Vacuum shrink bags are utilized across many industries, such as food & beverage, pharmaceuticals, and industrial packaging, owing to their higher capacity to increase shelf life, maintain product freshness, and ensure better protection from contaminants.

The bags provide good barrier properties against oxygen, moisture, and bacteria, making them suitable for vacuum-sealed packaging uses. High demand for high-performance and eco-friendly packaging solutions is likely to fuel substantial market growth in the next decade.

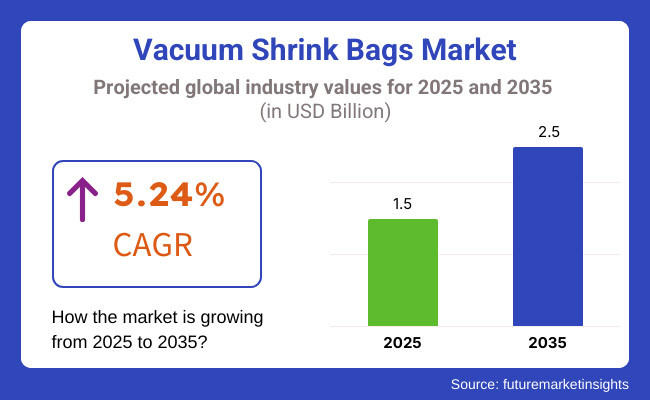

The size of the market is anticipated to be USD 1.5 billion by 2025 and is going to have a 5.24% CAGR growth between 2025 and 2035 to reach USD 2.5 billion by 2035. This is driven by mounting consumer demand for food products with longer shelf life, growing usage of vacuum-sealed pack in the meat and dairy sectors, and innovation in recyclable and biodegradable materials for shrink bags.

Furthermore, increasing regulatory needs for food safety and eco-friendly packaging options are further fueling market growth.

Market growth is also spurred by rising innovation in multi-layer and high-barrier shrink bags, such as recyclable options and antimicrobial coatings. The growth of the ready-to-eat and processed foods markets is further aiding market expansion. Developments in shrinking bag material composition, e.g., compostable plastics and high-performance barrier films, will further promote product efficiency and sustainability.

As per AMI analysis, Asia-Pacific will lead the market, spurred by the high growth of the food and beverage sector, high-barrier packaging demand, and the growing trend for fresh and vacuum-packed food items. China, India, and Japan are the major contributors among these countries, with huge investments in innovative and eco-friendly packaging solutions.

Moreover, the high adoption of products for seafood, meat, and dairy product packaging is also driving market growth.

Market growth in the region is bolstered by regulatory support for food safety and eco-friendly packaging materials from the government. Furthermore, technological development of high-barrier shrink films is likely to fuel innovation in the region. Greater global packaging company presence in Asia-Pacific is also enhancing regional production levels.

In addition, R&D in compostable and recyclable vacuum shrink bag products is likely to present fresh opportunities for growth in the region.

North America continues to be a key market for products because of robust demand from the food & beverage and pharmaceutical sectors. The United States and Canada are at the forefront of the region with advances in flexible packaging materials and green shrink bag manufacturing. The increasing trend for vacuum-sealed and portion-controlled packaging solutions among consumers is further enhancing market demand.

The use of next-generation vacuum shrink bag materials is becoming increasingly popular, driven by government policies for green packaging. Higher research and development investments for recyclable, compostable, and high-performance products are also boosting the market's growth.

Also, the expansion in e-commerce and direct-to-consumer food retailing is also fueling the demand for sustainable, durable, and light-weight vacuum packaging. Most of the companies in North America are also working towards enhancing the recyclability and shelf life to increase product performance. Smart packaging innovations like QR-code-enabled and tamper-evident vacuum-sealed bags are likely to further influence the market in the future.

Europe has a commanding percentage of the market due to strict regulatory environments favoring biodegradable and recyclable packaging. Germany, France, and the UK are among the leading economies in embracing sustainable packaging solutions. The growing investments in circular economy programs and research on high-performance compostable shrink bags are further enhancing the region's dominance in the market.

Strict environmental regulations encouraging plastic waste and single-use packaging reduction are driving the trend towards sustainable vacuum shrink bag alternatives. Furthermore, growing consumer interest and demand for green packaging will be driving long-term market growth.

The area is also experiencing a growing number of partnerships between food companies and shrink bag makers to create innovative vacuum-sealed packaging. In addition, European research institutions are investing in the next-generation vacuum shrink films with enhanced recyclability and barrier characteristics. These developments are likely to improve the overall efficiency and use of vacuum shrink bags across industries.

Challenges

High production costs

The manufacturing process for high-quality, recyclable products requires specialized materials and technology, impacting production expenses.

Regulatory restrictions on plastic waste

Government mandates are pushing for sustainable alternatives, requiring vacuum shrink bag manufacturers to develop biodegradable and recyclable solutions.

Opportunities

Expansion into new industries

Vacuum shrink bags are increasingly being explored for applications in pharmaceuticals, industrial packaging, and specialty food storage, offering new growth avenues.

Advancements in biodegradable and high-barrier shrink bag technology

Research in lightweight, high-barrier, and moisture-resistant materials is expected to drive innovation and enhance product applications.

Between 2020 and 2024, the vacuum shrink bags market witnessed steady growth due to rising demand in meat packaging, dairy products, and food safety initiatives. However, challenges such as high production costs and plastic waste concerns remained key obstacles for manufacturers. Additionally, the market saw increased investments in research to improve shrink bag recyclability, durability, and moisture resistance.

Growing concerns over plastic pollution prompted regulatory bodies to encourage the adoption of biodegradable alternatives. Furthermore, advancements in high-barrier vacuum packaging technology contributed to increased durability and functionality.

Moving forward, market expansion will be driven by innovations in biodegradable vacuum shrink bags, AI-integrated shrink bag manufacturing, and improved high-barrier packaging solutions. The integration of automation in shrink bag production and AI-driven quality control systems will further enhance market competitiveness.

Additionally, increasing demand for vacuum shrink bag solutions in high-value food products and pharmaceutical applications will create new growth opportunities. Companies are also focusing on enhancing shrink bag reusability and recyclability to meet industry-specific needs. The rise of customized and brand-enhancing vacuum shrink bags tailored for niche applications is expected to gain momentum in the coming years.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial focus on reducing single-use plastic shrink bags. |

| Material and Formulation Innovations | Development of multilayer high-barrier shrink bags. |

| Industry Adoption | Widely used in food packaging and pharmaceuticals. |

| Market Competition | Dominated by major shrink bag and flexible packaging brands. |

| Market Growth Drivers | Growth driven by food safety and extended shelf life. |

| Sustainability and Environmental Impact | Early-stage transition to biodegradable shrink bag options. |

| Integration of AI and Process Optimization | Limited AI implementation in manufacturing. |

| Advancements in Adhesive Technology | Traditional heat-sealing adhesives used in vacuum shrink bags. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies mandating biodegradable and high-performance shrink bags. |

| Material and Formulation Innovations | Expansion of bio-based, recyclable, and moisture-proof shrink bag materials. |

| Industry Adoption | Increased adoption in industrial, specialty food, and medical packaging. |

| Market Competition | Rise of sustainable packaging startups and collaborations with technology firms. |

| Market Growth Drivers | Market expansion fueled by AI-integrated solutions and eco-friendly designs. |

| Sustainability and Environmental Impact | Large-scale adoption of fully recyclable and compostable vacuum shrink bags. |

| Integration of AI and Process Optimization | AI-driven predictive modeling, automated quality control, and real-time performance monitoring for improved efficiency. |

| Advancements in Adhesive Technology | Development of stronger, eco-friendly, and temperature-resistant adhesives for enhanced sealing performance. |

The USA leads the market, propelled by rising demand for high-barrier and longer shelf-life packaging products across food processing, pharmaceuticals, and industrial packaging applications.

The requirement for better protection against oxygen, water vapors, and contaminants has urged producers to come up with multi-layer vacuum shrink bags offering sophisticated barrier features. Also, regulatory moves towards ensuring food safety and environmentally friendly packaging are compelling businesses to embrace recyclable and biodegradable vacuum shrink bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

The market in the UK is growing because companies are prioritizing food safety regulation and environmental sustainability. Higher demand for increased shelf life and environmentally friendly packaging has triggered demand for increased consumption in several industry verticals like meat processing, dairy, and frozen foods.

Plastic reduction policy initiatives by government organizations and sustainable waste management goals are additionally incentivizing businesses to incorporate high-quality vacuum shrink bag solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

Japan's vacuum shrink bag market is expanding steadily as a result of the growing demand for high-barrier packaging solutions for the seafood, meat, and ready-to-eat food markets. Advanced products with oxygen scavengers and increased resistance to moisture are being developed by companies to enhance food safety and shelf life.

As there are stringent regulations on reducing food packaging waste, companies are switching towards biodegradable and recyclable vacuum shrink bag materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea's market is witnessing rapid growth because of higher meat and seafood exports and developments in food processing technology. Demand for cost-effective and high-performance vacuum packaging solutions has encouraged manufacturers to introduce shrink bags with better puncture resistance and higher barrier properties.

Food safety and eco-friendly packaging government policies also help boost the market. In addition, companies are embedding smart tracking devices like QR codes and RFID tags in products to enhance supply chain efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Based on material type, the market is divided into polyethylene (PE), polypropylene (PP), polyamide (PA), bi-axially oriented polyethylene terephthalate (BOPET), EVOH, inorganic oxide coatings, PVDC, and others. Polyethylene (PE) and Polyamide (PA) are the most common materials for products because of their superior combination of flexibility, strength, and barrier properties.

PE is extremely popular for its affordability, good sealing strength, and puncture resistance, making it suitable for vacuum-sealed food packaging. PA, which is usually blended with PE, adds strength and offers better gas and moisture barrier properties, avoiding spoilage and increasing shelf life.

Whereas other materials such as EVOH and PVDC provide very high oxygen barriers, they are most often employed in the form of coatings or multilayer constructions instead of base materials. Inorganic oxide coatings and BOPET enhance gas barriers and clarity, but find lower usage for shrink applications as they are less flexible.

Based on barrier type, the market is divided into low barrier (1000 to 100 cc-mil/m2-atm), medium barrier (100 to 50 cc-mil/m2-atm), high barrier (50 to 0.1 cc-mil/m2-atm), and ultra-high barrier (0.1 cc-mil/m2-atm). Medium to high barrier (100 to 0.1 cc-mil/m²-atm). These are utilized the most since they achieve an optimum combination of protection, economicalness, and adaptability.

The barriers afford enough oxygen and moisture management to create longer shelf life in vulnerable items such as fresh meat, cheese, and fish, all of which can prolong the life of such items during transportation by avoiding contamination.

Based on thickness, the market is divided into up to 50 microns, 50 to 70 microns, 70 to 90 microns, 90 to 110 microns, and above 110 microns. The 50 to 70 microns thickness level is the most common for the product because it offers the best balance of strength, flexibility, and price.

This thickness offers adequate puncture resistance and durability to cushion products such as fresh meat, poultry, seafood, and cheese during storage and transportation while also enabling proper shrinkage for a tight seal. Bags in this category are often produced from multilayer constructions containing polyethylene (PE) and polyamide (PA) for barrier and strength.

Based on application, the market is divided into food, electronics, cosmetics & personal care, homecare, healthcare, industrial, and others. Packaging of food is the most common use of product because of the need for long shelf life, freshness retention, and contamination avoidance.

Vacuum shrink bags are used extensively by the food industry to package fresh meat, poultry, seafood, cheese, and processed food because they have great oxygen and moisture barriers that prevent spoilage and ensure the quality of the product. Multilayer films with polyethylene (PE), polyamide (PA), and EVOH are widely applied to provide durability and freshness.

The market is influenced by rising demand in food, healthcare, and industrial packaging applications. The market is witnessing innovation through new material formulations, such as biodegradable polymers, high-barrier coatings, and multi-layered protective films, addressing concerns about performance, sustainability, and efficiency.

Additionally, advancements in automated production and AI-driven supply chain tracking are further shaping industry trends. The rising preference for sustainable and reusable products is also contributing to market growth.

Furthermore, increased investments in eco-friendly vacuum packaging technologies are improving product efficiency and expanding market opportunities. Companies are also exploring hybrid products that integrate active freshness-preserving agents to enhance durability.

Additionally, collaborations between packaging manufacturers and food safety experts are driving the development of customized vacuum shrink bag solutions tailored to specific industry needs.

| Company | Estimated Market Share |

|---|---|

| SC Johnson (Ziploc) | ~18% |

| Space Bag | ~15% |

| Rubbermaid | ~12% |

| Sealed Air (Cryovac) | ~10% |

| AmazonBasics | ~9% |

| ULINE | ~8% |

| Intertape Polymer | ~7% |

| Household Essentials | ~6% |

| Honeywell | ~5% |

| Lippert GmbH | ~4% |

The overall market size for the vacuum shrink bags market was USD 1.5 billion in 2025.

The vacuum shrink bags market is expected to reach USD 2.5 billion in 2035.

The market will be driven by increasing demand from food, medical, and industrial sectors. Sustainability trends, innovations in high-barrier packaging materials, and improvements in food safety standards will further propel market expansion.

Key challenges include high production costs, limited recyclability, and regulatory restrictions on plastic usage. However, ongoing research into biodegradable alternatives and improved manufacturing processes is expected to mitigate these concerns.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Barrier Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Barrier Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Thickness, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Barrier Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Barrier Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Thickness, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Barrier Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Barrier Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Thickness, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Barrier Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Barrier Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Thickness, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Barrier Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Barrier Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Thickness, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Barrier Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Barrier Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Thickness, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Barrier Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Barrier Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Thickness, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Barrier Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Barrier Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Thickness, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Barrier Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Barrier Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Barrier Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Barrier Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Barrier Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Thickness, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Barrier Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Thickness, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Barrier Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Barrier Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Barrier Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Barrier Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Barrier Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Thickness, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Barrier Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Thickness, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Barrier Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Barrier Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Barrier Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Barrier Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Barrier Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Thickness, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Barrier Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Thickness, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Barrier Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Barrier Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Barrier Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Barrier Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Barrier Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Thickness, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Barrier Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Barrier Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Barrier Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Barrier Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Barrier Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Barrier Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Thickness, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Barrier Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Barrier Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Barrier Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Barrier Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Barrier Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Barrier Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Thickness, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Barrier Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Thickness, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Barrier Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Barrier Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Barrier Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Barrier Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Barrier Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Thickness, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Barrier Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Thickness, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Barrier Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Barrier Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Barrier Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Barrier Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Barrier Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Thickness, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Barrier Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Thickness, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Concentrators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Impregnated (VPI) Transformer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Pipe Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Grease Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Vacuum-Sealed Packaging Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA