor established emergency medical equipment manufacturers with proven immobilization technologies and comprehensive distribution networks supporting ambulance services and emergency response organizations. Value concentration occurs around lightweight vacuum systems capable of delivering reliable patient stabilization with simplified operation procedures, creating barriers for new entrants lacking clinical validation documentation and emergency service credibility. Several competitive archetypes dominate market positioning: global emergency medical equipment manufacturers leveraging broad product portfolios and established relationships across emergency service sectors; specialized immobilization system companies offering focused vacuum products with deep application expertise in trauma care and rescue operations; regional equipment distributors providing localized service capabilities and cost-competitive solutions for emerging market emergency services; and innovative material technology providers developing advanced lightweight systems with enhanced durability characteristics.

Switching costs remain moderate due to training requirements and protocol integration considerations, though equipment standardization initiatives and interagency compatibility requirements favor incumbent suppliers in established emergency service markets. Technology transitions toward lighter materials and simplified deployment mechanisms create opportunities for suppliers offering enhanced operational efficiency and reduced rescuer fatigue, while clinical validation requirements and regulatory approval processes slow adoption in conservative emergency medical environments. Consolidation pressure increases as larger medical equipment companies acquire specialized immobilization manufacturers to expand emergency service coverage and strengthen regional market positions.

Strategic positioning requires comprehensive clinical validation support and proven performance across diverse trauma scenarios, particularly for high-volume emergency medical service operations and industrial safety applications. Distribution network density and technical support responsiveness become critical differentiation factors as emergency organizations prioritize equipment reliability and rapid replacement capabilities in mission-critical operations. Market share stability depends on maintaining clinical protocol alignment and regulatory acceptance while adapting immobilization platforms to emerging lightweight material technologies and simplified operation requirements without disrupting established emergency service workflows or requiring extensive retraining investments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Splint, Pad and Mattress, Others |

| Application | Hospital & Clinic, Fire Rescue, Industrial Safety, Police & Military, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

| Key Companies Profiled | PAX Company, FERNO, Hartwell Medical, Kohlbrat & Bunz, Cramer, EGO Zlín, MeBer, Oscar Boscarol, Royax, BuW Schmidt GmbH, PVS, Inforest, Ambulancemed |

| Additional Attributes | Dollar sales by product type and application, regional demand across NA, EU, APAC, competitive landscape, emergency service adoption patterns, trauma care protocol integration, and equipment standardization initiatives driving patient safety, operational efficiency, and clinical performance |

By Product Type

The global vacuum products for emergency services market is estimated to be valued at USD 133.6 million in 2025.

The market size for the vacuum products for emergency services market is projected to reach USD 234.8 million by 2035.

The vacuum products for emergency services market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in vacuum products for emergency services market are splint, pad and mattress and others.

In terms of application, hospital & clinic segment to command 47.8% share in the vacuum products for emergency services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Tension Rolls Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Self-priming Mobile Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Sealed Packaging Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA