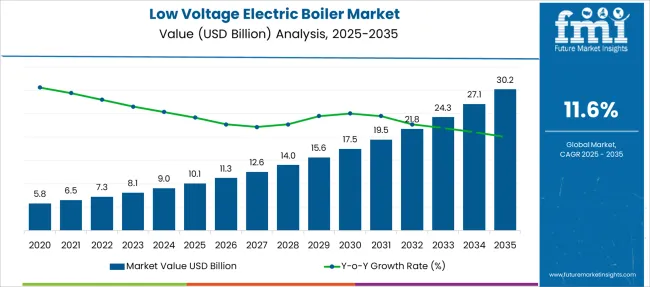

The Low Voltage Electric Boiler Market is estimated to be valued at USD 10.1 billion in 2025 and is projected to reach USD 30.2 billion by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period.

| Metric | Value |

|---|---|

| Low Voltage Electric Boiler Market Estimated Value in (2025 E) | USD 10.1 billion |

| Low Voltage Electric Boiler Market Forecast Value in (2035 F) | USD 30.2 billion |

| Forecast CAGR (2025 to 2035) | 11.6% |

The low voltage electric boiler market is undergoing substantial growth, driven by the global shift toward electrification, energy efficiency, and decarbonization of heating systems. Rising pressure on industrial and commercial sectors to reduce carbon emissions has accelerated the adoption of electric boilers, particularly those operating on low voltage, due to their adaptability and lower operational risks.

These systems are being increasingly integrated into energy-efficient building strategies, backed by government regulations and incentive programs targeting clean energy adoption. Advancements in heating technologies, coupled with the ability to integrate with smart grid systems and renewable sources, are enhancing the appeal of these boilers.

Demand is also being supported by rising electricity availability in emerging markets and the growing need for flexible heating solutions across commercial and service-based environments. With increasing awareness around lifecycle cost advantages and safety compliance benefits, low voltage electric boilers are expected to witness sustained demand across infrastructure and service domains..

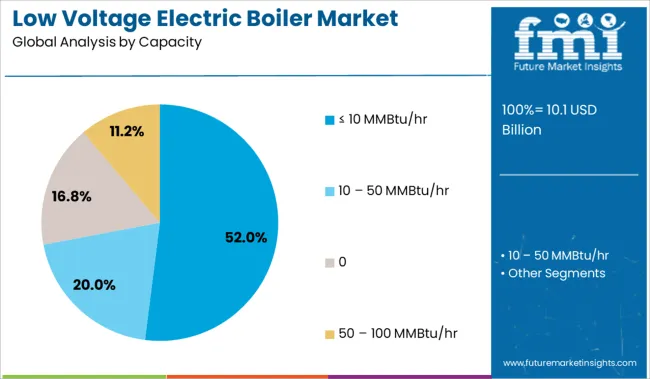

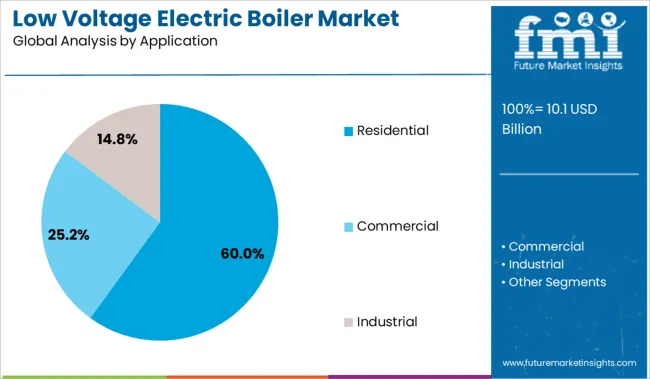

The market is segmented by Capacity, Application, and region. By Capacity, the market is divided into ≤ 10 MMBtu/hr, 10 - 50 MMBtu/hr, 50 - 100 MMBtu/hr, and 100 - 250 MMBtu/hr. In terms of Application, the market is classified into Residential, Commercial, and Industrial.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Level 2 subsegment within the charging infrastructure segment is projected to account for 61% of the Low Voltage Electric Boiler market revenue in 2025. This dominant position has been driven by the broad compatibility, shorter charging times, and cost efficiency of Level 2 systems.

These infrastructure setups have been widely adopted across residential, workplace, and commercial environments due to their ability to support higher power delivery while maintaining system safety and integration with smart energy management. Low voltage electric boilers operating within these systems have demonstrated enhanced performance reliability and lower installation complexity, which has contributed to their widespread preference.

The alignment of Level 2 infrastructure with energy efficiency standards and renewable energy storage systems has further strengthened its relevance in modern heating solutions. As building operators and fleet owners prioritize optimized energy use and space-saving installations, Level 2 infrastructure has continued to lead in deployments supporting electric heating systems..

The subscription subsegment within the service segment is expected to hold 45% of the Low Voltage Electric Boiler market revenue in 2025. Growth in this segment has been propelled by the increasing preference for operational expenditure-based models over capital-intensive ownership.

Subscription-based services have enabled organizations to access electric boiler technology without significant upfront investments, offering flexibility in usage, predictable maintenance, and real-time system upgrades. This approach has been especially advantageous for small and medium enterprises seeking to manage heating infrastructure within budget constraints.

The rising trend toward digitization and service personalization has allowed providers to offer analytics-driven maintenance, remote diagnostics, and software optimization as part of subscription packages. As end users focus more on reliability, cost control, and sustainability, subscription models have been recognized as an effective solution, contributing to their growing share within the overall service ecosystem..

The commercial subsegment within the service points segment is anticipated to capture 64% of the Low Voltage Electric Boiler market revenue in 2025. This leading position has been reinforced by strong demand from retail chains, office complexes, educational institutions, and hospitality infrastructure where heating requirements must be met reliably and efficiently.

Commercial facilities have increasingly transitioned to low voltage electric boilers due to regulatory compliance needs and a desire to eliminate fossil fuel dependency. These systems offer a safer, quieter, and more scalable solution for diverse commercial applications while supporting energy-saving initiatives and green building certifications.

Facility managers have favored electric boilers for their rapid installation, minimal maintenance, and compatibility with smart monitoring systems. As commercial properties continue to modernize their infrastructure in line with sustainability goals, the adoption of electric heating systems supported by commercial service points has been positioned as a strategic imperative, driving the segment’s strong market share..

The low voltage electric boiler market has found strategic opportunity through integration with smart grids and demand-response programs. From 2023 to 2025, boilers were deployed to absorb surplus energy, reduce peak load strain, and provide grid-interactive heating solutions. This shift positions electric boilers not just as heating equipment but as controllable energy assets, offering providers a compelling role in utility partnerships and decentralized energy management models.

Increasing mandates for carbon reductions have been recognized as a central driver in the adoption of low-voltage electric boilers. In 2023, installations were initiated in commercial buildings to replace oil-fired systems following new emissions reporting obligations. By 2024, industrial facilities were leveraging electric boilers to meet mandated heat decarbonization benchmarks, with performance incentives encouraging uptake.

In 2025, district heating networks were increasingly retrofitted with low-voltage electric units to comply with updated energy-use regulations and efficiency schemes. These installations have shown that regulatory emissions targets are not just compliance thresholds-they are prompting proactive operational shifts. Providers offering modular, load-responsive boiler systems have gained traction as preferred retrofit partners.

Pilot projects initiated in 2023 revealed that low-voltage electric boilers, when integrated with grid management systems, could absorb surplus renewable energy during off-peak hours, balancing supply and demand more effectively. By 2024, commercial boiler installations were found to participate in demand-response programs, enabling facility managers to reduce operational costs by modulating heat generation in response to grid signals.

In 2025, district heating schemes were being retrofitted with boilers equipped for two-way communication with energy systems, allowing utilities to dispatch heat resources dynamically. These deployments demonstrate that leveraging grid flexibility can transform electric boilers from standalone heat sources into active energy assets-an opportunity that forward-thinking equipment providers are beginning to exploit.

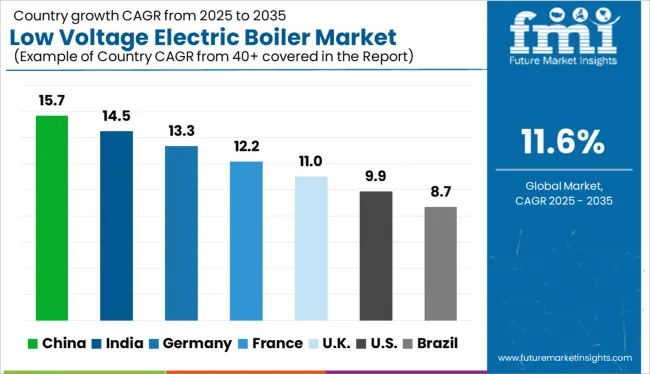

| Country | CAGR |

|---|---|

| China | 15.7% |

| India | 14.5% |

| Germany | 13.3% |

| France | 12.2% |

| UK | 11.0% |

| USA | 9.9% |

| Brazil | 8.7% |

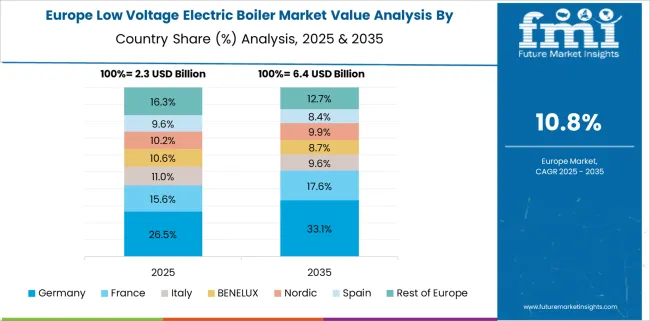

The low voltage electric boiler market is projected to expand at a global CAGR of 12% from 2025 to 2035. Among the 40 nations analyzed, China leads with 15.7%, followed by India at 14.5% and Germany at 13.3%. France closely aligns with the global average at 12.2%, while the United Kingdom records slightly slower growth at 11.0%.

China and India are advancing due to electrification of industrial heat, urban building retrofits, and incentives for coal-to-electric conversion. Germany focuses on clean heating in district systems and low-emission manufacturing. France leverages EU efficiency directives, while the UK shows stable growth in commercial and institutional deployments.

China is projected to grow its low voltage electric boiler market at a 15.7% CAGR, fueled by provincial decarbonization mandates and centralized retrofit programs in industrial parks. Coal-fired boiler replacement schemes are pushing electric alternatives in food processing, chemical, and textile clusters. Government programs support electric boiler integration in combined heat and power zones. Domestic manufacturers are scaling compact, multi-zone boiler units for urban high-rise and rural district heating.

India is forecast to grow its low voltage electric boiler market at a 14.5% CAGR, driven by rising demand from small and medium industrial units, public hospitals, and state schools. Thermal oil heaters and outdated diesel systems are being replaced with energy-efficient electric boiler systems. Adoption is strong in cold-region public infrastructure and private food manufacturing hubs. The government's push for distributed renewable energy use supports integration of electric boilers with solar microgrids.

Germany is projected to grow at a 13.3% CAGR in the low voltage electric boiler sector, supported by high building code standards and rapid electrification of decentralized heating systems. Industrial firms are installing low voltage boilers for process heating in chemical and machinery workshops. Municipalities use electric boilers in thermal balancing of grid-connected heat systems. Energy utilities have rolled out pilot programs pairing boilers with dynamic electricity pricing.

France is forecast to grow its low voltage electric boiler market at a 12.2% CAGR, supported by building decarbonization policy and demand from residential collectives, public facilities, and commercial offices. Electric boilers are widely used in schools and mid-rise apartment blocks undergoing renovation. Heat-pump-compatible low voltage units are gaining attention in hybrid heating systems. State grants under the Energy Renovation Plan encourage their uptake, especially in colder zones.

The United Kingdom is forecast to grow its low voltage electric boiler market at an 11.0% CAGR, shaped by commercial sector upgrades, social housing electrification, and clean heat compliance. Electric boilers are used in care homes, leisure centers, and retail buildings where gas grid access is limited or phased out. Building developers are trialing electric boilers in zero-carbon new builds. However, grid readiness and tariff volatility present hurdles.

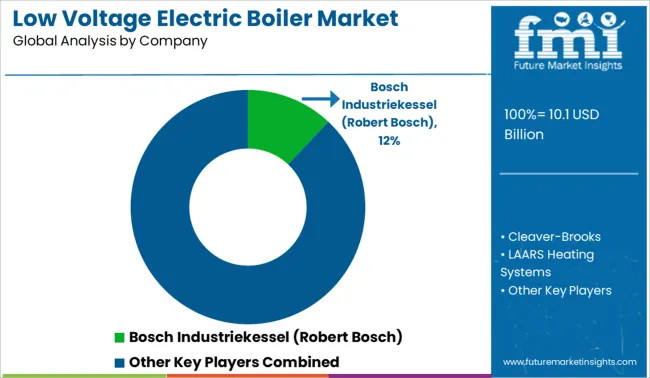

The low voltage electric boiler market is moderately consolidated, led by Bosch Industriekessel (Robert Bosch) with a 12% market share. The company holds a dominant position through its energy-efficient electric heating systems, robust manufacturing capabilities, and long-standing presence in industrial thermal solutions. Dominant player status is held exclusively by Bosch Industriekessel (Robert Bosch).

Key players include Cleaver Brooks, LAARS Heating Systems, Precision Boilers, and Lochinvar - each offering compact, safety-certified electric boilers designed for low-voltage applications in commercial, institutional, and light industrial settings.

Emerging players such as Acme Engineering and Viessmann focus on modular installations, smart control features, and customizable low-emission heating systems tailored to regional electrification initiatives. Market demand is driven by carbon-reduction mandates, grid-supportive electric heating strategies, and the transition from fossil-based to electric-powered boiler systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.1 Billion |

| Capacity | ≤ 10 MMBtu/hr, 10 - 50 MMBtu/hr, 50 - 100 MMBtu/hr, and 100 - 250 MMBtu/hr |

| Application | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Industriekessel (Robert Bosch), Cleaver‑Brooks, LAARS Heating Systems, Precision Boilers, Lochinvar, and [Others: Acme Engineering, Viessmann…] |

| Additional Attributes | Dollar sales by boiler type and voltage range, regional demand trends (APAC fastest growth), competitive landscape, buyer preference for energy-efficient and smart boilers, integration with renewables, innovations in IoT-enabled controls and efficiency. |

The global low voltage electric boiler market is estimated to be valued at USD 10.1 billion in 2025.

The market size for the low voltage electric boiler market is projected to reach USD 30.2 billion by 2035.

The low voltage electric boiler market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in low voltage electric boiler market are ≤ 10 mmbtu/hr, 10 – 50 mmbtu/hr, 50 – 100 mmbtu/hr and 100 – 250 mmbtu/hr.

In terms of application, residential segment to command 60.0% share in the low voltage electric boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Voltage Commercial Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA