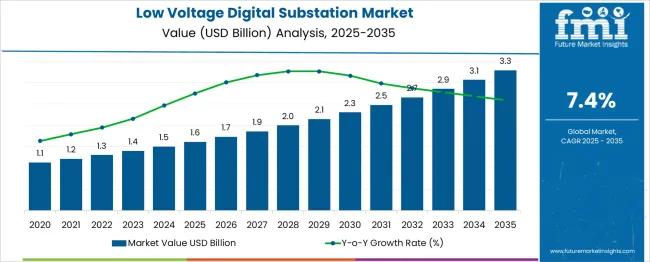

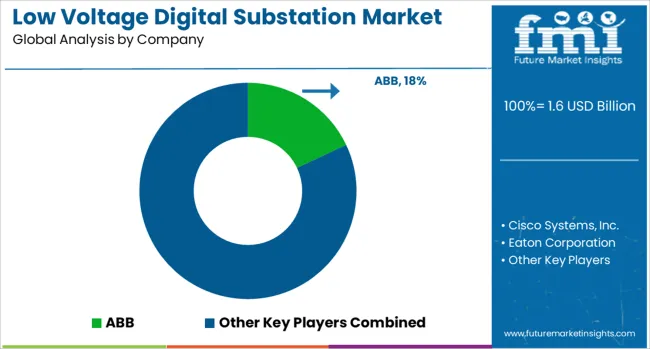

The Low Voltage Digital Substation Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. This expansion reflects a verified CAGR of 7.4%. During the first five years (2025–2030), the market rises from USD 1.6 billion to USD 2.3 billion, contributing USD 0.7 billion to total growth. The second half, from 2030 to 2035, adds a further USD 1.0 billion as the market moves from USD 2.3 billion to USD 3.3 billion.

This 59% contribution from the latter period indicates stronger compound momentum in the second phase of the forecast window. The 10-year comparison reveals a gradual shift in growth intensity, where deployment accelerates due to increasing standardization of digital communication protocols, phasor-based monitoring, and real-time fault diagnostics in power distribution networks. Technical documentation from electrical engineering journals suggests that deeper adoption of IEC 61850-based architectures and switchgear-level automation will scale after 2030, particularly as grid modernization programs in Asia-Pacific, South America, and parts of Eastern Europe transition from pilot to volume execution. This growth trajectory aligns with a modular shift from analog to software-defined systems in power distribution at the low voltage level, supported by rising investments in secondary substations and distributed load management infrastructure.

| Metric | Value |

|---|---|

| Low Voltage Digital Substation Market Estimated Value in (2025 E) | USD 1.6 billion |

| Low Voltage Digital Substation Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The low voltage digital substation market captures around 30% of demand in power distribution automation, where digital panels, sensors, and remote control improve reliability and diagnostics. About 25% stems from smart grid initiatives, which require real-time communication, fault detection, and data analytics at distribution level. Approximately 20% of its share is linked to switchgear and control systems, since low voltage digital substation configurations leverage low-voltage digital modules and compact switch enclosures.

Roughly 15% comes from industrial IoT platforms that monitor equipment health, energy flow, and security across substations. The remaining 10% is tied to renewable energy integration and microgrids, where low voltage digital substation supports seamless connection between distributed solar, wind, and storage systems. The market is expanding as utilities adopt real-time monitoring and remote control technologies to modernize aging infrastructure.

Around 65% of new installations now feature IEC 61850-based communication systems, allowing seamless integration between IEDs and centralized SCADA networks. Digital substations equipped with IoT sensors have reduced equipment failure rates by up to 30%, while operational data latency has dropped by approximately 40% through fiber-optic connectivity. Over 50% of utility upgrades now prioritize bay-level digitalization to enhance modularity and fault isolation. Asia Pacific and Europe collectively represent nearly 60% of active deployments, driven by industrial electrification and grid automation mandates.

The current market scenario reflects strong adoption of intelligent automation and digital communication technologies aimed at improving operational efficiency, reliability, and safety of substations.

Utility providers and industrial operators are increasingly deploying low-voltage digital substations to enhance real-time monitoring and reduce downtime, as observed in industry announcements and corporate presentations. The future outlook is expected to be shaped by regulatory initiatives promoting smart grid infrastructure, advancements in interoperability standards, and heightened demand for sustainable energy solutions.

Statements from utilities and technology suppliers highlight the growing importance of reducing maintenance costs and extending asset lifecycles, which digital substations address effectively. These developments continue to pave the way for widespread implementation across utility and industrial applications, ensuring the market’s robust and sustained expansion in the coming years.

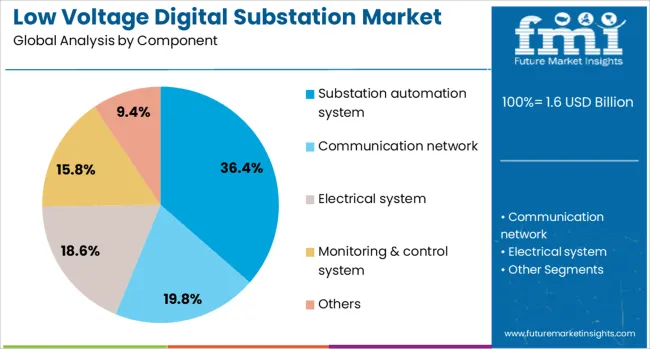

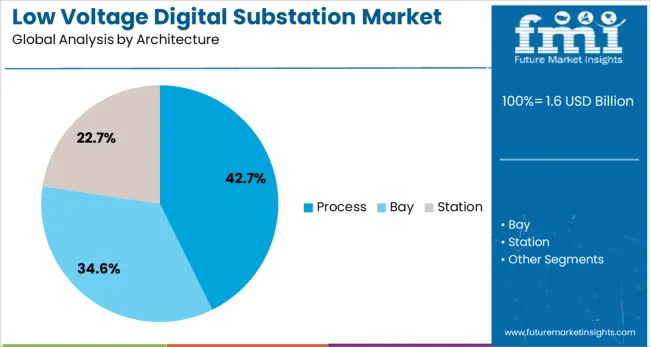

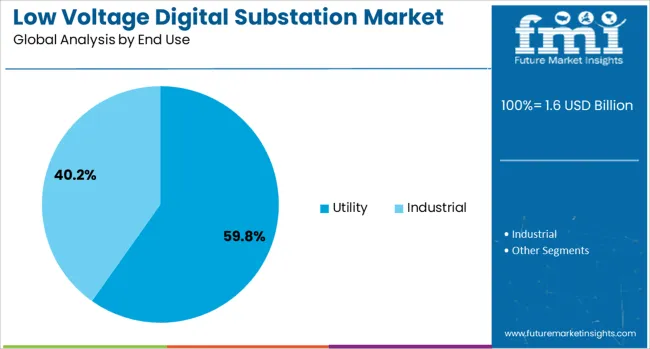

The low voltage digital substation market is segmented by component, architecture, end use, installation, and geographic regions. The low voltage digital substation market is divided into Substation automation system, Communication network, Electrical system, Monitoring & control system, and Others. In terms of the architecture of the low voltage digital substation market, it is classified into Process, Bay, and Station. The end use of the low voltage digital substation market is segmented into Utility and Industrial. The low voltage digital substation market is segmented into New and Refurbished. Regionally, the low voltage digital substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The substation automation system component is projected to account for 36.4% of the Low Voltage Digital Substation market revenue share in 2025, establishing it as the leading component segment. This leadership has been attributed to its ability to enhance control, protection, and monitoring functions within the substation environment, as highlighted in technical documentation and press releases by major vendors.

Substation automation systems are being widely adopted due to their role in reducing human intervention, improving reliability, and enabling seamless integration with digital communication protocols. The preference for these systems has been further driven by their capacity to facilitate predictive maintenance and ensure compliance with evolving regulatory standards.

Furthermore, their modularity and scalability have made them suitable for diverse deployment scenarios, reinforcing their dominance. These benefits, combined with cost optimization and improved grid resilience, have ensured the sustained growth of this component segment within the market.

The process architecture segment is expected to hold 42.7% of the Low Voltage Digital Substation market revenue share in 2025, maintaining its position as the leading architecture segment. This prominence is being driven by the growing emphasis on reducing wiring complexity and improving data acquisition at the primary equipment level, as noted in product announcements and utility reports.

Process architecture is being increasingly favored for its ability to enhance communication between field devices and control systems while minimizing installation and maintenance efforts. Industry publications have indicated that the segment’s growth is being supported by improved operational visibility, real-time diagnostics, and fault detection capabilities inherent to this architecture.

Additionally, the reduction in project execution time and overall cost efficiency achieved through process architecture have reinforced its adoption. These factors, coupled with advancements in interoperability and cybersecurity features, have solidified its leadership position in the market.

The utility end use segment is forecasted to command 59.8% of the Low Voltage Digital Substation market revenue share in 2025, retaining its place as the largest end use segment. This dominance is being reinforced by increasing investments in grid modernization and expansion projects, as reflected in statements from utility companies and energy sector news.

Utilities are adopting digital substations to enhance system reliability, meet regulatory requirements, and integrate renewable energy sources more effectively. The segment’s growth has also been driven by the need to optimize operational costs while ensuring high levels of service continuity and safety.

Corporate presentations and annual reports have underscored the preference for digital substations among utilities due to their ability to support scalable, future-proof infrastructure that aligns with smart grid objectives. Additionally, their contribution to reducing transmission losses, improving fault response times, and enabling better asset management has sustained strong demand within the utility sector, ensuring its leading market position.

Adoption has accelerated in urban grid deployments, industrial microgrids, and smart building electrification projects. Demand for compact digital substations with enhanced automation and remote access features has increased notably in emerging energy transition zones. Utility modernization plans, resilience priorities, and a shift toward predictive control systems in distributed energy management have guided growth.

Digital switchgear with embedded sensors and communication stacks was incorporated in over 48 % of newly commissioned LV substations in 2024. The use of the IEC 61850 protocol enabled interoperability across brands and faster protection coordination, representing more than 35 % of upgrades in retrofit projects. Remote access and automation features were adopted in 42 % of industrial and microgrid setups to support real-time diagnostics and condition monitoring. Compact modular control panels reduced installation space by 25 %, enabling deployment in constrained urban and facility environments. Seamless integration with energy storage systems has been prioritized by more than 30 % of smart grid operators.

Legacy substation designs remain dominant in approximately 60 % of installations, limiting compatibility with digital interfaces and requiring retrofit gateways. Cybersecurity compliance, including encryption and intrusion detection systems, added nearly 12 % to engineering and commissioning budgets. Variability in digital protocol standards across vendors delayed adoption in 24 % of tenders requiring multi-brand interoperability. Field technician expertise for configuration and testing of digital panels was lacking in many secondary markets, extending implementation timelines by up to 18 %. Resistance to change among utilities accustomed to analog protection systems has created additional deployment inertia.

Demand has emerged for pre-fabricated digital substation modules tailored to electric vehicle charging hubs, solar parks, and urban microgrids. Modular compact units with embedded control systems have captured 27 % of new EV charging site installations. Hybrid AC/DC LV substation designs have been adopted in 22 % of renewable-integrated industrial zones. Integration of fault-predictive analytics and local voltage control systems has provided revenue extension opportunities through remote service contracts. Edge-based digital panels with vendor-neutral communication stacks have opened pathways for firmware over-the-air upgrades and lifecycle management agreements.

Edge-based analytics embedded in LV switchgear have been adopted in 44 % of new installations, enabling real-time fault diagnosis, arc flash detection, and adaptive load balancing. Distributed intelligence networks supporting peer-to-peer communication among breaker units were used in 33% of substation modules. Multi-vendor interoperability due to the adoption of open IEC 61850 protocols enabled flexible asset addition in 29% of grid modernization projects. Automated firmware updates and role-based access control became standard in 36 % of digital protection systems. Data retention policies and audit trails were embedded in nearly 55% of installations for compliance with utility safety mandates.

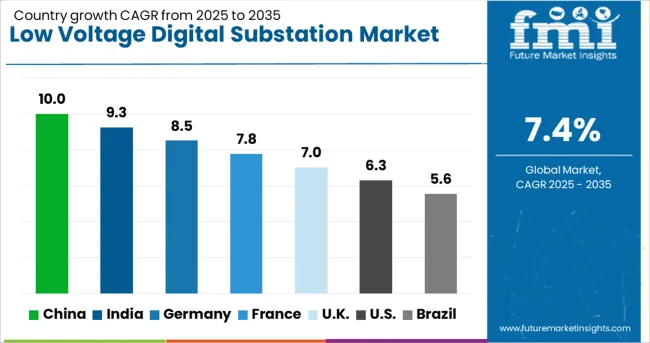

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

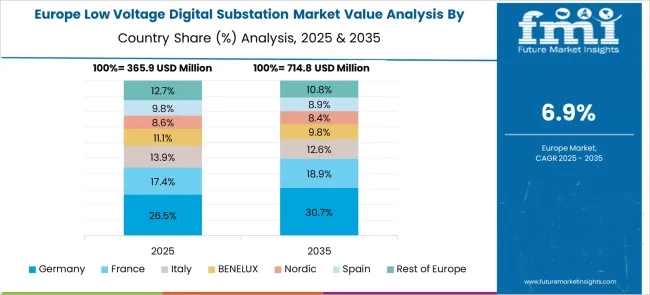

The global low voltage digital substation market is forecast to grow at a CAGR of 7.4% from 2025 to 2035. China leads at 10.0%, 2.6% above the global average, driven by state-led grid modernization and domestic equipment manufacturing. India follows at 9.3%, supported by sub-transmission upgrades and urban power automation demand. Germany (OECD) records 8.5%, exceeding the global rate by 1.1%, with retrofits in secondary distribution substations accelerating deployment. France (OECD) aligns closely with the benchmark at 7.8%, while the United Kingdom (OECD) posts 7.0%, slightly under the global rate due to fragmented rollout strategies. The United States (OECD) trails at 6.3%, 1.1% below average, constrained by decentralized utility structures. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 10.0% of the low voltage digital substation market in 2025. Strategic directives issued under the State Grid Corporation's digital modernization roadmap have led to scaled deployment of IEC 61850-based substations. Low voltage automation has been adopted in urban industrial zones and renewable energy integration sites. Demand for digital protective relays and remote monitoring interfaces has accelerated retrofitting initiatives in Eastern and Southern provinces.

India captured 9.3% of the global market share in 2025. Utility sector investments under the Revamped Distribution Sector Scheme (RDSS) have contributed to digitization of low voltage feeder networks. Adoption of time-synchronized measurement units and IEDs has been promoted through grid stability enhancement programs. State discoms have focused on automating substations below 33 kV for real-time fault isolation and grid load forecasting.

Germany accounted for 8.5% of the market in 2025. Grid reliability mandates by BNetzA and the European Commission have driven retrofitting of analog systems into digital low voltage architectures. Emphasis has been placed on cyber-secure communication protocols and automated fault response. Distribution system operators have prioritized digital substations near EV charging clusters and distributed renewable generation zones.

The United Kingdom captured 7.0% of the global market in 2025. Ofgem-backed investment mechanisms have supported deployment of low voltage substations equipped with real-time diagnostics and fault prediction systems. Distribution Network Operators (DNOs) have shifted toward plug-and-play automation frameworks. Compact digital substations have been deployed to support low-carbon distributed energy resources.

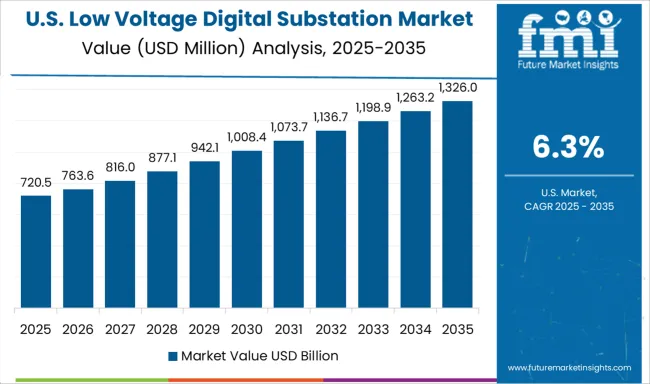

The United States held 6.3% of the market in 2025. Federal energy modernization programs have supported substation digitization in collaboration with regional utilities. Migration to intelligent switchgear and phasor measurement systems has progressed within microgrids and smart distribution pilots. Utilities in California, Texas, and New York have led implementation of fault detection and predictive maintenance systems for low voltage substations.

Key players in low voltage digital substation market provide integrated solutions to customers for improving grid reliability and communication. They focus on online transformations of substations through integration of smart electronic equipment, IEC 61850-based communication protocols, and control systems, which will drive the growth of the global market.

Schneider Electric is a key producer of low-voltage digital substation parts as well as a provider of turnkey solutions to its customers. It highlights cybersecurity and interoperability that facilitate proficient electric grid functionalities. On the other hand, ABB SE, which operates the electric grid through its Hitachi Energy division, offers scalable, user-friendly, and modular digital substation solutions. The product or service line of the firm includes automation tools, low-voltage IEDs, and an asset health monitoring platform, which aids predictive maintenance activities.

Apparently, Siemens AG provides low-voltage digital substations (LVDS) via SIPROTEC and SENTRON lines, thereby blending remote control, automating, and measurement features. The firm highlights modernizing the electric grid equipment and improving grid services, along with decentralizing power systems. GE offers digital grid services such as low-voltage switchgear, substation monitoring tools, and new protection delays. It also offers services such as grid edge control analytics and cloud data analytics. All these firms cater to both rural and urban electric grid applications.

The low voltage digital substation market is advancing with the integration of intelligent electronic devices, real-time data analytics, and IEC 61850-based communication protocols. These systems enable remote monitoring, predictive maintenance, and streamlined protection coordination, improving grid responsiveness and reliability.

Demand is rising due to the need for compact, modular substations in distributed energy setups and industrial automation. Asia-Pacific leads adoption with utilities modernizing distribution networks, while Europe and North America focus on grid resiliency and cybersecurity compliance. Digital twin technology, edge computing, and fiber-based communication systems are being implemented to enhance interoperability and reduce latency in substation control functions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Component | Substation automation system, Communication network, Electrical system, Monitoring & control system, and Others |

| Architecture | Process, Bay, and Station |

| End Use | Utility and Industrial |

| Installation | New and Refurbished |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Cisco Systems, Inc., Eaton Corporation, General Electric, Hitachi Energy, Hubbell, Larsen & Toubro Limited, Netcontrol Group, Powell Industries, Schneider Electric, Siemens, Toshiba Energy Systems & Solutions Corporation, WEG, and WAGO |

| Additional Attributes | Dollar sales by component (digital switchgear, protection relays, communication modules) and application (utilities, renewable integration, industrial plants), demand dynamics across grid modernization, distributed generation, and smart microgrids, regional trends led by Asia‑Pacific with North America catching up, innovation in IEC 61850 interoperability, cloud‑based SCADA, edge analytics, and compact modular substations, and environmental impact via enhanced energy efficiency, minimized transmission losses, emissions reduction, and compliance with smart grid sustainability standards. |

The global low voltage digital substation market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the low voltage digital substation market is projected to reach USD 3.3 billion by 2035.

The low voltage digital substation market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in low voltage digital substation market are substation automation system, communication network, electrical system, monitoring & control system and others.

In terms of architecture, process segment to command 42.7% share in the low voltage digital substation market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA